deposit:

- €2000

Trading platform:

- MetaTrader4

- Trader Workstation

- MetaTrader5

- IBKR Mobile

- IBot

- Apps

- API

- Client-Portal

- Webtrader TWS

- Central Bank of Ireland

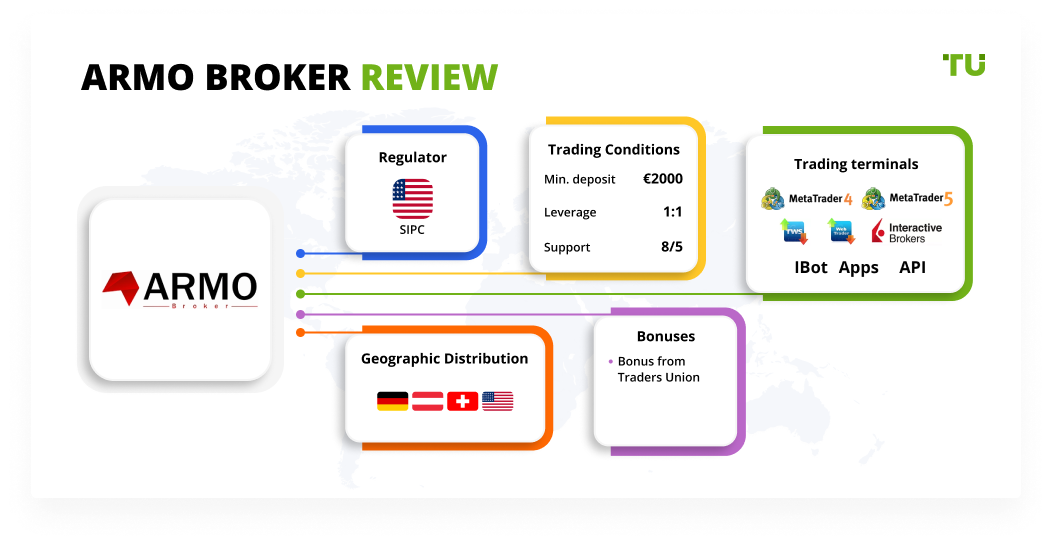

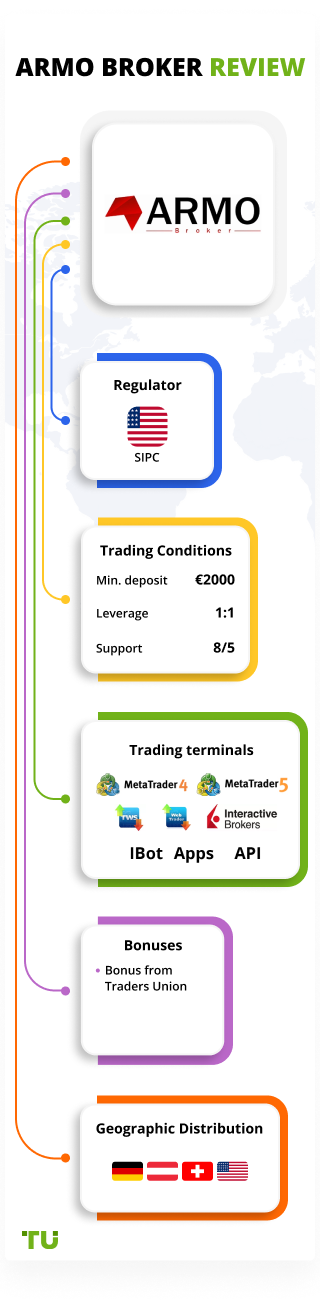

ARMO Broker Review 2024

deposit:

- €2000

Trading platform:

- MetaTrader4

- Trader Workstation

- MetaTrader5

- IBKR Mobile

- IBot

- Apps

- API

- Client-Portal

- Webtrader TWS

- Margin trading available

- No

Summary of ARMO Broker Trading Company

ARMO Broker is a broker with higher-than-average risk and the TU Overall Score of 4.81 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ARMO Broker clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. ARMO Broker ranks 61 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The ARMO broker is suitable for traders and investors with different trading styles. However, the services range of the company does not include the possibility of earning passive income. ARMO is designed for cooperation with active market participants and provides services to professional and novice traders alike, regardless of the country of residence.

ARMO is a stockbroker based in Germany that provides financial services internationally. The conditions of the company are suitable for traders and investors with any level of knowledge in stock market trading, and it also provides access to a training center. There are no investment offers or methods to get passive income at the ARMO broker; therefore, the broker cooperates exclusively with active market participants only. Among the trading instruments at ARMO are stocks, options, futures, bonds, exchange-traded funds, CFDs, and Forex. In total, the company has over a million assets.

| 💰 Account currency: | EUR, USD, AUD, GBP, CAD, CZK, DKK, HKD, HUF, US, JPY, MXN, NZD, NOK, PLN, SGD, SEK, CHF, and CNH |

|---|---|

| 🚀 Minimum deposit: | €2000 |

| ⚖️ Leverage: | Margin trading available |

| 💱 Spread: | Fixed |

| 🔧 Instruments: | Stocks, options, futures, bonds, precious metals, ETFs, CFDs, and Forex |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with ARMO Broker:

- The broker provides a free demo account.

- ARMO customers can open a multi-currency account.

- The company provides training materials for beginners and professional traders.

- It protects client capital.

- ARMO clients have access to a wide range of trading instruments.

- There is no commission for non-trading activities.

👎 Disadvantages of ARMO Broker:

- High level of minimum deposit.

- The company does not provide programs and services to receive passive income.

- There are few ways to replenish the deposit and withdraw funds.

Evaluation of the most influential parameters of ARMO Broker

Geographic Distribution of ARMO Broker Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of ARMO Broker

ARMO Broker is a German stockbroker providing financial services to clients from 33 countries. The attraction for clients from many countries is confirmed by the broker's trading conditions. For example, ARMO offers accounts in 20 currencies, and also makes it possible to open a multi-currency account. The trading commission is also indicated for clients from different countries. The company positions itself as a universal broker, whose services are suitable for both beginners and professionals. But unfortunately, the company has established a high minimum deposit of €2,000. When opening an account, the broker also asks for the trader's experience in trading various assets.

The ARMO advantages are access to 130 international exchanges, as well as a wide range of trading instruments, more than 1.2 million. Assets belong to different groups, so investors can build a highly diversified portfolio. The broker's trading platform also allows you to set up a comfortable workflow, regardless of the device used to trade.

It is also worth noting that trading commissions at ARMO Broker are higher than the market rates, and the company's trading conditions are suitable exclusively for active traders since the company does not have services for generating passive income, including a referral program.

Dynamics of ARMO Broker’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

The ARMO Broker offers a range of different assets for traders and investors. The company prefers cooperation with clients who choose an active trading strategy and receive income from trades. For this reason, ARMO does not have programs for copying trades and generating passive income.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

ARMO’s affiliate program:

Earning income or benefits through participation in the affiliate program with the ARMO Broker is also excluded. The broker does not provide a referral program for its clients.

Trading Conditions for ARMO Broker Users

The ARMO Broker aims to provide financial services to clients with different needs. The company presents accounts with different forms of ownership, each of which can be opened in two versions—cash and margin. An account can be opened in one of 20 currencies, and multicurrency accounts are also available. To open an account, the client must be of full age and make and replenish the deposit with €2,000 or more. ARMO’s clients have access to a variety of assets, including stocks, futures, options, ETFs, and other instruments. The trading fee is fixed, depending on the trader’s country of residence and what tools he uses in his work. Trading is carried out on the platform from a personal computer, browser, or mobile device. There are no passive income programs at ARMO.

€2000

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | TraderWorkstation, Client-Portal, Webtrader TWS, IBot, API, IBKR mobile apps, MetaTrader 4, MetaTrader 5 |

|---|---|

| 📊 Accounts: | Individual, Joint, Corporate, Demo |

| 💰 Account currency: | EUR, USD, AUD, GBP, CAD, CZK, DKK, HKD, HUF, US, JPY, MXN, NZD, NOK, PLN, SGD, SEK, CHF, and CNH |

| 💵 Replenishment / Withdrawal: | Bank transfer only |

| 🚀 Minimum deposit: | €2000 |

| ⚖️ Leverage: | Margin trading available |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | Fixed |

| 🔧 Instruments: | Stocks, options, futures, bonds, precious metals, ETFs, CFDs, and Forex |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | No |

| 🎁 Contests and bonuses: | No |

ARMO Broker Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual | From €1.9 | No |

| Joint | From €1.9 | No |

| Corporate | From €1.9 | No |

There is no commission for maintaining an account, using the trading platform, or placing different types of orders.

The Traders Union also compared the trading commission rates at ARMO Broker with those of other stockbrokers such as Ally and Charles Schwab. As a result of the research, brokers were assigned a low, medium, or high commission level. You can see the data in the table below:

| Broker | Average commission | Level |

| ARMO Broker | $1.9 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of ARMO Broker

ARMO is a broker for global traders. The company provides comfortable trading conditions and offers several types of trading accounts: individual, joint, and corporate. A demo account is also available. Accounts can be opened in one of the presented currencies, as multicurrency accounts. Trading is possible at the expense of personal funds, if the client is over 18 years old; for margin trading, the user must be at least 21. The ARMO broker targets clients who prefer active trading strategies. The company does not provide services for copying trades, managing a trading account, or supplying trading signals.

ARMO Broker by the numbers:

-

The company's clients have access to 130 international exchanges.

-

The broker serves traders and investors from 33 countries.

-

ARMO offers over 20 base currencies for accounts.

-

More than 60 order types are available for users trading with ARMO.

-

The account maintenance fee is USD 0.

-

ARMO processes over 1,000,000 trades per day.

-

You can trade with ARMO Broker 24 hours a day, 6 days a week.

-

The company has over 1.2 million trading instruments.

ARMO is a broker for active traders worldwide

After opening an account, ARMO’s clients have the opportunity to trade stocks, futures, options, precious metals, Forex instruments, CFDs, ETFs, and other instruments. In total, the company presents more than one million assets.

The instruments provide access to 130 international exchanges. The wide selection also allows investors to create portfolios with a high level of diversification. ARMO’s trading platforms allow clients to choose the most suitable trading options and optimize the workflow according to their own gaming strategies. Note that ARMO does not provide consulting services; however, clients can receive individual advice from an independent professional trader who is associated with ARMO.

ARMO’s clients can participate in the trading process from any convenient device. The broker provides platforms for installation on a personal computer, as well as a web version of the terminal, plus there are mobile applications for comfortable trading from smartphones and tablets.

Useful services of ARMO Broker:

-

Training center. The training section was created to improve the professional level of traders. Martin Chlošek is a professional trader and prominent speaker at Forex and other trading webinars and seminars. He also presents for for the clients of ARMO Broker.

-

FAQs. This is a section where users can find answers to frequently asked questions regarding account opening, margin trading, and cooperation with the ARMO broker.

Advantages:

A wide range of trading assets.

Access to international exchanges ensures the liquidity of trading instruments.

The tutorials section includes information useful for both professionals and beginners.

The broker protects its clients’ capital.

ARMO customers have a variety of ways to contact support, including the ability to visit the broker's brick-and-mortar office.

Access to trading is possible from any device: from a personal computer to electronic smart devices.

How to Start Making Profits — Guide for Traders

The ARMO broker provides services to traders from different countries. ARMO has three main types of accounts with different forms of ownership. Clients receive equal trading conditions and broker services regardless of what type of account is opened.

Account types:

All types of accounts are presented in two forms: cash and margin. Any user over 18 can open a cash account, but margin accounts are available only to users over 21. The company has a demo account so that clients can explore the broker's trading conditions and trading practices.

Bonuses Paid by the Broker

The ARMO broker is aimed at providing services to active traders and investors and provides favorable conditions for trading various assets, regardless of which strategy the client chooses. For this reason, the company does not have a bonus program.

Investment Education Online

The ARMO broker provides services for active traders. Therefore, the company offers a section with training materials, thanks to which professionals can develop professional skills, and novice players can learn to trade in stock and other markets.

ARMO Broker’s clients can test their knowledge of trading various assets, as well as test new trading strategies on a virtual demo account. It eliminates financial risks, but it is also impossible to make money on such an account.

Security (Protection for Investors)

which guarantees clients’ capital protection up to USD 500,000, of which USD 250,000 is paid in cash. Investors' funds are also additionally protected by Excess SIPC - Interactive Brokers Llc, which covers accounts of up to $30 million, of which $900,000 can be paid in cash.

The ARMO broker secures its customers’ personal privacy account data. The company uses a two-factor authentication system, including a mobile one. For clients with accounts over USD 500,000, the broker provides a digital security card service.

👍 Advantages

- The company protects clients’ capital

- Personal data of clients and access to the account are protected by two-factor authentication

👎 Disadvantages

- Client funds are not held in segregated accounts

- The broker does not provide information on regulatory bodies

Withdrawal Options and Fees

-

To replenish a deposit or withdraw funds, ARMO clients need to go to their personal account and complete a transaction in the "Transfer and Payment" section.

-

To carry out financial transactions, the broker offers only one way: bank transfer. The broker's website contains the details of three banks, the services of which a trader can use, depending on the currency in which the trading account is opened.

-

There is no data on the timing of crediting funds to a deposit or personal bank account.

-

There is no commission for deposits or withdrawals at ARMO. However, a trading fee may be charged by the transferring bank the trader selects.

Customer Support Service

For users who have problems during the workflow, registration, and other operations, ARMO provides a free support service. You can contact the broker's employees by phone during the hours of 10/5 (on weekdays) or send an email.

👍 Advantages

- The broker offers different ways to contact support

- Clients have the opportunity to visit the physical office of the company

👎 Disadvantages

- Customer support is not 24/7

- No online chat

This broker provides the following communication channels for its clients:

-

fill out the contact form on the website;

-

call the number indicated in the "Kontakt" section;

-

request a callback on the website;

-

send a letter via email;

-

write a physical letter to the broker's postal address.

Also, traders can arrange an appointment for a consultation and visit the company's brick-and-mortar offline office.

Contacts

| Foundation date | 2018 |

| Registration address | Hüttenstraße 87, 40215 Düsseldorf |

| Regulation |

Central Bank of Ireland Licence number: 648125 |

| Official site | https://armobroker.de/ |

| Contacts |

Email:

support@armobroker.de,

|

Review of the Personal Cabinet of ARMO Broker

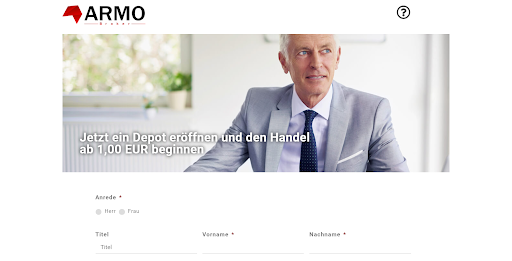

You can start trading stock and other assets with the ARMO broker after opening a live trading account. You can do this online by following the step-by-step instructions below.

Open the broker's official website. To open a live trading account on the main page, click on the "Livekonto eröffnen" button.

Fill out a short questionnaire with personal data: enter your first name, last name, email, phone number, and residence address.

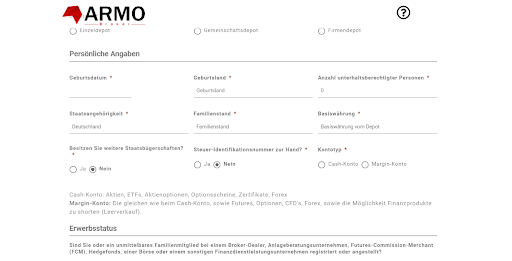

Continue filling out the questionnaire. Select the type of account (individual, joint, or corporate). Enter the date and country of birth, your nationality, marital status, select the currency of the account, and the type of account (cash or margin).

Write if you or your family members are registered with a broker, hedge fund, or other financial services company. Indicate the type of employment, the area of your activity, as well as whether you have other sources of income.

Secure your trading account. Select three security questions and enter the answers to them.

Form W-8Ben: Indicate if you have a green card, permanent residency in the US, US citizenship, US tax ID, reside in the US for more than 183 days a year, pay US taxes for other reasons.

Enter your annual income. Select your investment goals, as well as the desired methods of earning income (savings, hedging, etc.). Indicate if you have experience in trading various assets.

Read the customer agreement and sign it to complete registration.

This completes the application for opening an account with ARMO. If during the registration process you did not upload copies of the requested documents, send them to the broker's surface address via standard mail. If you have any questions, the ARMO staff will contact you by mail.

Additionally, in the personal account of the broker, the client has access to:

-

Deposit/withdrawal transaction histories.

-

A section for performing trade operations and accessing their transaction history.

-

Support section and customer portal.

-

Section with personal data.

-

Technical section for changing/restoring access.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the ARMO Broker rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about ARMO Broker you need to go to the broker's profile.

How to leave a review about ARMO Broker on the Traders Union website?

To leave a review about ARMO Broker, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about ARMO Broker on a non-Traders Union client?

Anyone can leave feedback about ARMO Broker on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.