According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- MetaTrader5

- Markets.com

- CySEC

- FCA

- ASIC

- FSCA

- BVI FSC

- 2006

Our Evaluation of Markets.com

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Markets.com is a moderate-risk broker with the TU Overall Score of 6.09 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Markets.com clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Markets.com is a licensed active and passive trading broker that is more suitable for experienced traders with capital stock.

Brief Look at Markets.com

Established in 2009, Markets.com has grown to become one of the most trustworthy Forex&CFD brokers. Markets.com is fully regulated by the FCA (507880), ASIC (424008), FSCA (46860), CySEC (092/08), and the BVI FSC (SIBA/L/14/1067). The company accepts customers globally and offers every customer unmatched smooth trading services. With Markets.com, one can trade with more than 2,200 trading tools, and use multiple technical and analytical tools on an innovative Investment platform.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- licensed and monitored by four reputable regulators;

- a wide range of Forex and CFD trading instruments;

- no restrictions on the use of trading strategies.

- minimum deposit of $100;

- availability of swaps for moving a position to the next day;

- complex site navigation.

TU Expert Advice

Author, Financial Expert at Traders Union

Markets.com offers a variety of trading instruments encompassing currencies, cryptocurrencies, and indices through MetaTrader 4 and MetaTrader 5 platforms. Its clients can open the Standard account with a minimum deposit of $100, benefiting from leverage up to 1:500. The broker provides extensive educational resources, economic calendars, and real-time expert insights to facilitate informed trading for its clients.

However, Markets.com may have some drawbacks, including a minimum deposit requirement that may not appeal to all investors, especially beginners. Additionally, website navigation can be complex, and spreads may be wider compared to some competitors. Considering these factors, Markets.com may be more suitable for experienced traders who can utilize a broad spectrum of instruments and educational features, but it may not be ideal for those prioritizing lower trading costs or ease of use.

- You're skill-conscious, as in you're new to trading or have some experience, because their user-friendly platforms (WebTrader, MT4, MT5) and educational resources are tailored to your level, providing a supportive environment for learning and growth.

- You want diverse asset choices as they offer a wide range of CFDs on forex, shares, commodities, indices, ETFs, and cryptocurrencies, giving you ample opportunities to diversify your investment portfolio and explore different markets.

- You value transparent pricing as they offer commission-free trading with spreads built into the price, ensuring transparency in pricing and eliminating hidden fees or charges.

- You prioritize tightest spreads as while their spreads are transparent, they might not offer the tightest spreads compared to some rivals. If getting the absolute lowest spreads is your priority, you may want to consider other brokers with narrower spreads.

- You reside in an unsupported jurisdiction as they don't accept clients from certain countries, like the US and Canada.

Markets.com Trading Conditions

Your capital is at risk. 74.2% of retail investor accounts lose money when trading CFDs with this provider. Markets.com Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, Markets.com platform |

|---|---|

| 📊 Accounts: | Demo, Standard |

| 💰 Account currency: | EUR, USD, GBP, SEK, DKK, ZAR, NOK, PLN, AUD, AED, CZK |

| 💵 Deposit / Withdrawal: | Bank transfer, bank cards Visa/Mastercard, Neteller, Skrill, PayPal |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,5-1,8 pips |

| 🔧 Instruments: | Currencies, cryptocurrencies, stocks, ETFs, indices, bonds, commodities, precious metals, blends |

| 💹 Margin Call / Stop Out: | 50% |

| 🏛 Liquidity provider: | Not listed on the site |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Instant execution, Market execution |

| ⭐ Trading features: | Markets.com proprietary platform |

| 🎁 Contests and bonuses: | No |

Markets.com’s trading conditions are not suitable for every trader. The minimum deposit starts at $100 and the leverage does not exceed 1:500. The broker offers accounts with floating spreads. The minimum trade volume is 0.01 lot.

Markets.com Key Parameters Evaluation

Video Review of Markets.com

Share your experience

- Best

- Last

- Oldest

ZA Johannesburg

ZA Johannesburg Office are local South Africa.

Bad customer Support

Trading Account Opening

To start trading with Markets.com and receive spread compensation from Traders Union, you need to follow these steps:

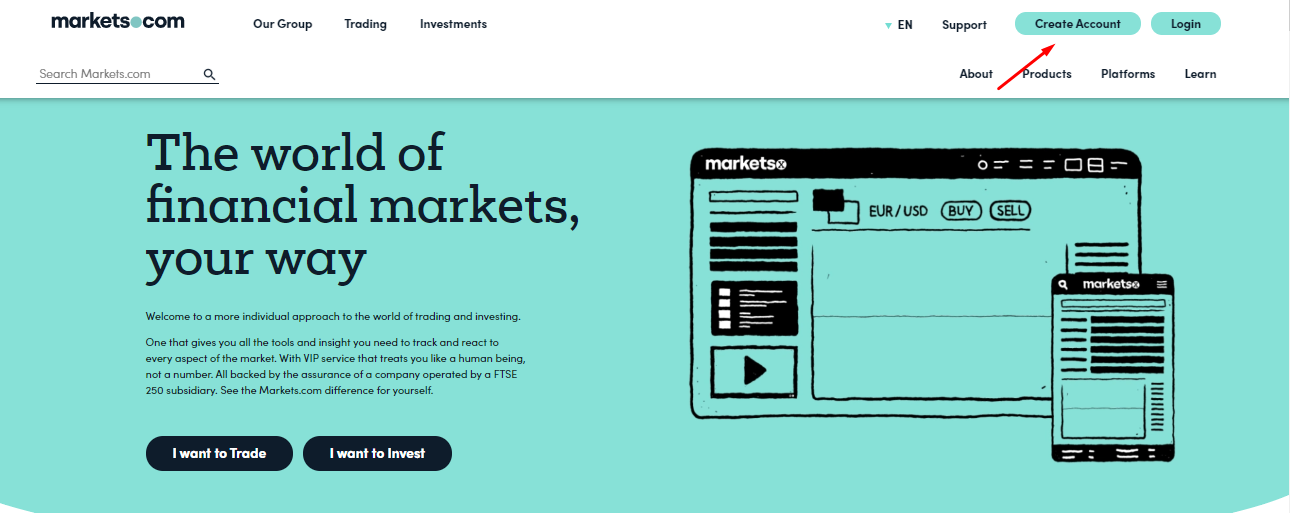

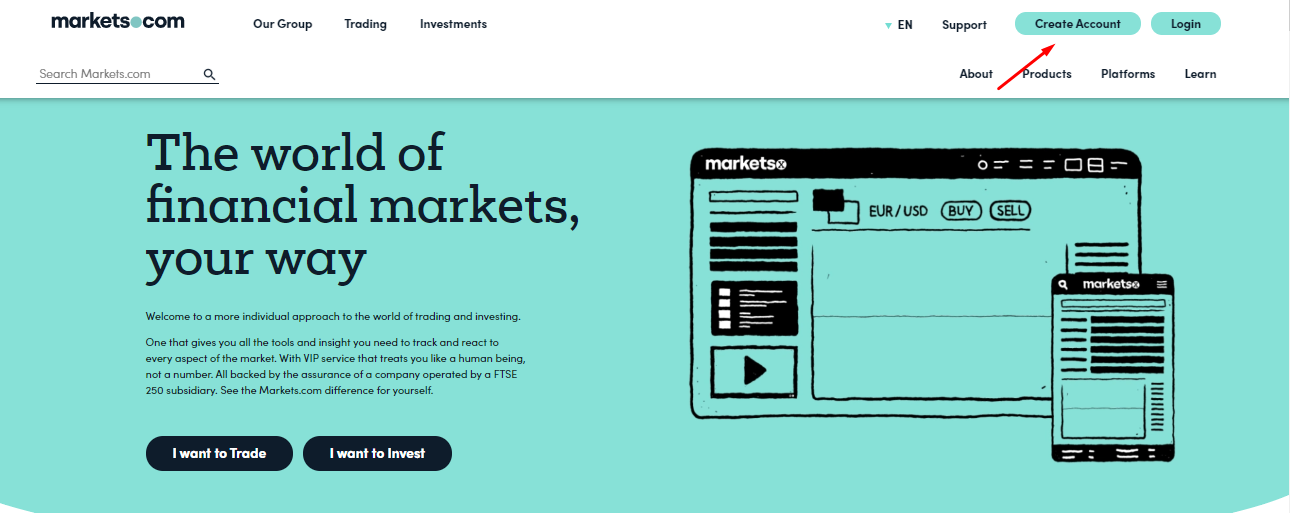

Register on the Traders Union website, and using the referral link, go to the broker's official website. On the main page, click the "Create Account" button.

You can register in several ways - through your personal Google, Facebook, and Apple accounts, or by filling out a dedicated form. In the latter case, you need to provide an email address, a password, and select the currency for the account. Then you should indicate your personal information: name, surname, telephone number, residence address, and citizenship, as well as financial data, trading experience, and level of financial knowledge.

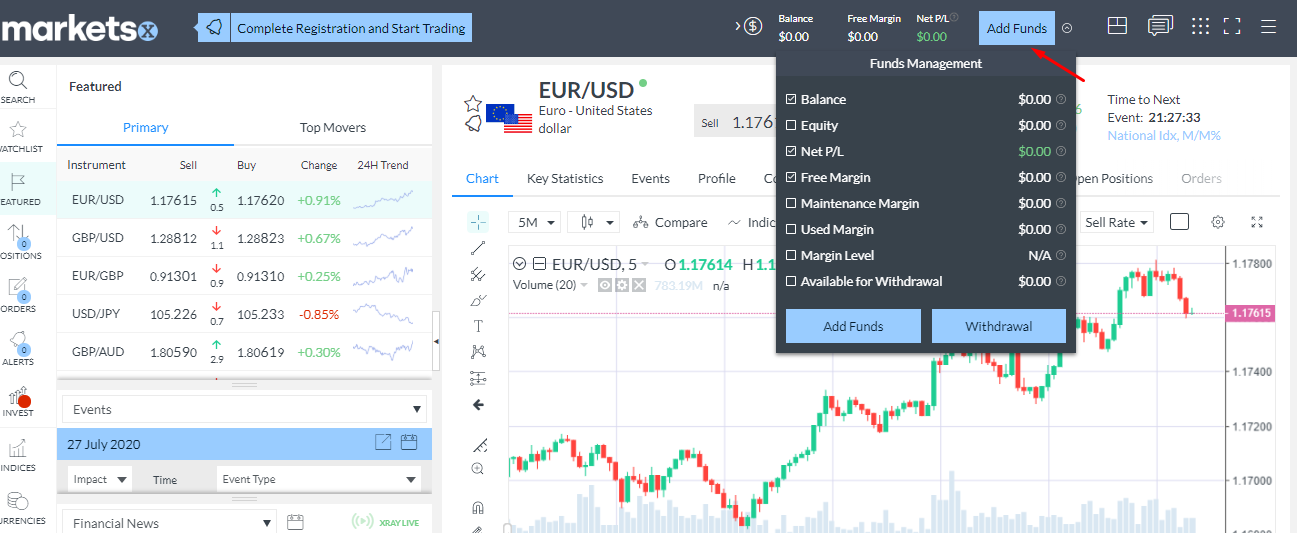

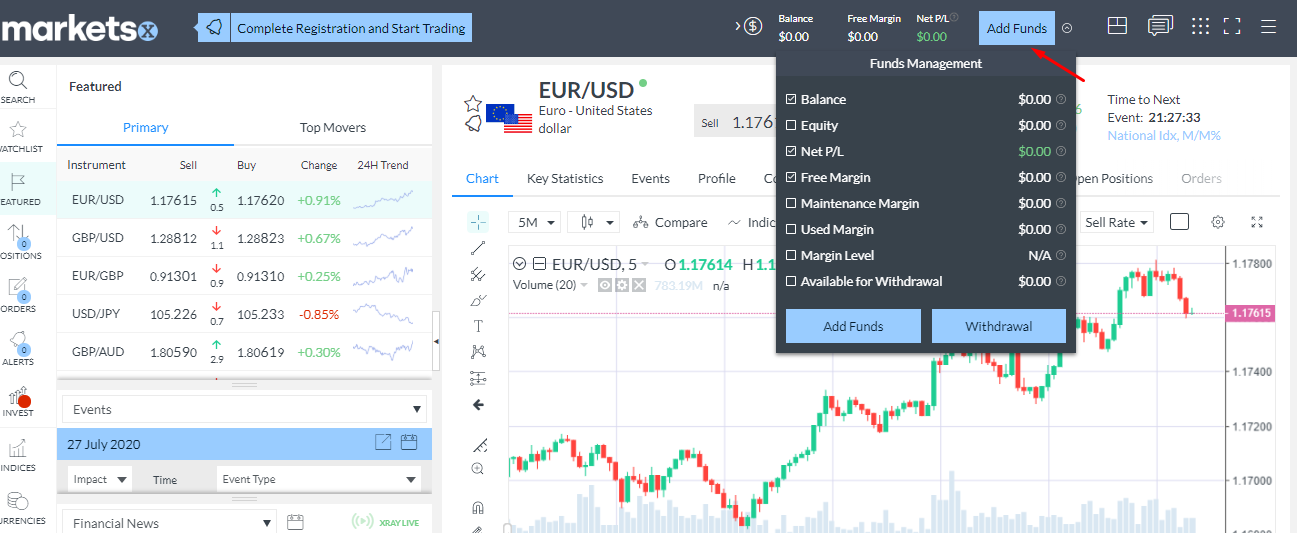

The following functions are available in the Personal account of Markets.com:

The following data is also displayed in the Trader's Personal account:

-

latest economic news, as well as the news archive;

-

an economic calendar with dates and work schedules of various financial exchanges that are relevant to traders;

-

currency quotes that are updated in real-time;

-

information about open and closed orders for a certain period.

Regulation and safety

Markets.com has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 19 years

- Strict requirements and extensive documentation to open an account

Markets.com Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

BVI FSC BVI FSC |

British Virgin Islands Financial Services Commission | British Virgin Islands | No specific fund | Tier-2 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

Markets.com Security Factors

| Foundation date | 2006 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Markets.com have been analyzed and rated as High with a fees score of 4/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Markets.com with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Markets.com’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Markets.com Standard spreads

| Markets.com | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,6 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,0 | 1,4 | 0,5 |

Does Markets.com support RAW/ECN accounts?

As we discovered, Markets.com does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Markets.com. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Markets.com Non-Trading Fees

| Markets.com | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 10 | 0 | 0 |

Account types

Markets.com offers its clients one main account type. Trading accounts differ in the type and size of the spread, as well as the amount of the minimum deposit. There are no micro (cent) accounts, and the minimum deposit of $100 is more geared toward professional traders.

Account types:

The broker provides a free demo account with $10,000 of virtual funds so that traders can test the platform before depositing their own funds.

Markets.com is suitable for both beginners and experienced traders. The broker provides clients with a knowledge center where beginner traders can familiarize themselves with trading terminology as well as the different trading tools offered.

Deposit and withdrawal

Markets.com received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Markets.com provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No withdrawal fee

- Bank card deposits and withdrawals

- BTC available as a base account currency

- No deposit fee

- PayPal not supported

- Wise not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

What are Markets.com deposit and withdrawal options?

Markets.com provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, BTC, USDT.

Markets.com Deposit and Withdrawal Methods vs Competitors

| Markets.com | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Markets.com base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Markets.com supports the following base account currencies:

What are Markets.com's minimum deposit and withdrawal amounts?

The minimum deposit on Markets.com is $100, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Markets.com’s support team.

Markets and tradable assets

Markets.com offers a limited selection of trading assets compared to the market average. The platform supports 465 assets in total, including 70 Forex pairs.

- Passive income with bonds

- Indices trading

- Crypto trading

- Futures not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by Markets.com with its competitors, making it easier for you to find the perfect fit.

| Markets.com | Plus500 | Pepperstone | |

| Currency pairs | 70 | 60 | 90 |

| Total tradable assets | 465 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Markets.com offers for beginner traders and investors who prefer not to engage in active trading.

| Markets.com | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Markets.com received a score of 8.85/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- Trade directly from TradingView

- cTrader with advanced tools and Level II pricing

- One-click trading

- Trading bots (EAs) allowed

- No access to a proprietary platform

- Strategy (EA) Builder is not available

- No access to API

Supported trading platforms

Markets.com supports the following trading platforms: MT4, MT5, cTrader, TradingView. This selection covers the basic needs of most retail traders. We also compared Markets.com’s platform availability with that of top competitors to assess its relative market position.

| Markets.com | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | Yes | No | Yes |

| TradingView | Yes | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key Markets.com’s trading platform features

We also evaluated whether Markets.com offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 68 |

| Tradable assets | 465 |

Additional trading tools

Markets.com offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Markets.com trading tools vs competitors

| Markets.com | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | Yes | No | Yes |

Mobile apps

Markets.com supports mobile trading, offering dedicated apps for both iOS and Android. Markets.com received a score of 6.5/10 in this section, indicating a generally acceptable mobile trading experience.

- Strong Android user ratings, currently at 4.6/5

- Solid iOS user feedback, with a rating of 4.6/5

- Indicators supported

- Mobile alerts not supported

- Mobile 2FA not supported

We compared Markets.com with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Markets.com | Plus500 | Pepperstone | |

| Total downloads | 1,000,000 | 10,000,000 | 100,000 |

| App Store score | 4.6 | 4.7 | 4.0 |

| Google Play score | 4.6 | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | No | Yes | Yes |

Education

Information

The broker's website contains a training section called "Knowledge Center" with information and education materials on Forex trading and investment principles. There are also subsections with analytics, online news, and answers to popular questions.

The theoretical knowledge gained can be tested on a virtual demo account.

Customer support

Information

The broker's support service is open from 22:00 Sunday to 21:00 Friday (GMT + 00).

Advantages

- There are online chat and telephone support

- Multilingual support

Disadvantages

- Closed on weekends

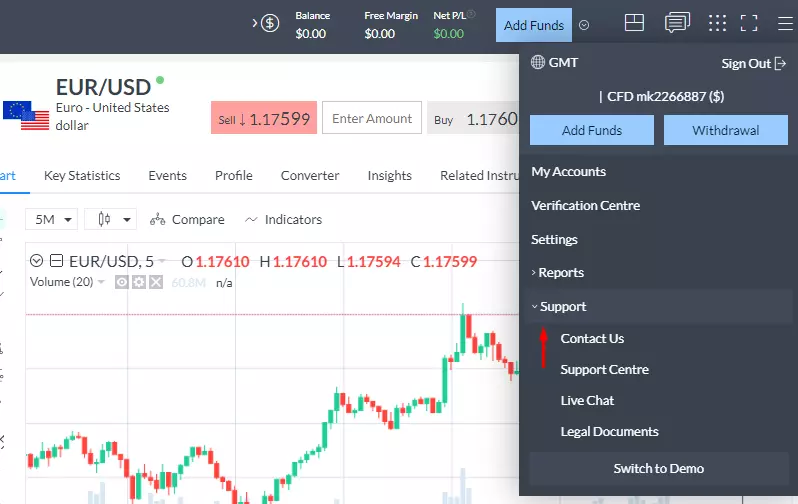

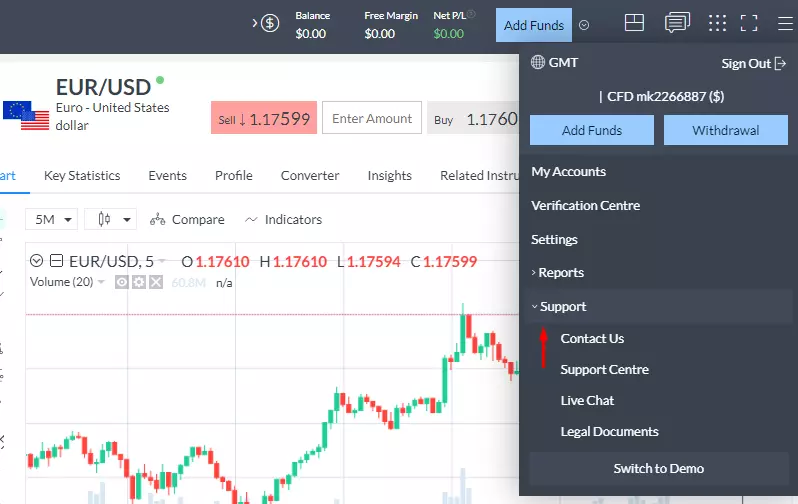

There are several ways to contact Customer support:

-

by phone, as specified in the contact section;

-

by email;

-

in the online chat on the broker's website.

Support is available from the broker's website and from your Personal Account.

Contacts

| Foundation date | 2006 |

|---|---|

| Registration address | 148 Strovolos Avenue, 2048, Strovolos, P.O.Box 28132, Nicosia, Cyprus. |

| Regulation | CySEC, FCA, ASIC, FSCA, BVI FSC |

| Official site | markets.com |

| Contacts |

+442031500380

|

Comparison of Markets.com with other Brokers

| Markets.com | Eightcap | XM Group | RoboForex | TeleTrade | FxPro | |

| Trading platform |

MT4, MT5, Mobile, Markets.com | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $250 | $100 | $5 | $10 | $10 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | 1.00% | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 70% / 20% | 25% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed Review of Markets.com

Markets.com is a subsidiary of the Safecap Investment Ltd group, which is part of Playtech PLC investment holdings. It is listed on the London Stock Exchange under the symbol "PTEC" and is also listed on the FTSE 250. Through the implementation of innovative solutions, the broker provides its clients with the opportunity to trade on the global financial markets online. However, accounts with Markets.com cannot be opened by citizens of Japan, Canada, Belgium, or the United States.

A few figures about Markets.com that will be of interest to traders who are in the process of choosing a broker:

-

more than 2,200 trading instruments;

-

5 licenses from reputable regulators - CySEC, FCA, ASIC, FSCA and BVI FSC;

-

more than 12 years in the international Forex market.

Markets.com is a broker for experienced traders

Markets.com is a reliable broker that provides quality service and favorable conditions for traders with a certain amount of trading knowledge. The company's clients trade from standard and premium accounts with instant execution and market execution. For the safety of its clients, Markets.com uses the SSL protocol, which protects its servers from unauthorized access. Also, the broker cooperates only with international payment systems with PCI level certificates. The company's servers are located in data centers certified in accordance with SAS 70, which is the standard for storing confidential information that was developed by the AICPA Institute.

Clients trade through the broker's own Markets.com platform, as well as MetaTrader 4 and MetaTrader 5. The company provides a web terminal and makes it possible to work through mobile devices based on the Android and iOS operating systems. Connecting to a multi-terminal platform allows you to parallel trade from multiple accounts.

Useful Markets.com Services:

-

Advanced Charts allow you to track positions, view forecasts, and compare assets, which can be customized;

-

Economic calendar displays important events such as central bank notifications, PMIs, inflation reports, etc .;

-

XRay Streaming Service displays comments from renowned Forex financiers and experts. The XRay content is broadcast in real-time and is recorded for display at a later time for the user.

Advantages:

high reliability of the broker because it is monitored by several international regulators;

customer funds are held in segregated accounts that are not linked to company accounts;

8 types of trading assets, the total number of which exceeds 2200 instruments;

the ability to choose accounts with fixed and floating spreads;

availability of mobile terminals and a web platform;

advisors are allowed.

Traders who have opened an account with a broker can use any trading strategies, including hedging, locking, and scalping.

Latest Markets.com News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i