What Is The Annual Return Of Gold?

Gold investments have seen an average annual return of 12.44% over the past decade, 9.84% in 20 years, and 8.3% in 30 years. However, some years have seen negative returns, such as 2015 and 2018.

Using gold as a means of value exchange is perhaps the oldest form of trading, ever since the Ancient Egyptians started using it for international trade three and half thousand years ago. Today, gold is traded not only as a form of wealth storage and as a long-term investment, but as a hedge against inflation and for portfolio diversification. Investors trade in physical gold, gold futures contracts, gold ETFs, and even stocks of gold mining companies. But how much can traders make from trading gold? Traders Union is here to answer that question for you.

| Period | Average Annual Return |

|---|---|

10 years |

12.44% |

20 years |

9.84% |

30 years |

8.3% |

50 years |

7.78% |

-

Has Gold Been a Good Investment Over the Long Term?

Yes, as a long-term investment, gold has seen consistent growth when calculating averages. However, some years have seen negative returns.

What is the annual return for gold?

As a commodity, gold tends to be a volatile asset. Multiple factors can affect its price, such as inflation reports, geopolitical tensions, or even a miners’ strike. Gold’s value can fluctuate significantly, rising during times of high inflation, or falling when the US dollar is strong. Yet, over time, the value of gold on average has consistently and considerably grown, despite periods of temporary downturn. Its continuous growth can be attributed to several factors; its finite supply, increasing demand across various industries, and investors’ tendency to keep huge amounts of gold for storage of value.

If we look at the return on gold investments over the past 50 years, returns average out at around 7%. When looking at the numbers in a shorter period, such as 20 years, average returns are closer to 8.65%. If one were to only use numbers for the past decade, returns on average would be roughly 0.92%.

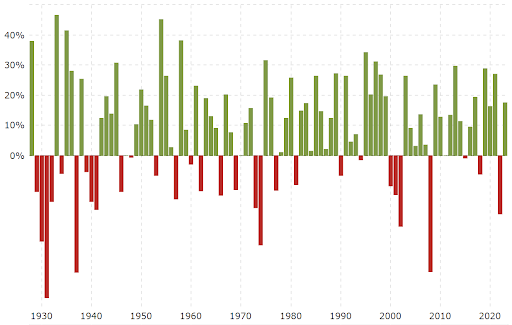

You’d be forgiven for thinking that gold investments guarantee returns for years to come. However, gold is incredibly volatile, and if we look at the returns for each year, we get a different picture. For example, in 2020, gold gave investors a return of over 20%, due to a sudden surge of gold investment at the onset of the pandemic. In 2022, returns stood at just 0.44%. In fact, returns were negative in 2018, 2015, and 2013. Because of the way averages work, they paint a picture of consistent growth. In reality, the most important factor for positive returns is when you decide to invest.

Annual return of gold

Has gold outperformed the S&P 500?

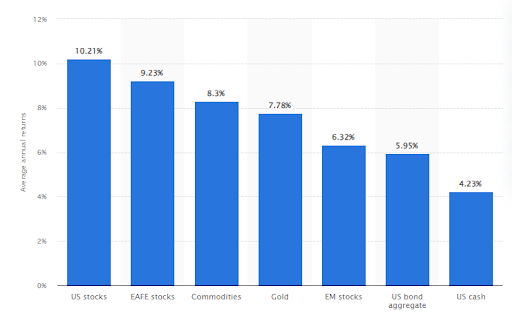

Out of the most common trading assets and their average annual returns over the past 50 years, from 1971 to 2022, gold has performed moderately well. Stocks in the US market, and the EAFE market, as well as general commodities, have all returned higher average yields compared to the gold market. Emerging market stocks (EM), US bonds, and US cash, have all generated lower average annual returns than gold. The numbers for each can be seen in the table below.

Figure 1 Annual Average Returns across financial markets for 50 years

stastista.com

The S&P 500 stock index has performed considerably better than all these financial markets. As a market-capitalization-weighted index of 500 of the leading publicly traded companies in the U.S., it is naturally going to perform well over several decades. Since 1957, the average annual return has amounted to 11.88%. Like gold though, it has seen several years where returns have been negative, most recently in 2018 and 2022. So, although it has seen a consistent trend of general growth over time and on average nets positive returns, the crucial factor in generating a positive yield is knowing when to invest.

Figure 2 S&P 500 Average Annual Returns

macrotrends.net

Best brokers to trade gold (XAUUSD)

How to Start Trading Gold?

If you’d like to take advantage of the generally positive returns offered by trading gold, you can do so- by following these steps.

-

Open Account: Research and choose a reputable and reliable brokerage platform that offers gold trading services. Open an account with them, providing the necessary personal and financial information for registration.

-

Choose Asset: Decide whether you want to trade futures contracts, exchange-traded funds (ETFs), or Contracts for Differences (CFDs). Futures and CFDs tend to involve higher risk, while ETFs are a more straightforward way for beginners to start trading gold.

-

Make Trading Decisions: Next, you need to start trading. Stay informed about factors influencing gold prices, then develop a trading strategy that aligns with your risk tolerance and financial goals. Implement stringent risk management practices to protect your capital. Keep an eye on any market developments, then review and adjust your trading strategy accordingly.

Conclusion

Overall, gold is a stable asset for investment that generally gives positive returns, particularly when looking at averages over a long enough time scale. However, it is not without its risks, as some years see downturns in its price leading to negative returns. Make sure to conduct thorough research before making any investment decision, and time your entry into a gold trade carefully.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.