deposit:

- $1

Trading platform:

- Proprietary myDavy platform

- FCA

- CSSF

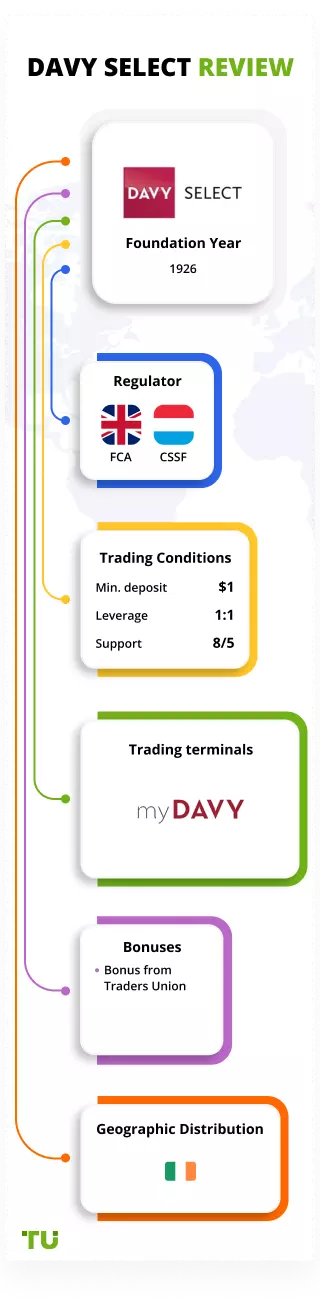

Davy Select Review 2024

deposit:

- $1

Trading platform:

- Proprietary myDavy platform

- 1:1

- Only web terminal is available for trading, high fees for orders, lack of margin accounts

Summary of Davy Select Trading Company

Davy Select is a broker with higher-than-average risk and the TU Overall Score of 4.87 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Davy Select clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Davy Select ranks 59 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Davy Select is a broker for experienced traders from the EU who want to expand their investment opportunities and trade not only the UK and Irish securities, but also assets listed on world exchanges.

Davy Select is an Irish brokerage company that has been providing access to the stock market since 1926. It is registered in Dublin and regulated by the Central Bank of Ireland, but also has offices in Belfast, Cork, and Galway. Davy Select’s representative office in the UK operates under FCA (172140) control and in Luxembourg under a CSSF license. The broker is a member of the London Stock Exchange and Euronext Dublin. In October 2012 a platform for online securities trading and retirement savings was launched. It allowed EU residents to invest in stocks, bonds, options, and ETFs in more than 30 international markets.

| 💰 Account currency: | EUR, USD, GBP |

|---|---|

| 🚀 Minimum deposit: | From €500 on trading accounts, from €1 on Pension Accounts |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, funds, bonds, options |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Davy Select:

- High level of security. The broker is regulated by the Central Bank of Ireland and client funds are kept in segregated accounts with major European banks.

- Participation in the FSCS scheme according to which each Davy Select investor in case of bankruptcy of the broker is paid £85,000.

- Availability of ready-made portfolio solutions with different risk levels for inexperienced investors who want to receive passive income.

- Opportunity for Europeans to invest in international securities, including US, Canadian and Australian equities, and ETFs.

- Convenient web platform with many tools for research and market analysis.

- No deposit or trading terminal fees.

- Fully digital account opening and verification procedure.

👎 Disadvantages of Davy Select:

- Suboptimal trading conditions for beginners. The deposit starts from €500, the minimum broker's commission is €14.99.

- Cooperation only with the residents of Ireland, Great Britain, and the European Union.

- On the website, there is no online chat, news, analytics, or qualitative and detailed training.

Evaluation of the most influential parameters of Davy Select

Geographic Distribution of Davy Select Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Davy Select

Davy Select is a reliable company that has been active on the stock market for almost 100 years. Its services are used both by retail investors, and institutional clients representing the interests of smaller market participants. The company pursues an active policy to attract new clients. To this end, there are no minimum deposit requirements for all available pension accounts.

To satisfy the investment requirements of different traders, the Davy Select broker has expanded the line of trading accounts as much as possible. On its website, it is possible to open accounts for online trading, including those focused on long-term strategies. The Telephone Trading Account is also at everyone’s disposal. It’s an account for adherents of classic telephone trading over the trading desk.

As traders who have worked with Davy Select note in their reviews, the broker's main drawback is its high trading fees. The minimum fee per trade is €14.99, which is significantly higher than its competitors. And considering that many stockbrokers have abandoned commissions for equity trades altogether, we can't recommend Davy Select for trading securities, especially for beginners.

Dynamics of Davy Select’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Davy Select helps its clients who have no experience in securities trading to earn passive income in the stock market. For this purpose, the broker offers pre-diversified asset portfolios.

Davy GPS funds and portfolio strategies for passive investments

Davy GPS funds are three funds with several managers that invest in a carefully selected range of underlying assets. The portfolios include stocks, bonds, alternative investments, and cash in varying percentages. The investor needs to choose a fund based on an acceptable risk level and then make a deposit of €500. If the portfolio is rebalanced, additional investments of at least €100 may be required.

Davy Select offers the following portfolio types:

-

Davy Cautious Growth Fund. The fund with the lowest risk level, which is 55% bonds. The management fee is 1.51% per year. Suitable for investors who prefer a strategy aimed at reducing volatility.

-

Davy Balanced Growth Fund. A portfolio with a balance between lower and higher asset volatility. Designed for investors who take a moderate approach to risk. The underlying asset is equities (50%), with an annual management fee of 1.58%.

-

Davy Long-Term Growth Fund. A 70% equity fund designed for investors who are willing to accept a higher degree of volatility for higher returns over the long term. The investor pays the broker 1.58% of the investment amount for managing the portfolio.

Managers can diversify their portfolios in several ways: by geography (investors get access to securities in different regions), by asset classes (the underlying funds are linked to three major funds), and by sector (e.g., finance, information, or biotechnology, etc.).

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Davy Select's affiliate program:

-

There is no information on the company's website about active affiliate programs for retail clients.

Trading Conditions for Davy Select Users

The Davy Select broker offers its clients a wide range of investment accounts with a deposit starting from €500. There is no minimum investment amount for most markets, however, trades in securities listed on exchanges in Canada, Hong Kong, Japan, China, Australia, and Singapore require a balance of €5,000 or more. Davy Select has no bonus or affiliate programs, nor mobile or desktop terminals. Deposits and withdrawals can only be made by bank transfer.

$1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Proprietary myDavy (web) platform |

|---|---|

| 📊 Accounts: |

Trading Accounts: Personal Investment Account, Telephone Trading Account, Trading Plus Account, Investment Only Account Pension Accounts: Personal Retirement Savings Account (PRSA), Approved Retirement Fund Account (ARF), Approved Minimum Retirement Fund Account (AMRF), Executive Pension Portfolio Account (EPP), Personal Retirement Bond Account (PRB) |

| 💰 Account currency: | EUR, USD, GBP |

| 💵 Replenishment / Withdrawal: | Bank transfers only |

| 🚀 Minimum deposit: | From €500 on trading accounts, from €1 on Pension Accounts |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, funds, bonds, options |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Only web terminal is available for trading, high fees for orders, lack of margin accounts |

| 🎁 Contests and bonuses: | No |

Davy Select Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Personal Investment Account | From €14.99 per order | For international and instantaneous withdrawals |

| Telephone Trading Account | From €100 per order | For international and instantaneous withdrawals |

| Trading Plus Account | From €400 yearly | For international and instantaneous withdrawals |

| Investment Only Account | From €400 yearly | For international and instantaneous withdrawal |

The inactivity fee is €50 per quarter, and the fees paid by the customer are deducted from this amount.

The Trading Plus Account and the Investment Only Account are designed for long-term investing, while the Telephone Trading Account focuses on telephone dealing. For this reason, we compared the commission on the Personal Investment Account online trading account to that of other stockbrokers that are similarly situated.

| Broker | Average commission | Level |

| Davy Select | $17.8 | High |

| Charles Schwab | $11 | Medium |

| Ally Bank | $4 | Low |

Detailed Review of Davy Select

Regulated by the Central Bank of Ireland, the Davy Select broker is a member of the Irish and London Stock Exchanges. It offers clients a variety of trading accounts from which to invest in more than 1,200 funds, 650 ETFs, and 7,500 stocks in 30 international markets. At the moment the company not only works with traders from Ireland but also serves tens of thousands of investors from European Union countries.

Davy Select by the numbers:

-

More than 95 years in the securities business.

-

Over 800 employees on staff.

-

Serves more than 400 institutional clients.

-

The broker manages more than €14 billion in client assets.

Davy Select is a broker for investors from EU countries who trade on international markets

Davy Select offers clients stocks, bonds, funds, and ETFs which are listed not only on the Irish and UK stock exchanges but also on many global markets, including the EU, US, Canada, Australia, and Hong Kong. The broker supplies research, analysis, and market overviews from leading news resources Morningstar and Thomson Reuters. Its clients have access to both independent trading and ready-made investment solutions, including diversified asset portfolios and professional money management.

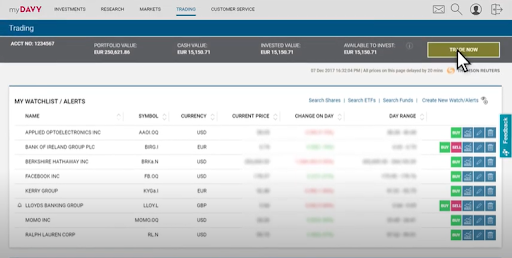

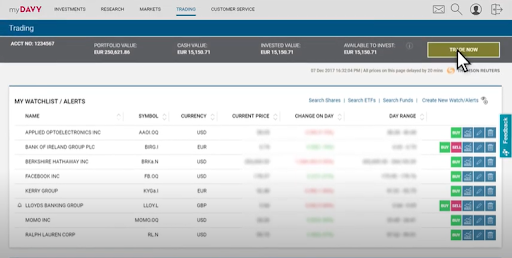

The company does not have a special mobile application or desktop terminal. The broker offers the myDavy proprietary web trading platform to all its customers. It can be accessed from desktop computers and laptops as well as from smartphones and tablets. The myDavy platform has research, trade ideas, screeners, and portfolio tracking tools. You can also set up two types of price alerts, which are triggered at specified times or when the value of the marked assets changes.

Davy Select's useful services:

-

Morningstar’s Portfolio X-Ray. A tool that helps an investor track statistics on selected funds and analyzes the optimality of asset allocation.

-

Research. Regular reviews of 110 stocks in key industries by 30 Davy Select analysts with a focus on the UK and Irish securities.

-

Investment insights. Independent investment research and analysis from leading data provider Morningstar.

-

Screening Tools. A tool to find investments that meet an investor's personal needs. Assets can be sorted by company rating, key statistics, and financials.

-

Price alerts. Customized alerts for stocks, exchange-traded funds, and market indices that investors can customize to their own needs.

Advantages:

Broker clients can invest in more than 9,000 financial instruments in 30 international markets.

The company provides a convenient in-house developed web terminal with all the necessary functionality for trading and analysis free of charge.

You do not need to actively trade to generate income. You can invest in ready-to-use asset portfolios that are managed by professional managers.

A wide range of trading and retirement accounts with investment options is available, enabling traders to work under the best conditions for themselves.

Potential clients can transfer to Davy Select assets, which are on accounts of other brokerage companies, for free.

The broker does not prohibit day trading and does not limit the number of available transactions.

How to Start Making Profits — Guide for Traders

Davy Select offers retail clients trading and retirement accounts with investment opportunities. In this review, we will focus in detail on Trading Accounts. They differ in the amount of trading commissions. The size of the minimum deposit on all types of trading accounts is €500.

Types of accounts:

Davy Select, like most stockbrokers, does not offer its clients demo accounts.

Irish broker Davy Select primarily targets local traders and investors who are looking for a company for simultaneous investment and retirement planning.

Bonuses Paid by the Broker

There are no direct bonus offers from Davy Select.

Investment Education Online

Teaching materials on Davy Select's site are not separated into a separate block, so to find useful information traders review all sections. The most informative section in terms of education is Guides & Tools.

The training presented on the company's website is not enough for an in-depth study of trading on the stock market.

Security (Protection for Investors)

Davy Select is part of the Irish holding company Davy Group, which also has offices in the UK and Luxembourg. The Dublin-based unit is regulated by the Central Bank of Ireland, in the UK by the Financial Conduct Authority (FCA), and in Luxembourg by the Commission de Surveillance du Secteur Financier (CSSF).

All of the broker's clients are covered by the Financial Services Compensation Scheme (FSCS) and their funds are held at 40 major banks in Europe, including Lloyds Banking Group, UniCredit, JP Morgan Chase & Co., HSBC, and BNP Paribas. Davy Select also has a U.S. representative office of Davy Securities, which allows it, as a broker in Europe, to transact in U.S. securities. The US-registered firm is a member of FINRA and SIPC.

👍 Advantages

- SIPC and FSCS compensation is available to broker's clients

- The Central Bank of Ireland regularly monitors the company financially

- The broker fulfills the obligations specified in the service agreement

👎 Disadvantages

- All payment transactions can only be made via bank transfer

- The number of countries the broker cooperates with is limited

- An account can only be opened after passing full identity verification.

Withdrawal Options and Fees

-

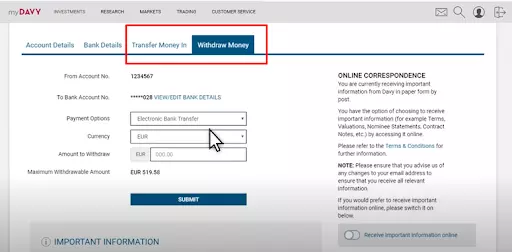

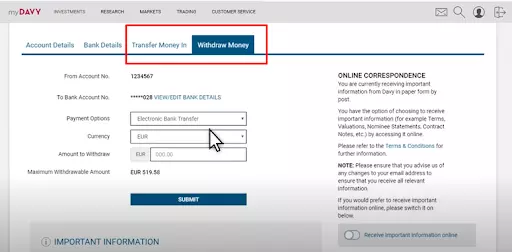

Withdrawing funds from Davy Select accounts is only possible by bank transfer. The company transfers money not only to Irish bank accounts but also to bank accounts in other countries.

-

The presence of a fee depends on the client's country of residence and the time frame in which he wants to get the money. The broker charges a fee for withdrawals to banks outside of Ireland or if the client has applied for an urgent transfer, i.e., a transfer on the day of application. The fee varies depending on the country and is €25 to €50 per transaction.

-

Funds can be withdrawn in any currency. However, for the conversion of the account currencies (EUR, USD, or GBP) into another withdrawal currency, the broker will deduct an exchange fee.

Customer Support Service

The working hours of the support team are Monday to Friday from 8:00 to 18:00 (GMT+1).

👍 Advantages

- You can contact the support team via phone or order a callback

- Email replies come within hours

👎 Disadvantages

- Online chat is not available

- You can’t reach out to them on Saturday, Sunday, or public holidays

This broker provides the following communication channels for its clients:

-

callback;

-

phone call;

-

email;

-

letter by regular mail;

-

personal visit to one of five offices.

-

The company has messenger profiles on Facebook, Twitter, and LinkedIn.

Contacts

| Foundation date | 2018 |

| Registration address | Davy Select, 49 Dawson Street, Dublin 2, Ireland |

| Regulation |

FCA, CSSF |

| Official site | https://www.davyselect.ie/ |

| Contacts |

Phone:

01 614 8900

|

Review of the Personal Cabinet of Davy Select

The Davy Select Live Account is for managing your trading account and making trades. To create it follow these instructions:

On the home page of the official website, click on the Open an Account button.

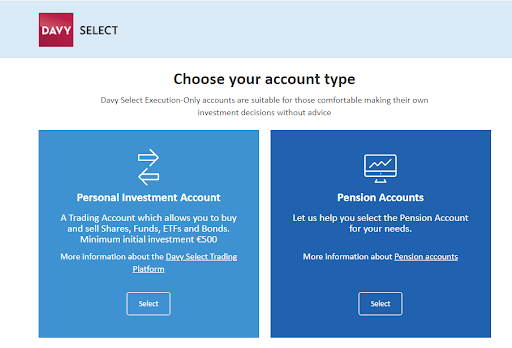

Select the type of account:

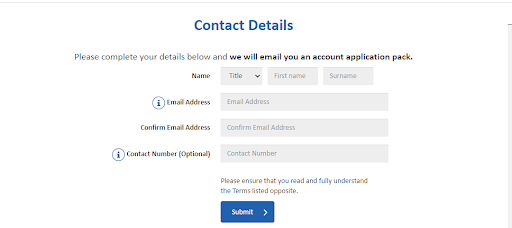

Fill out the registration form:

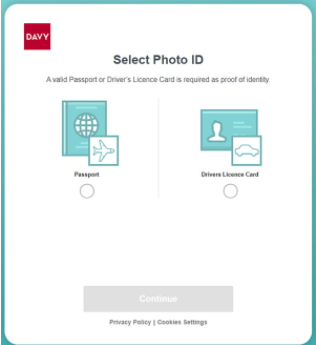

Go through digital verification:

After completing your identification, confirm the email you gave at registration and pass the two-factor authentication for full authorization. For this purpose the broker sends a text message to the cell phone with a code to enter the personal cabinet, the code is valid for only 10 minutes.

In your personal account you have access to the following actions:

1. Deposit and withdrawals:

2. Buy and sell securities:

1. Deposit and withdrawals:

2. Buy and sell securities:

Moreover, in your personal account you can do the following:

-

Edit your personal data.

-

View reports on pre-formed portfolios.

-

Set price alerts.

-

Management email subscriptions.

-

Generate account statements.

-

Close the account.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Davy Select rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Davy Select you need to go to the broker's profile.

How to leave a review about Davy Select on the Traders Union website?

To leave a review about Davy Select, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Davy Select on a non-Traders Union client?

Anyone can leave feedback about Davy Select on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.