Elliott Waves Principle Prompts Profitable Trading

The Elliott Wave Principle is a special category of technical analysis. The author of the principle, Ralph Elliott, suggested dividing the sequence of price fluctuations into separate waves to estimate the market’s current phase and predict its subsequent movement.

Elliott waves are quite difficult to study, although they are based on simple proportions that occur naturally. Many traders consider themselves supporters of the Elliott wave theory, but there are also convincing critics.

This article will teach you how to use Elliott waves while you view these topics:

History of Elliott Wave Theory

The rules used in the theory

Wave descriptions

Examples on charts

How to apply waves in real trading

Indicators for working with Elliott waves

List of brokers and relevant books

Elliott Wave Theory. Fundamentals

Ralph Nelson Elliott was an accountant and lived in the United States. During the last years of his life, retiring due to illness, Elliott devoted himself to the study of stock charts.

Ralph Nelson Ellion

He looked at over 75 years of stock charts and indexes covering various timeframes, and successfully identified recurring patterns based on fractals. The patterns he found helped him to accurately pinpoint the market collapse of 1935.

Elliott published his theory intermittently as follows:

-

in a booklet entitled, The Wave Principle (1938);

-

in a series of articles for Financial World magazine (1939);

-

in the treatise entitled, The Laws of Nature: The Mystery of the Universe (1946).

Elliott predicted that people, like other processes of nature, are subject to rhythms and live in cycles consisting of oscillations. Therefore, calculations made according to ever-present waves (thus, the Wave Theory) can accurately forecast fluctuations in the price of trading assets.

Rules of the Elliott Wave Theory

The crux of Elliott's theory is that traders' behavior (crowd psychology) develops according to recognizable pattern (waves), forming repeating large and small structures, which can be folded, measured, analyzed, and — with proper and careful analyses — predicted.

Basic rules

Progress does not follow a simple straight line, nor is it chaotic. It is ordered in a sequence that can be seen throughout the living world.

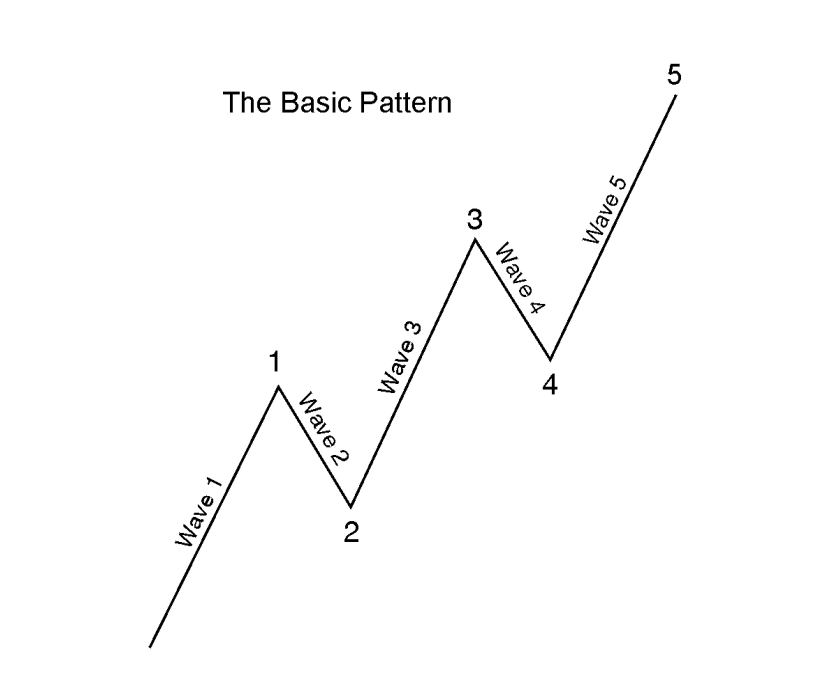

The basic rule of Elliott’s theory is that there are 2 types of waves that alternate each other.

Motive waves – wave 1, wave 3, and wave 5 in the image below.

Corrective waves – wave 2 and wave 4 in the image below.

a basic pattern

The impulsive wave has a basic structure of 5 waves (the Five Waves Principle) – three impulsive waves and two corrective waves.

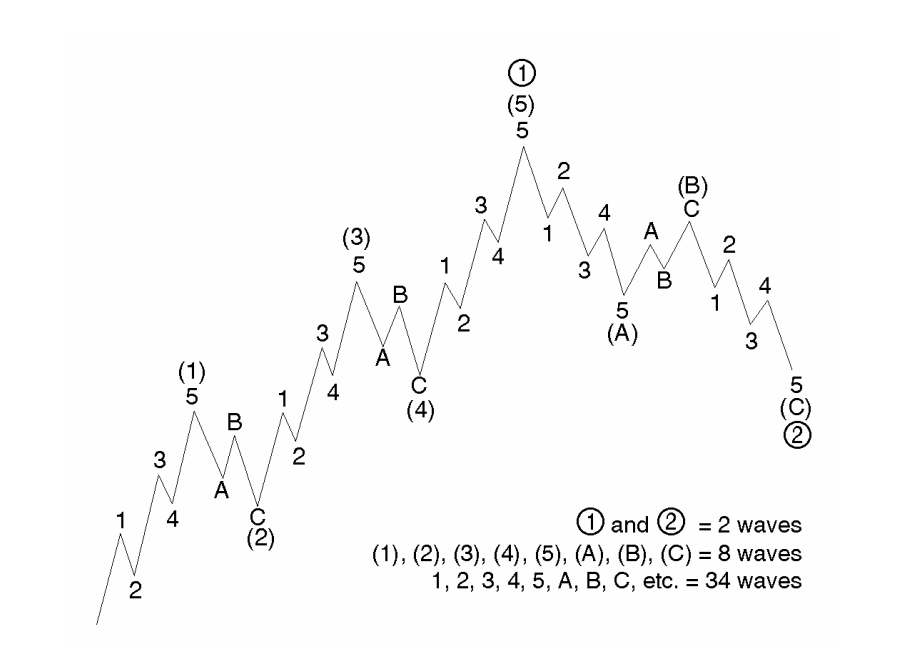

The image below shows how large and small waves stack up against each other (evidencing the "Nesting" Principle).

the "Nesting" Principle

Impulse waves form a trend, and corrective waves form counter-trend pullbacks.

Note that Elliott designated impulsive waves by the numbers 1-2-3-4-5 and corrective waves by the letters A-B-C.

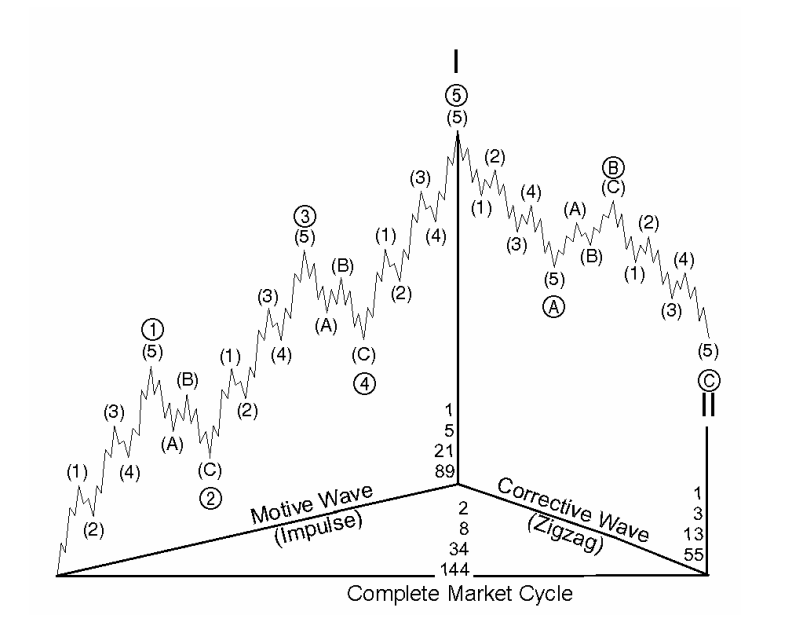

The image below shows how the waves form a Full Cycle.

a Full Cycle

Depending on which cycle the wave belongs to, it is uniquely identified on the chart with brackets (round and square), Roman and Arabic numerals, capital and small letters, or other symbols.

Elliott distinguished the following cycles (wave degrees), depending on their duration:

| Cycle name | Duration | |

|---|---|---|

1 |

Grand Supercycle |

For centuries |

2 |

Supercycle |

Approximately 40-70 years |

3 |

Cycle |

From 1 year to several decades |

4 |

Primary |

From a few months to 2 years |

5 |

Intermediate |

From weeks to months |

6 |

Minor |

For weeks |

7 |

Minute |

For days |

8 |

Minuette |

For hours |

9 |

Subminuette |

For minutes |

The Great Supercycle consists of 8 waves of Supercycle. These waves in turn also consist of 8 waves of a smaller cycle, and so on.

Some analysts use their own variations on the above cycle structure, adding cycles such as Millenium, Micro, Nano, and their nomenclatures.

Additional rules

The market can be in one of two phases:

-

great bull market

-

great bear market

The trading volume decreases on corrective waves.

There is a proportionality between the impulsive waves and the subsequent corrective waves. The stronger the impulsive wave, the stronger the corrective wave, and vice versa.

It is acceptable that motive wave structures include:

-

truncations

-

extensions

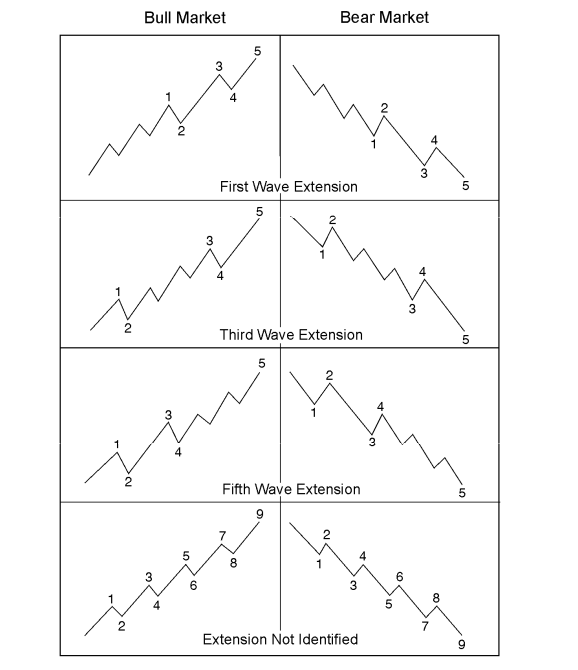

For example, the following example shows how extensions are formed for the first, third, and fifth impulsive waves in bull and bear markets. The lower image shows an example where an extension cannot be confidently attributed to one of the 5 waves that form an impulse.

identified and unidentified impulse wave extensions

Obviously, for novice traders, extensions and truncations add to the difficulty of breaking down the chart into waves.

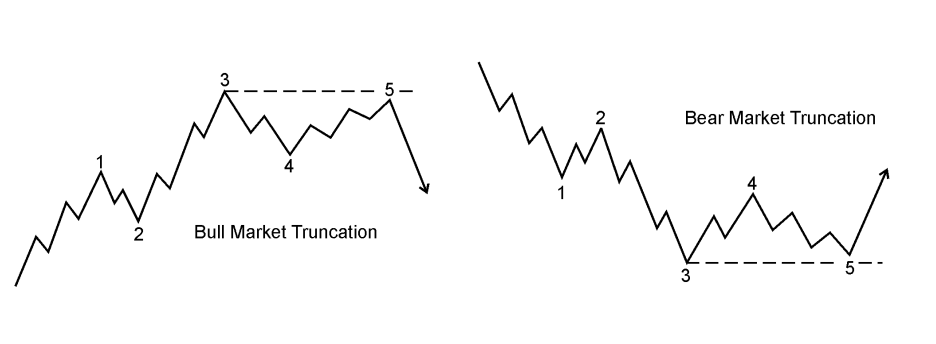

Rules for determining truncations (truncated waves):

-

a truncated 5th wave should not exceed the extremum of wave 3;

-

a truncated wave shall include the structure of 5 nested waves;

-

a truncated wave often appears after a very strong third wave.

The diagram below shows a truncated 5th wave formed in a bull and bear market, respectively:

a truncated 5th waves

Examples of waves on the expert’s chart

After Elliott’s death, his work was continued by dedicated followers. Robert Prechter stands out among them. He studied Elliott’s wave theory when he worked as an analyst at Merrill Lynch bank.

Robert Prechter

The Elliott waves helped him to act correctly in the bull market of stocks in the 1980s and predict the fall of the markets in 1987. Robert then decided to popularize the Elliott Theory. He is the author or co-author of 14 books on Elliott waves.

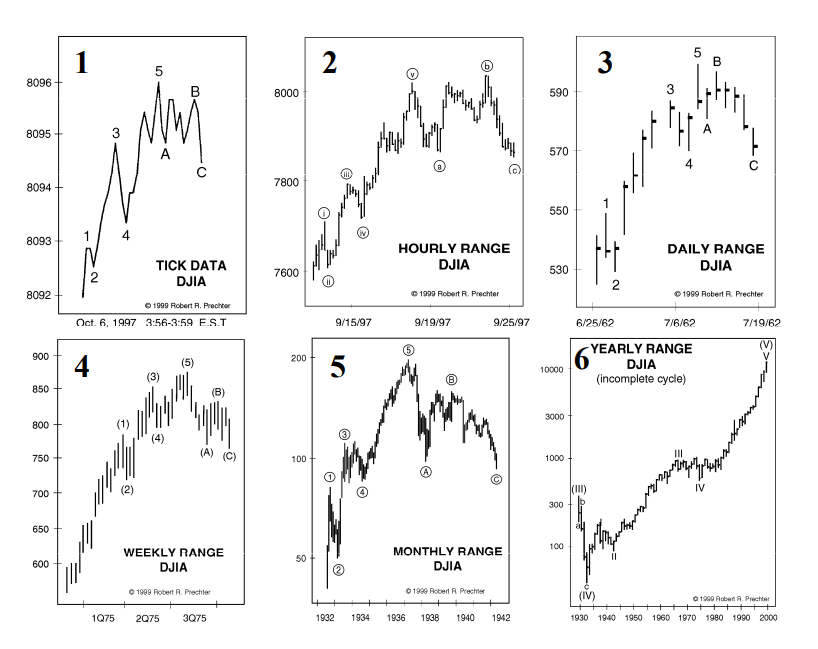

Here are 6 examples from Prechter’s books about waves on real charts of different periods:

waves on real charts

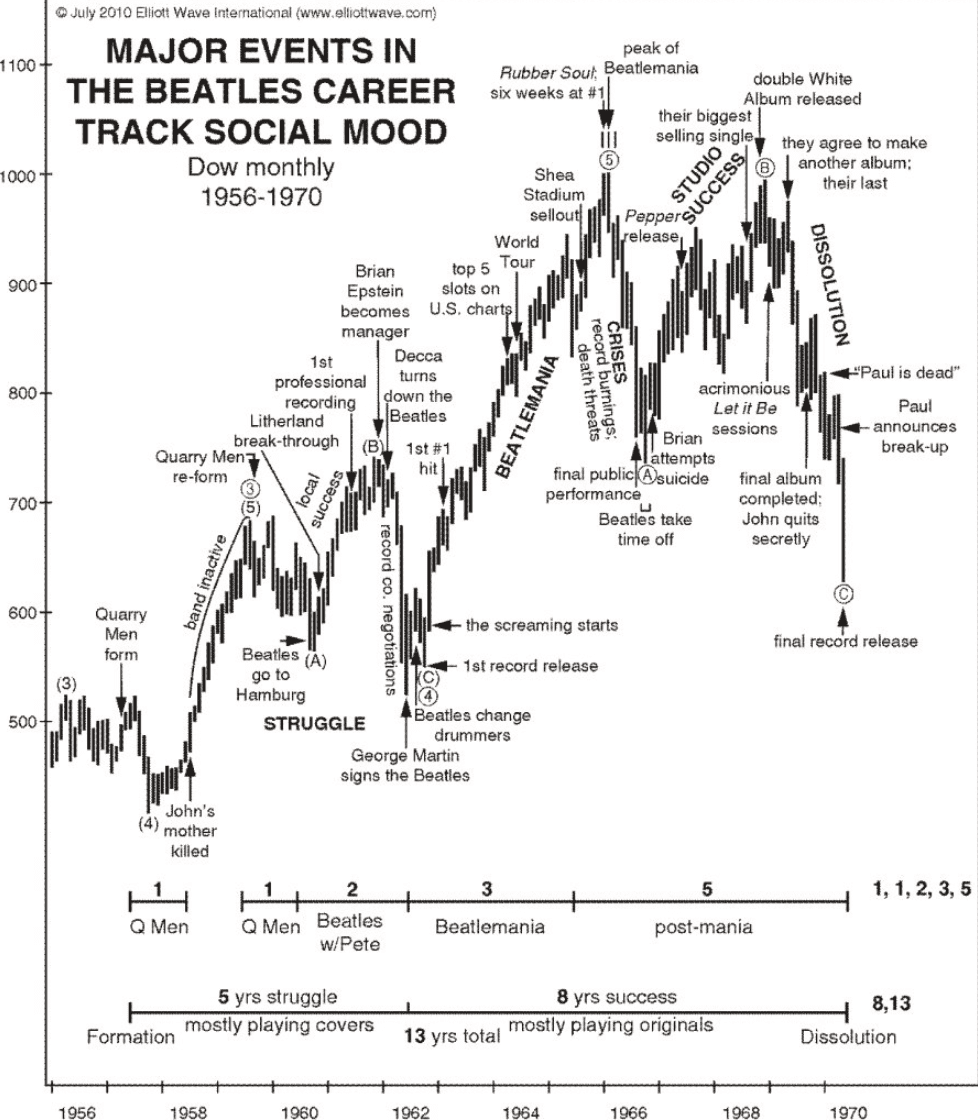

And the image below shows how Prechter breaks down the monthly Dow Jones chart into Elliott waves.

the monthly Dow Jones chart into Elliott waves

Interestingly, the main stages of the legendary Beatles band epoch are plotted on the graph. In this manner, the Prechter shows the connection of prices, psychology, and regularities in the developmental process.

Motive waves

Key characteristics of a motive wave:

-

It has a structure containing 5 waves.

-

It moves in the direction of the main trend of a higher order.

-

Wave 2 cannot roll back more than 100% of the first wave.

-

Wave 3 cannot be the smallest.

-

Wave 3 is always impulsive and is often the largest.

-

Wave 4 never enters the territory of wave 1.

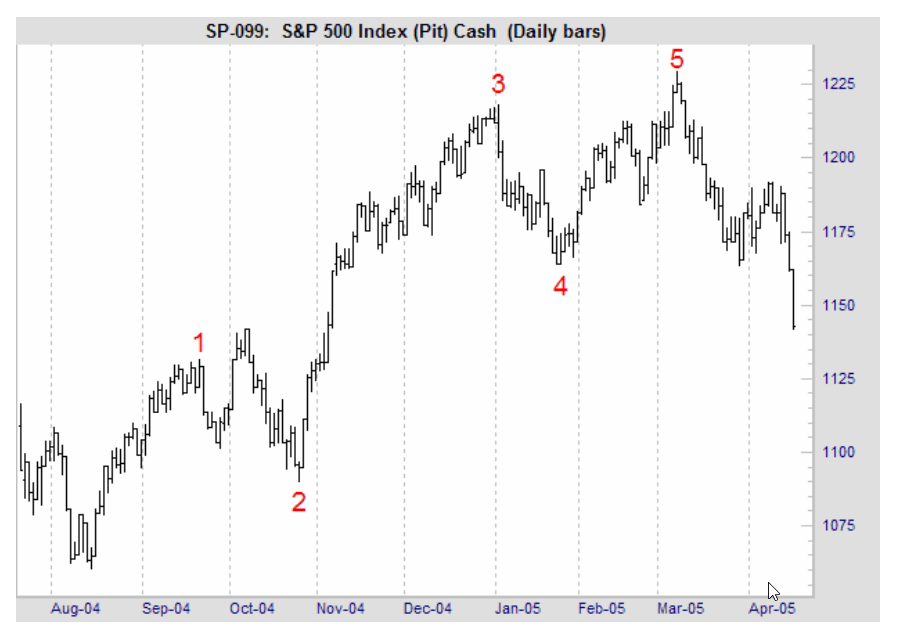

An example of a motive wave is on the S&P-500 index chart below:

An example of a motive wave is on the S&P-500 index chart

The Elliott Wave Theory describes waves within the upward motive trend as follows:

Wave 1. Usually, the news is still negative and the emergence of wave 1 is difficult to recognize. Most believe that the previous trend is still effective. In bearish forecasts, sometimes wave 1 appears very abruptly, breaking through important resistance, and reacting to strong positive news. But usually, it is a minor move against the background of a general hesitation.

Wave 2. It occurs as a correction of the first wave. It should never fall below the starting point of the first wave. Therefore, wave traders have reason to put a stop loss behind this extreme. The news may still be bad, but it is important to note that:

The volume on wave 2 may be less compared to wave 1.

The correction should end before reaching the 61.8% level of the first wave gain.

These are two signs that a third wave will closely follow.

Wave 3. It is usually the most powerful trend wave, and it is usually calculated by those who trade using Elliott. The news background changes, so do the forecasts and opinions of analysts. It may be problematic to enter even on a small pullback during the third wave. By the middle of the third wave, the "crowd" joins the trend. The third wave often extends the first wave to the ratio of 1.618:1.

Wave 4. This is a corrective wave. Prices may be in a sideways corridor for a significant amount of time. The fourth wave usually rolls back less than 38.2% of the third wave. The volume is clearly lower than in the third wave.

Wave 5. The main trend is cooling down. Divergences between price and momentum indicators are forming on the charts. The news is still bullish, but prices do not linger at the tops of the new highs. The volume of the fifth wave is lower than the third wave.

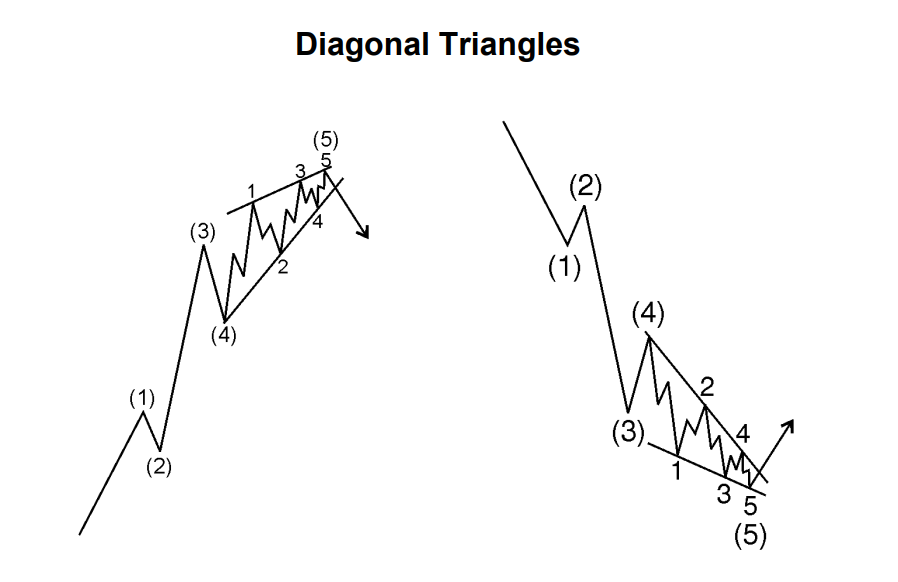

When talking about impulsive waves, don’t overlook Diagonal Triangles. They can be expanding or tapering.

Diagonal Triangles

Some sources say that diagonal triangles are a type of motive wave. A motive wave can be of two kinds:

-

A simple impulsive motive wave consists of 5 lower-order impulsive waves with extensions and truncations.

-

A diagonal triangle, consisting of 3 waves of lower order.

But for novice traders, this classification is usually not given, and all motive waves are referred to by the general name of the “Impulsive wave”.

Corrective waves

If the description of impulsive waves seems confusing to you, it is even worse with corrective waves. The identification of waves is the most difficult part of the Elliott Wave Theory. And it is the corrective waves that are the most difficult to identify.

Varieties of corrective waves:

-

Zigzags

-

Fleet waves

-

Triangles of various shapes

-

Setups of the above three varieties

The example below shows a classic corrective wave in the zigzag/A-B-C format:

the example of a classic corrective wave in the zigzag/A-B-C format

Wave A: Analysts often see wave A as a correction within the preceding 1-2-3-4-5 trend structure. But the volume and duration of the wave should be alarming.

Wave B. Price rises on the residual optimism. It is very difficult to identify. Sometimes it forms the right shoulder in the "Head & Shoulders" model. The volume should be lower than on wave A.

Wave C. Volumes are rising and analysts are talking about a change in trend. Wave C is usually no smaller than wave A and often extends to a 1.618 wave A or more.

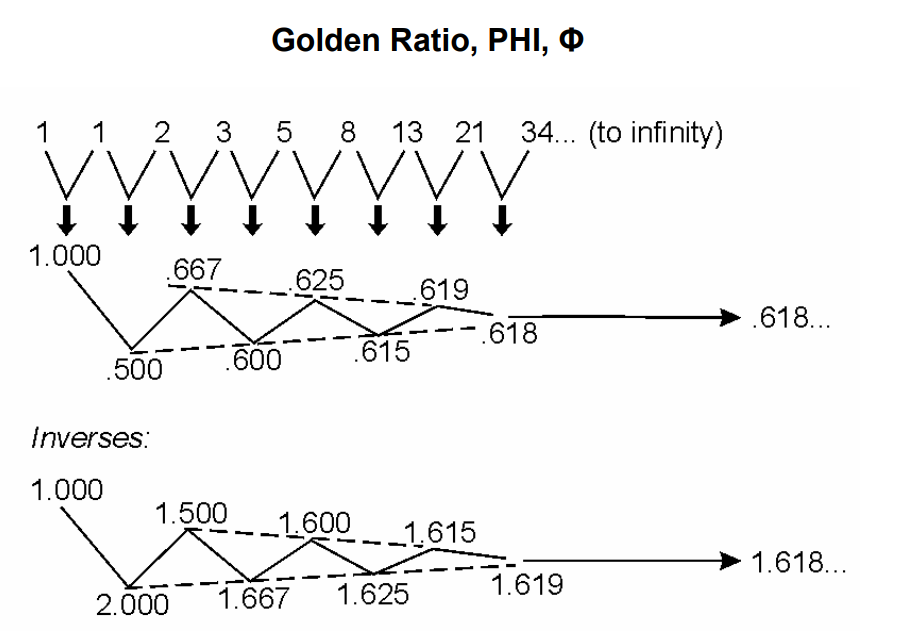

Elliott Theory and the Fibonacci Sequence of numbers

Perhaps you noticed the number 1.618 in the wave descriptions.

This is not surprising, because the Elliott Wave Theory is inextricably linked to the Fibonacci sequence, and the golden ratio of 1:1.618, which is between the numbers from the Fibonacci sequence.

the golden ratio of 1:1.618

The Fibonacci numbers help analysts apply the Elliott Wave Principle to find the end of pullbacks and thus optimize the ratio of risk to potential profit.

The image below shows that a correctly recognized first descending wave (1) gives a reference point for the area (indicated by the arrow) where the trader can expect the end of the ascending corrective wave (2) to open a short position in the direction of the bearish trend.

expect the end of the ascending corrective wave

It is interesting that Ralph Elliott while developing his wave theory, *claims that he didn’t know about the Fibonacci sequence of numbers (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, etc.). Indeed, it has been reported that he once famously exclaimed: “When I discovered The Wave Principle action of market trends, I had never heard of either the Fibonacci Series or the Pythagorean Diagram”.

However, it cannot be denied that the Fibonacci numbers are inseparable from the Elliott waves.

For example, the:

-

structure of the movement trend consists of 5 waves;

-

correctives consist of 3 waves;

-

cycle consists of 8 waves;

-

complete impulsive model consists of 89 waves;

-

completed corrective model consists of 55 waves;

-

ratio of wavelengths between the waves is 0.382, 0.5, or 0.618;

-

ratio in time is also reflected in the Fibo sequence.

Some critics accuse those who see Fibonacci ratios in the financial markets of pareidolia.

Robert Prechter denies that the "Fibonacci ratios are indeed more common in the stock market than one would expect them to be in a random environment."

Applying Elliott waves in practice

The Elliott Wave Principle allows a trader to:

-

predict the direction of the market;

-

recognize turning points;

-

receive instructions for entering and exiting positions.

A potential sell set-up is on the NZD/CAD chart below, which marks the motive wave 1 and the corrective wave 2 (its top is still in doubt, but if there was no doubt, it would be too late to go short).

a potential sell set-up is on the NZD/CAD chart

The red dotted line shows the level of the protective stop loss, and the dark rectangle is a reference point for the expected descending third wave. The risk:reward ratio, in this case, is about 1:8.

The advantages and disadvantages of the Elliott Theory

👍 Advantages

• It works on all markets and timeframes.

• Reflected in natural processes based on psychology

• Allows predicting the market both in the direction of price movement and in its duration. Forecasts can be made for both short-term and long-term periods.

• The availability of specialized tools that help in the breakdown and calculation of waves on the chart

• Allows infinite oscillations to be structured into cycles and waves

👎 Disadvantages

• Subjectivity. The Wave Theory can facilitate markups on the same graph in different ways.

• Difficulty in especially identifying corrective waves

• Requires in-depth training to master — preferably under the tutelage of an experienced trader.

Critique of the Elliott Wave Theory

Elliott waves are not always clearly visible even on a history chart. Therefore, their use is very problematic for forecasting data updated in real-time.

Critics of the Elliott Wave Principle argue that:

-

the theory is too vague;

-

predicting waves is a matter of inherent uncertainty;

-

the results from predictions made by the Elliott theory are ambiguous;

-

the principle is obsolete. Computers came along, economics and politics changed. Markets have evolved, but the waves have not.

Supporters believe that:

-

The theory gives enough freedom to explain any movement and, at the same time, to make predictions about future movements.

-

The rules of the theory are rigorous enough to structure price fluctuations into a consistent and predictable story of ebbs and flows.

Elliott wave indicators

Special free indicators were created to help novice investors to break down the Elliott waves of the price chart on Forex.

The indicators must be loaded into the classic MetaTrader 4 terminal. Consider these four indicators:

-

1

Elliott waves

-

2

Elliott wave oscillator

-

3

Elliott wave prophet

-

4

Elliott + Fibo indicator

Let's test them to see if the indicators can actually detect waves.

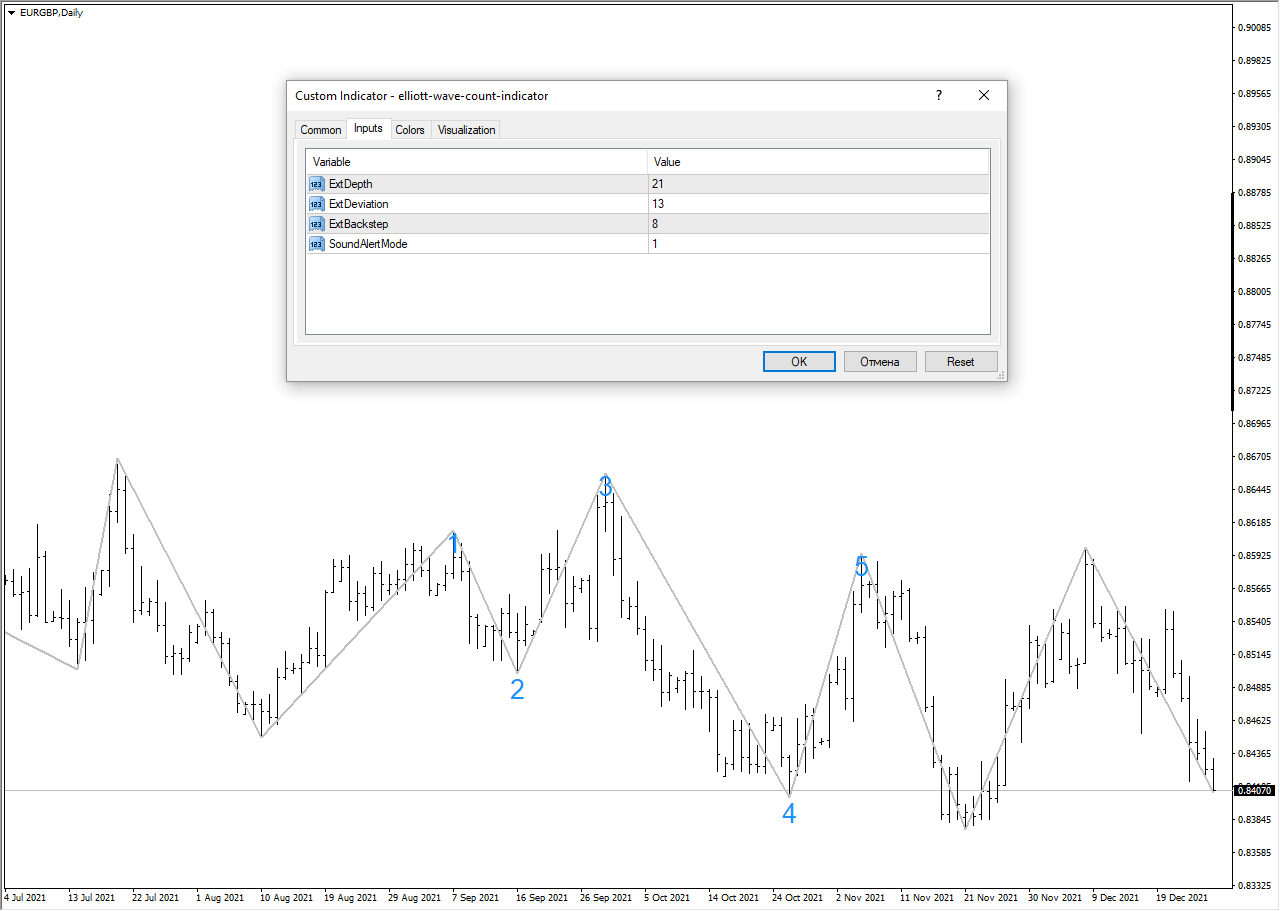

Elliott waves

The first indicator in the experiment is an indicator called Elliot waves. When you load the indicator on the price chart in the MetaTrader 4 terminal, you can see that a broken gray line and blue numbers indicate waves that appear on top of the price.

Elliot waves indicator

At first, it is clear that the indicator is not doing its job, because:

-

wave 4 drops below wave 2 and even below the base of wave 1;

-

waves from different cycles are not tracked;

-

there is no wave count on the right edge of the graph;

-

there are no forecasting tools.

The Elliott wave count indicator is similar to zigzag, which places numbers on extrema without observing any rules of wave construction. So, it is not recommended for use.

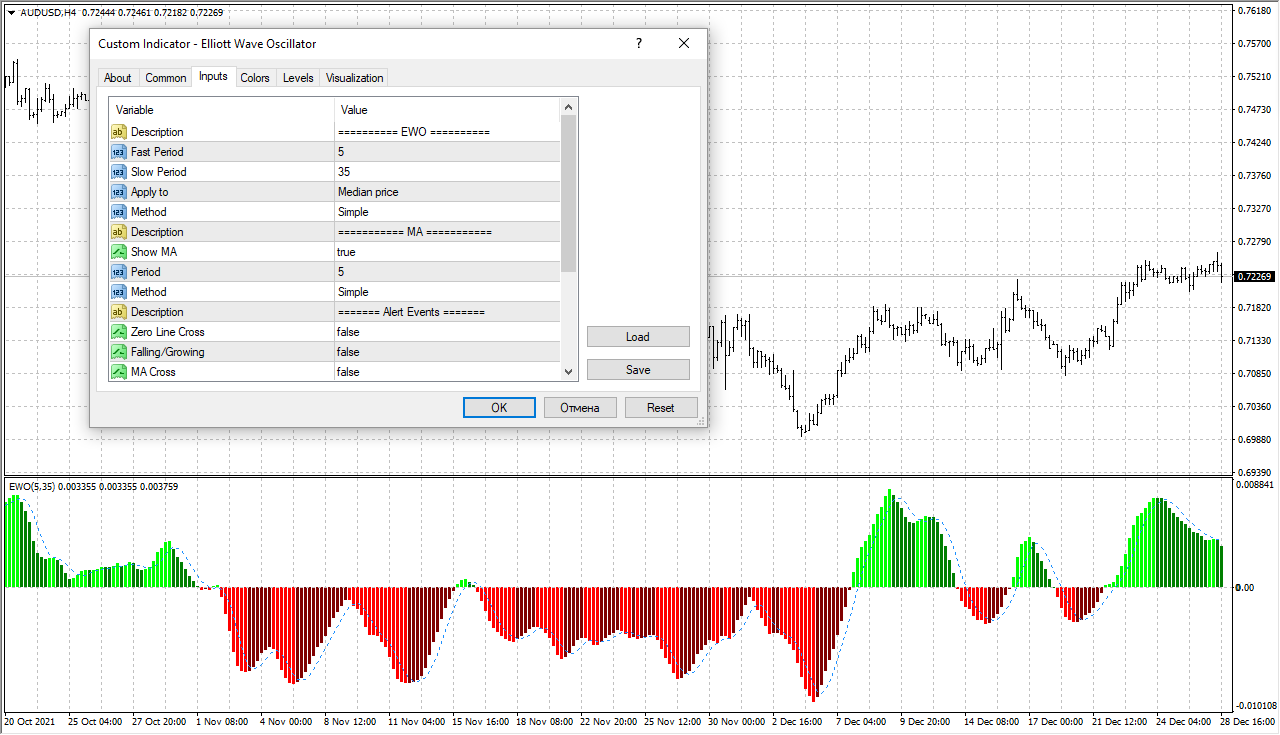

Elliott wave oscillator

When you load the Elliott wave oscillator on your chart, you will see something very similar to the classic MACD (Moving Average Convergence Divergence) indicator in the oscillator area. Or something like the more modern Squeeze Breakout (a method for short-term trading).

Elliott Wave Oscillator

The settings show periods of different moving averages, so the similarity with MACD is not accidental. The author assumed that tracking the oscillator would help to break the chain of prices into a sequence of impulsive waves and corrective waves. But it is too simple to calculate waves. So, it is not recommended for use.

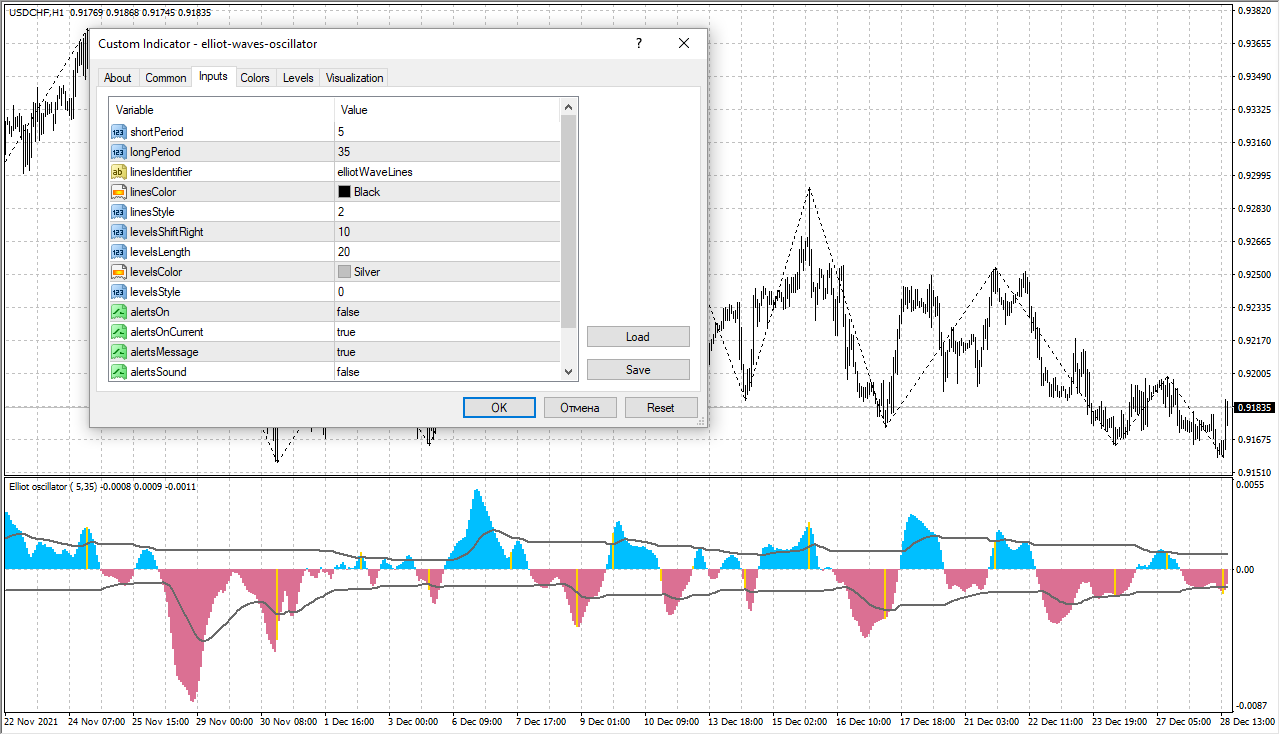

Elliott Wave Prophet

When you load the Elliott Wave Prophet indicator onto the chart, you will see a broken line appearing in the price area. And there is a red and blue histogram in the area of the oscillators.

Elliott Wave Prophet indicator

This histogram is also very similar to the MACD, but this time Bollinger Bands are added over it. Indeed, the histogram is calculated based on the dynamics of the moving average. Developers planned the Elliott Wave Prophet indicator to be used on a histogram to identify impulsive waves when they exceed the averages.

It is concluded that the indicator doesn’t do the job, because:

-

the broken line is not much different from the zigzag indicator;

-

the Elliott Wave Prophet doesn’t do wave numeration;

-

there are no forecasting tools;

-

the histogram doesn’t provide valuable help in identifying Elliott waves.

Accordingly, it is not recommended for use.

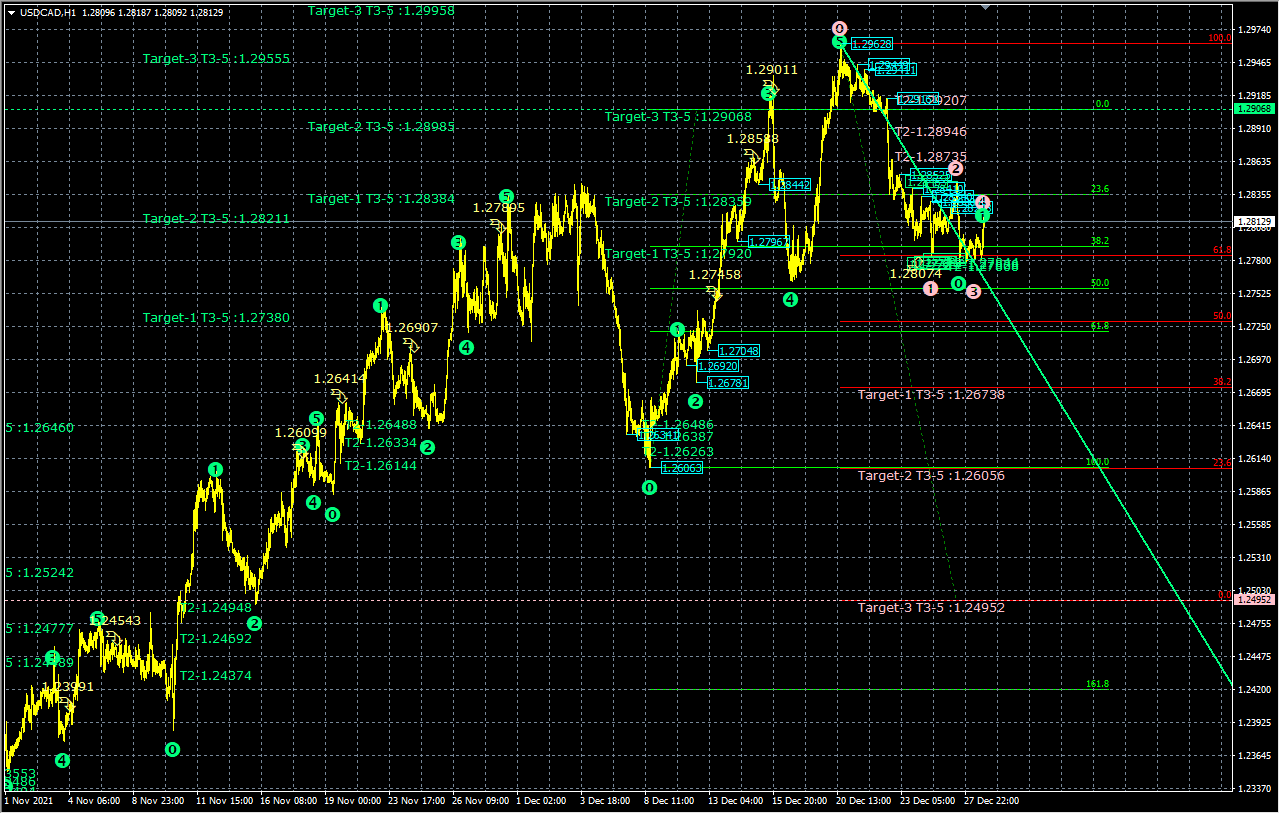

Elliott + Fibo indicator

When you load the Elliott + Fibo indicator onto the chart, you will see that the following elements appear in the price area:

-

wave breakdown;

-

Fibonacci proportions.

Elliott + Fibo Indicator

The Elliott + Fibo indicator was developed for the MetaTrader platform. It looks like a much better analysis tool compared to the indicators reviewed earlier. It can be used for a quick chart layout and will be useful for novice traders working within the Elliott Wave Theory.

Results of the experiment

Applying and analyzing Elliott waves is not an easy job. It requires experience and honed analytical skills. Simple free tools are hardly capable of evaluating the overall image and breaking it down into fragments while observing the rules of the Elliott Wave Theory. Therefore, it is recommended that you rely more on your own knowledge in making money on Forex, especially since there is plenty of literature on the Elliott waves.

Recommended reading on Elliott waves

recommended reading on Elliott waves

The Ralph Elliott Wave system works since he is the creator of the Wave Principle for market analysis:

-

The Wave Principle, 1938.

-

The Law of Nature: The Mystery of the Universe, 1946. This is perhaps the author's major work.

-

Masterworks. This is a collection of articles and bulletins by Ralph Elliott, describing specific rules on how to identify, predict and profit from wave patterns.

In addition to Elliott's books, those written by his acolyte Robert Prechter should also be highlighted

-

Elliott Wave Principle: Key to Stock Market Profits, 1977

-

Conquer the Crash, 2002. (New York Times Bestseller)

The best brokers

To learn the theory and apply the Elliott principles in practice, you will need an account with a broker. The broker will provide a trading terminal as well as a deep database of historical data to learn to break down the charts into a sequence of impulsive and corrective waves.

RoboForex

Benefits of the RoboForex broker

active in the Forex market since 2009;

a recognized authority in the industry;

over 4.5 million customers (as of 2020);

valid licenses and positive reputation;

the minimum deposit is only $10;

spreads are floating;

from 0 pips (depending on account type);

clients have access to Forex markets, including stock, commodity, and cryptocurrency markets;

ability to trade twenty-four/seven (depending on markets);

manual and algorithmic trading are available;

free analytics from experts;

deposit bonus (check with client support about current availability of the campaign)

When trading with a RoboForex broker, you can download extra plugins, advisors, and indicators into the provided MetaTrader terminal. They will signal you when newly-formed candlestick patterns are detected.

FxPro

Benefits of the FxPro broker

FxPro was founded in 2006 and is headquartered in London;

It serves clients from 170 countries and its capital exceeds €100 million;

Valid licenses by regulators in the UK, Cyprus, and South Africa;

Protection from negative balance;

You can trade on Forex, as well as futures, stock, commodities, and cryptocurrency markets;

Leverage is up to 1:500;

Spreads from 0.1 pips;

Cent accounts are available to reduce risks;

Free demo accounts are available without restrictions.

FxPro has over 90 international awards and executes about 7,000 trades per second.

XM Group

Benefits of the XM Group broker

it has been active on the market since 2009;

it has a valid license from a reputable European regulator;

it has the best training programs of the year — Forex Expo 2023 award;

its minimum deposit is just $5;

spreads are from 0.6 pip (depends on the account type);

clients have access to Forex markets, including the stock and commodity markets;

leverage is up to 1:888 (one of the largest in the industry);

free analytics from experts;

commission-free deposit and withdrawal of funds;

demo and micro-accounts for novice traders.

For new clients, XM offers a welcome bonus of +100% on the initial deposit (find out the current terms of the promotion from the client service).

Summary

The Elliott Wave Principle is based on mass psychology. It shows how the mood of investors develops in tandem with the markets. The development occurs according to the structure of motive and corrective waves.

The three main rules for breaking down a price chart into Elliott waves:

Wave 2 always retraces less than 100% of wave 1

Wave 3 is never the shortest of impulsive waves 1, 2, and 3

Wave 4 never overlaps the price territory of wave 1 (the exception is the rare case of a diagonal triangle)

Elliott waves is not a magic pill for fast enrichment. The method is difficult to master, but spending time mastering it can benefit you later.

FAQs

Should I use Elliott waves?

The Traders Union cooperates with dozens of professional traders. Some of them actively use Elliott waves, some of them do not use them at all. So, use caution and determine if the theory fits your strategy. If your individual view of charts helps you to correctly structure all available fluctuations into a sequence of Elliott waves without breaking the rules, you should definitely use the wave principles.

At what point should I do the counting?

This is an important point. If you are making a long-term forecast, use the maximum available history. If you need to calculate waves for short-term trading, start counting from an important extremum, which can usually be found on the history within 1,000-1,500 candles. The advantage of Elliott's theory is that you can detail the important fragments (on the right side of the chart); and in the history, you can mark important reversal points.

What is the best set-up for trading on Elliott waves?

Open a position at the beginning of the 3rd wave in the direction of the trend. It is the most obvious and working option. But when should you open a position? Whether to open it when wave 3 has already begun or to try to anticipate the end of wave 2? Either approach is acceptable and depends on your personal risk preferences and your ability to correctly mark waves. Try both options. Keep in mind, if you want to enter a position when wave 3 is already developing, you can limit yourself in time to make sure your decision is correct.

How to trade against the trend on Elliott waves?

Look for the end of the fifth wave to enter at the beginning of a correction. The Fibonacci proportions will help you find the area where the end of the trend should occur. Keep in mind that trading against a trend carries higher risks. But with a demo account from your broker, you are free to experiment with different approaches to applying Elliott waves.

Waves are not magic, but rather a potentially powerful and effective method to find good entry points to suit your trading style.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!