deposit:

- £1

Trading platform:

- IG Trading Platform

- HL

- HL-mobile

- Financial Conduct Authority (FCA)

Hargreaves Lansdown Review 2024

deposit:

- £1

Trading platform:

- IG Trading Platform

- HL

- HL-mobile

- Not available for stock market instruments; up to 1:200 for CFD and Forex

- Participation in bidding by phone is possible

Summary of Hargreaves Lansdown Trading Company

Hargreaves Lansdown is a moderate-risk broker with the TU Overall Score of 5.32 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Hargreaves Lansdown clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Hargreaves Lansdown ranks 44 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Hargreaves Lansdown is suitable for trading and investment clients who are experienced in stock market trading.

Hargreaves Lansdown (Hargreaves) has been operating in the stock market since 2007 and provides access to securities that are listed on 23 world stock exchanges. The company is controlled by the Financial Conduct Authority (FCA, 115248) and its clients' investments are protected by the Financial Services Compensation Scheme (FSCS). Many stocks on Hargreaves Lansdown are also included in the FTSE 100 index, which is an indicator of its success. In 2021, the broker was recognized as the Best Investment Platform according to Your Money Awards, and also was awarded the Best for Digital ISA and Best Buy Pension from Boring Money Best Buys. Hargreaves Lansdown is headquartered in Bristol, UK.

| 💰 Account currency: | £ |

|---|---|

| 🚀 Minimum deposit: | From £1 |

| ⚖️ Leverage: | Not available for stock market instruments; up to 1:200 for CFD and Forex |

| 💱 Spread: | From 0.6 pips (for currency pairs) |

| 🔧 Instruments: | ETCs, ETFs, stocks, trusts, CFDs, Forex |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Hargreaves Lansdown:

- FCA monitors the brokers’ trading activities.

- participation in the FSCS funds protection program.

- Zero brokerage commission on UK stocks.

- Free funds withdrawal from investment accounts.

- the minimum deposit is £1.

- a wide range of assets - over 3,000 investment funds.

- Convenient search for funds, with filters for the investor's portfolio.

- Provides free advice from professional investment experts.

👎 Disadvantages of Hargreaves Lansdown:

- Trading in futures, options, and cryptocurrencies is not supported.

- Investing in retirement accounts is only available to UK citizens.

- Lack of demo accounts and online chat on the website.

Evaluation of the most influential parameters of Hargreaves Lansdown

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Hargreaves Lansdown News

- Analysis of Hargreaves Lansdown

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Hargreaves Lansdown

- User Reviews of Hargreaves Lansdown

- FAQs

- TU Recommends

Geographic Distribution of Hargreaves Lansdown Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Hargreaves Lansdown

The Hargreaves Lansdown broker offers three types of investment accounts, which differ in minimum deposit, taxation methods, and fees. UK tax residents can open Junior accounts for a child with management rights after the age of 18 and Active Savings.

Hargreaves Lansdown doesn’t have a fixed trading platform for securities trades. Trading is carried out on the website or using a mobile application with advanced functionality for quick financial instruments search. Available order types are Market, Limit, Stop loss, Stop trailing. Integration with third-party terminals is only available to traders who trade CFDs and currency pairs through an IG Markets partner broker.

The Web Terminal on the broker's website allows you to use technical indicators and graphical tools to adjust for the chosen strategy; however, actual quotes come with a delay of up to 15 minutes. But the main disadvantages of Hargreaves Lansdown are the lack of an online chat and demo account, as well as a currency exchange commission when trading foreign stocks.

Dynamics of Hargreaves Lansdown’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Hargreaves offers over 3,000 investment funds, trusts, ETFs, CFDs, and stocks.

Investing in VCT is a great deal from Hargreaves Lansdown

Investing in venture capital trust (VCT) funds is aimed at generating income from investments in startups. They are selected by the experts at Hargreaves Lansdown, and at the request of the client, the selected funds can be presented in the form of a ready-made investment portfolio. Features of investing in VCT funds:

-

Investing in venture capital funds stimulates the state by providing tax incentives of up to 30%.

-

The customer gets tax-free dividend income.

-

There are high financial risks since investments are made in developing companies.

-

Shares can be sold without losing dividends no earlier than five years later.

The experts at Hargreaves structure investments in core companies only, which ensures stable dividends and reduces the client's financial risks.

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Hargreaves Lansdown’s affiliate program

-

The Referral Program is designed for website owners. It involves placing links and advertising banners dedicated to the activities of Hargreaves Lansdown on the owner's thematic resource. The amount of remuneration to be paid to a partner depends on the effectiveness of advertising and is determined on an individual basis.

The website owner must fill out an application on the broker's website indicating the URL of his resource to take part in the affiliate program. A positive decision on the accrual of remuneration is made by the company if the content of the website offered corresponds to Hargreaves Lansdown's activities.

Trading Conditions for Hargreaves Lansdown Users

Hargreaves allows investing in British and foreign stocks, funds, trusts, and CFDs. The broker doesn’t provide leverage, and the size of the minimum deposit, depending on the type of account, is from £1 or £100. Trading operations can be carried out with the support of a financial advisor at the request of the client. Forex and CFD trading are provided by an IG partner (IG Index Limited and IG Markets Limited).

£1

Minimum

deposit

1:200

Leverage

8/5

Support

| 💻 Trading platform: | HL, HL-mobile, IG Trading Platform (spread betting & CFD) |

|---|---|

| 📊 Accounts: | Fund & Share Account, Junior Investment Account, Stocks and Shares ISA, Lifetime ISA (LISA), Junior Stocks and Shares ISA, SIPP, Junior SIPP, Active Savings |

| 💰 Account currency: | £ |

| 💵 Replenishment / Withdrawal: | Faster Payment, bank transfer |

| 🚀 Minimum deposit: | From £1 |

| ⚖️ Leverage: | Not available for stock market instruments; up to 1:200 for CFD and Forex |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | From 0.6 pips (for currency pairs) |

| 🔧 Instruments: | ETCs, ETFs, stocks, trusts, CFDs, Forex |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Participation in bidding by phone is possible |

| 🎁 Contests and bonuses: | Yes |

Hargreaves Lansdown Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Fund & Share | from $5.95 | No |

| SIPP | from $5.95 | No |

| ISA | from $5.95 | No |

The broker doesn’t charge a commission for inactivity on accounts. After assessing the fees of Hargreaves Lansdown by Traders Union analysts, they were compared with the commissions of Ally and Charles Schwab. Since all three brokers don’t charge fees for trading in stocks quoted on national exchanges, please find the comparison of ETF fees in the table below.

| Broker | Average commission | Level |

| Hargreaves Lansdown | $5.95 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of Hargreaves Lansdown

Hargreaves Lansdown offers you ready-made investment solutions such as portfolios of funds and shares that are composed by the company's experts taking into account liquidity and the degree of financial risks desired by the client. The investor can independently form his portfolio from the offered products or use the financial consultant’s help.

Hargreaves Lansdown in figures:

-

The company's services are used by about 1.5 million customers with a total capital of £120 billion.

-

There are 1,500 ETFs and 3,000 ETCs available for trading.

-

The broker provides access to 23 leading stock exchanges.

-

The commission for trading in UK stocks is £0.

Hargreaves Lansdown is a broker for large retail traders and investors who are familiar with the stock market

Hargreaves provides clients with a wide range of funds, stocks, and CFDs. To help traders, the company offers investment ideas and research analysts, the View Wealth Shortlist service for creating a portfolio of assets taking into account their long-term potential, as well as a wide range of tools for technical market analysis. Moreover, Hargreaves allows clients to allocate pending orders of all types and execute trades by phone for £1 per trade.

Trading is available through an interactive platform on the broker's website, available from any device that has internet access. You can open the website in all available browsers, and the mobile application works on smartphones with iOS 10.0 or better and Android version 5.0 or better.

Useful Hargreaves Lansdown services:

-

Forms and tools for quick amendments and additions to your account.

-

Watchlists for stocks and price movements with notifications of upcoming important news or significant events.

-

Drawdown, inflation, and regular investment calculator.

-

Guides for choosing funds for investment.

-

Research section by asset class, sector, and market.

-

The News Feed covers events at Hargreaves Lansdown and other major companies that trade on the world's stock exchanges.

Advantages:

Free maintenance and opening of trading accounts.

No commission fees for deposits or withdrawal of funds.

Possibility of opening youth accounts for minors with the registration of trust management.

All software is provided free of charge.

Over 1,500 British stocks can be traded without commission.

Trade more and pay less. This commission policy applies for active traders monthly in an automatic mode.

How to Start Making Profits — Guide for Traders

Hargreaves Lansdown offers traders and investors three types of investment accounts (including retirement) and one savings account. Each differs in applicable commissions and the versatility of the financial instrument.

Types of accounts:

The company doesn’t provide a demo account.

The Hargreaves Lansdown broker cooperates with experienced traders who invest in international equity markets, as well as UK tax residents interested in professional financial and retirement planning.

Bonuses Paid by the Broker

Loyalty bonus

The company makes monthly payments to clients for completed trades. The amount of the bonus depends on the number of lots closed. Funds paid to ISA and SIPP accounts are not taxable. You can get bonuses in cash, use them to pay commissions, or reinvest them. You can find the amount of the bonus under the "Bonus balance and loyalty settings" segment of the personal account.

Investment Education Online

Hargreaves Lansdown doesn’t provide courses for novice traders and investors, but hl.co.uk offers a Learn section with recommendations for working in the stock market, as well as useful services and guides.

Risk-free test trading is impossible since the broker doesn’t provide a demo account.

Security (Protection for Investors)

Hargreaves Lansdown is controlled by the Financial Conduct Authority (FCA).

Since the broker's shares are included in the FTSE 100 index, the regulator conducts frequent and thorough audits. But CFDs are not a stock market instrument and therefore these trading assets are not regulated. Client funds are held in segregated accounts with third-party banks and are insured against bankruptcy by the Financial Services Compensation Scheme (FSCS) for up to £85,000 per registered investor.

👍 Advantages

- The broker is insured

- You can file a claim with a supervisory authority

- Listed on the London Stock Exchange

- Doesn’t use credit or borrowed funds

- Clients’ funds are stored in third-party bank accounts

👎 Disadvantages

- CFD trading is not regulated

- Limited amount of insurance

- The variety of withdrawal options is limited by the supervisor

Withdrawal Options and Fees

-

The broker offers two ways to withdraw funds: bank transfer and payments through the Faster Payment System. First, specify the account number to which the transfer will be made in the case of a bank transfer. A withdrawal request can be made by phone. There is also a form to fill out on the website.

-

Withdrawals by bank transfer are carried out within 3-5 working days, and instantly through the payment system. Moreover, just processing the application takes up to two days.

-

There is no commission for withdrawing funds, but foreign citizens are charged separately for currency conversion in the amount of 1% of the amount. Also, extra commissions can be charged by the bank/intermediary/recipient.

Customer Support Service

Support is available six days a week from 8:00 am to 5:00 pm Monday through Friday and from 9:30 am to 12:30 pm on Saturday, Central European Time.

👍 Advantages

- You can contact the support by request for service form

- Nine phone numbers are available according to the topic of the problem

- There is a FAQs section

- You can email the company.

👎 Disadvantages

- No 24/7 support

- No online chat

This broker provides the following communication channels:

-

by phone, using the numbers indicated on the website;

-

by writing an email.

-

by filling out the request form on the broker's website.

-

by sending a letter by regular mail as indicated on the hl.co.uk website if the issue cannot be resolved with the help of support.

Contacts

| Foundation date | 1981 |

| Registration address | One College Square South, Anchor Rd, Bristol BS1 5HL, United Kingdom |

| Regulation |

Financial Conduct Authority (FCA) |

| Official site | https://www.hl.co.uk/ |

| Contacts |

Phone:

0117 980 9950

|

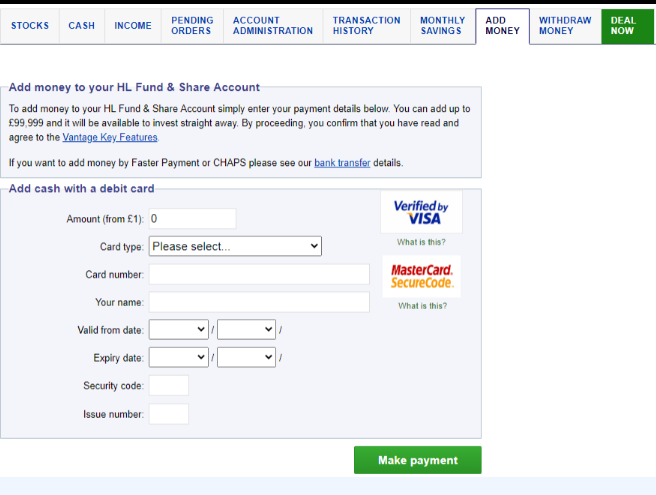

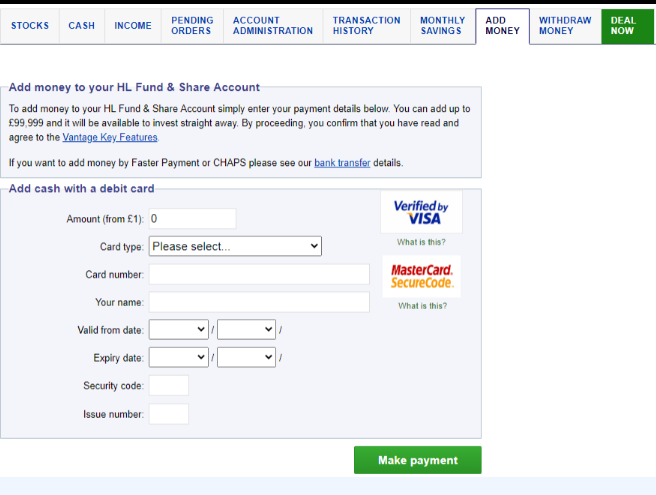

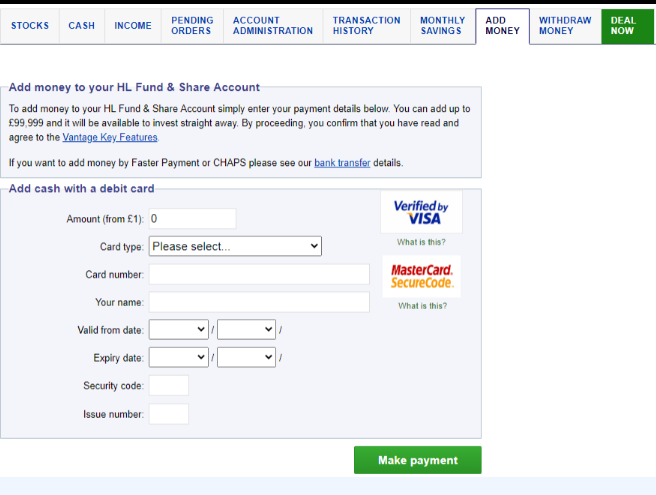

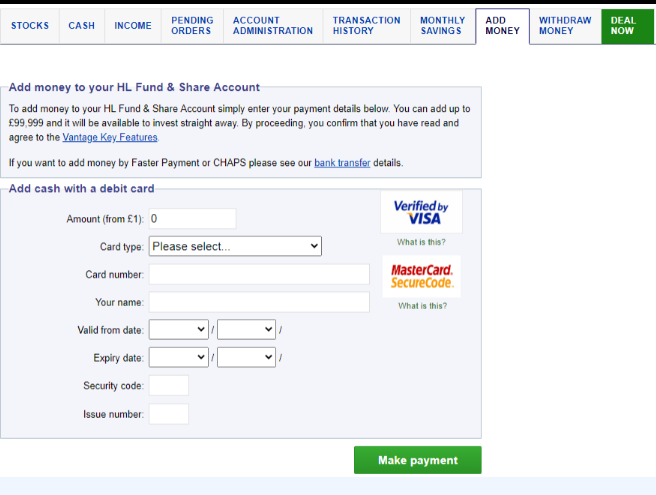

Review of the Personal Cabinet of Hargreaves Lansdown

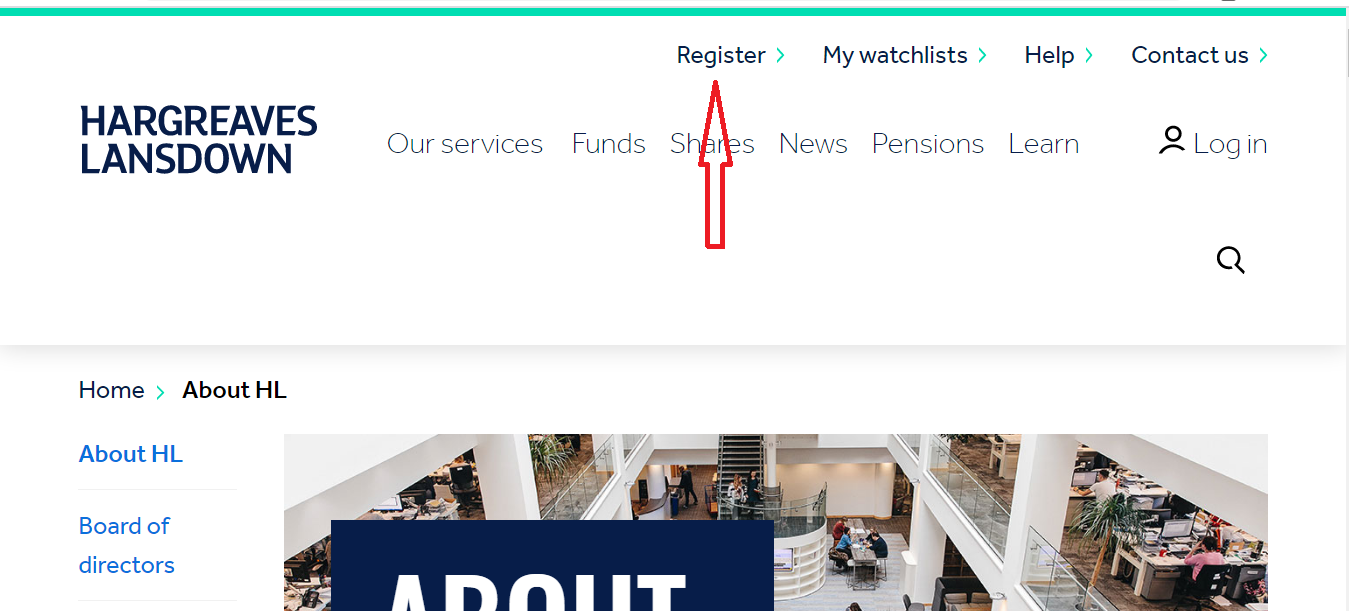

Select an account type and complete the registration form to become a Hargreaves Lansdown customer. The brief matrix of actions is below:

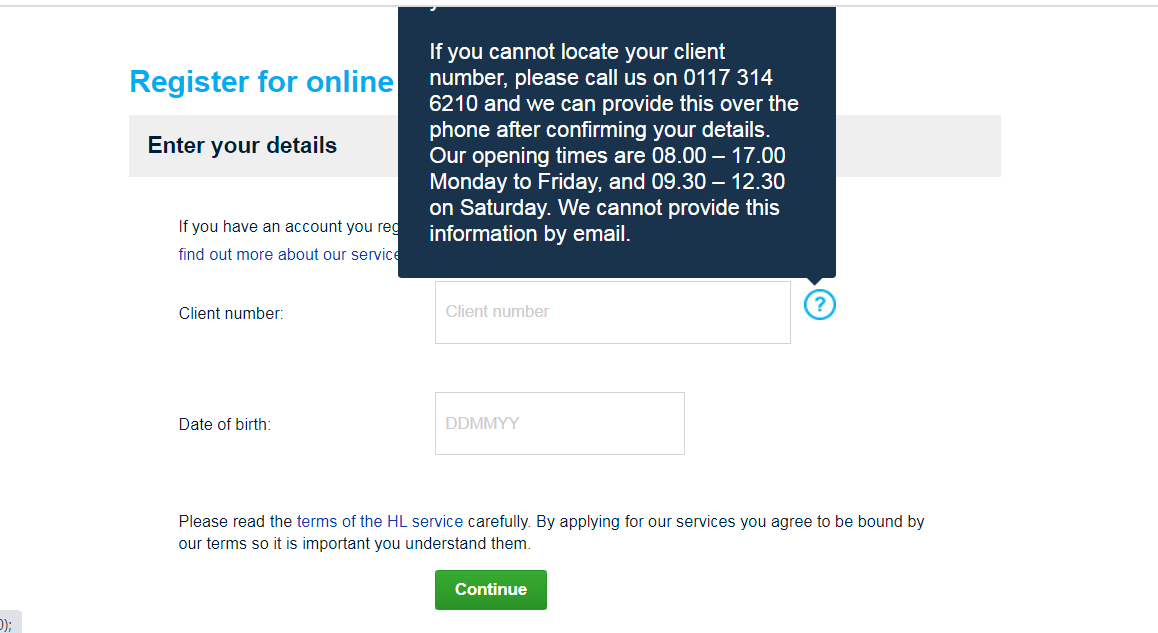

Follow the broker's website and click the "Register" button at the top of the screen to register.

Enter your personal data and the client number assigned by the broker in the form below. You can get it from the support service by calling during company business hours. This information is not provided by email.

Enter your personal account after approval of the application for opening an account. Enter the password and three randomly selected digits of the generated secret number for authorization in the system. Then go through verification and make a deposit. Also, at this stage, access to the software and the execution of trade operations opens.

A personal account allows you to:

1. Deposit and withdraw funds:

2. Place orders via the web terminal:

1. Deposit and withdraw funds:

2. Place orders via the web terminal:

The following actions are also available to the investor in the personal account:

-

Search for an instrument or broker for investment by company name or asset ticker.

-

Connecting alerts and notifications about price movements, dividend payments, and news from regulatory bodies.

-

View reports with the approximate calculation of trading commissions for the selected portfolio for the next five years.

-

Choice of the methods to use bonuses such as withdrawal to the account, payment of trading commissions, or reinvestment.

-

Gaining trading ideas which are recommendations from leading brokerage and financial companies, including Barclays, HSBC, UBS, and others.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Hargreaves Lansdown rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Hargreaves Lansdown you need to go to the broker's profile.

How to leave a review about Hargreaves Lansdown on the Traders Union website?

To leave a review about Hargreaves Lansdown, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Hargreaves Lansdown on a non-Traders Union client?

Anyone can leave feedback about Hargreaves Lansdown on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.