What is XAUUSD: The Ultimate Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

XAUUSD is the symbol for the spot gold exchange rate on the foreign exchange market. Gold (XAU) is traded against the US dollar (USD), and its price represents the cost of one ounce of gold in USD. The XAUUSD symbol is usually used in terminals provided by forex brokers.

XAUUSD is a financial symbol that represents the exchange rate between gold (XAU) and the US dollar (USD). Traders use this pairing to speculate on the price movements of gold in relation to the US dollar.

Understanding XAUUSD includes examining the factors that influence both gold and the USD, making it a critical instrument in the world of forex and commodities trading.

What is XAUUSD?

In XAUUSD, the symbol XAU represents gold. It signifies the exchange rate between gold and the US dollar, displaying the value of the precious metal expressed in currency.

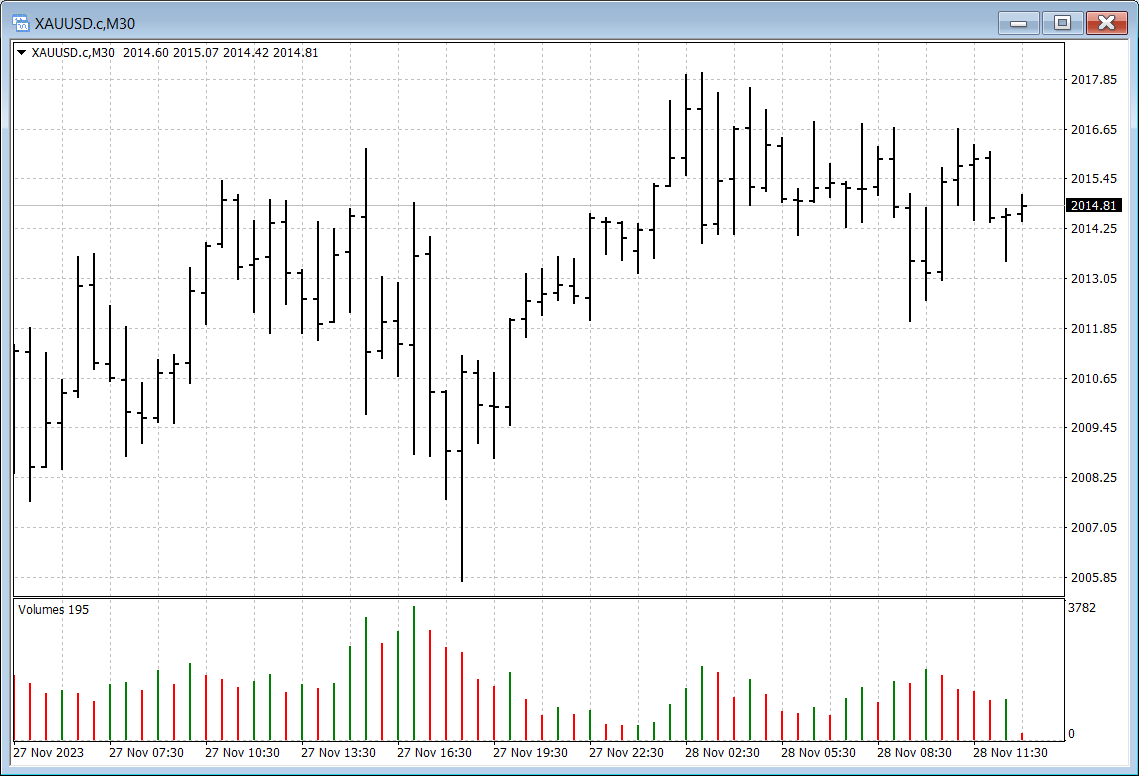

Metatrader

MetatraderThe XAU/USD quote changes during the 24/5 business day with a short break at night when trading in gold futures on New York's COMEX exchange is paused.

Gold trading activity is very variable intra-day, so it's important to read the article: What Is The Best Time To Trade Gold Forex?

How to trade XAUUSD

To perform a successful trade XAUUSD, here are 5 steps that you can follow:

Select a Trading Platform: Select a reputable forex trading platform that offers XAUUSD as a tradable instrument. You can look for the platform that has superior rating in terms of trading speed and liquidity.

Market Analysis: Conduct thorough analysis of gold and USD factors using technical and fundamental analysis. It helps you in developing a basic understanding of the gold market and analyzing the trends which may impact gold prices.

- Risk Management: Set clear risk management parameters, including stop-loss and take-profit levels, to protect your investment.

- Execute Trades: Place your trades based on your analysis, follow the direction you believe XAUUSD will move. It requires a deep understanding of technical and fundamental parameters which can develop with the passage of time.

- Monitor: Keep a close eye on market trends and news. Adjust your strategy as required to respond to changing conditions. Events like interest rates change or inflationary control measures will impact the gold prices, act accordingly.

Choosing the right forex broker to trade XAUUSD could be an exhausting task. This article will help you understanding the ideal steps you can take to choose the right broker to start your trading carrier: How to choose a Forex broker wisely

Best brokers for XAUUSD trading

| Plus500 | Pepperstone | OANDA | |

|---|---|---|---|

|

XAU/USD trading |

Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No |

|

XAU/USD spread, pips |

45 | 22 | 30 |

|

Regulation |

FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA |

|

TU overall score |

6.83 | 7.17 | 6.8 |

|

Open an account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Factors that affect the price of XAUUSD

The various factors affecting the price of XAUUSD include:

Economic Conditions: The overall economic health of countries can impact the XAUUSD. Economic instability or downturns may implore investors preferences toward gold as a safe-haven asset, influencing its price.

Political Uncertainty: Political instability or geopolitical tensions can increase demand for gold as a hedge against uncertainty. Traders often turn to gold during times of geopolitical risk, affecting XAUUSD prices.

Interest Rates: Changes in interest rates, especially in the United States, can impact XAUUSD. Higher interest rates may strengthen the US dollar, usually leading to a decrease in gold prices, and vice versa.

Inflation: Gold is often noted as a hedge against inflation. When inflation increases, the real value of currencies may fall, and investors may turn to gold as a store of value, influencing XAUUSD prices.

Forecasting gold prices will be useful for traders who are looking forward to trade in XAUUSD, here is the detailed analytics of gold prices: Gold Analysis Today – XAU/USD Support and Resistance.

Conclusion

In XAUUSD, the US Dollar (USD) is the currency against which the price of gold (XAU) is quoted. XAUUSD represents the price of 1 ounce of gold (XAU) quoted in United States dollars (USD). The quote changes 24/5, offering speculation and investment opportunities.

FAQs

What is the meaning of XAUUSD in forex?

XAUUSD in forex depicts the exchange rate between gold (XAU) and the US dollar (USD). It represents how much one unit of gold is valued in terms of US dollars in the global financial markets.

What is the difference between gold and XAUUSD?

Gold is the physical precious metal, while XAUUSD is the forex symbol representing its exchange rate with the US dollar.

Is XAUUSD a currency or commodity?

XAUUSD is a commodity pair in forex that represents the exchange rate between gold (XAU) and the US dollar (USD).

Is XAU pure gold?

XAU is the financial symbol for 99.99% purity bank gold. However, forex trading with XAUUSD does not mean that you will be dealing with physical bullion.

Related Articles

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

In the Forex market, a “trend” is the label used to describe the general direction that the prices of currency pairs are moving in, over a specific period of time. Trends are basically the pattern that a currency pair appears to be following and can help traders determine when to enter and exit a trade.