deposit:

- €1

Trading platform:

- Web-bank

- Mobile banking

- FGDL

- ESMA

BGL BNP Paribas Review 2024

deposit:

- €1

Trading platform:

- Web-bank

- Mobile banking

- 1:1

- It is allowed to invest in funds through a savings account, the trading commission is calculated as a percentage of the trade amount.

Summary of BGL BNP Paribas Trading Company

BGL BNP Paribas is a moderate-risk broker with the TU Overall Score of 5.08 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by BGL BNP Paribas clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. BGL BNP Paribas ranks 52 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The BBP focuses on experienced investors who do not need training and are ready to invest significant funds.

The BGL BNP Paribas (hereinafter also referred to as “BBP”) broker is a subsidiary of the French financial conglomerate BNP Paribas Group, which is registered and operates in Luxembourg. The broker operates under the supervision of the European Securities Market Supervision Authority (ESMA). Its clients have the opportunity to invest in stocks, bonds, ETFs, precious metals, funds of the BNP Paribas Group, and funds of other issuers. The BBP group offers a wide range of banking, brokerage, and investment services, as well as financial advice and wealth management.

| 💰 Account currency: | EUR - for Direct Invest+ and Self Invest EUR, USD, AUD, CAD, GBP, SEK, CHF, JPY, DKK, NOK, and NZD - for savings accounts with investment options |

|---|---|

| 🚀 Minimum deposit: |

From €1 (when investing from a savings account). From €50,000 (for Direct Invest and Self Invest accounts) |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | No |

| 🔧 Instruments: | Shares, bonds, ETFs, investment funds, precious metals |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with BGL BNP Paribas:

- No deposit fees for Luxembourg citizens or foreign residents.

- Provides a sample of funds that BBP thinks are reliable.

- Possibility of round-the-clock placement of orders for trades on European and American exchanges (21 exchanges are offered).

- Participation in the FGDL (Fonds de Garantie des Dépôts Luxembourg) deposit guarantee scheme, which involves payments of up to €100,000 for each investor.

- Assistance by a personal consultant when contacting by phone or in a Web bank chat.

- Opening a savings account to manage financial services is available in 11 currencies.

- Access to the dynamic investment of deposits from a savings account.

👎 Disadvantages of BGL BNP Paribas:

- High requirements for the size of the minimum deposit, which must be at least €50,000.

- There is no fixed brokerage fee.

- The site lacks quality training on the basics of stock market trading.

Evaluation of the most influential parameters of BGL BNP Paribas

Table of Contents

Geographic Distribution of BGL BNP Paribas Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of BGL BNP Paribas

The BBP brokerage offers a unique solution in the stock market for independent trading and work under the guidance of consultants. The broker allows you to invest in funds directly from a savings account without requiring a minimum deposit, subject to a regular payment of €50 per month or €100 per quarter. The advantage of such conditions is that the plan is determined in advance, therefore, the possibility of making rash decisions is excluded.

To manage the BBP account, the client can use internet banking, which is available on the website and in the mobile application. The Genius Expert Advisor informs the account holder in real-time about all completed and planned transactions and makes a forecast based on the analysis of account movements for the last 6 months. To improve security, there are automatic notifications about suspicious transactions or a decrease in the balance to a critical level.

Novice investors can use an additional service that provides expert assistance from the company's specialists. During portfolio management, the tools give advice and recommendations on all available financial instruments. The disadvantages of BBP are the lack of an online chat, high minimum deposit requirements (if there are no savings accounts opened in the company), and an unfixed brokerage commission.

Dynamics of BGL BNP Paribas’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

BNP Paribas offers over 5,000 investment funds and ETFs for trading on its stock exchanges, categorized by risk level and asset class. If necessary, the company's specialists are ready to provide consulting and complete investment portfolio management services.

Thematic funds are a popular way to invest with BBP

To create or diversify a portfolio depending on the goals and profile of the investor, the broker offers 10 funds of various thematic ranges comprising emerging markets, innovative technologies, etc. All funds have a good reputation and a high degree of profitability, which significantly reduces financial risks. Many of them are socially responsible and therefore more attractive for investment. Socially responsible investing is becoming popular since capital is invested in companies with high-quality management and social structure, as well as the highest development potential. Features of investing in thematic funds:

-

The ability to invest in funds that match the focus of the investor’s profile.

-

Socially Responsible Investment (SRI) funds are a priority in asset selection.

-

The company's specialists determine the profile of the investor and, following it, allocate and distribute funds in the investment portfolio.

-

The investor can diversify the portfolio (independently or with the help of a consultant) by expanding the list of financial instruments.

If the client has a savings account, the broker does not set the minimum deposit for investing in funds. But when opening a separate trading account, you must deposit an amount of at least €50,000. A PDF document is available on the broker's website describing the benefits of direct and independent investing in thematic funds.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

BGL BNP Paribas’ affiliate program

At the moment, the broker has no affiliate programs. But BBP provides companies and private entrepreneurs with the opportunity to open a personal current account, where additional services and banking products are available to the client such as professional investments, insurance policies, lease agreements, and real estate projects. A personal consultant is provided to resolve all issues.

Trading Conditions for BGL BNP Paribas Users

The broker offers its clients a wide range of instruments: more than 5,000 of its own and third-party funds, ETFs, precious metals, stocks, and bonds. From a savings account without a minimum deposit requirement, you can only invest in thematic funds and BGL BNP Paribas' own funds. Access to the rest of the instruments is possible only after opening a separate trading account and depositing an amount of at least €50,000.

€1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Web-bank, Mobile banking |

|---|---|

| 📊 Accounts: | Direct Invest+, Direct Invest+ International, Self Invest, Self Invest International |

| 💰 Account currency: | EUR - for Direct Invest+ and Self Invest EUR, USD, AUD, CAD, GBP, SEK, CHF, JPY, DKK, NOK, and NZD - for savings accounts with investment options |

| 💵 Replenishment / Withdrawal: | Bank transfer, internet banking |

| 🚀 Minimum deposit: |

From €1 (when investing from a savings account). From €50,000 (for Direct Invest and Self Invest accounts) |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | No |

| 🔧 Instruments: | Shares, bonds, ETFs, investment funds, precious metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | It is allowed to invest in funds through a savings account, the trading commission is calculated as a percentage of the trade amount. |

| 🎁 Contests and bonuses: | No |

BGL BNP Paribas Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Direct Invest+ | From €50 | Applied to certain international payments |

| Direct Invest+ International | From €50 | Applied to certain international payments |

| Self Invest | From €50 | Applied to certain international payments |

| Self Invest International | From €50 | Applied to certain international payments |

A currency conversion fee is also charged at the exchange rate: for a transaction over €100,000, its amount is €0.1-0.2.

To determine how profitable it is to trade US stocks with BBP, Traders Union compared BBP’s terms with other brokers that offer their services on the stock market. The results of the study are shown in the table below.

| Broker | Average commission | Level |

| BGL BNP Paribas | $50 | High |

| Charles Schwab | $11 | Medium |

| Ally Bank | $4 | Low |

Detailed Review of BGL BNP Paribas

The BGL BNP Paribas broker considers corporate social responsibility a priority in its activities, for which in 2011 and 2020 it received the title of a socially responsible company (ESR) from the National Institute for Sustainable Development. The La Commission Européenne de son côté définit les Entreprises Socialement Responsables (Enterprise Socialement Responsable) mark confirms the guarantees of the fulfillment of the assumed obligations on civil, environmental, social, and economic responsibility.

A summary of some facts about the BGL BNP Paribas broker:

-

Twelve years of experience in the BNP Paribas Group.

-

One of the main shareholders is the state of Luxembourg.

-

The company is CSR (Corporate Social Responsibility) certified.

-

First place in the ESG / Impact Investing category at the Euromoney Private Banking Awards.

The BGL BNP Paribas broker is client-oriented and makes long-term large investments in corporate and thematic funds

More than 5,000 investment funds (including 10 thematic funds), stocks, bonds, ETFs, and precious metals, are available for clients familiar with the stock market for investing capital. For those who have no experience in the stock market, financial advice, investment advice, and asset management are provided on an individual basis. The broker provides the opportunity to create and manage your own portfolio of securities at your discretion, or use the services of experts who offer ready-made solutions.

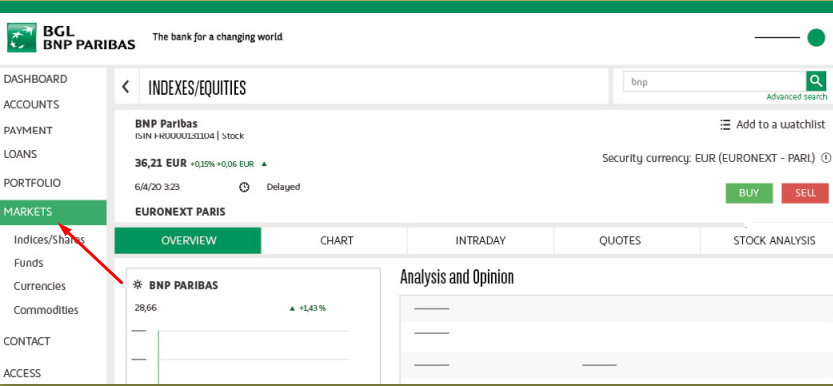

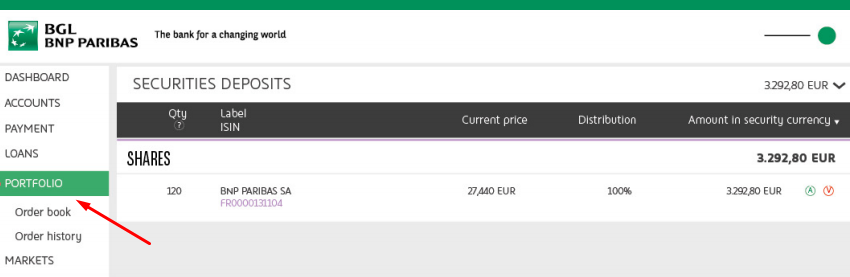

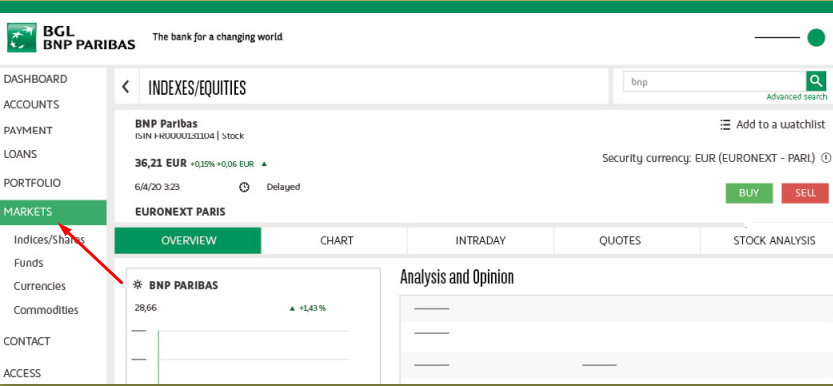

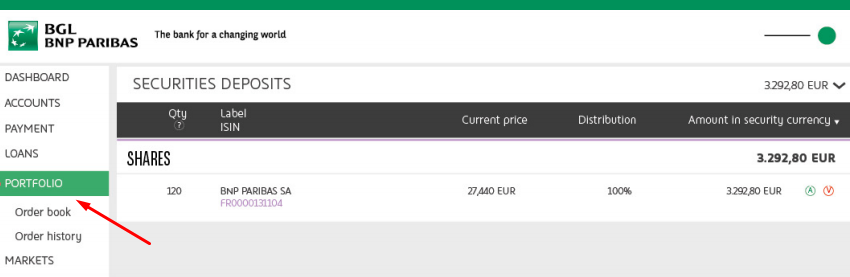

To place market and pending orders, control their portfolio, and monitor prices for financial instruments, after opening an account, the client gets access to the Web-bank trading platform on the BGL BNP Paribas website.

To increase security, the connection to the terminal is carried out in two stages: after authorization on the site, you must additionally enter a (i) ten-digit client code and a (ii) six-digit password. All functions for operations with an investment portfolio are also available through the Web-banking mobile application, which can be downloaded and installed on the Google Play Market or App Store, depending on the operating system of the mobile device.

Useful services of BGL BNP Paribas investment:

-

FAQs - a list of answers to frequently asked questions related to the specifics of cooperation.

-

Latest news - a feed of the latest news about the company's activities.

-

CSE is a section with information on civil, social, economic responsibility.

-

Press releases - Press releases for the last 5 years.

-

Interactive map - to find the nearest branch.

Advantages:

Simple trading commission structure and no hidden fees.

A selection of 10 thematic funds is recommended for building a diversified portfolio.

Availability of internet banking, which combines banking services and investment management.

Placing orders for transactions is available by phone.

No fees for opening an account.

The ability to invest from a savings account.

Providing access to information documents such as Key Investor Information Documents.

Individual advice and assistance in portfolio management are available to clients who prefer private equity.

How to Start Making Profits — Guide for Traders

The BGL BNP Paribas broker offers four types of accounts for trading on the stock markets. Two of them are for clients who are residents of Luxembourg and two are for foreign citizens. In addition, you can invest from a savings account opened with a company in any of 11 currencies: EUR, USD, CAD, GBP, CHF, JPY, AUD, DKK, NOK, NZD, and SEK. On all types of trading accounts, the opening fee is not charged, and the minimum deposit is €50,000.

Account types:

The broker does not offer a demo account for testing the trading terminal and trial work without financial risks.

Due to the high requirements for the size of the deposit, BGL BNP Paribas is suitable for large investors who prioritize long-term capital investments.

Bonuses Paid by the Broker

This broker does not offer bonus programs and promotions for investors at the moment.

Investment Education Online

The BBP broker does not offer training courses on stock market trading, but its website (www.bgl.lu) has an “Our Advice” section, which features articles and videos with investment advice from the company's experts.

Inexperienced traders during trading sessions can seek help from the company's professional experts.

Security (Protection for Investors)

BGL BNP Paribas is regulated by the European Securities and Markets Authority, and the broker protects its clients’ funds keeping them in segregated accounts at third-party banks.

The company's clients are also protected by the Fonds de Garantie des Dépôts Luxembourg (FGDL), a public fund that provides compensation to depositors. The maximum FGDL payout is €100,000 per person. For the safe execution of transactions with assets on the website and in the BGL BNP Paribas application, dual authorization is provided.

👍 Advantages

- The company is under the control of a top-level regulator

- Customer funds are in segregated accounts

- Access to the trading terminal is carried out in 2 stages

- Luxembourg's legal regulation provides enhanced protection for funds in investment accounts

👎 Disadvantages

- No additional regulatory bodies

- ESMA restricts withdrawal methods

- Lengthy verification process

- When registering, you must provide documents confirming tax residency

Withdrawal Options and Fees

-

Withdrawals are only possible via internet banking or bank transfer, as other methods are restricted by the regulator.

-

No commission is charged for withdrawing funds to BBP bank accounts. For SEPA payments ≤ of €125,000 to accounts of other banks, the first 15 withdrawals are free, each additional transaction will cost €0.75. For a SEPA transfer≤ €125,000, the investor pays €10. Commission for international payment through other systems is 0.15% of the transaction amount (minimum is €5; maximum is €180).

-

Also, additional fees are possible from the receiving bank of the transfer.

Customer Support Service

Customer Service Representatives are available to assist customers from 8:00 am to 6:00 pm Eastern European Time, excluding weekends and holidays. Clients who have accounts with a personal advisor can also receive advice during company business hours.

👍 Advantages

- Multichannel support

- You can order a callback

- The site has a schedule of low-traffic hours

- Video support available

- Customer support in English, French and German

👎 Disadvantages

- No 24/7 support

- There is no live chat on the site

- There are no ready-made forms for contacting via email

This broker provides the following communication channels for existing clients and potential investors:

-

send a message in the help section of your personal account;

-

send an email;

-

call the number indicated on the website;

-

request a Webex conference

-

order a callback

-

BBP has accounts on social networks such as Facebook, Twitter, and Instagram.

Contacts

| Foundation date | 1999 |

| Registration address | 50 Avenue J.F. Kennedy, 2951 Ettelbruck, Luxembourg |

| Regulation |

FGDL, ESMA |

| Official site | https://www.bgl.lu/ |

| Contacts |

Phone:

+(352) 42 42-2000

|

Review of the Personal Cabinet of BGL BNP Paribas

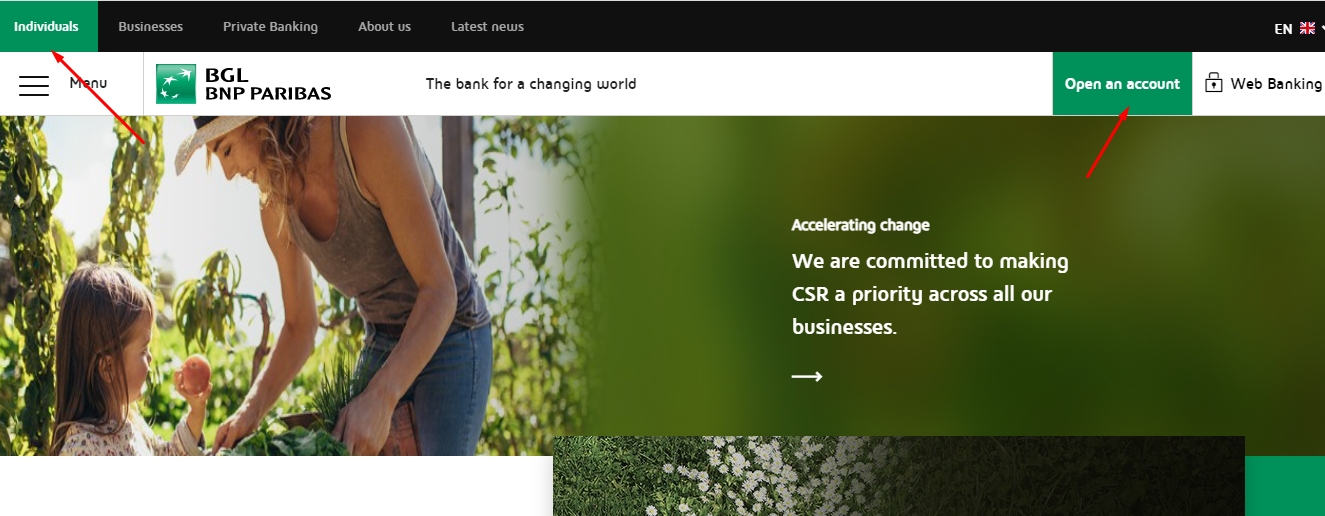

To become a client of BGL BNP Paribas, you need to register on the broker's website and apply to open an account. Here's a quick guide to creating an account:

On the main page of the company's official website, go to the Individuals section and click the Open an Account button.

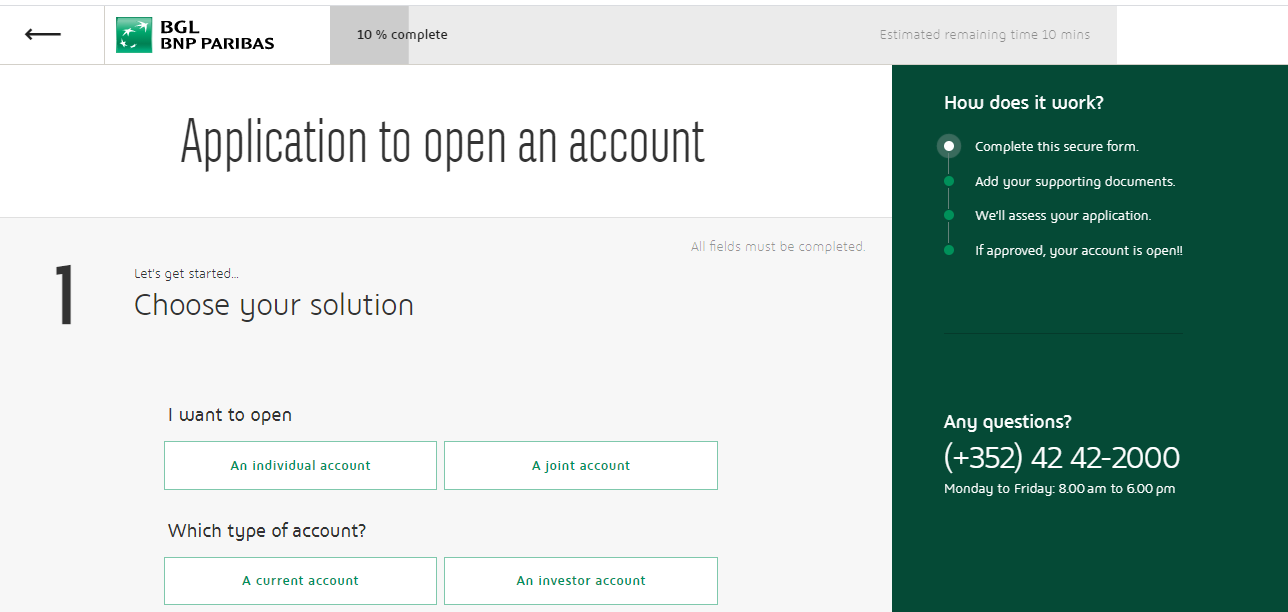

Apply for an account, indicating what type of account you want to open (individual or joint) and what type of account you are interested in (current or investment):

After choosing the type of account, fill out the proposed form in which you must specify your personal data. Access to the personal account for managing the account is opened for the client after the approval of the application for registering the account and passing the verification. To verify your identity, you must provide a passport, employment contract/payroll (dated within the last three months), tax number, and a document confirming the address of residence.

The following actions are available to the investor in the BGL BNP Paribas personal account:

1. Making Trades:

2. Portfolio review:

1. Making Trades:

2. Portfolio review:

Also, in the personal account, the client of the company can:

-

Create and view watch lists for priority assets.

-

Manage your investment account.

-

Generate reports on payment and trade transactions.

-

Ask questions to technical support representatives.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the BGL BNP Paribas rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about BGL BNP Paribas you need to go to the broker's profile.

How to leave a review about BGL BNP Paribas on the Traders Union website?

To leave a review about BGL BNP Paribas, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about BGL BNP Paribas on a non-Traders Union client?

Anyone can leave feedback about BGL BNP Paribas on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.