Forex Trading in the UK - A Full Beginner’s Guide

Forex trading is an exciting, profitable activity that can be a hobby or a full-time job. If you’re like most people, you may be interested in starting out by trading in your spare time.

In that case, you’ll need to understand the basics of forex, how to choose a suitable trading platform, and how to comply with the legal and tax requirements for the UK. Below, we’ll guide you through a general overview of forex and how to get started.

Do you want to start trading Forex? Open an account on FxPro!

What is Forex Trading?

Forex stands for foreign exchange. The forex market is a global marketplace where traders from anywhere can exchange different currencies. Since the global economy is so interconnected, the forex market is the largest financial market in the world.

Forex traders profit by buying and selling currencies as they fluctuate in value. For example, suppose you buy an undervalued currency. In that case, you can profit by selling it later if the price rises due to market pressure or external factors.

To learn more about the basics of forex, read our article, What is Forex? Or, you can watch our video introduction to forex here.

Is Forex Trading Legal in the UK?

Yes. Forex trading is completely legal and regulated in the UK. In fact, the UK forex trading volume is among the highest in the world.

The Financial Conduct Authority (FCA) is in charge of overseeing forex brokers and monitoring their activities. Accordingly, all professional brokers must register and obtain a license from the FCA to operate.

However, traders take note. Even though the forex market is regulated, many brokers still try to take advantage of inexperienced traders. Scammers and fraudulent operators often target forex beginners. That’s why UK residents should always trade with brokers that are FCA-regulated. This ensures that the broker adheres to strict financial standards and reports their activities as required.

For example, in the UK, brokers are required to report any changes to their terms of service. They must also undergo regular audits. Transparency measures help protect traders from losing their funds to malicious or incompetent brokers.

How Much Money Do I Need To Start Trading?

Before deciding how much money you should begin with for your forex trading account, remember this crucial rule: never invest more money than you can afford to lose. Forex trading can be risky and result in losses for inexperienced and experienced traders alike. So always be careful to do your research and learn sound trading strategies before beginning.

Many brokers have a minimum deposit requirement as low as $10. While this may sound attractive, be aware that you will have to trade on a high margin. This means that most or all your collateral will be exposed when you trade, which could result in heavy losses.

How to trade Forex with $100?Beginners should always avoid trading on a large margin. However, once you’ve gained experience and have a better idea of your risk tolerance, you can consider learning how to margin trade.

The recommended amount to start forex trading is between $500-1000. This amount allows you to make trades that result in reasonable profits without exposing you to considerable losses. That being said, you should always determine your own budget for your lifestyle and work within those limits.

UK Forex Brokers Minimum Deposit Amount Comparison

| Admiral Markets | eToro | FxPro | |

|---|---|---|---|

MInimum Deposit |

$1 |

$50 |

$100 |

How to Begin to Trade Forex in the UK? A Step-by-Step Guide

It’s simple to set up a UK-based forex account and start trading. Follow these steps, and you’ll be trading in no time.

How to start Forex trading in 5 stepsStep 1. Choose an FCA-Regulated Forex Broker

There are many forex brokers on the market competing for your attention, which can make it challenging to select the right one. However, the most crucial aspect of choosing a forex broker is ensuring that it is FCA-regulated. If not, you risk losing your funds to mismanagement or theft.

Another thing to consider is the size of the commission. If the broker takes a high percentage from each trade, are they providing outstanding service in return? Most beginners should choose a platform with low fees. This will help you maximize your earnings.

Finally, take a look at the possibilities for earning passive income. Copy-trading, or pooled money trading (PAMM), are two common strategies for earning passive income. Both rely on qualified traders to generate profits for others.

Step 2. Try Demo

You should always try out the platform before opening an account. Most platforms offer free demo accounts or paper trading accounts to allow potential users to get a feel for the interface. The user experience should be smooth and easy to understand. Suppose the platform doesn’t match the level of complexity or simplicity for your needs. In that case, you may need to search for another option.

Step 3. Think About Your Trading Strategy

If you don’t approach forex trading with a set plan, you’re basically gambling. True, it’s impossible to predict precisely how the market will move. But you can still influence your outcome positively if you have a sound approach.

For beginners, you should first experiment with low-activity trend strategies. Don’t attempt a high trading volume or conduct high leverage trades until you gain more experience. After all, the best trading skill is risk management. If you can manage your risk tolerance appropriately, you have a better chance of success as a trader.

The best Forex strategy - TU ResearchStep 4. Explore Passive Income Options

Specific strategies can help beginner traders earn passive income even if they don’t have much trading experience.

For instance, copy trading allows you to copy the actions of professional traders with a proven track record of making profitable trades. This popular social trading strategy encourages traders to learn from their peers and share trading techniques.

Another type of passive income strategy is the percentage allocation management module (PAMM). It sounds complicated, but it’s essentially a pool of money managed by a qualified trader/money manager.

The performance of funds that you allocate to the pool of your choice depends on your chosen money manager's skill, experience, and good fortune. While there is still a risk that you could lose funds if the pool performs poorly, it’s also a passive way to potentially earn profit.

Step 5 Learn, Learn, Learn

If you want to be a successful trader, the best advice is to always keep learning. If you approach trading with the right mindset, you’ll continue to improve over time by recognizing the right signals and executing more efficient trades.

Be patient, learn from your mistakes, and don’t let your emotions get the best of you. Set your targets and recognize when you’ve extended yourself beyond your budget. Traders who fail to continue learning have a higher chance of failure.

Top 8 Best Trading Apps in the UKBest UK Forex Brokers for Beginners

Admiral Markets

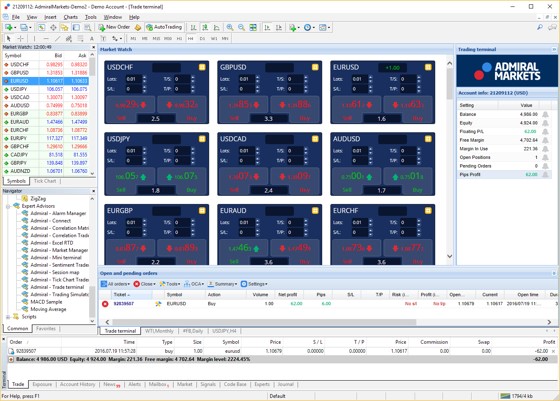

Admiral Markets platform

Admiral Markets is known for its excellent educational resources to help less-experienced traders get on their feet. However, it’s not just for beginners. It also offers low spreads, advanced MetaTrader features and premium analytics to help you make the most informed trading decisions.

· Minimum deposit: $1

· Trading fees: Around 0.6-0.7 pips for EUR/USD

· Opportunities for passive earnings: copy trading

· Education: excellent educational materials, including daily forex news, market commentary, premium analytics, social sentiment, and other valuable resources

eToro

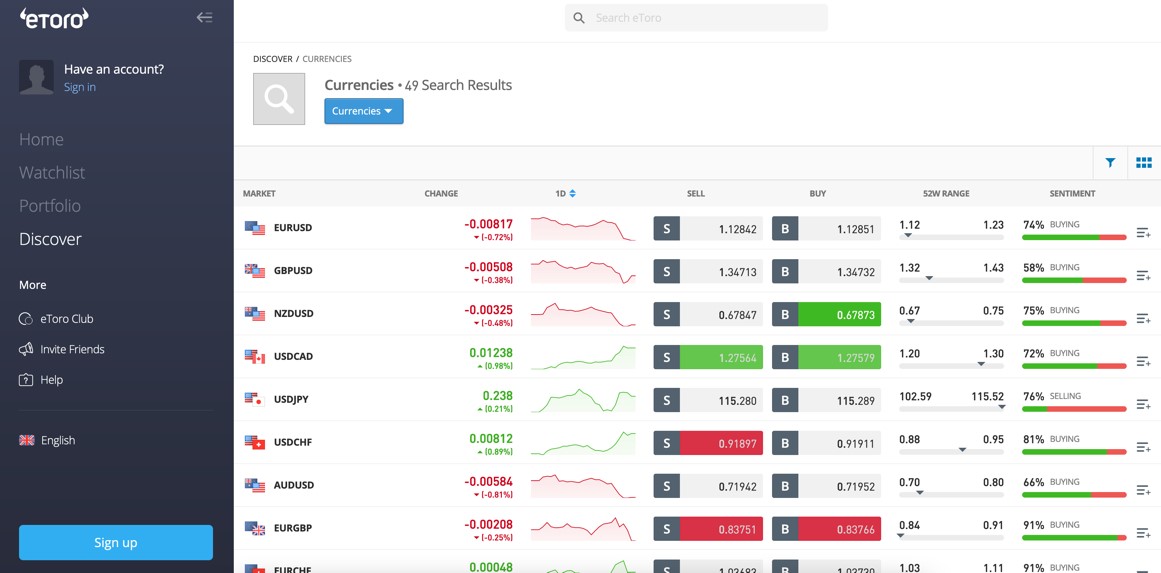

eToro platform

eToro’s platform is easy to learn for beginners. In addition, it features some of the best copy trading tools to help traders earn passive income by copying the trades of experienced investors. eToro is one of the best platforms out there for those dipping their toes into the world of forex trading.

· Minimum deposit: $50

· Trading fees: Averages around 1 pip on EUR/USD, which is slightly higher than average

· Opportunities for passive earnings: social copy trading

· Education: online trading academy with webinars, trading videos for beginners and advanced traders, information database

How to earn money on copy trading?FxPro

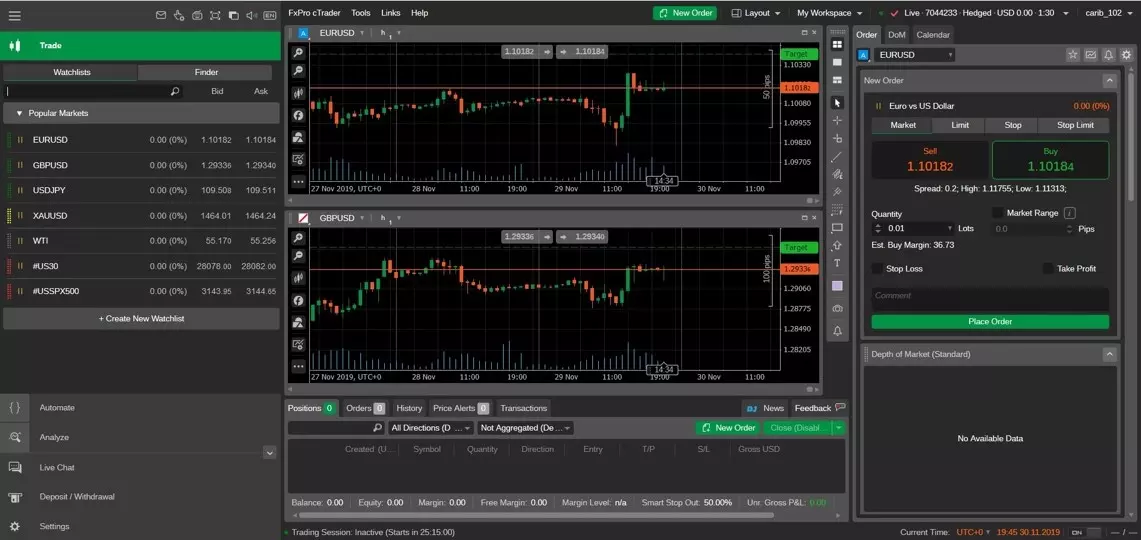

FxPro platform

FxPro is one of the top MetaTrader platform brokers. It offers over 70 currency trading pairs as well as passive income strategies to help traders maximize earnings. While its fees are slightly higher than competitors, FxPro is a trustworthy broker that can execute large orders and features a variety of excellent platforms and tools.

· Minimum deposit: $100

· Trading fees: Around 1.27 pips for EUR/USD, which is higher than average

· Opportunities for passive earnings: copy trading

· Education: educational section with written content and videos, which tracks your progress as you learn about various trading topics

IG Markets

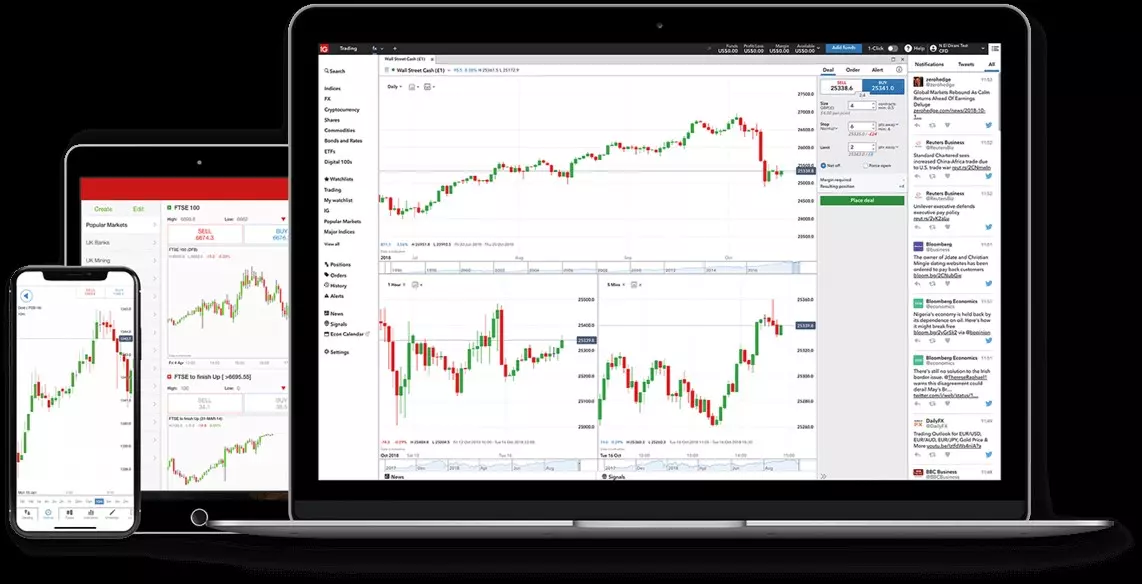

IG markets platform

IG ranks highly across most categories when it comes to offering the best tools and resources for beginning and advanced traders alike. It features a wide range of assets, attractive fees, helpful educational resources, and a well-designed platform interface.

· Minimum deposit: £250

· Trading fees: Between 0.3-0.8 pips for EUR/USD

· Opportunities for passive earnings: social copy trading

· Education: a leader in educational content, with a comprehensive resource centre full of videos, courses, quizzes, articles, and webinars hosted by professional traders

Do I Pay Forex Taxes in the UK?

The UK is one of the most trader-friendly places regarding forex taxation. Still, you may be liable for taxes depending on the type of trader you are and what kind of trades you carry out.

Always consult a tax professional before proceeding with any tax-related decisions. However, you can ask yourself the following questions to determine the general category you fall into.

Are you a part-time or full-time trader?

If you only trade part-time, your earnings from spread betting are considered secondary income. In this case, you don’t need to pay taxes on your earnings.

If trading is your primary source of income, then it’s considered a business activity. In this case, you’ll be liable to pay taxes on either your income or capital gains.

What type of instruments are you trading?

If you’re engaging in spread betting – where you’re betting on the direction of a price – then it’s considered a form of gambling or speculation. This type of forex trading is free of capital gains tax.

But suppose you trade in contract for differences (CFDs). In that case, you are subject to capital gains tax on any profits from your trading activities. For the basic rate tax bracket (£12,571 to £50,270), the capital gains tax rate is 10%.

How Much Can I Earn?

Forex is the largest global financial market. There are millions of traders worldwide contributing to a daily trading volume in the trillions of dollars. So, for many people, forex is a profitable activity.

Some people have made fortunes by trading forex. One of the most notable examples is George Soros. He famously shorted the British Pound and netted over one billion dollars.

However, there is no guarantee that you will make money trading forex. There is no fixed income that one can earn, nor is there a formula to calculate your potential profits or losses.

Profitability depends on many factors, including experience, trading strategy, market forces, and external factors like political events or even climate disasters. So you must always do your research before trading forex. And remember – don’t invest more money than you can afford to lose.

FAQs

What are the risks of forex trading?

The concept of forex may seem simple, but it’s possible to lose a lot of money if you’re not careful. The main risk of forex trading is trading with too much leverage. While a high margin can increase your potential profits by a significant percentage, it can also result in heavy losses. As a result, many traders are forced to quit forex because they lost too much money in leveraged trades.

If you are interested in trading on a high margin, start low until you are comfortable with your trading strategy. Then, you can consider increasing your amount of leverage.

Is forex trading regulated?

Yes. The Financial Conduct Authority (FCA) regulates forex brokers in the UK. Therefore, UK traders should only open accounts with brokers who have registered with the FCA and obtained the proper licenses.

However, note that the forex market itself is global and not regulated by a single, centralized authority.

What are the trading hours of the forex market?

Since the forex market is global, it is almost always open somewhere in the world. That means you can trade 24 hours a day, five days a week. The only time the market is closed is between 4 P.M. EST on Friday and 5 P.M. EST on Sunday.

This allows investors to have a great deal of flexibility in terms of trading hours. Many traders have day jobs and trade forex during their hours off work.

What are the most traded currencies?

While you can trade almost any currency, seven major trading pairs have the most liquidity.

- EUR/USD (euro/dollar)

- USD/JPY (dollar/Japanese yen)

- GBP/USD (British pound/dollar)

- USD/CHF (dollar/Swiss franc)

- AUD/USD (Australian dollar/dollar)

- USD/CAD (dollar/Canadian dollar)

- NZD/USD (New Zealand dollar/dollar)

Team that worked on the article

Dwight specializes in risk, corporate finance, alternatives, fintech, general business trends, and financial markets, and he has broad experience managing complex projects. Dwight is an author for the Traders Union website.

Dwight was a financial columnist for The Wall Street Journal and The New York Times during the Great Financial Crisis. He has served as Editor-in-Chief of Worth, a personal finance magazine for the wealthy, and as Editor of Risk, the premiere global publication about derivatives, risk management, and quantitative finance, based in London.

He has also served as Managing Editor at The Economist Group and ran the Americas operations of two British trade publications.

For the last 12 years, Dwight has worked as a freelance writer and editorial project manager, serving clients in the financial technology, banking, broker/dealer, consulting, asset management, and corporate sectors. This has given him considerable experience in idea generation and project management, working collaboratively to help clients meet their goals with little or no supervision.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.