Forex Trading Sessions in Australia

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best time to trade Forex in Australia - from 23.00 to 07.00 GMT. The range of trading in Australia is highlighted in a separate session - the Pacific. It partially overlaps with the Asian trading session and belongs to the time period with the lowest volatility.

Twenty-four hours a day, five days a week, the FX markets are open globally. This is a result of the key markets' distribution over four geographical regions that fall under several time zones. The Sydney, Australia market’s best time to trade is from 10 p.m. GMT till 7 a.m. GMT.

The majority of trading happens during the winter months when the American, European, and UK forex markets are open from 10:00 p.m. to 2:00 a.m. AEST. Due to daylight saving time, these hours change in the summer from 12:00 a.m. to 4:00 a.m. local time.

Within these hours, there are specific times that are ideal to trade forex for Australian clients.

Classical Forex Trading Sessions

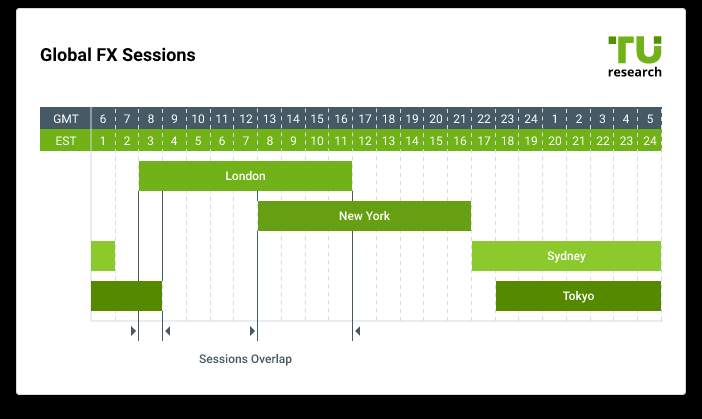

A trading session is a period of time when the banks and trading platforms of one or more nations situated in the same geographic region engage in active trading on the Forex market, impacting the rates of different currencies throughout the world. Overlapping trading sessions are times when one trading session runs into another, significantly affecting market liquidity and volatility.

Traders Union has examined the major trading sessions in Asia (Tokyo), the Pacific Region (Sydney), Europe (London), and America (New York) to find the most active and volatile period for trading foreign exchange. By volume, the trading sessions in the aforementioned financial cities account for over 65% of the world's forex market. London accounts for 35%, New York for 20%, Tokyo for 6%, and Sydney for 4% of the world's total liquidity.

Time Zones in Australia

Forex trading takes place in Sydney from 2:00 GMT to 7:00 GMT. NZD/USD, AUD/USD, and other currency pairings featuring NZD and AUD are the most frequently traded currency pairs in the area. Sydney, Australia, and the whole Pacific area share a single time zone for forex trading, which is true for the entire forex market. If you would like to trade in different markets, you will need to convert your own time zone to be able to trade when the respective market is open.

Rules and Regulation

- Forex regulation in Australia

The Australian Securities and Investments Commission (ASIC) serves as the primary regulatory authority overseeing Forex activities within the country. Its mandate involves ensuring compliance with regulations, maintaining market integrity, and protecting investors.

To obtain a Forex license in Australia, firms must:

- meet ASIC’s capital requirements

- implement certain risk management protocols

- adhere to anti-money laundering (AML) regulations.

- Investor protection in Australia

Australia has strong investor protection mechanisms, with ASIC playing a pivotal role in safeguarding investor interests. Through market surveillance, enforcement actions, and investor education initiatives, ASIC promotes fair and transparent trading practices.

Additionally, the Australian Financial Complaints Authority (AFCA) offers recourse for investors in case of disputes with financial service providers, further enhancing investor confidence in the market.

- Taxation in Australia

Forex trading profits in Australia are typically subject to taxation under the Australian tax system. Individuals engaging in Forex trading may be liable for capital gains tax or income tax, depending on various factors such as trading frequency, duration, and intent. However, certain tax exemptions or deductions may apply, and it's essential for traders to consult with tax professionals to ensure compliance with applicable tax laws.

What is the Best Time to Trade Forex in Australia?

Best time to Trade Forex - TU Research

Traders Union has conducted extensive research on the best times to trade forex across all markets, including Australia.

Sydney and Tokyo's trading hours overlap from 23:00 GMT to 7:00 GMT, during which the volume of some regional currencies, such as the AUD/USD, AUD/JPY, AUD/NZD, USD/JPY, NZD/JPY, and NZD/USD, reaches its peak. The number of traders trading concurrently grows significantly when trading sessions overlap, which has an effect on trading volumes. A higher probability of orders being completed, a reduced likelihood of slippages, and a narrowing of spreads between currency pairings are all indicators of increased liquidity.

Best Time for Forex Day Trading in Australia

Despite being the smallest of the mega-markets, Australia has a lot of early activity when the markets open again on Sunday afternoon because individual traders and financial institutions are attempting to recoup their losses or gains after the extended break starting on Friday afternoon.

After analyzing market trading overlap, Traders Union’s pros found that the best time for forex day trading in Australia is between 23:00 and 7:00 GMT. During this time, there is often a significant increase in liquidity.

Best Forex Pairs to Trade in Australian Trading Sessions

Trader Union’s experts have also taken the time to research the best possible forex pairs to trade during Australian trading sessions.

In order to identify the most liquid currency pairings, the team of Traders Union experts first analyzed statistical data from reputable sources on trade volumes on the Forex market.

According to the Bank for International Settlements, trade in the EUR/USD pair makes up 27.95% of all Forex market activity. USD/JPY is followed by it with 13.34% of the total trading volume. The following currency pairs' positions are as follows:

GBP/USD — 11.27%

AUD/USD — 6.37%

USD/CAD — 5.22%

USD/CHF — 4.63%

NZD/USD — 4.08%

EUR/JPY — 3.93%

GBP/JPY — 3.57%

EUR/GBP — 2.78%

AUD/JPY — 2.73%

EUR/AUD — 1.8%

The remaining 12.33% comes from the other currency pairs.

Time to Pause Forex Trading in Australia

There are a few scenarios in which it is better to not place forex trades in Australia, specifically during periods of low liquidity.

We’ve mentioned that the forex market is open 24 hours a day, five days a week. However, time zones can affect what is open and what is not open for Australian traders. This denotes periods of different trading days when the market may be thin and price spreads may expand considerably. Basically, avoiding trading in extremely volatile markets and during moments of low liquidity will help you save money on your trading position as well as any potential bid-offer spread charges.

The Sunday night session and Fridays, when the market is anticipating the weekend and often trades counter-trend as trade positions are squared, are other occasions when trading may not be as favorable.

The release of significant data points like the U.S. Non-Farm Payrolls is another period when trading is perilous. If the actual amount is significantly different from what the market had anticipated, the exchange rate may quickly alter to reflect the new information.

Best Forex Brokers in Australia

If you still want to take your chances at trading forex in Australia’s market, you have a couple of decent options when it comes to forex brokers.

eToro

eToro is well-loved across the globe as a general broker, but it can also be an excellent forex broker for Australian traders. eToro accepts Australian residents and is fully regulated by and compliant with the Australian Securities & Investments Commission (or ASIC). eToro has an average EUR/USD spread of 1.00 and only requires a minimum deposit of $10. Overall, eToro is a pretty dependable broker for forex traders in Australia.

IC Markets

If you’re an Australian trader looking for low broker spreads on EUR/USD, IC Markets is worth looking into. IC Markets’ average EUR/USD spread is 0.1 pips with a small commission fee of $3.50 per side. IC Markets has some pretty competitive spreads and offers some useful educational material for those new to forex trading in Australia. IC Markets is authorized by ASIC as well.

FAQs

When are the best hours for trading forex in general?

The trading hours make currency trading distinct. The week starts from Sunday at 5 p.m. EST and ends on Friday at 5 p.m. Not all of the day's hours are equally favorable for trading. When the market is at its most active, that is usually the best possible time to start executing trades. The market becomes very active when more than one market is open at the same time, as there are more variations in terms of currency pairs.

Currency pairings frequently become trapped in a narrow pip spread with just about 30 pip of movement when only one market is active. When significant news is revealed, two markets opening at once can easily see volatility north of 70 pips.

Can economic news impact forex numbers and volatility?

While knowing the markets and how they overlap might help a trader plan his or her trading schedule, one factor that shouldn't be overlooked is the real-time release of important economic news. A major news event might boost a typically inactive or poorly-performing market session. A significant economic statement can cause currency to gain or lose value in a matter of seconds, especially if it contradicts the forecast.

A trader does not have to be familiar with all of the dozens of economic announcements that occur each day across all time zones and affect all currencies. Prioritizing news releases into those that should be viewed and those that should be tracked is crucial.

Is liquidity that important when trading forex in Australia?

The definition of liquidity is simple– it simply refers to how easy it is to quickly acquire or sell off assets at a desirable price. The bid and ask spread will be closer and you will be able to trade more without changing the market if there is significant liquidity. The space between the bid and ask, however, may be quite broad and not specifically that deep in an illiquid market. In general, active currency pairs with substantial trading volume are considered liquid currency pairs.

How do I find out which Australian forex broker is right for me?

Great forex brokers include eToro and IC Markets. Search for appropriate leverage levels if you want to look elsewhere. Making big gains or losses would be nearly impossible without leverage. While using leverage in foreign exchange trading has several advantages, it also raises your risk exposure. Only individuals with a lot of trading expertise and a strong tolerance for risk should use a broker's maximum leverage.

When looking for forex brokers, it's a good idea to consider spreads as well. Determine the volume you want to trade, and then determine which broker will offer you the most value for your money based on typical spreads and costs.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).