6 Best Copy Trading Platforms in the UK 2024

Copy trading is a popular and helpful trading method that all traders should try at least once in their careers. In this guide, we will look at the features of 6 reliable copy trading platforms for UK citizens. Carefully analyze their profiles to see which of them suits your needs most. These are hand-picked by us for your convenience, so no options will be bad:

eToro (Copy Trader) - Best Copy Trading Platform in the UK

AvaTrade (AvaSocial) - Best Copy Trading App

Pepperstone (MyFxBook, MetaTrader MQL5, DupliTrade) - Best Client Service

FXTM (FXTM Invest) - Flexible, Versatile Trading Services

Tickmill (MyFxBook) - Best for High Volume Traders

FBS (CopyTrade) - Best Split-Second Execution

Copy Trading Platforms in the UK - Comparison

This is how the best 6 copy trading platforms for UK citizens compare to each other:

| Minimum Deposit | Subscription Price | Markets | ||

|---|---|---|---|---|

$200 |

Free |

US Stocks, Forex, Crypto, ETFs |

||

$100 |

Free |

Forex, Stocks, Commodities, CFDs, Bonds, ETF, Cryptocurrencies |

||

$200 |

Free |

Forex, CFDs |

||

$100 |

$10 |

Forex, CFDs, Stocks, Commodities |

||

$100 |

Free |

Forex, Bonds, CFDs |

||

$1 |

Free |

Forex, CFDs |

eToro (Copy Trader) - Best Copy Trading Platform in the UK

Safety and regulation:

FCA, ASIC, CySEC

Usability:

Beginner friendly

Review of features:

How to pick the right trader

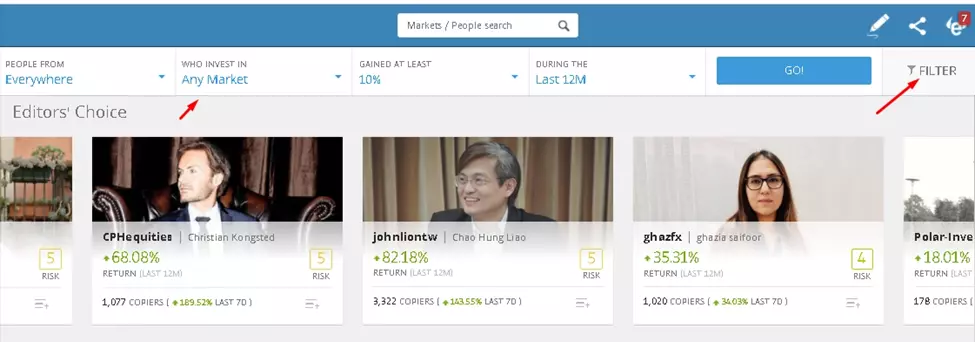

You can choose traders on eToro using two main methods: following eToro’s advice and using filters.

You will adhere to the guidance given directly by eToro when using its advice. As we've already indicated, the broker offers to analyze the profiles of the most successful traders who have already been chosen based on the following criteria on the CopyTrader home page:

Return rate

Strategy

Number of copiers

Risk score

This is the most preferred method for new traders because it involves no complex analysis. Also, with the use of the filtering system found in the upper menu on the Copying People page, eToro users can independently establish the requirements for finding traders to copy.

eToro Copy Trading

AvaTrade (Ava Social) - Best Copy Trading App

Safety and regulation:

Central Bank of Ireland, ASIC, FSCA, Japanese FSA, ADGM, FRSA

Usability:

Beginner friendly

Review of features:

How to pick the right trader

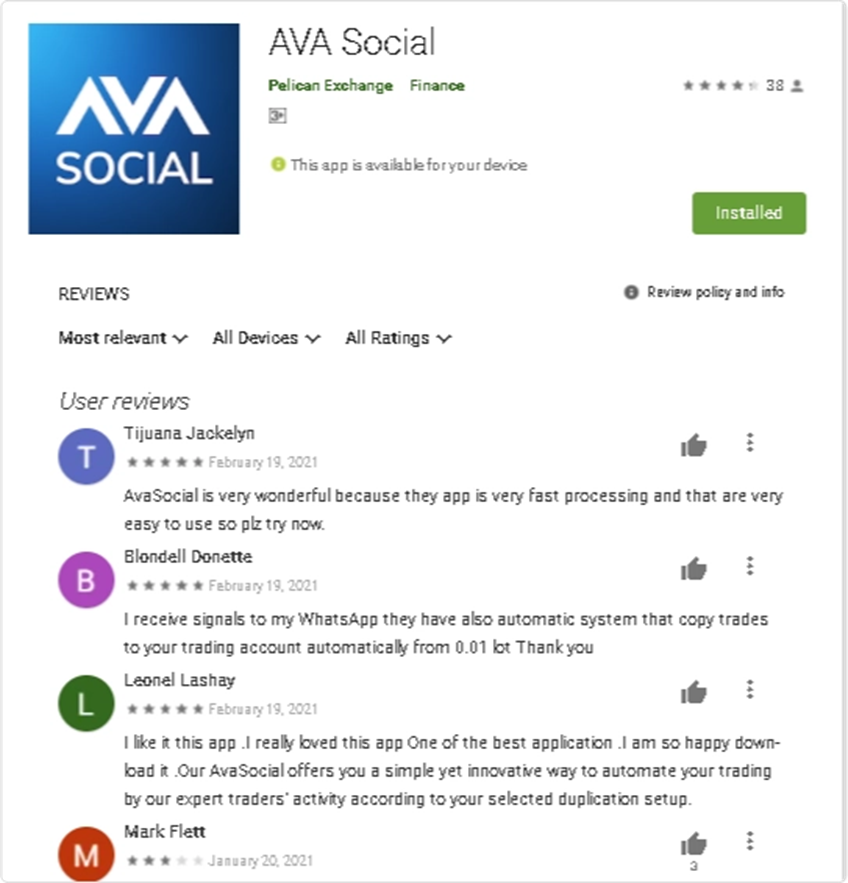

AvaSocial by AvaTrade did not have a large selection of alternatives for seeking traders to imitate at the time this evaluation was being written. Even though there aren't many profiles, the majority of them can be seen using the trial technique because the software doesn't yet feature complex filters.

Therefore, to find the right trader on AvaTrade:

Pay attention to maximum drawdowns in addition to general profitability. Better is having them lower. The trader in the sample below, for instance, has a return rate of 633%, but the maximum drawdown was 100%. This implies that there is a very significant risk involved in working with him.

Look for traders who have been active on AvaSocial for the longest. Only pure luck could account for the outstanding results over such brief times. For traders, stability is the most crucial factor.

Remember that you can specify a maximum drawdown for each trader. If it is attained, trade copying will halt, protecting your funds from risk.

Another useful resource is the reviews. Pay close attention to them since there is not much to work with.

AvaTrade Copy Trading

Pepperstone (My FXBook, MetaTrader MQL5, Dupli Trade) - Best Client Service

Safety and regulation:

ASIC, FCA

Usability:

Beginner friendly

Review of features:

How to pick the right trader

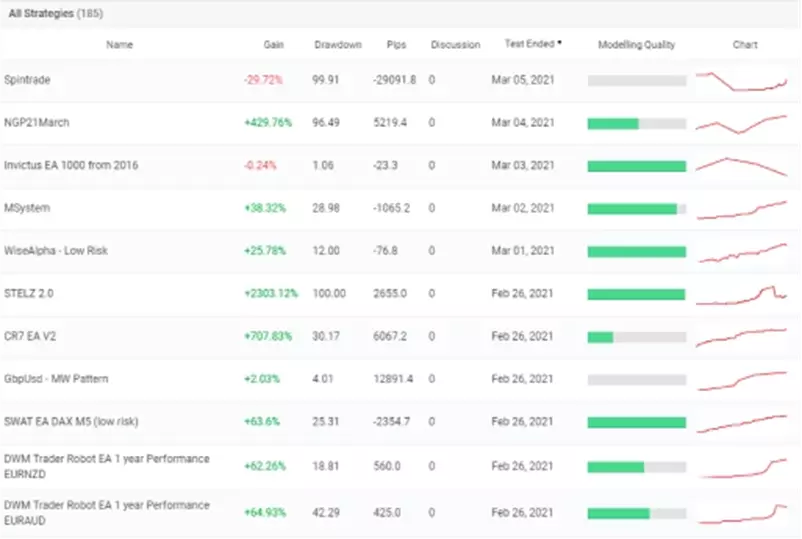

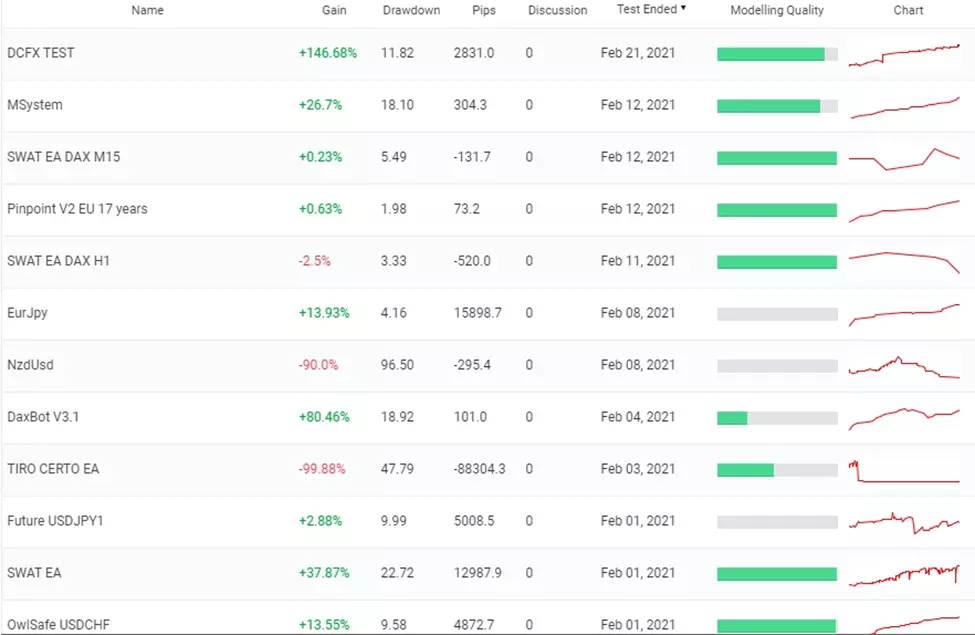

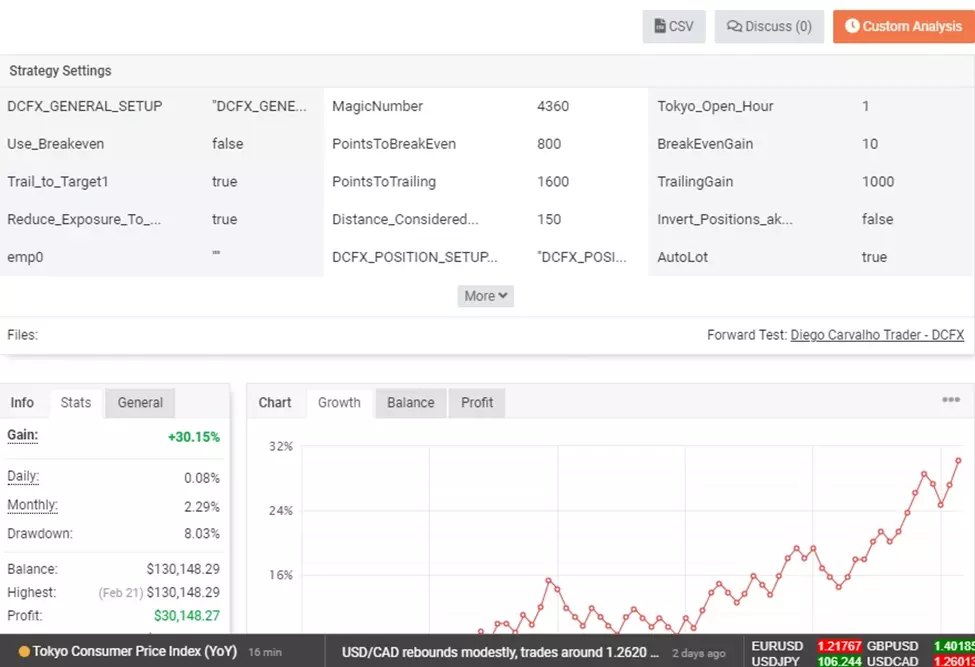

Selecting a trader to copy is done directly on the platform you selected for copy trading. Let's go over the MyFxBook strategy provider selection process. You must choose Strategies from the top menu before choosing All Strategies from the pop-down list. Key information about the traders who offer their trades for copying will be displayed in a table.

Pepperstone Copy Trading

You can employ filters to choose a trader. The table's columns can all be clicked on. The platform will automatically sort the strategy providers by this column if you click on the name of the column. The following are the indicators:

Name

Discussion

Drawdown

Chart

Test Ended

Modeling quality

MyFxBook's search functionality, however, is not very strong. Particularly, no filters exist. A search bar that may be used to find a trader by name is also absent.

Pepperstone Copy Trading ReviewFXTM (FXTM Invest) - Flexible, Versatile Trading Services

Safety and regulation:

CySEC, FCA, FSCA, FSC.

Usability:

Beginner friendly

Review of features:

How to pick the right trader

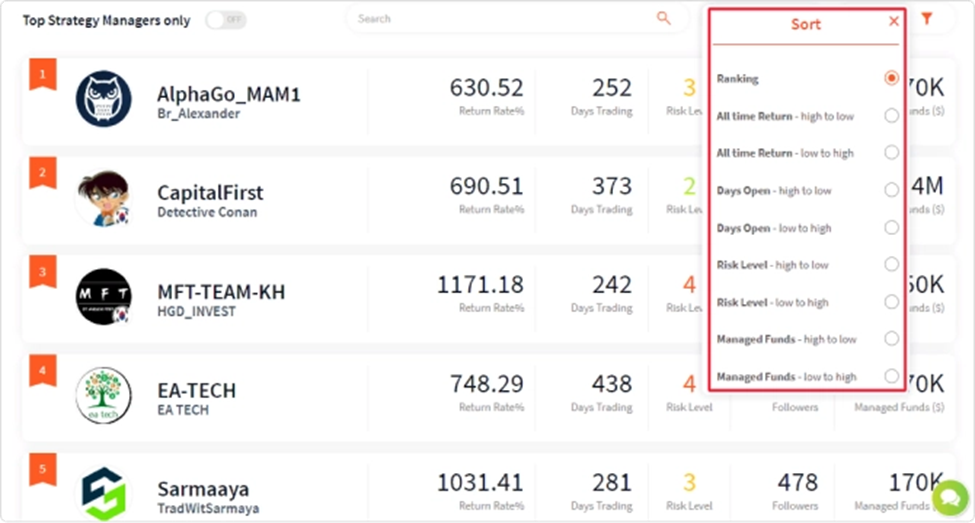

The platform will let you choose an FXTM copy trading manager. A list of managers who are providing their services will be displayed. The broker will first present you with a list of strategy suppliers that are ranked at the top on FXTM. You can choose any manager that offers his or her strategy on the FXTM copy trading service if you turn the Top Strategy Managers only option OFF.

You can pick a manager who best suits your needs if you are unsure of which trader to subscribe to. Four factors are used to sort users of the FXTM copy trading service:

All-time run

Managed funds

Days open

Risk level

When sorting, you can choose from ‘high to low’ or from ‘low to high’.

FXTM Copy Trading

Tickmill (My FX Book) - Best for High-Volume Traders

Safety and regulation:

FCA, ASIC, CySEC

Usability:

Beginner friendly

Review of features:

How to pick the right trader

Click Systems in the top menu to identify a provider of strategies. Choose Strategies from the drop-down list, followed by All Strategies. The complete list of traders who make their transactions available for copying will appear in a table.

Tickmill Copy Trading

On MyFxBook, traders are only chosen through sorting. The following indicators can be used to sort traders on the platform:

Gain

Pips

Drawdowns

Test ended

Modeling quality

Chart

Unfortunately, the sole method for choosing a trader is to sort the table. Filters are absent.

You must look over a trader's data in order to select them. On MyFxBook, it is really thorough. By reading our assessment of the MyFxBook social trading platform, you can examine the statistical data made available on the platform. You can read reviews of Tickmill MyFxBook in the account as well. You must click the Discuss button to access the reviews.

Tickmill Copy Trading Review

Tickmill Copy Trading

FBS (Copy Trade)-Best for Split-Second Execution

Safety and regulation:

Regulated by IFSC but not FCA.

Usability:

Beginner friendly

Review of features:

How to pick the right trader

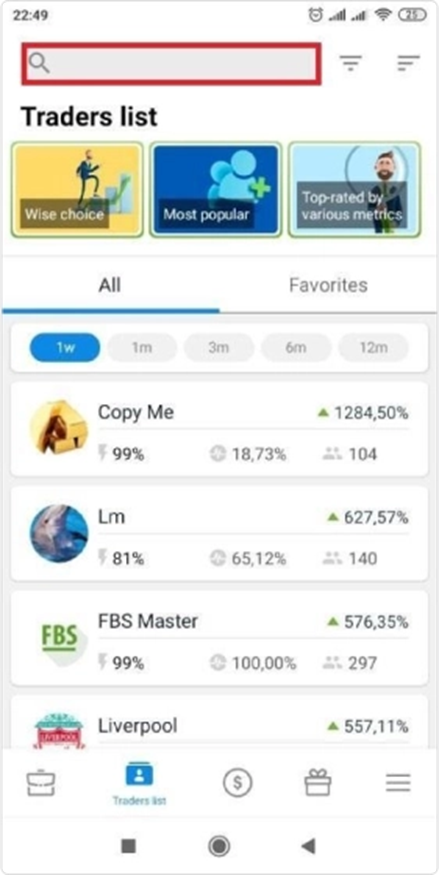

On FBS, you must first choose the proper strategy suppliers. There are roughly 600 managers who can copy transactions. You can add traders there for subsequent comparison using the Favorites function. To locate and choose a manager, utilize search. The system will locate the manager's nickname based on your request if you provide the manager's nickname.

FBS Copy Trading

You can choose strategy providers and make use of trader listings when using the FBS service for replicating trades. The platform provides customers with three lists in total:

Wise Choice

Top rated by various metrics

Most popular

What is Copy Trading?

Copy trading is one of the most popular forms of trading today. This type of trading allows inexperienced traders to manually or automatically mimic the trades of more seasoned traders on the Forex market and other financial marketplaces. All of which is perfectly legal.

The features of a social network and a platform for duplicating trades were combined by the developers and specialized for the needs of traders. It turned out to be a perfect combination that continues to gain popularity today, with no signs of slowing down.

Using some or all of their capital, users can subscribe to traders and start replicating their trades thanks to the tools offered by today's copy trading platforms.

Every position that the duplicated trader opens, together with any associated Stop Loss and Take Profit orders, is likewise automatically carried out on the copied trader's account. The option of assembling a specific analog of a portfolio from various signal providers is also available.

It is also an exceptionally flexible model, you are never bound to it if you end up feeling that it is not to your preference. On the majority of platforms, a copier can subscribe to different management or unsubscribe from a trader at any time and begin trading independently.

How to Choose a Copy Trading Broker

Follow these five suggestions when selecting a broker for social trading in order to evaluate the broker's dependability and the social trading options it provides to its clients.

Assessment of regulation and dependability. It is crucial to select a broker with trustworthy regulation because many brokers, even those with a dubious reputation, provide trading on copy trading platforms. The regulation in the UK (FCA), European Union (CySEC), Australia (ASIC), and other developed nations is particularly lauded by Traders Union specialists.

Best Forex Trading RegulatorsDetermining the Network's Size. In terms of social trading, a larger network offers its users better options. There is a wider range of managers available to investors, and there are more opportunities for managers to raise money.

Trading Conditions. In copy trading, the issues of commissions, variety of trading instruments, and order execution quality are also priorities. When providing this kind of service, some brokers charge extra in the spread, which could significantly affect the outcome. Every intricacy needs to be explained upfront.

Transparency. All managerial statistical information must be accessible to the general public and available for an impartial audit.

How to Choose a Forex Broker?How to Start Copying Trades

It's easy to set up your copy trade. Select the user you want to copy, enter the budget you want to use, then click COPY. Their positions will be immediately duplicated in real-time and direct proportion. A user's copying can be started or stopped at any moment.

eToro provides the option to subscribe to an investment portfolio if you don't want to spend a lot of time learning about the features of other traders' portfolios. Several traders and instruments will be immediately copied to your account at once in this scenario. However, since the minimum investment in this instance rises from $500 to $5,000, this is only a possibility for customers with greater money.

On eToro, the CopyPortfolios feature is similar to Copy People in functionality and is accessible in the relevant section of the Personal Account. For searching and subscribing, the same tools and filters that are used with individual traders can be used. Portfolios can be chosen based on factors like performance or risk score.

On eToro, there are three different kinds of copy portfolios:

-

Thematic

-

Top Traders

-

Partner CopyPortfolio

Generally, here are some more steps you can follow for any platform:

-

Find a trustworthy broker who provides this kind of service.

-

Choose one or more managers whose traders you want to imitate. To do this, you will have to do a lengthy review of their financial results (the longer the better).

-

The following stage is to research the terms of working with the traders and allocate your investment funds to them in the necessary proportions.

-

Adapt the social trading platform to your requirements. Numerous systems allow for extensive risk criteria customization; additionally, one can choose between partial or entirely automatic copying.

-

View your managers' performance statistics regularly to change the size of your investment.

Copy trading is not difficult to start. All you need is the will to get going, and a platform that supports you along your journey.

Is Copy Trading Legal in the UK? Is it Safe?

Copy trading is not prohibited in the UK. However, traders are better off choosing regulated brokers such as eToro to trade. Trading on unregulated brokers could expose you to scammers and other nefarious actors after your capital. As with any other form of investment, due diligence is called for.

Summary

Copy trading is a profitable and simple method to trade. It is convenient for both novices and experienced traders and has the potential to earn substantial profits. Find the right platform for your needs, grasp the basics of trading and enjoy the adventure that is copy trading.

FAQs

Can I Make Money Copy Trading?

One of the most well-liked passive income streams in the financial industry in recent years has been copy trading. Novice traders have a chance to make as much money as the professionals they copy by utilizing specialized platforms and features that let them mimic experienced traders.

How Much Does eToro Copy Trading Cost?

Only the broker's commission is paid by the copier. According to the information provided on eToro's website, the broker's commission is solely derived from the spread of the transactions that are replicated onto your account. Successful managers are rewarded under unique terms that have been worked out with the broker.

Is Copy Trading Safe?

Since you decide whether to imitate another trader's position, copy trading isn't quite as dangerous. But this might also be equally disastrous if you blindly follow their every step without completing your research. Therefore, before attempting copy trading, be sure you are familiar with the market and the reasoning behind the trader's selections. If you do this, you make copy trading safer.

Is Copy Trading Good For Beginners?

One of the best ways to learn about trading is by copy trading. When you copy trade, your trading account automatically duplicates the transactions of a more seasoned trader. You can watch a trader in action in real time, which can help you learn about trading charts and how to buy and sell at the right times depending on the market.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.