How to Backtest Forex Expert Advisor in MT4

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Backtesting on MT4 in four simple steps:

- Choose and load your Expert Advisor (EA)

- Open the Strategy Tester from the view tab

- Set your test parameters and date range

- Run the test and scrutinize the results. It's like a time machine for your trading strategy

In Forex trading, the difference between success and "better luck next time" often boils down to the strategies employed. Forex robots can be at the heart of these strategies. Backtesting helps ensure the robot does its job right.

This article dives into the intricacies of backtesting your Forex robot on the MetaTrader 4 (MT4) platform.

How to backtest a Forex Expert Advisor in MT4

MetaTrader 4 (MT4) is a widely used platform in the Forex trading community, notable for its robust functionality and user-friendly interface. Integral to its operation is MQL4, a programming language specifically designed for developing trading strategies, indicators, and Expert Advisors (EAs).

These EAs, essentially automated trading algorithms, require rigorous testing to ensure effectiveness and reliability in live market conditions.

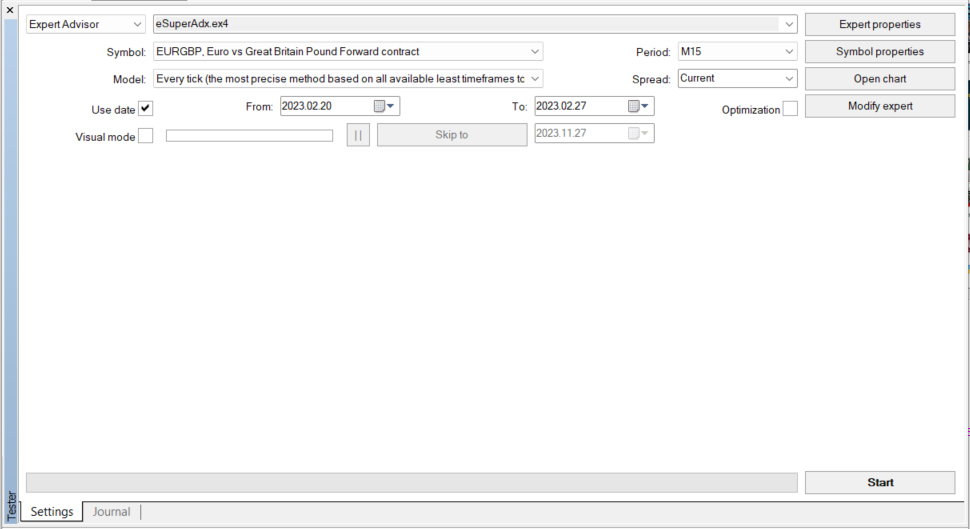

This is how the interface for testing the Expert Advisor looks like

This is how the interface for testing the Expert Advisor looks likeThe following list outlines the necessary parameters that must be defined to perform the test:

EA : This refers to the selection of the specific Expert Advisor to be tested. It is a critical step as it determines the algorithm that will be subjected to historical data analysis

EA Properties : Configuring the EA properties involves adjusting various operational parameters of the Expert Advisor. This step ensures you’re tailoring the backtest to reflect specific trading conditions and strategy preferences

Model : The model setting dictates the type of backtest to be conducted. It defines the methodological approach for the simulation, impacting the accuracy and comprehensiveness of the test

Period : The period parameter sets the timeframe over which the backtest is conducted. This can range from short-term intervals to extended durations, depending on the intended application of the EA

Date : Specifying the date range serves to select the historical data period over which the EA will be tested. This allows for a targeted analysis of the EA’s performance under specific market conditions

Upon setting these parameters, the backtest can be initiated. This process involves MT4 retrieving historical market data from the broker's server, which is then used to simulate how the EA would have performed during the specified period. This simulation provides valuable insights into the potential effectiveness and reliability of the trading strategy embodied in the Expert Advisor.

How to interpret backtest results

Interpreting the results of a backtest conducted on MT4 is obviously a necessary step in assessing the viability of a Forex Expert Advisor (EA). Traders need to analyze various metrics to understand the EA's performance during the testing phase.

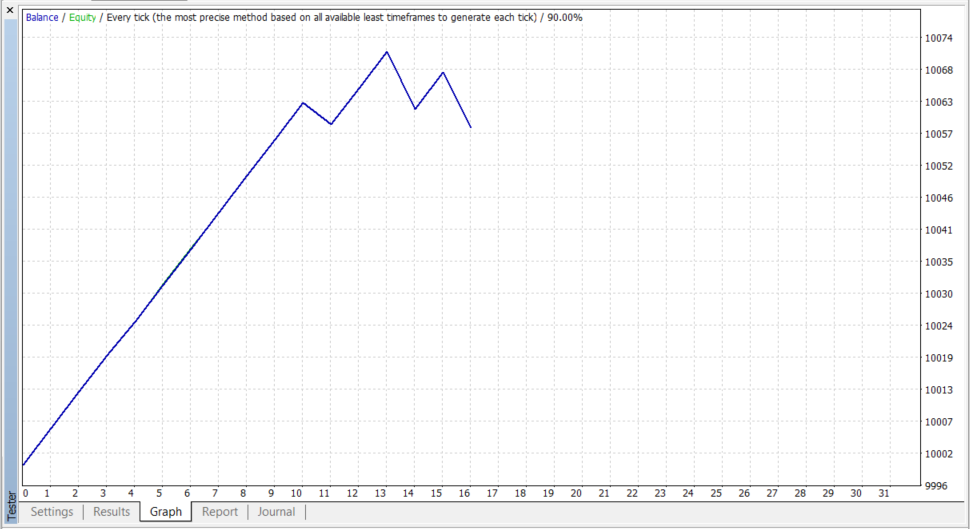

Testing shows a positive change in equity

Testing shows a positive change in equityUse the tabs in the Metatrader tester to analyze the maximum information about the EA backtesting

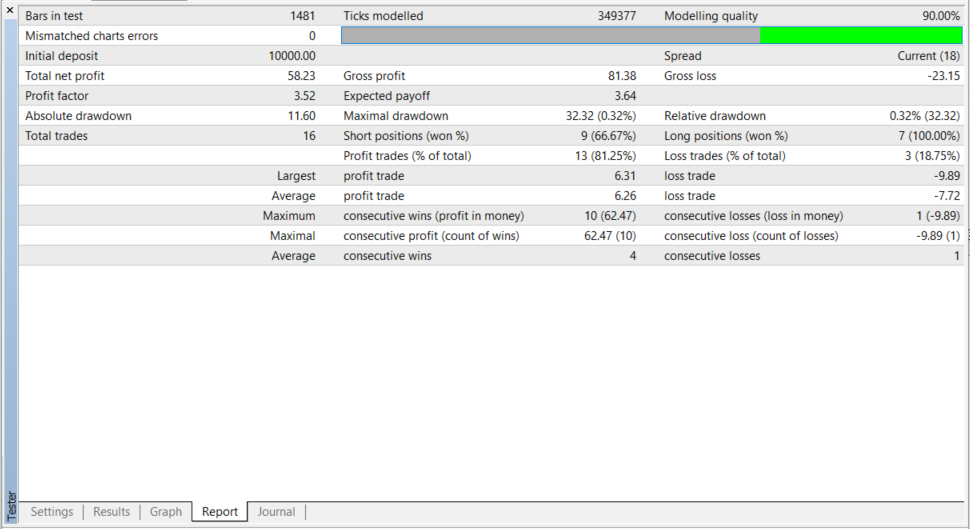

Test results may deteriorate if a longer period is chosen

Test results may deteriorate if a longer period is chosenHere's a breakdown of the key factors to consider:

Drawdown : This metric reflects the largest drop from peak to trough in the account balance during the backtest period. A smaller drawdown suggests a potentially lower risk, as it indicates that losses from a string of losing trades are not excessively large. However, do consider this in the context of overall returns; an EA with a small drawdown but also minimal profits may not be desirable

Quality of backtesting : The modeling quality indicates the perceived accuracy of the simulation. It is determined by the quality of the historical data used. In the provided screenshot, a 90% modeling quality suggests that the backtest results are relatively accurate and can be considered a fairly reliable representation of the EA's performance with the given data. Generally, aim for the highest modeling quality possible to ensure the most accurate simulation

Profit factor : This is the ratio of gross profits to gross losses. An EA with a profit factor greater than 1 is generally considered profitable, as it indicates that the system has won more than it has lost. For instance, a profit factor of 3.52, as seen in the screenshot, implies that EA's gross profits are 3.52 times the gross losses, which is a strong indicator of a profitable trading strategy

When analyzing these factors, traders should look for a consistent upward trend in equity, which suggests that the EA is profitable over time. They should also be cautious of any significant dips in the equity curve, as this may indicate periods of high risk or an EA that doesn't handle market volatility well. Additionally, traders should examine the total net profit, the absolute and relative drawdown, and the number of profitable trades compared to losing trades.

Ultimately, while these metrics can guide traders in evaluating an EA's past performance, they must remember that past performance is not always indicative of future results. Continuous monitoring and testing against current market conditions are advised to ensure ongoing effectiveness.

Pros and cons of backtesting robots in MT4

Backtesting on MT4 offers a mixed bag of benefits and drawbacks for traders using automated systems.

- Pros

- Cons

- Versatile testing : MT4 supports backtesting over various timeframes and markets, allowing for a broad evaluation of a strategy

- Customization : Numerous settings are available, enabling detailed adjustments to refine the testing process

- Speed : The platform can quickly backtest strategies, saving valuable time for optimization

- Risk management : Backtesting aids in identifying risk factors, helping traders to adjust strategies accordingly

- Market insight : It provides an understanding of how strategies might perform under past market conditions

- Data reliability : Historical data may be incomplete or inaccurate, potentially skewing test results

- Developer fraud : There's a risk of manipulated results from unscrupulous developers

- No guarantee of future performance : Successful backtests do not guarantee future performance due to ever-changing market conditions

- Overfitting : Over-optimization can lead to strategies that perform well on historical data but fail in live markets

Best Forex brokers

Tips for backtesting Forex Expert Advisors in MT4

To maximize the effectiveness of backtesting and ensure realistic results, consider the following tips:

Optimize responsibly : Utilize MT4’s built-in optimization features to fine-tune your EA’s parameters. This helps in identifying the most promising settings for performance. However, try to avoid over-optimization as it could lead to misleading backtest results due to overfitting to historical data

Set realistic expectations : Understand that backtesting is about strategy validation, not a promise of future riches. Successful backtesting does not guarantee profitable trading, as market conditions are constantly changing and past performance is not indicative of future results

Test on a demo account : Before going live, run your optimized EA in a demo account. This provides a real-time testing environment without financial risk. It allows you to observe the EA's interaction with live market conditions and make necessary adjustments before committing real capital

Following these tips allows traders to approach backtesting with a balanced perspective, aiming for sustainable performance rather than immediate financial gains.

Conclusion

Backtesting Forex Expert Advisors within MT4 stands as an essential practice for any serious trader. It provides a statistical foundation upon which to evaluate and enhance trading strategies.

While it's an invaluable tool in a trader’s arsenal, one must engage in backtesting with a discerning approach, acknowledging its limitations. By optimizing cautiously, maintaining realistic expectations, and confirming strategies with demo account testing, traders can develop robust EAs capable of navigating the ever-changing Forex market.

Ultimately, backtesting is not about predicting the future but about preparing to meet it with confidence.

FAQs

What is backtesting?

Backtesting is the process of testing a trading strategy or model by applying it to historical data to assess its effectiveness and predict its future performance.

Does MT4 have a strategy tester?

Yes, MT4 comes equipped with a built-in strategy tester that traders can use for free to evaluate the performance of their Expert Advisors and indicators.

How to run strategy tester in MT4?

To run the strategy tester in MT4, simply press Ctrl+R on your keyboard, which will open the tester panel for you to configure and start your tests.

Can I backtest an indicator in MT4 tester?

Yes, you can backtest an indicator in the MT4 tester to analyze its historical performance and effectiveness in signaling trades.

Related Articles

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

An Expert Advisor (EA) is a piece of software or script used in the MetaTrader trading platform to automate trading strategies. EAs are programmed to execute trading decisions based on predefined criteria, rules, and algorithms, allowing for automated and systematic trading without the need for manual intervention.

Uptrend is a market condition in which prices are generally rising. Uptrends can be identified by using moving averages, trendlines, and support and resistance levels.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.