Top Rated Forex Brokers in the UK (Low Fees, Great Platforms)

Top FCA Regulated Forex Broker in the UK - Eightcap

Best Forex brokers in UK are:

-

Eightcap - Best broker to trade directly from TradingView charts

-

Vantage Markets - Best for trading CFDs on major U.S. Stocks (zero fees apply)

-

FxPro - Biggest choice of currency pairs (70+ FX CFDs)

-

Tickmill - Best for EUR/USD trading (avg spread is 0.1 pips)

-

Admirals - Best for MetaTrader charting (with company's proprietary Supreme Edition plug-in)

-

IronFX - Best for VIP services (access to prop traders, forecasts, free VPS)

In the world of forex trading, choosing a reliable and well-regulated broker is paramount. The Financial Conduct Authority (FCA) acts as the primary regulator for financial services in the UK, ensuring brokers adhere to strict guidelines and consumer protection measures. Trading with an FCA-regulated broker offers significant advantages, including security of your funds, fair dealing practices, and access to dispute resolution procedures.

This guide, compiled by the Traders Union experts, meticulously evaluates the top 30 FCA-regulated forex brokers in the UK. We compared them across a comprehensive range of criteria, including security, regulatory compliance, trading conditions, and fees. By delving into this in-depth analysis, you'll be equipped to select the forex broker that best aligns with your trading goals and risk tolerance.

Top 30 FCA-Regulated Forex Brokers in the UK

TU experts analysed hundreds of Forex brokers in the United Kingdom and shortlisted the top 30 based on the criteria that comprise authorization by FCA, low minimum deposit, favourable trading conditions, good educational content, and top-notch customer support.

| Forex Broker | Overall Score | FCA Regulation | Minimum Deposit | Advantages | |

|---|---|---|---|---|---|

9.04 |

100 USD |

|

|

||

8.8 |

$50 |

|

|

||

8.74 |

100 (USD, EUR, GBP, CHF) |

|

|

||

8.37 |

100 US dollars |

|

|

||

8 |

$1 — $100, $250 |

|

|

||

7.64 |

$100 |

|

|

||

7.46 |

USD 0 |

|

|

||

7.34 |

$1 |

|

|

||

7.22 |

$1 |

|

|

||

6.78 |

From $1,000 |

|

|

||

6.58 |

$1 |

|

|

||

6.33 |

$1-$300 (depending on the country) |

|

|

||

5.96 |

$500 |

|

|

||

5.9 |

$10 |

|

|

||

5.7 |

50$ |

|

|

||

5.6 |

From $1 and from $1,000 depending on the account type |

|

|

||

5.28 |

No |

|

|

||

5.17 |

no minimum deposit |

|

|

||

5.12 |

$100 |

|

|

||

4.99 |

$100 |

|

|

||

4.97 |

$500 |

|

|

||

4.91 |

0$ |

|

|

||

4.86 |

$100 |

|

|

||

4.78 |

From $50 for retail clients, from $10,000 for professional clients |

|

|

||

4.57 |

20 USD (EUR 100 - EU) |

|

|

||

3.63 |

$200 |

|

|

||

1.9 |

From $/€0. |

|

|

||

6.83 |

$100 |

|

|||

6.68 |

$1 |

|

|||

5.98 |

From $1 |

|

Comparison of the Top 10 Forex Brokers in the UK

| Broker | Trading platform | Instruments | Spread | Trust management | Margin Call / Stop Out | Execution of orders | Cent accounts | Replenishment / Withdrawal | Trading features | Account currency |

|---|---|---|---|---|---|---|---|---|---|---|

MT4, MT5 |

CFDs on currency pairs, cryptocurrencies, indices, stocks, commodities, and precious metals |

0 points |

80%/50% |

Market Execution |

Visa, MasterCard, POLI, wire transfer, BPAY, UnionPay, Skrill, Neteller, BTC and ETH wallets, PayPal, WorldPay, FasaPay, PayRetailers, and PSP |

Free 30-day demo account; |

AUD, USD, GBP, EUR, NZD, CAD, and SGD |

|||

MT4, MT5, WebTrader, Mobile Apps |

Currency pairs (57), CFDs on stocks (226), indices (26), and commodities (22), energy, ETFs, bonds, share SFDs |

0 points |

100/50% |

Market Execution |

Bank transfer, Visa and Mastercard, Neteller, Skrill, FasaPay, Thailand Instant Bank, and PayPal payment systems |

Automated trading; Pro Trader Tools; VPS server; Analytical instruments; Proprietary mobile application. |

AUD, USD, GBP, EUR, SGD, and CAD |

|||

MT4, MobileTrading, MT5, cTrader, FxPro Edge |

Over 2,100 assets are available: currencies, stocks, indices, futures, metals, energies, and cryptocurrencies. |

0 points |

25/20 |

Market Execution |

VISA/MasterCard, Maestro, UnionPay, Cryptocurrency transfers, Perfect Money, Skrill, Neteller |

Scalping - for all types of financial instruments; Negative balance protection for customer accounts; 24-hour multilingual support, 5 days a week; Advisors; Algorithmic Trading. |

USD, EUR, GBP, CHF, AUD, PLN, ZAR and JPY |

|||

MT4, MT5, Tickmill Mobile App |

Instruments include currency pairs, commodities market assets, stock indices, stocks, bonds, and cryptocurrencies |

0 points |

100% and 30% |

Market Execution |

Tickmill.EU - Bank Transfer, Visa, Mastercard, Skrill, Neteller, PayPal, Dotpay, Trustly. Tickmill.com - Bank Transfer, Visa, Mastercard, Skrill, Neteller, Webmoney, and cryptocurrency payments. |

Hedging; Scalping. |

Tickmill.EU - USD, EUR, PLN, CHF, GBP. Tickmill.com - USD, EUR, GBP. |

|||

MT4, MT5, WebTrader, Mobile platforms |

stocks, ETFs, as well as CFDs on currency pairs, commodities, stocks, indices, bonds, ETFs, and cryptocurrencies. |

0.5 points |

50% for retail traders and 30% for professional traders. |

Exchange execution, Market Execution |

Bank transfer, Visa and MasterCard bank cards (deposits only), Skrill, and Neteller for the ASIC regulated broker. Bank transfer, Visa and MasterCard bank cards, Skrill, Neteller, Klarna (deposits only), PayPal, and iBank&BankLink for the FCA regulated broker. Bank transfer, Visa and MasterCard bank cards, Skrill, and Klarna (deposits only) for the CySec regulated broker. Bank transfer, Visa and MasterCard bank cards (deposits only), and Perfect Money for the JSC regulated broker. |

Available options for protection against volatility; One-click trading. There is a copy trading platform (available with CySec) |

ASIC - AUD, USD. FCA - EUR, USD, GBP, CHF, RUB. CySEC - EUR, USD, GBP, CHF, BGN, RON, PLN, HUF, HRK, CZK. JSC - EUR, USD, JOD, AED, GBP. |

|||

WebTrader, MetaTrader4 |

Forex, Commodities, Indices, Stocks, Metals, Futures (ALL CFDs) |

0 points |

Depending on the trading instrument |

STP, Market Maker, ECN |

Wire bank transfers, Local bank transfers, credit/debit cards, payment apps (Skrill, Neteller, etc.) |

Indicators; Advanced Terminal. |

USD, EUR, GBP, AUD, JPY, PLN, CZK JPY, PLN, and CZK |

|||

MT4, MobileTrading, MultiTerminal, MT5 |

Forex, Metals, Energies, Stocks, Indices, Bonds, Commodities, ETFs, Cryptocurrencies |

0 points |

50%/20% |

Market Execution |

Wire Transfer, Visa/MasterCard, Crypto, Fasapay, Neteller, PayRedeem, Perfect Money, Skrill, Bitpay |

Hedging; Account for scalping; Trading on the news. |

USD, EUR, NGN, JPY |

|||

Trade Nation Platform, MT4, Mobile platforms |

Currency pairs, stock indices, energies, metals, bonds, cryptocurrencies (spot), U.S. stocks, UK stocks, European stocks, and South African stocks |

0.6 points |

100%/50% |

Market Execution |

Bank cards, bank transfers, cryptocurrencies, Skrill, AstroPay, Rapid, Jeton, and other e-wallets |

Spread betting; |

USD, GBP, AUD, EUR, DKK, SEK, ZAR, and NOK |

|||

MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView |

CFDs on Forex, Index, Stocks, Currency Indices, Commodities, ETFs, Crypto |

0 points |

90% / 20% |

Instant Execution |

Visa, Mastercard, bank accounts, PayPal, Neteller, Skrill, BPay, Union Pay, EMPESA |

Trading using advisors; Auto copying; Scalping; Hedging; Trading on the news are allowed. |

AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD and HKD |

|||

MT4, MobileTrading, WebTrader, Advanced Trader |

Currencies, CFD, precious metals, stock indices, bonds, commodities, cryptocurrencies |

1.4 point |

100/30% |

Instant Execution |

eBanking, Visa, Mastercard |

A large selection of currency pairs; Including exotic and minor ones; Cryptocurrencies. |

EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, CZK |

Top 3 Forex Brokers in the UK - Expert Reviews

Expert Reviews of Eightcap

Eightcap has been in business for 14 years. This is one of the largest brokers with millions of clients globally. It is registered in Seychelles and the Bahamas, and controlled by SCB. All this indicates the reliability and transparency of the company. Nevertheless, Traders Union experts checked it and found no confirmed conflicts with its clients, problems with tax reporting, or other negative aspects. In terms of trading conditions, Eightcap rightfully takes one of the leading positions. The reason is that it manages to keep extremely low spreads. The declared indicator for account types with a raw spread is from 0 pips. The broker does not hide anything, thus current spreads can be checked on the website. For a number of assets, they really start from 0 pips, while the average indicator is about 0.5-0.7 pips. For most other brokers such parameters seem unreachable. But spreads are not the only advantage of Eightcap. The broker offers over 800 assets. This is an impressive number, but keep in mind that those are CFDs only. That is, currencies, cryptocurrencies, stocks, indices, and commodities are not available as independent instruments, but only in the form of CFD trading. This is not necessarily a disadvantage; traders just need to understand what they are working on. No other broker provides so many CFDs on cryptocurrencies. Plus, the maximum leverage is 1:500. By itself, the indicator is market average, however, in combination with other advantages of the broker, it provides much more opportunities. Eightcap has no options for passive income, and this can really be defined as a conditional disadvantage. There is not even a referral program, that is, the company's clients can earn only by actively trading in the available markets. Also, you can trade via MT4/MT5 from a desktop or smartphone, while the TradingView solution is available for browsers. Here the broker also offers comfortable working conditions. That's why its clients love it.

Expert Reviews of Vantage Markets

Vantage Markets is the broker best suited for traders who prefer ECN trading. This gives users direct access to liquidity providers and can save on trading fees. The company offers two types of ECN accounts at once, one of which is for professional traders with a large deposit. Vantage Markets will be the optimal choice for clients who are primarily interested in trading. However, there are few options for passive investing. The company offers a vast array of currency pairs and does not impose restrictions on trading strategies. The company is also suitable for clients who prefer automated trading. Trading robots can be used without restrictions. Traders can choose an attractive type of commission for themselves: spread or fixed fee. To do this, you need to select the appropriate type of account. The size of the initial deposit can be considered quite low. The broker focuses on the safety of clients' funds, so traders will have to go through additional checks to withdraw funds. The company's technical support service is efficient and responds quickly.

Expert Reviews of FxPro

FxPro is one of the brokers that successfully combines marketing policy and technological development. The company has been in the market for more than 17 years and has been able to maximize its technical potential. Average order execution is up to 14-30 ms, while the market average is 100-150 ms. Average spreads for the EUR/USD pair range from 0.3 to 0.8 pips, and expansion at moments of fundamental volatility does not exceed 30-50%. You can check these numbers by installing a script for MT4/MT5. But there are no doubts that they are true. This is largely thanks to such liquidity providers as Barclays, Citibank, and RBS banks, which are FxPro's longtime partners. Trading conditions are ideal for everyone, regardless of experience level. Novice traders can improve their skills on demo accounts, which can be opened for any trading platform (cTrader, MT4/MT5, or FxPro Edge). All platforms, except FxPro Edge, support custom indicators, scripts, and Expert Advisors. There are auxiliary tools in the user account such as market sentiment, which is an indicator displaying the current position volumes and their number in both directions, volatility of currency pairs, analytics and tools of Trading Central, and news feed with streaming information. The number of payment methods is limited, but this is required by regulators. To compensate for this, FxPro guarantees instant processing of withdrawal requests and quick crediting of money. First impressions of the broker are positive, therefore it is rightfully included in the rating of the TU Top best companies. Check it out by opening a free demo account.

Top 3 UK Forex Trading Platform for Beginners

For novice traders, beginning with a demo or cent account, or engaging in copy trading, can be an excellent method to learn and acquire experience. Demo accounts provide a risk-free environment for practicing trading strategies, using virtual funds. Cent accounts, on the other hand, enable traders to trade with small amounts of actual money, reducing risk while maintaining a genuine trading experience. Copy trading entails mimicking the trades of seasoned traders, enabling beginners to learn from their strategies and decisions.

| Broker | Demo | Cent | Copy Trading | |

|---|---|---|---|---|

|

||||

|

||||

|

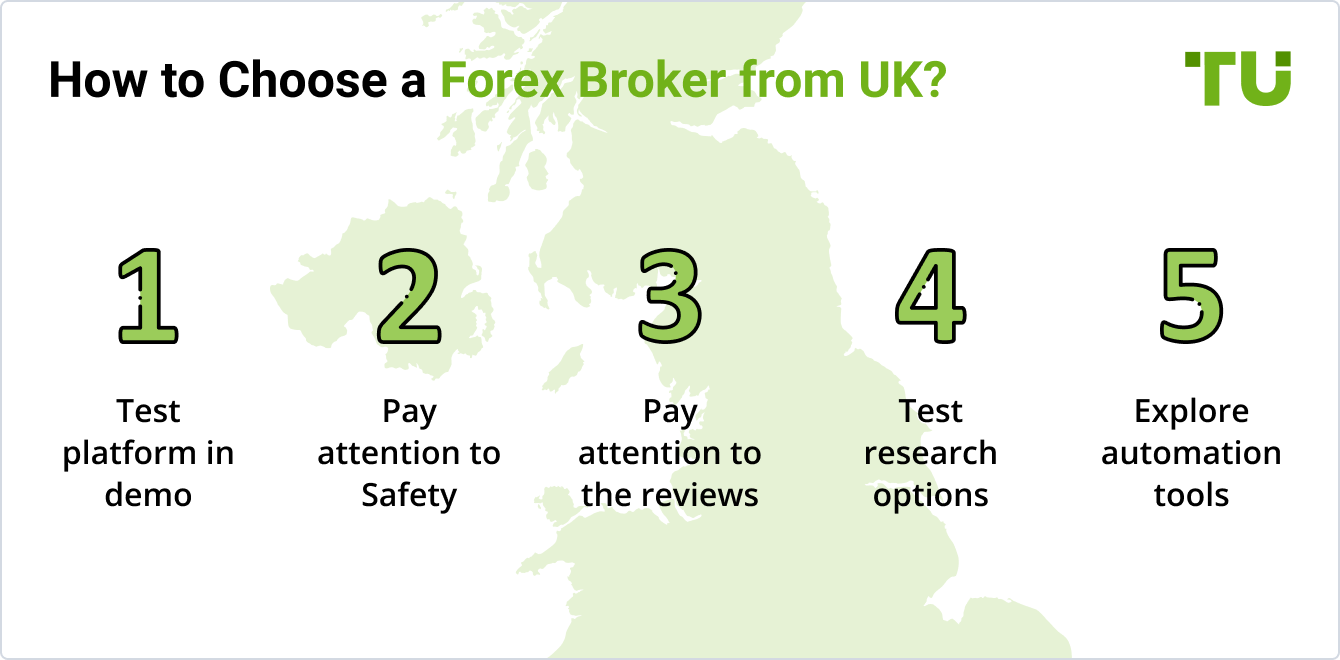

5 Tips to Choose the Best UK Brokers

Novice traders may use the following 5 tips while choosing the best UK brokers:

Test Platform in Demo: Demo account would help novice traders to gain an in-depth understanding of the features of the trading platform. It also helps to understand the trading conditions.

Pay attention to Safety: Users should choose a broker that is regulated by tier-1 and tier-2 regulatory bodies like FCA, ASIC, and CySEC. Don’t choose a broker that does not have relevant approvals and licenses.

Pay Attention to the Reviews: You should read reviews of experienced and novice traders online. You may go through articles about the best brokers on Traders Union’s website before making a decision.

Test Research Options: The technical indicators, educational content, analytical reports, and charting tools play a crucial in the success of a Forex trader. Check if the trader you are going to choose has good analytical tools.

Explore Automation Tools: Automation tools such as Expert Advisor, Copy Trading, PAMM, and LAMM would help to execute trades without your physical presence. Choosing a broker that offers automation tools is always beneficial.

How to Check FCA Regulation?

Financial Conduct Authority (FCA) is a regulatory body that operates independently of the government of the UK. It is a tier-1 regulatory authority that monitors the conduct of 58,000 businesses in the UK.

The following are the steps a trader can use to check if a broker is FCA regulated. We have taken eToro as example to showcase how one can verify if the broker is FCA regulated or not.

Step-1: Go to the website of the broker and find out the FCA registration number.

Step-2: Go to https://register.fca.org.uk/, where you can find a section “Check information about a firm, or an individual at a firm”.

Step-3: Enter the FCA registration number or reference number, tick ‘frims’, and click the search button. If the broker is registered, the name of the broker would be displayed.

For example, the FCA Reference or registration number of eToro as per its website is 583263.

Is Forex trading legit in the UK?

Forex trading is completely legal and regulated in the United Kingdom. The Financial Conduct Authority (FCA) regulates forex brokers in the UK, ensuring that they adhere to strict standards and provide a secure trading environment for traders. The FCA requires that all forex brokers obtain proper authorization before offering their services and maintain adequate capital reserves to protect traders' funds.

Furthermore, all transactions must be conducted in accordance with applicable laws and regulations. The UK has some of the world's most robust laws and regulations governing forex trading. All transactions are subject to anti-money laundering rules, which require brokers to verify customers' identities and report suspicious activity. Additionally, all customer funds must be held in segregated accounts separate from broker funds for added security.

Forex Trading in the UK - A Full Beginner's GuideWhat Is FCA UK?

The Financial Conduct Authority (FCA) is the conduct regulator for around 50000 financial services firms and financial markets in the UK and the prudential regulator for over 18000 of those firms. It regulates the activities of financial service firms, including Forex brokers, hedge funds, insurance companies, banks, and the London Stock Exchange, to ensure they are operating honestly and fairly.

The FCA also works to protect consumers by ensuring that firms are not engaging in any fraudulent or deceptive practices. The FCA has a range of powers, including the ability to impose fines on firms that breach its rules. It also has the power to suspend or cancel a firm's authorization if it believes that it is not meeting its obligations. In addition, the FCA can investigate any suspected misconduct and take action against those responsible. We also encourage investors to follow the FСA UK on social media - @TheFCA.

Is there some Forex trading limitation in the UK?

The FCA has imposed a ban on forex bonuses and promotions, which means brokers are not allowed to offer any kind of bonus or incentive to encourage traders to open an account or trade with them. The FCA has also imposed leverage limits on forex trading.

The maximum leverage available for retail clients is 1:30 for major currency pairs and 1:20 for non-major currency pairs. This means traders cannot use more than 30 times their own capital when trading major currency pairs and 20 times when trading minor currency pairs.

Brokers must also keep client funds in segregated accounts and maintain a minimum amount of operational capital, which currently sits at 1 million GBP, to ensure they can meet their financial obligations.

UK forex brokers must also be members of the Financial Services Compensation Scheme (FSCS), which provides compensation of up to £85,000 per person if a broker becomes insolvent or ceases trading. Finally, CFDs on cryptocurrencies are prohibited by the FCA due to market manipulation and volatility concerns.

Should I pay taxes as a Forex trader?

UK Forex traders are required to pay taxes on their profits from trading. Forex trading is considered a business, so the profits from forex trading are taxable and must be reported to HMRC (Her Majesty's Revenue and Customs). The way in which UK Forex traders report their taxes depends on how they trade.

If a trader is classified as speculative by HMRC, then any profits made are exempt from Income Tax and Capital Gains Tax (CGT). Speculative traders trade spontaneously without any consistent method, and trading is not their primary source of income.

However, if the self-employed trader is classified as an investor, then profits are subject to income, capital gains, or corporation tax. If you're a trader with gains below £50,000, you'll pay 10% in capital gains tax. If you make more than £50,000, you'll pay 20%. There's also the private investor, and gains are taxed as capital gains tax. However, you must own the asset for at least 12 months to pay for it.

What are Forex Trading Hours in the UK?

The Forex market is open 24 hours a day, 5 days a week, allowing traders to trade whenever they want. In the UK, trading begins at 8:00 AM local time and ends at 6:00 PM local time.

Asian Session

The Asian session forex time in the UK typically runs from 11:00 PM to 8:00 AM GMT. During this session, the most active currency pairs are those with the Japanese Yen (JPY) as one of its components.

London (European) Session

The London session forex time in the UK typically runs from 7:00 AM to 4:00 PM GMT. This is when the majority of trading activity takes place and when most major currency pairs are traded.

New-York Session

The New York session forex time in the UK typically runs from 12:00 PM to 8:00 PM GMT. During this session, the US Dollar (USD) is usually the most active currency pair.

How Can I Trade Forex in the UK?

To trade Forex in the UK, beginners should start by choosing a regulated Forex broker and verifying the available currency pairs. It’s crucial to understand spreads and commissions, consider the minimum deposit requirement, evaluate the trading platform, and ensure security and regulatory compliance.

Choose a Regulated Forex Broker

The first step is to select a reputable Forex broker regulated by a recognized authority, such as the Financial Conduct Authority (FCA) in the UK. Regulation ensures that the broker operates within the legal framework and provides a certain level of protection for your funds.

Verify Available Currency Pairs

Check the broker's offering of currency pairs to ensure they cover the ones you are interested in trading. Major pairs like EUR/USD, GBP/USD, and USD/JPY are commonly available, but it's essential to check if they provide the specific pairs you want to trade.

Understand Spreads and Commissions

Forex brokers make money through spreads (the difference between the buying and selling prices) or commissions. Understanding the cost structure and comparing spreads or commissions across different brokers is essential. Lower costs can have a significant impact on your trading profitability.

Consider the Minimum Deposit Requirement

Brokers often have a minimum deposit requirement to open an account. Consider your budget and choose a broker that aligns with your financial capabilities. Remember that a higher deposit may grant access to better trading conditions or additional features.

Evaluate the Trading Platform

The trading platform is the software provided by the broker to execute trades and access market data. Ensure the platform is user-friendly, offers essential features like charting tools and order types, and suits your trading style. Many brokers offer demo accounts, allowing you to test the platform before committing to real funds.

Ensure Security and Regulatory Compliance

Confirm that the broker has adequate security measures in place to safeguard your funds and personal information. Additionally, verify their regulatory compliance to ensure they adhere to industry standards and protect your rights as a trader.

Remember, trading Forex involves risk, and it's essential to educate yourself, develop a trading strategy, and practice risk management techniques. It's also beneficial to keep up with economic and market news that can impact currency prices.

Why Is the FCA Regulation Important?

The Financial Conduct Authority (FCA) is an independent government agency in the UK responsible for regulating the financial industry. It oversees around 50,000 businesses, sets standards for 18,000 firms, and supervises 48,000 firms prudentially. The FCA's role is to protect consumers, maintain industry stability, and promote competition among financial service providers.

By regulating the financial services industry, the FCA ensures fair markets, financial stability, innovation, and competition. Its aim is to create honest and fair markets for individuals, businesses, and the overall economy, ensuring consumers receive a fair deal and promoting market integrity. The FCA's regulation is crucial for safeguarding consumers and maintaining a healthy financial environment in the UK.

Is MetaTrader legal in the UK?

In the UK, it’s legal to use MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are trading platforms developed by MetaQuotes Software Corporation. These platforms are widely used in the financial industry and offer mobile, web, and desktop versions for trading.

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is a well-known electronic trading platform used by online retail foreign exchange traders. It was released in 2005 and gained popularity for its ability to automate trading through user-written scripts and robots. Despite being an older platform, MT4 remains highly popular and is supported by many Forex brokers in the UK.

MetaTrader 5 (MT5)

MetaTrader 5 (MT5) is the newer version of the MetaQuotes software and has gained significant popularity worldwide. However, MT4 still holds the title as the more widely used platform. When choosing a broker that provides access to MetaTrader 5, there are various options available with different fees, costs, and regulations.

Brokers that offer MetaTrader 4 are often referred to as MT4 brokers, while those offering MetaTrader 5 are known as MT5 brokers.

What Are the Best Metatrader Brokers In the Uk?

To make things easier for you, we've highlighted the key features offered by MT4 brokers with UK reulation. These include various versions of MT4 and MT5, demo accounts, automated trading with bots (Forex advisors), and the ability to scalp.

| Broker | MT4 | Demo account | MT5 | WebTrader | Copy trading | Scalping allowed | Trading bots (EAs) | Open an account |

|---|---|---|---|---|---|---|---|---|

Our Methodology

We evaluate and assess each broker using over 100 objective criteria, resulting in an average score for each Forex broker, which characterizes all aspects of its work. We also take into account its trading volume, which we have access to thanks to hundreds of thousands of traders of our Union. We also take into account reviews on brokers by their traders, which we curate on our website. As a result, according to our unique algorithmic matrix, which is applied to all companies, our program impartially calculates the overall average for each company and its position in the rating. This makes our rating system the most objective and independent in the Forex market.

Table of categories of criteria for evaluating Forex brokers

| Criteria category name | Criteria number in category |

|---|---|

Financial |

38 |

Reliability |

27 |

Security |

18 |

Trading conditions |

15 |

Customer support |

9 |

Summary

Not all Forex brokers in the UK are safe, reliable, and free. Traders should carefully analyse brokers before choosing a suitable one. The 30 best Forex brokers identified in this guide are regulated by tier-1 regulator FCA and other regulators such as CySEC, ASIC, FINMA, and FSC. These 30 brokers are reliable because of their good customer support and super-fast trading speeds. Novice traders are advised to check if the broker is FCA authorized before registering with it. The tips such as testing the trading platform in the demo, paying attention to safety, reading reviews, testing research options, and exploring automation tools would help novice traders choose a suitable broker.

Expert Opinion

I like the fact that this article shows – in the box at the top of the article – the best brokers with specific notes as to what they’re best at. For example, FxPro is shown as having the “biggest choice of currency pairs” to trade. This kind of information is important because the main thing to look for when choosing a broker is whether or not it offers the things that meet your personal needs and wants as a trader. For instance, some brokers provide a wealth of investor education resources, while others only offer basic market news.

Other factors that may influence your decision when choosing a broker include things such as average trading spreads and multi-market access (whether the broker provides you with the ability to trade additional financial assets beyond just forex).

Trading with brokers in the UK that are regulated by the Financial Conduct Authority (FCA) offers traders above average financial protection. The FCA requires that registered member brokers keep all client funds in segregated bank accounts separate from the brokerages’ own accounts, and that they provide insurance on client funds up to £50,000 of coverage for each account. On the negative side, FCA-registered brokers can only offer a maximum of 30:1 leverage.

FAQs

Is Forex trading legal in the United Kingdom?

Forex trading is completely legal in the UK, and it's supervised by the FCA (Financial Conduct Authority). It's important to choose the online brokerage that's fully authorized and regulated by this financial body to protect your funds.

Is Forex trading taxable in the UK?

If you perform Forex trading as spread betting, then you won't need to pay any tax in the UK. However, you'll be liable to pay tax if you earn personal profits through Forex trading. The tax will be charged and paid as CGT (Capital Gains Tax) once the tax year ends.

Can I make a living from Forex trading?

Forex trading has the potential to make you rich, and you can make a handsome living out of it as well. But it's important to note that Forex is basically currency trading that requires skills, knowledge, and experience. Like any other skill, it takes diligence, patience, and time to learn new trading styles and refine your strategies.

Should I use Passive Investment tools?

Yes, you can use passive investment tools if you don’t have time to keep track of the forex market. Passive tools help you automate trades and execute trades in your absence.

Which are the best currency pairs for UK customers?

The most traded currency pairs in the UK are GBP/USD, EUR/USD, and USD/JPY.

Can I deposit money to the brokerage account through my credit card?

Yes, most brokers accept deposits via credit cards. We suggest you visit the website of the broker you are using to get more details on payment methods.

Is Copy Trading good?

Yes, copy trading is the best alternative to generate decent revenues from Forex trading for novice investors who don’t have sufficient knowledge of the Forex market.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.