deposit:

- $1

Trading platform:

- CFD Trader

- WebTrader

- PRO Trader

- Mobile

- REST API

- Guidants

- TraderFox

- German Federal Financial Supervisory Authority (BaFin)

Comdirect Review 2024

deposit:

- $1

Trading platform:

- CFD Trader

- WebTrader

- PRO Trader

- Mobile

- REST API

- Guidants

- TraderFox

-

up to 1:5 for CFD-Basis-Konto

up to 1:30 for CFD-Trader-Konto

- No zero commissions for trading stocks and ETFs. Leveraged CFD trading and social trading are available, and you can invest through a robot advisor

Summary of Comdirect Trading Company

Comdirect is a moderate-risk broker with the TU Overall Score of 5.05 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Comdirect clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Comdirect ranks 53 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Comdirect is a broker for experienced and professional investors who are willing to pay high trading fees for high reliability and first-class service, and who are sufficiently fluent in German to make prudent trades in that language.

Comdirect is an investment bank and broker founded in 1994 that is owned and operated by the largest German bank Commerzbank AG. Comdirect is listed on the Frankfurt Stock Exchange and regulated by BaFin, the German Federal Financial Supervisory Authority. It offers clients accounts for Forex trading and investing in securities of the German, European and international markets. Comdirect has received numerous awards for its banking products and brokerage services. In 2021 they won the annual Euro am Sonntag and Broker-Wahl voting for the title of the best online broker.

| 💰 Account currency: | EUR, USD, GBP, CAD, JPY, SEK, AUD, HUF, NOK, PLN, TRY, MXN, and ZAR |

|---|---|

| 🚀 Minimum deposit: | From 1 unit of the base currency of the account |

| ⚖️ Leverage: |

up to 1:5 for CFD-Basis-Konto up to 1:30 for CFD-Trader-Konto |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, ETPs, bonds, options, futures, certificates, funds, CFDs on stocks, currencies, indices, futures, bonds, raw materials, and precious metals |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Comdirect:

- No minimum deposit requirements.

- A wide range of investment assets for diversified portfolios.

- Huge number of tools for advanced market analysis.

- Ability to make transactions through a mobile application and third-party terminals.

- Free withdrawal of funds from investment accounts.

- Availability of an affiliate program and various bonus offers.

👎 Disadvantages of Comdirect:

- High trading commissions on all asset classes.

- The broker does not have a website in English. Personal account, terminals, and communication with company representatives are conducted in German only.

- Complex and lengthy process for opening an account for traders who are located outside of Germany and Austria.

Evaluation of the most influential parameters of Comdirect

Geographic Distribution of Comdirect Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Comdirect

Comdirect is a bank and investment company with 27 years of experience in the financial markets. Severe regulation and a long presence in the market are the main reasons why securities investors trust this company. Another point that has a positive effect on the popularity of this broker is the availability of its wide range of investment assets.

Comdirect is ready to welcome clients from most European countries. Residents of Germany and Austria can quickly open an account in digital format, but for non-residents of those two countries, the procedure takes up to 7-14 days. In this case, you need to go through a notarial verification of your identity documents in your country and send the application by snail mail. In addition, the potential client must have a good command of the German language as the entire registration process is in German. Comdirect does not work with US citizens.

The main drawback of the broker is high trading commissions for all instruments. Also, the company sets minimum commission limits, so its clients have to pay from €9.9 per transaction, even with low trading activity. Unlike other stockbrokers that offer zero commissions for trading stocks and ETFs on the national exchange, Comdirect charges fees for trades in German securities.

Dynamics of Comdirect’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

This broker opens a plethora of investment opportunities for its clients. After opening an account with Comdirect, investors who are not interested in independent trading can copy the trading strategies of other market participants, invest in ready-made portfolios and transfer capital for management. The broker also offers a referral program that offers rewards for connecting referrals.

Investing in diversified portfolios and social trading are the most popular types of passive investing from Comdirect

Comdirect offers a huge variety of investment solutions not only for professionals but also for beginners and inexperienced investors:

-

Wikifolio is a third-party online social trading platform where experienced traders post their investment strategies, including all purchases and sales of securities. An investor can copy trades and receive income without independently analyzing the market. The basic fee is €4.9 per trade. Commission for an order is 0.25% of the volume (minimum € 9.9; maximum € 59.9), but if more than 125 transactions are made in the previous six months, the trader is given a 15% discount on the trading fee.

-

Cominvest Depot is an advisor robot for professional digital asset management that distributes funds to an investor without his participation. The robot regularly checks the portfolio and, when the market situation changes, automatically adjusts it, and informs the investor about it. The management fee is 0.95% per annum of the investment volume, including statutory sales tax. The minimum amount for connecting Cominvest Depot is €3,000.

-

AnlageAssistent manages investments in ready-made asset portfolios formed by the company’s experts. For passive investors, Comdirect offers professional investment strategies to choose from for optimal investment diversification. The line includes portfolios with different terms (short, medium, and long) and risk levels (low, medium, and high). The portfolio consists of stocks, bonds, and alternative investments in different percentages. The minimum investment amount is €3,000 for a one-time connection and €100 for a savings plan.

Any Comdirect client who has opened a securities account and made the required deposit can become a passive investor. To copy transactions or broadcast your own investment strategy, you must additionally register at wikifolio.com.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Comdirect’s affiliate program:

-

Comdirect’s affiliate program is for website owners and bloggers offered by the broker through its financeAds partner. Comdirect pays a fixed commission for each attracted client. When a referral opens a current bank account, the partner receives €40; for Depot (accounts for trading securities), he receives €90; and for Cominvest (for trading with an advisor robot), he receives €200.

All Comdirect clients participate in the affiliate program free of charge. Each partner gets direct and easy access to ready-made advertising banners and texts, online reports, and statistics on the number of connected referrals.

Trading Conditions for Comdirect Users

Comdirect offers clients to trade stocks, funds, ETFs, ETPs, bonds, options, futures, certificates, and CFDs after depositing 1 unit of the base currency. Traders can trade securities through the company’s proprietary terminals or use third-party analytical investment platforms. The company has mobile versions of the terminals. The broker provides leverage only for CFD transactions, and investors must trade securities using their own funds.

$1

Minimum

deposit

1:30

Leverage

24/7

Support

| 💻 Trading platform: | Web Trader, Pro Trader (desktop), mobile, REST API, Guidants, TraderFox, CFD Trader (for Forex trading) |

|---|---|

| 📊 Accounts: | CFD-Demokonto, Comdirect Depot, Währungsanlagenkonto (Currency Asset Account), LiveTrading, CFD-Konto (CFD-Basis-Konto and CFD-Trader-Konto) |

| 💰 Account currency: | EUR, USD, GBP, CAD, JPY, SEK, AUD, HUF, NOK, PLN, TRY, MXN, and ZAR |

| 💵 Replenishment / Withdrawal: | Bank transfer only |

| 🚀 Minimum deposit: | From 1 unit of the base currency of the account |

| ⚖️ Leverage: |

up to 1:5 for CFD-Basis-Konto up to 1:30 for CFD-Trader-Konto |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | N/A |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, ETPs, bonds, options, futures, certificates, funds, CFDs on stocks, currencies, indices, futures, bonds, raw materials, and precious metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | No zero commissions for trading stocks and ETFs. Leveraged CFD trading and social trading are available, and you can invest through a robot advisor |

| 🎁 Contests and bonuses: | Yes |

Comdirect Commissions & Fees

-

For the purchase and sale of German stocks and ETFs, the broker withholds 0.25% of the transaction amount plus €4.9 per order (minimum €9.9; maximum €59.9).

-

Exchange commissions are 0.0025% of the turnover (minimum €2.5) or 0.005% (but not less than €5).

-

For transactions with international stocks, the investor pays 0.25% of the volume, plus €7.9 per transaction (minimum €12.9; maximum €62.9) plus any third-party costs.

-

Commission for orders in terms of OTC trading is 0.25% plus €4.9 (minimum €9.9, maximum €59.9).

-

Each futures index or ETF and index option contract costs €4.5, and a stock futures contract costs €2.5. The minimum commission for futures and options is €19.

Comdirect does not charge any fees for account opening, deposits, or withdrawals. The inactivity fee is €0 during the first three years. After that, it is €1.95 per month, if the client has not completed 2 transactions per quarter or does not have a savings or current account with Commerzbank AG.

| Account type | Spread (minimum value) | Withdrawal commission |

| Comdirect Depot | from 9.9€ | no |

| Währungsanlagenkonto (Currency Asset Account) | from 12.9€ | no |

| LiveTrading | from 9.9€ | no |

| CFD-Konto | from 0€ | no |

Additionally, the commission for placing an order by phone is €4.90 per CFD transaction and €14.90 with securities.

The table below shows a comparison of Comdirect trading commissions and popular US stock brokers. For clarity, we calculated what fee brokers will withhold for a transaction of €2,000.

| Broker | Average commission | Level |

| Comdirect | $8 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of Comdirect

Comdirect gives traders direct access to trading major asset classes on the German and global stock exchanges. The broker currently serves 1.7 million securities accounts. Its clients can trade online on 12 stock exchanges in Germany, as well as on the stock markets of 12 countries, including the USA, Great Britain, Australia, France, Greece, Italy, Canada, the Netherlands, Sweden, Switzerland, Spain, and Japan.

In addition to German and foreign stocks, Comdirect offers its clients access to the following types of assets:

-

1,000 ETFs;

-

30,000 bonds;

-

10,000 funds from over 150 stock companies;

-

900,000 certificates;

-

1,200 CFDs.

Comdirect is a broker for traders who work with a wide range of financial instruments

Comdirect is targeted at investors who invest in securities. However, its clients can also make transactions with Forex assets. The French financial conglomerate Société Générale plays the role of the market maker for CFD traders. All terminals and a website have trading ideas, fundamental analysis, and screeners for finding major asset classes. There are 47 indicators available for technical analysis. Also, the user can create his own charts.

To make online transactions in securities, the broker’s clients can use his personal account on the website, the ProTrader stationary terminal, or a smartphone application. Forex trading is carried out through a separate CFD Trader platform, which is available in desktop and mobile versions. With the REST API, clients can develop their own applications according to their trading needs. Third-party analytics platforms Guidants and TraderFox are also available. Their functionality accommodates not only receiving trading ideas and strategies from more than 100 financial experts but also making transactions.

Useful services of Comdirect:

-

TraderFox Trading Desk. This interface provides free real-time quotes for 12,000 international stocks and professional tools for charting, setting price alerts, and tracking assets.

-

TraderFox Screener. An algorithm that monitors news and immediately informs the user of the most important items via push notifications. It also displays a list of stocks experiencing strong price reactions to the news.

-

Newsletters. Reference reports from an independent editorial team on all aspects of the stock exchange and important information on new offers and products.

-

Financial Knowledge Journal. It includes articles on market conditions, information for improving financial literacy, and podcasts. The journal also features the top 5 most traded stocks among Comdirect clients over the past week.

-

Informer. This section of the site displays exchange rates, current prices for commodities, gold, and silver, as well as prices and charts for the most important stocks and indices such as the Dow Jones and DAX.

Advantages:

The company is part of one of the five largest German banks and is regulated by the central supervisory authority for financial services in Germany, BaFin.

The broker’s clients can trade on German and international exchanges as well as the OTC market.

There are no non-trading commissions for deposits, withdrawals, account maintenance, or inaction during the first three years.

Traders enjoy a free ProTrader’s advanced desktop platform with professional charting and highly customizable options.

For passive income, there is social trading and investing using a robotic algorithm.

Comdirect has no restrictions on trading strategies. Hedging, intraday trading, and placing various types of orders are allowed.

How to Start Making Profits — Guide for Traders

Comdirect offers three types of securities trading accounts as well as two types of CFD accounts. The minimum deposit for all types of accounts is 0 units of the base currency of the account.

Account types:

Comdirect only has a demo account for Forex trading (CFD-Demokonto). The broker does not provide a demo account for securities.

Comdirect offers a wide range of securities trading accounts for the German domestic and foreign exchanges as well as the OTC market.

Bonuses Paid by the Broker

Welcome bonus

New clients who open a securities account receive €50 24 days after making their first deposit. The bonus is credited provided that at least 3 transactions (except for Eurex, CFD trading, and new stocks) are completed within 14 days from the date of opening a securities account. This offer is valid until August 31, 2021.

There is a 15% discount on order commission

The bonus is available to traders who copy investment strategies presented on the wikifolio.com social trading platform. The discount is provided to investors who have made more than 125 transactions in the previous six months. The offer is valid until December 31, 2021.

Gifts for connecting new clients

The advertiser pre-selects a gift in the bonus gift store and then applies to participate. The referred person must open an account using the referral link and actively use it within 6 months from the date of opening, that is, make a monthly deposit of €25 (or their equivalent in securities). Gifts are only delivered within Germany.

Investment Education Online

There is no separate section with training materials on the Comdirect website. Information useful for a beginner is not systematized and is scattered throughout the site, which makes it impossible to quickly find the information you need. The basics of securities trading can be found in the Help and Service, Financial Literacy, and FAQs sections.

For more advanced traders, Comdirect provides access to specialized online seminars from company experts and invited speakers.

Security (Protection for Investors)

Comdirect is listed on the Frankfurt Stock Exchange and regulated by the German Federal Financial Supervisory Authority (BaFin, 100005).

The broker is a trademark of Commerzbank AG, which provides clients the protection of their funds and securities. For investors with opened accounts from all countries, insurance coverage is available for €20,000 for securities and €100,000 for a cash deposit. Comdirect also provides negative balance protection for spot Forex trading, but only for retail clients from the European Union.

👍 Advantages

- There is insurance coverage

- Operates under the control of the German government regulator

- High level of security

👎 Disadvantages

- Earnings from investments can only be withdrawn to a bank account

- Digital account opening is available only to citizens of Germany and Austria

- Professional and non-EU clients are not protected from a negative balance

Withdrawal Options and Fees

-

To withdraw funds, only one withdrawal method is available - bank transfer. You can transfer money to a local bank, as well as to a financial institution outside Germany by SEPA payment.

-

Funds are credited to a bank account within 3-5 business days.

-

Comdirect does not charge fees for withdrawals.

-

The client can withdraw funds only to an account opened in his name.

Customer Support Service

The support service works around the clock seven days a week.

👍 Advantages

- Can be contacted 24/7

👎 Disadvantages

- Support language is in German only

- Live-чат is displayed on the site, but operators are not available

This broker provides the following communication channels for existing clients and potential investors:

-

Live-Support (a direct interaction service that allows a client to share their platform screen with a broker’s representative);

-

phone numbers indicated on the website;

-

email;

-

Fax.

The broker’s clients and unregistered users can also ask a question in Facebook and Twitter messengers, Instagram profiles, and on the Youtube channel.

Contacts

| Foundation date | 1994 |

| Registration address | Pascalkehre 15, 25451 Quickborn, Germany |

| Regulation |

German Federal Financial Supervisory Authority (BaFin) |

| Official site | https://www.comdirect.de/ |

| Contacts |

Phone:

04106 - 708 25 00

|

Review of the Personal Cabinet of Comdirect

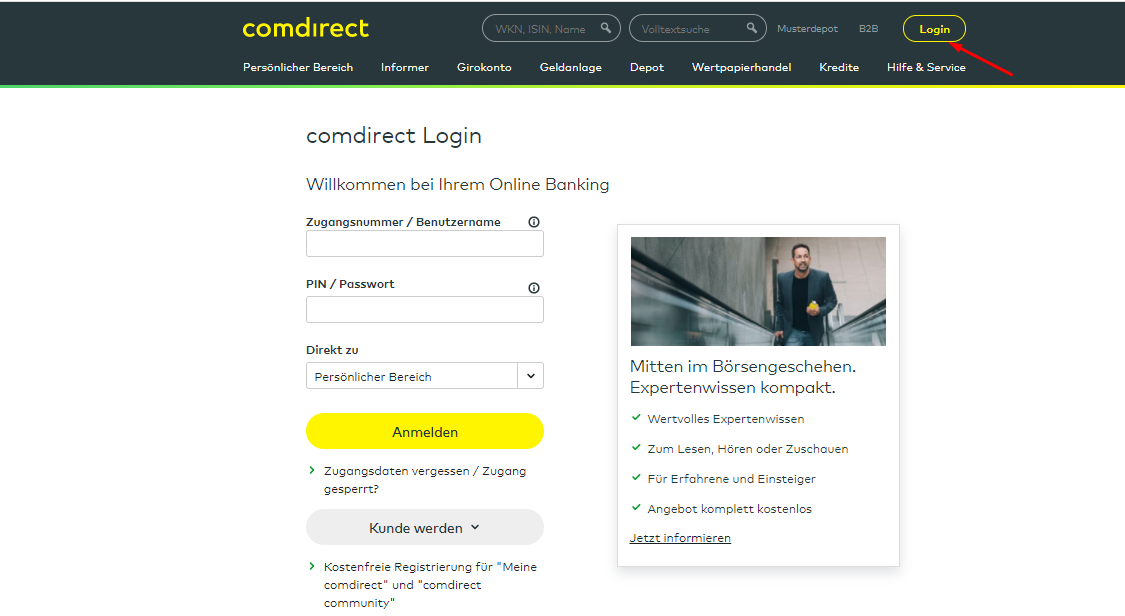

In this section, Traders Union provides brief instructions on how to create a personal account on the Comdirect website. Follow these steps:

Open a Depot securities account. To do this, on the main page of the company’s official website, click the Jetzt Depo eröffnen button and then fill out an application for opening an account.

Go through verification. For residents of Germany and Austria, the process is completely digital and takes place using video authentication. Citizens of other countries must send documents certified by a notary by mail. After checking the provided data, the client receives an email with the TAN code - the password for authorization and the first login to the system.

Next time you log in, you can use photoTAN or SMS authentication. The photoTAN is a scanning tool similar to a QR code, which is carried out in a special application on a smartphone

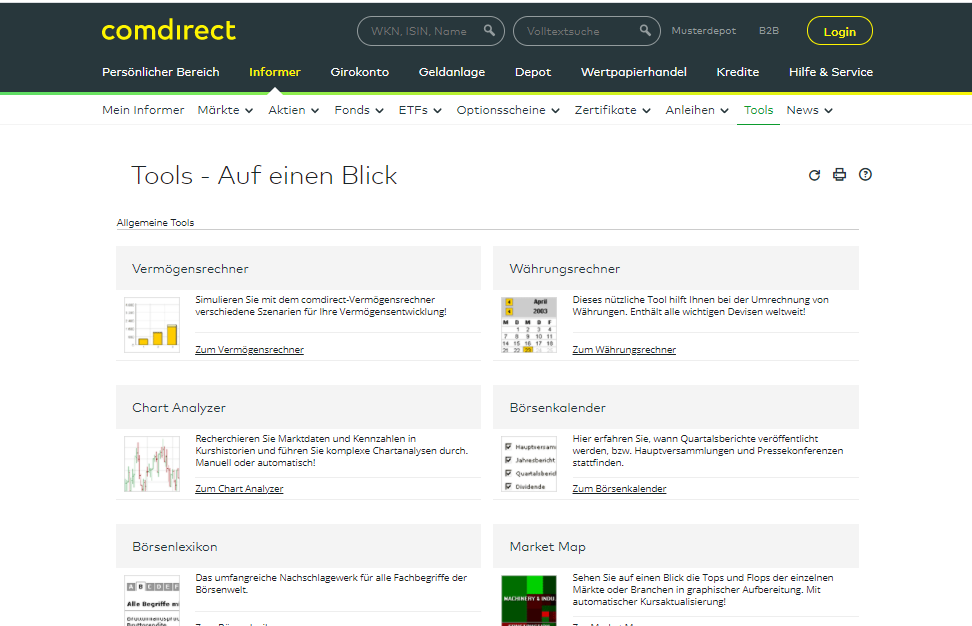

In the Comdirect personal account, the client has access to:

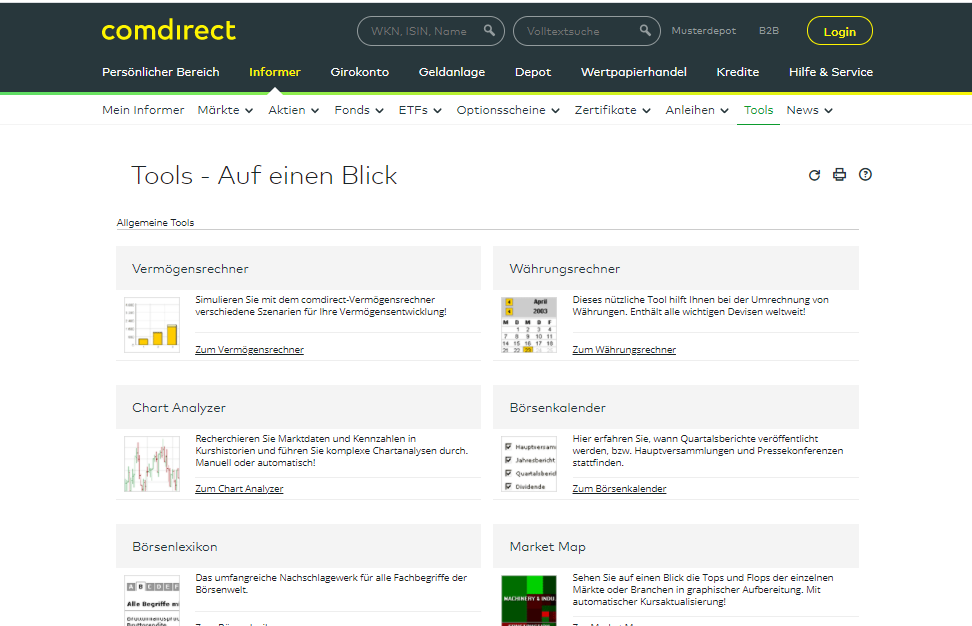

1. Useful tools such as income calculators, a currency converter, stock exchange calendars, a market heatmap app, stocks, funds, and bonds screeners.

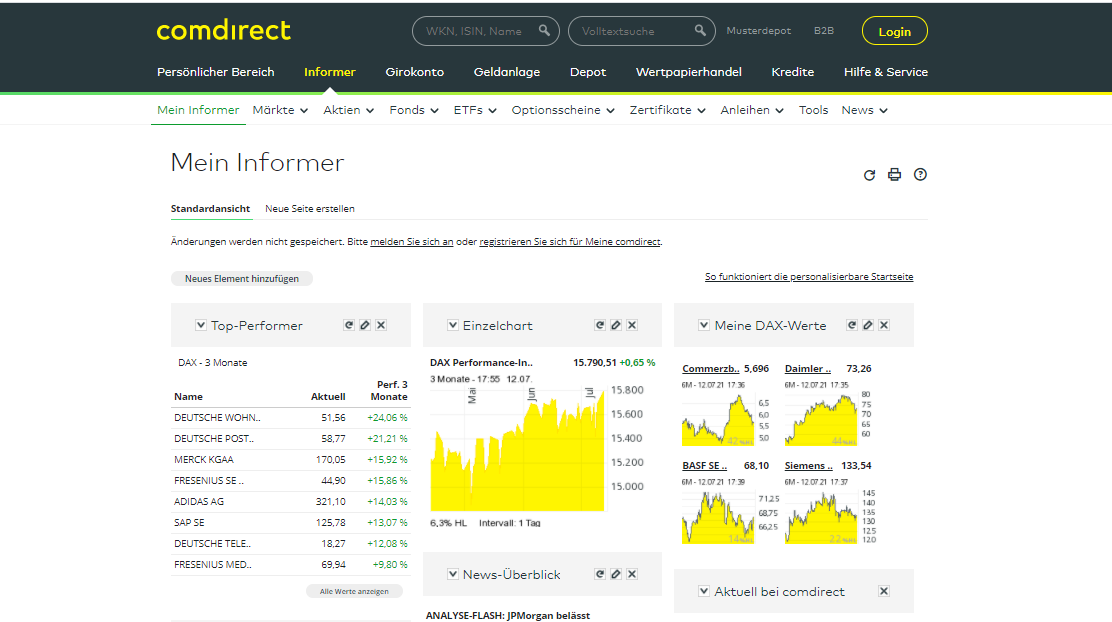

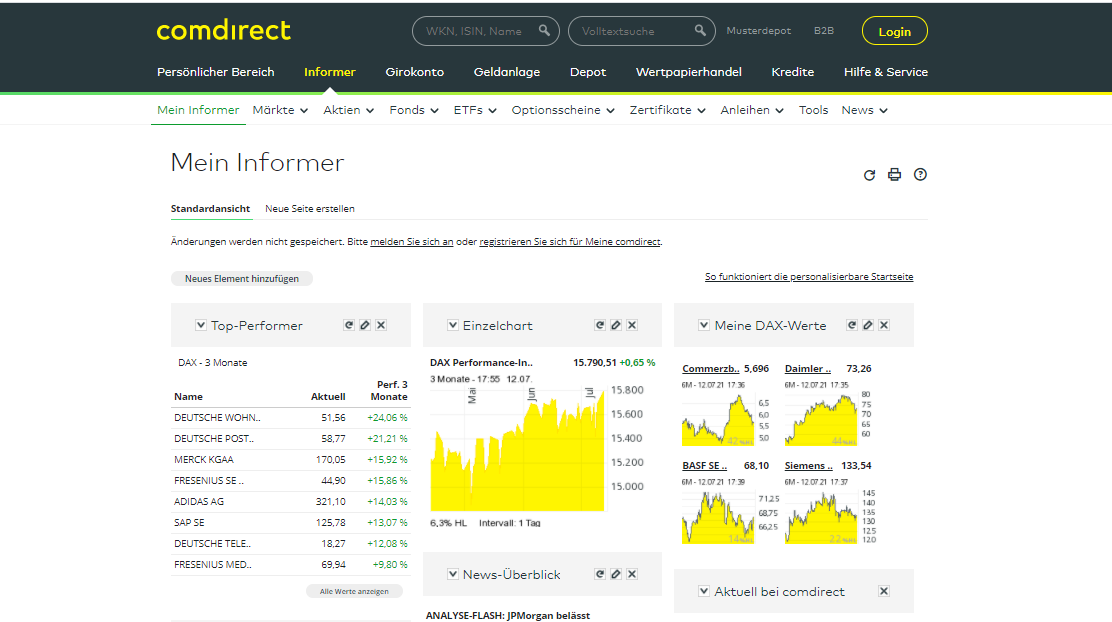

2. Setting up and adapting your personal account to your own trading needs. The user can select the types of charts, news by industry, an overview of a typical portfolio, the rise and fall of the asset price:

1. Useful tools such as income calculators, a currency converter, stock exchange calendars, a market heatmap app, stocks, funds, and bonds screeners.

2. Setting up and adapting your personal account to your own trading needs. The user can select the types of charts, news by industry, an overview of a typical portfolio, the rise and fall of the asset price:

Also, in the personal account, the broker’s client can perform the following actions:

-

Sell and buy securities.

-

Create and store customized order templates for all relevant transactions to be sent directly to the exchange at the right time.

-

Configure the one-click order confirmation option.

-

Find assets by type, price, or exchange value.

-

Generate reports on the portfolio and commissions withheld by the broker.

Disclaimer:

Your capital is at risk. Options trading entails significant risk and is not appropriate for all investors. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Losses can potentially exceed the initial required deposit. You need to complete an options trading application and get approval on eligible accounts.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Comdirect rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Comdirect you need to go to the broker's profile.

How to leave a review about Comdirect on the Traders Union website?

To leave a review about Comdirect, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Comdirect on a non-Traders Union client?

Anyone can leave feedback about Comdirect on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.