deposit:

- $500 000

Trading platform:

- Proprietary platform

- SEC

- FCA

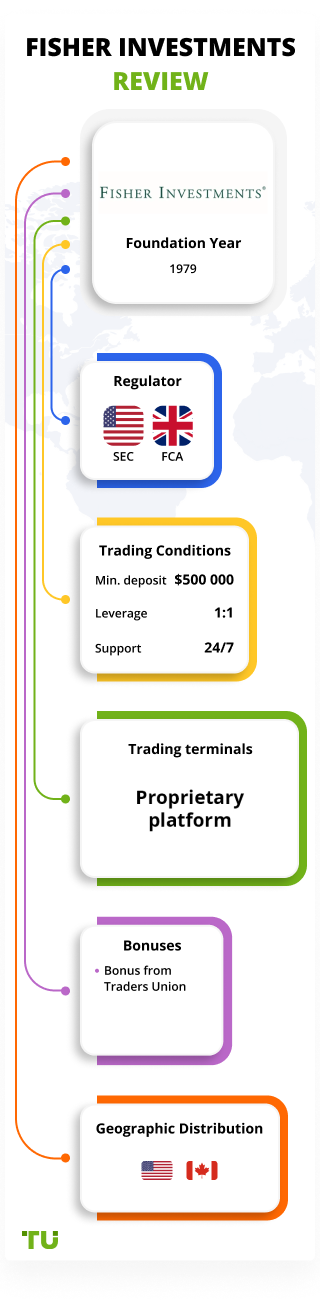

Fisher Investments Review 2024

deposit:

- $500 000

Trading platform:

- Proprietary platform

- No

- The trading process is run by managers, independent trading is not available

Summary of Fisher Investments Trading Company

Fisher Investments is a broker with higher-than-average risk and the TU Overall Score of 4.69 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Fisher Investments clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Fisher Investments ranks 65 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Fisher Investments is a stockbroker suitable for individuals and organizations. The company's services are effective capital management and assistance in achieving long-term investment goals.

Fisher Investments is a stockbroker founded in 1979 in America. Since its foundation, the company has enlisted the support of almost 100 thousand large investors and opened branches in 14 more countries. The company's activities are registered within each territory and each branch is regulated by the relevant authority. In the US, this is the SEC (Securities and Exchange Commission), in the UK, it is the FCA 191609 (Financial Conduct Authority). Fisher Investments is focused on clients with impressive capital and does not cooperate with novice investors. The broker offers services for long-term investment and is responsible for the care of portfolio management. The peculiarity of the broker is the provision of an individual financial plan to each client, taking into account his financial situation and life’s circumstances.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | USD 500,000 |

| ⚖️ Leverage: | No |

| 💱 Spread: | No data |

| 🔧 Instruments: | Stocks, bonds, securities, stock assets |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Fisher Investments:

- Comprehensive approach to client capital management.

- Before building an investment strategy, a personal manager learns detailed information about the client.

- The broker offers individual investment solutions for each client.

- Fisher Investments works with clients' annuities, turning them into profitable investments.

- The broker's website has free investment training materials.

- Client funds are held in segregated accounts.

👎 Disadvantages of Fisher Investments:

- High level of minimum deposit.

- The company does not offer ways to independently manage capital.

- It is not possible to open an account online.

Evaluation of the most influential parameters of Fisher Investments

Trade with this broker, if:

- You value personalized service, as this broker offers dedicated advisors for personalized assistance, catering to clients who prefer hands-on support.

- You appreciate a fee-only structure, as operating on a fee-only basis ensures transparency in fees, appealing to clients who prefer clear and straightforward pricing.

Do not trade with this broker, if:

- You prefer a low-cost approach, as their fees may be higher compared to discount brokers, making them less suitable for those seeking cost-effective investment options.

- You have a smaller portfolio, as if you do not meet their minimum investment requirements, this broker may not be accessible to you.

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Fisher Investments News

- Analysis of Fisher Investments

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Fisher Investments

- User Reviews of Fisher Investments

- FAQs

- TU Recommends

Geographic Distribution of Fisher Investments Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Fisher Investments

Fisher Investments is a stockbroker aimed at cooperation with big organizations and private investors with large capital. The company cooperates with clients from 15 countries with offline broker offices. Opening an account is possible only with a personal visit to the Fisher Investments’ physical office. Also, the investor needs to have at least 500,000 USD.

Fisher Investments specializes in working with long-term investments and is also suitable for calculating a retirement plan. The uniqueness of this broker is an individual approach to the needs of each client. Fisher Investments does not set the same conditions for all investors and always builds on the client's current position. Money management, buying securities, and investing in other instruments is a task that this broker fully fulfills. It is enough for an investor to form his financial goals together with a consultant and discuss ways to achieve them. After the approval of the financial plan, a team of consultants will begin portfolio management and will keep the investor informed about everything that is happening with his funds.

The disadvantages of this broker include a high level of a minimum deposit of $500,000. Also, the broker does not offer trading conditions for the investor to manage funds independently.

Dynamics of Fisher Investments’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

The Fisher Investments broker specializes in providing investment services for high-income individuals and large organizations and assumes control of all the assets. Thus, it is enough for an investor to discuss his investment goals with a manager, develop individual plans for financial growth, retirement planning, and monitor profitability. We may say that Fisher Investments itself is one major investment program that the company's employees adapt to the needs of each client. There are no programs for copying trades, PAMM accounts, or other automated trading tools at Fisher Investments.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Fisher Investments’ affiliate program:

Fisher Investments also lacks a program that allows investors to receive financial or other bonuses by inviting new users to the company. The broker aims to cooperate with investors who are really interested in developing their financial capabilities and do not need additional reasons to open a trading account.

Trading Conditions for Fisher Investments Users

Fisher Investments is a company for those investors who want to create an effective plan to achieve their financial goals. The broker does not provide investors with the opportunity to trade on their own: the consultant initially learns detailed information about the client's life, income, goals, health, etc., to create an individual financial plan, taking into account all the needs and characteristics of the client. The investor deposits $500,000, then a trading account is opened with the company. Portfolio management is handled by Fisher Investments, therefore data on the trading platform, order execution method and other trading conditions are not available. The investor only needs to understand their financial goals and follow the plan, if necessary, the client can discuss ways to manage the portfolio with a personal manager. There is no leverage at Fisher Investments, the mobile app is available for US investors. In addition to financial development plans, Fisher Investments also offers individual retirement plans.

$500 000

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | Proprietary platform |

|---|---|

| 📊 Accounts: | Investment, Retirement |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Discussed individually with the manager |

| 🚀 Minimum deposit: | USD 500,000 |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | No data |

| 🔧 Instruments: | Stocks, bonds, securities, stock assets |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | No |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | The trading process is run by managers, independent trading is not available |

| 🎁 Contests and bonuses: | Yes, Traders Union’s rebate service |

Fisher Investments Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Investment account | From 1.12$ of the account amount | Discussed individually |

| Retirement account | From 1.12$ of the account amount | Discussed individually |

Account maintenance fees and other non-trading activities are not applicable.

Fisher Investments' commission rates have also been compared by the Traders Union analysts to those of other successful stockbrokers such as Charles Schwab and Ally Bank. As a result of the comparison, each of the brokers was assigned a commission level. You can see the results in the table below:

| Broker | Average commission | Level |

| Fisher Investments | $1.12 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Fisher Investments

Fisher Investments is a company that offers investment services to well-heeled private investors and organizations. It should be noted that the main principle of the broker is an individual approach to each client: Fisher Investments does not offer ready-made portfolios. The consultants initially get to know the client, find out his financial situation, health status, financial goals, and only then devise a plan to achieve the desired goals. Clients have access to both long-term investment services and retirement plans.

Fisher Investments by the numbers:

-

The broker provides services to investors in 15 countries.

-

The company has been offering customized financial solutions for over 40 years.

-

Fisher Investments has 29 offline offices in different countries.

-

Fisher Investments manages over $188 billion.

-

The broker's client base numbers over 95,000 investors.

Fisher Investments is a long-term investment broker

The investor's portfolio includes stock assets that will help to achieve financial goals as quickly and efficiently as possible. The broker also works with annuities if clients have them. At Fisher Investments, annuities are not offered as a trading tool, but they help you take advantage of all the opportunities that an existing annuity provides. Any trading strategy, purchase, or sale of assets is discussed with the investor during planning. Then the portfolio goes under the management of a personal advisor, the possibility of self-management of capital at Fisher Investments is not provided. There are also no automatic programs for generating passive income.

The company pays special attention to customer service. Unlike most stockbrokers offering consulting services, Fisher Investments not only conducts a thorough analysis of the client's current financial situation but also offers comprehensive measures to optimize the portfolio and increase its efficiency. The investor's portfolio is managed by a team of specialists, and a personal consultant is in touch as often as the investor wishes.

Useful services of Fisher Investments:

-

Retirement calculator. With the help of the built-in calculator, the investor can calculate the amount of annual profit that must be achieved to retire. The calculator also allows the investor to understand how effective his investment instruments are, how many years it takes to retire and what income can be expected after retirement. It should be noted that the results of the calculator are hypothetical and not guarantees.

-

Informative financial guides. With their help, investors can understand how investing works and get basic information about how to invest.

-

FAQs. A section with answers to frequently asked questions from investors.

-

Calculators. In this section, in addition to the calculator of the estimated period of retirement, there are special calculators for rent that determine the future value of investment assets. There is also a 401 (k) calculator.

Advantages:

Investment solutions are matched to the client's personal history and goals.

The investor does not need to monitor the market situation, since the management of funds lies with the employees of Fisher Investments.

The account manager contacts clients not only to adjust the account but also in times of market drawdown. In this way, the investor always knows what is happening with his portfolio.

The broker works with annuities, analyzes them, and suggests the most effective ways to use this tool.

Broker's clients get free access to educational materials, comprehensive reports, and market updates.

The activities of the broker's employees are monitored by the Investment Policy Committee (IPC).

How to Start Making Profits — Guide for Traders

At Fisher Investments, there is no clear division into account types. Managers draw up each account following the needs and financial goals of the client. In total, the broker offers two main services: long-term investing and retirement plans.

Account types:

At Fisher Investments, portfolio management is only possible in real market conditions.

Residents of the following countries can open an account with the company: Australia, Belgium, Great Britain, Germany, Denmark, Sweden, Spain, Canada, Finland, France, Ireland, Italy, Norway, Luxembourg, and the USA.

Bonuses Paid by the Broker

Fisher Investments fully fulfills all portfolio management tasks. This specificity, as well as the focus on investors with a high level of income, presupposes the lack of bonus programs. The investor receives funds exclusively through competent capital management.

Investment Education Online

The Fisher Investments website contains a section with useful information for investors that is worth knowing to understand how money can work for you. However, the broker does not provide a knowledge base sufficient for an investor to independently manage his funds since, at Fisher Investments, portfolio management is taken over by personal managers.

The omnipresence of the Fisher Investments broker assumes the nonexistence of a demo account that clients could use to practice their trading skills.

Security (Protection for Investors)

Fisher Investments is an international broker, and its activities are regulated by different authorities, depending on the country. So, the work of a broker in the United States is regulated by the Securities and Exchange Commission - SEC (license: CRD # 107342 / SEC #: 801-29362). The company's operations in the UK are controlled by the Financial Conduct Authority - FCA (license: 191609). In total, the Fisher Investments broker provides services in 15 countries, and the company is officially registered in each country.

The concern for client funds is that the broker uses third-party, segregated accounts to store investors' capital. Thus, Fisher Investments is unable to use these funds and does not have access to them.

👍 Advantages

- The broker is licensed to provide financial services in different countries

- Client funds are protected

👎 Disadvantages

- Fisher Investments does not cooperate with compensation funds

- The broker's website does not contain information about all of its licenses and regulators.

Withdrawal Options and Fees

-

To withdraw the earned funds, the investor must directly contact the personal manager.

-

The broker does not charge a commission for transferring funds to a client’s personal account.

-

Information on withdrawal methods is not available, the manager selects a payment system individually for each client.

Customer Support Service

The Fisher Investments broker does everything to help existing and potential clients solve all the questions and problems that arise. In this regard, the company offers hotline numbers and provides all its clients with a personal investment advisor.

👍 Advantages

- Each client receives a personal manager who resolves all issues

- The broker offers numbers for registered clients and those who have not yet opened an account with Fisher Investments

- Investors may visit the offline offices of the company

👎 Disadvantages

- The broker does not indicate the working hours of its support team

- Online chat is not available on all pages of the site

This broker provides the following communication channels for its clients:

-

call one of the numbers indicated in the "Contact Us" section;

-

fill out the feedback form;

-

use the online chat, which is available in the "What We Offer" section;

-

visit the physical office of the broker.

Fisher Investments is also represented on social networks like Facebook, LinkedIn, YouTube, and Twitter.

Contacts

| Foundation date | 1979 |

| Registration address | The broker's head office is located at 5525 NW Fisher Creek Drive Camas, WA 98607 |

| Regulation |

SEC, FCA |

| Official site | https://www.fisherinvestments.com/ |

| Contacts |

Phone:

1 (888) 823-9566

|

Review of the Personal Cabinet of Fisher Investments

Fisher Investments’ services and offers are available to users who have become clients of the broker. To open an account with a company, an investor needs to visit the real (brick and mortar) office of Fisher Investments located at 5525 NW Fisher Creek Drive, Camas, WA 98607 because the online opening of an account is not possible. On the broker's website, you can only request a consultation with a manager who will select an individual investment plan. This can be done by opening the "Contact Us" section and conveniently contacting the company’s employees.

After registering with a broker, the client will have access to the following options in his personal account:

-

Trading and entering stock exchanges through a broker.

-

Contact the broker's support service.

-

Communicate with a personal manager.

-

Make financial transactions for depositing funds and withdrawing profits.

-

Open different types of accounts for investment and retirement savings.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Fisher Investments rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Fisher Investments you need to go to the broker's profile.

How to leave a review about Fisher Investments on the Traders Union website?

To leave a review about Fisher Investments, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Fisher Investments on a non-Traders Union client?

Anyone can leave feedback about Fisher Investments on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.