What Is The Best Time Of Day To Trade AUD/USD?

The AUD/USD pairing sees highest volatility and liquidity at certain times during the trading day. These times are, in GMT format:

12PM to 4PM: At the middle of the London session and beginning of the New York session.

1AM to 3AM: At the peak of the Sydney session and early hours of the Tokyo session.

6PM to 9PM: During the closing hours of the New York market session.

The U.S.A. and Australia are strong trading partners and home to two of the world’s The U.S.A. and Australia are strong trading partners and home to two of the world’s major currencies. Their currency pair, the AUD/USD is commonly described as a major pair and is also one of three commodity pairs, meaning it’s sensitive to changes in commodity prices. This somewhat unique status makes it a popular choice for both beginner and experienced traders. In this article, Traders Union will explore what makes AUD/USD a good pair to trade, what hours to trade AUD/USD, and the advantages of trading AUD/USD.

Is AUD/USD a good pair to trade?

The AUD/USD pair in Forex, nicknamed ‘the Aussie’, is one of the more popular currency pair options for traders. Though its designation as a ‘major currency pair’ is contested, it is one of the three most-traded ‘commodity currencies’ against the US dollar. AUD/USD is the 6th most traded currency pair according to Investopedia and makes up 5.1% of the Forex market share as of 2023.

Australia has the 14th largest economy in 2023, according to Forbes, and is a major exporter of coal, iron-ore and other metals and minerals. Its status as a major commodity exporter, and the country’s close trade relations with the U.S.A., make AUD/USD a strong pairing. Additionally, Australia has had relatively high-interest rates compared to the United States, which attracts ‘carry traders’, who seek to profit from the interest rate differential between nations.

Additionally, the Australian economy has close ties to Asian economies, especially China. Changes in economic conditions in Asia can impact the AUD/USD pair, providing trading opportunities for those who follow these markets.

AUD/USD trading hours

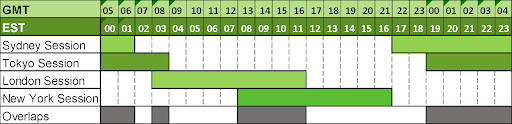

AUD/USD, like all currency pairs, can be traded 24 hours a day, five days a week (Monday to Friday, or Sunday night to Friday depending on your time zone and location). However, there are times that are preferable for trading AUD/USD. Major foreign exchange markets in different countries are open at specific times during the day, leading to variations in liquidity and volatility throughout the trading day. It’s important to know when each market is open, and when market sessions overlap, to coordinate your trading times and strategy.

There are four major foreign exchange markets around the world, each with their own market sessions throughout the trading day:

-

Tokyo Session (Asian Session): Runs from 12:00 AM to 9:00 AM GMT. It’s dominated by Asian markets and sees increased activity in AUD pairs.

-

London Session (European Session): Is open from 8:00 AM to 5:00 PM and overlaps with Tokyo, providing liquidity. The EUR, GBP, and CHF pairs are most active. AUD/USD sees highest volatility during this session.

-

New York Session (North American Session): Running from 1:00 PM until 10:00PM GMT, this session overlaps with London, resulting in high liquidity. USD pairs are the most in focus.

-

Sydney Session (Pacific Session): Open from 10:00 PM to 7:00 AM GMT. It’s the smallest session, and AUD and NZD pairs are most active. It overlaps with Tokyo’s session and provides continuity between sessions.

AUD/USD trading hours

The best times to trade AUD/USD

The best times to trade AUD/USD will depend largely on a trader’s trading strategy, location and time zone, and financial goals. However, trading during times of high volatility means higher liquidity, narrower spreads in the bid-ask price, and more trading opportunities leading to higher profit potential. However, times of high volatility also means higher risk, as price movements are more significant and unpredictable.

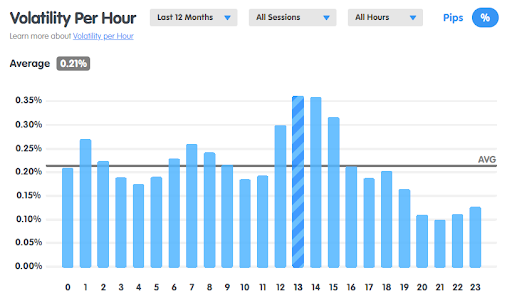

The times of day that see the highest volatility in AUD/USD trading, based on GMT, are:

-

1

Peak of European Session 12PM to 4PM GMT: These are the peak hours of the London session and beginning of the New York session, marking the New York – London market session overlap. Volatility peaks here. Major economic releases for both Australia and the U.S. frequently occur during this overlap. This is 8AM to 12PM EST in New York, and 11PM to 3AM local time when trading from Sydney.

-

2

Peak of Sydney – Tokyo Overlap 1AM to 3AM GMT: AUD/USD sees its second highest volatility at the early hours of the Asian session and middle of the Pacific session, during their long overlap. Australian economic data releases often happen during this time, contributing to the increased volatility. In New York, this is 9PM to 11PM EST. In Sydney time, this is 12PM to 2PM.

-

3

Closing of New York Session 6PM to 9PM: When the New York market session is ending, market news or economic releases are announced that affect USD pairs, and AUD/USD volatility sees an uptick. This is 5AM to 8AM in Sydney, and 2PM to 5PM EST in New York.

Volatility per hour - Source: Babypips.com, GMT Time Zone

What is the daily volatility of the AUD/USD?

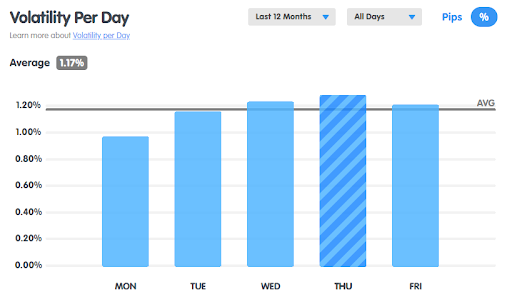

Many factors can influence daily volatility in AUD/USD, causing it to fluctuate throughout the trading week. On Monday, traders are often reacting to weekend events when the market opens. Stability varies throughout the week, and with most currency pairs volatility is at its highest on Fridays. However, with AUD/USD, volatility is highest on Thursdays. It’s at its lowest on Mondays.

Daily Volatility of AUD/USD (Source: babypips.com)

How to trade AUD/USD?

Trading the AUD/USD involves considering various factors, such as the differential in interest rates, the Reserve Bank of Australia (RBA), and commodity prices. Make sure to consider these key factors when adopting your trading strategy:

-

Correlation with Commodities: The Australian Dollar is closely tied to commodity prices, particularly metals and minerals. Monitor commodity markets, especially iron ore and gold prices, as they can influence the price of the AUD/USD pair.

-

Commodity Price Trends: Look for trends in commodity prices and how they align with the movement of the AUD/USD. Trend Following strategies can be employed based on these correlations, such as Commodity-Currency Trend Following.

-

News from RBA: The Reserve Bank of Australia (RBA) decisions on interest rates, and statements and economic assessments provide insights into the health of the Australian economy. A positive outlook may support the AUD, while a cautious or negative outlook could lead to depreciation. The RBA sets targets for short-term interest rates and issues monetary policy guidance on the first Tuesday of each month.

-

Interest Rate Carry Trades: Take note of interest rate differentials between Australia and the U.S.A. Traders may engage in carry trades by going long on the currency with a higher interest rate (AUD) and short on the currency with a lower interest rate (USD)

-

Key Economic Indicators: Regularly check economic indicators such as employment data, GDP growth, and inflation rates from both Australia and the U.S.A. Australian economic indicators can be found at the website of the Australian Bureau of Statistics.

Pros of trading the AUD/USD currency pair

There are several benefits to trading the AUD/USD currency pair, as is evidenced by its position as the sixth most popular currency pair (or fifth, depending on the source). The advantages are:

-

Liquidity: As one of the most traded currencies in the world, AUD/USD sees high liquidity. This allows ease of trade, less slippage, lower trading costs, and a deeper market depth that buffers against shocks to the wider market.

-

Narrow Spreads: As a widely traded currency pair, spreads between the bid and ask price for AUD/USD is relatively tight compared to less popular pairs. This can reduce the overall price for traders.

-

Carry trading: Australia and the United States typically have very different interest rates. This creates opportunities for carry traders who seek to profit from the interest rate differential between AUD and USD.

-

Diversity of Trading Sessions: The AUD/USD can be actively traded during various market sessions, including the overlap of the Asian, European, and U.S. sessions. This allows traders to choose from different time frames that suit their preferences and strategies.

For up-to-date analyses and forecasts for AUD/USD price action, see Traders Union’s expert analytics feed.

Best Forex brokers

Summary

Overall, the best time to trade AUD/USD will depend on your financial goals and general strategy for trading the popular currency pair. Trading during the peak hours of the European market session, and the London – New York overlap, as well as during the middle of the Tokyo – Sydney overlap and end of the Sydney session, will see the highest volatility. Trading during times of high volatility makes more sense if you want to see larger price movements and profit potential.

Be aware of Risks

Be considerate of your own time zone. If based in Sydney, or the same time zone, you might want to take advantage of the Sydney and Tok

While high volatility presents trading opportunities, it also leads to increased risk. Be sure to implement stringent risk strategies to minimize losses. Additionally, the volatility of commodities adds an extra layer of risk to AUD/USD trading, due to their correlation. Due to the USA and Australia having almost opposite time zones, it can be difficult to follow economic releases and market news for both countries, as they occur half a day apart. Be cautious of political, geopolitical and market events that affect both Australia and the U.S.A.

FAQs

What time does the AUD USD market open?

The Forex market is open 24 hours a day, five days a week, and the AUD/USD pair can be traded anytime during the trading week. The overall Forex market opens on Sunday at 10PM GMT, when the Sydney (Pacific) market opens, and closes on Friday at 10PM GMT when the New York (American) session closes.

Is AUD bullish or bearish?

The market has been predominantly bearish since 2013. In 2013 one AUD was worth 1.06 USD, in 2024 one AUD is worth 0.65 USD.

What is the Australian dollar trading at today?

For the exact value of the exchange rate for today, please visit: Aussie Price Predictions.

Is AUD USD good for scalping?

Generally speaking, yes. The scalping strategy favors high liquidity, low spreads, and high volatility. During the right trading hours, scalping is a good strategy for AUD/USD.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

4

Scalping

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

-

5

Economic indicators

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).