Can Gold Beat Inflation?

-

Gold is considered a safe-haven hedge against inflation with a long history as a store of value

-

Its real-world uses in jewelry and electronics provide tangible value, and it has a limited supply unlike fiat currencies

-

Gold’s effectiveness as an inflation hedge has shown mixed results historically, with periods of both success and underperformance

-

Recent increases in gold prices have sparked doubts about its effectiveness as an inflation hedge, despite some evidence suggesting it can be effective over the long term

-

Gold’s performance as an inflation hedge varies depending on factors such as currency, and it is not the only hedge against inflation available to investors

Inflation is an increase in the price of goods and services that leads to the depreciation of money. In today’s uncertain economic climate, many investors are looking for ways to protect their wealth from the effects of inflation. Gold has long been seen as a hedge against inflation, as its price tends to increase during periods of high inflation.

However, is this still the case? This article will explore the relationship between gold and inflation, analyzing whether gold does indeed protect against inflation and discussing the factors that affect gold prices today.

Do you want to buy gold? Open an account on Roboforex!-

Does gold actually keep up with inflation?

Gold is often viewed as a hedge against inflation because historically, its price tends to increase when the cost of living rises. However, its performance in keeping pace with inflation can be inconsistent, especially over short periods, and it may not always match or exceed the rate of inflation.

-

What is the best investment to beat inflation?

There is no single "best" investment to beat inflation, as it depends on individual risk tolerance, investment goals, and market conditions. Investments like stocks, real estate, Treasury Inflation-Protected Securities (TIPS), and commodities are commonly considered for outpacing inflation.

-

What are the disadvantages of investing in gold?

Investing in gold has several disadvantages, including lack of dividend or interest income, high storage and insurance costs if held physically, and price volatility. Additionally, gold's value doesn't necessarily correlate with economic growth, which can make it a less attractive investment during periods of strong economic performance.

-

What are the advantages of investing in gold?

The advantages of investing in gold include its status as a safe-haven asset during economic uncertainties, its potential as a hedge against inflation and currency devaluation, and its historical preservation of wealth. Gold's value is also largely independent of any single country's economic policies, making it a diversification tool in a global investment portfolio.

Is gold still a good hedge against inflation?

Historically speaking, gold has indeed served to protect against inflation over the long term. Over the past 100 years, the price of gold has risen by an average of 7% per year, which is significantly higher than the inflation rate in most countries around the world. This means that investors who have invested in gold have been able to maintain or even increase their purchasing power.

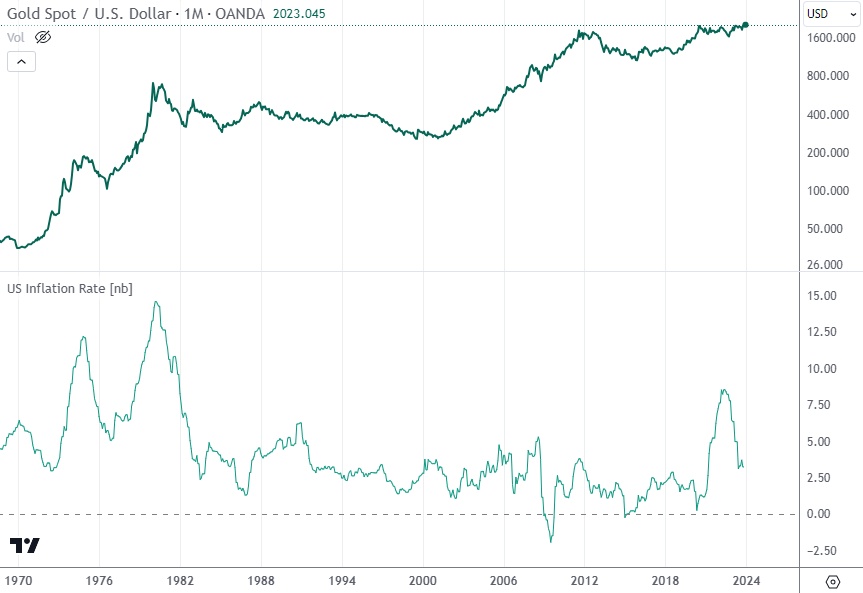

XAU/USD chart

The graph above shows the performance of gold since the 1970s compared to different rates of inflation.

In recent years, gold has been called into question as an effective hedge against inflation, leaving many to wonder if it is still a reliable protection against rising prices. Even though gold has been used as a store of value and a hedge against inflation historically, its recent track record as an inflation hedge is mixed, with periods of outperformance during high inflation and underperformance during average inflation rates.

Recent studies have suggested that gold can still act as a hedge against inflation when looking at long-term performance, although its low sensitivity to changes in the Consumer Price Index (CPI) means that it may not be as effective for investors in the US. Additionally, gold prices can be volatile and are influenced by various factors, so it is not a foolproof protection against inflation.

Ultimately, whether gold is a good hedge against inflation depends on an individual investor’s circumstances and risk tolerance.

Best brokers to trade gold (XAUUSD)

Inflation vs Gold: Who will win?

In the short term, gold prices can be very volatile. They can rise or fall rapidly depending on various factors such as the geopolitical situation, the state of the economy, and investor sentiment. Therefore, investing in gold does not guarantee protection against inflation in the short term.

The outcome of inflation versus gold is uncertain, as both assets are subject to various factors and market conditions. Gold has a long history as a store of value and limited supply. Demand for gold has historically increased during periods of high inflation, indicating its potential effectiveness as an inflation hedge. However, its performance as an inflation hedge is impacted by factors such as supply, trading trends, and investor sentiment.

| Asset | Inflation | Gold |

|---|---|---|

Supply |

Unlimited |

Limited |

Performance |

Uncertain |

Uncertain |

Impact |

Economic & Political Factors |

Supply, Trading Trends & |

Despite gold outperforming Bitcoin as an inflation hedge in the past two years, its recent unimpressive performance raises doubts about its effectiveness in the current inflationary environment. The forecasts for inflation rates for 2024 and 2025 put it at 2.3% and 2.1% respectively, and it’s expected to stabilize around 2% for 2026 and 2027.

Investors should carefully consider their risk tolerance and investment objectives when deciding on the allocation of gold and Treasuries in their portfolios, as the future performance of both assets is uncertain amidst inflation concerns.

To learn more, read our article on Gold (XAU) price prediction 2024, 2025, 2030.

How does inflation affect gold prices?

Traditionally, rising inflation has contributed to a higher gold price more often than not. But there have been exceptions to this. For example, in the early 1980s, inflation in the U.S. was high and gold was declining.

However, several factors may explain why gold fell in value during this period.

-

The 1970s saw an increase in the supply of gold. This occurred for several reasons, including advances in gold mining technology and increased gold production in South Africa

-

The 1970s saw a decline in the demand for gold. This was because central banks began selling their gold reserves and because investors became more interested in other assets such as real estate and stocks

By examining the historical relationship between inflation and gold prices, it is possible to gain insight into how inflation affects gold. Inflation has an indirect influence on gold prices, as rising prices may lead investors to buy more gold to preserve purchasing power.

Additionally, gold has a limited supply, which can further drive up its price during times of economic uncertainty or geopolitical instability. However, gold’s performance as an inflation hedge is mixed, as factors like supply, trading trends, and investor sentiment also influence gold prices in addition to inflation.

As a result, it is difficult to predict gold price movements solely based on inflation. Gold’s effectiveness as an inflation hedge also varies depending on the currency it is held against, and has shown significant increases against certain currencies. Therefore, while gold can provide some protection against inflation, it is not a foolproof strategy.

Gold analysis today

Today, it is worth analyzing how gold has fared in recent years as an inflation hedge. Gold has traditionally been seen as a safe-haven asset during times of economic uncertainty or geopolitical instability. However, its performance as an inflation hedge has been less clear-cut in recent years.

At the moment, gold is trading just slightly above the $2000 mark, which tends to serve as a big even support level. The resistance at $2035 is still going strong, however. To initiate a bearish correction on an intraday basis, the gold price broke through the bullish channel's support line and closed the last four hours' candlestick below it.

XAU/USD chart

Gold has been outperformed by Bitcoin in recent years, and its recent weak performance has raised doubts about its effectiveness as an inflation hedge. Investing in ETFs that invest in gold and hold Treasury bonds can be a suitable solution for many investors, as it offers exposure to gold while reducing the risk of holding a single asset in a volatile market.

Additionally, gold’s performance as an inflation hedge varies depending on the currency it is held against. Despite this, gold has been a reliable inflation hedge for millennia, and its limited supply can still help protect against devaluation caused by inflation expectations.

This in-depth guide provides a great summary of Gold Analysis Today – XAU/USD Support and Resistance.

Summary

Ultimately, it appears that gold can be an effective hedge against inflation when held for the long-term and in the right currency. Gold’s performance as an inflation hedge varies depending on factors such as currency and its effectiveness has shown mixed results historically.

However, it has a long history as a store of value and its real-world uses in jewelry and electronics provide tangible value. Additionally, gold has a limited supply unlike fiat currencies, which can further drive up its price during times of economic uncertainty or geopolitical instability.

Investors should take into account that gold is not the only hedge against inflation available and its price can be volatile. Recent increases in gold prices have sparked doubts about its effectiveness as an inflation hedge, despite some evidence suggesting it can be effective over the long term.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.