DupliTrade is a social trading and copy trading platform that is notable for its strict selection of strategy providers. If almost any participant can become a provider on MQL5, for example, then DupliTrade carefully selects from among them the most experienced traders with proven strategies.

Interested in Copy Trading? - Try RoboForex

The platform is regulated by the Cyprus Securities and Exchange Commission (CySEC), so it can be considered reliable. It cooperates with such well-known brokers as AvaTrade, Pepperstone, Axi, IC Markets.

What do social trader and copy trading platforms mean?

Social trading appeared more than 10 years ago. Social trading platforms aim to unite experienced traders and novice traders in one place. They are designed to communicate, share experiences and make money together. An important feature of such platforms is the availability of copy trading.

On the DupliTrade copy trading platform, traders develop and improve strategies, and control risks. Novice traders, in turn, get the opportunity to subscribe to them and start copying trades automatically.

Thus, novice investors solve several problems at once:

-

They gain immediate entry into the market without having to spend years on training and developing strategies;

-

Have the potential to earn at the level of professionals who have already learned the ropes;

-

Acquire valuable knowledge by studying the strategies of professionals.

DupliTrade social trading network review in 2024

A platform for copy trading |

DupliTrade |

Regulation |

CySEC |

Terminals |

MT4 |

The number of brokers offered |

12 |

Top brokers |

AvaTrade, Pepperstone, IC Markets, Fusion Markets, AxiTrader, FXPro |

The minimum investment for copy trading |

$2,000-$5,000 |

Commission for using the service |

No |

Signal providers |

162 |

Brokerage commission |

Depending on the selected broker |

Types of accounts |

Real account, demo account |

Markets |

12 signal providers |

DupliTrade social trading platform review

Let's start our DupliTrade review with the system is configured smartly for a specific function—copying 12 carefully selected strategy providers. It's hard to get among the suppliers. There are not so many functions for communication and socialization here as on ZuluTrade and MQL5, so this platform is more suitable for copying trades.

The main task of the investor is quite simple - to monitor 12 strategy providers and choose one, or more, to start copying transactions.

Strategy providers

Strategy providers

The main section at DupliTrade is strategy providers, where you can choose a trader to copy. DupliTrade explains that there are only a few strategies because traders go through fairly strict verification, interviews, and strategy testing for long periods.

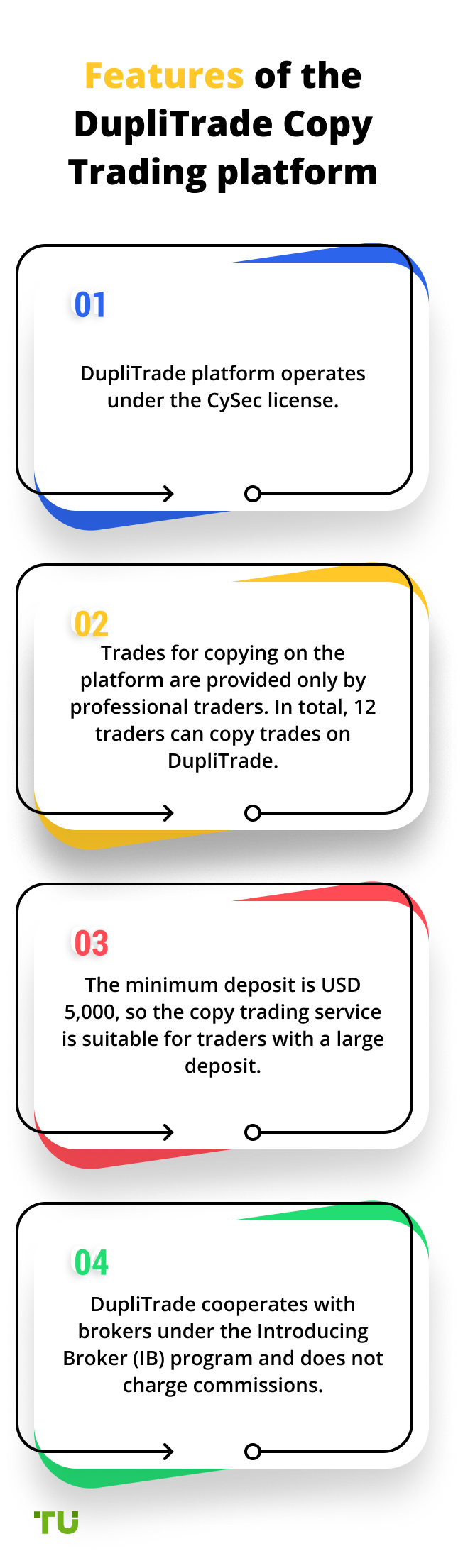

In the general list, traders are sorted by the number of subscribers. Also, when you first look at the table, you can evaluate such data as net income during trading, the number of transactions, the percentage of profitable transactions, the number of active weeks, and the examine the profitability chart.

Strategy description

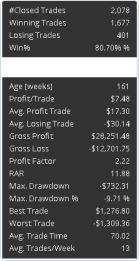

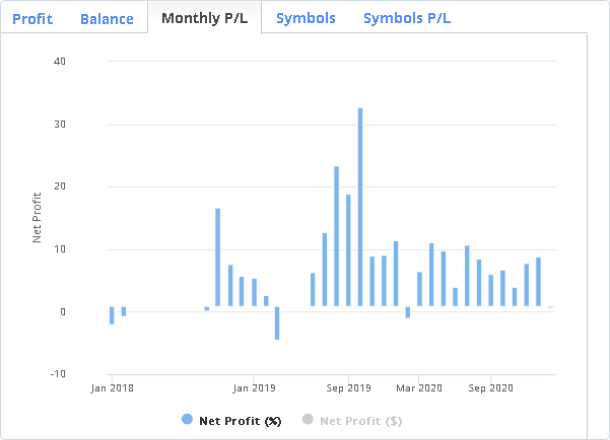

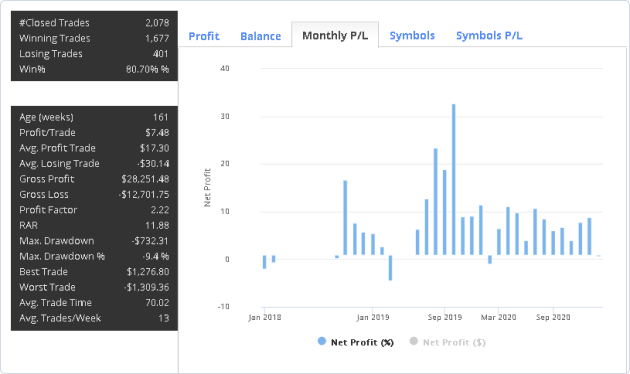

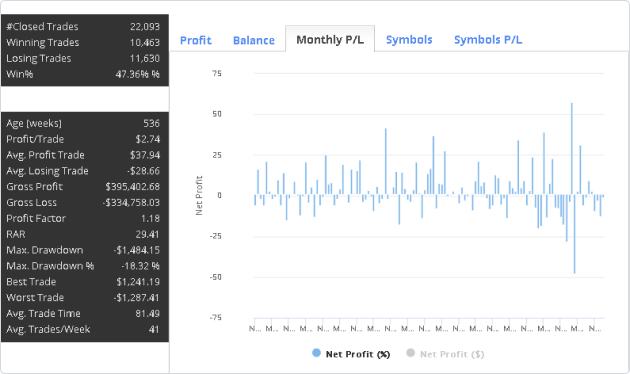

Statistics table

The Statistics table, including the number of trades, the profitable to unprofitable trades ratio, and the maximum profit and loss per trade, etc.

Profitability chart

Here you can study the schedule of changes in profitability and the history of transactions.

Diagrams

Several useful diagrams are presented. Thus, you can track the profitability and loss dynamics by month.

There is nothing more interesting than to watch DupliTrade. Yes, there is also a trading simulator, which allows you to find out how much you would earn if you started copying one of the DupliTrade traders at a certain time. However, we believe that such services are manipulative because results in the past are never a guarantee of repetition in the future.

Summary

The data is sufficient for the basic needs of a novice investor. For more advanced investors who'd like to choose a trader to copy according to their own needs, there is nothing to look for on the platform and it is significantly inferior to the leader of our rating of the best social trading platforms, which is eToro.

Pros and cons of copying traders on DupliTrade

👍 Pros

• A simple and convenient platform that is good for novice traders

• Strict selection of strategy providers

• Regulation by CySEC

• No commission for using the service

👎 Cons

• The high minimum threshold for copyings

• A small number of signal providers

• There is no deep adjustment of risk parameters and exit from positions

• Weak toolkit for communication and experience sharing

How to find the right trader to copy on DupliTrade

DupliTrade offers only 12 traders to copy, so the selection process should not present any difficulties. You can study the profiles of all traders in 15-20 minutes on the Strategy Providers page. We recommend you to pay attention not only to the net income but also to the trader's trade stability. To do this, look at the monthly profitability, as well as the maximum drawdown on the account.

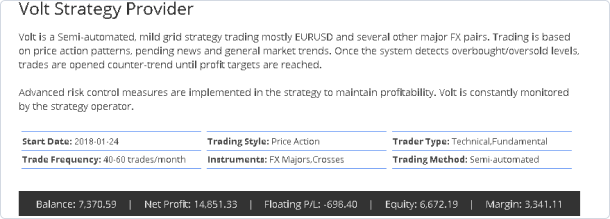

For example, let's compare the leader of DupliTrade's rating. He trades under the nickname Volt and the second-highest-ranking trader uses the nickname Legacy.

Volt

vs

Legacy

Trader: Volt

Trader: Legacy

Analysis of statistics shows that Volt can be considered a more stable trader since its monthly results are less volatile, its maximum drawdown is only 9.4% against 18.32% for Legacy, and the percentage of profitable trades is 80.7% against 47.36%.

It is worth mentioning that excellent results in the past never guarantee the same in the future and there are always risks in trading, but the chances that Volt will trade more stably are still higher.

To reduce the risks, you can also start copying at least 3-5 traders, however, given the high minimum deposit on DupliTrade, not every investor can afford it.

How to get started to copy traders on DupliTrade

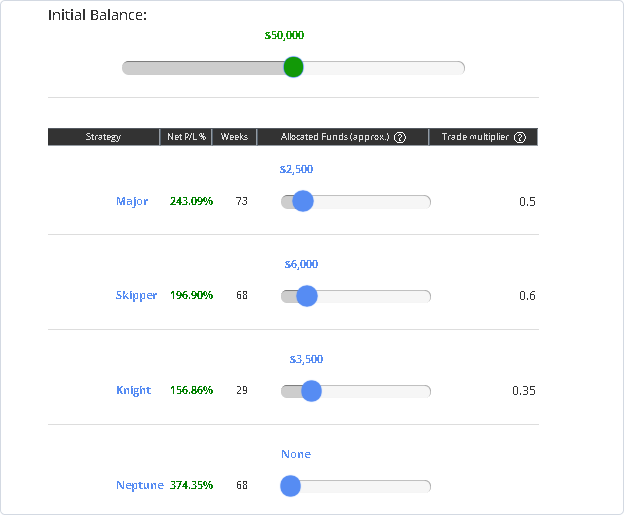

It's easy enough to start copying traders on DupliTrade. Once you have identified which Strategy Providers are of interest to you, click on the Duplicate button in front of the nickname on the list, or select him directly from the trader's profile. Here you will see a panel where you can easily distribute investments between different managers in different proportions.

This function is very convenient for novice traders. A minimum of $500-$2,500 should be allocated for each strategy depending on the vendor.

The downside of the system is that deep customization of risk-management parameters for copy trading, like on eToro, is not available here.

Once the choice is made, click Save Changes at the bottom of the table. You can monitor traders' results by following the My Account page, where the overall performance, as well as all open and closed trades, is displayed.

Opening account on DupliTrade

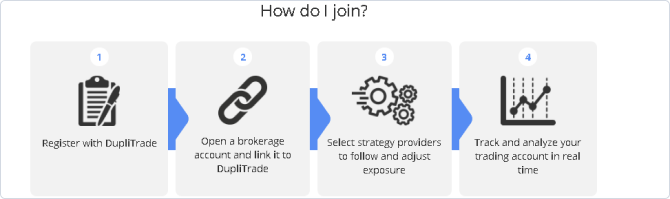

Opening account on DupliTradeDupliTrade's system requires that you first register on the platform for copy trading, and then link this account to the account of one of the partner brokers.

The scheme of working with DupliTrade is as follows:

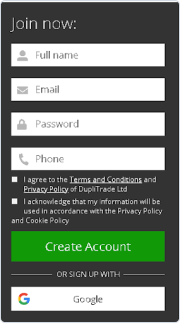

The registration process takes only a few minutes.

When you click on Sign Up, you will see a registration window. You can fill in the data manually or log in with Google.

After you click Create Account, a demo will automatically open with a test balance of up to 500,000. You can use it for 30 days.

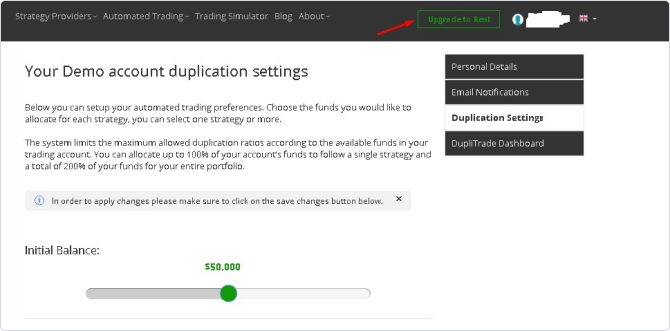

Opening a real account

Opening a real accountTo open a real account at DupliTrade, click on the Upgrade to Real button in the upper right corner of your personal account.

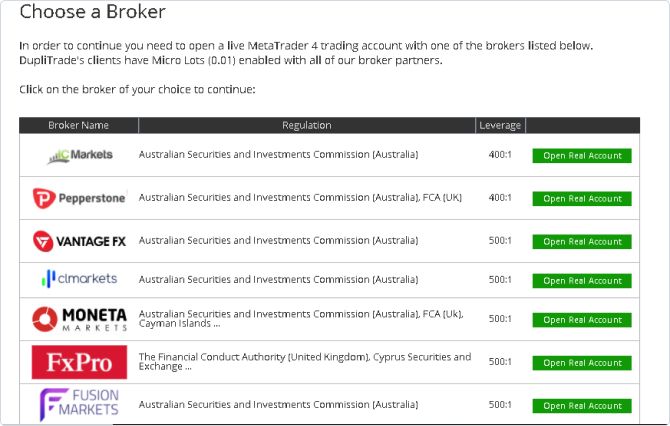

The system will prompt you to choose one of the 12 partner brokers.

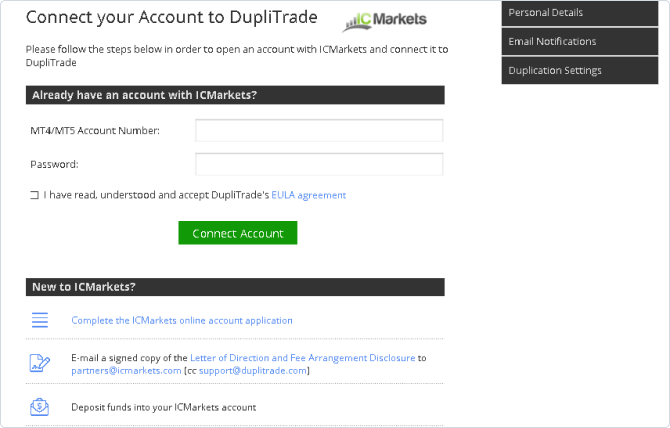

When you click on the green button next to the broker's name, a window opens where you can link a valid MT4/MT5 account number to DupliTrade. If you don't have an account yet, you have to go through the whole registration procedure with your broker, deposit to your account and then link it to DupliTrade.

Top 6 brokers to work with at DupliTrade

The choice of brokers that DupliTrade works with is not very large - there are 12 of them in total. However, there are several major international companies among them.

| Broker | Minimum deposit | Regulator | Platform | |

|---|---|---|---|---|

1 |

Minimum deposit $2,000 |

Regulator ASIC, Central Bank of Ireland |

Platform MT4 |

|

2 |

Minimum deposit $5,000 |

Regulator ASIC |

Platform MT4 |

|

3 |

Minimum deposit AUD 5,000 |

Regulator ASIC, FCA |

Platform MT4 |

|

4 |

Minimum deposit $5,000 |

Regulator FCA, CySEC |

Platform MT4 |

|

5 |

Minimum deposit $5,000 |

Regulator ASIC |

Platform MT4 |

|

6 |

Minimum deposit $5,000 |

Regulator ASIC |

Platform MT4 |

Can I make money by copying traders on DupliTrade?

Of course, you can make money on the DupliTrade copy trading platform because you can use it to copy experienced traders. Copying transactions can be a source of extra income.

However, it is worth remembering that there are no risk-free investments in financial markets. Excellent financial results of traders in the past do not guarantee the same in the future. Please keep that in mind when deciding to invest.

What are DupliTrade fees

Subscribing to DupliTrade is free. The provider of the copy trading platform gets remuneration directly from the partner brokers.

Brokers charge execution commissions according to their trading terms. Be sure to familiarize yourself with them before you start working with DupliTrade.

It is also worth considering that the minimum deposit to start trading with most brokers is $5,000 or the equivalent in local currency.

Is DupliTrade social trading platform safe?

We believe that the DupliTrade copy trading platform is safe because it is regulated by the Cyprus Securities and Exchange Commission (CySEC). Moreover, DupliTrade only works with regulated brokers, which are mainly registered in regions with a high legal culture such as Australia, the UK, EU countries, and the USA.

Summary

DupliTrade is a fairly small platform for social trading. It is significantly inferior in scale, depth of customization, and the number of subscribers when compared to eToro and ZuluTrade.

However, it can be useful for some categories of investors because the small number of traders is compensated by the thoroughness of their choice. DupliTrade also differs in that it doesn't charge a commission for copying transactions, regulated in Cyprus, and works only with reliable partner brokers.

Expert review

DupliTrade may somewhat confuse experienced copy traders who were already working on large platforms. However, first impressions can be deceptive. I know many DupliTrade clients who are convinced that the efficiency of the signal providers on this platform is not any worse than on eToro, and is noticeably better than on MQL5 and ZuluTrade. This does not surprise me, given that the platform provider is very careful in selecting traders for cooperation.

Antony Robertson,

Traders Union’s financial analyst

DupliTrade social trading platform reviews

-

1

John, 44, Boston

I was skeptical about this platform at first. Here, the choice of managers is tiny compared to the market leaders, and the minimum amount for investments is pricey. However, this service for copy trading has its niche. People who are willing to invest $5,000 know what they're getting into. I took a risk and earned 47% for the year, which is higher than my typical result on eToro.

-

2

Mary, 37, New York

I know about DupliTrade from my friends who copied signals on this platform. The reviews were very positive. However, a large minimum deposit is an insurmountable obstacle for me to try it myself. If DupliTrade would meet the needs of not the richest novice traders, it would be priceless!

-

3

Dillan, 42, Manchester

I started working with DupliTrade four months ago. At first, it was a shock. The risk-management settings here are not very good and one of the traders that I copied, at one point went into a deep deficit. I had to refuse to cooperate with him. Thankfully, the other providers were in good positions and I'm having +8% for now. But if such a loss happens again from someone, I'll have to unsubscribe.

FAQ

Does DupliTrade provide a demo account?

Yes, you can test copy trades on a demo for 30 days. You can use up to $500,000 of virtual capital to test strategy providers.

What amount is best to start working with DupliTrade?

Unfortunately, this platform has a high threshold to start copying trades, so you must start with a minimum of $5,000.

What brokers work with DupliTrade?

The provider works with 12 brokers. They are quite large and well-known, such as AvaTrade, IC Markets, Pepperstone, FxPro, Fusion Markets, and Axi.