Which Forex Trading Strategy Is Best For Me?

Traders can choose from a variety of trading strategies, such as Price action trading. Trend trading, Range trading, Breakout strategy, News trading, Retracement trading, Grid trading, and Carry trade, among others. The choice depends on the following key considerations

-

Your trading goals

-

Your trading style and risk tolerance

-

Selection of instruments to be traded

-

Entry and exit criteria

-

Backtesting results

As a Forex trader, the choice of trading strategy is perhaps the most important. With so many approaches to choose from, confusion is almost guaranteed. To guide you out of this perplexing situation, the experts at TU have discussed the most common trading strategies employed by traders along with their key characteristics. By understanding the same, you can take a call on which strategy might fit the best with your trading style.

Introduction

In order to learn how to choose a Forex trading strategy, clarity on some aspects is almost a requirement. These aspects include the understanding of what a Forex trading strategy is, factors to consider when choosing a Forex trading strategy, and the importance of choosing the right Forex trading strategy.

What is a Forex trading strategy?

Forex trading strategies are a set of techniques and rules that guide traders on when to buy or sell currency pairs. These strategies can vary in terms of trading style, such as day trading, swing trading, or scalping.

Factors to consider when choosing a Forex trading strategy

The key factors to consider when choosing a Forex trading strategy are

-

Trading style

Your preferred trading style, whether it's day trading for quick profits or position trading for longer-term investments, influences your choice of strategy. -

Currency pairs

The type of currency pairs you want to trade, be it major, minor, or exotic pairs, affects strategy selection due to differences in volatility. -

Risk tolerance

Assess your risk tolerance and align your strategy with it, as some strategies offer the potential for higher profits but also come with increased risk. -

Trade volume

Decide how many positions you plan to open daily, which significantly impacts your choice of strategy and capital allocation. -

Time commitment

Recognize the time required for your chosen strategy. Some strategies demand continuous monitoring, while others allow for more flexibility. -

Market timing

Understanding market behaviour and knowing when specific currency pairs are most active, like during the overlap of the New York and London sessions, is crucial.

Why is it important to choose the right Forex trading strategy?

The right Forex trading strategy can make your set-up technically sound, mainly because of the following aspects

-

Determines success

The strategy you choose greatly influences your trading outcomes. The right strategy can lead to consistent profits, while an ill-suited one may result in substantial losses. -

Risk management

A suitable strategy is essential for effective risk management. It should align with your risk tolerance and financial objectives, helping minimize losses and preserve capital. -

Alignment with your trading style

Your strategy should harmonize with your trading style and personality. Using a strategy that feels comfortable and manageable is crucial to avoid mistakes and losses. -

Market behaviour

Understanding market behaviour is key. Market direction, trending or ranging conditions, and other factors inform your choice of strategy. -

Trading costs

Your strategy can impact trading costs. Choosing one with competitive pricing and lower trading expenses can boost profitability. -

Adaptability

Flexibility in your chosen strategy allows you to adapt to changing market conditions. Being prepared to adjust strategies as needed helps maintain your trading edge.

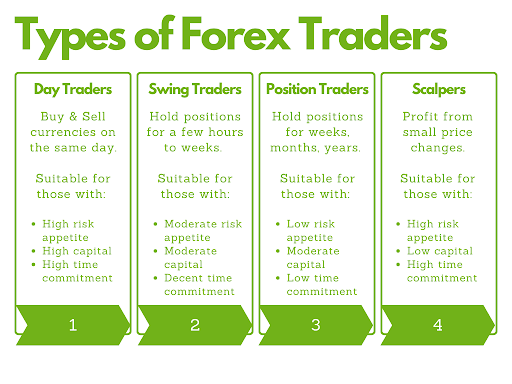

Types of Forex traders

Types of Forex traders

Before we move on to the best Forex trading strategies, it is essential to understand the larger subsets that they fall in. This aspect can broadly be classified in the “types” of Forex traders

| Style | Advantages | Disadvantages |

|---|---|---|

|

Position trading |

Less stressful and time-intensive compared to other styles |

Extended period may be required to generate profits |

|

Day trading |

Offers potential for substantial short-term profits |

Demands extensive experience and discipline |

|

Scalping |

Provides quick, small profits |

Requires a significant amount of screen time and discipline |

|

Swing trading |

Profitable in both trending and range-bound markets |

May take several days or weeks to generate profits |

Day trading

A day trader focuses on opening and closing positions within the same trading day. They meticulously analyze market conditions using a combination of fundamental and echnical analysis. They rely on various technical indicators like the Moving Average Convergence Divergence (MACD), the Relative Strength Index, and the Stochastic Oscillator to identify trends and trading opportunities. Day trading demands constant vigilance and decision-making, making it suitable for traders who can dedicate significant time to trading each day.

Swing trading

A swing trader focuses on capturing smaller gains within short-term trends while promptly cutting losses. They typically maintain their positions for a few days to several weeks, but there is flexibility in the holding period. Though individual gains may be relatively modest, consistent application of this strategy can lead to considerable annual returns. This approach includes several sub-strategies, such as trend trading, counter-trend trading, and momentum trading. Trend trading aims to participate in and ride larger market trends. Counter-trend trading focuses on identifying potential trend reversals and trading in the opposite direction. Momentum trading centres on recognizing stocks with strong directional movements and trading in the direction of that momentum.

Position trading

A positional trader focuses on capturing major price movements over an extended period, typically weeks, months, or even years. They employ a combination of technical indicators and fundamental analysis to make trading decisions and often use weekly and monthly price charts to analyze market trends and conditions. This approach is popular among traders who have other commitments and prefer a more leisurely trading style that doesn't require constant monitoring.

Scalping

A scalper aims to profit from small price movements within the same trading day. They primarily focus on major currency pairs with tight spreads and high trading volumes, such as EURUSD, GBPUSD, USDJPY. Successful scalping requires trading in highly liquid markets with tight spreads. Traders utilizing this strategy need to closely monitor their positions throughout the trading day, making it suitable for those who can dedicate significant time to real-time trading decisions.

The following matrix summarizes the key aspects of the four trading styles

| Particulars | Day Trading | Swing Trading | Scalping | Position Trading |

|---|---|---|---|---|

|

Risk |

High |

Moderate |

High |

Moderate |

|

Capital |

High |

Moderate |

Low |

Moderate |

|

Duration |

Short-term |

Medium-term |

Short-term |

Long-term |

|

Skills Required |

Advanced |

Intermediate |

Advanced |

Intermediate |

|

Frequency of Trades |

High |

Low |

Very High |

Low |

|

Time Commitment |

High |

Moderate |

High |

Moderate |

|

Market Sensitivity |

High |

Moderate |

High |

Moderate |

|

Technical Analysis |

Essential |

Essential |

Essential |

Essential |

|

Fundamental Analysis |

Less Crucial |

Important |

Less Crucial |

Important |

|

Emotional Control |

Essential |

Important |

Essential |

Important |

|

Leverage Usage |

Moderate |

Moderate |

High |

Moderate |

|

Commissions Impact |

High |

Low |

High |

Low |

Different types of Forex trading strategies

Price action trading

Price action trading

This strategy involves making trading decisions based on the movements of currency prices without relying on external factors like economic news or indicators. Here, traders analyze candlestick charts to identify potential trading opportunities, mainly arising out of chart patterns. Sometimes, price action trading is also used alongside other strategies like swing trading or day trading to complement the broader trading approach.

One of the benefits of this strategy is its real-time nature, as it doesn't require waiting for external factors to trigger trades. Nonetheless, it's essential to note that price action trading is subjective, and different traders might interpret the same data differently, leading to varying trading decisions.

Trend trading

Trend trading

Trend trading is a straightforward yet popular strategy that involves trading in the direction of the prevailing market movement. To implement this strategy, traders identify the current trend's direction and monitor the market to exit their positions when the trend reverses. Generally, trend traders look to open long positions during upward trends and short positions during downward trends, making the strategy adaptable to various market conditions.

One of its advantages is that traders do not need to perfect their trade timing. They often wait for confirmation signals before entering or exiting positions to avoid false starts. Many trend trading strategies complement their approach with momentum indicators, such as the stochastic oscillator and relative strength index (RSI), which help assess trend strength and identify overbought and oversold conditions.

Range trading

Range trading

Based on the concept of support and resistance, this strategy identifies levels at which the market tends to reverse, creating a range or sideways pattern. In rangebound markets, prices continually bounce between these support and resistance levels, presenting opportunities for scalping or swing trading. Range traders aim to profit from the price oscillations within this defined range. Unlike trend traders, traders using this strategy are not concerned with breakouts or trends. They focus on short-term movements within the range.

Momentum indicators often become useful for identifying support and resistance levels where price reversals are likely to occur. When prices reach these points, momentum tends to weaken before a reversal takes place, and range traders use this information to make trading decisions.

Breakout trading

Breakout trading

Traders using this strategy buy a currency pair when it breaks above a resistance level or sell it when it breaks below a support level. This strategy is based on the belief that once a currency pair breaks out of a trading range, it will persist in its newfound direction. There are further extensions of this strategy into various sub-strategies, including momentum breakout and reversal breakout. Momentum breakout entails identifying currency pairs exhibiting strong directional movement with significant trading volume and subsequently entering positions aligned with the momentum. Reversal breakout, on the other hand, revolves around recognizing currency pairs breaking out of trading ranges and entering positions contrary to the breakout direction.

News trading

The Forex market is affected by a multitude of events and macroeconomic factors. Hence, comprehending the probable impact of these factors on currency pairs is crucial for Forex traders. However, some traders take this a step further by adopting news trading as their primary strategy. News trading strategies predominantly revolve around specific events, such as interest rate announcements and economic data releases. These events are considered more reliable and predictable compared to unexpected market-shaking news. A comprehensive economic calendar is generally the primary tool used by news traders, helping them make sharp decisions based on the timing of these events. Additionally, historical data from previous events is often analyzed to identify patterns and predict market reactions. However, it's also important to note that news trading carries increased risk due to heightened market volatility surrounding major announcements, as numerous traders enter and exit positions, making price movements more challenging to forecast.

Retracement trading

This strategy involves identifying moments when market prices temporarily reverse before resuming the prevailing trend. These retracements should not be confused with reversals, where prices change direction entirely, forming a new trend. Temporary price reversals often present favorable entry points for Forex traders aiming to join a trend at more advantageous price levels. Additionally, retracements can serve as early indicators of a waning trend, suggesting an imminent reversal. Technical analysis tools, such as Fibonacci retracements, are widely used by traders to distinguish different types of retracements. Fibonacci levels are considered significant price points where retracements may conclude. Many traders place stop-loss and take-profit orders at these crucial levels to manage risk and lock in profits. Implementing trailing stop-loss orders is also a advisable when trading retracements, as they protect profits when the market moves favourably and minimize losses in case of adverse price movements.

Grid trading

This strategy involves placing multiple stop-entry orders above and below the current market price to create a grid of orders. It ensures that regardless of the market's direction, an order is triggered, resulting in a position. While entering the market at less favorable prices may seem counterintuitive, the grid trading approach seeks to confirm the trend before establishing a position. Grid traders often start by identifying support and resistance levels, typically determined using drawing tools like trend lines and moving averages. By identifying these key price levels, traders create stop-entry orders that capture potential breakouts or reversals. For instance, if a currency pair has a well-defined resistance level, a grid trader might set up stop-entry orders for both long and short positions around this resistance. This approach ensures that the market's movement, whether it breaks above the resistance or reverses from it, triggers a position that capitalizes on the price movement. Grid trading provides flexibility for traders to navigate different market scenarios.

Carry trade

At its core, the carry trade capitalizes on the interest rate differential between two countries. It operates on the premise of borrowing a currency with a lower interest rate, known as a "low-yielding currency," and employing the proceeds to purchase a higher-yielding currency. This strategy is founded on the principle that your funds will appreciate at a faster rate than if they were retained in the low-yield currency.

An example of this strategy is the AUD/JPY (Australian Dollar/Japanese Yen) and NZD/JPY (New Zealand Dollar/Japanese Yen) pairs, both of which feature substantial interest rate differentials. Carry trade strategies are favored by Forex traders looking to capitalize on the disparity in interest rates, resulting in favorable returns from holding higher-yield currencies. These strategies are relatively more straightforward in nature, focusing on capturing interest rate differentials rather than intricate market analysis or technical indicators.

Advantages and disadvantages of different Forex trading strategies

| Strategy | Advantages | Disadvantages |

|---|---|---|

Price action |

Easy to comprehend and execute |

Requires significant screen time and a disciplined approach |

|

Range trading |

Can be profitable in markets with low volatility |

Challenging to identify and profit from ranges |

|

Trend trading |

Potential for substantial gains in trending markets |

Risk of significant losses if the trend reverses |

|

Breakout strategy |

Opportunity for substantial profits if prices break out of a range |

Potential for significant losses if prices do not break out |

|

News trading |

Potential for substantial profits if news events favourably impact the market |

Can be risky without a solid understanding of the news calendar and trading strategies |

|

Retracement trading |

Profitable in both trending and range-bound markets |

Identifying and capitalizing on retracements can be challenging |

|

Grid trading |

Automation options with reduced screen time required |

May yield lower profits in comparison to other styles |

|

Carry trade |

Potential profitability in low-volatility markets |

Becomes risky if the interest rate differential changes |

How to choose a Forex trading strategy

To answer this question, experts have provided a breakdown of the important considerations every trader must make

Consider your trading goals

The first step is to consider your trading goals. Determine the amount of profit you aspire to make, your risk tolerance, and the time you can commit to trading. These goals will guide you in selecting a strategy that aligns with your expectations and limitations.

Choose a trading style that suits your personality and risk tolerance

Choose a trading style that matches your personality and risk tolerance. Forex offers various styles, including swing trading, day trading, and scalping. Swing traders hold positions for a few days or weeks, while day traders open and close positions within the same day. Scalpers, on the other hand, aim to profit from small price movements during the trading day. Your trading style should resonate with your comfort level and preferences.

Select trading instruments that you are familiar with

Opt for trading instruments that you are familiar with and have experience trading. Different currency pairs exhibit unique characteristics, and being knowledgeable about the instruments you trade can be advantageous. It's advisable to focus on pairs that you understand well and can analyze effectively.

Develop your entry and exit criteria

Develop clear entry and exit criteria based on your trading goals and the chosen trading style. This step involves defining when you will enter a trade and, equally important, when you will exit to secure your profits or limit potential losses. Having well-defined criteria helps maintain discipline and consistency in your trading.

Backtest your trading strategy to see how it would have performed in the past.

Backtesting is a critical practice for any Forex trader. It involves testing your trading strategy against historical market data to evaluate its performance. By reviewing how your strategy would have fared in the past, you can identify strengths and weaknesses, allowing for refinements and improvements. Backtesting provides valuable insights into the strategy's potential and its compatibility with your goals.

Which Forex trading strategy is best for me?

Choosing the right Forex trading strategy is a crucial decision and, unfortunately, there is no universal solution. The best strategy for you hinges on a variety of personal factors, including your trading goals, preferred style, risk tolerance, and experience level.

It's important to recognize that some Forex trading strategies are more beginner-friendly than others. Price action trading and range trading, for instance, offers a relatively straightforward approach that is easier to grasp and put into practice.

If you are just beginning your Forex trading journey, it's advisable to start with a strategy that aligns with your current skill level. As you gain more experience and confidence, you can gradually introduce more complex strategies into your trading toolkit. Remember, the key is to build a strategy that fits you best and helps you achieve your financial goals while staying within your comfort zone.

Best Forex brokers

FAQs

How do I choose the best Forex trading strategy?

The best Forex trading strategy is subjective to each individual’s goals, risk tolerance, and trading style.

What is the most efficient Forex strategy?

The efficiency of any Forex strategy varies; it depends on market conditions and your skills.

Is there a 100% winning strategy in Forex?

No, there's no strategy with a guaranteed 100% success rate. This reflects the dynamic nature of Forex markets.

What is the 5 3 1 trading strategy?

The 5 3 1 trading strategy involves selecting 5 currency pairs, developing 3 strategies, and choosing the best trading time.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.