When is the Best Time to Buy Gold?

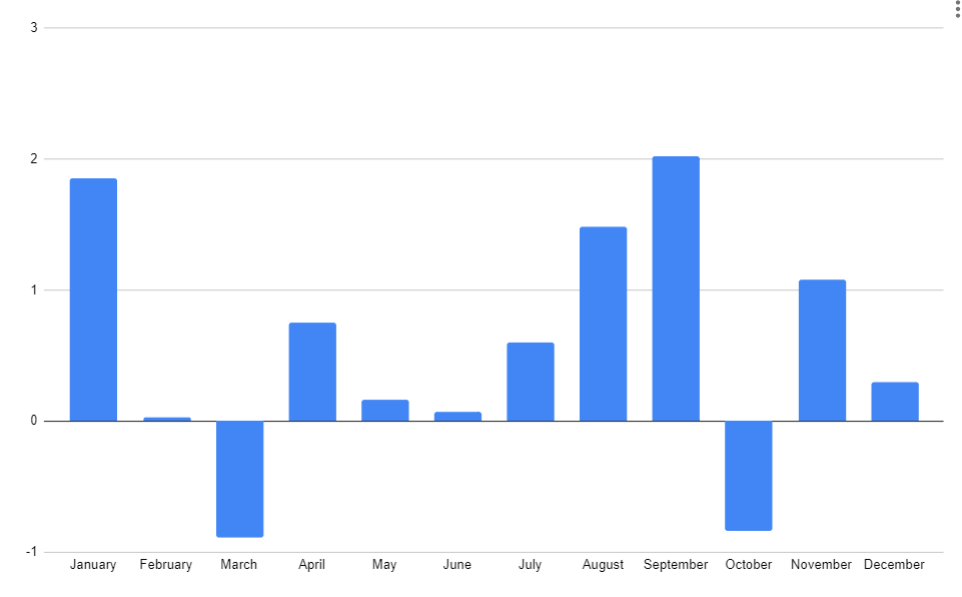

In the last 42 years, March has typically seen the biggest drop in gold prices, making it a statistically preferable time to buy. On average, gold has historically increased in price by 2.02% in September, making it the best performing month for the precious meta

However, it's crucial to monitor inflation, the state of the US Dollar and many other factors when buying and selling gold.

January - Monthly Change: 1.85

February - Monthly Change: 0.03

March - Monthly Change: -0.89

April - Monthly Change: 0.75

May - Monthly Change: 0.16

June - Monthly Change: 0.07

July - Monthly Change: 0.6

August - Monthly Change: 1.48

September - Monthly Change: 2.02

October - Monthly Change: -0.84

November - Monthly Change: 1.08

December - Monthly Change: 0.3

Gold has long been a valued financial asset and a reliable investment outlet. Today, not just individual investors but also central banks bank on gold. Its role as protection against inflation and a sound option to fiat currencies keeps its investment demand strong. Even with the global trend of low or negative interest rates, gold, which doesn't yield interest, stands out compared to bonds or cash. In uncertain geopolitical or economic times, gold often sees a rise in safe investments. This article will discuss the best timing to invest in gold to maximise your returns.

-

What is XAU/USD?

XAU/USD is the spot gold traded on the foreign exchange market label. Gold (XAU) is traded against the US dollar (USD), and its price represents the cost of one ounce of gold in USD. Like any traditional currency pair, XAU/USD is traded on forex marketplaces.

What is the best time of the year to buy gold and silver?

Historically, the start of the year is often an excellent time to buy gold as prices typically rise.

Gold price change by month based on statistics since 1975

The prices tend to dip during spring and summer but pick up again from late August to September, lasting until the end of the year.

Records highlight March as the most affordable month to buy gold, with prices staying low until the second quarter, making it a perfect time to buy. Looking at gold's trends since 1975, when it was legal to buy again, the best times to purchase gold are the beginning of the year, March, and the end of April.

Like gold, the best times to buy silver follow a similar pattern. However, the price of silver is more volatile due to its smaller market size, lesser liquidity, and fluctuating demands from different sectors. These factors should be kept in mind when diversifying an investment portfolio. Usually, there’s a drop in silver prices in January, making it a favorable time to buy. After January, silver prices increase at different times during the year, with March and mid-June to July being other good periods to buy.

What months are best to invest in gold?

Based on historical data, if you want to buy gold, the best months to consider are early January, August, September, and December. Gold prices usually increase during these months, allowing investors to buy at relatively low prices before the seasonal increase.

January often sees a rise in demand for retail jewelry after the Western holiday season. The autumn months of August and September also experience an increase in global gold purchases as people prepare for end-of-year celebrations. December experiences a similar rise. While these seasonal patterns may not hold true every year, their historical reliability can guide you on the best times to buy.

It's also crucial to acknowledge certain seasonally weaker periods, namely June and July. These months have typically recorded the most significant dips in gold's market value. Gaining awareness of these high-risk periods is integral for informed decision-making. These intervals may be utilized either to avoid investments or to exploit potential price reductions.

What month is gold most expensive?

Analyzing several decades of monthly price data shows that gold prices peak in September. This pattern aligns with the end of the summer rally that usually happens before the fall season. In January, gold prices are typically high, likely due to increased retail jewelry sales around the Chinese New Year and winter holidays.

However, TU’s experts suggest to focus only a little on individual months - looking at broader trends over several quarters or years can provide a more accurate forecast of prices. Also, remember that past events don't necessarily predict the future. Just because gold prices have traditionally been strong in September and January doesn't mean this will always be true. Market conditions change over time.

Best brokers to trade gold

What will gold be worth in 10 years?

Predicting future gold prices is not precise due to the many unpredictable factors that can affect the market over extended periods. Still, past patterns can give a basic idea of potential gold price trends in the coming ten years. This rough goal suggests that current prices, adjusted for inflation, are still lower than peak records from the early 1980s. However, it's important to note that gold isn't guaranteed to follow past patterns, as unforeseen events or changes can always arise.

The price of gold is bullish, in long-term

Looking ahead, it's smart for long-term investors not to focus too much on predicted price goals. Staying focused and disciplined as circumstances change is more beneficial than depending on ten-year forecasts.

In the end, reacting smartly to evolving big-picture situations over the investment period is most important for success - not sticking to random future price estimates.

Now, looking at nearer-term predictions, many banks and institutions have offered 2024 gold price outlooks:

-

The World Bank predicts an average of $1,950 per ounce next year as geopolitical conflicts could heighten uncertainty and lift gold.

-

The IMF's forecast is slightly lower at $1,775, reflecting expected global growth and inflation improvements.

-

Goldman Sachs sees further upside in 2024 with an average of $2,133, driven by safe-haven flows amid recession risks.

-

JPMorgan forecasts prices rising from current levels to average $2,175 by Q4 2024 as they expect Fed rate cuts to commence.

-

Citigroup and UBS also predict gains next year, pegging their average price targets at $2,040 and $2,200, respectively, based on easing inflation, lower real yields, and resilient investment demand.

-

Other bullish 2024 projections come from TD Securities and ABN AMRO, while ING and Commerzbank anticipate consolidating prices but remaining elevated above $2,000.

Based purely on past cycles and mean reversion patterns, Traders Union analysts suggest gold could potentially trade around $2,422.25 per ounce by 2032.

| Year | Price in the middle of the year | Price at the end of the year |

|---|---|---|

| 2024 | $1,905.85 | $1,903.05 |

| 2025 | $1,760.65 | $1,739.85 |

| 2026 | $2,023.05 | $1,837.55 |

| 2027 | $1,938.95 | $1,971.45 |

| 2028 | $1,899.15 | $1,954.65 |

| 2029 | $2,103.35 | $2,150.55 |

| 2030 | $2,651.45 | $2,475.75 |

| 2031 | $2,482.75 | $2,422.25 |

| 2032 | $2,447.35 | $2,585.25 |

You can read this article - Gold (XAU) price prediction 2024, 2025, 2030 to get more insights of Gold’s forecasting.

Conclusion

Looking at past monthly price patterns, evident seasonal trends for Gold stand out. Even though making purchases based solely on seasonal factors presents risks, these trends and keeping an eye on essential influencers like inflation and the dollar can aid in making investment decisions. Gold remains a wise portfolio balancer, and measured accumulation may help reduce volatility.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).