Merrill Edge Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Merrill Edge

- 1:1

- The broker is suitable for investing and does not offer tools for active trading.

Our Evaluation of Merrill Edge

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Merrill Edge is a moderate-risk broker with the TU Overall Score of 6.19 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Merrill Edge clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Merrill Edge is a brokerage company focused exclusively on working with American investors, yet it’s suitable for both beginners and professionals.

Brief Look at Merrill Edge

The Merrill Edge brokerage company was created by the Bank of America Merrill Lynch. The broker’s activities are regulated by two government bodies: the Financial Industry Regulatory Authority (FINRA, CRD#: 7691/SEC#: 801-14235,8-7221) and the Securities and Exchange Commission (SEC).

The broker is focused on cooperation with investors and offers instruments for long-term and short-term investment. The company offers accounts for beginners and professionals, and also allows you to choose the appropriate deposit option, including savings for retirement, providing a financial cushion for children’s future education, and others.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Availability: the minimum investment amount to start investing is $1.

- The user can link his account to a bank account and manage his portfolio from the mobile application 24/7.

- The broker is only suitable for investing, there are no instruments for active trading.

- Reaching out to the support is an Augean task.

- Only US residents can open an account at Merrill Edge company.

- Complicated and snail-paced registration procedure.

TU Expert Advice

Author, Financial Expert at Traders Union

Merrill Edge offers a range of investment services, focusing on American investors with platforms suitable for both beginners and experienced traders. It provides account types, which cater to different trading needs. The company supports long-term and short-term investment strategies, particularly in stocks, ETFs, and bonds, with a minimum deposit of $1. Trading platforms include both desktop and mobile options, and it offers a comprehensive educational library and personal consultation services to enhance investor knowledge.

However, Merrill Edge shows certain drawbacks, including the absence of tools for active trading, as the offerings primarily suit long-term investors. Client support can be challenging to reach, and registration is limited to U.S. residents with a complicated process. Its trade fees may deter cost-focused traders. Therefore, Merrill Edge may be more suitable for investors aiming for long-term gains, rather than those seeking short-term trading opportunities or Forex. Its limitations can significantly affect traders who prioritize international accessibility and leverage.

Merrill Edge Summary

| 💻 Trading platform: | No |

|---|---|

| 📊 Accounts: | Merrill Edge Self-Directed, Merrill Guided Investing, Merrill Guided Investing with an advisor |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Visa bank cards, ATM top-up possible, transfer of funds from a Merrill Lynch bank account, and checks |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | $0.1 |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Stocks, exchange-traded funds (ETFs), mutual funds, bonds, and options |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Not indicated |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | The broker is suitable for investing and does not offer tools for active trading. |

| 🎁 Contests and bonuses: | No |

Merrill Edge offers optimal trading conditions for investing, as well as several instruments with which you can make a profit in the short- and long-term. There are no Forex assets in the broker's arsenal.

The minimum deposit on an account for beginners is $1. Professional accounts are limited to $1,000 and $20,000.

There is no leverage, but the broker offers margin lending. This feature is only available on a beginner account.

Merrill Edge Key Parameters Evaluation

Video Review of Merrill Edge

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

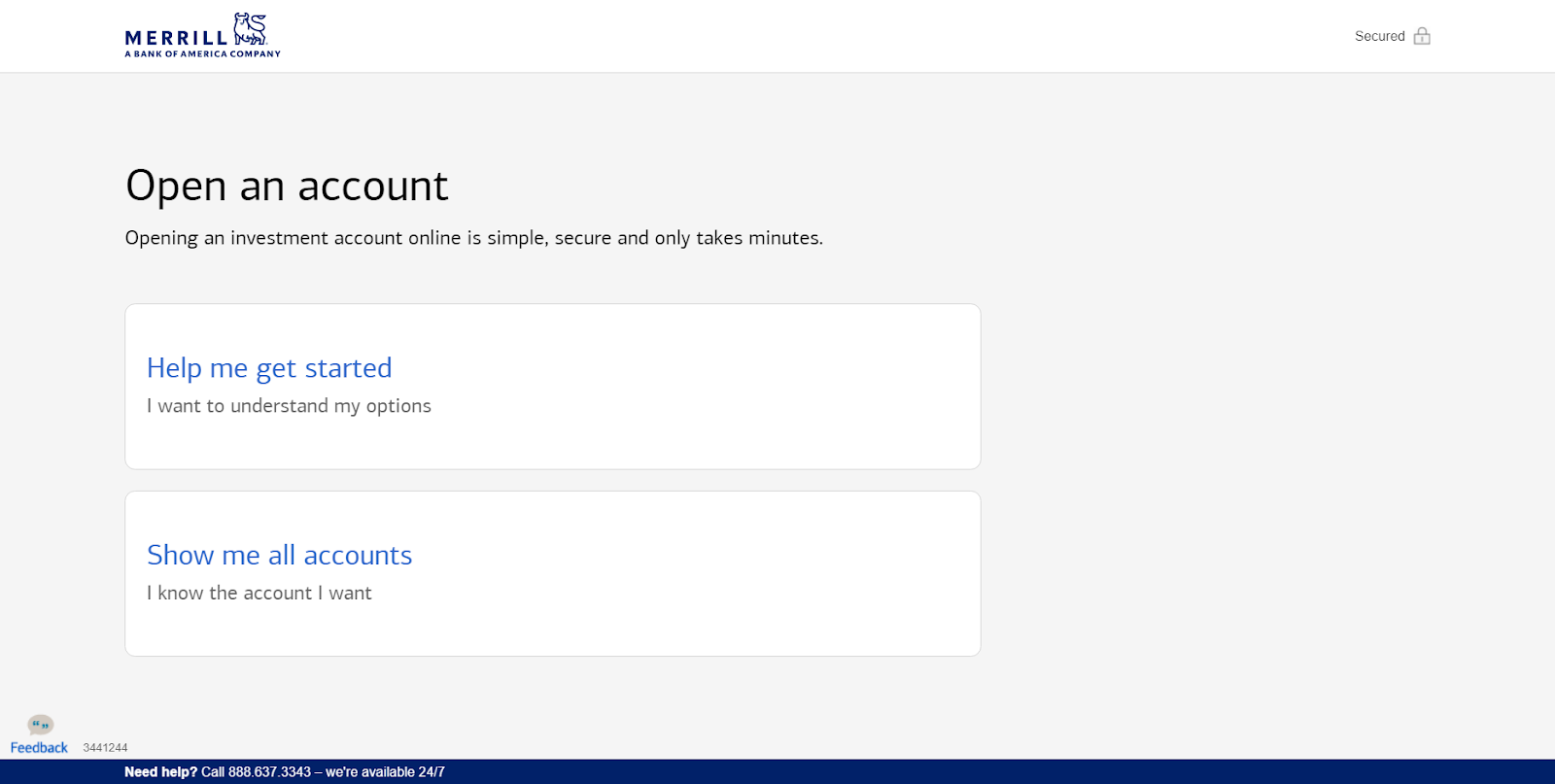

To open an account with Merrill Edge, enter the broker's official website. On the main page in the upper right corner, there is a button "Open an account", click on it. If you already have a brokerage account, fill out the form on the left and click "Log in".

In the "Help me get started" tab you can familiarize yourself with the types of accounts offered by the broker. If you have already selected the type of account, click the "Open now" button.

On the next page, the broker specifies the data that must be entered to register on the Merrill Edge website, such as: name, address, data on income, and investment experience. After filling out the registration form, your request will be sent for consideration. If the company approves the request, you will receive a letter from the broker, which will indicate the next steps to open an investment account.

Regulation and safety

The Merrill Edge broker is a subsidiary of Merrill Lynch Bank. Merrill Lynch Bank is registered with the SEC (US Securities and Exchange Commission). Also, its activities are controlled by FINRA (the Financial Industry Regulatory Authority) in the United States.

An investment account can be connected to a bank account and the company guarantees the confidentiality of the client's data. If the investor has any questions regarding the security of the brokerage account, he can contact the bank’s employees.

Advantages

- The broker is affiliated with Bank of America, which guarantees data confidentiality

- Merrill Edge is regulated by the SEC, FINRA

Disadvantages

- The company didn’t envision the creation of a segregated account.

- The broker and the bank have access to the investor's funds

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Merrill Edge Self-Directed | Stocks & ETFs - $0, Brokerage - $29.95 | Wire transfer fee - $24.95, fee for transferring funds to another brokerage company account - $49.95. From $2.5 or 0.25% of the transaction amount for a transfer via VISA. |

| Merrill Guided Investing | Stocks & ETFs - $0, Brokerage - $29.95 | Wire transfer fee - $24.95, fee for transferring funds to another brokerage company account - $49.95. From $2.5 or 0.25% of the transaction amount for a transfer via VISA. |

| Merrill Guided Investing with an advisor | Stocks & ETFs - $0, Brokerage - $29.95 | Wire transfer fee - $24.95, fee for transferring funds to another brokerage company account - $49.95. From $2.5 or 0.25% of the transaction amount for a transfer via VISA. |

The broker does not entertain swaps because trading accounts are suitable only for long-term investment. The Traders Union experts compared the commission level of Merrill Edge with other brokerage companies. The analysis showed that Merrill Edge’s trade fees are very high.

| Broker | Average commission | Level |

|---|---|---|

|

$29.95 | |

|

$4 |

Account types

To get started with Merrill Edge, you need to open a professional or beginner trading account.

Account types:

There is no demo account but the broker is agog to cooperate with investors, regardless of experience. The site contains training materials for all tools, and it is also possible to get advice from a specialist in the field of investment. A Merrill Edge Self-Directed account holder can also seek advice from a consultant.

Deposit and withdrawal

-

To withdraw funds, an investor needs to submit an application using his personal account. If you withdraw earnings to a Merrill Lynch bank card, no fee will be charged.

-

You can replenish your trading account with a Merrill Lynch bank card or through an ATM.

-

The broker does not provide information on the timing of the transfer of funds to the client's card.

-

You can use USD to top up your trading account. You need to check with the company's employees about the possibility of replenishing the deposit with other currencies.

-

To get started, the client must go through the verification procedure following registration, only after that, is it possible to deposit into the account. The broker may also require additional documents to transfer funds to the client's personal card.

Investment Options

Merrill Edge is a broker for investors that offers several ways to manage money:

-

Merrill Edge Self-Directed. This investment option is suitable for those who are ready to independently trade stocks, options, and other assets that make it possible to make a profit in the future. The investor can invest and manage funds at his discretion. Trading is also available from a mobile device.

-

Merrill Guided Investing or investment advisory program. Created for investors who not only want to make a profit but also achieve specific financial goals. A consultant who is always in touch will help the user fulfill the maximum plan.

-

Invest with an Advisor. An option for investors who want to manage an account single-handedly, but at the same time have a financial advisor nearby who will assist in selecting the most profitable investment options; and find a local or comprehensive solution to the client's financial issues.

Depending on the method of managing funds, the size of the minimum deposit, as well as trading conditions, change.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Merrill Edge’s affiliate program

The goal of any affiliate program is to provide traders and investors with an additional channel to receive passive income without making transactions personally. However, Merrill Edge is not able to receive financial bonuses for new customer acquisition. The broker aims to cooperate exclusively with active traders who make deals.

Customer support

If in the course of work the client encounters difficulties or has any questions, he can reach out to the broker's support service.

Advantages

- The line through which you can contact the company's specialists is available 24/7

Disadvantages

- Few ways to contact support

- Company employees do not perform their duties promptly

Available communication channels with customer support specialists include:

-

by phone using the number indicated on the website;

-

via Linkedin, Twitter, or Youtube.

Contacts

| Foundation date | 2009 |

|---|---|

| Registration address | Two Park Place, Hatch Street, Dublin 2, Ireland. Branch Office: 2 King Edward Street, London EC1A 1HQ. |

| Regulation | SEC, FINRA |

| Official site | merrilledge.com |

| Contacts |

888.637.3343

|

Education

Merrill Edge is committed to working with both experienced and budding investors. For clients to make deliberate and profitable trading decisions, the broker provides access to training materials. They allow you to monitor the market, understand how it works, and analyze the situation.

It will not be possible to check the broker's trading conditions without financial risks since Merrill Edge does not provide a demo account for risk-free trial investments.

Detailed Review of Merrill Edge

Merrill Edge looks into the future. The main task of the company is to provide its clients with a comfortable old age financially and achieve their other goals through investment. The broker is focused on short-term and long-term investments and is not suitable for active traders seeking instantaneous results.

The company offers a choice of three accounts: two for professionals and one for those new to investment. Also, each client can create an account taking into account their goals: savings for retirement, an account for minors, and a general trading account. Clients, regardless of the type of trading account, have access to the help of highly qualified specialists and an extensive library of training materials.

Merrill Edge by the numbers:

-

0.012 seconds is the average order execution speed.

-

95.35% of orders are executed at a price equal to the quoted price or even higher.

-

$1 is the size of the minimum deposit on a stand-alone account.

-

24/7 are the working hours of the support service.

Merrill Edge is the optimal broker for passive, long-term investing

The broker provides its clients with access to the stock markets, and allows them to buy and sell stocks, bonds, securities, and other assets that bring significant profits after a few months or years.

Useful Merrill Edge services:

-

Personal retirement calculator. Helps to calculate your future income and determine the period after which you can get a financially secure pension.

-

Roth IRA Conversion Calculator. With the help of it, you can find out if this tool suits you, and how beneficial it is for you.

-

RMD calculator. Option for clients aged 72 and over. Calculates the minimum annual allocation from the IRA.

-

Rollover calculator. Used when a client changes jobs. Shows the different retirement plan options for reallocation.

-

Finance distribution calculator. Allows you to consider various options for a pension plan when distributing funds, to determine the most effective one.

-

IRA selection tool. The function helps an investor choose the type of IRA, taking into account its characteristics.

-

Retirement Evaluator. A tool in which you can define your goals and check if you are getting closer to them. There are also tips to help you improve the performance of your portfolio.

Advantages:

The minimum deposit for a trading account for beginners is $1.

An extensive library that houses educational articles, videos, webinars, courses.

A client with any type of account can get advice from a licensed professional and increase the profitability of their portfolio.

Assets can be managed both from a personal computer and from a mobile phone.

The company does not restrict its clients and allows them to manage assets on their own. There are also no restrictions on the number of assets.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i