According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- FCA

- SCB

- 2008

Our Evaluation of Capital Index

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Capital Index is a moderate-risk broker with the TU Overall Score of 5.99 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Capital Index clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The broker targets active traders regardless of their level of trading experience but does not provide an opportunity to earn passive income.

Brief Look at Capital Index

Capital Index UK was established in 2014. The broker provides all conditions and instruments required for active trading on the spread rates and the Forex market. Capital Index is registered in the UK territory and is regulated by the Financial Conduct Authority (FCA, UK, 709693). Capital Index (Global Limited) is authorized and regulated by the Securities Commission of the Bahamas (SCB, SIA-F199). The broker has not provided information about the awards it has received.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- User-friendly website interface;

- Possibility to trade micro-lots;

- Accounts for beginners and professional traders.

- No cent accounts for novice traders;

- Limited educational materials;

- Small leverage;

- No investment or referral programs for earning passive income.

TU Expert Advice

Author, Financial Expert at Traders Union

Capital Index provides a variety of trading services, including Forex and CFDs on metals, commodities, and indices, accessible via the widely used MetaTrader 4 platform. The broker offers three account types tailored for novice to professional traders, facilitating a minimum deposit of $100. With a leverage cap of 1:30 and the ability to trade micro lots, Capital Index aims to create a secure trading environment with minimized financial risk.

However, the broker's drawbacks include limited educational resources, no cent accounts, and the absence of passive income opportunities. Despite robust regulation by the FCA and SCB, the company's relatively high trading fees and reported client support issues may not suit traders who prioritize cost-efficiency and client service. Overall, Capital Index may be more appropriate for those focused on active trading rather than investment or educational enrichment.

Capital Index Trading Conditions

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Advanced Account, Pro Account, Black Account |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Deposit / Withdrawal: | Debit/credit cards, wire transfer |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3-0,5 pips |

| 🔧 Instruments: | 55 currency pairs, CFDs on precious metals, commodities, stock indices, spread betting |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Interbank liquidity |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | High-quality execution (Market Execution) |

| ⭐ Trading features: | Spread betting |

| 🎁 Contests and bonuses: | No |

Capital Index provides comfortable conditions for traders with any level of experience, from beginners to professionals. The minimum deposit is 100 units of the base currency, the minimum lot is 0.01. The leverage is not big on any account types, not exceeding 1:30, which allows traders to avoid losing large amounts of money during trading.

Capital Index Key Parameters Evaluation

Video Review of Capital Index

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To become a customer of Capital Index and use the broker’s services while receiving financial compensation from Traders Union, you need to open an account with the company. In our guide, we will tell you how to do it and will also go over the personal account and its features.

Access your Traders Union account or create a new one. Registration on the website will take no more than 10 minutes. Then, find Capital Index in the rating section and click on the referral link to access the broker’s website. On its home page, click Create Account to open a live account.

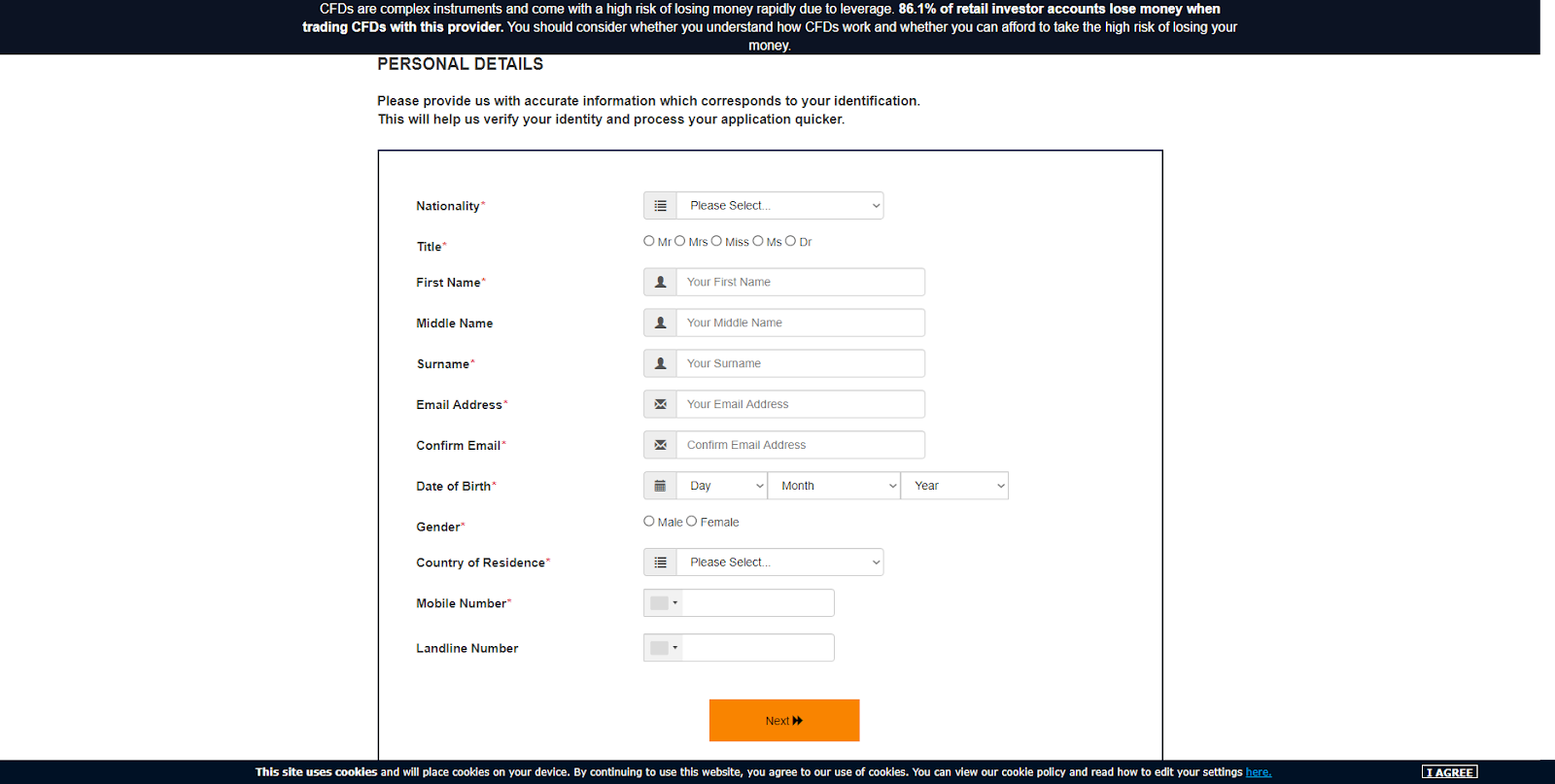

In the opened window, you will see a questionnaire. Fill it out by providing your personal information such as your first name, last name, nationality, country of residence, title, mobile number, date of birth, gender, etc. After you fill out everything on this page, press Next.

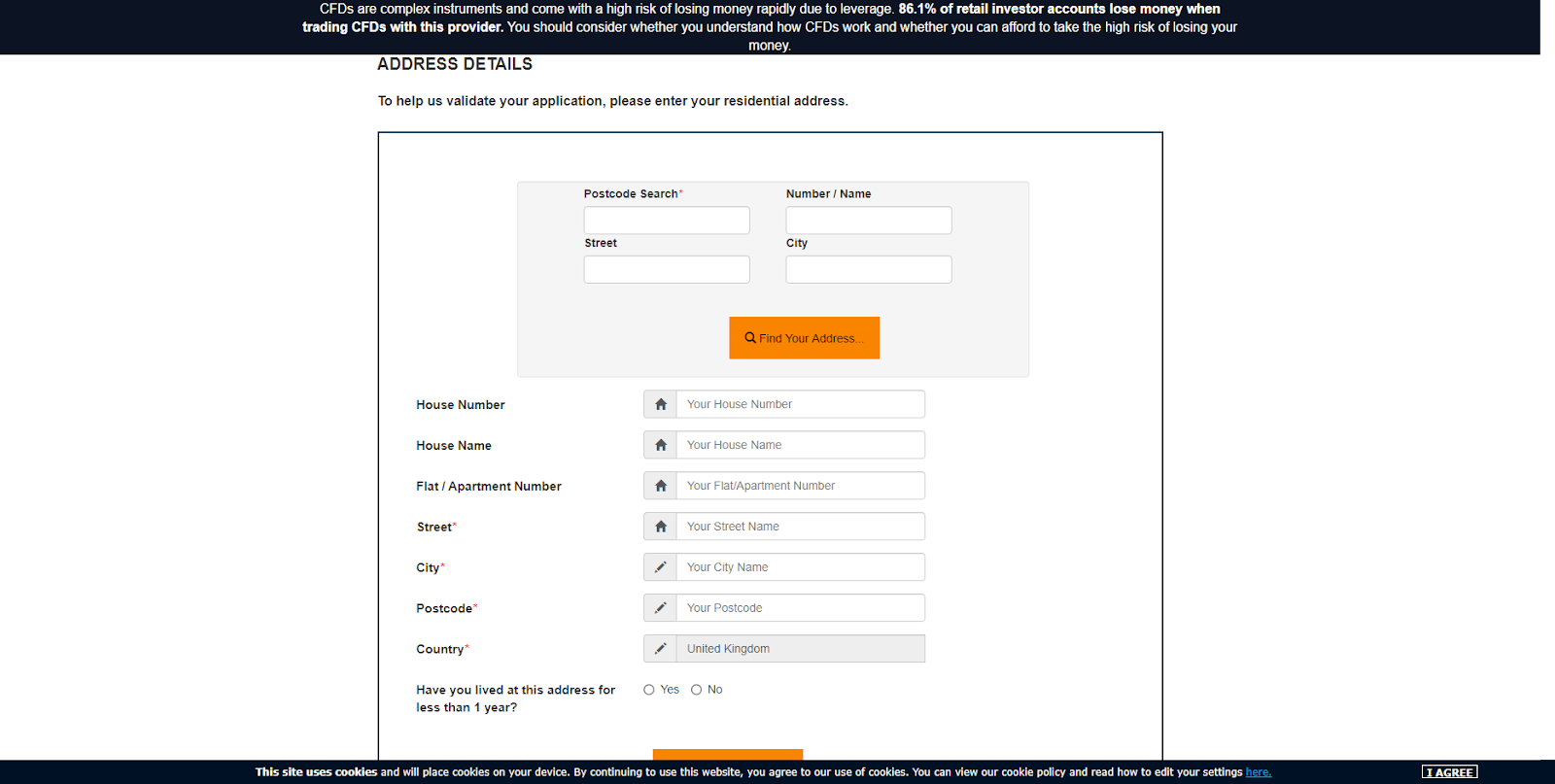

On the next page, you will be asked to provide information about your whereabouts: country, city, address, postal code, and the period of living at the current address.

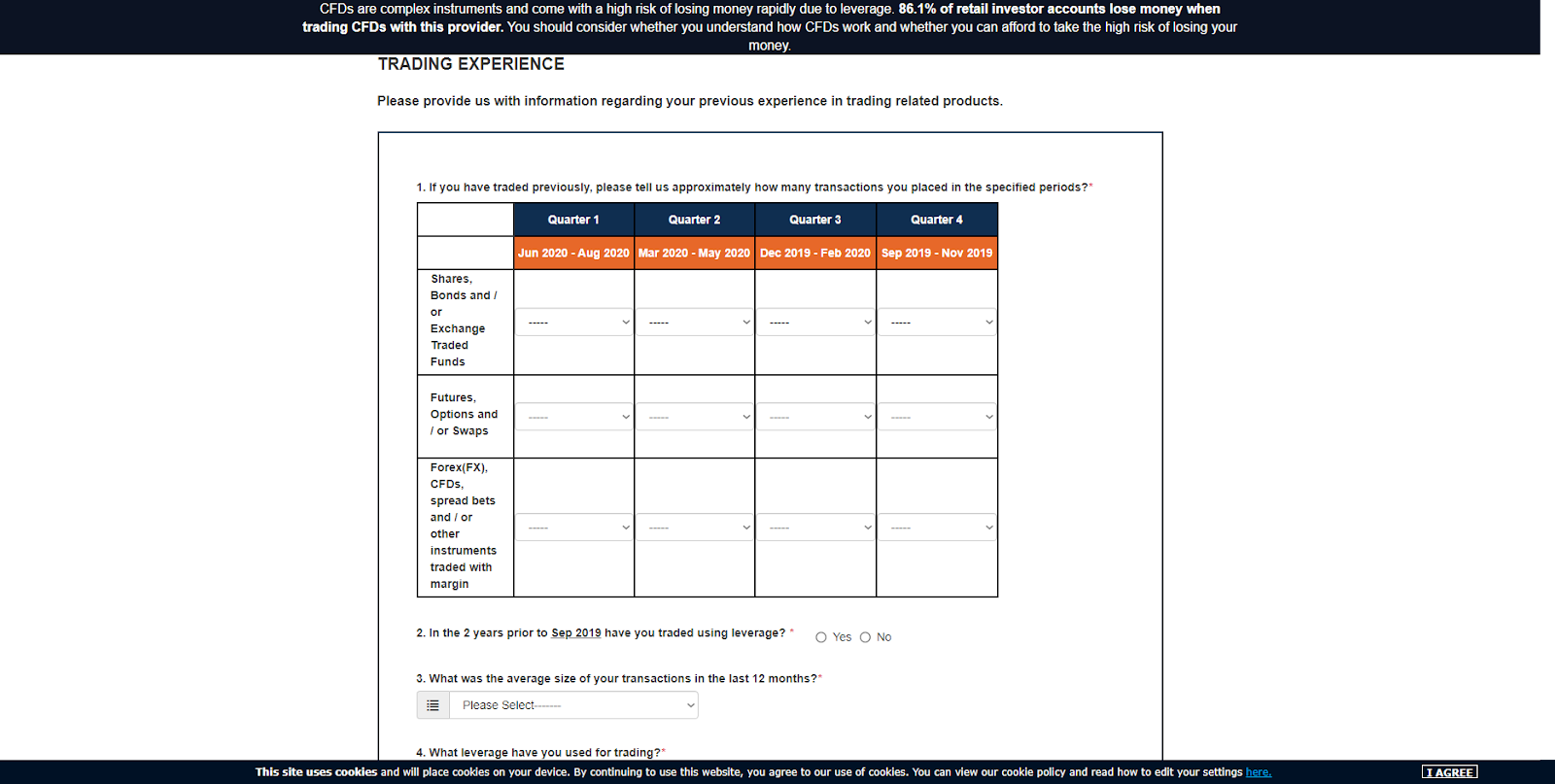

The next step is to specify your trading experience, more precisely your experience in trading currency pairs, CFDs, spread bets, and the number of closed transactions in each sector. The broker also asks you to provide information about your level of knowledge, education in finance and trading.

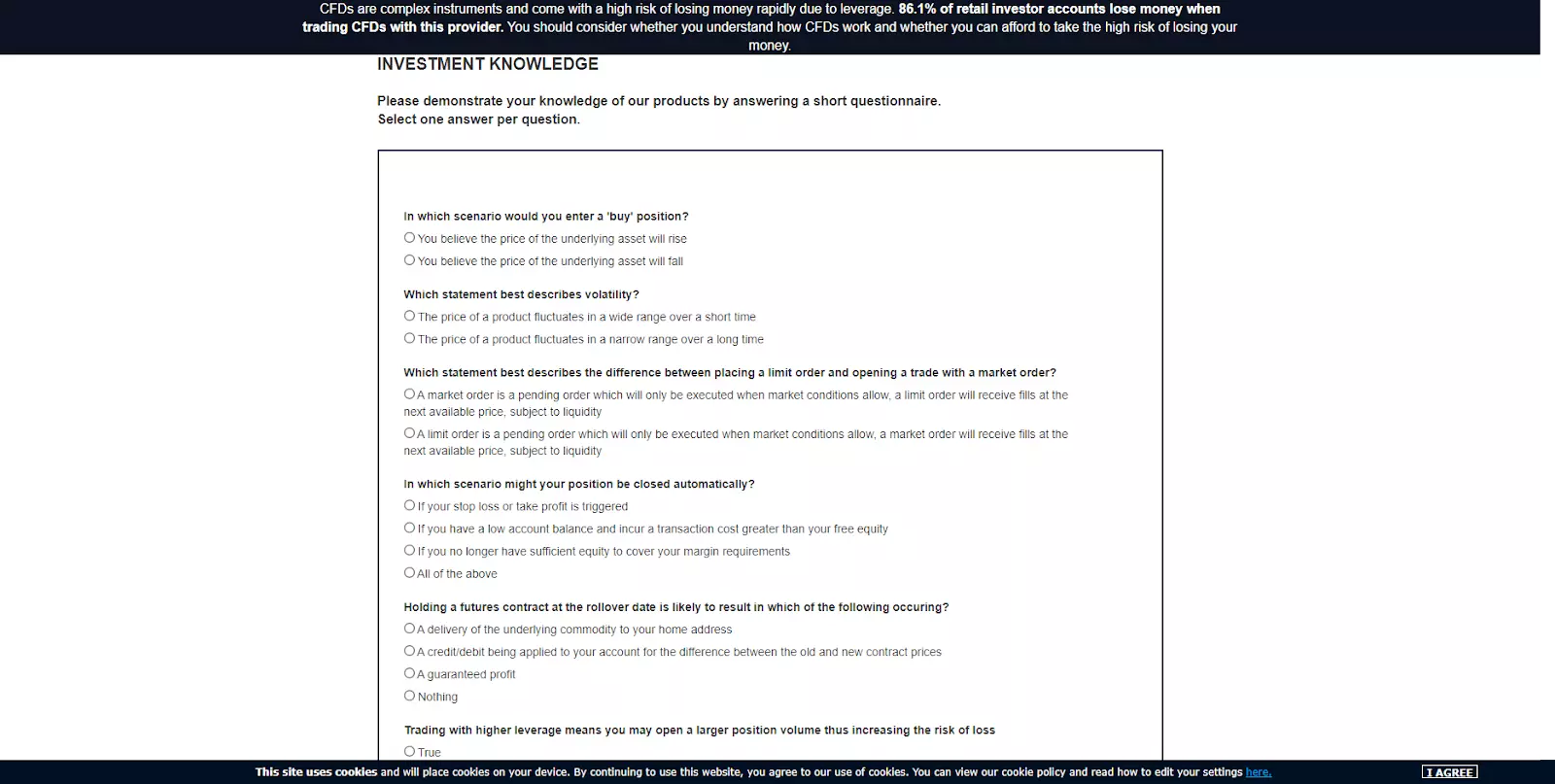

The broker then offers you a short test to check your knowledge about trading.

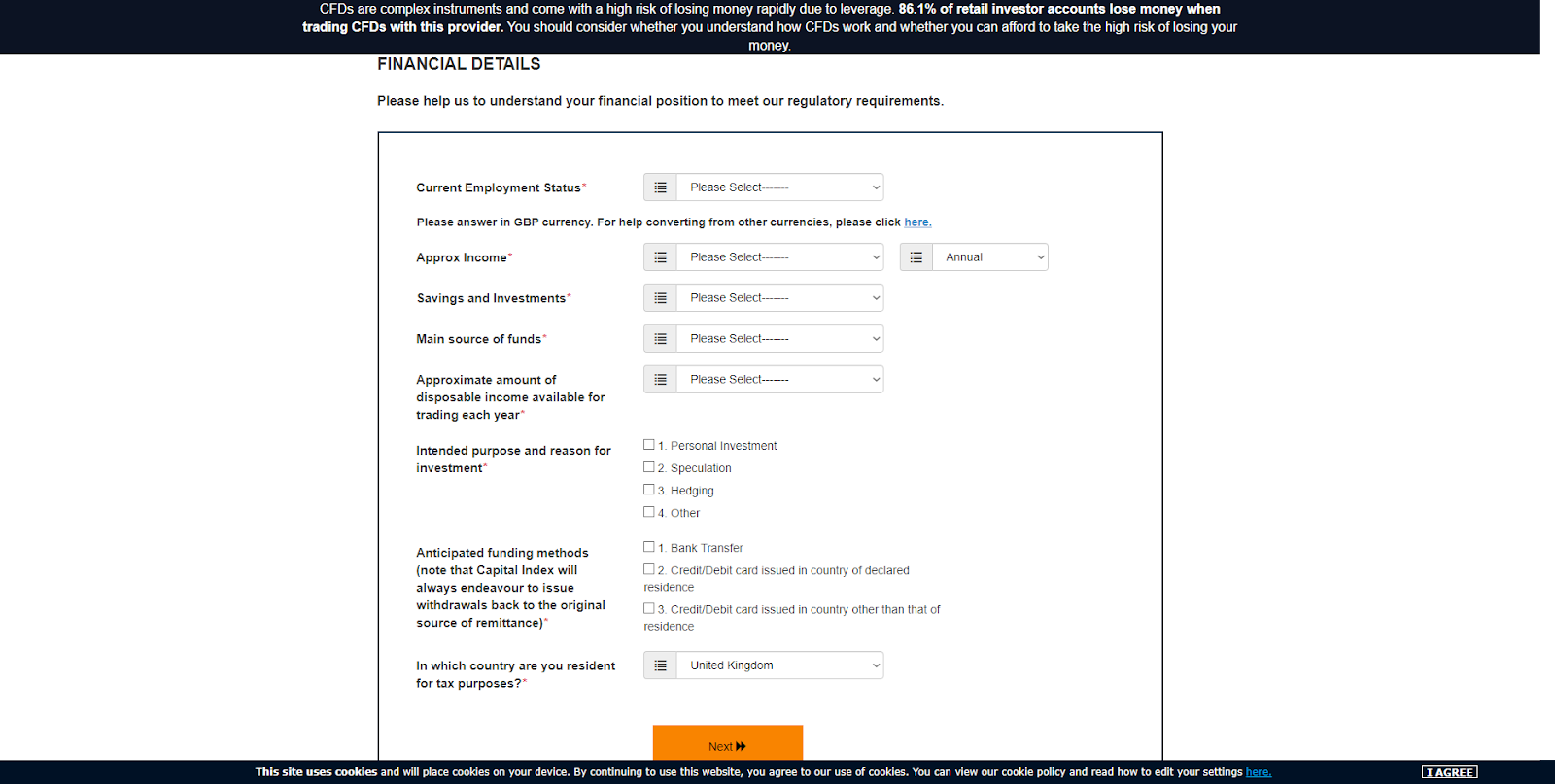

Then, you need to provide information about your financial position – your source of income, monthly income, savings, and the amount that you are prepared to invest in trading.

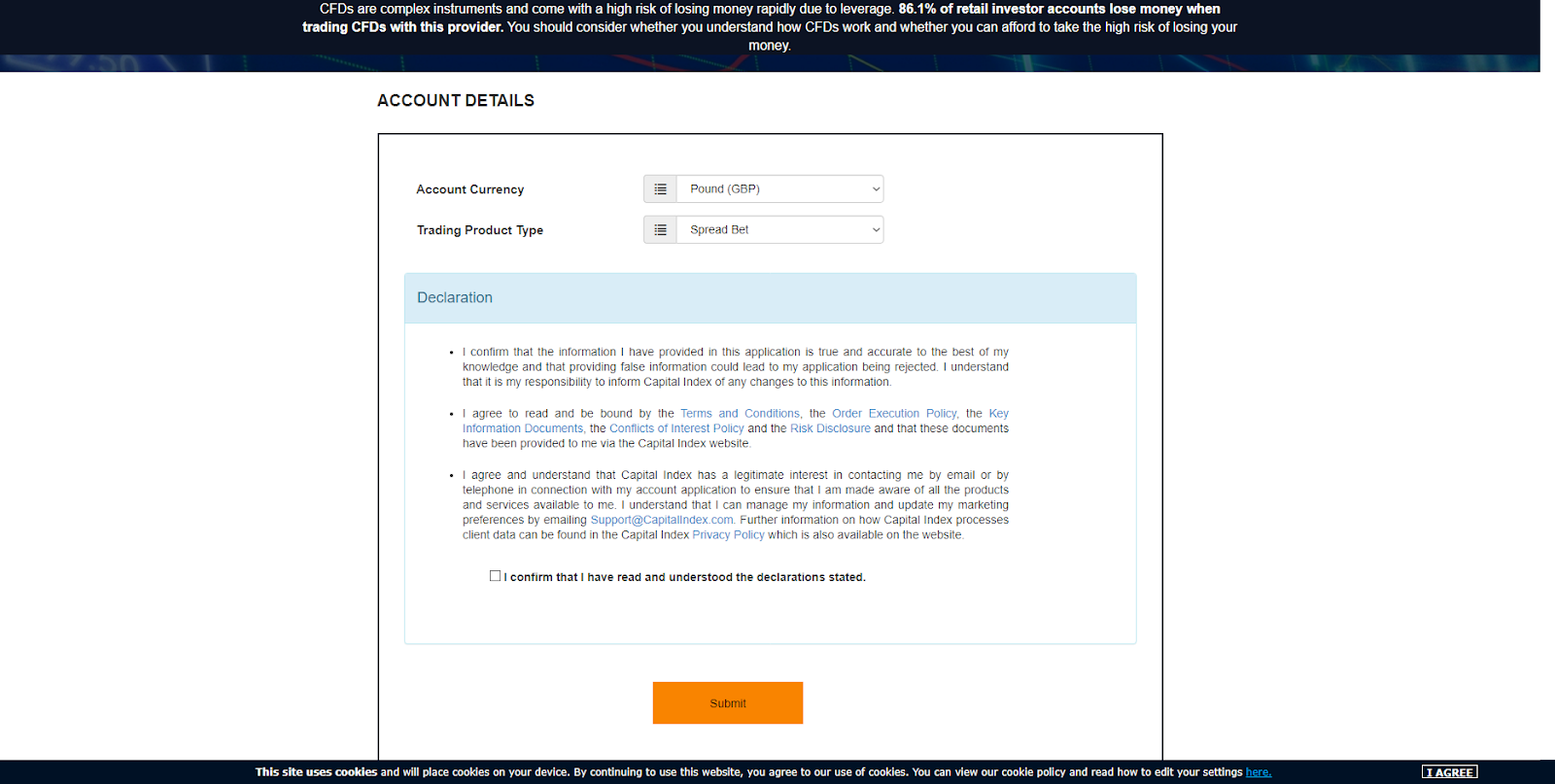

The last step is setting up your personal trading account.

After you fill out all forms, the broker will send you an email, specifying the documents you will need to provide scanned copies of, and the email address to which to send them to verify your account. Access to your personal account will be granted only after verification.

The following features are available in Personal Account:

-

Setting up Personal Account;

-

Deposits and withdrawals.

Regulation and safety

Capital Index has a safety score of 9/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 17 years

- Strict requirements and extensive documentation to open an account

Capital Index Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

Capital Index Security Factors

| Foundation date | 2008 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Capital Index have been analyzed and rated as Medium with a fees score of 5/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Capital Index with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Capital Index’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Capital Index Standard spreads

| Capital Index | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,5 | 1,4 | 0,5 |

Does Capital Index support RAW/ECN accounts?

As we discovered, Capital Index does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Capital Index. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Capital Index Non-Trading Fees

| Capital Index | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0-15 | 0 | 0-15 |

| Inactivity fee ($, per month) | 15 | 0 | 0 |

Account types

Capital Index aims at working with traders, regardless of whether they have trading experience or not. It also offers three account types to choose from. They differ by minimum deposit, spread, and commissions.

Account types:

You can use the demo account to learn more about trading conditions and possibilities provided by the broker, and not risk your own money at the same time.

Capital Index is a broker that uses innovative technologies in its operation that help bring active trading to a higher, more professional level.

Deposit and withdrawal

Capital Index received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Capital Index offers limited payment options and accessibility, which may impact its competitiveness.

- Bank wire transfers available

- Minimum deposit below industry average

- No deposit fee

- Low minimum withdrawal requirement

- Only major base currencies available

- Wise not supported

- USDT payments not accepted

What are Capital Index deposit and withdrawal options?

Capital Index offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire. This limitation may restrict flexibility for users, making Capital Index less competitive for those seeking diverse payment options.

Capital Index Deposit and Withdrawal Methods vs Competitors

| Capital Index | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Capital Index base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Capital Index supports the following base account currencies:

What are Capital Index's minimum deposit and withdrawal amounts?

The minimum deposit on Capital Index is $100, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Capital Index’s support team.

Markets and tradable assets

Capital Index offers a limited selection of trading assets compared to the market average. The platform supports 65 assets in total, including 50 Forex pairs.

- Indices trading

- 50 supported currency pairs

- Crypto trading not available

- Futures not available

%1$s Supported markets vs top competitors

We have compared the range of assets and markets supported by Capital Index with its competitors, making it easier for you to find the perfect fit.

| Capital Index | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 65 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Capital Index offers for beginner traders and investors who prefer not to engage in active trading.

| Capital Index | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

The broker offers customer support service to help traders resolve issues and get answers to their questions.

Advantages

- Sufficient number of methods of communication

- All assistance is by qualified experts

Disadvantages

- The broker does not state the operating hours of customer support

The following methods of contacting customer support are available:

-

Phone call;

-

Email;

-

Feedback form;

-

Online chat on the website.

You can contact customer support from your personal account and directly on the website.

Contacts

| Foundation date | 2008 |

|---|---|

| Registration address | P.O. Box SP 61567, Goodman’s Bay Corporate Centre, 2nd Floor, Nassau New Providence, The Bahamas. |

| Regulation |

FCA, SCB

Licence number: 709693, SIA-F199 |

| Official site | capitalindex.com |

| Contacts |

+44 207 0605120

|

Education

The broker provides its customers with basic information that will be useful to novice traders with no trading experience. There are no materials on skill enhancement on the Capital Index website.

To rule out financial risk during your first trading experience or testing of a new trading strategy, we advise you to use the demo account.

Comparison of Capital Index with other Brokers

| Capital Index | Bybit | Eightcap | XM Group | VT Markets | NPBFX | |

| Trading platform |

MetaTrader4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ | MT4 |

| Min deposit | $100 | No | $100 | $5 | $50 | $10 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:200 to 1:1000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.4 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.4 points |

| Level of margin call / stop out |

100% / 50% | No / 50% | 80% / 50% | 100% / 50% | No / 50% | No / 30% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed Review of Capital Index

Capital Index is widely known in the UK, although it provides its services also for traders from other countries. The broker focuses on the development of the platform for active trading, which will allow users to trade under the most beneficial conditions. Meanwhile, investment programs are not found among Capital Index services. Cryptocurrency trading is also unavailable.

Several figures about Capital Index, which will be useful for traders, who are selecting their broker:

-

2014 — the year Capital Index was established;

-

3 account types are available for customers with different levels of expertise;

-

100 units of base currency – minimum deposit;

-

55 Forex instruments are available to trade

-

1:30 – maximum leverage

-

Spread from 0.4 pips.

Capital Index is an optimal broker for active and passive investments.

Capital Index is a broker specializing in providing comfortable conditions for active trading and spread betting. The broker is actively developing these services. Capital Index offers three account types, which are designed for novice traders, more experienced ones, and market professionals. Order execution is STP-based. The traders thus avoid contact with the deal, get higher-order execution speed, and beneficial levels of spreads.

For comfortable trading, the broker offers the good ole MetaTrader 4 platform. The platform’s version is for desktop or laptop, as well as mobile devices are available. The platform also accommodates the iOS and Android platforms. Capital Index does not have proprietary platforms or web versions.

Useful services of Capital Index:

-

Economic calendar – helps traders adjust their trading strategy based on the upcoming events on the Forex market;

-

FAQs. In this section, customers can find answers to the most frequently asked questions about the broker, trading, instruments, etc.;

-

Trading Holidays. Schedule of Forex market operation on days offs and holidays will help you adjust your working schedule on the specified days.

Advantages:

Competitive levels of spread;

The most popular trading instruments are available;

Simple and intuitive navigation on the broker’s website;

Trading accounts with different levels of experience;

Registration and license;

Use of the most popular trading platform – MetaTrader 4;

Possibility to trade from mobile devices.

Latest Capital Index News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i