Cryptocurrency Exchanges and Digital Banks | Pros and Cons

In 2021, the cryptocurrency market reached unprecedented highs, crushing the records of 2017. Prices of many Top 100 coins recorded more than 10x growth compared with the beginning of the year, showing several surges and drops in between.In several months, smart investors managed to make more than 1,000% in profits. Exchanges accounted for over 90% of trading volume. January 2023, however, brought an event that radically changed the views of investors: the FTX exchange suddenly announced bankrupt.

Prior to its bankruptcy, FTX was one of the top 5 crypto exchanges by trading volume and a leader by the volume of cryptocurrency futures. In November, CoinDesk reported that the owner of FTX had increased the equity of his company Alameda Research by using FTT (FTX tokens) and customer money. Further investigation showed that over $4 billion had been withdrawn from FTX.

This event had a radical impact on investors’ priorities. FTX is not the first case of a major exchange bankruptcy. The same happened to Mt.Gox after it got hacked and to BTC-E following a case of fraud. That is why investors looked into other ways to invest in cryptocurrencies. One of them is to buy BTC with an account at a digital bank.

What are digital banks?

A digital bank (neobank, online bank) is a platform that provides banking services on the internet. In most cases, digital banks do not have physical branches, which allows them to charge lower fees compared to traditional banks. Most services for private customers are the same as in classic banking: deposits, debit and credit cards, international payments, exchange transactions, , home mortgage, etc. And since recently, digital banks have been offering access to cryptocurrency trading.

Advantages of digital banks over crypto exchanges

Benefits of cryptocurrency trading with digital banks:

Regulation. Digital banks operate in full compliance with licenses from financial regulators that also control traditional banks. This includes opening financial statements, undergoing audit, and meeting other legal requirements. Many European neobanks hold licenses from one of the most reputable regulators, the FCA (UK). Exchanges hold nominal licenses, which is shown by the examples of some of the largest exchanges that “suddenly” went bankrupt: QuadrigaCX (Canada), Africrypt (South Africa), Thodex (Turkey), and FTX.

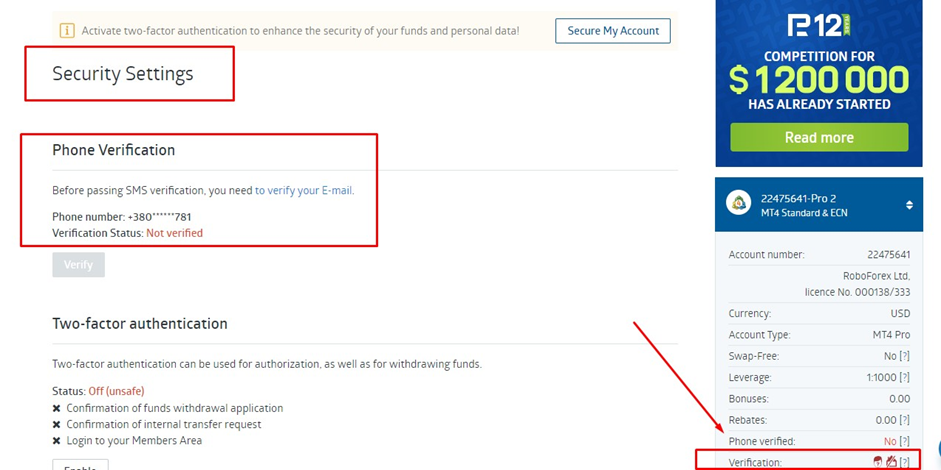

Account security and protection. Both digital banks and exchanges use reliable protection methods, such as two-factor authentication, SSL protocols, and facial and fingerprint recognition. However, crypto exchanges, as well as user accounts, get hacked regularly. Digital banks have not been hacked so far.

Fees are low due to the absence of physical offices and corresponding administrative expenses.

Insurance coverage. In case of a hack, crypto exchanges compensate for losses at their own discretion. Digital banks, in accordance with regulatory requirements, allocate money for independent insurance funds that offer insurance coverage in the amount of 50,000-100,000 US dollars or euros (depending on the fund), in force majeure cases.

Marketing and a wide choice of trading instruments are the strengths of crypto exchange, but they can alsocollapse any moment. Reliability supported by constant control by regulators is the strong side of digital banks.

Best Crypto-Friendly Banks You Should Know

Disadvantages of digital banks compared to crypto exchanges

Disadvantages of cryptocurrency trading with a digital bank:

Limited choice of coins. On average, digital banks offer no more than 10 coins for trading, whereas crypto exchanges from the Top 20 have over 100-150 altcoins and tokens in their listings.

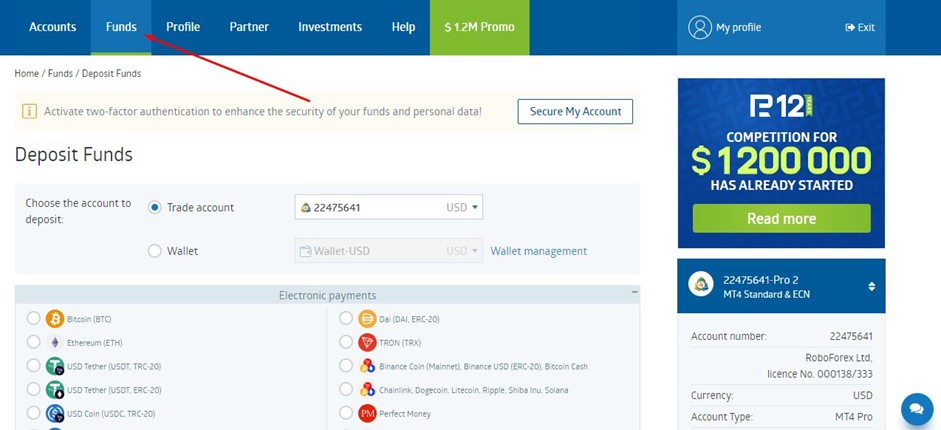

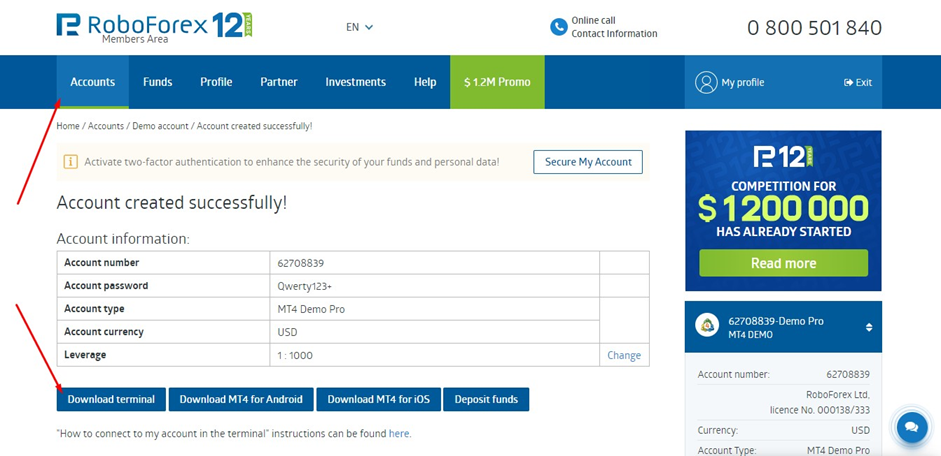

Lack of trading instruments. Digital banks offer only one type of service: buying or selling cryptocurrencies and holding them in crypto accounts. So far, only several neobanks offer full-featured trading platforms, but over time digital banks will add this functionality as well.

Transfer time. Transferring bitcoins to a bank account may take from a few minutes to several hours.

For those who are interested in long-term investing in top coins, these drawbacks are insignificant. Reliability of a digital bank – the guarantee that the platform will not disappear at some point together with client money – remains the key factor of choice.