5 Problems Of Trading Bots, And How To Solve Them

The main 5 problems with trading bots are (all of the above risks are true for forex, crypto and other markets):

-

Strategy: May be too complex or simple, lack transparency, or ignore volatility

-

Risk Management: Some bot strategies incur too much risk, or don’t manage it

-

Backtesting: Bots may contain malicious code or come from unreliable sources

-

Fraud: Bots may contain malicious code or come from unreliable sources

-

Usage: Inexperienced users may not input correct settings/ not optimize

Trading bots allow the automation of processes that would otherwise be time-consuming and require pinpoint accuracy and 24/7 attention. Trading bots can execute trades faster and more efficiently than any human could, while processing amounts of data that are incomprehensible to human traders – and all this without the weight of emotions that burden many traders. It’s no wonder so many traders are drawn to trading bots. Yet, that’s not to say trading bots don’t come with flaws.

In this article, Traders Union explains five of the main problems that plague trading bots and their users and offers advice on how to solve or avoid them.

-

What do trading bots do?

Trading bots are software tools that automatically execute buy and sell orders without human intervention, based on preset trading parameters designated by a human. They come in many forms and are used in different ways, but essentially, trading bots automate trading.

-

Are trading bots reliable?

The reliability of trading bots varies. While some well-developed and reputable bots can be reliable, there are also risks associated with factors such as strategy implementation, user errors, and fraud. Users should carefully research and choose trading bots from trusted providers.

-

Why do trading bots fail?

Though trading bots are speedy and accurate in execution, they can give rise to a number of issues, including problems with strategy, increased risk, challenges in backtesting, risk of fraud, and mistakes in usage.

-

Can you lose money with crypto bots?

The short answer is yes. While trading bots can automate processes, they don't guarantee profits. Market volatility, strategy errors, technical glitches, and unexpected events can lead to financial losses.

Why do trading bots fail?

Trading bots are invaluable pieces of software that allow traders to automate their trades. When people speak about trading bots, they could be referring to any one of the different types out there. The idea of automated electronic trading has been around since the 80s, and as far back as 2014, 75% of US stock trades were executed using automated trading systems.

Today, trading bots are something different. Trading bots became more commonly used during the surge in interest in cryptocurrencies. As cryptocurrencies are digital currencies on a decentralized blockchain, they are perfectly suited for automated trading, so many of the trading bots you’ll find online are specifically for crypto. However, since generative AI burst onto the scene, the use of algorithmic AI trading bots for trading stocks, indices, commodities, and other assets, has been on the rise, since trading bots can now interpret a lot more types of data.

Modern trading bots are able to use machine learning and deep learning to rapidly analyze huge amounts of data, from a wide number of sources, including market data such as price movements, volume, and other indicators. They can identify correlations between market events and price action, detect market shifts, and find trading opportunities, then automatically execute buy or sell orders based on predefined criteria or algorithms. And best of all, they can do all of this at breakneck speed, 24/7, and with high accuracy.

Of course, if that all sounds too good to be true, note that trading bots do pose some problems and risks, which we’ll be looking at here. The 5 main problems of trading bots are:

-

Problems with strategy

-

Problems with risk management

-

Problems with backtesting

-

Risk of Fraud

-

Mistakes in the usage

Problems with strategy

Though trading bots are unbeatable when it comes to speed and execution, they can’t think for themselves, and follow pre-defined strategies set by their users. There are plenty of strategies that they can use, including analysis-based or entry-based strategies, market analysis strategies, parameter-based or time-based strategies, and approaches based on trading style. Each category of strategy also has smaller sub-categories, resulting in a wide range of trading bot strategies.

As there are so many strategies, selecting the best one can be a significant issue for some traders, as any of these problems might arise:

-

Too Simple: A strategy that is too simple may not capture the intricacies of the market, leading to missed opportunities or ineffective trading. For example, a Simple Move Average trading bot strategy is a simple one, which calculates the daily new average based on the five most recent closing prices. However this simple, one-dimensional tactic wouldn’t account for other technical indicators or fundamentals

-

Too Complex: An overly complex strategy can be challenging for beginners to understand and implement effectively, potentially resulting in errors or suboptimal performance. One example is the arbitrage strategy for trading bots, where the bot buys and sells on different exchanges and profits from the difference. This is technically complex to set up and requires programming skills, making it complicated for inexperienced traders

-

Transparency: Some trading bot creators may not disclose the details of their strategy. A lack of transparency can raise concerns as users may not fully understand how the bot operates, making it difficult to assess the strategy's effectiveness and potential risks. Hidden strategies can lead to a lack of trust among users and make it difficult to allocate capital to the bot

-

Lack of Advantage: Not all strategies provide a competitive advantage in the market. Some strategies may be outdated, overused, or simply ineffective. Traders need to carefully evaluate whether a chosen strategy offers a unique edge or if it's a common approach that might not lead to consistent profits

-

Ignoring Market Volatility: The best trading bot strategies take advantage of periods of high volatility, using their precise, rapid trade execution ability to capture profits during large price movements. Failure to incorporate volatility into the strategy may result in poor performance during turbulent market periods or missed opportunities during more stable times. Traders should select strategies that account for varying market conditions to enhance overall effectiveness

To alleviate some of these problems, ensure you choose a strategy that aligns with your experience and skill levels in trading. Regularly assess and refine your chosen strategy to ensure it adapts to changing market conditions without unnecessary complexity. Opt for bots where creators openly communicate their strategy's principles. Additionally, go for strategies that incorporate volatility considerations, as adaptive strategies that adjust to different market conditions tend to perform better.

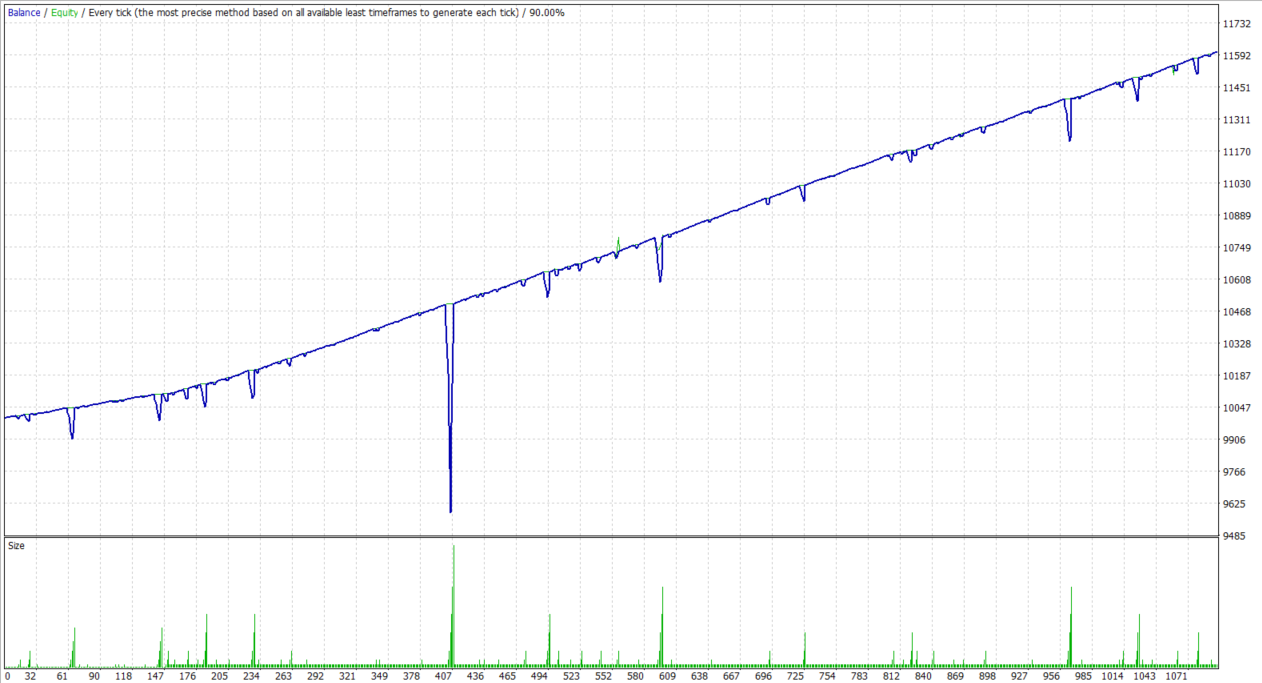

Example: The result of the bot's trading is that the capital growth curve is very flat, a characteristic sign that the bot is trading. The graph also shows that the bot is using a dangerous strategy, increasing the lot after losing trades to get back to the growth curve.

The result of testing the trading bot

According to TU expert Oleg Tkachenko:

The use of such strategies will sooner or later lead to the collapse of the deposit. And this can happen long before the bot manages to double the deposit.

Problems with risk management

Effective risk management is a pivotal aspect of successful trading, and this holds true for trading bots as well. However, some trading bots and strategies fail to sufficiently implement risk management. Two notable challenges in this area are the utilization of risk-increasing strategies like martingale, grids, and averaging, along with the tendency of trading bots to open an excessive number of positions.

The Martingale trading strategy, often used by bots, involves increasing a position size (usually double) when a loss is incurred, so that eventually you recover all the losses and sell the whole position. This poses significant risks, as when the number of losses increases, the amount of capital or leverage needed increases drastically. The aggressive nature of this strategy can generate high profits in a short time, but carries with it extremely high levels of risk, particularly when automated by a trading bot. Theoretically, if the trader had large sums of capital, they could risk it all if they did not stop the bot from continuously doubling down.

GRID bots use another high-risk trading strategy, that’s similar to those of Dollar Cost Averaging (DCA) bots. With a GRID strategy, the bot places an equal number of buy and sell orders within a predetermined range, based on algorithmic interpretation of historical price data. A DCA bot buys a fixed amount of assets at regular intervals, regardless of current price, to average out the cost of the assets and reduce the impact of short-term price movements. The problem here is that both of these rely on a general upward trend in the relevant financial markets, and can lead to continuous losses if used in a market downturn, posing significant risk.

Another difficult-to-manage risk of trading bots is that they may exhibit a tendency to open a large number of positions simultaneously, leading to overtrading. This not only increases transaction costs but also heightens the risk of portfolio imbalance and exposure.

To avoid the risks inherent in some trading bots, opt for those that employ conservative strategies emphasizing risk mitigation. Choose those with a focus on controlled position sizing and limited exposure, avoiding the aggressive nature of martingale and similar methods. Furthermore, implement strict position limits within the trading bot's configuration, and set predefined thresholds for the maximum number of concurrent positions, aligning with your risk tolerance and overall portfolio strategy.

Problems with backtesting

Certain trading bots focus on backtesting, whereby the bot retroactively tests an automated trading strategy on historical data to see how it would have performed and look for any potential improvements. Due to the immense processing power of bots, they can provide accurate reporting using massive amounts of past data.

Despite its advantages, trading bot backtesting comes with inherent limitations. One significant challenge is its failure to consider real-world factors such as slippage, commissions, spreads, and micro-fluctuations within one minute. While backtesting provides insights into historical performance, it often falls short of accurately simulating the complexities of live trading conditions – even when using bots.

To counter these issues, incorporate realistic transaction costs, including slippage and commissions, into the backtesting model – a feature offered by some trading bots. Adjust spreads and factor in micro-fluctuations within shorter timeframes to better mimic the dynamic nature of live markets. These modifications can help you make a more realistic assessment of a strategy's performance and make informed decisions based on comprehensive data.

Risk of Fraud

As with all platforms and tools used for trading, the provider of any trading bot should be an accredited, legitimate, and trustworthy source. Otherwise, when you are selecting a trading bot, these issues related to the risk of fraud could arise:

-

Hidden Programming Errors: The presence of concealed programming errors in the bot's code may lead to unintended consequences or vulnerabilities

-

Scammers Selling Fraudulent Bots: Dishonest sellers may engage in fraudulent activities by selling you bots with false claims of profitability, creating a risk of financial loss

-

Malicious Code: The presence of malicious code in a trading bot can compromise your security, leading to unauthorized access or other harmful activities

-

Unreliable Bot Providers: Choosing untrustworthy or unreliable bot providers may expose you to fraudulent schemes

-

Lack of Transparency: Bots lacking transparency in their operations and performance can increase the risk of fraud, as you may not have access to accurate information about the bot's capabilities and track record

-

Ponzi Schemes: Some trading bots may be part of larger Ponzi schemes, where returns to earlier investors are paid using the capital of newer investors, creating a fraudulent investment structure

To avoid falling prey to any of these risks related to fraud, look for well-established and reputable bot providers, conducting thorough research and seeking reviews from trusted sources before making a purchase. Verification through independent reviews, user testimonials, and a transparent track record of the bot's performance can help mitigate this risk. Additionally, you could use antivirus software and conduct regular security audits to detect any harmful elements within the code of the platform or bot you use.

Traders Union has conducted thorough research into which crypto trading bots are fraudulent and which ones you can trust. To see that list and have some peace of mind in choosing your bot, click here: What are the Best Crypto Trading Bots for 2024?

Mistakes in usage

Last in our list of trading bot risks is the risk posed by mistakes that may be made by you, the user. As a beginner trader in particular, you may be more likely to make errors when using a trading bot. Some of those mistakes are:

-

Wrong Settings/Markets: Some users may make mistakes in configuring the bot by choosing incorrect settings or selecting inappropriate markets. This can result in the bot executing trades that are not aligned with users’ intended strategy

-

Lack of Optimizing: Inadequate optimization of the trading bot's parameters or neglecting the optimization process can lead to suboptimal performance. Failure to fine-tune the bot for changing market conditions could also lead to lower effectiveness

-

Loss of Bot Connection or Power Outage: Though this usually isn’t a user’s fault, it is an issue on their end. Technical issues such as loss of connection between the trading bot and its server or power outages can disrupt the bot's operations, potentially causing missed trading opportunities or unintended consequences

-

Work Delays: Delays in the execution of trading commands by the bot can occur due to various reasons, including slow internet connection, server issues, or bottlenecks in the bot's processing capabilities

-

User Interference or Neglect: Users may unintentionally interfere with the bot's operations by not taking necessary actions when required or, conversely, by making abrupt adjustments without understanding the bot's strategy. Both scenarios can lead to undesirable outcomes and undermine the effectiveness of the bot

The best advice we can offer here is – just try to avoid these mistakes! Familiarize yourself with the bot’s user interface and settings, operate it on a strong internet connection, and educate yourself on how to use the bot properly.

Best Forex brokers for Trading With Bots in 2024

Tips on using trading bots

-

Research Indicators: If you’re using your own strategy, take the time to research indicators and whether they work with your trading style and market conditions. Test them out extensively before using real capital

-

Use Paper Trading: Jumping straight into real trading without prior experience is a common mistake. Use the paper trading mode offered by most trading platforms to practice your strategy and build on your trading knowledge

-

Backtest: Perform thorough backtesting before implementing any configuration. Learning from the past is a proven way to avoid repeating the same mistakes in the future. Use what you learn from backtesting to perfect your bot's strategy

-

Understand the Bot: Before deploying a trading bot, thoroughly understand its functionalities, settings, and limitations. Each bot operates differently, and a clear comprehension will help you make informed decisions

-

Pick Your Assets Wisely: Whether it’s cryptocurrencies, stocks, or Forex, the specific assets you choose to trade will largely determine the outcome of your journey. Follow social media channels or accounts related to the assets you choose, stay up to date with them, and research them well

Conclusion

In conclusion, trading bots offer a powerful means to automate and optimize trading strategies, yet they come with challenges. The complexity of selecting the right strategy, managing risks effectively, addressing issues in backtesting, avoiding fraudulent schemes, and mitigating user mistakes requires careful consideration.

You should choose transparent strategies aligned with your expertise, prioritize risk management, and incorporate realistic factors in backtesting. Opting for reputable bot providers, conducting thorough research, and staying vigilant against potential fraud, are crucial. Your education, and diligent use of the bot, including paper trading and understanding its intricacies, will help to enhance your overall trading experience.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.