According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- MetaTrader4

- MetaTrader5

- FIX

- DARWIN API

- CNMV

- FCA

- 2012

Our Evaluation of Darwinex

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Darwinex is a moderate-risk broker with the TU Overall Score of 6.34 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Darwinex clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Darwinex provides extensive trading opportunities for both active traders and investors, including beginners with a limited capital amount.

Brief Look at Darwinex

Darwinex has been operating as a broker and asset management company since 2012. Regulated in the United Kingdom (FCA) and Spain (CNMV), the broker participates in investment insurance mechanisms, with client funds held in major EU banks. Darwinex offers ECN accounts on both MT4 and MT5 platforms for trading Forex, CFDs on indices, metals, energies, U.S. stocks, and ETFs. Integration with Interactive Brokers allows traders to access futures and real stock markets using more advanced software such as Trader Workstation (TWS). Trading CFDs through Darwinex is not available for traders from the U.S. and Canada, but they can participate in the Darwinex Zero capital distribution program.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The broker is licensed by the British regulator FCA, and Spanish CNMV (National Securities Market Commission).

- The broker protects clients’ funds against misuse and Darwinex bankruptcy.

- The broker offers a wide range of trading instruments, with over 950 CFDs and more than 500 exchange-traded assets offered by Interactive Brokers.

- Competitive floating spreads and low commission per lot.

- Reduced commissions for traders with a successful trading strategy and rebates for Professional status clients.

- CFD trading, including currencies, on MetaTrader 4 and MetaTrader 5 platforms.

- An amount starting from 200 USD/EUR/GBP can be transferred to an experienced trader into management.

- The minimum deposit is 500 USD/EUR/GBP.

- Absence of commission-free accounts, cent accounts for beginners, and Islamic accounts without swaps.

- Darwinex does not support cryptocurrency transactions and does not offer trading of digital assets.

TU Expert Advice

Financial expert and analyst at Traders Union

Darwinex is a regulated intermediary for entering derivative markets, offering competitive commissions and a wide range of trading instruments. The broker does not provide STP or Islamic accounts. The ECN technology connects its clients directly to liquidity providers, enabling near-zero spreads and minimal trade execution delays. However, using ECN implies an additional trading fee charged in the form of a commission per lot.

The minimum deposit for individual/joint accounts is $500/€500/£500; for corporate accounts, it is $10,000/€10,000/£10,000. Subsequent deposits can be made starting from $100/€100/£100 via cards and electronic payment systems, but bank transfers must be at least $500/€500/£500. When clients deposit funds, they go to the wallet of their Darwinex account. From there, the funds can be transferred between their trading and investment accounts.

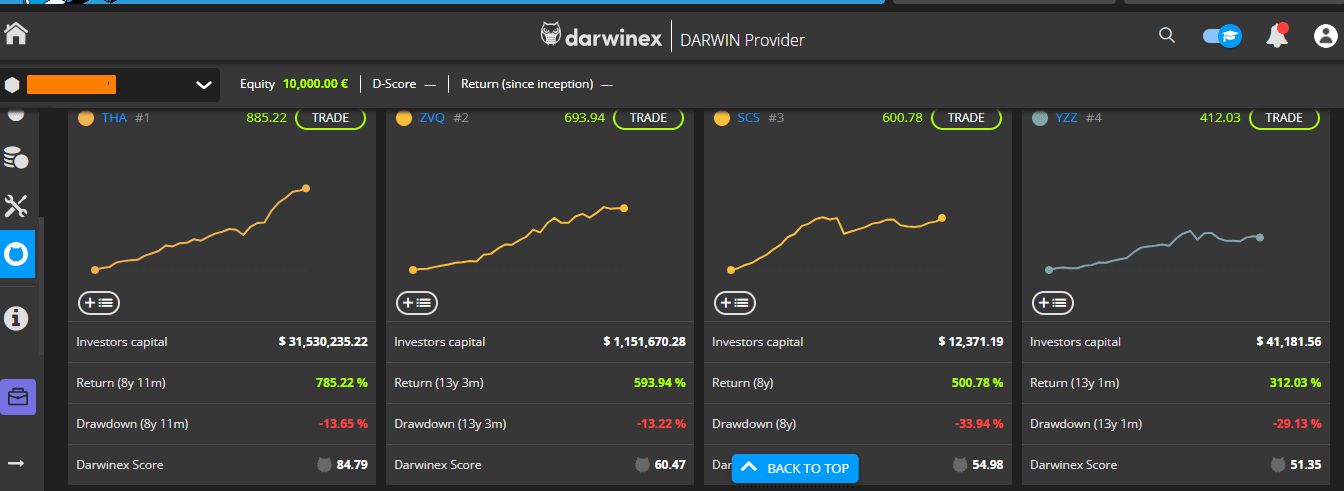

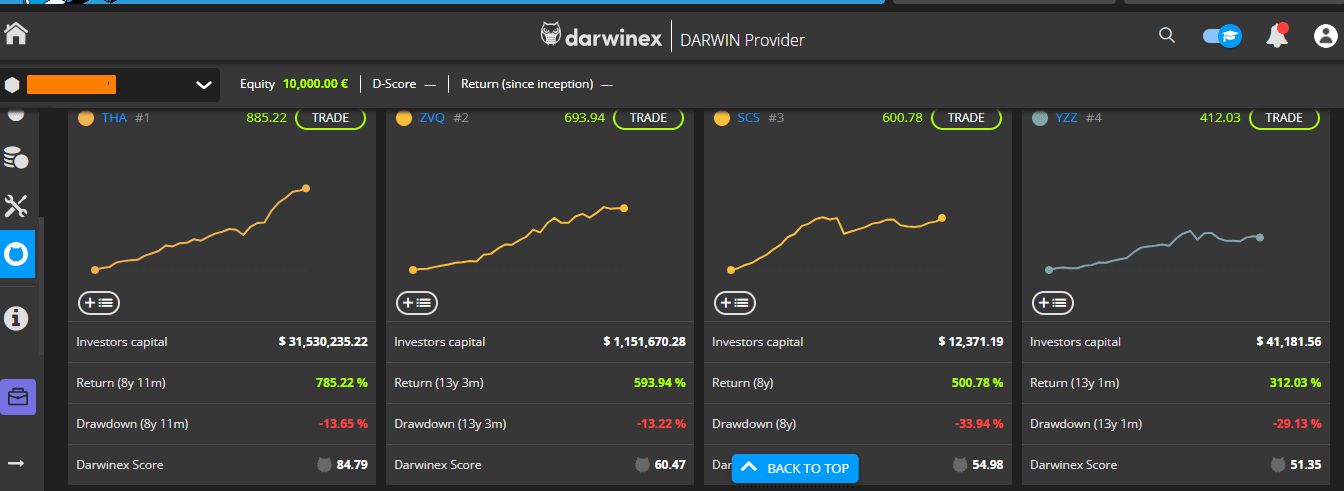

Darwinex aims to expand opportunities for both active traders and investors. To achieve this, the broker created an ecosystem of managed capital with a turnover exceeding $140 million. Investment program rules are regularly improved. In 2023, the company upgraded the DarwinIA capital allocation program, making it more progressive and accessible to non-professional traders.

- Regulatory compliance is essential for you. This broker is licensed by reputable authorities such as the British regulator FCA and the Spanish CNMV, providing a strong regulatory framework. Additionally, they prioritize the protection of clients' funds against misuse and bankruptcy.

- You are seeking a broker with a low entry barrier. This broker imposes a minimum deposit requirement of 500 USD/EUR/GBP, which may be considered relatively high for some traders.

- You prefer commission-free accounts, cent accounts for beginners, or Islamic accounts without swaps. This broker does not offer these account types, potentially limiting your choices based on your trading preferences.

- Cryptocurrency trading is crucial for you. This broker does not support cryptocurrency transactions or offer trading of digital assets, which might be a drawback if you are interested in this market.

Darwinex Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Darwinex Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MetaTrader (МТ4 and МТ5), DARWIN API, FIX |

|---|---|

| 📊 Accounts: | Demo, Retail, Professional, and Darwin IBKR account (stock trading account) |

| 💰 Account currency: | EUR, USD, GBP |

| 💵 Deposit / Withdrawal: | Bank transfer, credit and debit cards Mastercard, VISA and VISA Electron, and Skrill |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: |

Up to 1:30 (Retail) Up to 1:200 (Professional) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3 pips |

| 🔧 Instruments: | CFDs on Forex, commodities, indices, stocks (U.S.), ETFs (U.S.), futures, real stocks, and ETFs through Interactive Brokers |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | Variable spreads and algorithmic trading is allowed |

| 🎁 Contests and bonuses: | Rebate Scheme for professional clients, and Pricing Discounts for money managers |

The maximum trading leverage varies depending on the asset class and client status: for retail traders, it's 1:30; for professionals, it's 1:200. Darwinex does not provide Islamic accounts (no swaps). The broker offers ECN accounts with floating spreads and low commissions per lot. The wallet currency is set when creating the account, and all subsequent accounts will automatically be opened in that currency. The currency cannot be changed or added later.

Darwinex Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

PK Rawalpindi

PK Rawalpindi Professional Behaviour

None

KE Nairobi

KE Nairobi Starting my trading journey a few months ago, I found Darwinex's demo account to be so useful in training my skills. The access to live market data and an environment without any risks allowed me to experiment with different trading strategies without the fear of losing money. Darwinex Zero apart is their commitment to providing beginners like myself with a platform to gain confidence before diving into live trading. The demo account not only allowed me to familiarize myself with their platform but also gave me the chance to test out different trading techniques and improve my approach. Thanks to Darwinex's demo account, I was able to build the confidence and skills needed to transition into live trading with ease. It's the ideal starting point for anyone looking to embark on their trading journey, and I couldn't recommend it more highly to fellow beginners.

None

PK Islamabad

PK Islamabad Profitable spreads for intraday trading

----

US New York

US New York Good performance of the trading platform

no weaknesses

PK Peshawar

PK Peshawar Beginner Friendly

None

KE Nairobi

KE Nairobi Great interface and real-time updates

Must-have tool

PK Chichawatni

PK Chichawatni Lots of educational information for beginners

I like everything, I don't see any disadvantages

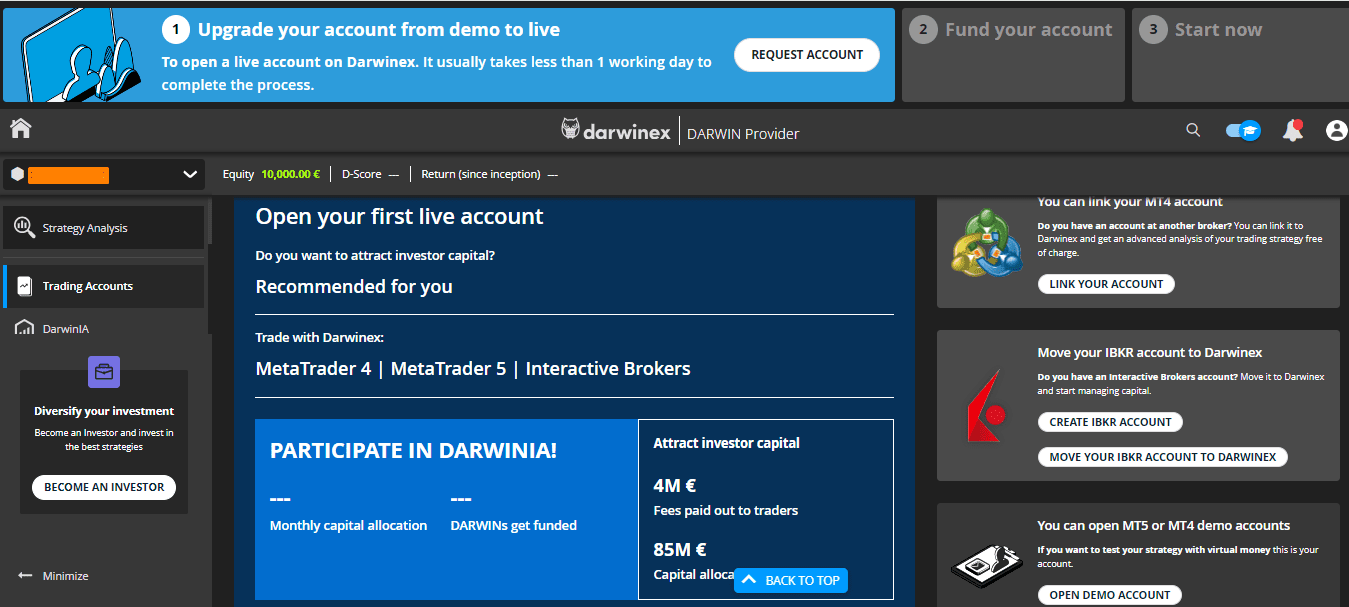

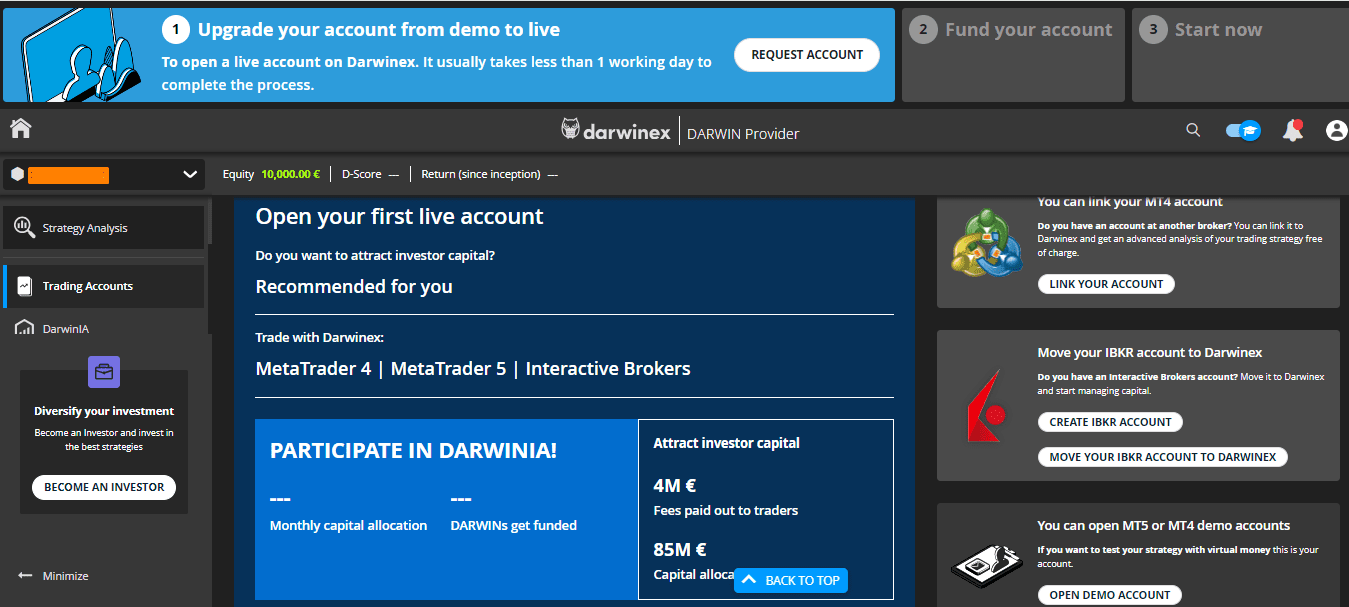

Trading Account Opening

You won't be able to access your user account on the Darwinex website unless you are registered with this broker. To do so, follow these simple steps:

On the official Darwinex broker website, click Open A Live Account.

Fill out the account opening form, providing personal information and answering questions about trading experience, investment goals, and income sources. The form also requires entering an email address and password (which can be created manually or generated automatically using special programs). The email and password are needed for client account authorization.

In the Darwinex user account, the user can do the following actions:

Your Darwinex user account also allows you to:

-

Upload documents for identification.

-

Deposit and withdraw funds.

-

View information on rebates and commission discounts.

-

Analyze trading strategies.

-

View rating of top managers.

-

Access Portfolio statistics.

Regulation and safety

Darwinex has a safety score of 9.7/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 13 years

- Strict requirements and extensive documentation to open an account

Darwinex Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

CNMV CNMV |

Comisión Nacional del Mercado de Valores | Spain | Up to €100,000 | Tier-1 |

Darwinex Security Factors

| Foundation date | 2012 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Darwinex have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Darwinex with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Darwinex’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Darwinex Standard spreads

| Darwinex | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,1 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,1 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,0 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Darwinex RAW/ECN spreads

| Darwinex | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,3 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,4 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Darwinex. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Darwinex Non-Trading Fees

| Darwinex | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0-5 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

If a trader plans to trade CFDs and Forex through Darwinex, they can use accounts on MT4 and MT5 platforms. Grading is applied to both retail and professional clients. Spreads and commission per lot are the same for all trader types but margin requirements differ. For trading basic assets, not derivatives, a trader needs to register an existing account with Interactive Brokers or open a new one through the Darwinex website.

Account types:

Darwinex offers demo accounts for MT4 and MT5. The balance of virtual funds is chosen when opening an account. Once depleted, a new account needs to be opened. If a trader doesn't use the demo account for 20 days, the account is blocked.

Traders with any level of experience can find a suitable account type at Darwinex. However, the broker has high requirements for the initial deposit.

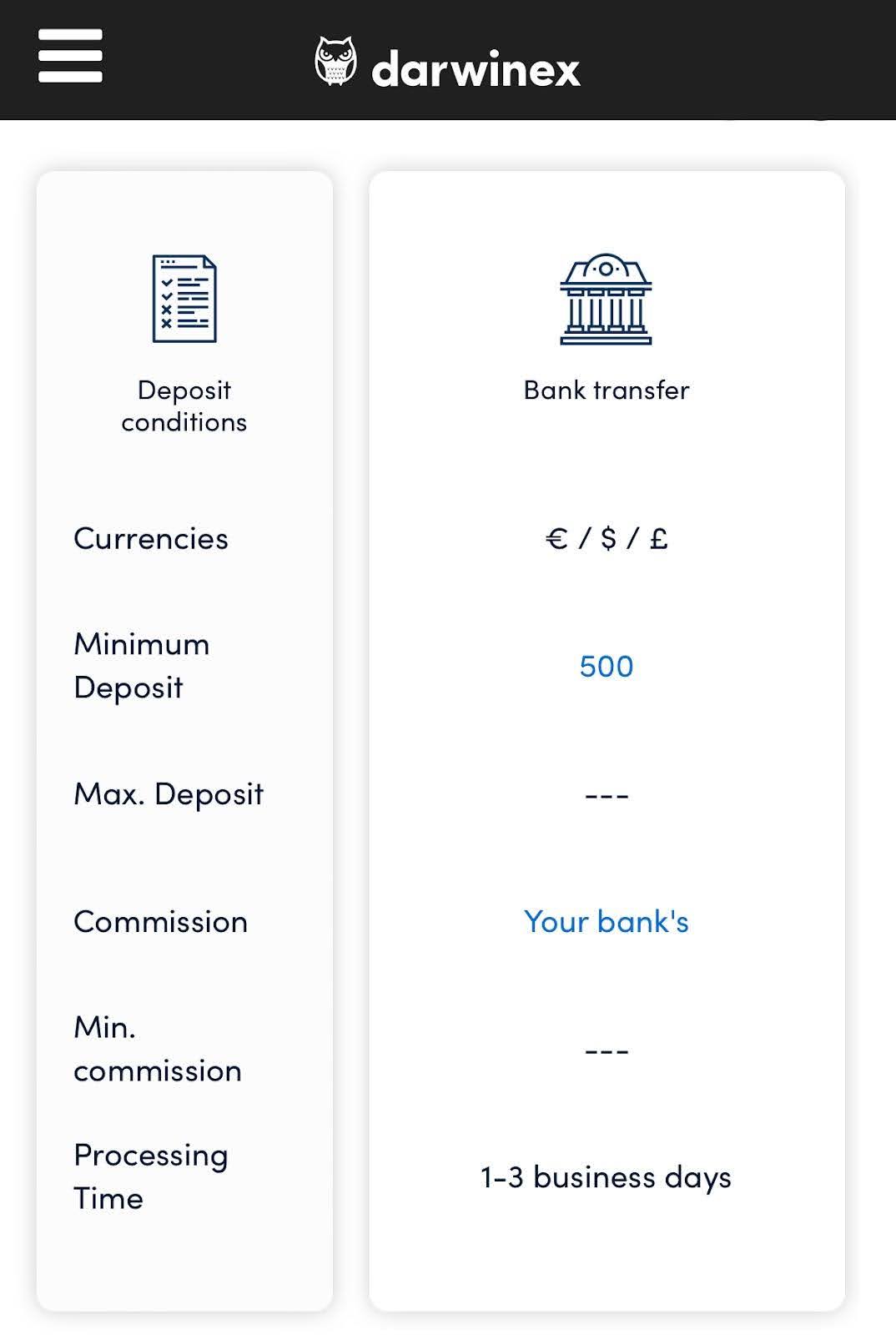

Deposit and withdrawal

Darwinex received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Darwinex provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- Bank card deposits and withdrawals

- No withdrawal fee

- Bitcoin (BTC) accepted

- Only major base currencies available

- Minimum deposit above industry average

- Wise not supported

What are Darwinex deposit and withdrawal options?

Darwinex provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC.

Darwinex Deposit and Withdrawal Methods vs Competitors

| Darwinex | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Darwinex base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Darwinex supports the following base account currencies:

What are Darwinex's minimum deposit and withdrawal amounts?

The minimum deposit on Darwinex is $500, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Darwinex’s support team.

Markets and tradable assets

Darwinex provides a standard range of trading assets in line with the market average. The platform includes 956 assets in total and 80 Forex currency pairs.

- 956 assets for trading

- 80 supported currency pairs

- Commodity futures are available

- Copy trading not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Darwinex with its competitors, making it easier for you to find the perfect fit.

| Darwinex | Plus500 | Pepperstone | |

| Currency pairs | 80 | 60 | 90 |

| Total tradable assets | 956 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Darwinex offers for beginner traders and investors who prefer not to engage in active trading.

| Darwinex | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Darwinex received a score of 7.15/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- Strategy (EA) Builder is available

- Trading bots (EAs) allowed

- MetaTrader is available

- One-click trading

- No access to API

- No access to Free VPS

- No access to cTrader and its advanced tools.

Supported trading platforms

Darwinex supports the following trading platforms: MT4, MT5. This selection covers the basic needs of most retail traders. We also compared Darwinex’s platform availability with that of top competitors to assess its relative market position.

| Darwinex | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key Darwinex’s trading platform features

We also evaluated whether Darwinex offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | No |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 68 |

| Tradable assets | 956 |

Additional trading tools

Darwinex offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Darwinex trading tools vs competitors

| Darwinex | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | No | No | Yes |

| Strategy (EA) builder | Yes | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

Darwinex supports mobile trading, offering dedicated apps for both iOS and Android. Darwinex received a score of 7/10 in this section, indicating a generally acceptable mobile trading experience.

- Supports mobile 2FA

- Strong Android user ratings, currently at 5/5

- Solid iOS user feedback, with a rating of 5/5

- Low app installs across iOS and Android

- Indicators not supported

We compared Darwinex with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Darwinex | Plus500 | Pepperstone | |

| Total downloads | 10,000 | 10,000,000 | 100,000 |

| App Store score | 5 | 4.7 | 4.0 |

| Google Play score | 5 | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | No | Yes | Yes |

| Mob. Alerts | No | Yes | Yes |

Education

In the footer of the Darwinex website, there is a Support section that provides useful information for beginners and potential clients.

Demo accounts help reinforce theoretical knowledge in practice. Trading in a simulator on the chosen platform (MT4 or MT5) allows you to prepare for entering the real market.

Customer support

Chat on the Darwinex website operates 24/7, thanks to the built-in bot. Communication with both the chatbot and live operators is available in Spanish, English, French, and Chinese.

Advantages

- Chatbot responds quickly

- Variety of communication channels are available

Disadvantages

- Chat operators are not available 24-hour

- There is no support through messaging apps

To contact the company, a trader can:

Call the numbers provided on the website.

Send an email.

Engage in the online chat.

Fill out the feedback form.

If a client encounters a situation preventing them from trading under normal conditions, they can fill out a special form for an emergency contact request.

Contacts

| Foundation date | 2012 |

|---|---|

| Registration address | Sapiens Markets EU Sociedad de Valores SA, Calle de Recoletos, 19, Bajo, 28001 Madrid, Spain |

| Regulation |

CNMV, FCA

Licence number: 586466 |

| Official site | darwinex.com |

| Contacts |

+44 20 3769 1554

|

Comparison of Darwinex with other Brokers

| Darwinex | Eightcap | XM Group | RoboForex | Markets4you | InstaForex | |

| Trading platform |

MT4, MT5, DARWIN API, FIX | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MobileTrading, MT5 | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $500 | $100 | $5 | $10 | No | $1 |

| Leverage |

From 1:1 to 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:10 to 1:4000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 20% | 30% / 10% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | Yes |

Detailed review of Darwinex

Darwinex works with verified liquidity providers and top-level banks in Spain. All servers (liquidity providers, Darwinex's Metatrader trading, and VPS from BeeksFX) are located at the Equinix LD4 data center in London. This ensures the maximum data transmission speed, a priority for brokers using ECN technology. Retail clients benefit from protection against negative balances, helping to limit losses in leverage trading.

Darwinex by the numbers:

The broker has 11+ years of experience in financial markets.

The broker is regulated by 2 authorities.

The broker has up to €100,000 compensation per client in case of bankruptcy.

Over 950 CFDs are available.

The broker has over $140 million in assets under management.

Darwinex is a broker offering a wide range of derivatives and leverage trading

Currently, the broker provides 42 currency pairs with leverage up to 1:20-1:30 for retail, and up to 1:200 for professional traders. Trading the top 10 global indices in CFD format is also available, with leverage up to 1:10 for SPA35 and up to 1:16 for others. Commodity choices are limited to gold, platinum, oil, and gas, with retail client leverage up to 1:20. ETFs and stocks are represented by U.S. assets, including over 100 CFDs on ETFs from well-known fund providers (Vanguard, Invesco, iShares) and over 800 CFDs on stocks included in the Dow Jones index and traded on Nasdaq and NYSE exchanges.

For Forex and CFD trading, Darwinex offers MetaTrader trading platforms - MT4 and MT5. Traders can connect their accounts to Interactive Brokers and trade on more advanced platforms such as NinjaTrader, TWS (Trader Workstation), or TradingView.

Darwinex’s analytical services:

Blog with news and important updates about Darwinex's product lineup.

Articles with tips for beginners, and recommendations for refining trading strategies for advanced traders.

Capital management programs that both investors and experienced traders with successful strategies can participate in.

Board with exchange hours and trading schedule changes.

Advantages:

The broker provides access to advanced trading and analytical platforms from third-party developers.

Liquidity aggregation from two sources with different quote generation models.

The broker provides discounts on trading commissions for successful trading.

No prohibition on algorithmic trading using EAs, APIs, and the Zorro tool.

The ability to combine trading and investment activities within a single account.

Darwinex offers the most accurate and fastest execution, and ECN pricing model. The broker works not only with professionals but also with retail traders from more than 100 countries.

Latest Darwinex News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i