eToro Minimum Deposit

eToro is a popular broker, especially for social trading. New traders can copy the trades of more experienced traders, which can be a great way to learn and get started with forex trading. We'll take a look at the eToro minimum deposit, fees, and currencies so that you can decide if this is the right broker for you.

What Is eToro Minimum Deposit?

The minimum deposit is the amount of money required to open a new account with a broker. This amount can vary depending on the broker and the type of account you open. You need to transfer this amount from your bank account to your brokerage account to start trading.

A good broker will have a low minimum deposit so that you can start trading without risking a lot of money. eToro is that broker. The eToro first minimum deposit starts from as low as $10. The amount varies depending on your country.

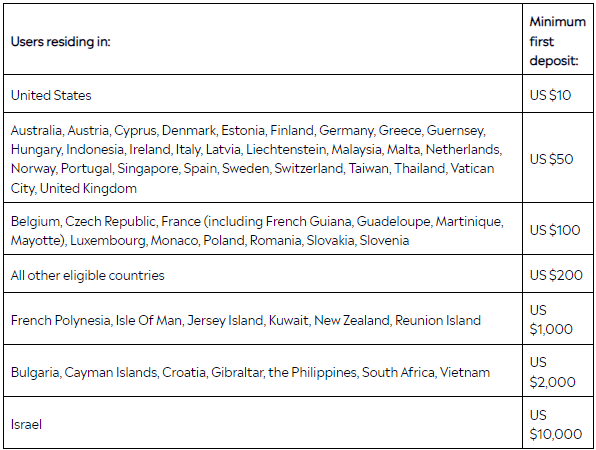

US residents can open an account with a $10 minimum deposit, and for residents of the United Kingdom the minimum deposit is as low as $50. For other countries, the first minimum deposit ranges between $50 and $10,000. Israel pays the highest minimum deposit of $10,000.

While these are figures for most payment methods, there are some exceptions. If you deposit money via wire transfer, the minimum deposit is $500, irrespective of your country. If you're opening a corporate account, the minimum deposit is $10,000.

Below is an image showing the eToro standard account minimum deposit amount for different countries:

eToro standard account minimum deposit amount for different countries

After the first account opening deposit, subsequent deposits have a minimum of $50 except for US and UK residents, whose limit is $50.

What Is eToro UK Minimum Deposit?

Unless you're funding your account via wire transfer, the eToro UK minimum amount for first and subsequent deposits is $50. For wire transfer deposits, the minimum deposit is $500.

If you deposit the funds in GBP, eToro will convert it to USD at the current market rate. eToro's base currency is USD, and all profits and losses are denominated in USD.

eToro Minimum Deposit vs. Competitors

You can't talk about eToro minimum deposit without mentioning the competition. Here's how eToro compares with other popular brokers:

| eToro | IC Markets | Oanda | |

|---|---|---|---|

| Minimum Deposit | 50$ | $200 | $0 |

eToro CopyTrader Minimum Deposit

CopyTrader is eToro's social trading feature that lets you copy the trades of other traders on the platform. When you copy a trader, you will automatically copy their trades. You can also copy a portfolio of traders, giving you a diversified portfolio.

The eToro CopyTrader minimum deposit is $200. This is the minimum deposit required to start copying trades. However, please keep in mind that the peculiarities of some trading strategies may need a larger minimum deposit than others.

For example, if a trader uses a high-risk strategy, they may require a larger minimum deposit to offset the increased risk. Ultimately, it's up to you to decide how much you're comfortable investing in any given trader.

eToro Deposit Methods and Fees

Having a low minimum deposit is great, but you also need to fund your account easily. eToro offers a variety of deposit methods so that you can choose the one that's best for you.

The available deposit methods are:

Bank transfer

Debit card

Electronic wallets such as Skrill, and Neteller

eToro does not charge any deposit fees, regardless of your payment method. However, your payment service provider may charge a fee. For example, if you're using a credit card, you may be charged a cash advance fee by your card issuer.

eToro Deposit Methods vs. Competitors

| eToro | IC Markets | XM | |

|---|---|---|---|

| Bank Transfer | yes | yes | yes |

| Debit/Credit Card | yes | yes | yes |

| Payment apps | yes | yes | yes |

| Cryptocurrencies | no | no | no |

eToro Deposit Fees

Currently, eToro does not charge any deposit fees. This means you can add money to your account without incurring any additional charges.

eToro Deposit: Processing Time

Assuming there are no issues with your payment, eToro will immediately credit your account for electronic wallets, online banking, and credit/debit cards. The funds will be credited to your account within 4-7 business days for bank transfers.

eToro Account Currencies

Brokers usually have a base currency, the currency they use to quote their prices. For some, it's just USD, while others may have a basket of currencies. eToro's base currency is USD, which means that all profits and losses are denominated in USD.

If you deposit money in a currency other than USD, eToro will convert it to USD. The conversion will be done at the current market rate, and you may incur a loss due to the currency conversion.

| eToro | IC Markets | XM | |

|---|---|---|---|

| Account Currencies | USD | USD, EUR, AUD, GBP, NZD, SGD, JPY, CAD, CHF, HKD | USD, AUD, EUR, HUF GBP, CHF, PLN, JPY or RUB. |

How to Deposit Money On eToro? Step by Step Guide

Funding your account is easy and can be done in just a few steps:

Log in to your eToro account.

Click on the "Deposit Funds" button

Enter the amount you want to deposit and select your currency

Select your preferred payment method

And that's it! The funds will be credited to your account immediately (for electronic wallets, online banking, and credit/debit cards) or within a few days (for bank transfers).

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

"Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more"

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQs

Is social trading with eToro a good idea?

Yes, social trading with eToro is a good idea. It's a great way to start investing and learn from more experienced investors. Plus, with the CopyTrader feature, you can automatically copy the trades of other successful investors on the platform. However, it's important to remember that all investing carries risk, so you should always do your research before investing.

Is eToro legit?

Yes, eToro is a legitimate broker. It's regulated by the Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA), and other financial authorities. Plus, it has been in business since 2007 and has over 20 million registered users.

How much money can I make with eToro?

Your investment strategy and risk tolerance depend on how much money you can make with eToro. Some investors have made a lot of money with eToro, while others have lost money. Remember, all investing carries risk, so you should never invest more than you can afford to lose.

How many traders can I copy on eToro?

You can copy up to 100 traders on eToro. However, it's important to remember that you don't have to copy that many. It's often best to focus on a small number of traders so you can more easily monitor their performance. Plus, when you copy too many traders, your returns may suffer because of the inherent risk in investing.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.