According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- NetTradeX

- 2007

Our Evaluation of IFC Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

IFC Markets is a moderate-risk broker with the TU Overall Score of 5.52 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by IFC Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

IFC Markets is a mid-level broker with interesting innovative developments. The broker will be of interest to those seeking new trading products and original solutions.

Brief Look at IFC Markets

IFC Markets was established in 2006. The company is owned by IFCM Group, a financial corporation that turned the services of providing access to international asset markets into a separate business. The broker focuses on two areas – classical trading services and synthetic instrument trading services. The broker is regulated by BVI FSC SIBA/L/14/1073 (British Virgin Islands). Deposits of the traders are insured at AIG Europe Limited.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Unique instruments for trading: portfolio quoting, continuous stock indices and derivatives, and a proprietary trading platform.

- Insurance against risks of professional liability.

- Over 600 trading assets of different classes, including synthetic instruments.

- Relatively high spread – from 1.8 pips.

- Complex verification. Certification of the documents by a notary public and their translation into English may be required.

- Offshore regulation, which is unlikely to help a trader in any way.

- The broker’s proprietary platform does not envisage the use of an advisor and indicators on MQL. Translation into the platform’s language is performed at the trader’s expense.

- There are no passive income programs.

TU Expert Advice

Author, Financial Expert at Traders Union

IFC Markets provides a comprehensive range of services, including Forex, commodities, and CFDs on cryptocurrencies, utilizing the MT4, MT5, and its proprietary NetTradeX platforms. The broker offers diverse account types with a minimum initial deposit, potentially appealing to both novice and experienced traders. Advantages include access to over 600 trading assets, innovative synthetic asset trading, fast order execution, and no inactivity fees, appealing to those interested in diverse and flexible trading options.

However, IFC Markets has drawbacks such as high spreads starting from 1.8 pips, complex verification processes, and offshore regulation, which may concern some traders. The limited payment methods and regulatory concerns make it less appealing. Overall, IFC Markets may suit traders interested in synthetic assets and those comfortable with its trading conditions.

IFC Markets Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ4, МТ5, NetTradeX |

|---|---|

| 📊 Accounts: | NetTradeX - Beginner-Fixed, Standard-Fixed, Beginner-Floating, and Standard-Floating accounts; MetaTrader 4 – Micro-Fixed and Standard-Fixed accounts; MetaTrader 5 – Micro-Floating and Standard-Floating accounts |

| 💰 Account currency: | EUR, USD, and JPY |

| 💵 Deposit / Withdrawal: | WebMoney, Neteller, Skrill, QIWI, Perfect Money, Unistream, Visa, Mastercard, ВТС, Western Union, and international wire transfer |

| 🚀 Minimum deposit: | From $1 and from $1,000 depending on the account type |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | From 0.01 |

| 💱 EUR/USD spread: | 0,4-1,2 pips |

| 🔧 Instruments: | Currencies, assets of stock and commodity markets, synthetic instruments, Cryptocurrency CFDs |

| 💹 Margin Call / Stop Out: | Stop out - 10% |

| 🏛 Liquidity provider: | N/a |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Instant execution, Market execution |

| ⭐ Trading features: | Synthetic asset trading |

| 🎁 Contests and bonuses: | Yes |

Trading conditions of IFC Markets are differentiated – depending on the account type and whether a fixed or floating spread is applied. The spread and leverage depend on the asset type. For the MT4 and NetTradeX accounts, the spread is from 1.8 pips, for the accounts on MT5 – from 0.4 pips. The broker charges a commission per trade on CFDs and on stocks.

IFC Markets Key Parameters Evaluation

Video Review of IFC Markets

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Start earning on IFC Markets with free registration on Traders Union, a rebate service website. After you follow the partnership link to the broker’s website, you will receive a partial rebate of the spread for each trade regardless of its result. Do not miss this opportunity!

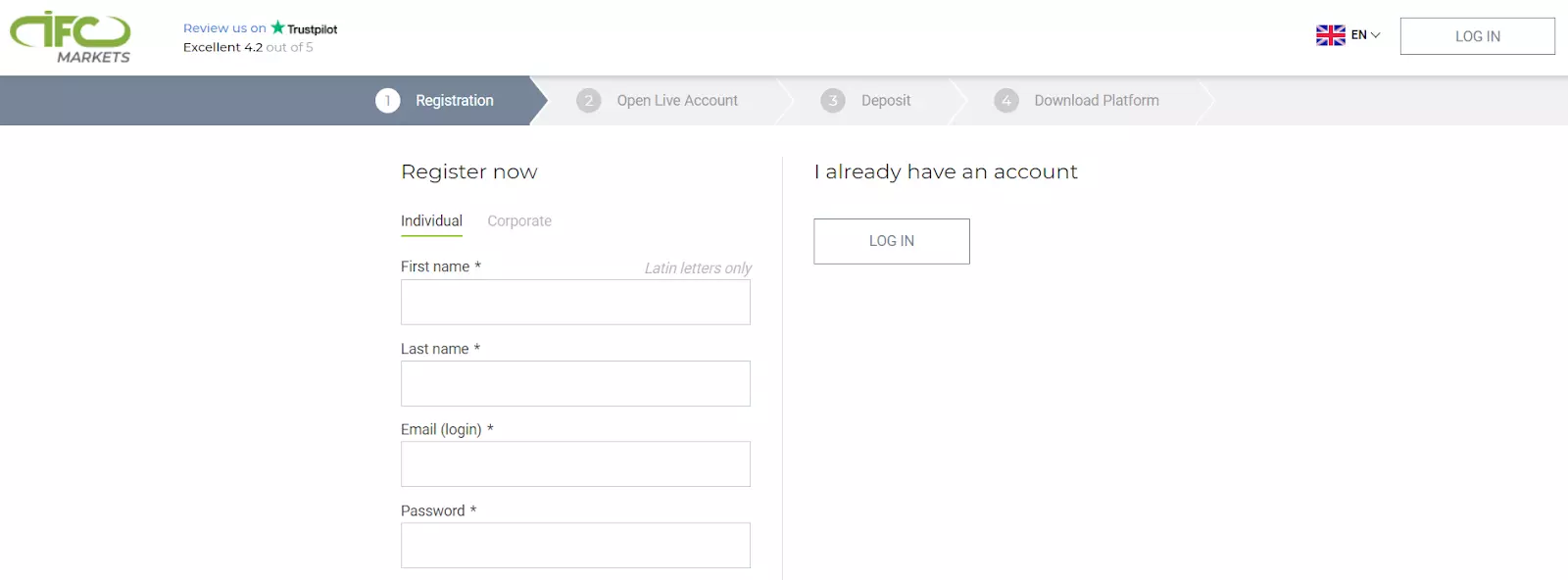

To open an account with IFC Markets, follow these steps:

Press Open Account at the top of the page.

Fill in the registration information.

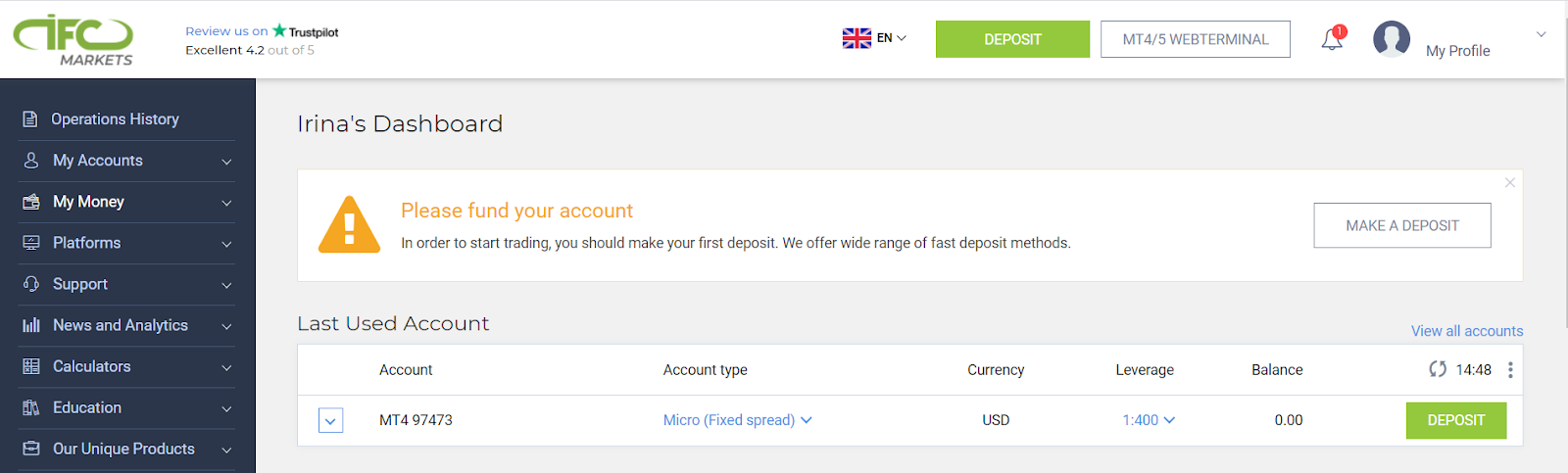

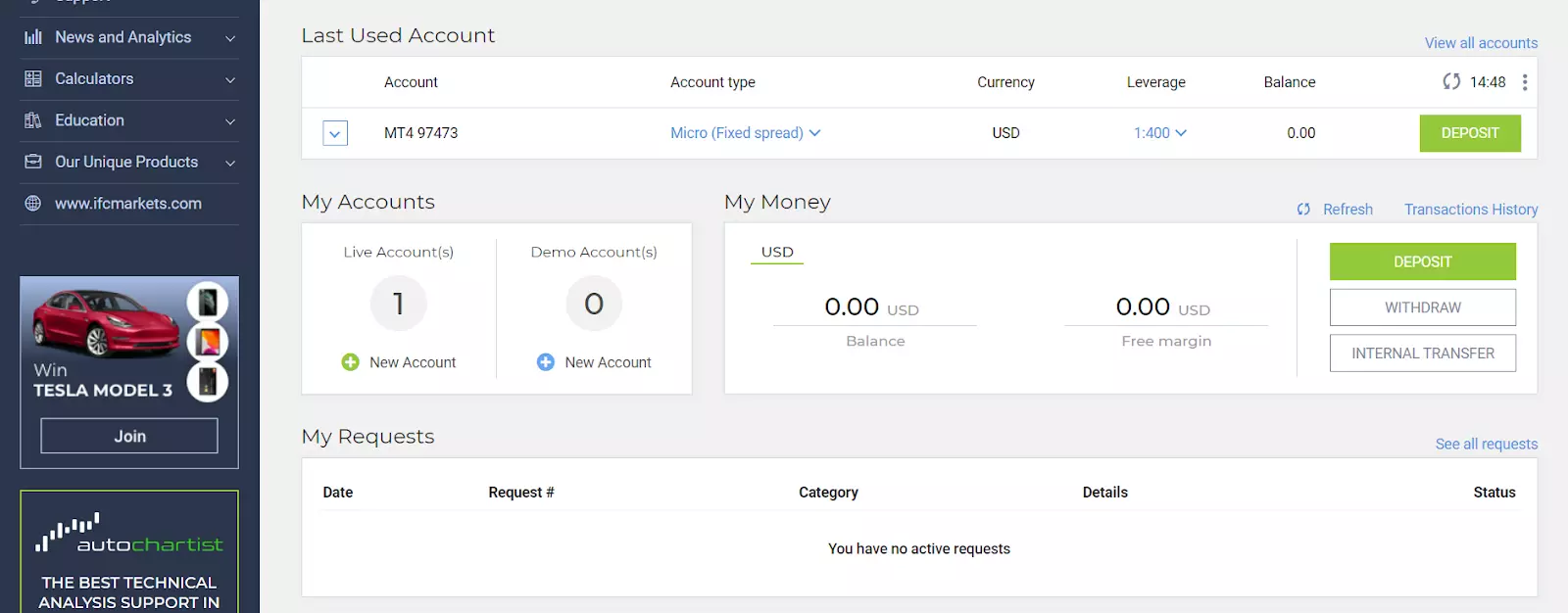

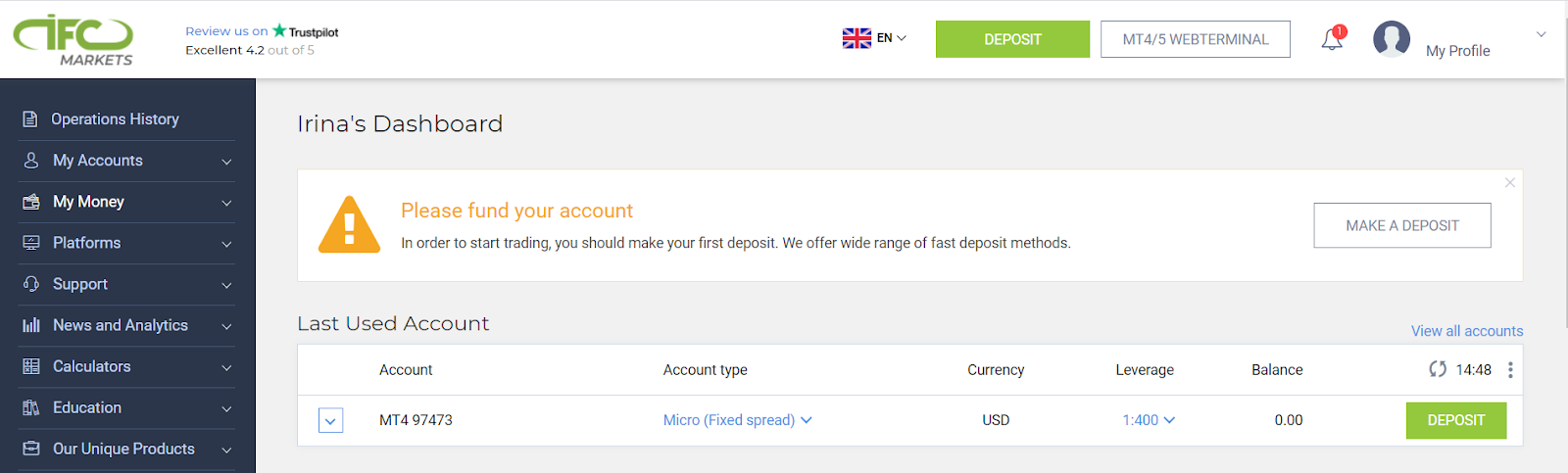

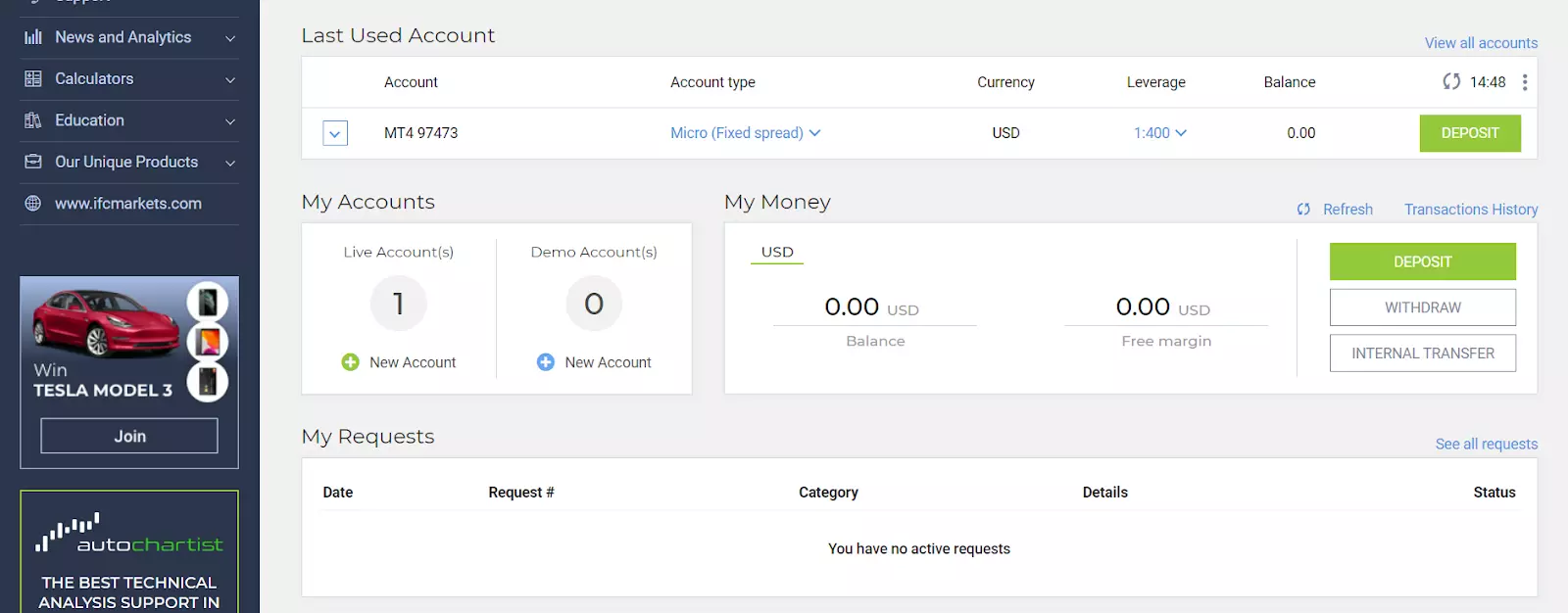

The following features are available in the personal account at the IFC Markets:

Other features of the personal account at the IFC Markets:

-

Access to additional instruments: profit/loss, margin calculators, currency converter.

-

Access to the Autochartist.

-

Access to synthetic instruments library.

-

Access to news and analytics.

-

History of trades and account activity.

Regulation and safety

IFC Markets has a safety score of 9.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Regulated in the UK

- Track record over 18 years

- No negative balance protection

IFC Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

IFC Markets Security Factors

| Foundation date | 2007 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker IFC Markets have been analyzed and rated as High with a fees score of 4/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of IFC Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, IFC Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

IFC Markets Standard spreads

| IFC Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,4 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,4 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,2 | 1,4 | 0,5 |

Does IFC Markets support RAW/ECN accounts?

As we discovered, IFC Markets does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with IFC Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

IFC Markets Non-Trading Fees

| IFC Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0-1,99 | 0 | 0 |

| Withdrawal fee, % | 0,5-4 | 0 | 0 |

| Withdrawal fee, USD | 0-20 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

A trader can open only one account of a specific type. The account types are determined by the following specifications: base currency (USD/EUR/JPY), platform (NetTradeX, МТ4 or МТ5), account type (standard, micro, demo), spread type (fixed or floating), order accounting system (netting/hedged).

Account types:

All account types can be tested in the demo version.

Deposit and withdrawal

IFC Markets received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

IFC Markets offers limited payment options and accessibility, which may impact its competitiveness.

- BTC available as a base account currency

- Bitcoin (BTC) accepted

- Bank card deposits and withdrawals

- Bank wire transfers available

- Limited deposit and withdrawal flexibility, leading to higher costs

- Wise not supported

- Withdrawal fee applies

What are IFC Markets deposit and withdrawal options?

IFC Markets offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire, BTC. This limitation may restrict flexibility for users, making IFC Markets less competitive for those seeking diverse payment options.

IFC Markets Deposit and Withdrawal Methods vs Competitors

| IFC Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are IFC Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. IFC Markets supports the following base account currencies:

What are IFC Markets's minimum deposit and withdrawal amounts?

The minimum deposit on IFC Markets is $1, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact IFC Markets’s support team.

Markets and tradable assets

IFC Markets provides a standard range of trading assets in line with the market average. The platform includes 600 assets in total and 80 Forex currency pairs.

- 80 supported currency pairs

- Indices trading

- Commodity futures are available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by IFC Markets with its competitors, making it easier for you to find the perfect fit.

| IFC Markets | Plus500 | Pepperstone | |

| Currency pairs | 80 | 60 | 90 |

| Total tradable assets | 600 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products IFC Markets offers for beginner traders and investors who prefer not to engage in active trading.

| IFC Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

The broker provides customer support 24/5. There are some limitations on the operating hours of customer support in certain languages.

Advantages

- Support is available in 18 languages

- Quick response to customers’ questions

Disadvantages

- No

Methods of contacting customer support:

-

online chat.

-

call back.

-

messaging apps (telegram, Skype, etc.).

-

email.

-

phone.

Contacts

| Foundation date | 2007 |

|---|---|

| Registration address | Quijano Chambers, P.O. Box 3159, Road Town, Tortola, British Virgin Islands |

| Official site | ifcmarkets.com |

Education

The Education page on the IFC Markets website covers practically everything. The Introduction to Trading section is perfect for novice traders. There is information about how Forex works and how to earn a profit on it. There is the Market Forecast section for advanced traders, featuring instruments for technical and basic analysis.

The broker also offers demo accounts, where you can test obtained knowledge and run strategies.

Comparison of IFC Markets with other Brokers

| IFC Markets | Bybit | Eightcap | XM Group | VT Markets | InstaForex | |

| Trading platform |

MT4, MT5, NetTradeX | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $1 | No | $100 | $5 | $50 | $1 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | Yes | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.4 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No / 10% | No / 50% | 80% / 50% | 100% / 50% | No / 50% | 30% / 10% |

| Order Execution | Market Execution, Instant Execution | Market Execution | Market Execution | Market Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | No | No | No | No | Yes |

Detailed Review of IFC Markets

The trading conditions of IFC Markets, an STP broker, can be conditionally divided into two areas. The first one is classical trading. The trading conditions are designed for traders with any level of knowledge. There are accounts for professional traders on the MT5 platform with narrow fixed or floating spread from 0.4 pips, but with a high minimum deposit. For the beginners, there are micro accounts on MT4 and MT5 with a minimum deposit of $1. For the fans of non-standard trading, the broker has NetTradeX, a proprietary platform. It largely resembles MT4 in terms of features, but has some useful perks, for example, a combination of charts of several instruments in one window or Trailing Stop on the server-side.

Several figures about IFC Markets that might be of interest for traders:

-

165,000 customers in 80 countries.

-

Instant execution – up to 100ms

-

Its basic set of trading instruments features over 600 assets but when the synthetic instruments are included, the number is unlimited.

Synthetic assets – a new concept in innovative trading

The second business focus of IFC Markets is providing access to synthetic asset trading. The technology is patented and is available on the NetTradeX platform. Using this technology, traders can create their own asset in the form of an investment portfolio or a pair by determining the share of each base asset. The quotes of the final product are calculated mathematically and delivered to the platform. A trader can study the correlation between the assets and build unlimited combinations with them on the historical charts. The idea resembles a structured mutual fund or ETF, where the value of assets depends on the structure of the portfolio and the distribution of shares of instruments in it.

Continuous futures is another innovation of the platform. These are CFDs on indices or commodity futures, which are not tied to the expiration of the derivatives. The mechanism of quote calculations allows avoiding sharp movements and gaps at the time of expiration of the current futures.

Useful services offered by IFC Markets:

-

Autochartist. Chart analysis instrument.

-

Market sentiment. Analytical instrument showing traders’ attitudes towards a specific asset on a fixed timeframe.

-

Commodity market calendar. A calendar of economic news on commodity markets.

-

Synthetic Instruments Library. Access through your personal account.

Advantages:

Interesting technical solutions of NetTradeX platform.

Rapid order execution and absence of markup.

Availability of micro-accounts.

The broker does not set any restrictions on the strategies traders use. Scalping and algorithmic trading are welcome.

Latest IFC Markets News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i