Trive Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €/$0

- MetaTrader4

- MetaTrader5

- Trive

- MFSA

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €/$0

- MetaTrader4

- MetaTrader5

- Trive

- MFSA

Our Evaluation of Trive

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Trive is a high-risk broker with the TU Overall Score of 1.85 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Trive clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. Trive ranks 415 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The Trive brokerage company is registered in Malta and is widely known in the EU. It offers competitive trading conditions such as narrow spreads, low commission fees, a large pool of assets, and moderate leverage. There is a free demo account and three real accounts for traders with different goals. Unfortunately, there are almost no options for alternative earnings, and most of the financial instruments are in the form of contracts for price differences (CFDs). You can choose MT4/5 or the broker's proprietary terminal.

Brief Look at Trive

Trive broker offers stocks, ETFs, as well as CFDs on currency pairs, stocks, indices, and commodities. Trading accounts are available in three types, including a free demo account. In the Classic account, there is no minimum deposit, but in Prime and Prime Plus accounts, it is €2,500 and €15,000, respectively. Spreads start at 0.1 pips, and the maximum leverage is 1:30. You can withdraw funds by bank transfer with a commission’ and Visa/Mastercard, or e-wallet with a commission of 1.5%. Traders can use the broker's own terminal. It is also possible to use MT4 and MT5. There is an affiliate program with two plans: CPA (cost per acquisition) and CPL (cost per lead). Technical support is represented by a call center, email, and live chat.

- A free demo account allows you to study the site and practice trading strategies without risk;

- Three real accounts allow you to get the most comfortable working environment;

- The broker has a low entry threshold, no minimum deposit requirements on the Classic account, and full transparency of cooperation;

- The company's clients are not restricted during trading, and all strategies and methods are available;

- Asset diversity and moderate leverage increase the trader's profit potential;

- The platform works with three trading platforms, two of which are recognized as the best in the segment;

- Technical support has predominantly positive feedback, and managers can be contacted in various ways.

- Currency pairs, indices, and commodities are represented as contracts for difference (CFDs);

- The platform does not offer passive earning options, only participation in CPA/CPL programs;

- Technical support does not work on weekends.

TU Expert Advice

Financial expert and analyst at Traders Union

The Trive broker is managed by Trive Financial Services Malta Ltd. As the name implies, the company is registered in Malta and is regulated by the Malta Financial Services Authority (MFSA). The company's head office is located there, and it also has several offices in other regions, including Germany and Spain. The retrospective analysis did not reveal any evidence of the platform's failure to fulfill its obligations to traders.

Trive's trading conditions are similar to those offered by the broker's leading competitors. For example, there is a free demo account, several live accounts, floating spreads from 0.1 pips, and no commissions on most accounts, which are all standard fair. The €5 fee for 1 lot on the Prime Plus account looks quite competitive, as does the 1.5% withdrawal fee. Trive customers also have the option to withdraw with no fees if they use a bank account transfer.

The pool of assets is moderate. It is important to keep in mind that currency pairs, indices, and commodities are presented only as contracts for price differences. Users can also work directly with stocks and ETFs. Trive's up-to-date list of assets allows you to form a diversified portfolio and trade comfortably using almost any strategic decision. In this respect, the company goes out of its way to meet its clients' needs, excluding any restrictions.

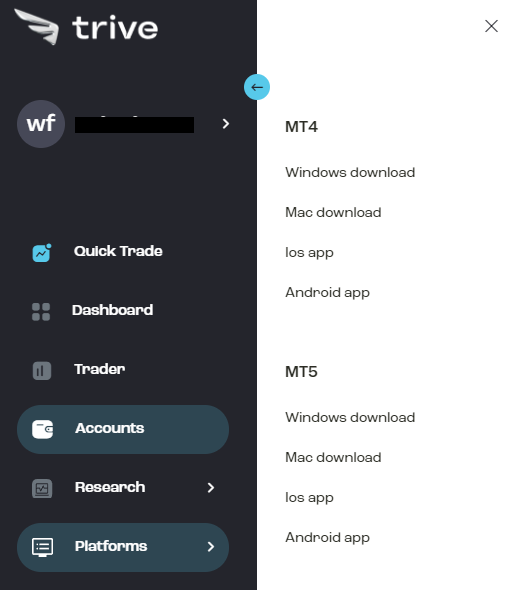

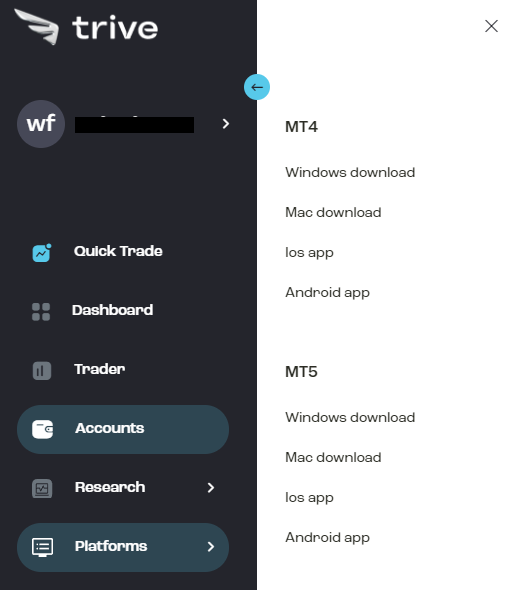

You can trade both through MetaTrader 4 and MetaTrader 5. MT’s capabilities can be easily increased by using the MetaBooster complex option. The broker also has a proprietary trading terminal, plus a mobile version. Even in its standard form, it is convenient, reliable, and functional. In addition, the broker uses TradingCentral, a well-known solution for comprehensive analytics, which includes an economic calendar, newsfeeds, and many other special tools.

As a rule, the main disadvantages of Trive are the lack of passive income options and insufficient transparency of the site for an outside user. The broker has only an affiliate program based on CPA/CPL models, no copy trading, nor MAM or PAMM accounts. As for transparency, for example, there is no data on the technical support mode on the site. It can be ascertained in the user account only after registration.

Trive Summary

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Trive and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | Trive (proprietary), MetaTrader 4, MetaTrader 5 |

|---|---|

| 📊 Accounts: | Demo, Classic, Prime, Prime Plus |

| 💰 Account currency: | EUR, USD |

| 💵 Replenishment / Withdrawal: | Bank transfer, bank card, electronic purse |

| 🚀 Minimum deposit: | From $/€0. |

| ⚖️ Leverage: | Up to 1:30. |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 0.1 pip |

| 🔧 Instruments: | Stocks, ETFs, CFDs on currency pairs, stocks, indices and commodities |

| 💹 Margin Call / Stop Out: | N/A |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Demo is free of charge, three real accounts, a low entry threshold, many different types of assets, moderate leverage, spreads are floating and narrow, additional commission only on Prime Plus, and the withdrawal fee depends on the withdrawal channel (no fee for bank transfers). |

| 🎁 Contests and bonuses: | Yes |

If a broker offers several trading accounts, the minimum deposit for each can be different. In the case of Trive, when opening a Classic account, it is possible to deposit any amount, as there are no minimum deposit requirements. A Prime account requires a minimum of €2,500, and a Prime Plus account requires €15,000. Leverage is the same for all accounts, or rather, its range is always the same — from 1:1 to 1:30. Leverage depends on the specific asset and trader's choice. Technical support for the site is always ready to help, and you can contact it by phone, email, or live chat on the site. It works around the clock, but only on weekdays.

Trive Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

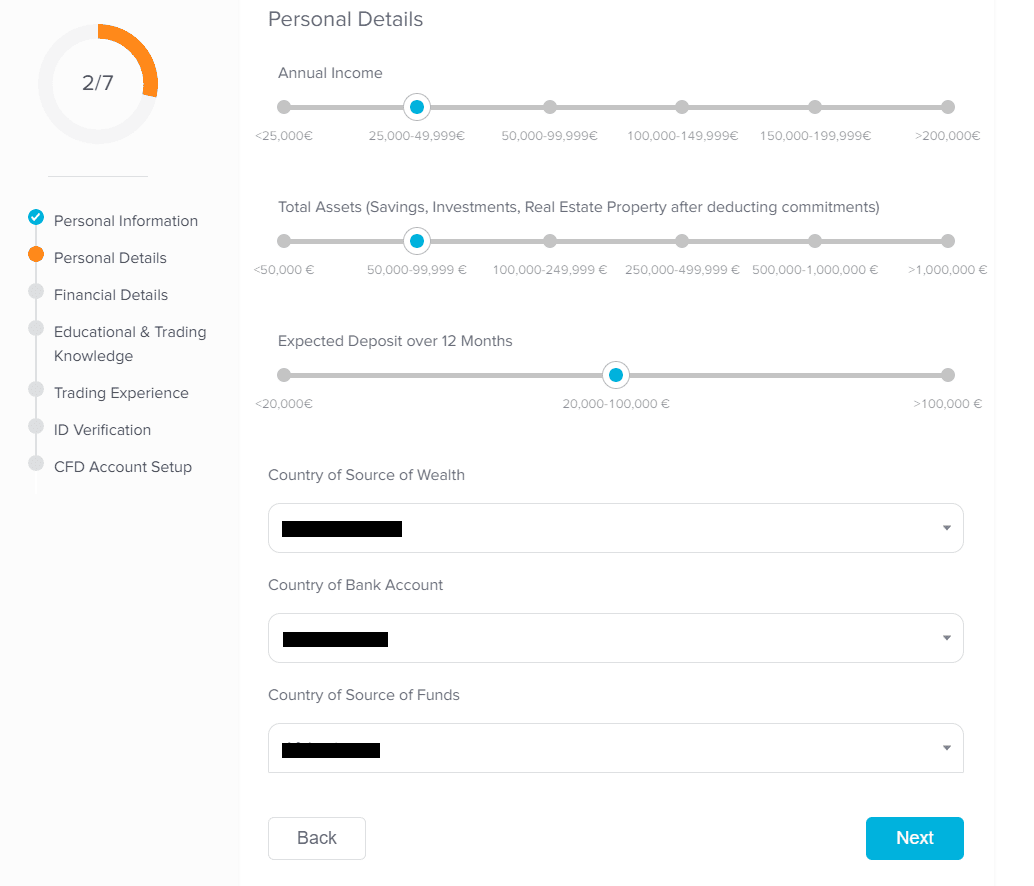

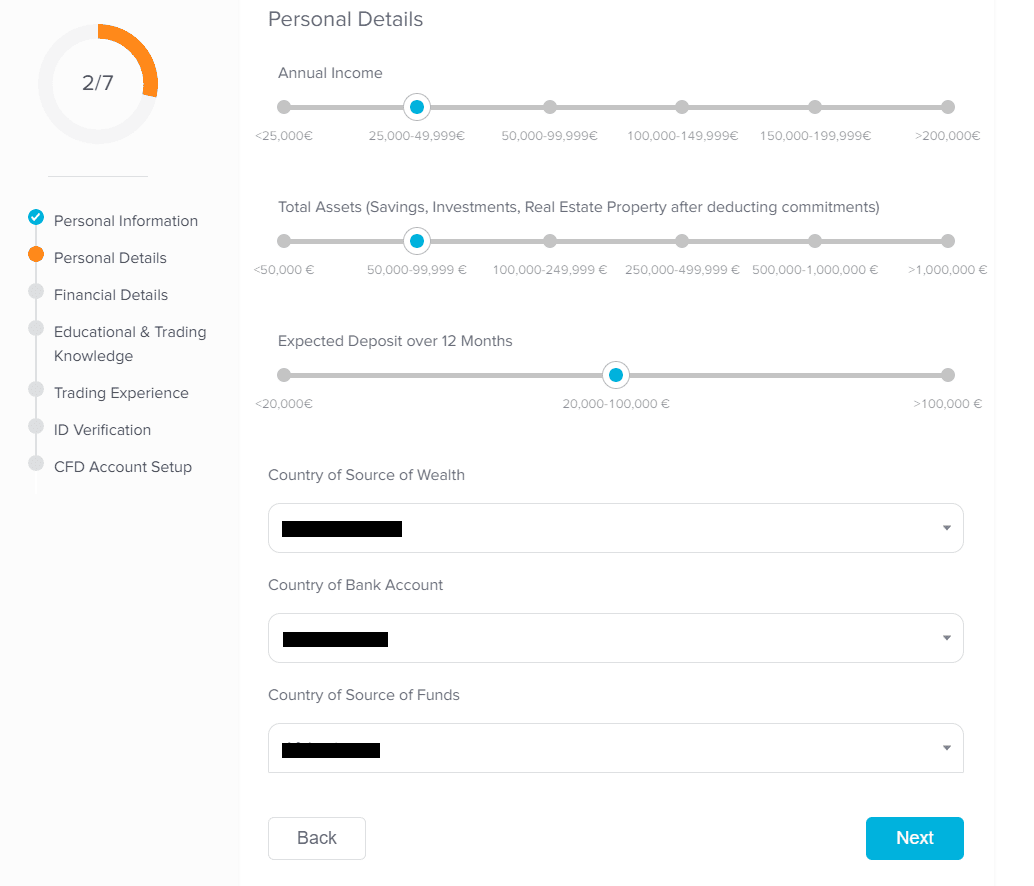

Trading Account Opening

If you want to start cooperating with a broker, register on its official website, get a user account, open a live account, and make a deposit. Verification (confirmation of personal data) is also required. Traders Union experts have prepared a step-by-step guide to minimize questions on these processes.

Go to the broker's website. In the upper right corner, select your preferred interface language. Click "Open an account".

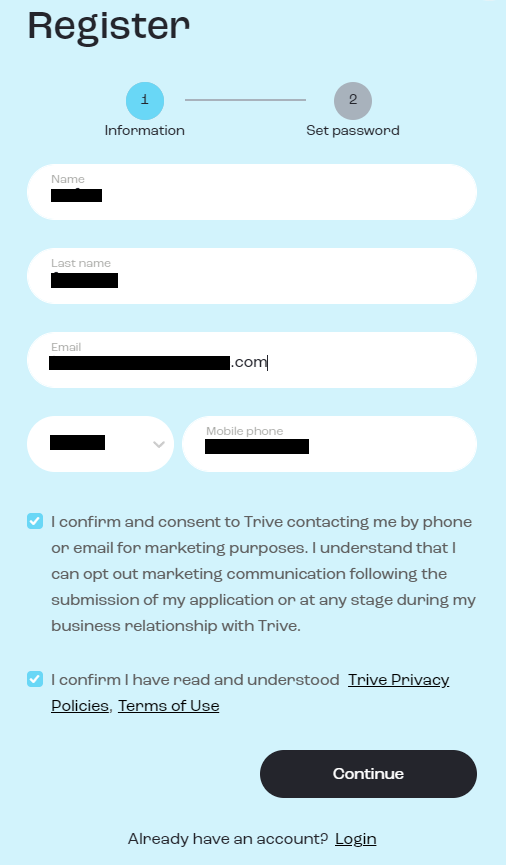

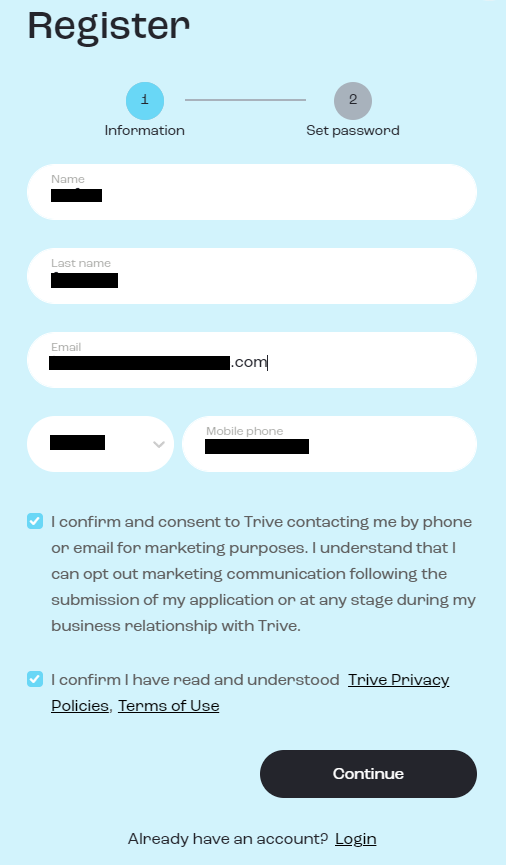

Enter your first and last name, email address, and phone number. Agree to the terms of cooperation by checking the two boxes. Click "Continue".

Generate a password. Confirm that you are not a U.S. citizen by checking the box. Click "Done".

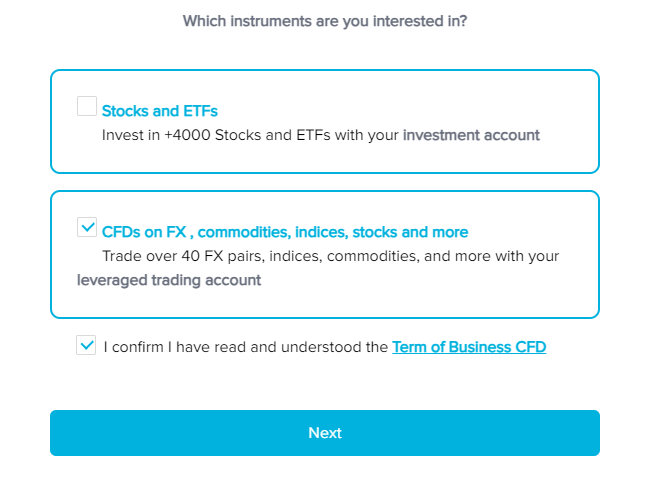

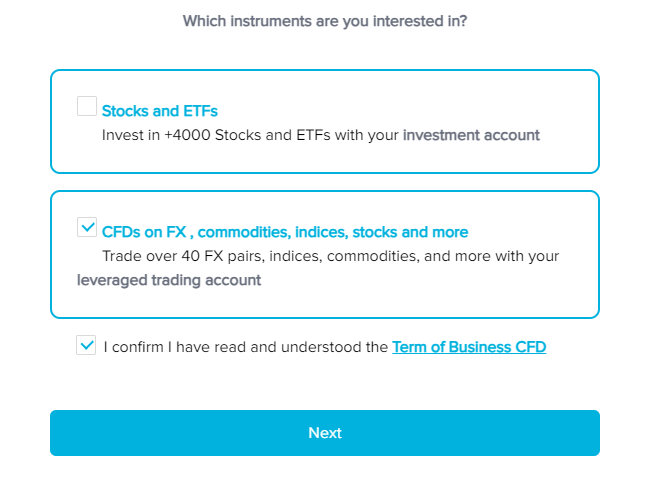

Select the asset group you are most interested in. Agree to the broker's terms and conditions and click "Next".

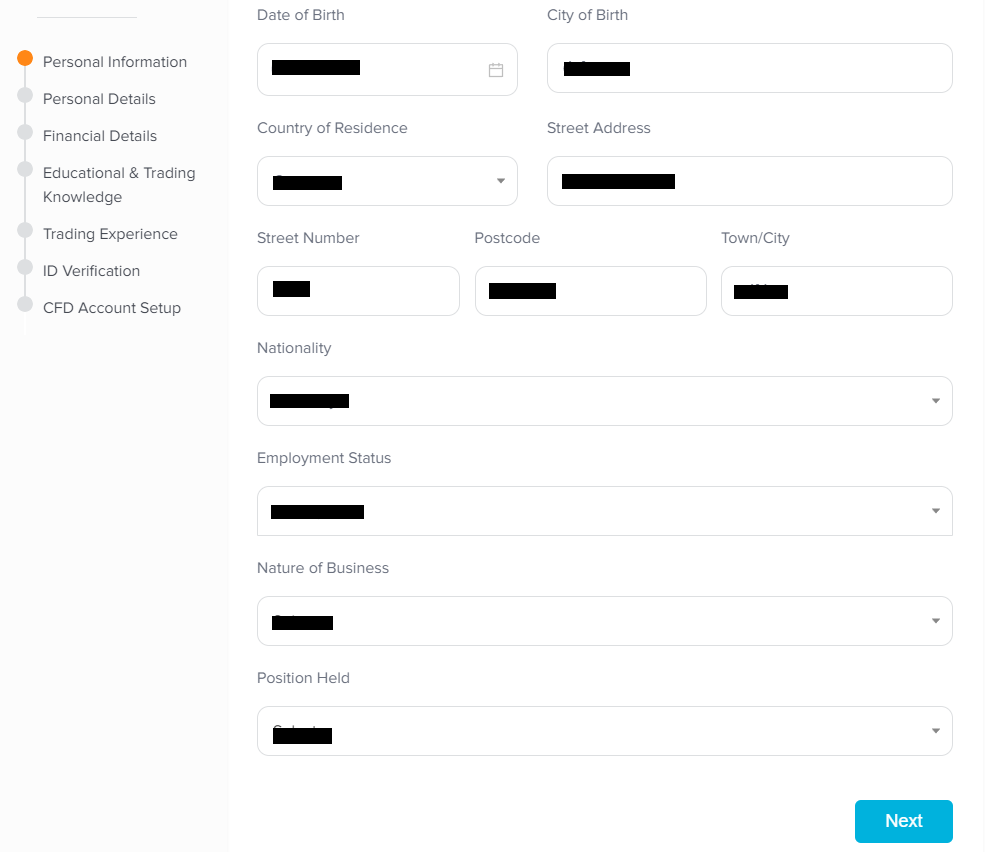

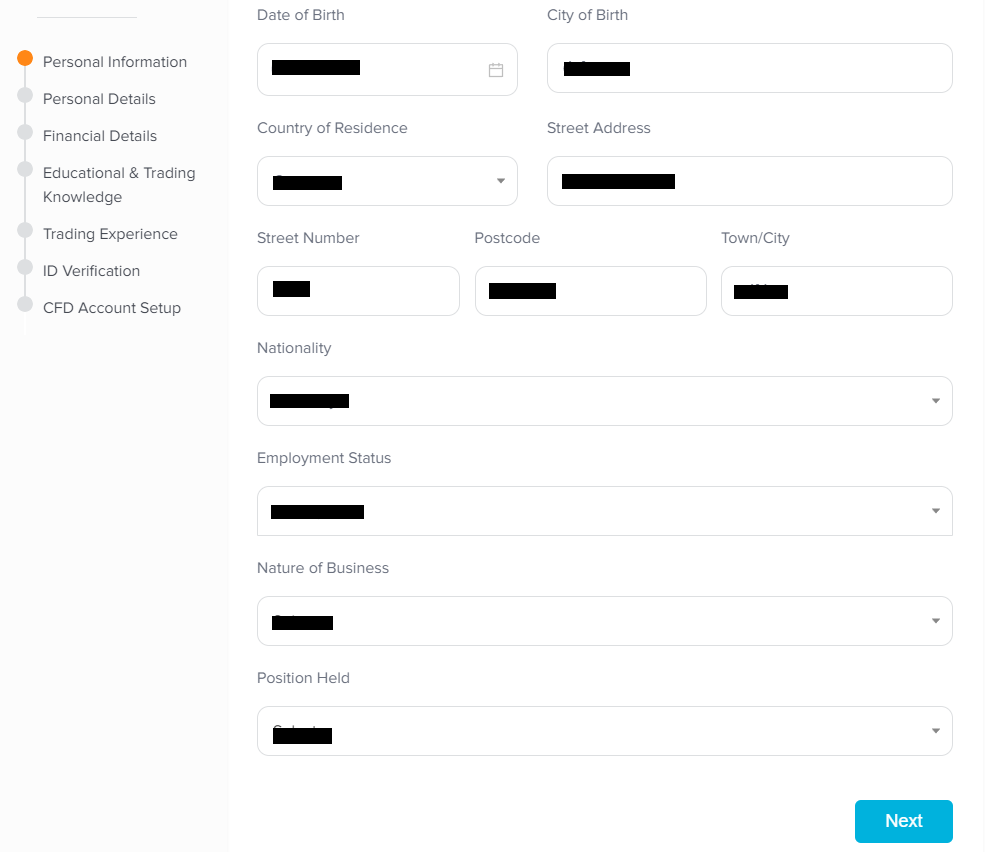

Select your gender, enter your date and place of birth. Select your country of residence from the list and enter your full address with postal code. Enter your nationality and status. Click "Next".

Continue answering the broker's questions. After each block, click the "Next" button. The process takes some time.

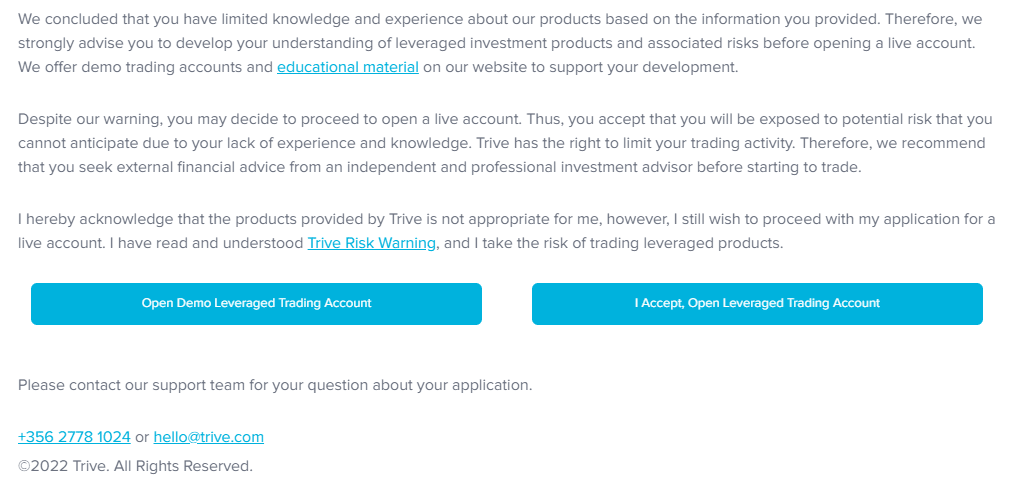

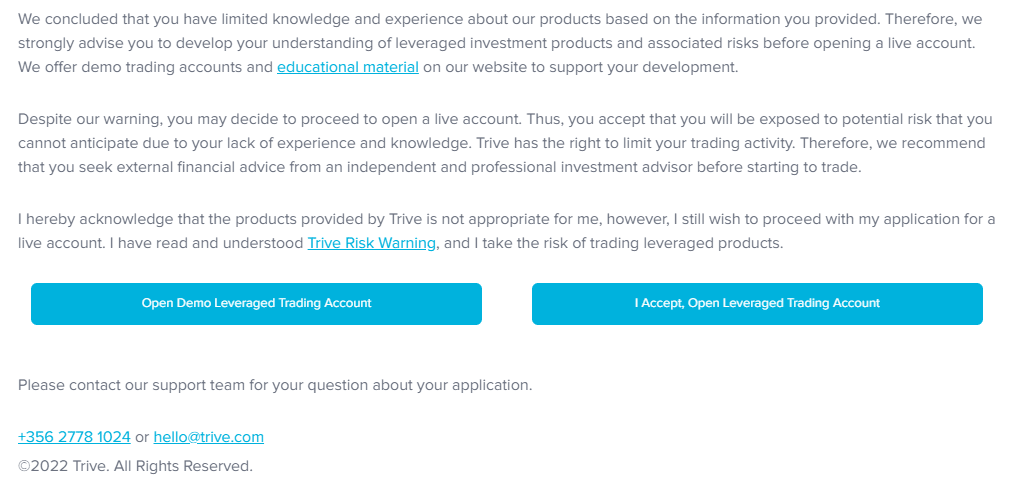

The broker tests your trading knowledge with a small test. The result of the test has no effect whatsoever. You can open a demo or real account in any case.

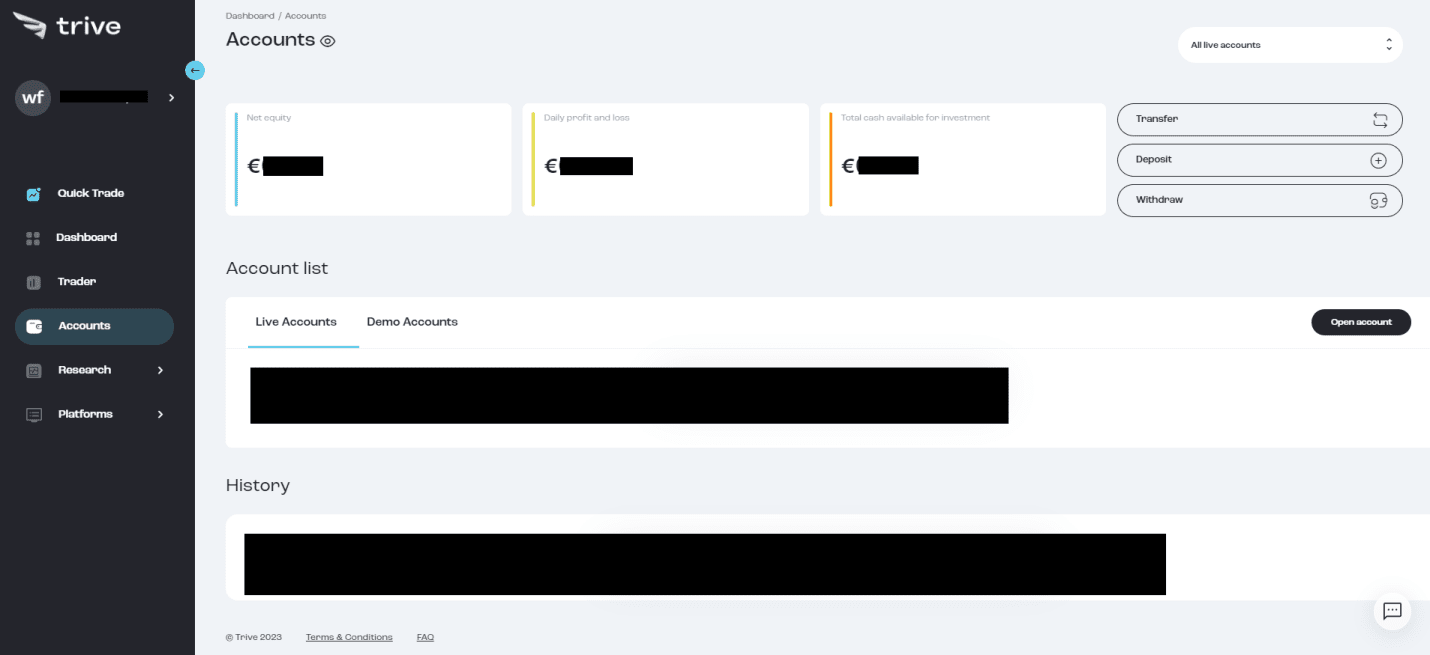

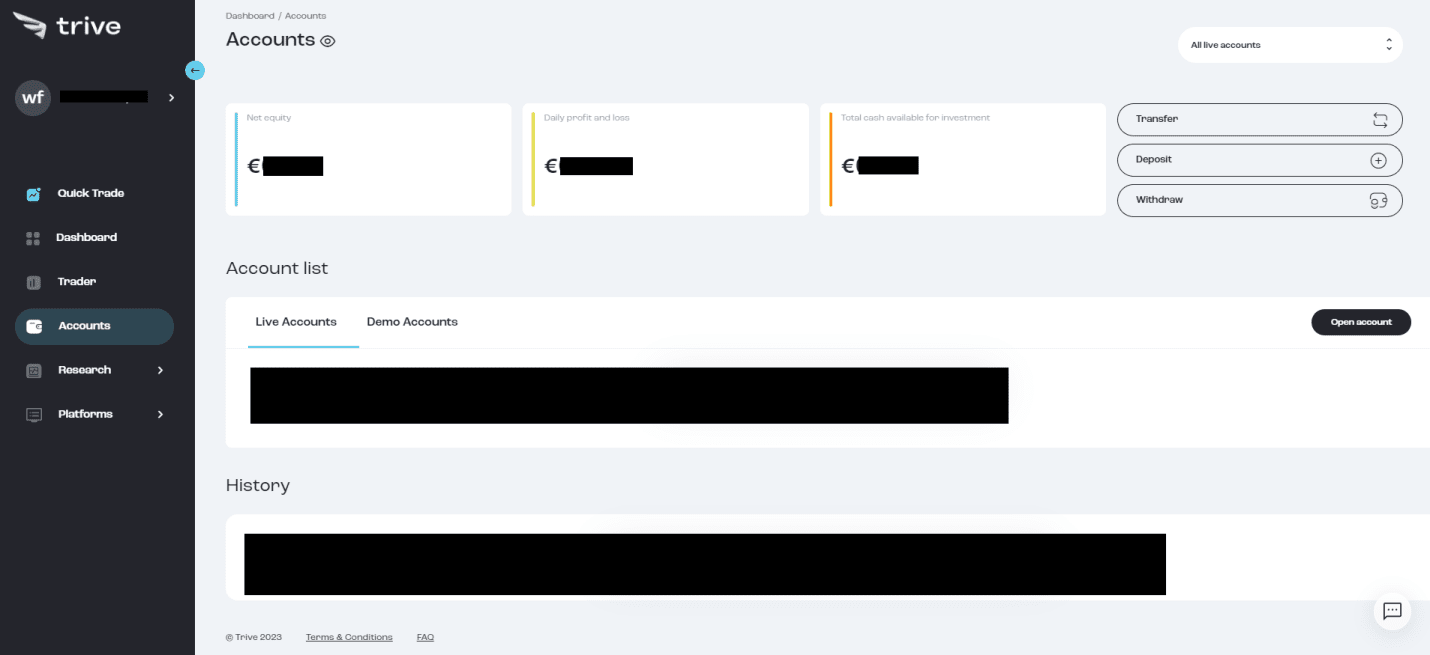

To open a live account, select the appropriate option and simply follow the instructions on the screen. You need to verify yourself by sending scans/images of your identity documents to the broker. Next, you need to choose the type of account, trading terminal, leverage, and other parameters. You can always register a new account through the "Accounts" menu, where there is a corresponding option to "Open an account".

Finally, download the trading terminal. MT4 and MT5 distributions are available in the user account.

You can also perform the following actions in the user account:

-

Fast trading. Thanks to this option a trader can make deals directly from the user account in the browser.

-

Dashboard. Here the summary data on all accounts of the trader is displayed, and details on deals and reports are available.

-

Accounts. In this block the trader sees the state of his accounts, here you can open and close accounts.

-

Research. A large block with a wide range of analytical tools from TradingCentral.

-

Platforms. The block is intended for downloading the MetaTrader 4 and MetaTrader 5 trading terminals.

-

Also in the user account, a trader can modify personal data and set profile security settings.

Regulation and safety

If a trader encounters a broker for the first time, he will want to know whether the broker is a scammer. This desire is understandable and fair because there are still a lot of Forex crooks operating in the market. Trive’s reliability cannot be doubted as the brand belongs to Trive Financial Services Malta Ltd, a large fintech company registered in Malta with several headquarters in continental Europe, such as Italy and Germany. The company is regulated by the MFSA (Malta Financial Services Authority).

Advantages

- Broker has been in the market for many years

- Registered in Malta

- Regulated by the MFSA

Disadvantages

- Not all countries can protect the interests of the trader at the regional level

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Classic | From $7, no commission | There are in most cases |

| Prime | From $5, no commission | There are in most cases |

| Prime Plus | From $1, a fee of €5 for 1 lot | There are in most cases |

If a client of the site withdraws money to a bank account, he does not pay a commission, the broker fully compensates the costs. If the withdrawal is made to a Visa or Mastercard card, or the trader uses an electronic wallet, the fee is 1.5%. This figure does not change under any circumstances. So a trader always knows in advance what his costs will be.

The table below summarizes the average trading fee for Trive and two leaders of the trend. This makes it possible to evaluate the company's offer in comparison and understand how profitable it is.

| Broker | Average commission | Level |

|---|---|---|

|

$5.66 | |

|

$1 | |

|

$8.5 |

Account types

First, decide on the account type that suits you. The broker itself positions Classic as the most universal option because it has a moderate spread and no commission. Prime has a lower spread and no commission, but unlike Classic, the minimum deposit is €2,500. On Prime Plus the deposit is the highest, from €15,000, but the trader receives the smallest spread (from 0.1 point) and the average market commission of €5 for 1 full lot. Also, decide which platform is more convenient for you. Try all three — MT4, MT5, and the broker's proprietary solution. You can do it thanks to the free demo account. The platforms are similar in their basic functions, but they differ quite a lot in additional options and customizable tools.

Account types:

If a trader has never cooperated with this platform before, the ideal option would be to first open a demo account. This will allow them to explore the broker's capabilities and practice without financial risks. Later on, the user can choose a real account according to his needs.

Deposit and Withdrawal

-

Trading on a real account (unlike a demo account), a trader makes full-fledged deals and receives a profit when successful.

-

Profits can be withdrawn at any time by bank transfer, bank card, or e-wallet.

-

Withdrawals are requested in the user account and is considered by managers within a business day.

-

There is no fee for a bank transfer, for a transfer to a card, or cryptocurrency wallet. The fee is 1.5% of the amount.

-

Note that a third party involved in the transaction (such as a bank) may charge its own fee.

-

Withdrawal takes 2-3 days on average to complete.

Investment Options

Some brokers have their own services for copying trades. They may also offer joint accounts and partnership programs, where traders can receive bonuses for invited referrals. However, alternative ways of earning money should not be an end in itself for a site focused on active trading. This is largely why Trive has no passive income opportunities, only partnerships with flexible conditions.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Trive’s affiliate program:

Any client of the site can apply for a partnership. It is not necessary to have high qualifications or meet certain requirements to get the application approved. The company's partner receives at his disposal ready-made marketing tools that allow him to effectively advertise the broker on websites and in social networks by mail, and by messengers. Of course, to earn on such a program, you need to be socially active. You can choose CPA or CPL. The more new customers will come to the site through the partner, the higher his payments will be. Individual terms of cooperation are possible.

Customer support

What types of orders can be opened in the Trive trading terminal? Is replenishment of the account from MC bank cards available? What is the current spread for currency pairs involving euros? Some questions of traders may be caused by their inattention or insufficient transparency of information on the broker's website. It is also not uncommon for users to encounter non-trivial situations and need professional assistance. Trive clients always have the opportunity to contact the technical support service, which is represented by a call center, email, and live chat.

Advantages

- Three communication channels

- Managers respond promptly

- Client questions are followed by a detailed consultation

Disadvantages

- Customer service is not available on weekends

It is not necessary to have a user account on the broker's website to contact customer service. Trive's customer support team is honored with high user reviews and works precisely to eliminate any questions for potential and current clients.

Here are the actual methods of contact:

-

call center;

-

email;

-

live chat on the website and in the user account.

The broker is represented on the following social platforms: Twitter, Facebook, Instagram, YouTube, and LinkedIn. Through them, you can also get in touch with a client service manager. It is recommended to subscribe to one of these social platforms in order not to miss Trive's important news.

Contacts

| Registration address | Floor 5, The Penthouse, Lifestar, Testaferrata Street, Ta' Xbiex XBX1403, Malta |

|---|---|

| Regulation | MFSA |

| Official site | https://www.trive.com/ |

| Contacts |

+356 203 41530

|

Education

Often users with little or no experience come to brokers, and for them, the complexity of entering the financial markets can be overwhelming. Thus, Trive provides its clients with basic training in the form of a booklet on trading. Plus, the site has a FAQs section that explains all aspects of cooperation with the platform.

Traders with an average level and proven professionals will not find any useful information on the Trive website. However, it should be understood that the broker is not obliged to tutor its clients. Its task is to provide a comfortable trading environment, and Trive achieves with that to the fullest.

Comparison of Trive with other Brokers

| Trive | RoboForex | Pocket Option | Exness | FxPro | 4XC | |

| Trading platform |

MetaTrader4, MetaTrader5, Trive | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT5, MT4, WebTrader |

| Min deposit | $1 | $10 | $5 | $10 | $100 | $50 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 25% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of Trive

The broker uses an advanced technology stack, including virtual servers, ensuring the highest speed of order execution. The platform is not a monolith, but a complex of microservices so that the probability of a general failure is excluded and any element can be scaled independently. Also, Trive is sensitive to feedback from its traders. It is thanks to user feedback that the pool of assets was recently increased and new stocks and commodities were added. The company is also expanding physically, opening new offices across Europe. All this speaks in favor of the reliability and trustworthiness of the site.

Trive by the numbers:

-

€0 is the minimum deposit;

-

3 real accounts + demo account;

-

from 0.1 pip on spreads (on Prime Plus account);

-

1:30 is the maximum leverage;

-

€0 commission fee for withdrawal of funds when using bank transfers.

Trive is a comfortable trading platform for traders of different levels

Here a trader can trade shares, ETFs, and CFDs on currency pairs, stocks, indices, and commodities with leverage up to 1:30. The costs are objectively low with floating spreads starting from 0.1 point, and there are commissions only on Prime Plus, and the fee of €5/lot corresponds to the market average. Important for trading comfort is a large number of assets. A trader can easily implement a wide range of strategic decisions because the broker does not limit him in any way. Hedging, scalping, trading on news events, and advisors are available. In addition, an extensive pool of assets is an opportunity to diversify trading risks by including different types of instruments in the investment portfolio. It is also important to note the moderate leverage. The indicator 1:30 is quite enough to increase the profit potential even with de minimis capital, and at the same time, the risk remains within acceptable limits.

Useful services offered by Trive:

-

Demo account. The availability of a free demo is mandatory for a modern broker. This account type allows you to trade on real markets but with virtual money. This is a great opportunity to study the site and practice.

-

Affiliate program. This is not about passive income. After all, marketing materials and mechanisms that the broker provides to its partners are designed for high social activity by the client/partner. But it is not a bad option to extract additional profit.

-

Trading Center. This is the name of a complex analytical tool that is not presented on the company's website but is available in the user account of a registered user. It includes an economic calendar, newsfeeds and commentary by experts.

Advantages:

The trader chooses from several real accounts with trading conditions that are optimal for his situation.

Trive's clients can trade via MT 4 and 5 versions or choose the company's proprietary solution.

There are no restrictions on trading styles or methods; the trader decides for himself how exactly to earn.

A large number of assets from different categories combined with sufficient leverage provides high-profit potential even for novices.

The site has FAQs and a small article on trading basics, and TradingCentral features are available to the broker's clients.

User Satisfaction