Three Steps To Trade Forex With A Robot

Three Steps To Trade Forex With A Robot

-

Step 1. Choosing a Forex Robot

-

Step 2. Setting Up a Forex Robot

-

Step 3. Monitoring and Managing Trades

Forex robots, also known as Expert Advisors (EA, emerged as automated solutions driven by pre-established rules and algorithms. These computer programs operate tirelessly to execute trades on behalf of traders, offering an automated approach to navigate the complexities of the Forex market.

This article elucidates the fundamental steps involved in harnessing the power of Forex robots, guiding traders through the process from selecting an appropriate robot to setting it up, and finally, effectively monitoring and managing trades. As we delve into each step, you'll gain insights into optimizing your Forex trading experience through the strategic integration of these intelligent algorithms.

-

How do I find a good forex broker?

To find a good forex broker, prioritize factors like regulatory compliance, trading costs, platform reliability, customer support, and educational resources. Research through online reviews, regulatory bodies, and direct contact with brokers to make an informed decision.

Understanding Forex Robots

The Forex robots bring both benefits and drawbacks to traders. By automating trades, emotional decisions are minimized, ensuring adherence to consistent strategies. However, the drawback lies in the absence of human judgment, potentially hindering adaptability to market shifts.

To harness the advantages and mitigate the challenges, follow these three essential steps-

-

1

Choosing a Forex Robot: Select a robot that aligns with your trading goals, considering factors like strategy, risk tolerance, and historical performance.

-

2

Setting Up a Forex Robot: Run backtests. Optimize your chosen robot by configuring parameters, such as lot size, risk management, and preferred trading hours, to align with your unique trading preferences.

-

3

Monitoring and Managing Trades: Regularly review the robot's performance, keeping a watchful eye on market conditions. Adjust settings if needed and intervene when necessary to maintain control over your trading portfolio.

These steps empowers the advantages of Forex robots while minimizing potential drawbacks, fostering a balanced and efficient automated trading experience.

Step 1. Choosing a Forex Robot

Embarking on the journey of automated trading begins with the crucial first step of choosing a Forex robot. Here's a structured guide for this phase:

-

Research and Selection: Conduct research on available Forex robots, analyzing factors such as historical performance, reputation in the market, and the quality of customer support.

-

Reputable Providers: Opt for a Forex robot offered by a reputable provider with a proven track record of success.

-

Compatibility: Ensure seamless integration by confirming that the chosen robot is compatible with your trading platform and broker.

For more insights into the best free Forex trading robots and how they can assist in your algorithmic trading carrier, we recommend reading the article: Best Forex Trading Robots

Step 2. Setting Up a Forex Robot

With the decision on a Forex robot made, the next critical step is setting it up for optimal performance. Here's a systematic approach for this phase:

Download and Install

Begin by downloading the robot's software from the developer's official source. Follow the installation instructions to ensure a seamless integration with your trading platform.

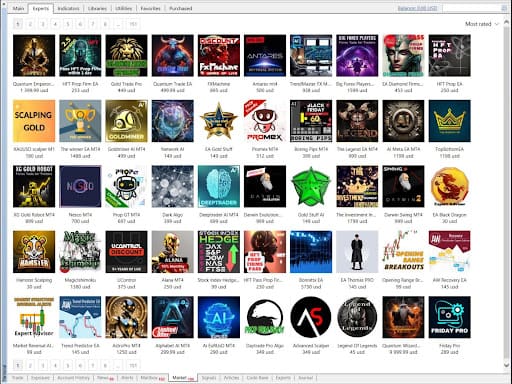

A simple way to do this is to use the Expert Advisors marketplace, which is built into the MT4 terminal:

Metatrader4

Parameter Configuration

Customize the robot's parameters according to your trading preferences. This includes defining risk

management settings, selecting trading strategies that align with your goals, and establishing clear entry and exit criteria.

Backtesting

Before deploying the robot in live market conditions, conduct thorough backtesting using historical data. This step allows you to evaluate the robot's performance under various market scenarios.

By diligently following these steps, you not only ensure a smooth setup process but also lay the groundwork for a Forex robot that is finely tuned to your specific trading requirements. You can also be interested in information about Free Download Trading Bots For MT4 read the Traders Union article.

Step 3. Monitoring and Managing Trades

The third step in the career of trading Forex with a robot involves vigilant monitoring and proactive management of trades. Here's a structured guide to navigate this phase:

Real-Time Monitoring

Stay actively engaged by continuously monitoring the robot's performance in real-time. This allows you to promptly identify any anomalies, potential issues, or unexpected market conditions that may require manual intervention.

Performance Evaluation

Regularly evaluate the robot's performance against your predefined trading goals and risk tolerance. Assess its ability to adapt to changing market dynamics and ensure that it aligns with your overall trading strategy.

Adjustment and Optimization

Flexibility is key in automated trading. Be prepared to make adjustments or optimize the robot's parameters based on market conditions and the ongoing evaluation of its performance. By adopting an adaptive approach to monitoring and managing trades, you empower yourself to get the full potential of a Forex robot while retaining control over your trading portfolio.

Best Forex brokers

Tips for Trading Forex with a Robot

Trading Forex with a robot can be rewarding, but it requires careful considerations. Here are essential tips to enhance your automated trading experience:

-

Choose a Reputable Forex Broker

Select a reputable Forex broker that accommodates algorithmic trading. -

Set Realistic Expectations

Understand that while backtests provide valuable insights, they may not fully mirror real trading conditions. Set realistic expectations and be prepared for variations between historical performance and live trading results. -

Be Cautious

Exercise prudence and only invest what you can afford to lose. Despite the advantages of automation, be cautious and monitor your robot's performance to avoid significant financial risks. -

Start with Demo Trading

Before engaging in live trading, practice using the robot on a demo account. This allows you to gain valuable experience, assess the robot's effectiveness, and refine its parameters without risking real money. -

Continuous Learning

Stay informed about market trends, trading strategies, and advancements in robot technology.

Conclusion

With careful planning and execution, forex robots can be a valuable tool for forex traders, but they are not a guarantee of success. By doing your research and choosing a reputable robot, you can increase your chances of making money trading forex.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

-

4

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

5

Expert Advisor

An Expert Advisor (EA) is a piece of software or script used in the MetaTrader trading platform to automate trading strategies. EAs are programmed to execute trading decisions based on predefined criteria, rules, and algorithms, allowing for automated and systematic trading without the need for manual intervention.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).