Note: the classic inverse correlation of gold to the dollar can be broken by non-standard market factors. For example, the XAU/USD rally, which started in December 2023, is caused by geopolitical problems, supply/demand imbalance and expectation of the US Federal Reserve monetary policy correction, but there is no similar sharp decline in the dollar. A multi-factor fundamental analysis must be performed to properly assess gold's dynamics.

Trading Gold On Forex: A Guide For Beginners

You can start trading gold on Forex by taking the next steps:

-

Open a trading account with a reputable trading platform

-

Research the best strategy to execute trades

-

Open a Demo account

Gold Forex trading involves analyzing and speculating on the value of gold against fiat currencies within the forex exchange market, with XAUUSD being the most popular trading pair. It allows traders to diversify their trading portfolio, thereby reducing potential losses from currency volatility. Gold is considered a safe haven due to its intrinsic value and ability to hedge against inflation, making it highly appealing to traders.

This article will give you more insight on how to trade gold in the Forex market.

-

What Is XAUUSD?

XAUUSD is the symbol for gold traded against the US dollar in the forex exchange market based on the International Organization for Standardization (ISO) standards. In this code, XAU stands for gold, the 'base' currency; the USD represents the United States Dollar, the 'quote' currency.

What Is Forex Gold Trading?

Forex gold trading is speculating the price of gold against fiat currencies on the foreign exchange market. The XAU is the symbol used to identify the precious metal on the FX market, where X stands as an index while “AU" implies “Aurum,” a Latin word meaning gold. This symbol is paired against fiat currencies like the USD(US Dollar).

The FX market offers flexible exposure to the precious metal allowing traders to speculate on its price without directly owning it; traders use fundamental and technical analysis to assess gold's price movement within the FX market, determining whether it is experiencing a bullish or bearish trend. When the USD is in a downtrend, XAU tends to be in an uptrend, and vice versa. However, the market can also be sideways, lacking a clear trend.

Advantages of Trading Gold on Forex

Trading gold on Forex has numerous benefits, such as:

Opportunity to leverage

Leveraging refers to the opportunity to control larger positions with a smaller initial investment, amplifying potential return. Some brokers offer high leverage such as 100x or more. With a $1000 trading account and 100x leverage a trader can control a position size of up to $100,000. However, traders should apply proper risk management tools when trading with leverage.

24/5 Market Access

Forex gold trading also allows trading 24 hours daily, five days a week. This is unlike traditional stock markets that operate within specific hours and days of the week. The 24-hour access gives traders the chance to capitalize on market opportunities regardless of their time zone and at their convenience.

Liquidity

The liquidity of the Forex market ensures that gold trades can be executed swiftly and at competitive prices. Since there are numerous participants actively trading currencies and gold within the market, there is a constant flow of buyers and sellers. This abundance of liquidity allows traders to enter and exit gold positions quickly without significant delays or price slippage.

Hedge Against Inflation

This is a popular advantage of yellow metal; this implies that gold tends to keep its value intact or even become more valuable during inflation. Gold also has a limited supply, which contributes to its value.

Disadvantages of Trading Gold on Forex

The following are some of the disadvantages of trading gold on Forex.

Unique Market Characteristics

Like other assets and commodities, gold has its own supply and demand dynamics driven by factors such as jewelry consumption, industrial demand, central bank purchases, and investor sentiment. Traders need to consider these factors and stay updated on relevant news and events that can impact the gold market. Therefore, a deep understanding of how the market operates is required.

Gold prices can be highly volatile

Another disadvantage of trading gold in Forex is that the market can experience significant price swings in a short period. This volatility is often influenced by speculators who engage in day trading, aiming to profit from short-term price fluctuations. The involvement of these speculators can amplify price movements, making gold prices more unpredictable compared to other financial instruments.

Market Manipulation

Market manipulation is also a disadvantage of gold trading on Forex;it is a deliberate act of influencing the market price by false brokers to deceive traders. In the case of trading gold in the Forex market, market manipulation can occur when the big player in the market engages in activities that disrupt the market price flow, leading to unfair or artificial price movement.

What is the best Forex broker to trade gold?

Here is a list of some brokers that offer gold trading instruments on their Forex trading platform

| Forex Broker | Minimum Deposit | Commission in Trading Gold (XAUUSD) |

|---|---|---|

10 USD |

3.8 USD per lot per side |

|

|

200 USD |

3.5 USD per lot per side |

|

|

1 USD |

3.5 USD per lot per side |

|

|

500 USD |

4 USD per lot per side |

|

|

100 USD |

$0 (charges spread) |

Here is a full list of reliable brokers you can use

How can beginners start trading gold in Forex?

As a beginner, you can start trading gold on Forex by taking the following steps:

Open a trading account with an online trading account

To start your Forex trading journey, you must open a trading account with a reputable trading platform

You can conduct research for a user-friendly trading platform that offers useful trading tools. Ensure you verify the platform's reputation by checking for comments from past users, as it will help you make informed decisions.

Research, learn, and build a strategy

The next step is to study appropriately and research the best strategy to execute trades. You will start getting familiar with some trading principles and terminologies in this stage. Moreover, constantly reading news on gold and the exchange market will improve your understanding of how the market works.

Open a Demo account

Learn more than just the theory aspect; you must take some practical training before using a live account. Almost every brokerage offers a free demo account that you can use to practice what you are learning. Ensure you repeatedly test your strategy on a demo account until you are confident enough to try it out on a live account.

The next step is to study appropriately and research the best strategy to execute trades. You will start getting familiar with some trading principles and terminologies in this stage. Moreover, constantly reading news on gold and the exchange market will improve your understanding of how the market works.

For more in-depth understanding read How to Trade Gold Online? A Guide For Beginners

What's the best strategy for trading gold?

The best strategy for trading gold depends on the trader's preference and trading style. However, the following are some popular strategies traders use when trading gold.

Buy and hold

This is a method of investing in gold; it involves buying and holding the commodity for a long time, which can be for weeks, months, or even years. Traders who use this strategy believe in the long-term value of gold. Moreover, it requires less active management. However, since it's a long-term strategy, it is unsuitable for day traders or anyone seeking quick money.

Technical analysis (short-term)

Aside from buying and holding and waiting for a breakout, you can also become a short-term trader using technical analysis to analyze your trade. Traders use various indicators and tools to time their traders and determine their optimal entry and exit points. Some popular technical indicators include candlesticks, MA, RS, MACD, and Bollinger Bands.

Fundamental analysis (long-term)

Fundamental analysts conduct various research to know what is driving the market per time. They do this by following key metrics and listening to the news to understand the economic factors that influence the price of gold. These traders also typically hold the price for long after getting a good entry point.

It is important to note that many traders use a combination of these strategies when trading. It is not uncommon for a trade to conduct technical analysis to understand price action and, at the same time, follow the news to see what factors are dominating the market at a specific time. Such traders may also be looking to open a long-term position.

What are the factors that influence the price of gold?

Value of US dollar and other fiat currencies

One factor that influences the price of gold is the US dollar; a form of tie exists between gold and USD. The price of gold is expressed in how much fiat currency (in this case, US dollars) it takes to purchase a unit of gold. This pricing, therefore, creates a form of inverse relationship between XAUUSD. Thus, when there is a surge in the value of the USD, the price of gold declines; conversely, when the price of XAU spikes up, the price of USD declines. In this case, when the dollar is weak, the purchasing power of investors is weak, leading to demand for gold.

Demand for Gold

Demand for gold is an essential factor that can also affect its price. There are some industries whose interest and changes in their demand for gold would impact the overall demand-supply whose interest and changes in their demand for gold would impact the overall demand-supply dynamics and, consequently, the price of gold.

The exchange-traded fund (ETF) is a notable source of gold demand. When investors buy shares of gold ETFs, the fund gets more gold to support those shares—leading to increased demand for physical gold. This increased demand can contribute to higher gold prices. Gold ETFs offer investors the opportunity to gain exposure to the gold market without directly owning physical gold, and their demand can have a similar effect on gold prices as other types of demand.

Supply of Gold

Another main factor that affects the price of gold is the mining rate. When the price of gold rises, mining becomes more profitable, and mining companies are motivated to increase their production rates to take advantage of the higher prices. This increased production can lead to an increase in the overall supply of gold in the market, which can also eventually regulate the price or make it drop.

Note: When you analyze data on gold production, you need to filter it wisely. For example, China remains the leader in gold production, but this metal is not exported, but is immediately deposited in gold reserves and does not affect the market price of XAU/USD. A similar situation: when American production volumes increase, the dollar does not strengthen, because such gold does not enter the commodity markets, but is fully realized in the domestic market to solve current problems of the economy. Actual data on production and turnover of physical gold can be found on the website of the World Gold Council.

Which market session is the best time to trade XAUUSD gold in Forex?

When trading gold on the Forex market, timing is crucial in determining profitability. The price of gold can fluctuate throughout the day due to factors such as economic data releases, geopolitical events, and other factors that can affect market sentiment. Depending on your strategy, either as a short or long-term trader, it is essential to note that different trading strategies have varying timing requirements. Liquidity, chart patterns, and volatility in the market are necessary factors that traders consider when timing their gold trades.

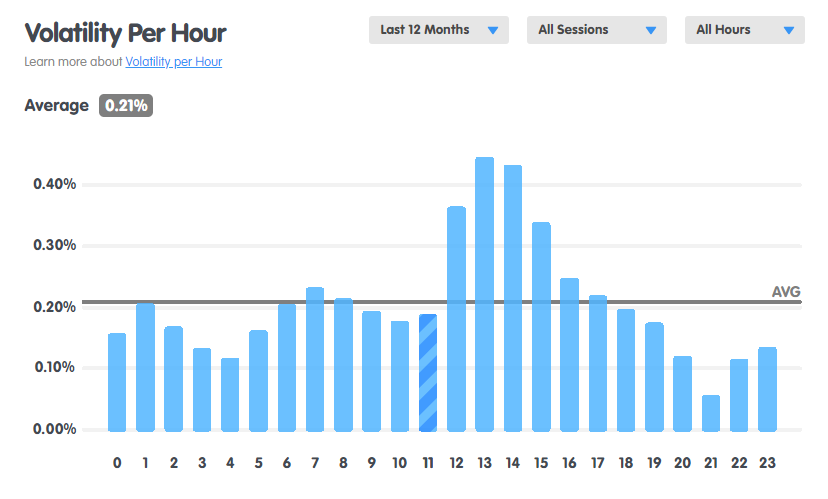

Volatility per hours

Using the above image, the horizontal numbering of "0 to 23" is the number of hours a day from 00:00 UTC to 23:00 UTC. Meanwhile, the vertical numbering from 0% to 0.40% is the average volatility for each hour. From the image, we can deduce that from 00:00 UTC to 11:00 UTC, the average price movement of gold was between 0.10% to 0.20%, representing an average volatility.

From 12.00 UTC, the market volatility is at its peak. This period also tallies with the end of the London market session break and the NewYork open; at this point, the spread is also very tight, making timing less critical. At this point, the market is moving very fast, and many day traders come in to make a profit. From 17:00 UTC, the volatility starts to drop to a moderate level again, and the period from 20:00 UTC to 23:00 UTC is also a time of low volatility.

Volatility reflects the magnitude of price fluctuations and may influence the timing of gold trades. Some strategies aim to capitalize on high volatility, while others prefer calmer market conditions.

Read here for more on What Time Is Best To Buy Gold On Forex?

XAUUSD: Example of trade

Example of trade

Let's use this image to provide a pictorial representation of how to trade gold in Forex. The instrument being traded is XAUUSD on the daily timeframe. Based on the chart, we can deduce that the entry point for the trade was $2024.18. The stop loss, which will be the exit level if the trade does not go as predicted, is set at $1991.80, and the take profit execution level (the highest point to secure profit) is at $2089.11. The trade is executed using one standard lot, and the risk-to-reward ratio is 1:2.

Considering a risk of 2%, if the trade hits the stop loss, we will be losing $1000 * 2% = $20, and it reaches the take profit; the total amount that will be gained is $40.

Conclusion

Now that you have understood how to trade gold in Forex and the best FX trading strategy. You must set clear investment goals, which will also determine how you define your risk-to-reward ratios and your trading strategies. Trading gold in Forex can be very profitable, but you need to take your time to practice using a demo account provided by your reputable broker; this will help you gain more insights and confidence as you hone your skills.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.