Best Forex Brokers with FCA regulation

Best Forex Broker with FCA regulation - Tickmill

Top Forex Brokers with FCA regulation:

-

Tickmill - Best trading opportunities for beginners (minimum deposit is 100 US dollars)

-

FxPro - Best for PAMM/MAM trading

-

Exness - Best for low spreads (from 0 pips)

-

Admiral Markets - Best for 5,000+ trading assets

-

eToro - Best for stock trading

The Financial Conduct Authority (FCA) is an agency that regulates forex brokers by authorizing and registering those that meet particular requirements.

This article will explore the best FCA (UK) forex brokers, brokers' fees, trading platforms, limitations, and supported assets.

-

What platform do forex brokers use for trading?

MetaTrader is one of the most popular forex trading platforms, with two versions: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This platform is available for download or online use.

-

When is the forex market open, and how does it work?

The forex market is open for the five weekdays, where world currencies are traded in pairs. Forex traders study these pairs to predict the direction that the market will move next. They can close a trade and earn a profit if their prediction is correct.

-

Do all forex brokers charge the same rates?

No, they do not. Instead, forex brokers’ rates vary depending on their commission fees and spreads. The spreads refer to the difference between their sell rate and buy rate when trading pairs.

-

What risk do I face by trading with a forex broker who is not FCA regulated?

Since no regulating authority holds them accountable, the broker can scam you out of your money.

Warning:

There is a high level of risk involved when trading leveraged products such as Forex/CFDs. Between 65% and 82% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is FCA Regulation?

FCA regulation refers to managing or modulating financial markets and firms that provide financial services. It exists in the United Kingdom but runs independently of the government. The member institutions of the FCA pay membership fees which finance this governing body.

The FCA must authorize all consumer, financial services, and investment firms to operate legally. This authorization is granted once a forex broker makes a successful application after meeting the requirements and standards under their regulatory system. As a result of the thorough process of authorization, the brokers regulated by the FCA are more reliable and credible to use.

On top of being a licensing body, the FCA also functions as a disciplinary agency regarding forex brokers. The accountability from this entity encourages brokers to be keen on providing quality services to their clients. Consequently, a more significant majority of traders choose to trade with FCA-regulated brokers.

On the other hand, unregulated forex brokers tend to be lax regarding their clients due to the freedom of not being monitored by a governing body. As a result, the risk traders face while trading with such brokers is that they may lose their capital without a trace. Therefore, it is right to conclude that FCA regulation is a critical aspect of forex trading.

Forex License Types - Best Forex Trading RegulatorsList of FCA Regulated Brokers

There are a myriad of choices when it comes to forex brokers in today’s market. Below is a compilation of the ten best FCA-regulated forex brokers:

Tickmill

Tickmill brokerage introduces a new standard in the provision of brokerage services. The focus on innovation is what the company is proud of and why traders choose it. The trading conditions of the broker are appreciated by fans of scalping and passive trading with the help of robots because Tickmill provides minimal spreads. The company has earned many awards. Thus, for two years in a row (2018 and 2019), it was awarded the “Best Execution Broker” title, and it also won the “Most Transparent Broker” title in 2019.

FxPro

The FxPro broker was registered in July 2006 in Cyprus. The company’s activities are licensed by financial regulators: CySEC (Cyprus), Bahamas SCB, FCA (UK), and South African FSCA. FxPro is successfully operating in more than 170 countries for retail and institutional clients. The broker has received more than 85 awards, including “Best Forex Trading Platform” and “Best Trading Platform”. FxPro has become known for providing the best trading tools. With FxPro broker, traders can trade more than 70 currency pairs, futures and stocks (Twitter, Apple, Google). The company has stock indices, metals and energy resources at its disposal. FxPro sets high safety standards with the client's funds being kept in large international banks. They are insured and separated from the broker's equity.

Exness

Exness Trading Company has been working in the Forex market since 2008. The broker’s activity is managed by Nymstar Limited, a company registered in the Republic of Seychelles. The service is regulated by licenses of CySEC (Cyprus Securities Commission), FCA (Office of Financial Regulation and Supervision of Great Britain) and FSA (Office of Financial Regulation and Supervision of the Republic of Seychelles). The broker holds the leading position in Forex ratings. The company’s monthly trading turnover totals $325.8 billion USD. The broker currently has CFDs available for cryptocurrency, stocks, more than 120 currency pairs, energy and metals. Exness’s service provides favorable working conditions for traders: low commission, instant execution of orders and withdrawal of funds. An infinite leverage makes it possible to earn on small deposits up to $999. There are several options for opening an account depending on the traders’ needs. A demo account is available - a training account that is useful for both beginner level traders and professional traders.

Admiral Markets

The Admiral Markets broker company commenced operations in 2001. The broker’s activities are registered and licensed by the Australian Securities and Investments Commission (ASIC). Admiral Markets now operates in more than 40 countries with a cash cycle of up to USD 40 billion. The broker holds a lifetime license issued by the Federal Financial Markets Service. It is also regulated by the Financial Conduct Authority (FCA). Access to the FX+Project as one of their specific features. In 2002 Admiral Markets was awarded the “Forex 2012” (“Best of the Best”) by The New Europe Magazine.

eToro

The eToro broker was founded in 2007. The company promotes itself as a social trading platform working with traders from over 140 countries. The broker has several divisions operating under different jurisdictions and licensed by different regulators. For example, eToro (Europe) is licensed by the Cypriot regulator CySEC and eToro (UK) is licensed by the British regulator FCA. The broker also has a representative office in Australia and the USA.

Pepperstone

Pepperstone (Pepperstone.com) was founded in 2010 in Melbourne, Australia, by professional traders who were not satisfied with the quality of services provided by most brokers. The founders decided to avoid many of the disadvantages of competitors, including high commissions, delayed execution of orders, etc. They also focused on improving the technical component. The company has set itself the goal of changing the “rules of the game” and setting the bar high for online trading. Today, the broker provides clients all over the world with some of the best technological solutions and favorable trading conditions. The company also provides professional tools that help not only master trading as a type of activity, but also significantly increase the efficiency of trades. Pepperstone is regulated by seven regulatory authorities, amongst wich ASIC (Australian Securities and Investments Commission) and FCA (UK Financial Conduct Authority). Clients' assets are held in aggregated accounts with major banks. These facts confirm the reliability of the company and guarantee the safety of the client's capital.

HFM

HFM is a broker owned by the HF Markets Group, offers a wide variety of account types, and has the widest selection of trading assets and high-quality software. HFM also has favorable trading conditions and instant execution of orders. Plus, a solid list of tools and services allow everyone to choose the best option. The broker's reliability is confirmed by the license of several regulators. The company's work experience in the financial, brokerage and other services market is over 10 years. Within that time, HFM has received 35 prestigious awards. For trading, MetaTrader 4 and MetaTrader 5 trading terminals are used.

Eightcap

Eightcap is regulated by the Australian Securities and Investment Commission (AFSL 443670) and by the Vanuatu Financial Services Commission (reg. no. 40377). Eightcap was incorporated in Melbourne, Australia, and offers its services as an online financial trading organization. Eightcap's line of business is Forex and CFD trading services offered to both retail and institutional clients. Eightcap gives access to one of the most popular trading platforms – MetaTrader 4.

Oanda

The name OANDA is an acronym for “Olsen & Associates” or “Olsen AND Associates”. It is registered in the United States and provides its clients with a wide range of financial services in most countries of the world. The company was founded in 1996 and is currently regulated in four jurisdictions. The main regulator of the broker is the UK Financial Conduct Authority (FCA). Oanda Canada is licensed by IIROC. The company has several significant awards to its credit, including a victory in the category "Best Forex Trading Technologies" from the UK Forex Awards, "Best Trading Platform" from FX Week, as well as "Best Customer Service" from the US Foreign Exchange Report.

AvaTrade

AvaTrade was founded in 2006 in Dublin, Ireland. The company has offices in 10 countries. It currently has over 300, 000 registered users and processes more than 2 million transactions every month. These factors contribute to AvaTrade being a reliable and trusted broker. They are accredited across five continents and are one of the market leaders. The broker is regulated by the Australian Securities and Investment Commission (ASIC), the Japanese FSA, and the South African FSCA. AvaTrade holds accreditation by the Central Irish Bank, the Abu Dhabi Financial Services Regulatory Authority, and the British Virgin Islands Financial Services Commission. AvaTrade allows traders to trade stocks, securities, indices, cryptocurrencies, and currency pairs. In total, the offer more than 1,200 tools to customers.

IG Markets

The Forex broker IG Markets is a structural subdivision of the IG Group corporation. Its securities are listed on the London Stock Exchange and are included in the FTSE 250 index. IG Markets is a UK registered company created in 1974, but since its inception, its representative offices have appeared in some other European countries. Since 2014, a retail line of brokerage services has been opened. The international division of the broker is registered in Bermuda and licensed by the Bermuda Monetary Authority

Swissquote

The Swissquote brokerage firm has been operating in the Forex market since 1996. The company is regulated by the Swiss Financial Markets Authority (FINMA), Luxembourg's Commission de Surveillance du Secteur Financier (CSSF), and the d UK's Financial Conduct Authority (FCA). The company is a member of the Swiss Bankers Association. It has offices in many financial capitals of the world: Zurich, London, Dubai, Hong Kong and is moderately popular among traders. Swissquote has prioritized reliability, while paying less attention to indicators that are important for each trader, such as the size of the minimum deposit, trading conditions, deposit conditions, and its rules on withdrawing funds. The quality of Swissquote Bank's customer support is also at a satisfactory level, but lower than that of the top brokers.

How to check FCA Regulation

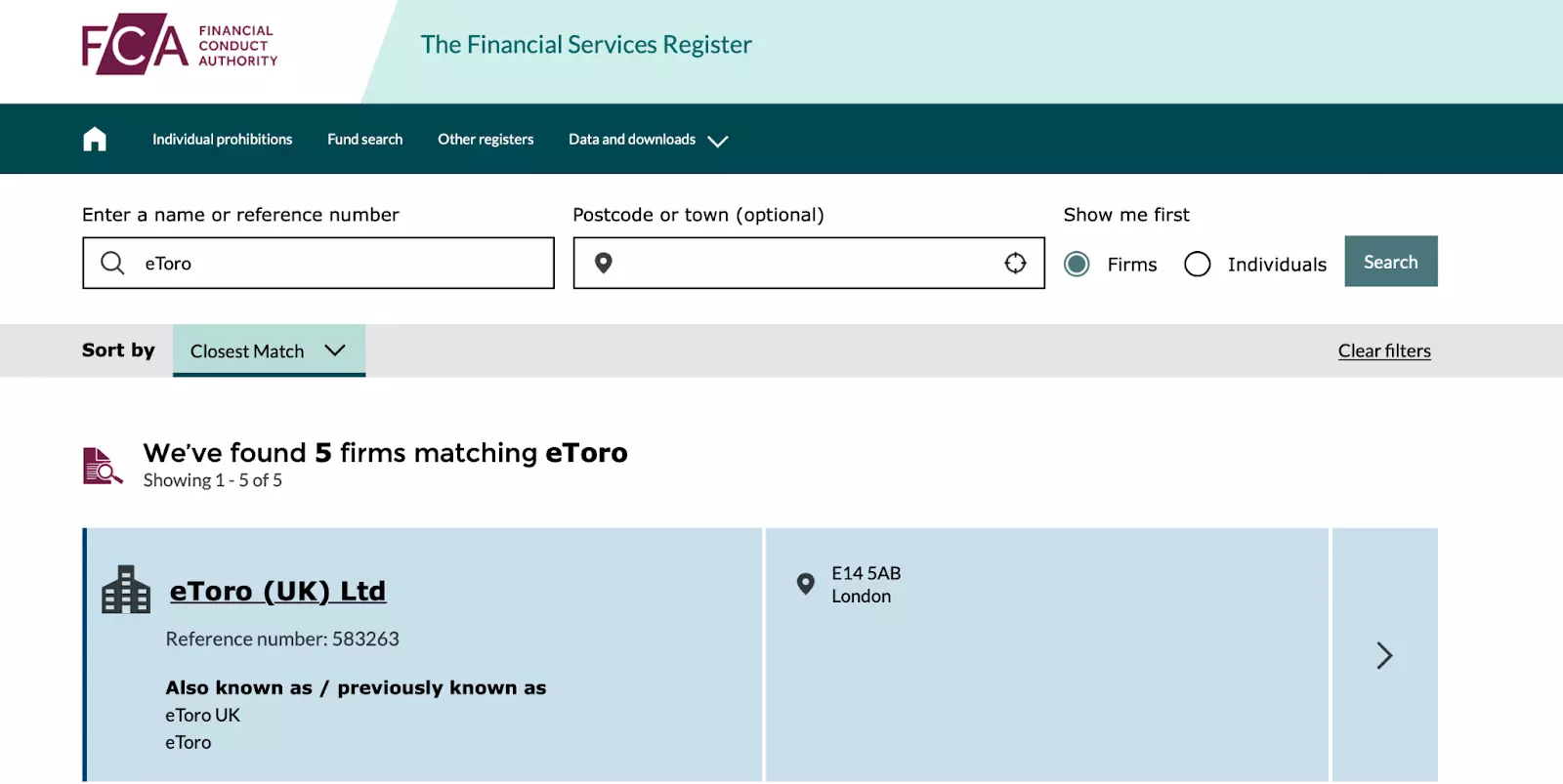

Visit the FCA's official website https://www.fca.org.uk/.

Use the FCA Register and search for the broker. Enter the name or registration number of the broker you want to check. The register provides information about authorized firms and individuals.

The FCA Register

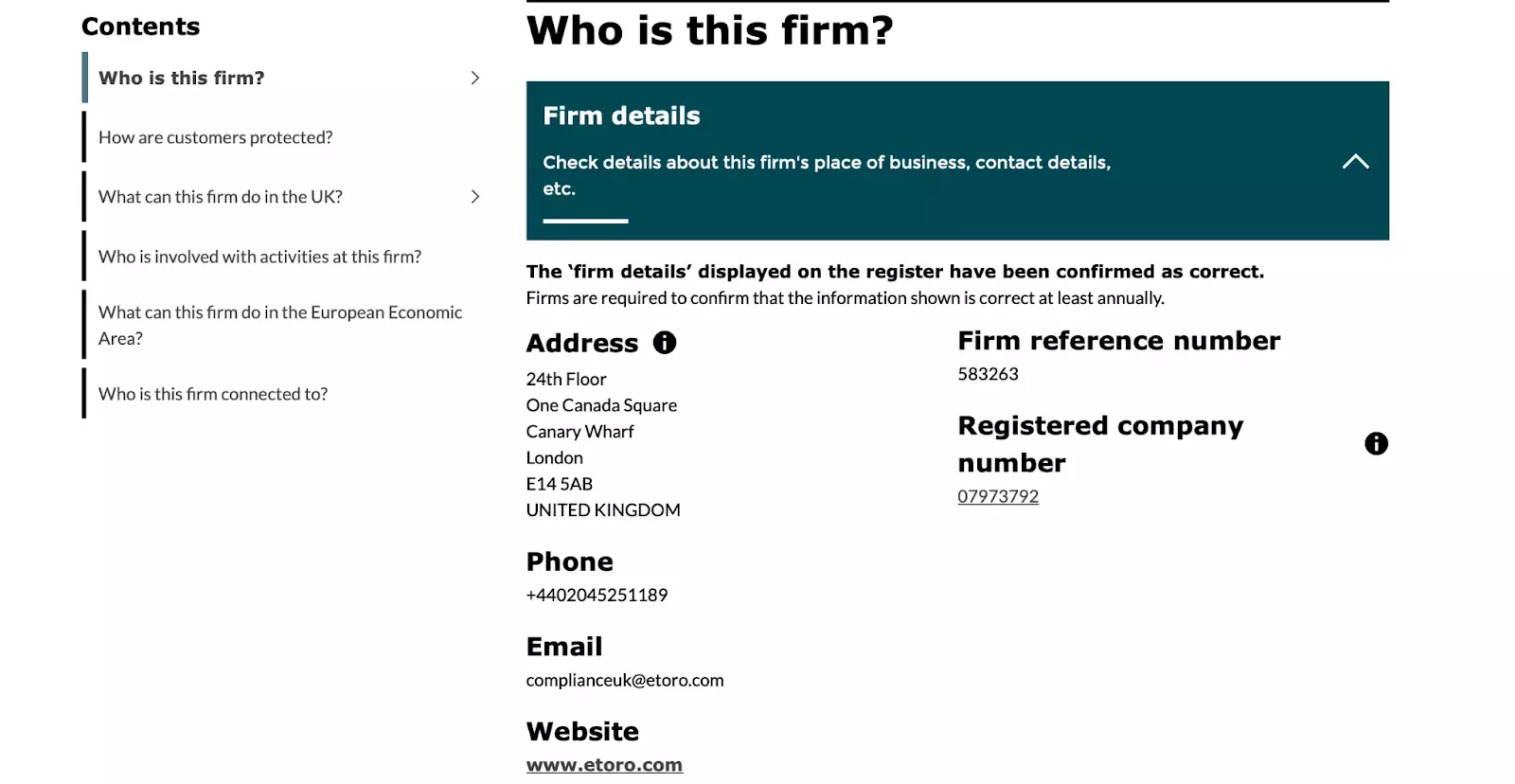

Verify the details. Review the information provided by the FCA (regulatory status, business address, and any additional information relevant to their authorization).

Verifying the details

Check for warnings or alerts. The FCA may issue warnings about firms engaging in unauthorized activities or scams.

UK-Regulated Brokers Trading Limitations

The Financial Conduct Authority is one of the most reliable and trustworthy regulatory agencies worldwide. This entity protects forex traders’ capital by ensuring that the brokers affiliated with them adhere to the requirements and standards of the country’s regulatory system.

Despite the benefits of being a UK-regulated forex broker, there are three limitations to be considered:

Protection of traders’ accounts

The FCA's protection ensures that traders cannot lose more money than what is in their trading accounts. This limitation shields the trader regardless of the forex broker they choose.

Limited leverage

Forex traders must have a specific minimum account balance to open trade positions. This balance varies from one forex broker to the other, depending on the leverage ratio, which is the amount of exposure you can gain for the capital invested.

The leverage ratio can range from 2:1 (twice the initial deposit) and is cupped at 30:1 (30 times the initial deposit) by the FCA. In other countries, this figure goes much higher.

Best high leverage (up to 1:2000) Forex brokersTransparency

It is a requirement for forex brokers to be candid with potential clients about the extent of losses accrued by their customers’ accounts.

How to Choose an FCA (UK) Regulated Broker

When choosing an FCA-regulated forex broker, it is crucial to consider the following:

Reliability

Ensure that you do your due diligence before settling for a forex broker. Reading reviews and additional information from past clients will paint a picture of what you may experience while trading with that particular broker.

Human beings tend to have an emotional attachment to their money. So in a situation where a trader feels like the security of their funds isn't assured, it will affect their decisions. Trading requires concentration, but how would you be able to trade if you aren’t confident that your finances are safe?

Therefore, it is vital to only engage with a broker that you can trust.

Trading Fees

When looking for a forex broker to work with, you must consider the profit margins you will make from your trades. There may be additional costs on your broker’s part that will affect the amount of money you receive per trade.

Some brokers charge both a commission and spread, while others claim to facilitate commission-free trading. However, the broker not charging a commission may have higher spreads than their counterparts. Therefore, it is essential to make a detailed comparison before assuming that one broker is cheaper than the next.

Top 12 Lowest Spread Forex BrokersSupported Assets

An essential aspect of forex trading is making deposits and withdrawals quickly and efficiently. Unfortunately, different forex brokers have varied systems regarding the handling of money. Therefore, you must research before committing to a broker to avoid disappointment.

Another asset to consider in choosing a forex broker is whether they provide a virtual or demo account that you can use for trading practice. This account will help you improve your skill and analyze the markets without causing you to spend your money.

Trading Platforms

The two leading trading platforms forex brokers use are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The more popular version is MT5 because it allows access to a more expansive scope of markets than MT4, which translates to more brokers and traders.

In addition, the greater reach increases forex traders’ capacity in the markets, making mt5 a more profitable platform than the others.

However, it is critical to note that not all forex brokers use the MT5 platform; therefore, you need to clarify with them before making a choice.

10 Best MetaTrader (MT4 and MT5) BrokersCustomer Service

Because the global markets run 24 hours straight on weekdays, it is essential to use a forex broker that offers customer service around the clock. If you need assistance from your broker while trading at odd hours, conversing with an actual person beats any automated responses.

An added advantage will be if your choice of forex broker has a physical office accessible to their clients. This factor would increase trust levels and accountability between the broker and their traders.

Training

One of the most vital aspects of successfully trading forex is proper training. This skill takes work, and with the dynamic shift in the global markets, there is always more to learn. Some FCA-regulated forex brokers offer free training to their clients, which is a bonus.

You may be a novice in forex trading with a keen interest in the trade but need to gain knowledge of market analysis. Rather than breaking the bank to receive training to equip you, find a trusted FCA-regulated broker who can get you started with the basics.

Conclusion

Forex trading is a lucrative business that has the potential to improve your financial situation drastically. However, ensuring that you engage the right forex broker is critical.

A regulating agency such as the Financial Conduct Authority (FCA) ensures that forex brokers are held accountable and managed appropriately, protecting the trader's interests. However, not all brokers are registered under similar regulation bodies, posing a risk to the security of their clients.

Therefore, all traders must research and find the best forex brokers with FCA regulations before making a choice.

Methodology for compiling our ratings of Forex brokers

Traders Union applies a rigorous methodology to evaluate brokers using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

Trading instruments. Brokers are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

Trading platforms. Brokers are assessed based on the variety, quality, and features of platforms offered to clients.

Other factors like brand popularity, client support, and educational resources are also evaluated.

Find out more about the unique broker assessment methodology developed by Traders Union specialists.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.