Top Dividend ETFs To Invest In

Top 7 High-Dividend ETFs For to invest in long-term in 2024 are:

-

JEPI - Consistent Monthly Income, Lower Volatility

-

PFF - Stability, High Dividend Yields

-

MORT - Diverse Mortgage Market Exposure

-

IDV - International Diversification, High Dividends

-

DIVS - Active Management, Global Diversification

-

DDIV - Momentum Factor, Dividend Income

-

MADVX - High Dividend Yield, Sector Diversification

In this insightful analysis, TU experts delve into the top high-dividend Exchange-Traded Funds (ETFs) for long-term investment in 2024. The discussion focuses on unique strategies employed by these ETFs, ranging from stability-focused covered call options to global diversification. Investors can explore opportunities in diverse sectors, including technology, real estate, and preferred stocks. With a focus on income generation and growth potential, this article provides a comprehensive guide to navigating the evolving landscape of dividend ETFs in the coming year.

-

What is a Dividend ETF?

A Dividend ETF is an investment fund that holds a diversified portfolio of dividend-paying stocks, providing investors with a convenient way to earn regular income.

-

How do Dividend ETFs generate income?

Dividend ETFs generate income by investing in stocks of companies that distribute a portion of their profits as dividends. The ETF collects these dividends and distributes them to its investors.

-

What are the benefits of investing in Dividend ETFs?

Investing in Dividend ETFs offers the potential for a steady income stream, portfolio diversification through a range of dividend-paying stocks, and the convenience of professional management.

-

How often are dividends distributed in Dividend ETFs?

Dividends in Dividend ETFs are typically distributed to investors regularly, commonly quarterly. The frequency may vary, but it provides a predictable income stream for investors.

Dividend ETFs for long term investing

| ETF Name | Stock Ticker | AUM | Dividend Yield (%) | Expense Ratio (%) |

|---|---|---|---|---|

|

JPMorgan Equity Premium Income ETF |

JEPI |

$30.563B |

11.56 |

0.59 |

|

iShares Global Preferred Stock ETF |

PFF |

$13.561B |

6.28 |

0.41 |

|

VanEck Mortgage REIT Income ETF |

MORT |

$259.902M |

10.68 |

0.46 |

|

iShares International Dividend Value ETF |

IDV |

$4.402B |

7.61 |

0.35 |

|

SmartETFs Dividend Builder ETF |

DIVS |

$29.994M |

7.74 |

0.4 |

|

First Trust Dorsey Wright Momentum & Dividend ETF |

DDIV |

$42.519M |

8.2 |

0.9 |

|

BlackRock Equity Dividend Fund |

MADVX |

$21.5B |

11.55 |

0.70 |

JPMorgan Equity Premium Income ETF (JEPI)

The JPMorgan Equity Premium Income ETF (JEPI) stands out as a unique income-focused fund with substantial assets totaling over $31 billion as of December 2023. JEPI employs a dual strategy to provide consistent monthly income to investors. Firstly, it invests in a portfolio of low-volatility, large-cap US stocks renowned for their reliable dividend payouts. Secondly, the fund actively engages in selling covered calls on the S&P 500 Index, generating premium income while limiting potential upside in case of significant market surges.

Experts have highlighted below some key reasons to invest in JEPI in 2024

| Key Reasons to Invest in JEPI in 2024 | Details |

|---|---|

|

Consistent Monthly Income |

JEPI assures steady monthly income through dividends and covered calls, a boon for retirees and cash flow seekers. Consistent payouts in all market conditions add reliability |

|

Lower Volatility Compared to the Market |

JEPI's focus on resilient, large-cap stocks reduces portfolio volatility, making it a safer choice in turbulent markets |

|

Potential for Higher Income in High Volatility Environments |

JEPI benefits from market volatility, offering the potential for increased monthly payouts through its option-selling strategy. Ideal for those anticipating market turbulence in 2024 |

|

Diversification Benefits |

JEPI's mix of equities and options provides diversification, mitigating risk and improving overall portfolio returns |

|

Experienced Management Team |

Managed by JPMorgan Asset Management, JEPI brings the credibility of a successful firm, ensuring reliable stock selection and disciplined options selling |

The top 10 holdings of this ETF are mentioned below in the table

| Company Name | Stock Ticker | Holding % |

|---|---|---|

|

Johnson & Johnson |

JNJ |

5.54% |

|

Verizon Communications Inc. |

VZ |

5.47% |

|

Coca-Cola Company (The) |

KO |

5.23% |

|

Procter & Gamble Company (The) |

PG |

5.11% |

|

Exxon Mobil Corporation |

XOM |

4.98% |

|

Chevron Corporation |

CVX |

4.79% |

|

Merck & Co., Inc. |

MRK |

4.76% |

|

PepsiCo, Inc. |

PEP |

4.62% |

|

AbbVie Inc. |

ABBV |

4.57% |

|

JPMorgan Chase & Co. |

JPM |

4.53% |

Regional/Sectoral Analysis

| Region/Sector | Allocation (%) | Top Holdings | Focus |

|---|---|---|---|

|

United States |

98+ |

JNJ, PG, KO, PEP, XOM, CVX, MRK, ABBV |

US dividend payers, S&P 500 covered calls |

|

Consumer Staples |

23.2 |

JNJ, PG, KO, PEP |

Defensive, consistent income |

|

Healthcare |

18.2 |

MRK, ABBV |

Resilient, dividend potential |

|

Information Technology |

12.5 |

Microsoft, Apple |

Diversification with income priority |

|

Energy |

10.2 |

XOM, CVX |

Income & potential benefit from energy prices |

|

Financials |

8.3 |

JPM |

Income & exposure to key economic sector |

|

Other (Utilities, Industrials, Materials, etc.) |

< 5 |

- |

Diversification |

|

International |

< 2 |

- |

Diversification |

Breakout from the downtrend channel

The chart reveals a breakout from the downtrend channel established in June 2022. The price has confidently exceeded the upper channel line, signaling a potential transition from bearish to bullish momentum. Furthermore, the price-maintenance positions above both the 50-day and 200-day EMAs indicates a potential for sustained upward momentum.

The iShares Preferred & Income Securities ETF (PFF)

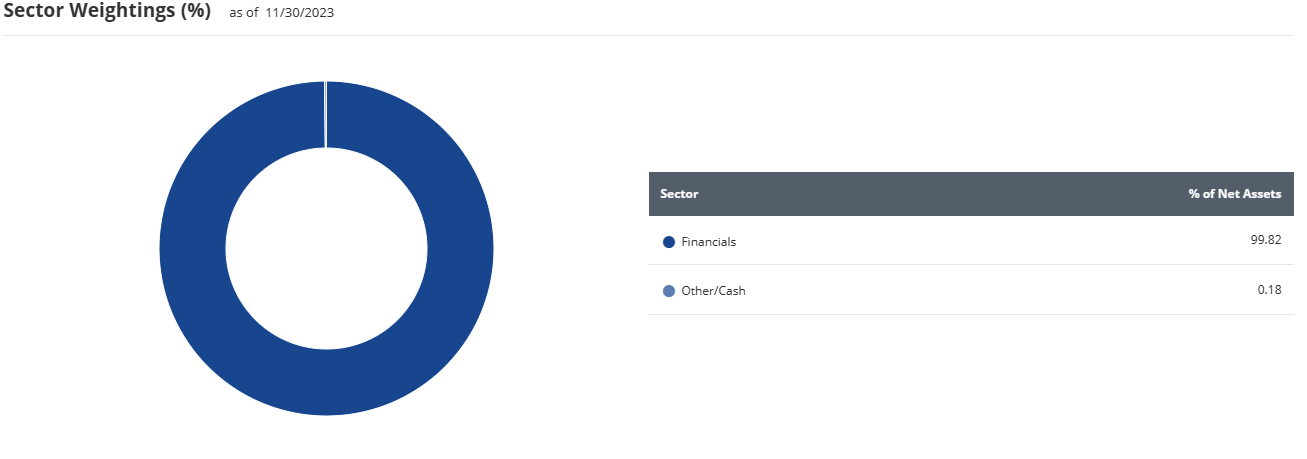

The iShares Preferred & Income Securities ETF (PFF) offers a unique investment approach in 2024, blending aspects of stocks and bonds. As a preferred stock, PFF provides a stable income stream similar to traditional corporate bonds but carries some risk, lacking default protection and holding a secondary position in case of liquidation.

PFF's appeal lies in prioritizing dividends over common stocks, ensuring investors a steady income. However, it's crucial to note the increased risk without default protection. In liquidation, preferred stockholders, including PFF investors, rank behind common stock owners, highlighting the inherent risk but also the potential for enhanced income.

As preferred stock is commonly used by large enterprises for financing, PFF has a notable concentration, with three-quarters of its assets in the financial sector. This aligns with the practice of financial industry entities issuing preferred stocks.

As of December 27, 2023, PFF has a year-to-date return of 2.47%, and its net asset value stands at $26.35 per share. With a reasonable expense ratio of 0.46%, PFF proves cost-effective for investors, showcasing financial performance and efficiency, and contributing to its attractiveness in the investment landscape.

The top 10 holdings of this ETF are mentioned below in the table

| Company Name | Stock Ticker | Holding % |

|---|---|---|

|

Wells Fargo & Co. |

WFC-G |

7.94% |

|

JPMorgan Chase & Co. |

JPM-B |

6.13% |

|

Bank of America Corp. |

BAC-B |

6.06% |

|

Citigroup Inc. |

C-Y |

4.93% |

|

Goldman Sachs Group Inc. |

GS-N |

4.41% |

|

Morgan Stanley |

MS-F |

4.00% |

|

Blackstone Mortgage Trust Inc. |

BXMT |

3.70% |

|

Citigroup Inc. Depositary Shares |

CIK |

3.64% |

|

NextEra Energy Inc. Units, Series 01/09/2025 |

NEEPR |

1.03% |

|

JPMorgan Chase & Co. Series D |

JPMPD |

0.92% |

Regional/ Sectoral Analysis

| Region/Sector | Focus | Potential Top Holdings |

|---|---|---|

|

Global (Developed Markets) |

Diversification across developed markets |

JP Morgan Chase & Co., Wells Fargo & Co., HSBC Holdings plc, Deutsche Bank AG, Barclays PLC |

|

Financials (Banks) |

High income from preferred stock dividends |

Citigroup Inc., Bank of America Corp., Morgan Stanley, Mitsubishi UFJ Financial Group Inc., BNP Paribas SA |

|

Utilities |

Stable income and lower volatility |

Duke Energy Corp., Exelon Corp., Southern Co., NextEra Energy Inc., Berkshire Hathaway Inc. |

|

Consumer Staples |

Consistent income and defensive characteristics |

Procter & Gamble Co., PepsiCo, Inc., Coca-Cola Co., Johnson & Johnson, Nestlé SA |

|

Other Sectors |

Smaller exposure for diversification |

Apple Inc., Microsoft Corp., Boeing Co., Johnson & Johnson, AbbVie Inc. |

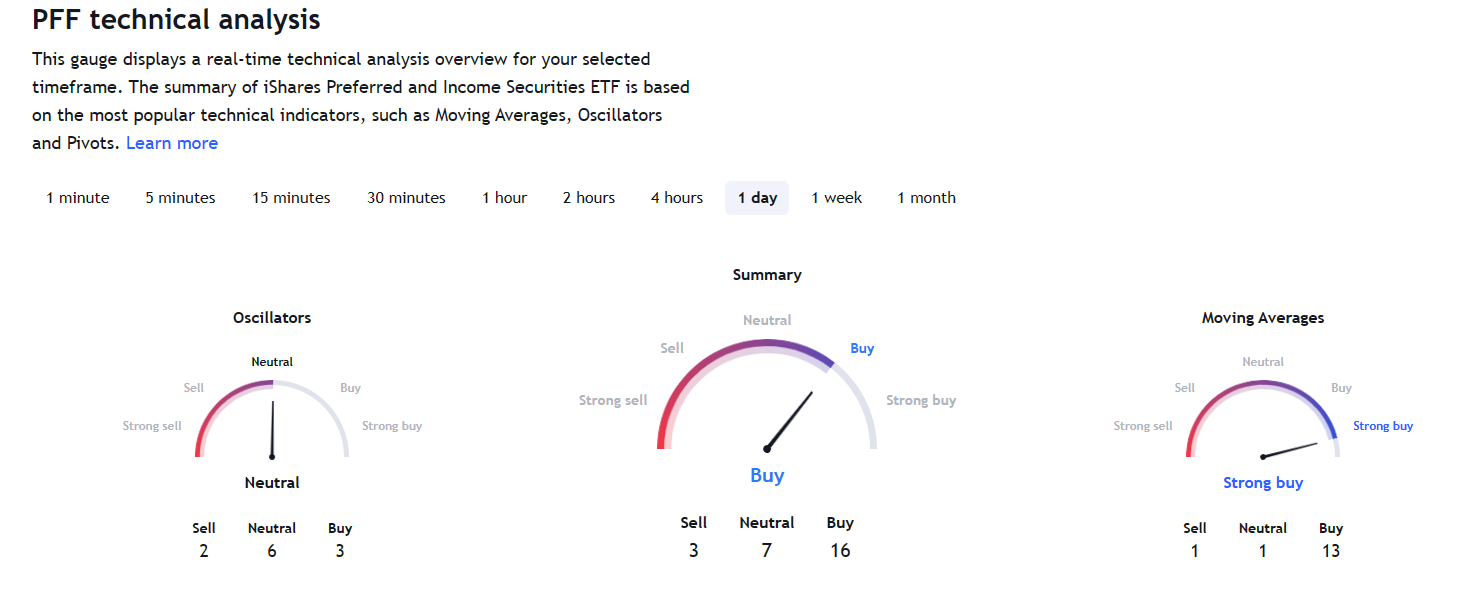

PFF technical analysis

Clear break of the downtrend

The chart indicates a clear break of the downtrend that persisted since April 2022. The price has just recently surpassed the trendline, indicating a potential shift from bearish to bullish momentum.

VanEck Mortgage REIT Income ETF (MORT)

Investing in the VanEck Mortgage REIT Income ETF (MORT) in 2024 could be a smart move for several reasons that everyday investors can understand. Firstly, MORT focuses on companies that invest in mortgages rather than physical properties, offering a unique way to tap into the real estate market without owning actual buildings. What makes this ETF appealing is its potential for high dividends that is money paid out regularly to investors. Historically, these types of companies have offered higher dividend yields than other investment options, making them attractive for those looking to boost their income.

Additionally, MORT provides exposure to different parts of the mortgage market, such as agency mortgage-backed securities and commercial loans. This diversity can be beneficial for investors, spreading the risk across various areas of the mortgage sector. Furthermore, the ETF aligns with the evolving mortgage finance market, potentially positioning itself for gains as the industry changes. The VanEck Mortgage REIT Income ETF (MORT) has an expense ratio of 0.43%.

While the ETF has experienced some ups and downs, it has shown positive returns, aiming to finish the year in the black with around 5% returns. This performance, coupled with its focus on about 25 high-yield real estate stocks, might be enticing for investors seeking both growth and income.

The top 10 holdings of this ETF are mentioned below in the table

| Company Name | Stock Ticker | Holding % |

|---|---|---|

|

AGNC Investment Corp. |

AGNC |

14.49% |

|

Starwood Property Trust, Inc. |

STWD |

10.71% |

|

Rithm Capital Corp. |

RITM |

8.13% |

|

Blackstone Mortgage Trust, Inc. |

BXMT |

7.70% |

|

Two Harbors Investment Corp. |

TWO |

5.51% |

|

New Residential Investment Corp. |

NRZ |

5.25% |

|

Ladder Capital Corp. |

LADR |

4.51% |

|

Invesco Mortgage Capital, Inc. |

IVR |

4.05% |

|

ARCP Capital Holdings, LLC |

ARCP |

3.80% |

|

Capstead Mortgage Corp. |

CMO |

3.76% |

iShares International Select Dividend ETF (IDV)

Investing in the iShares International Select Dividend ETF (IDV) in 2024 presents a compelling opportunity for investors looking to diversify their income portfolio beyond U.S. borders. One of the primary attractions of IDV is its ability to offer exposure to international companies that often yield higher dividends than their domestic counterparts. The ETF's 100-stock portfolio includes stalwarts like Rio Tinto, Eni, and British American Tobacco, providing investors with a diverse basket of well-established, large-cap income players akin to U.S. blue-chip stocks.

One of the notable advantages of IDV is its simplification of the complexities associated with investing in international stocks. Rather than navigating the intricacies of individual positions and dealing with erratic payment schedules, investors can benefit from global dividend income through a single, well-managed fund. This streamlining makes it an attractive option for those seeking international income without the hassle.

Moreover, the current market conditions offer an additional incentive for considering IDV in 2024. Some international markets, particularly in Europe, are trading at lower valuations compared to the U.S., potentially presenting bargain opportunities for dividend-seeking investors. This aligns with the fund's focus on providing exposure to developed market stocks that have historically offered robust dividend yields.

The ETF's performance further strengthens the investment case, with a year-to-date return of 9.67% as of December 22, 2023.

The top 10 holdings of this ETF are mentioned below in the table

| Company Name | Stock Ticker | Holding % |

|---|---|---|

|

Nestlé S.A. |

NESN.SW |

5.23% |

|

Roche Holding AG |

ROG.SW |

3.97% |

|

Novartis AG |

NOVN.SW |

3.67% |

|

British American Tobacco plc |

BATS.L |

3.50% |

|

Unilever PLC |

ULVR.L |

3.20% |

|

Royal Dutch Shell plc |

RDS.A |

3.18% |

|

HSBC Holdings plc |

HSBA.L |

2.99% |

|

BP plc |

BP.L |

2.81% |

|

GlaxoSmithKline plc |

GSK.L |

2.78% |

|

Rio Tinto Group |

RIO.L |

2.74% |

Sector Weightings

Regional Analysis

| Percentage | Region |

|---|---|

|

0.50% |

Africa |

|

13.70% |

Asia Developed |

|

11.20% |

Australasia |

|

9.80% |

Canada |

|

8.40% |

Europe Ex Euro |

|

30.30% |

Eurozone |

|

8.90% |

Japan |

|

1.30% |

Middle East |

|

15.90% |

United Kingdom |

-

The breakout above $26.60 is seen as a positive sign, suggesting that the previous downtrend may be coming to an end

-

This breakout could be an indication of a potential shift in the investment trend, presenting an opportunity for investors to benefit from a potential upward movement

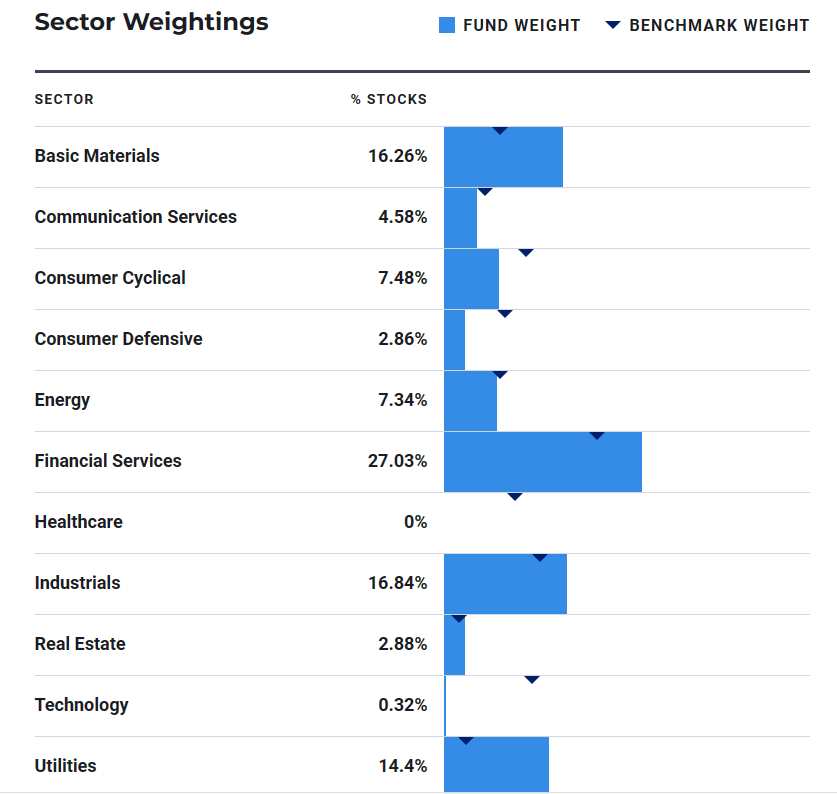

SmartETFs Dividend Builder ETF (DIVS)

Investing in the SmartETFs Dividend Builder ETF (DIVS) in 2024 seems like a good idea. It's actively managed and focuses on strong companies with a solid track record. The portfolio has around 35 equally important positions, prioritizing financial strength and future dividend growth.

What's interesting about DIVS is its global diversification, with 60% in U.S. stocks and 40% in international ones. This not only spreads the risk but also lets you benefit from different market opportunities.

DIVS stands out for looking at more than just historical growth; it considers the economic health of each company. It has a five-star rating from Morningstar and has performed well, with a 6.39% return as of December 26, 2023, beating its benchmark, the MSCI World Index. Despite being around since 2021, DIVS has gathered $29.994 million in assets, showing growing interest in its unique approach.

DIVS provides a good mix of sectors, covering cyclical, defensive, and technology. This diversification helps you navigate different economic conditions and industry trends. With a 0.65% expense ratio, DIVS is a cost-effective choice for an actively managed fund, letting you potentially benefit from expert management without high fees.

The top 10 holdings of this ETF are mentioned below in the table

| Company Name | Stock Ticker | Holding % |

|---|---|---|

|

Broadcom Inc. |

AVGO |

5.02 |

|

Aflac Incorporated |

AFL |

3.42 |

|

Novo Nordisk A/S Class B |

NVO |

3.42 |

|

Eaton Corp. Plc |

ETN |

3.39 |

|

Atlas Copco AB Class A |

ATLAC |

3.23 |

|

ABB Ltd |

ABB |

3.17 |

|

Illinois Tool Works Inc. |

ITW |

3.13 |

|

Emerson Electric Co. |

EMR |

3.07 |

|

Mondelez International, Inc. |

MDLZ |

3.04 |

|

BlackRock, Inc. |

BLK |

2.99 |

Regional Analysis

| Region | Weighting (%) | Top Holdings (by Country) |

|---|---|---|

|

North, Central, and South America |

59.01 |

Broadcom (US), Aflac (US), Eaton Corp. (US), Emerson Electric (US), Mondelez International (US) |

|

Europe |

36.41 |

ABB (Switzerland), Atlas Copco (Sweden), Novo Nordisk (Denmark), BlackRock (UK) |

|

Asia Pacific |

2.55 |

Taiwan Semiconductor Manufacturing Company (Taiwan) |

|

Other |

2.02 |

- |

Sectoral Analysis

| Sector | Weighting (%) | Top Holdings (by Industry) |

|---|---|---|

|

Industrials |

25.72 |

Eaton Corp., Atlas Copco, ABB, Illinois Tool Works |

|

Financials |

15.46 |

Aflac, BlackRock |

|

Technology |

10.24 |

Broadcom |

|

Healthcare |

7.01 |

Novo Nordisk |

|

Consumer Staples |

6.13 |

Mondelez International |

|

Other |

25.44 |

Diverse holdings across various sectors |

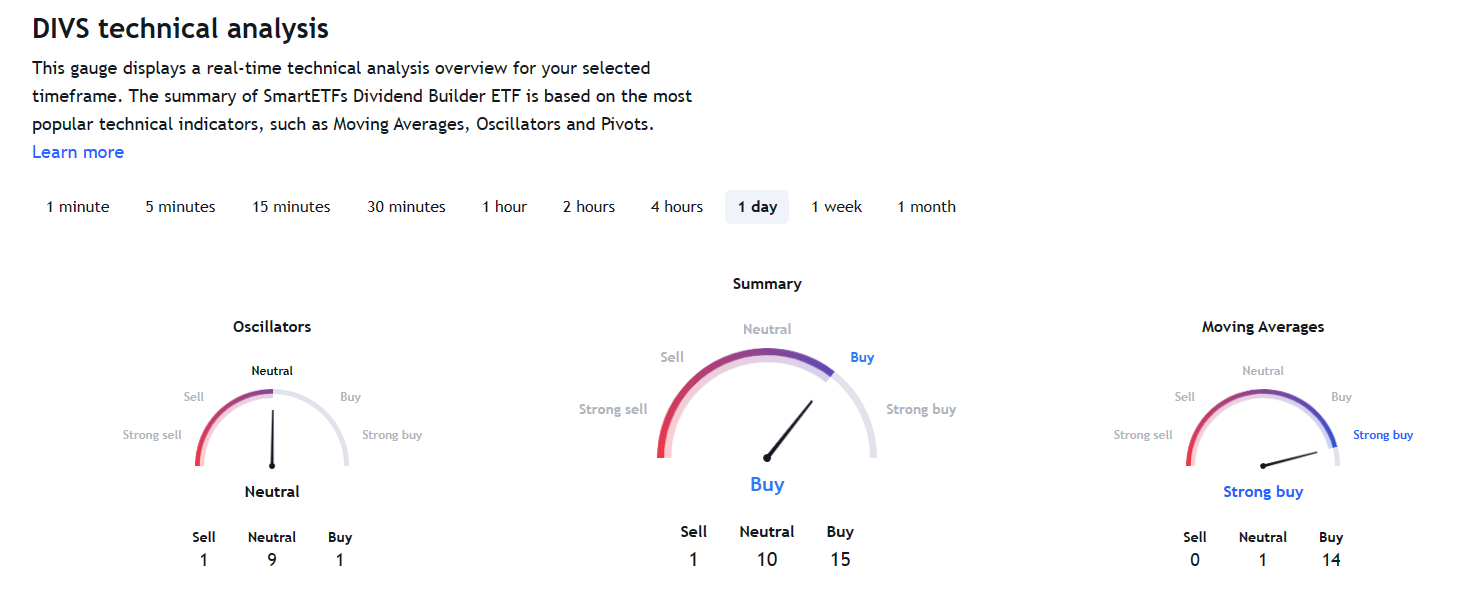

The price is about to break a key resistance zone, suggesting potential for upward movement. A double bottom pattern, where the price hits a low twice before rising, signals bullish momentum. The subsequent upward trend is supported by a trendline drawn from the double-bottom lows, adding further confirmation.

DIVS technical analysis

First Trust Dorsey Wright Momentum & Dividend ETF (DDIV)

Investing in the DDIV ETF in 2024 looks promising for a few reasons. Firstly, it focuses on strong-performing stocks, which historically do well over time. If the market continues to rise in 2024, DDIV could offer strong returns.

Secondly, DDIV targets high-dividend-yielding stocks, providing a potential income source in a scenario where traditional options like bonds may be less attractive due to rising interest rates. This adds appeal for investors wanting both growth and income.

DDIV's emphasis on large-mid cap stocks brings stability, especially compared to smaller companies. Despite being a smaller ETF, DDIV uses the respected Dorsey Wright momentum strategies, adding sophistication to its approach. Its unique blend of a value tilt and a mid-cap high dividend yield portfolio sets it apart.

The careful stock selection process, based on forward price momentum and the top 50 highest dividend yields, highlights a thoughtful strategy. DDIV's well-diversified portfolio, spanning large, mid, and small-cap names with a tilt toward cyclical, positions it well for economic recovery. Trading at about 12 times earnings and yielding around 3%, DDIV offers a mix of growth potential and income, making it an appealing choice for a strategic and diversified investment portfolio.

The top 10 holdings of this ETF are mentioned below in the table

| Company Name | Stock Ticker | Holding % |

|---|---|---|

|

OneMain Holdings, Inc. |

OMF |

5.34% |

|

Antero Midstream Corp. |

AM |

5.27% |

|

Kinder Morgan, Inc. |

KMI |

5.03% |

|

Iron Mountain Incorporated |

IRM |

3.29% |

|

Zions Bancorporation |

ZION |

3.19% |

|

Old Republic International Corporation |

ORI |

2.91% |

|

Darden Restaurants, Inc. |

DRI |

2.89% |

|

Phillips 66 |

PSX |

2.89% |

|

Chord Energy Corporation |

CHRD |

2.75% |

|

Popular, Inc. |

BPOP |

2.69% |

Regional Analysis

| Region | Allocation (%) |

|---|---|

|

United States |

97.7 |

|

Canada |

2.3 |

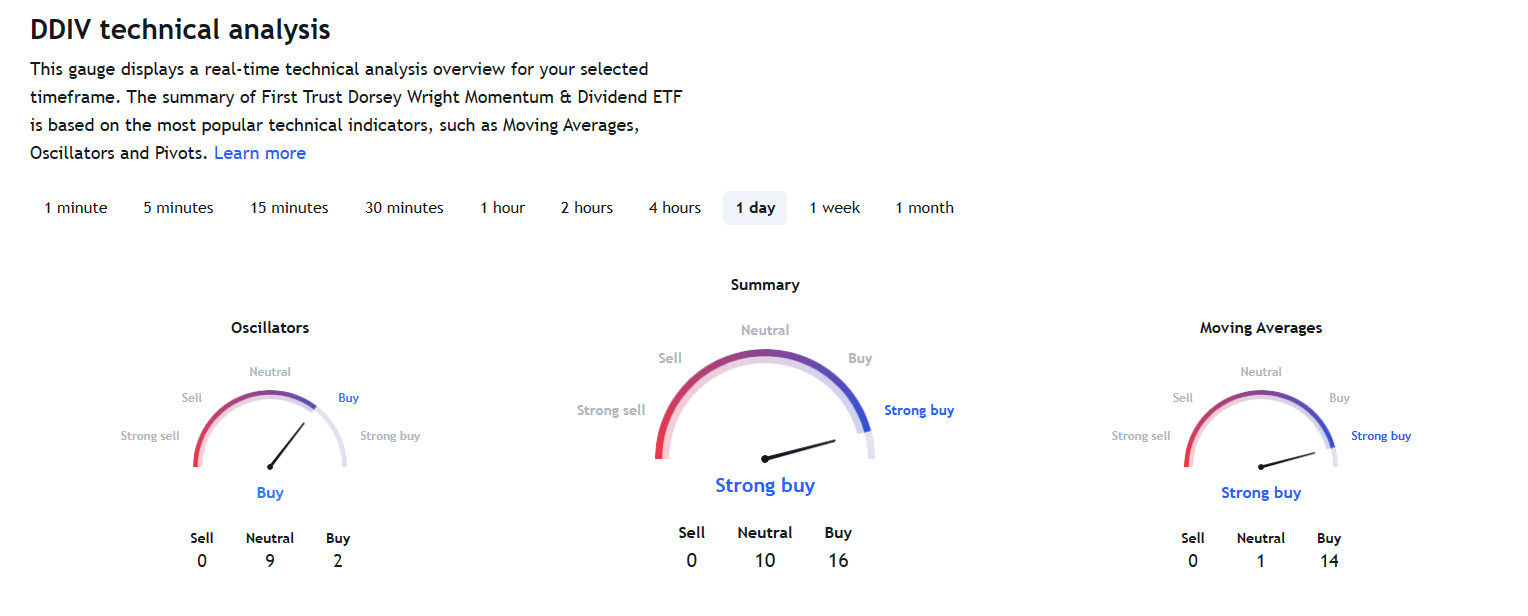

DDIV technical analysis

Clear break of the downtrend

The chart indicates a clear break of the downtrend that persisted since April 2022. The price has convincingly surpassed the trendline, indicating a potential shift from bearish to bullish momentum. Additionally, breaking through a significant resistance zone at Price of 30.00 further supports the bullish outlook, as this level previously impeded upward movement.

BlackRock Equity Dividend Fund (MADVX)

Investing in MADVX in 2024 could be a compelling choice for income-focused investors looking for a combination of high dividend yield, exposure to US equities, sector diversification, active management, and a track record of consistent dividends. These factors collectively make MADVX a noteworthy option for those seeking a balance of income and growth potential in their investment portfolio.

MADVX, represented by its ticker symbol, is the BlackRock Equity Dividend Fund Institutional Shares. It holds a Morningstar rating of 4 stars, further attesting to its performance. The fund has demonstrated an ability to outperform its benchmark, the Russell 1000 Value Index, over the past three years, adding credibility to its potential for delivering returns.

The BlackRock Equity Dividend Fund, in 2024 may be worthwhile for income-seeking investors based on several factors that cater to specific goals and risk tolerances.

Experts have highlighted below some key reasons to invest in MADVX in 2024

| Key Features of MADVX | Details |

|---|---|

|

1. High Dividend Yield |

MADVX offers an impressive double-digit yield, currently around 11.5%. This makes it an attractive choice for investors seeking a reliable source of regular income |

|

2. Focus on US Equities |

The fund primarily invests in dividend-paying companies within the United States, leveraging the stability and strength of the US market for investor confidence |

|

3. Exposure to Multiple Sectors |

MADVX provides diversification across various sectors, including Consumer Staples, Financials, Healthcare, and Utilities, mitigating risk for a well-rounded portfolio |

|

4. Active Management |

Employing an active management strategy, MADVX selects stocks with strong dividend potential and growth prospects, adapting to changing market conditions for potential outperformance |

|

5. Track Record of Consistent Dividends |

MADVX has a history of consistently distributing dividends, even during market downturns, providing stability for income-dependent investors |

The top 10 holdings of this ETF are mentioned below in the table

| Company Name | Stock Ticker | Holding % |

|---|---|---|

|

Brookfield Infrastructure Partners LP |

BIP |

6.01% |

|

Ares Capital Corp. |

ARCC |

5.87% |

|

New Residential Investment Corp. |

NRZ |

5.48% |

|

Invesco High Yield 2024 Target Term Fund |

HYT |

5.09% |

|

PennantPark Investment Corp. |

PKC |

4.90% |

|

PIMCO Income Strategy Fund II |

PKI |

4.80% |

|

Athene Holding Ltd. |

ATH |

4.77% |

|

Cohen & Steers Closed-End Opportunity Fund Inc. |

COF |

4.66% |

|

First Republic Bank |

FRC |

4.64% |

|

Cohen & Steers Quality Income Real Estate Fund Inc. |

RLJ |

4.52% |

Best Stock brokers

How do dividend ETFs work?

| Step | Description |

|---|---|

|

1. Underlying Holdings |

Dividend ETFs invest in a portfolio of dividend-paying companies, either tracking a specific index or selected actively by fund managers |

|

2. Dividend Collection |

When the underlying companies pay dividends, the ETF collects these payouts |

|

3. Dividend Distribution |

The ETF then distributes the collected dividends to its shareholders, usually on a quarterly basis |

|

4. Share Price |

The ETF's price fluctuates based on market demand and supply, similar to individual stocks. Dividends contribute to the total return, while share price changes impact performance |

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

Yield

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.