Types of Tickmill trading accounts

Types of trading accounts at Tickmill

Clients of the Tickmill broker trade on three standard accounts. Also, traders are allowed to open an Islamic (swap) and a risk-free demo account. The company does not provide micro (cent) accounts, and the minimum deposit is $100. These conditions show the broker’s intentions to cooperate with professional traders.

- ● Classic;

- ● Pro;

- ● VIP.

| Tickmill | XM | Admirals | |

| Number of real accounts types | 3 | 4 | 5 |

| Cent (micro) accounts | No | Yes | Yes |

| Number of demo account types | 3 | 2 | 1 |

The demo account at Tickmill

Tickmill provides clients with 3 types of demo accounts:

- ● Demo Classic;

- ● Demo Pro;

- ● Demo VIP.

The conditions of all three virtual accounts mimic the conditions of the real ones. The trader is not limited in the choice of trading instruments and strategies. All Tickmill demo accounts have no expiration dates and there is no maximum virtual deposit.

| Account currency | USD, EUR, GBP, and PLN |

| Highest leverage | 1:500 |

| Instruments | 62 currency pairs, precious metals, CFDs on stock indices, bonds, and oil |

| Spread | From 0.0 pips |

Cent accounts at Tickmill

The Tickmill broker does not have cent accounts. In addition, the minimum deposit on classic accounts is $100, so the company's trading conditions may not be suitable for novice traders.

Classic accounts at Tickmill

Clients of the Tickmill broker can trade on three types of accounts such as:

-

● Classic

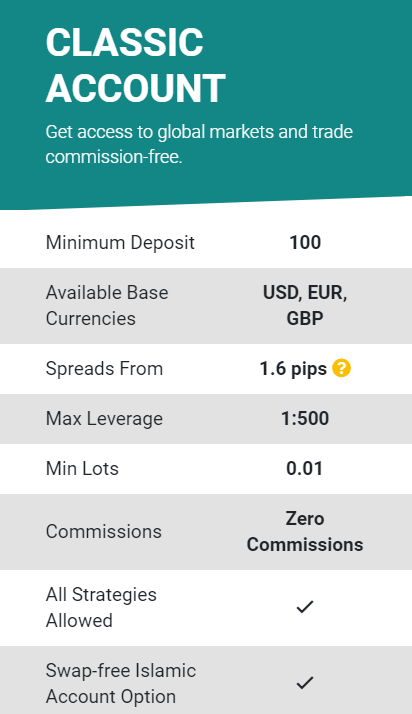

A classic account carries a minimum deposit of $100 and a lot of 0.01. The spread is floating and starts from 1.6 pips. There are no withdrawal fees. The maximum leverage is 1:500.

Tickmill Account Types - Classic

-

● Pro

The most popular account among the broker's clients. The minimum deposit is $100, the floating spread starts from 0.0 pips. The maximum leverage is 1:500. A fee is charged in both directions for each transaction made from $100,000. There are no restrictions on strategies and advisors are allowed.

Tickmill Account Types - Pro

-

● VIP

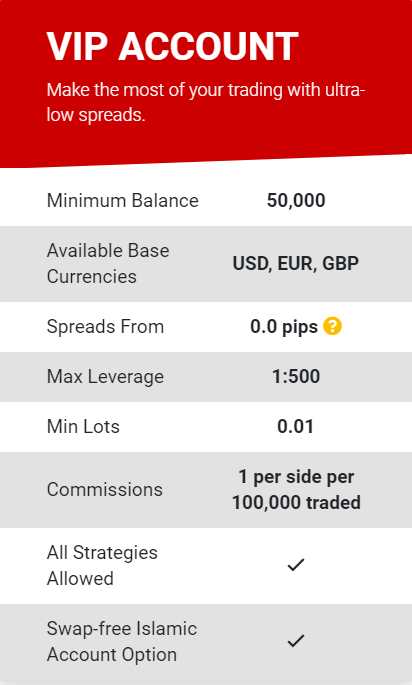

This is an account for seasoned traders with a minimum balance of $50,000. Any strategy is allowed. The minimum trading unit is 0.01 lot, it is possible to connect the Islamic (swap-free) account option. There is a fee in each direction for $100,000 in trades.

Tickmill Account Types – VIP

FAQs regarding account types at Tickmill

Is algorithmic trading possible on Tickmill?

It is allowed to use any trading strategies, including advisors and ready-made scripts on all three types of accounts. However, a fairly high entry threshold does not allow novice traders to consider this broker as a priority for cooperation.

What types of accounts at Tickmill are best for novice traders?

The broker's trading conditions are not suitable for newcomers to Forex. The company does not provide micro accounts and also sets a minimum deposit of $100. If you are a novice trader, we recommend that you study TU’s rating of brokers to select a more suitable company.

How much money do I need to start trading with Tickmill?

The broker's main priority is to attract experienced traders. That is why the minimum deposit for Classic and Pro accounts is $100. The minimum balance on a VIP account is $50,000.

How do I open a trading account with Tickmill?

A trader can open an account with a broker by registering on the official Tickmill website using the Traders Union referral link.

What are the benefits of opening a trading account through Traders Union?

All traders who use the Traders Union referral link when opening an account will receive a rebate from the Union. The return of a part of the spread is provided for each completed transaction and does not depend on its result.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.