deposit:

- $1

Trading platform:

- Proprietary platform

- ACPR

- l’ORIAS

Fortuneo Review 2024

deposit:

- $1

Trading platform:

- Proprietary platform

- Up to 1:5

- Free investment guide is provided

Summary of Fortuneo Trading Company

Fortuneo is a broker with higher-than-average risk and the TU Overall Score of 4.33 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Fortuneo clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Fortuneo ranks 77 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Fortuneo is suitable for experienced traders and investors looking to shift their focus to Europe, provided they have a sufficient command of French, which effectively limits participation to residents of France, Belgium, Switzerland, and Luxembourg, as well as other Francophiles living elsewhere.

Fortuneo Broker (pronounced “For-tu-neo Broker”) was established in 2000 as a subsidiary of Crédit Mutuel Arkéa, a major French bank. It also provides brokerage services to traders. The primary focus in the financial markets includes stocks, bonds, and fund investments. A significant advantage for clients is the opportunity to receive a 100% reimbursement of expenses associated with transferring assets to Fortuneo from another broker. The bank equally caters to both individual clients (traders, investors) and corporate clients (various funds, and companies).

| 💰 Account currency: | EUR |

|---|---|

| 🚀 Minimum deposit: | €0 |

| ⚖️ Leverage: | Up to 1:5 |

| 💱 Spread: | Not available due to peculiarities of trading on the stock exchange |

| 🔧 Instruments: | Shares, trackers, treasury securities, SICAV, FCPs, and derivatives |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Fortuneo:

- The trading platform is fully adapted for online trading, with all features accessible from both PCs and mobile devices.

- The bank fully compensates all client expenses for transferring assets from another company to any account type at Fortuneo within four weeks of applying.

- The broker is transparent in its operations and is monitored by multiple European regulators.

👎 Disadvantages of Fortuneo:

- The broker caters to traders who are proficient in French.

- The company's website lacks comprehensive educational resources.

- Trading is limited to the stock exchange (without access to the Forex market).

- Online chat support is not available.

- Trading can only be conducted through a browser. There are no desktop trading platforms.

Evaluation of the most influential parameters of Fortuneo

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Fortuneo

Fortuneo Brokerage (Fortuneo Banque) offers a variety of options for investment. Even regular securities accounts have the option to be managed by the company's specialists. Traders can choose a tariff based on the frequency of transactions within the accounting period. Traders also receive free access to technical analysis tools, and there is no account maintenance fee.

Real-time economic news and stock summaries are presented in a separate section on the Fortuneo Banque (Fortuneo) website. The information is categorized by sectors such as stocks in the stock market, indices, etc. All information on the website is presented only in French, which may pose a challenge for effective use as it requires the user to have a fairly high proficiency level in the language. However, the website is intuitive and well-structured, allowing users to find all necessary information using an online translator. Client support can be reached by phone and email, but online chat is not available.

In general, Fortuneo Banque is an intuitively understandable platform for French-speaking traders and investors of any experience level. The initial investment size can be flexible, as the broker does not set requirements for a minimum deposit. Additionally, investment funds with zero entry thresholds are available.

Dynamics of Fortuneo’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Fortuneo offers investors a choice of over 9,000 funds, with 700 of them having zero entry thresholds. The available investment programs include PEA and PEA-PME accounts.

PEA and PEA-PME are accounts for investment from Fortuneo Banque

PEA and PEA-PME accounts are designed for investing in securities of small and medium-sized European companies. The main goal of such offerings is to stimulate the development of these enterprises within the European Union. Features of this investment type include:

Investor is free from paying taxes on net profit after 5 years of participation in the selected fund.

Free access to analytics and technical analysis tools, with company experts assisting in developing an investment strategy.

Accounts are available only for tax residents of France (unlike regular trading accounts, which can be opened by citizens of any country). The range of instruments is limited to shares of small companies.

The term of investment programs is at least 5 years, with annual profits not exceeding €225,000.

Fortuneo Banque is primarily focused on investors residing in France. Many of the offered long-term investment programs allow French citizens to benefit from tax advantages.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Fortuneo partnership program:

“Affiliate” is an online partnership program where Fortuneo rewards for traffic acquisition (pay-per-click), lead generation (payment per form), and the sale of banking or brokerage services.

“Sponsorship” partners receive €50 or €110 for each newly attracted client, depending on the type of service chosen by the referee. Rewards are available up to 10 times a year.

Fortuneo offers partner programs through Public Idées, a partner company of Crédit Mutuel Arkéa. Website owners, bloggers, and publishers receive a full range of solutions (Coregistration, Retargeting, White Label, and adFactory) with commissions for clicks, acquiring new clients, and selling marketing tools.

Trading Conditions for Fortuneo Users

To trade on the stock exchange with Fortuneo, you need to open a securities account with the broker. There are no requirements for a minimum initial deposit, and no maintenance fees are charged. All operations are conducted through the browser on a PC or mobile device, without the need to install desktop software. Each client can have an unlimited number of accounts, but it is not possible to transfer securities from a standard exchange account to PEA or PEA-PME accounts.

$1

Minimum

deposit

1:5

Leverage

11/5

Support

| 💻 Trading platform: | Fortuneo’s proprietary trading platform |

|---|---|

| 📊 Accounts: | Standard securities, investment PEA and PEA-PME |

| 💰 Account currency: | EUR |

| 💵 Replenishment / Withdrawal: | Visa, Mastercard, and Gold CB Mastercard |

| 🚀 Minimum deposit: | €0 |

| ⚖️ Leverage: | Up to 1:5 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | No |

| 💱 Spread: | Not available due to peculiarities of trading on the stock exchange |

| 🔧 Instruments: | Shares, trackers, treasury securities, SICAV, FCPs, and derivatives |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Free investment guide is provided |

| 🎁 Contests and bonuses: | Welcome bonuses from €50 to €130 for opening a bank account; rebates from TU |

Fortuneo Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard securities account | From €3.9 to €20 or from 0.1% to 0.2% of the transaction volume, depending on the selected tariff and the number of performed transactions | No |

| PEA | From €0 to €9.5 per transaction depending on tariff and number of orders | No |

| PEA-PME | From €0 to €9.5 per transaction depending on the tariff and number of orders | No |

Swaps for carrying over existing positions to the next day are not applied. Additionally, specialists at TU conducted an analysis and comparison of trading fees between Fortuneo and other brokers. The results of the analysis can be found in the table below.

| Broker | Average commission | Level |

| Fortuneo | $7.22 | High |

| Revolut | $2.99 | Medium |

| eToro | $1.1 | Low |

Detailed review of Fortuneo

Fortuneo Banque is a major international bank targeting French-fluent clients from France and European Union countries. Brokerage services are a key focus for the company, with a primary emphasis on investments for preferential tax treatment (through investments in securities of small and medium-sized enterprises) and active trading in the stock market. Fortuneo aims to retain its client base by offering advantageous trading conditions. The broker's fees decrease with an increase in the actual volume and number of transactions during the accounting period.

Fortuneo by the numbers:

Broker has over 800,000 clients from France, Belgium, Switzerland, and Luxembourg.

Total bank assets exceed 27 billion EUR.

Broker has over 35 international awards.

Fortuneo is a unique broker that provides investment solutions with the opportunity to benefit from tax advantages

Trading with Fortuneo is suitable for experienced active traders, as the website does not offer beginner-level training. However, the platform provides both fundamental and technical analyses, along with tools for forecasting investment potential in preferred directions. Fortuneo allows users to choose a tariff plan according to their trading strategy (which also determines the broker's commission). The tariff can be selected for both a regular securities account and for both investment account types. Experienced traders can optimize their costs independently, and with a high frequency of transactions, the commission is minimized to 0.1% of the total transaction amount. Within the same profile of activity, different tariffs can be used to gain additional benefits from reducing expenses.

New and existing clients can benefit from partner and bonus programs. Compensation for the transfer of assets to Fortuneo from other companies is also available.

Fortuneo’s analytical services:

News section with a map of major global stock exchanges. News is categorized as politics and economics, with a focus on events in European countries and key events globally.

Quotes for popular securities, categorized based on the type of the instrument.

Analytical reviews of global financial markets.

Filters for selecting investment instruments based on specified criteria.

The "Taxation" section includes a table of changes in the tax rate depending on the investment period for PEA and PEA-PME fund investors.

Advantages:

Broker offers the opportunity to reduce commission fees with an increase in transaction frequency.

The company’s activity is monitored by several European regulators.

Investment programs provide tax benefits for French citizens.

Compensation is available for the transfer of funds from another broker or bank.

The website is intuitive and well-structured.

The full mobile platform version is available and offers the same functionality as the desktop version.

For active traders, there are no restrictions on tactics in the stock market, but for short-term trading, the broker offers more favorable conditions (minimizing commission fees).

Guide on how traders can start earning profits

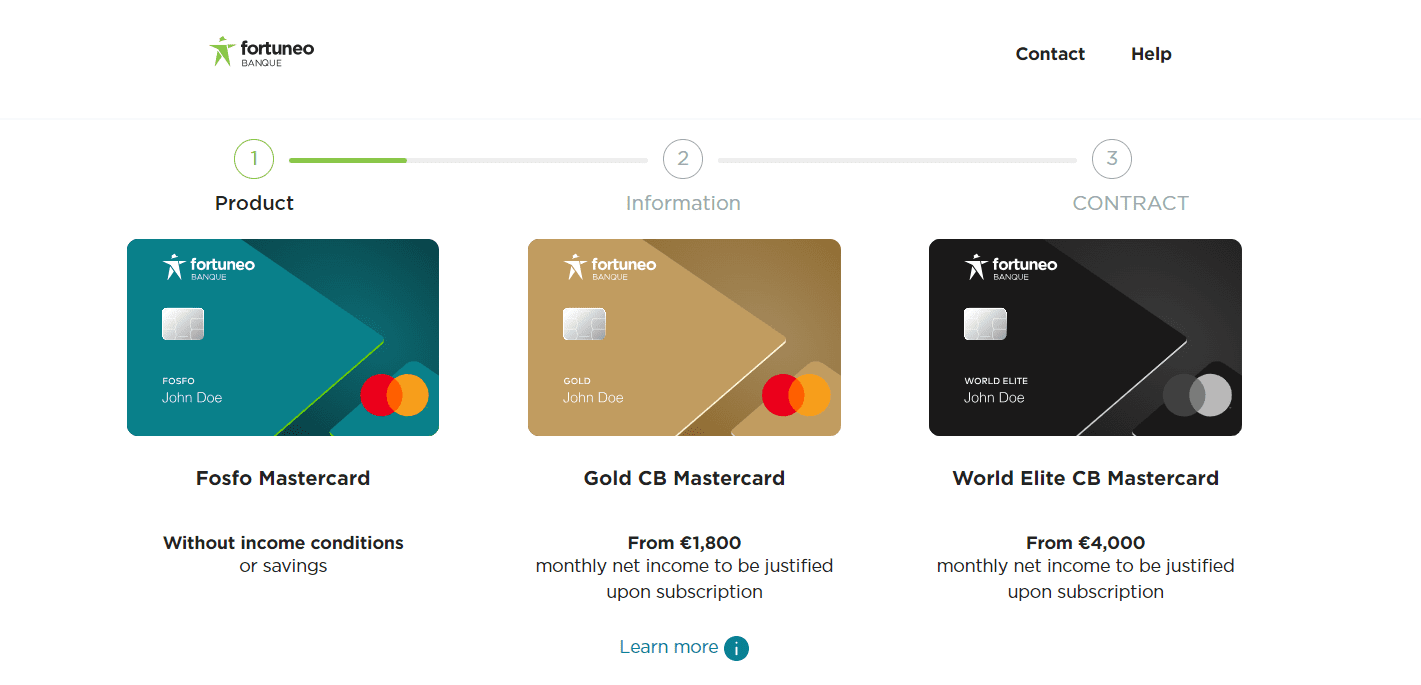

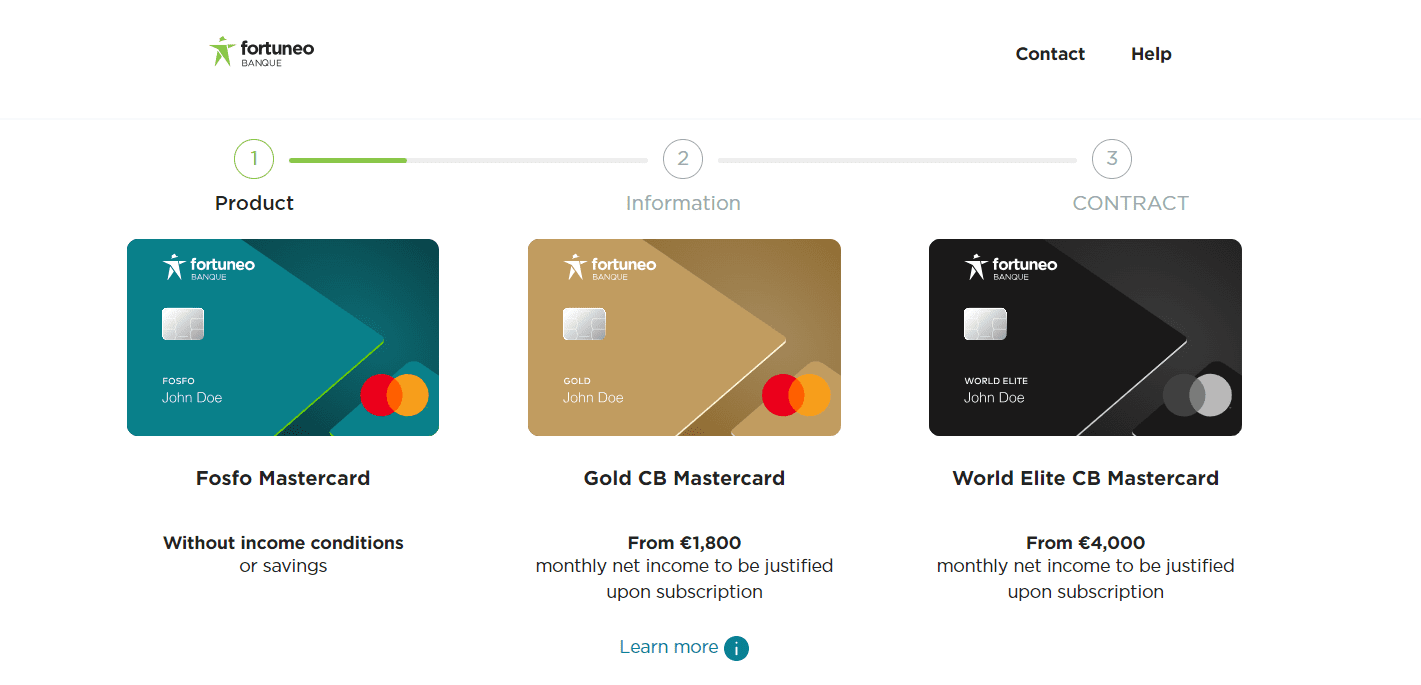

Fortuneo offers three types of accounts, two of which are investment accounts and one for trading.

Account types:

There are no educational opportunities for working with financial instruments of the stock market in demo mode.

The broker is well-suited for experienced traders engaged in intraday trading and for transferring assets to Europe for investment in local businesses.

Welcome bonus for using the Gold CB Mastercard

A new user who opens an account through the invitation of a previously registered company client receives €80 + an additional €50 when depositing at least €300 to the card.

Bonus for opening a FOSFO MasterCard bank account

A new client who subscribes through a special link receives €50 to the balance. The minimum account deposit amount to qualify for the bonus is €300.

Investment Education Online

Fortuneo does not offer comprehensive training. The company’s clients have access only to a limited number of paid online webinars. The basics of trading securities can be found in the "Stock Market Guide" section. All information is presented in French.

Demo accounts are not available. Consultations on the prospects of specific investments from experts can be obtained, but this option becomes available only during actual trading.

Security (Protection for Investors)

Fortuneo operates within the territories of European countries under the unified broker law, Sapin II. The protection of clients' data is based on the European Union Regulation (2016/679).

The company has obtained a license from the French Prudential Supervision and Resolution Authority (ACPR) for providing investment services. As an insurance broker, its activities are regulated by ORIAS — the Association for the Certification of Insurance, Banking, and Finance Intermediaries.

👍 Advantages

- Transparency of the bank's operations under the unified regulatory framework of the European Union

- Client funds are held in segregated bank accounts

👎 Disadvantages

- The broker is under the jurisdiction of France, which makes it nearly impossible for traders from other countries to submit complaints

- To trade on the exchange, you must first open a bank account

- Verification of personal and payment data is a mandatory procedure

Withdrawal Options and Fees

A client can submit a withdrawal request from Monday to Friday, between 8:00 and 19:00 (Paris time).

Withdrawal methods are limited, and funds can only be withdrawn to Visa, Mastercard, and Gold CB Mastercard bank cards.

To protect the client's card from online fraud, the Secure Internet Payment technology is applied, and a virtual card linked to the real one is created for each transaction.

Withdrawals are processed only in EUR.

The bank does not charge a commission for transferring funds to cards.

Customer Support

Client support specialists process inquiries and respond to client questions from Monday to Friday, from 8:00 to 19:00.

👍 Advantages

- Complaints can be submitted through a special section (available 24/7).

👎 Disadvantages

- Support is not available on weekends.

- There is no online chat on the website.

- The communication language is exclusively French.

Clients can contact support specialists through the following methods:

By phone.

Writing to the company's email.

Using a special feedback form in a dedicated section of the website.

Contact with client support can be made through the mentioned methods from the user account.

Contacts

| Foundation date | 2000 |

| Registration address | 380 Rue Antoine de St Exupéry, 29490 Guipavas, France |

| Regulation |

ACPR, l’ORIAS |

| Official site | https://www.fortuneo.fr/ |

| Contacts |

Email:

0800 800 040,

|

Review of the Personal Cabinet of Fortuneo

Before starting to work in the financial market with the Fortuneo broker, go through the following steps:

On the company's homepage, select the "Stock Exchange" section and click on the "Open an Account" button.

Choose the type of account (for trading, PEA, PEA PME). Fill out the registration form, and provide your name, surname, date of birth, country of residence, address, and phone number. You will also need to provide financial information about your annual income and its sources. Then, authorize a review in the "Client Access" section and undergo verification.

Features of the Fortuneo user account:

Your Fortuneo user account also provides access to:

-

Connection to a section with expert consultations for choosing a suitable trading strategy.

-

Display of bond interest rate indicators.

-

Track data on commodity quotes.

-

View the account balance, transaction history, and information on portfolios of acquired securities.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Fortuneo rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Fortuneo you need to go to the broker's profile.

How to leave a review about Fortuneo on the Traders Union website?

To leave a review about Fortuneo, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Fortuneo on a non-Traders Union client?

Anyone can leave feedback about Fortuneo on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.