According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 3,000 SGD

- MT4

- UTRADE Delta

- UTRADE terminals

- Monetary Authority of Singapore (MAS)

- 1996

Our Evaluation of UTRADE

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

UTRADE is a moderate-risk broker with the TU Overall Score of 5.82 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by UTRADE clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

UOB Kay Hian is intended for experienced and professional traders who are ready to invest large sums in trading with a reliable regulated broker that charges high commissions.

Brief Look at UTRADE

UOB Kay Hian (UTRADE) is a Singapore-registered broker that has been providing foreign exchange, CFD, and securities trading services since 1965. It is a part of UOB Group, the largest financial holding company in Singapore. Currently, it has 5 representative offices in Asia and is regulated by the Monetary Authority of Singapore (MAS, 197000447W). UTRADE offers accounts not only for individual trading in international markets but also for passive investments in managed portfolios.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Reliable regulation by the state supervisory body represented by the Central Bank of Singapore.

- Vast array of assets for Forex trading.

- Availability of investment solutions for passive income without independent trading.

- Opportunity to make transactions not only from UOB Kay Hian proprietary terminals but also from classic MT4.

- Access to currency and CFD trading with leverage.

- Quality analytics, research, and news from international markets, including the USA.

- Availability of an affiliate program with high rewards for trades of connected referrals.

- On-site training and 24/7 online support.

- Non-optimal conditions for beginners — minimum deposit from 3,000 SGD (~2200 USD), shortage of cent accounts.

- High spreads on most accounts — from 1.8 pips on the major currency pairs.

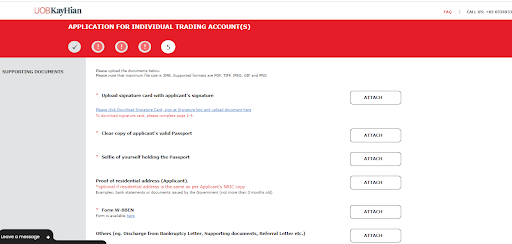

- Long waiting period for the account opening confirmation and the complicated verification require the provision of a large number of confirming documents.

TU Expert Advice

Author, Financial Expert at Traders Union

UTRADE offers a range of trading services, including trading Forex, CFDs, and securities through MT4 and UTRADE Delta platforms. The broker focuses on experienced traders by providing access to leverage, a variety of trading instruments, and detailed market analytics. Its regulatory compliance through the Monetary Authority of Singapore ensures a secure trading environment, which is further complemented by extensive research support and an affiliate program for additional income opportunities.

On the downside, UTRADE’s offerings may not be suitable for beginners due to a high minimum deposit requirement of SGD 3,000 and substantial spreads starting from 1.8 pips on major pairs. Additionally, the account verification process can be cumbersome. Thus, UTRADE may be more appropriate for experienced traders who are comfortable with high-stakes investments and are seeking a platform with solid regulatory credentials and robust analytical resources.

- You are based in Singapore or Southeast Asia and prefer a familiar regional broker, potentially providing a more localized and tailored trading experience.

- You are looking for a broker offering a diverse range of tradable assets, including stocks, ETFs, options, unit trusts, and bonds. This provides you with a broad spectrum of investment opportunities.

- Low minimum deposits are crucial for you. This broker may not be optimal for beginners, as it requires a minimum deposit from 3,000 SGD (~2200 USD), which could be considered high for those seeking lower entry barriers.

- You are looking for low spreads. This broker has high spreads on most accounts, starting from 1.8 pips on major currency pairs.

UTRADE Trading Conditions

| 💻 Trading platform: | MT4, UTRADE Delta, UTRADE authoring terminals for securities trading |

|---|---|

| 📊 Accounts: | For Forex trading: Demo MT4 Account, UTRADE Delta, MT4 Account.For securities investments: Securities Trading, UTRADE Edge, UTRADE Plus, UTRADE Robo |

| 💰 Account currency: | USD, SGD |

| 💵 Deposit / Withdrawal: | Depositing: cash or check in hand, credit cards (Visa or Mastercard), online banking with DBS/POSB, UOB, Standard Chartered, and HSBC, FAST Internet Funds Transfer, Telegraphic transfer.Withdrawal is conducted only through a wire transfer |

| 🚀 Minimum deposit: | 3,000 SGD |

| ⚖️ Leverage: | Up to 1:20 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs, CFD on shares, indices, commodities, ETFs, bonds, Daily Leverage Certificates (DLC), mutual funds |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | Leading Asian banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market, Limit, and Stop orders |

| ⭐ Trading features: | No cryptocurrency trading, only clients with active securities account can open Delta and MT4 accounts |

| 🎁 Contests and bonuses: | No |

For trading Forex instruments UOB Kay Hian offers 2 types of accounts that allow making transactions through MT4 and the broker's proprietary terminal called Delta. The minimum deposit amount depends on the type of asset being traded. Leverage is up to 1:20. Spreads on currency pairs start from 1.8 pips. There is a swap fee for carrying positions over to the next trading day. The demo account can be opened only in the MetaTrader 4 terminal.

UTRADE Key Parameters Evaluation

Video Review of UTRADE

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

It is impossible to create a personal cabinet on the site and in UTRADE mobile application without opening a trading account. You need to perform the following actions to register your account:

Visit the official site of UTRADE and click Open Account on any of its pages. The button is at the top of the page.

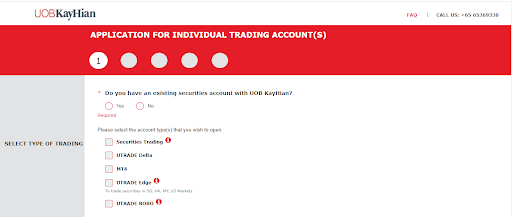

After that, you need to specify if you have a securities account with UOB Kay Hian and then select the type of account you want to open. If you don't have a securities account, you will still have to open one, even if you don't plan to trade that type of asset.

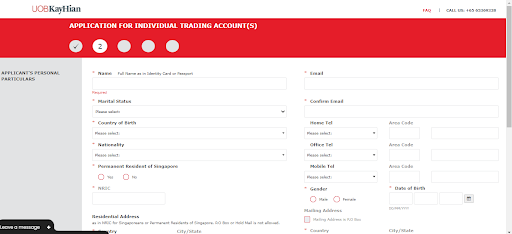

Then you need to enter your data in the registration form: name and surname (like in your passport), country of residence, phone number, and email.

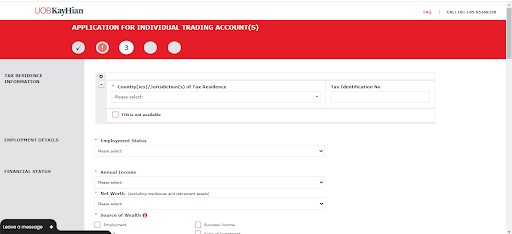

After that, the broker asks for tax and financial information, employment details, annual income, and available capital.

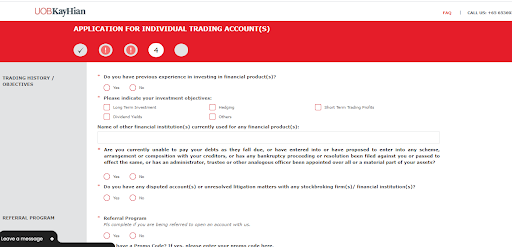

Next, enter your investment goals and trading experience, as well as your referral code (if any).

At the final stage, the user is obliged to upload scanned copies of documents and filled in forms (CRS, W-8BEN-E, W-9).

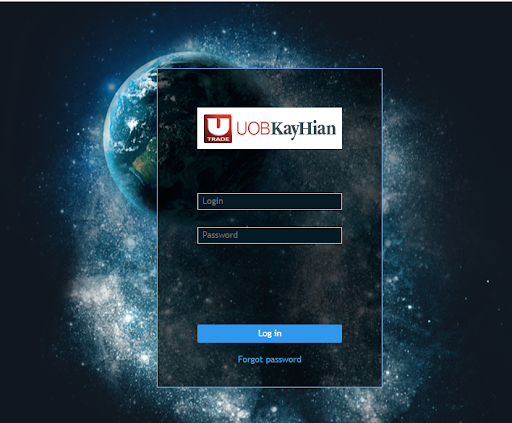

After the approval of the account application (its consideration takes up to 5 working days) you will be able to enter the personal cabinet. To do that click on the button Log In at the top of the page and then enter your login and password.

This data comes by email, but you can change it later in your personal cabinet.

Overview of UTRADE’s personal account — Log in to your personal account/cabinet.

A trader can do the following actions in the personal account/cabinet of UTRADE:

-

Install the UTRADE Token application to generate a one-time security password.

-

Trade via the web terminal.

Also, in the client’s personal account the trader can:

-

Manage his account and make deposits and withdrawals.

-

View quotes “live” or every 15 minutes (depending on the selected exchange).

-

View reports on intraday transactions.

-

View statistics on portfolio investments.

-

Have access to research, analytics, and trading tools.

Regulation and safety

UTRADE has a safety score of 9/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 29 years

- Strict requirements and extensive documentation to open an account

UTRADE Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

MAS MAS |

Monetary Authority of Singapore | Singapore | No specific fund | Tier-1 |

UTRADE Security Factors

| Foundation date | 1996 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker UTRADE have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of UTRADE with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, UTRADE’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

UTRADE Standard spreads

| UTRADE | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,1 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,7 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,1 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

UTRADE RAW/ECN spreads

| UTRADE | Pepperstone | OANDA | |

| Commission ($ per lot) | 5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with UTRADE. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

UTRADE Non-Trading Fees

| UTRADE | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

The UTRADE broker offers two types of accounts with leverage up to 1:20. The choice of account type depends on what platforms the client prefers to use in his work, either the universal classic MT4 or the broker’s proprietary terminals.

Account types:

The broker offers four additional account types: Securities Trading, UTRADE Edge, UTRADE Plus, and UTRADE Robo; but they are designed for trading and investing in securities, not Forex instruments.

UTRADE is a stock and Forex broker that offers accounts for margin trading in securities, foreign exchange, and leveraged CFDs.

Deposit and withdrawal

UTRADE received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

UTRADE offers limited payment options and accessibility, which may impact its competitiveness.

- No withdrawal fee

- Bank wire transfers available

- Bank card deposits and withdrawals

- No deposit fee

- USDT payments not accepted

- Limited deposit and withdrawal flexibility, leading to higher costs

- PayPal not supported

What are UTRADE deposit and withdrawal options?

UTRADE offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire. This limitation may restrict flexibility for users, making UTRADE less competitive for those seeking diverse payment options.

UTRADE Deposit and Withdrawal Methods vs Competitors

| UTRADE | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are UTRADE base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. UTRADE supports the following base account currencies:

What are UTRADE's minimum deposit and withdrawal amounts?

The minimum deposit on UTRADE is $3000, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact UTRADE’s support team.

Markets and tradable assets

UTRADE offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 50 Forex pairs.

- ETFs investing

- Commodity futures are available

- 50 supported currency pairs

- Copy trading not available

- Crypto trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by UTRADE with its competitors, making it easier for you to find the perfect fit.

| UTRADE | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products UTRADE offers for beginner traders and investors who prefer not to engage in active trading.

| UTRADE | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

UTRADE’s support team is available from 8:30 to 17:15 (Mon-Fri) Singapore Time (SGT).

Advantages

- Unregistered users can contact support operators

- Clients can ask questions in English

Disadvantages

- Operates in 24/5 mode

- Chat window on the site is for sending questions to email, not for contacting the support team in real-time

- Snail-paced response time via email

This broker provides the following communication channels for its clients:

-

write in the Leave A Message window on the website or in a personal cabinet

-

send a question to email;

-

fill in the contact form in the Contact Us section;

-

use the company's Facebook messenger.

The Contact Us section of the site provides contact details for the Data Protection Officer (phone and email) and the Complaints and Claims Department (email).

Contacts

| Foundation date | 1996 |

|---|---|

| Registration address | UOB Kay Hian Pte Ltd, 8 Anthony Road, #01-01, Singapore 229957 |

| Regulation |

Monetary Authority of Singapore (MAS)

Licence number: 197000447W |

| Official site | http://www.utrade.com.sg/ |

| Contacts |

(65) 6536 9338

|

Education

There is no separate training section on UTRADE's site. But you can find in the FAQs section a lot of information that may help you to master the trading of securities and assets on the Forex market. The site also has a Seminar section. It allows you to sign up for upcoming seminars which are temporarily converted into webinars due to the situation with COVID-19.

A demo account is an effective training tool that allows you to practice trading with virtual money. At the moment UTRADE offers demo accounts only for the MT4 terminal.

Comparison of UTRADE with other Brokers

| UTRADE | Bybit | Eightcap | XM Group | FBS | InstaForex | |

| Trading platform |

MT4, UTRADE CFD Pro | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MobileTrading, MT5, FBS app | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $3000 | No | $100 | $5 | $5 | $1 |

| Leverage |

From 1:1 to 1:20 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:3000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.8 points | From 0 points | From 0 points | From 0.8 points | From 1 point | From 0 points |

| Level of margin call / stop out |

100% / 50% | No / 50% | 80% / 50% | 100% / 50% | 40% / 20% | 30% / 10% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | Yes |

Detailed Review of UOB Kay Hian (UTRADE)

The UOB Kay Hian regulated stock and Forex broker gives its clients access to trading and investing on international exchanges. UTRADE provides every registered trader with monthly reports on open accounts in electronic form, as well as market data and news from the major Reuters news agency. The company offers high-quality market research and analytics, a wide range of trading accounts, and available assets.

About the UTRADE broker in numbers:

-

More than 55 years in the financial trading services industry.

-

Has received more than 50 international awards in banking and brokerage services.

-

Has 5 international representative offices and more than 80 branches worldwide.

-

It covers 19 markets on three continents.

UTRADE is a broker with a wide range of Forex assets, which aims to provide the highest level of security for its clients

UTRADE offers trading in CFDs and 44 currency pairs. Its clients can trade CFDs on ETFs and stocks in Singapore, Hong Kong, China, the USA, Australia, and Malaysia. Traders can also trade 6 CFDs on indices, including AUS200, HK50, and JP225. The company uses dedicated firewalls, an Intrusion Detection System (IDS), and SSL encryption for the security and protection of online trading. Two-factor authentication (2FA) is also used and each client receives a unique identifier for safe login to the Live Account.

The Forex trader UTRADE offers 2 trading platforms — Delta and MetaTrader 4. Both terminals are presented in mobile and web versions. However, they can also be installed on a PC or laptop. To do this you need to download the desktop version of the platform. Also, UTRADE offers several proprietary terminals for trading on the stock market.

Useful services of UTRADE:

-

UTRADE Token. The authentication application for registered clients can generate a one-time, 6-digit password (OTP) for secure login into your account.

-

ChartGenie. Technical analysis tool that generates stock trading ideas based on MACD, ADX, support, and resistance indicators.

-

Research. The website section features daily market reviews (for Asia and the USA), professional comments, Forex market recommendations, and CFD trading ideas.

-

Stock Alerts and Screener. Reflect the fundamental data and help optimize your search for investment-worthy assets.

-

ShareXplorer. Analysis tool that broadcasts charts, financial data, market news, and earnings and loss reports from the world's leading companies.

-

TechAnalyzer. Analyzes price trends and patterns using 20 indicators, and offers strategies that have been thoroughly tested on historical data.

Advantages:

The company has been providing brokerage services since 1965 and has established itself as a reliable intermediary for trading on the financial markets.

Registration with the broker allows trading not only currency pairs and CFDs but also securities at international exchanges.

UTRADE’s clients can make transactions via mobile applications and Web-Trader, which allows trading without being tied to a stationary computer.

The broker allows the use of expert advisors (bots) to automate the trading process.

Passive investors can copy Forex trades using MT4’s trading signals and invest in ready-made asset portfolios designed for specific objectives, terms, and risks.

The company does not withhold non-trading commissions from clients, such as for payment transactions, account maintenance, provision of terminals, and delivery of quotes.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i