Crypto.com Fees Explained

Regardless of the cryptocurrency exchange, traders have to pay a certain commission fee to use the platform for crypto trading. However, these fees differ across platforms, some exchanges being more affordable than others.

For instance, Crypto.com fees are comparatively lower than other cryptocurrency exchanges. Additionally, there are many ways to reduce your trading fees. The platform also has a VIP program with little to no trading fees for active traders.

In this guide, we explain the Crypto.com fees structure in detail. We also mention how to reduce trading and non-trading fees on the platform.

Crypto.com Fees - Short Introduction

Crypto.com is among the most reliable cryptocurrency exchanges. However, it stands apart from other exchanges due to its lower fees. The platform follows a maker-taker model. The maker fees range from 0.04% to 0.40%, while the taker fees range from 0.10% to 0.40%.

Like other exchanges, Crypto.com also has additional fees for traders who use their credit cards. On the flip side, Crypto.com provides discounts to certain investors. The higher up the tiered system a trader is, the larger discounts they can get.

| Type of fee | Size |

|---|---|

Maker |

0.04% to 0.40% |

Taker |

0.10% to 0.40% |

Debit/Credit card |

2.99% |

Withdrawal |

Varies by crypto type |

Crypto.com Fees vs Coinbase Fees

If you do Crypto.com fees vs Coinbase comparison, it’s easy to see that the former has a much more attractive commission structure. Additionally, crypto.com trading fees can be reduced by the exchange’s tiered discount program.

When compared to Coinbase, Crypto.com is much cheaper. Plus, it doesn’t have some additional non-trading fees that Coinbase charges. For example, Coinbase charges 1.49% for wallet conversion and bank account transfers. Meanwhile, both of these are free on Crypto.com.

Crypto.com vs. Coinbase Fees

| Type of Fee | Crypto.com | Coinbase |

|---|---|---|

Wallet Conversion |

Free |

0.50% |

ACH Transfer |

Free ($20 minimum) |

Free |

Crypto Conversion |

Free |

Up to 2% of the spread |

Debit/Credit Cards |

2.99% |

3.99% |

Trades |

Maker-taker model (fees vary based on 30-day trading volume) |

Maker-taker model |

Crypto.com Trading Fees Explained

The trading fees on Crypto.com are volume-based. It means that the fees get lower as the volume increases. Therefore, traders who initiate bigger trades get larger discounts.

Here are the trading fees you can expect to pay on the platform:

-

Maker Fees: You will pay a maker fee on your trade if it does not match immediately with a seller or buyer order on the exchange’s order book. A good example in this regard is the limit orders that are not immediately fulfilled.

-

Taker Fees: A taker fee is charged to your account if your trade is immediately matched with an order. An example is the market orders that are fulfilled immediately.

Crypto.com bases your fees on the post-30-day trading volume. The exchange calculates this by considering the amount of crypto you have traded in 30 days as an equivalent of USD.

Crypto Trading Fees

The spot and margin trading fees on Crypto.com are based on your tier level. The tiers go from Level 1 to Level 9, with Level 1 having the smallest trade volumes. As your level increases, the fees decrease. The table below shows this.

| Level | Level 1 | Level 2 | Level 3 | Level 4 | Level 5 | Level 6 | Level 7 | Level 8 | Level 9 |

|---|---|---|---|---|---|---|---|---|---|

Trading Volume (USD Equivalent) |

$0 - $25,000 |

$25,001 - $50,000 |

$50,001 - $100,000 |

$100,001 - $250,000 |

$250,001 - $1,000,000 |

$1,000,001 - $20,000,000 |

$20,000,001 - $100,000,000 |

$100,000,001 - $200,000,000 |

$200,000,001 and above |

Maker |

0.4% |

0.35% |

0.15% |

0.1% |

0.09% |

0.08% |

0.07% |

0.06% |

0.04% |

Taker |

0.4% |

0.35% |

0.25% |

0.16% |

0.15% |

0.14% |

0.13% |

0.12% |

0.1% |

Crypto.com also has a VIP program that rewards clients by giving them certain incentives. One of these perks is lower fees. Like regular trading on Crypto.com, the VIP program also has tiers. Traders on the top-most tier have to pay no maker fee and only a 0.020% taker fee.

VIP Tier |

30D Trading volume (USD) |

Maker Fee |

Taker Fee |

VIP 1 |

> 1% of monthly exchange volume |

0.020% |

0.040% |

VIP 2 |

> 3% of monthly exchange volume |

0.010% |

0.030% |

VIP 3 |

> 3% of monthly exchange volume |

0.000% |

0.020% |

Futures Trading Fees

Besides spot and margin trading, you can also trade derivatives on Crypto.com. Again, the fees are based on the 30-day trading volume and differ across tiers.

| Level | Level 1 | Level 2 | Level 3 | Level 4 | Level 5 | Level 6 | Level 7 | Level 8 | Level 9 |

|---|---|---|---|---|---|---|---|---|---|

Trading Volume (USD Equivalent) |

$0 - $25,000 |

$25,001 - $50,000 |

$50,001 - $100,000 |

$100,001 - $250,000 |

$250,001 - $1,000,000 |

$1,000,001 - $20,000,000 |

$20,000,001 - $100,000,000 |

$100,000,001 - $200,000,000 |

$200,000,001 and above |

Maker |

0.050% |

0.040% |

0.030% |

0.025% |

0.020% |

0.015% |

0.010% |

0.005% |

0.000% |

Taker |

0.070% |

0.065% |

0.060% |

0.040% |

0.035% |

0.030% |

0.025% |

0.020% |

0.015% |

VIP members also get different rates for derivatives trading based on their tier level. The rates are as follows:

VIP Tier |

30D Trading volume (USD) |

Maker Fee |

Taker Fee |

VIP 1 |

> 1% of Derivatives exchange volume |

0.010% |

0.030% |

VIP 2 |

> 3% of Derivatives exchange volume |

0.005% |

0.020% |

VIP 3 |

> 3% of Derivatives exchange volume |

0.000% |

0.010% |

Crypto.com Vs Coinbase Trading Fees

Whenever you trade cryptocurrency online, you need to be familiar with three types of fees: withdrawal, trading, and deposit. So let’s start the Crypto.com vs Coinbase comparison by mentioning fees the platforms do not charge.

Both platforms don’t charge a fee for bank transfer deposits. But they both have fees for debit card payments. Crypto.com charges 2.99% of the total transaction, while Coinbase charges 3.99%.

Secondly, the trading fees on Crypto.com are pretty transparent. Traders pay fees based on their trading tier, based on the 30-day crypto trading volume.

On the other hand, Coinbase’s crypto trading fees aren’t very transparent. The exchange calculates your fees after you place an order. Coinbase does not mention its maker or taker fee as other platforms like Crypto.com.

Crypto.com Non-Trading Fees

Besides trading fees, Crypto.com also has a few non-trading fees, although these are much lower than other platforms. Non-trading fees include debit/credit card transfers, crypto withdrawal, and conversion fees.

Does Crypto.com Charge Withdrawal Fee?

Does crypto.com charge fees for withdrawal? Yes, it does.

On Crypto.com, the withdrawal fees depend on the crypto type. Transferring crypto to Crypto.com wallet is free, though. Also, if you want to avoid paying withdrawal fees, you can use the platform’s Withdraw to App function.

Meanwhile, Coinbase does not disclose the fee for crypto withdrawal until you make the transaction. Like Crypto.com, moving crypto to Coinbase wallet is free.

Does Crypto.com Have a Conversion Fee?

Some platforms charge a conversion fee as an additional trading charge. For instance, Coinbase has a 0.50% flat fee for all conversions. Meanwhile, Crypto.com does not have any conversion fees.

Other Non-Trading Fees

Crypto.com charges a liquidation fee if there’s forced liquidation. These fees are on orders required to liquidate the traders’ collaterals. In addition, the platform charges a flat 0.16% taker fee.

You can avoid these fees by paying your loan on time. Or, you can make partial payments so your LTV is at a level where forced liquidation does not occur.

Crypto.com vs Coinbase - Non-trading Fees Comparison

The non-trading fees on Coinbase are higher than on Crypto.com. Moreover, Crypto.com doesn’t charge a fee for many actions, such as bank deposits.

| Type of Fee | Crypto.com | Coinbase |

|---|---|---|

Wallet Conversion |

Free |

0.50% |

ACH Transfer |

Free ($20 minimum) |

Free |

Crypto Conversion |

Free |

Up to 2% of the spread |

Debit/Credit Cards |

2.99% |

3.99% |

Crypto.com Interest Rates

With Crypto.com, traders can earn up to 14.5% on their crypto holdings. Meanwhile, the interest rate for stablecoins is up to 10% per annum. The reward rate of the Crypto.com Crypto Earn program depends on certain factors, such as the crypto amount in USD equivalent and the holding term.

Crypto Earn program

| CRO Lockup Amount | USD $400 or less | USD $400 or less | USD $400 or less | USD $4,000 or more | USD $4,000 or more | USD $4,000 or more |

|---|---|---|---|---|---|---|

Terms |

Flexible |

1 Month |

3 Months |

Flexible |

1 Month |

3 Months |

Stablecoins |

1.5% |

3% |

6% |

2% |

4% |

8% |

BTC,ETH |

0.5% |

1.5% |

3% |

1% |

2% |

4% |

LUNA, EGLD, ATOM |

1.5% |

2.5% |

4% |

2% |

3.5% |

5% |

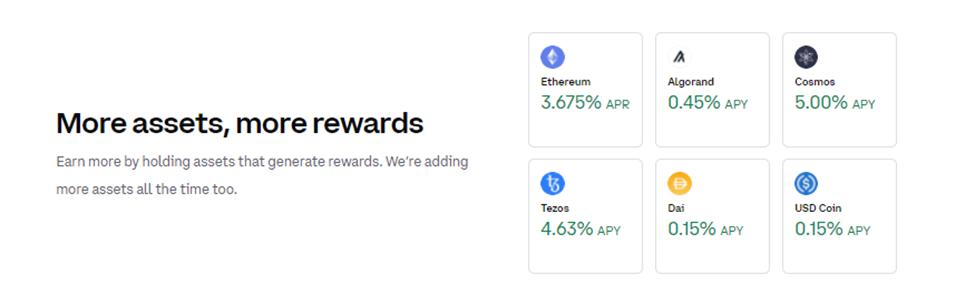

Meanwhile, Coinbase lets you earn up to 5% APR on your crypto assets. The rewards vary from one investment to another. For instance, the APY for Cosmos is 5%, while that for Ethereum is 3.675%. Likewise, Tezos has a 4.63% APY, while USD Coin comes with a 0.15% APY. Traders can earn more by staking crypto that makes the highest rewards.

Earn more by staking crypto

How to Reduce Crypto.com Trading Fees?

Traders on Crypto.com can save on their trading commissions by earning rebates through the Traders Union discount program. You need to register on the Traders Union website to get this discount. After that, you will get an affiliate link in your account. You can use this link to register on Crypto.com. Whenever you trade on Crypto.com, you will get a certain percentage of the commission fee as a rebate through the Traders Union affiliate partnership with Crypto.com. Thus, you can save money on Crypto.com trading fees even if you’re trading in the lower tiers.

Expert Opinion

Crypto.com is a popular choice for many cryptocurrency traders because it offers lower trading commissions than some other popular exchanges. Compared to Coinbase, Crypto.com fees tend to be more affordable in several ways.

One way Crypto.com keeps fees low is with a tiered membership program. The more you actively trade each month, the lower your transaction costs will be. Regular traders can save more over time versus occasional buyers.

Crypto.com also has a loyalty program for its native CRO token. Holding a certain amount can lower your trading fees even further. It also boosts the returns you earn from crypto savings accounts.

Additionally, funding your account through bank transfers is free of charge on Crypto.com. This is handy because some cards charge additional percentages on cryptocurrency purchases. Wires and checks don't have added costs like credit cards do.

FAQs

How much is the fee for crypto com?

0.04% to 0.4% maker fees, 0.1% to 0.4% taker fees, plus 2.99% for credit card purchases.

Are crypto com fees high?

The cost of using Crypto.com depends on how you choose to fund your account.

How do I avoid fees on Crypto com?

As with other transactions on the blockchain, there are commissions for withdrawing funds. They are charged even if you transfer funds to the Crypto.com wallet. To avoid commissions, you can use the "Withdraw funds to the application" option.

How much is crypto com withdrawal fee?

For example, Crypto.com currently charges a withdrawal fee of 0.0001 BTC to withdraw Bitcoin via the BEP20 network.

How Does Crypto.com Crypto Earn Work?

Crypto Earn is a crypto staking program offered by Crypto.com. The program allows traders to hold their assets in three terms: flexible, 1-month, or three months. Users lock up their CRO (the platform’s native token) and earn rewards on it annually.

Does Crypto.com Charge Fees on Withdrawals?

Yes, Crypto.com charges withdrawal fees, but there is no flat fee or rate. Instead, Crypto.com withdrawal fees are calculated based on the cryptocurrency you want to withdraw. So, for example, it only costs 0.001 CRO for withdrawing Cronos, but the withdrawal fee for withdrawing Bitcoin is 0.0001 BTC.

Are Crypto.com Fees High?

Crypto.com has much lower fees, both trading and non-trading, than popular crypto exchanges. Additionally, you can lower your costs by entering the VIP program or using the Traders Union rebate program. Crypto.com’s fees are transparent, allowing you to calculate the charges before making the transaction.

How to Reduce Crypto.com Trading Fees?

You can lower Crypto.com trading fees through different methods. For one, you can sign up for the platform using a partner’s link (such as Traders Union) and get a rebate on commission fees. Secondly, if you plan to trade large volumes, you can join the VIP program. The fees are almost negligible in the top tiers. As for non-trading fees, you can avoid them by using bank transfers rather than debit/credit cards to eliminate the 2.99% additional charge.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Over the past four years, Alamin has been working independently and through online employment platforms such as Upwork and Fiverr, and also contributing to some reputable blogs. His goal is to balance informative content and provide an entertaining read to his readers.

His motto is: I can dream or I can do—I choose action.

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.