How To Buy Stocks In France 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to buy stocks in France:

Over 1.5 million investors actively trade in the French stock market due to its potential for higher financial returns. With online brokers simplifying stock purchases, investing in France is easier than ever.

As the EU's third-largest and the world's sixth-largest economy, France boasts a strong, open market with significant global influence. It hosts 40 of the world's largest 500 corporations, offering diverse investment opportunities and a proven track record of attracting foreign businesses.

Online brokers are cost-effective for buying and selling stocks in France, avoiding the high commission fees of full-service brokers. Here's how you can use them to start investing.

How to buy stocks online in a few easy steps

Here’s how to buy stocks online:

Choose an online stock broker

To begin investing in stocks, you need to select an online stock broker. Look for a broker that offers a user-friendly interface, low fees, good customer service, and a wide range of investment options. It is essential to ensure that the broker is regulated and operates within your country's jurisdiction.

For beginners, brokerages with extra benefits such as social trading can be invaluable as they offer opportunities to learn from experienced traders, as well as study best strategies. Additionally, access to comprehensive educational resources, fractional shares trading, and a diverse range of ETF investment options can further empower beginners in making well-informed and diversified investment decisions.

| Available in France | Demo | Account min. | Min. stock/ETF fee | Withdrawal fee | Foundation year | Regulated | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | No | Zero Fees | $5 | 2007 | CySEC, FCA, ASIC, SEC, FSA in Seychelles, MFSA, FINRA, Gibraltar Financial Services Commission (GFSC), | Open an account Your capital is at risk.

|

|

| Yes | No | No | €2,00 for US stocks | No | 2008 | BaFin, DNB, AFM, FCA | Study review | |

| Yes | Yes | 2,000 | US Stocks $2, EU Stocks €4 | Varies | 2001 | FCA, BaFin | Open an account Your capital is at risk.

|

|

| Yes | Yes | £500 | $1/£5/€3 | $0 (standard) | 1992 | Danish Financial Supervisory Authority (FSA) Financial Conduct Authority (FCA) Securities and Futures Commission (SFC) Monetary Authority of Singapore (MAS) Australian Securities and Investments Commission (ASIC) Swiss Financial Market Supervisory Authority (FINMA) | Open an account Your capital is at risk. |

|

| Yes | No | No | Zero Fees | No charge | 2014 | Investment Industry Regulatory Organization of Canada (IIROC) U.S. Securities and Exchange Commission (SEC) Canadian Investor Protection Fund (CIPF) | Open an account Via Wealthsimple's secure website. |

Sign up for an account

Once you have chosen a suitable broker, you'll need to sign up for an account. The registration process typically involves providing your personal information, which may include:

Your full name.

Address and contact details.

Date of birth.

Social Security number (or equivalent).

Proof of identification (such as a driver's license or passport).

Employment and material status information is optional.

Keep in mind that some brokers might require mandatory verification of your identity and documents.

Make your first deposit

To pay for the stocks you want to purchase, you'll need to deposit funds into your brokerage account. Most brokerages offer various funding options, such as bank transfers, credit/debit cards, or wire transfers.

Bank transfers. Usually free or low-cost, but may take a few days to clear.

Credit/debit cards. Instant, but may involve additional fees.

Wire transfers. Instant, but may involve additional fees.

How much money should I deposit for the first time? TU experts recommend starting with a small amount to understand the stock market and gain practical experience.

Choose the stocks you want to buy

With your account funded, it's time to choose the stocks you want to buy. You can use your brokerage's research tools or other financial websites to gather information about potential investments. Take into consideration factors like your budget, risk tolerance, and long-term investment goals when making your decisions.

If you are inclined towards long-term investing, it is essential to focus on conservative trading strategies, prioritize portfolio diversification, and thoroughly understand the businesses of the companies you invest in. On the other hand, if you prefer active trading, consider learning technical analysis or other techniques to make informed decisions and navigate the dynamic nature of the stock market effectively.

Place your orders to buy stock

Understanding order types is key to stock trading:

Market order. Executes at the current market price, prioritizing speed over price. It ensures immediate execution.

Use case. Ideal for investors wanting to quickly enter or exit positions, especially in highly liquid stocks.Limit order. Sets a specific price for buying or selling. It offers price control and protection.

Use case. Suited for traders willing to wait for the market to reach their desired price.Stop order (stop-loss). Triggers execution when a stock hits a specified price, limiting potential losses.

Use case. Helps traders protect investments from significant price drops.

Monitor your investments

The stock market can be volatile, and the value of your holdings may fluctuate. Stay informed about the companies you've invested in and keep an eye on market trends. Remember that investing is a long-term endeavor, and it's essential to review and adjust your portfolio periodically based on your financial goals and risk tolerance.

By following these steps and staying informed, you can start your journey into the world of online stock investing. Remember that investing involves risks, and it's crucial to do thorough research and seek professional advice if needed. Happy investing!

How do I sell my stocks in France?

Choosing the right shares is key to profitable stock investing. Earnings depend on when and how you sell. In France, selling stocks when prices rise is straightforward with a licensed stockbroker.

France's government strictly monitors the stock market, ensuring secure transactions. By using a licensed online broker and following proper procedures, you can safely invest and trade in the French stock market.

The steps for selling stocks online in France are listed below.

Look up the most recent market price, then make a rough calculation of the value of the shares you intend to purchase.

Research and compare the services of several online stockbrokers. Verify whether a local, national, or international financial authority regulates the broker.

Since an online stock broker in France simplifies the process of buying and selling shares, the next step is to open an account with a reputable brokerage firm if you have not already.

Deposit funds into your brokerage account to cover transaction fees and the margin needed to sell stocks.

Select the “Sell Shares” option from the “Stockbroker Services” menu to begin the sale, and follow the instructions to register your shares on the platform. Include all pertinent information, including the number of shares and their respective prices.

A contract note outlining all the details of the sale will be sent to you for review after the stockbroker confirms the sale. You should be aware of any potential additional expenses or taxes when selling stocks in France.

Once the sale is complete, you will be paid. You can withdraw the funds from your stock brokerage account whenever it is convenient for you.

Note: Stay informed about price changes, market news, and economic trends through stock alert apps and financial updates. Monitoring French and global markets helps investors choose the best shares to invest in.

Rules and regulation

The total market capitalization of listed companies is around $4 trillion, ranking France among the top 10 globally.

Major stock exchanges

Euronext Paris is the primary stock exchange in France and a key component of the Euronext group, which operates exchanges across Europe. Founded in 1724, it is one of the oldest stock exchanges in the world.

The exchange also provides a platform for small and medium-sized enterprises (SMEs) to access capital markets through the Euronext Growth market (formerly known as Alternext). Trading hours are from 9:00 AM to 5:35 PM CET.

Market overview

The CAC 40 is the key index of Euronext Paris, featuring 40 major companies. It sees an average daily trading volume of around $9 billion. Key sectors include Luxury Goods, led by LVMH and Kering; Pharmaceuticals, with firms like Sanofi; and Energy, represented by TotalEnergies.

France's Aerospace and Defense sector also stands out, with Airbus and Thales among CAC 40 listings. The government plays a significant role in the market, holding stakes in major companies like EDF and Orange.

Regulation

The Autorité des Marchés Financiers (AMF) regulates France's financial markets. It ensures transparency, protects investors, and maintains market integrity. The AMF oversees market participants, enforces regulations, and handles disputes. Its role is vital in fostering trust and stability in the French stock market.

Are shares taxed in France?

Yes, shares are taxed in France. Profits from selling securities are subject to a single flat-rate tax (PFU) on capital gains.

The PFU applies not only to capital gains but also to investment income such as dividends, corporate bonds, and bank interest. The total tax rate is 30%, which includes 12.8% for income tax and 17.2% for social charges.

Investors should be aware of these taxes when trading shares in France and consider them when calculating overall investment returns. Proper tax planning can help manage these obligations effectively.

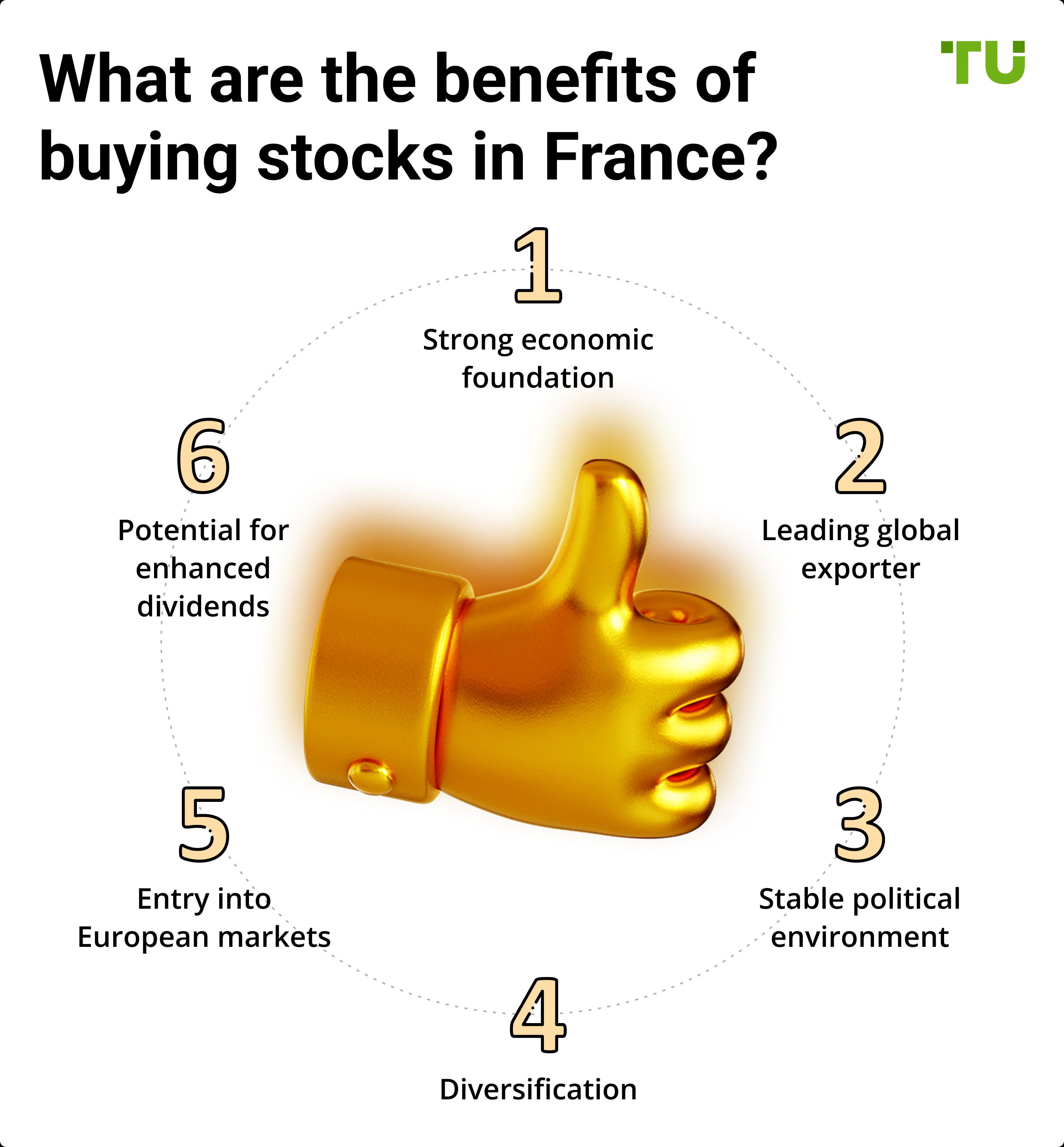

Investors may benefit from the potential capital gains from holding a stock that increases in value over time. Additionally, the potential income from the company's dividend payments, the lower tax rates on long-term capital gains, and other significant advantages of stock investing. But why is investing in stocks in France profitable?

Strong economic foundation

France is the world’s seventh-largest economy and the third-largest in Europe. The government invests heavily in policies, trade promotion, and investor support, creating a stable business environment. With 40 of the world’s top 500 corporations based here, companies benefit from strong infrastructure, affordable energy, and high-speed networks.

Leading global exporter

France plays a major role in global trade, ranking as the sixth-largest importer and ninth-largest exporter. While agriculture and manufacturing remain strong, the services sector dominates. The country boasts a skilled workforce, innovative business culture, and strong intellectual property protection.

Stable political environment

France enjoys a stable political system with effective, cooperative institutions. As a democratic republic with a long-standing multi-party system, it offers a reliable environment for investors to thrive.

Diversification

France’s diverse industries enable investors to spread their risks across sectors. With access to local and offshore stocks, investors can easily build diversified portfolios by including bonds, real estate, and commodities.

Entry into European markets

Investing in French stocks provides easy access to the broader European market. As a member of the EU and Eurozone, France offers flexible opportunities for investors to choose business models that fit their goals.

Potential for enhanced dividends

French law allows companies to pay a 10% higher dividend to investors who have held their shares for over two years, rewarding long-term investment.

Is it safe to buy stocks online?

Yes, in general, stock investing is safe, but you should learn some safe investing rules that will help protect your money:

Research and select a well-established, reputable online brokerage platform with a track record of security and customer satisfaction.

Buy stocks using a secure internet connection, preferably your private home network, to reduce the risk of unauthorized access or data interception.

Create strong and unique passwords for your brokerage account, incorporating a combination of letters, numbers, and special characters.

Enable 2FA whenever possible. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device, before accessing your account.

Educate yourself about common stock frauds and phishing attempts related to stock trading.

Can French people trade stocks with international brokers?

Yes, French residents can trade stocks with international brokers, as stock trading is permitted under French and European regulations. The Autorité des Marchés Financiers (AMF) and the European Securities and Markets Authority (ESMA) oversee trading activities, ensuring a secure environment for investors engaging with both domestic and international markets.

Trading with international brokers provides French investors access to a broader range of stocks and financial instruments from global markets. Offshore brokers often offer trading services tailored to meet the needs of French residents, allowing them to diversify their portfolios with opportunities in foreign markets.

When trading through international brokers, it is essential to consider regulatory compliance, trading fees, tax implications, and account requirements. Investors should ensure the broker is well-regulated and provides transparent pricing to avoid potential pitfalls. Additionally, it’s important to review the broker’s platform features, including ease of use, customer support, and risk management tools.

French investors should prioritize brokers that have a strong reputation and demonstrate a commitment to investor protection. Conducting thorough research and understanding the costs and benefits of international trading is key to maximizing the potential of a globally diversified portfolio.

What is the minimum stock investment in France?

The minimum stock investment in France depends on the stockbroker, typically ranging from $10 to $500, convertible to euros based on current exchange rates.

Stockbrokers set their own minimum deposit requirements, making it important to research brokers before starting. Some platforms cater to beginners with low minimums, while others may target more experienced investors with higher thresholds.

It’s also worth noting that additional costs, such as transaction fees or currency conversion rates, can affect your initial investment. Always factor in these expenses when determining how much to invest.

Can I trade fractional shares?

Yes. You can trade fractional shares since some of the leading stockbrokers in France offer fractional shares.

Investors would typically only receive fractional shares following a stock split because brokers previously only permitted the purchase of whole shares. Purchasing a fractional share of a stock entitles you to a smaller portion of that stock than one or more full shares. However, a few reputable brokers offer fractional shares that let you put as little as $1 into an investment.

Ensure long-term success by diversifying your portfolio

As an investor, I’ve found that diversifying a portfolio is not just a strategy but a necessity for managing risks and ensuring long-term success. While it’s tempting to focus on high-performing sectors like Luxury Goods or Energy in France, I recommend spreading your investments across industries, including Aerospace, Pharmaceuticals, and even ETFs for broader market exposure.

Another tip is to stay proactive in monitoring tax implications, especially if you plan to trade internationally. For example, understanding France’s 30% flat tax rate on capital gains and dividends or how tax treaties can minimize double taxation when investing in US stocks can save you from costly surprises later.

Take full advantage of educational resources and demo accounts provided by brokers. When I first started trading, practicing with a demo account helped me refine my strategies and build confidence without risking real money. Even experienced traders can benefit from testing new approaches in a risk-free environment. Stay informed, stay diversified, and always approach investing with a clear plan.

Сonclusion

Investing in stocks in France is a straightforward process when you choose the right brokerage, understand the market regulations, and develop a solid investment strategy. Whether you're trading through a French or international broker, it's essential to consider fees, tax implications, and market access. By conducting thorough research and leveraging available tools, you can navigate the French stock market with confidence and work toward your financial goals.

FAQs

Do French people invest in stocks?

Yes. Statistics show that most French people invest more money in the French stock market, with the Paris Stock Exchange being one of the original markets for the pan-European Euronext project. France, one of the world's most advanced economies, has a very sophisticated securities market.

Do I need a French bank account to buy stocks?

No, but having one can simplify transactions. Many international brokers allow foreign investors to trade French stocks.

What is the best way to buy stocks in France?

You can invest through a local broker, an international brokerage, or a French tax-advantaged account (PEA – Plan d'Épargne en Actions).

What is the minimum amount required to invest?

There is no fixed minimum, but it depends on the broker’s requirements and the price of the stocks you wish to buy.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).