The Traders Union explores what determines the Bitcoin price?

This article focuses on factors that influence the Bitcoin rate. Such factors become more and more relevant as the popularity of Bitcoin grows. Indeed, and if the central banks’ lending rates and economic performances are critical in the Forex market, then what determines the Bitcoin exchange rate, since it is not controlled by any central bank? The conclusions of the experts at the Traders Union are explained below.

Start trading cryptocurrencies right now with Binance!What is Bitcoin?

Bitcoin is considered the first functioning cryptocurrency, although attempts to create it were made earlier in the form of e-cash and e-gold, but they failed. Bitcoin emerged as a result of the 2008 crisis when banks and governments were unable to manage financial systems effectively.

On October 31, 2008, someone logged in as Satoshi Nakamoto and published a white paper describing Bitcoin as a "peer-to-peer e-money system" based on cryptographic ciphers. The Bitcoin network code is publicly available.

White Paper

The identity of Satoshi Nakamoto has not been established. In 2013, he stopped posting on forums, saying that: "Bitcoin is safekeeping." It is even unknown whether Satoshi is one person or a group of programmers.

At different times, there have been suggestions that Satoshi is Dorian Nakamoto, Hal Finney, Nick Szabo from the USA, or Craig Wright from Australia. All of them are computer scientists, they are concerned with programming and digital currencies to a different extent, but none of them has ever been recognized as the Bitcoin creator.

How Bitcoin works

Bitcoin is a decentralized system. This means that it doesn’t have a specific location, such as a Central Bank. It is necessary to install nodes on computers that store copies of the registry to participate in the system. Participants have equal rights, anyone can join.

The registry is a chain of blocks, literally the “blockchain”. The blocks store data on all transactions between system participants. To make changes to the registry, they must be approved by other members.

In plain English, the registry is like a Google document that a lot of people are working on simultaneously. Everyone can make changes to it, while the document is unified, distributed, and updated in real-time.

The system is based on cryptographic ciphers invented back in the 1970s. This makes Bitcoin nearly impossible to hack. The use of cryptographic ciphers defines the name for the entire asset class – cryptocurrencies.

But serious computing power is needed to solve cryptographic problems and add new blocks to the network. They are provided by miners. Miners perform complex calculations on their equipment and get Bitcoins as a reward for this. This process is called mining.

The system is designed for a limited number of coins. In total, 21 million Bitcoins can be mined. This number is hardcoded in the initial code. About 90% of the coins were mined at the end of 2023.

Because the number of Bitcoins is limited makes it possible to compare Bitcoin with gold, which is also limited. Modern investors, including even world-famous ones, use Bitcoin as a means of protecting against inflation and saving capital for a long time.

Such are the factors that determine the Bitcoin rate since the property of Bitcoin to retain value increases the BTC/USD rate.

Top 8 factors that affect the Bitcoin price

The factors are:

-

desire and willingness of people to invest in Bitcoin

-

desire and willingness of people to speculate on the Bitcoin rate

-

DeFi development

-

Bitcoin distribution as a means of payments acceptance

-

actions and statements of official financial regulators and politicians

-

actions and statements by opinion leaders like Elon Musk

-

halving

-

network effect

So, let's examine each factor individually.

1. Bitcoin investment level

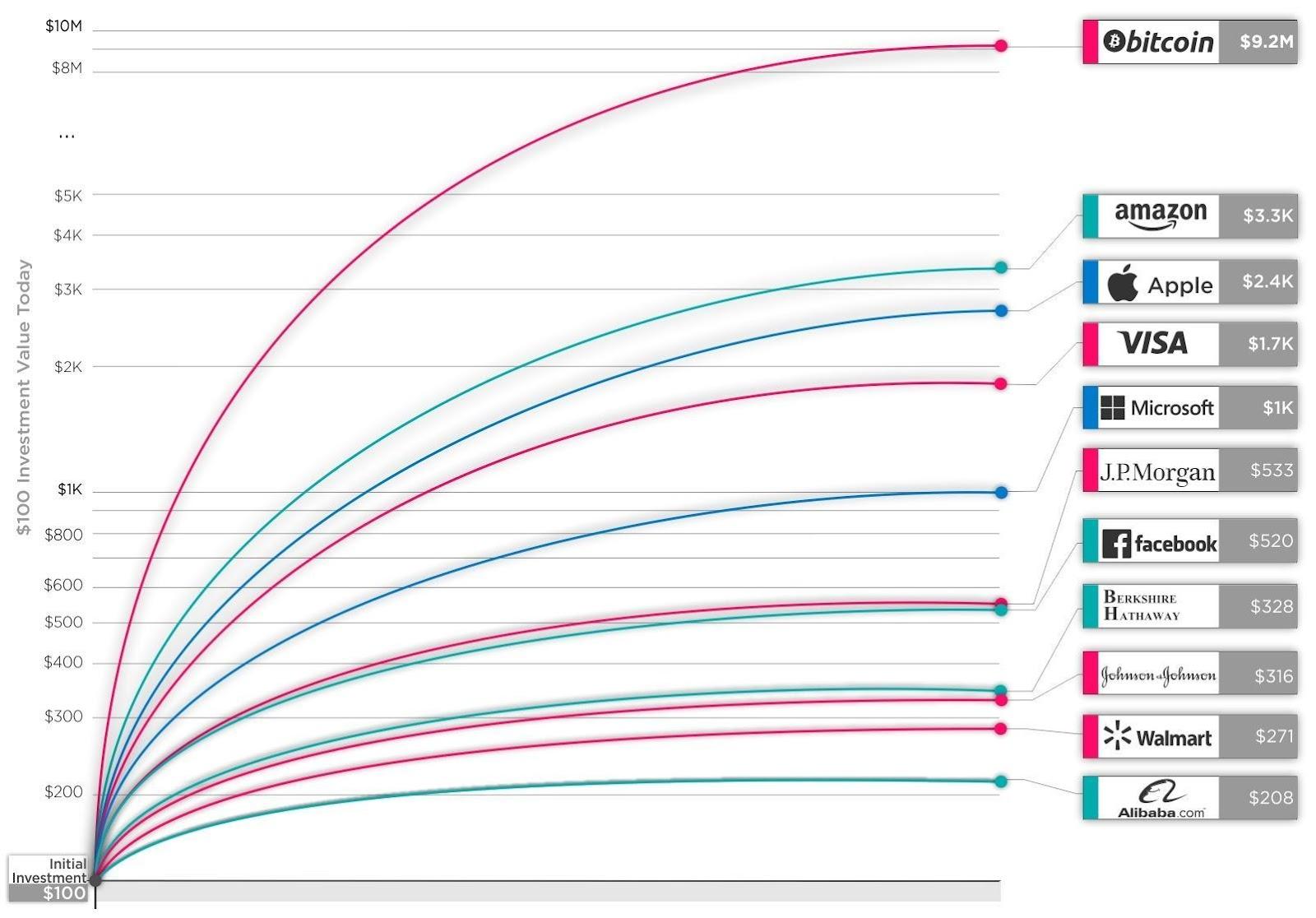

As shown in the chart below, in 2023 the Bitcoin rate (1) outstrips the growth of both commodity markets (2) and stock markets (3). And gold, a classic safe way for keeping capital from inflation, is disappointing (4).

Bitcoin Investment Level

Therefore, more and more people around the world, including the famous billionaire investor Paul Tudor Jones, believe that Bitcoin beats gold and that the precious metal transfers its functions to digital currency.

The Grayscale Fund, one of the leaders in investing in cryptocurrency, allows large investors to invest in Bitcoin and other cryptocurrency assets.

In January 2023, the ProShares Bitcoin Strategy ETF launched the first Bitcoin ETF in the United States, expanding the opportunities for investors to generate income from the Bitcoin rate conveniently and transparently. The fund (traded under the ticker BITO) doesn’t invest directly in cryptocurrency but seeks to provide capital gains by working with Bitcoin futures contracts that are traded on the CME exchange.

During the first 2 days of trading, the volume of investments in this ETF exceeded $1 billion, emphasizing the interest of investors.

Volume of Investments

At the end of 2019, Bitcoin was the best investment of all time according to the project. The world pandemic has confirmed Bitcoin's status as an attractive investment asset, despite its excessive intraday volatility and problems with the adoption by official regulators.

Volume of Investments

Public companies have long paid attention to Bitcoins and accept them to their balance. Macrostrategy is its largest holder. It owns over 114 thousand Bitcoins (at the end of January 2023) and is not going to sell its assets.

Conclusion: Over time, more and more market participants speak out positively about the investment properties of cryptocurrency. And they avouch their words with proofs. This contributes to the growth rate of Bitcoin.

2. Bitcoin trading activity

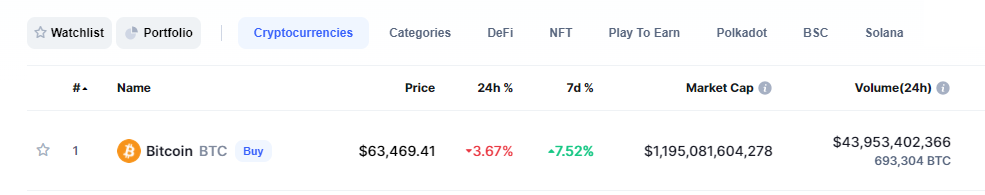

According to Coinmarketcap, the volume of Bitcoin trading is about $50 billion per day. Sure, not all of this volume is represented by the transactions of investors purchasing coins for long-term storage.

The Volume of Bitcoin Trading

The digital currency's high volatility provides infinite possibilities to benefit from scalping, algorithmic trading, intraday speculation, and buying Bitcoins for short-term storage.

All of these interests are accelerating the Bitcoin course-changing. It turns out to be a self-starting chain. As the Bitcoin rate changes → speculators take positions in the direction of the impulse → the rate changes even faster. All of this leads to bubbles and liquidations daily.

Aggregate Liquidations

Liquidation of $1 million positions in 1 minute is common

As Bitcoin price changes become stronger, they attract journalists, and news attracts new market participants who want to make a lot of money on the current trend. This is also accompanied by panics and asset bubbles.

Withdrawal: Over time, more and more people are trying to make money on short-term Bitcoin fluctuations, including using robots. This shakes the market and contributes to both growth and decline in the Bitcoin rate. You also can be interested in the best time to trade Bitcoin during the day.

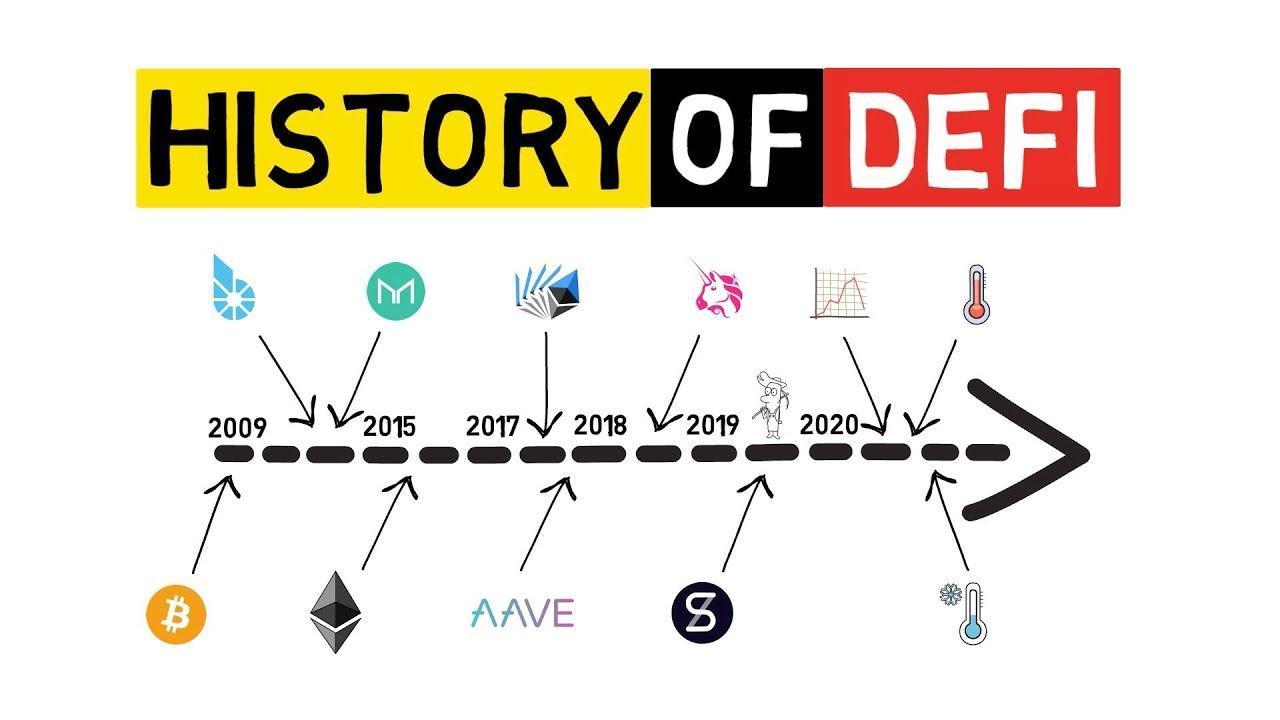

3. DeFi and digital infrastructure

DeFi (short for “decentralized finance”) is a generic term for many applications and projects in the public blockchain space, usually using smart contracts.

Smart contracts are auto-enforcing agreements that don’t require intermediaries to execute and can be accessed by anyone with an internet connection. Thanks to DeFi, you can implement the processes of simple lending, borrowing, or trading financial instruments without participating in the transaction.

DeFi is believed to have started in 2009 with the launch of Bitcoin, and the launch of Ethereum in 2015 made smart contracts plausible. The Ethereum network is a 2nd generation blockchain that allows the potential of this technology to be realized in the financial industry.

Conclusion. DeFi provides a variety of opportunities to create a transparent and reliable financial system that no one controls. The system develops and improves every year. And new projects indirectly support the Bitcoin rate.

4. Accepting payments

In 2020, PayPal introduced Bitcoin support for US residents, and since then, Bitcoin usage has increased.

The Coinbase cryptocurrency exchange card also allows you to use Bitcoins for shopping. You can pay with it in stores, while the funds are converted from a cryptocurrency account on the Coinbase exchange.

Cryptocurrency support is being gradually developed and implemented by the payment giants Visa and Mastercard. This means that more and more people will be able to use cryptocurrencies.

Conclusion. The integration of cryptocurrencies by payment operators as a method of payment for goods and services supports the Bitcoin rate.

5. Decisions by monetary authorities influence the Bitcoin rate

The Bitcoin rate is highly dependent on the actions and statements of official financial regulators and politicians. Let's consider two examples.

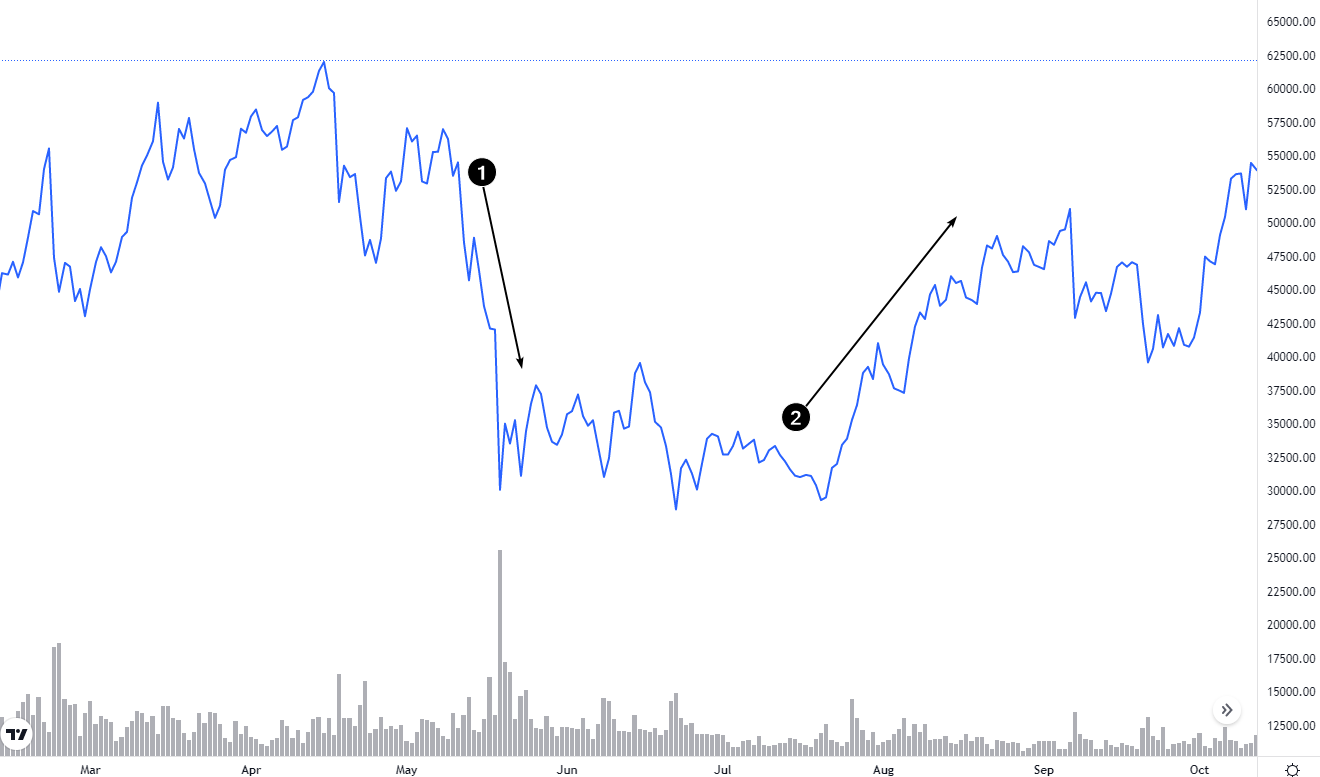

Example 1. The Chinese authorities have made negative statements regarding cryptocurrency traders, and especially miners. In 2023, China was experiencing problems with energy supplies, and cryptocurrency mining was banned. Entire factories for Bitcoin and other cryptocurrencies mining were forced to relocate. This contributed to the Bitcoin crash in May, as shown by the number 1 in the chart below.

Bitcoin Chart

Example 2. El Salvador in 2023 became the first country that approved Bitcoin as an official means of payment. The law officially entered into force in early September. Now sellers of any goods in El Salvador cannot refuse to accept Bitcoins. Moreover, President Bukele ordered the construction of a mining farm that uses the energy of volcanoes.

For some time before the law came into force, the Bitcoin rate grew steadily, as shown in the chart above by the number 2.

Conclusions. Statements and decisions of leading politicians, leaders of countries, heads of financial regulators greatly affect the Bitcoin rate. This is especially considered in the United States and China news.

6. Impact of statements of famous personalities on the Bitcoin rate

It is known that such athletes and celebrities as 50 Cent, Paris Hilton, Gwyneth Paltrow, Serena Williams, Floyd Mayweather, Kanye West, Mike Tyson, and many others have invested in Bitcoin.

There are no details about the amount of investment, but we are sure that they made a profit. And also that their fans followed them.

The author of the book “Rich Dad, Poor Dad”, Robert Kiyosaki, encourages people to buy Bitcoins.

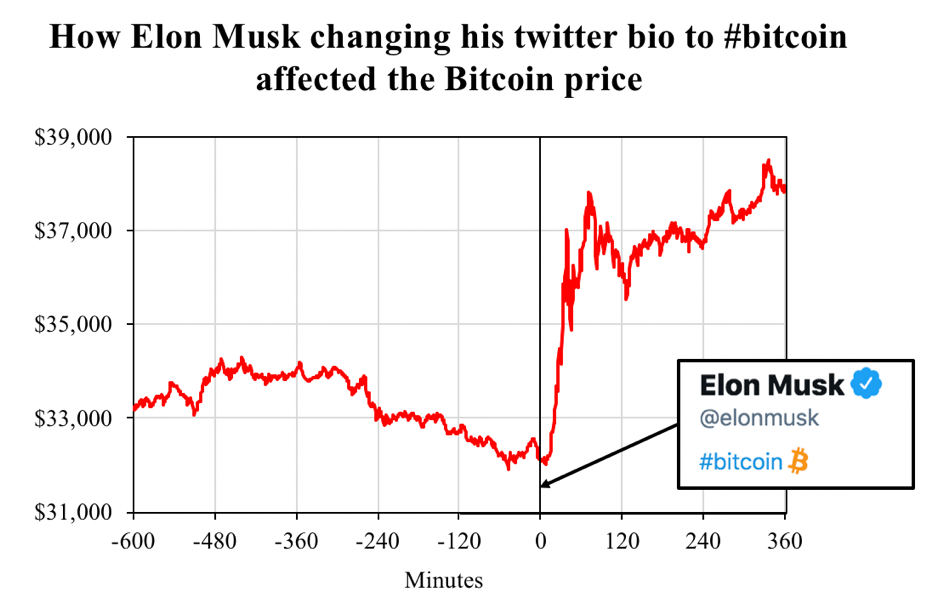

The influence on the Bitcoin rate of tweets of the richest man in the world Elon Musk deserves separate attention.

Lennart Ante from the University of Hamburg did the research. He measured the dynamics of the BTC/USD market after Elon's tweets. As a result, it turned out that tweets have a strong effect that tends to accumulate.

It turned out that in the first 5 minutes after the publication of Musk's tweet, the average change in the Bitcoin rate was 2%. And the average increase in trading volume was 10%. The great effect of influencing the BTC/USD rate was observed up to 6 hours after the tweet.

Bitcoin Price after Elon Musk Tweet

And although some publications are humorous, investors are asking questions:

-

Does Elon benefit from his tweets?

-

How to protect cryptocurrency assets that are subject to publications of famous personalities? If one tweet from Musk could lead to a $111 billion increase in Bitcoin capitalization, another tweet could also bring it down by a similar amount.

-

Under what conditions can famous people comment on specific cryptocurrencies?

After these issues began to be discussed in the market regulators’ circles, Musk became more cautious in his public messages.

Conclusion. Some people have the right to freely express their opinions, and cryptocurrency markets are relatively weakly regulated compared to, for example, the stock markets, where authorities fight against manipulation. Therefore, news of famous personalities about cryptocurrencies can greatly affect the price of Bitcoin, both upward and downward.

7. How halving affects the Bitcoin rat

Halving is a reduction in the remuneration that is paid to miners. This procedure is programmed into the Bitcoin code.

The halving occurs approximately every 4 years. And interestingly, within a year and a half after the halving, Bitcoin sets new significant high scores. The last halving took place in May 2020, when the Bitcoin rate was about 10 thousand. And already in January 2023, Bitcoin cost 6 times more. Coincidence or relationship? Opinions differ.

Conclusion. Although Bitcoin grows each time for 1.5 years after the halving, its impact on the rate hasn’t been reliably established.

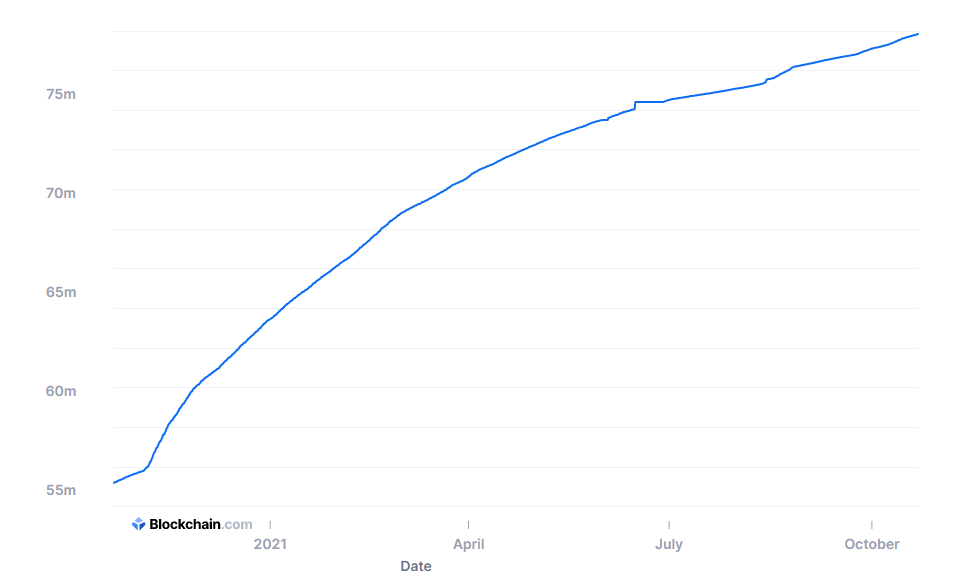

8. Network effect

A network effect is a phenomenon when a new user joins a product and adds value to the product. For example, a messaging platform will increase in value as more people join, thereby increasing the number of contacts with which to communicate.

Network effects are important for projects like Facebook, Uber, PayPal, and iMessage. It also has an impact on Bitcoin.

Network effects

The growing number of registered wallets and nodes connected to the Bitcoin blockchain assert the inner value of the coin.

Conclusion. The growth in the number of Bitcoin network users has a positive effect on the BTC/USD rate.

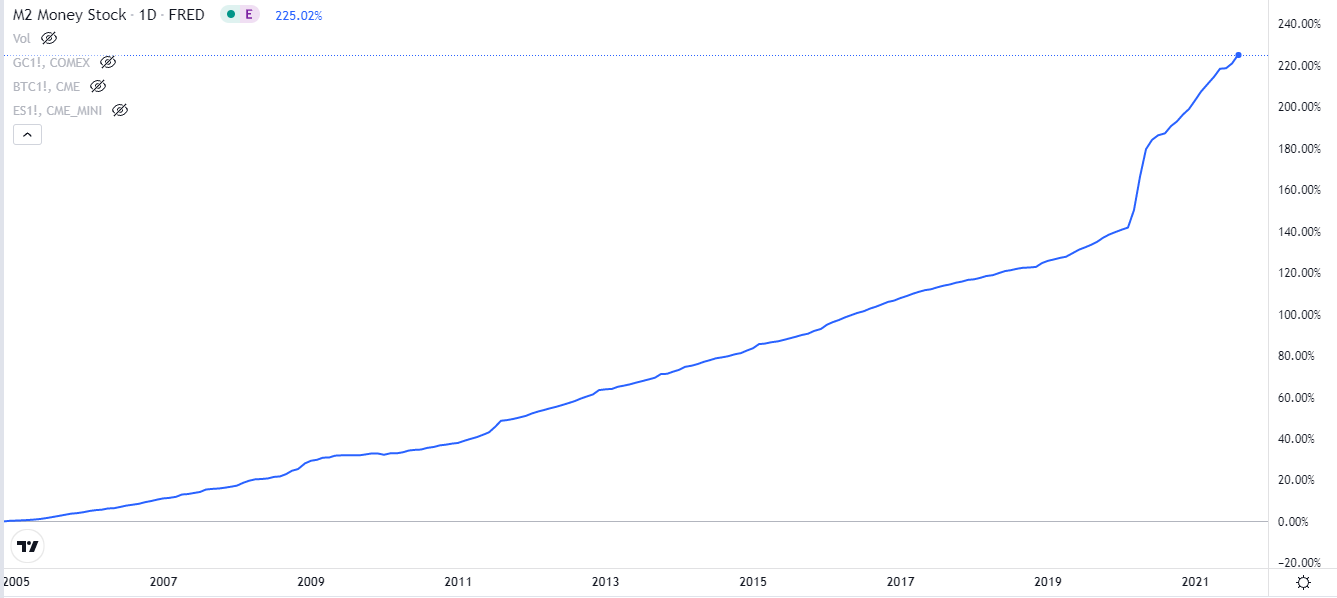

Why Bitcoin’s rate is growing in 2024

Since mid-2020, the amount of money in the world has grown faster than usual.

Bitcoin’s rate growing

To save the economy from the impact of the Covid-19 pandemic, the Federal Reserve System deposited over $4 trillion to its balance sheet as part of an indefinite quantitative easing program, while the US government allocated over $5 trillion in fiscal stimulus.

Similar liquidity injections have been carried out by central banks around the world.

All this money can be transferred into stocks, cryptocurrency, or real consumption, but the main problem is inflation. Therefore, seeking to find a haven for their capital, investors, from ordinary market participants to well-known fund managers, are paying more and more attention to Bitcoin.

Conclusion. Since the protection against inflation is embedded in the Bitcoin code, this has a positive effect on its rate and creates an advantage over fiat money, which the central banks of individual countries can infinitely issue.

Bitcoin’s price forecast

At any moment, you can find on the network a sufficient number of analysts and forecasters who argue their point of view both in favor of the Bitcoin growth and in the direction of the Bitcoin rate decrease. Moreover, these forecasts are constantly changing depending on the movements and news.

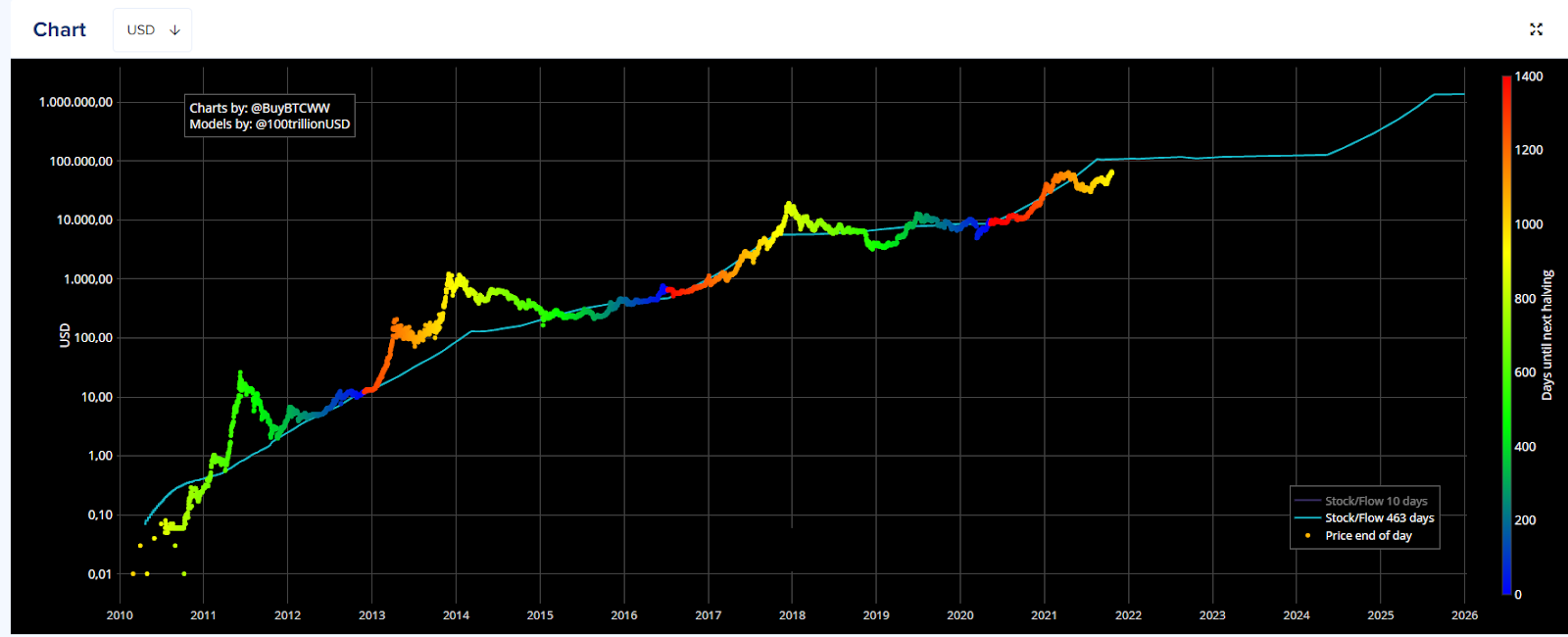

Therefore, a forecast comes from the anonymous mathematician PlanB, who created a statistical model of the dependence of the price on the amount of its available supply — stock 2 flow. This model describes the dynamics of Bitcoin quite well until the time of this article in the Autumn of 2023.

Dynamics of Bitcoin Quite in the Autumn of 2023

According to this model, the BTC rate will soon reach $100 thousand and will hold steady at this level for several years. Then it will grow to a million.

Only time will show whether it will be so in reality.

Advice. Trust internet forecasts and analysts less, develop your own judgment.

Why Bitcoin occasionally declines against the dollar

If you see headlines announcing that the Bitcoin rate against the dollar has decreased, most likely the reason for this is related to one of the influencing factors described above.

If this is not the case, then perhaps we can talk about some kind of failure associated with the fact that trading takes place online in the digital space. And the whole process is carried out according to algorithms, which may contain errors.

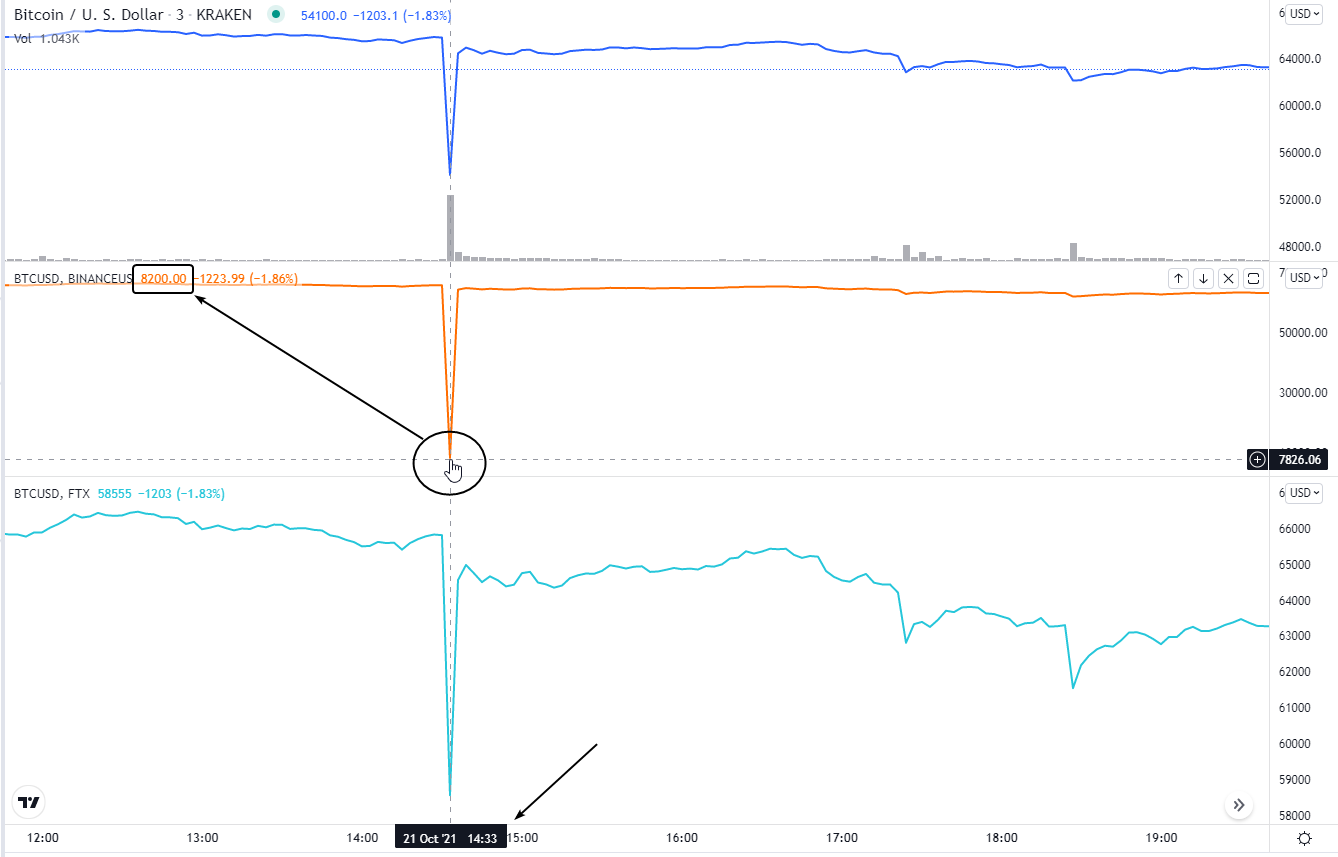

An example is a failure that occurred on October 21, 2023, when the Bitcoin rate on the Binance US exchange suddenly dropped from $64,000 to $8,000. Smaller abnormal movements have been seen on the Kraken and FTX exchanges.

Bitcoin Price

A similar sharp drop in price is often called a flash crash. The term was invented in May 2010 when the S&P 500 inexplicably dropped about 3% in just four minutes and rebounded sharply. As a result of an investigation that lasted 5 months, the state commission concluded that a combination of several influencing factors was the reason when a large fund made a sale, high-frequency algorithms increased the effect, and there were not enough buy orders in the order book.

The measures that were taken after the flash crash in 2010 turned out to be ineffective because the rapid crashes occurred later. The reason is the high degree of trade digitalization and algorithmization. Errors in code or settings can lead to crashes of all sizes, and Facebook’s shutdowns worldwide are examples.

Conclusion. Traders and investors should consider the likelihood of a recurring flash crash. During such reductions, stop-losses can be executed, but there is no counterparty for buy limits. Carefully control your risks, taking into account the size of the margin leverage.

Best Bitcoin brokers in 2024

Also, such spikes as in the picture above can occur due to the malicious intent of an unscrupulous broker who has the technical ability to manipulate quotes that are sent to their clients.

Therefore, in order not to become a victim of scams, it is recommended that you invest in Bitcoin through trusted brokers.

Such as:

-

Exness

-

Forex4you

-

Avatrade

Advantages of Exness:

rapid account opening

trading allowed twenty-four/seven

leverage is up to 1:200

narrow spreads

the absence of swaps (costs associated with moving a position overnight).

Advantages of Forex4you:

regulated broker

high-quality execution even in times of high volatility on PRO STP accounts

the ability to invest in Bitcoins, as well as LTC, ETH, BCH.

leverage is up to 1:5

low commissions

support from a live specialist in online telephony

Advantages of Avatrade:

regulated broker on 6 continents

instant execution

the ability to invest in Bitcoins, as well as LTC, ETH, BCH, XRP, BTG, EOS, and Dash

tamper resistance

no commissions

Moreover, by opening an account with a licensed broker, you also get access to trading on other instruments such as currency pairs (Forex), CFDs on stock indices, metals, stocks, and other financial assets. So you get the opportunity to form a diversified portfolio in one place!

Conclusion

At the dawn of Bitcoin's existence, its rate was calculated based on the cost of electricity that is needed for mining. So, in December 2009, the lowest Bitcoin price was registered as ₿1,600 for $1.

Over time, many more factors have affected the Bitcoin rate. These are economic and political, and related to the blockchain network as well as many other reasons discussed above.

A big positive impact on the price of Bitcoin comes from news of high-level adoption. For example, listings on the Coinbase cryptocurrency exchange and on the Nasdaq exchange.

This review does not claim to be all-inclusive, so if you have additional information relevant to this article that will be useful to many traders, please contact the Traders Union.

Studying the factors that influence the Bitcoin rate is the key to building effective Bitcoin trading strategies based on facts, not gambling impulses.

Before investing in Bitcoin, test your skills on a demo account.

FAQs

Does macroeconomic news affect Bitcoin’s price?

Partially, yes, since Bitcoin is quoted across the dollar. And the value of the dollar depends on news from the Federal Reserve, on unemployment, and inflation data. Therefore, you can see the BTC rate increased volatility during the release of important information related to the US dollar.

Bitcoins are very expensive, so can I buy only a small part of just one?

Sure. Digital coins can be highly fragmented. Therefore, you can start trading Bitcoin even with an amount of just several hundred dollars.

Bitcoin has already grown a lot, isn't it too late to start investing?

Of course not. The news of 2024 confirms that Bitcoin is with us for a long time. Its fluctuations are constant. By knowing how to trade Bitcoin, you can significantly improve your financial situation. Also, you can apply these skills to other markets.

Does technical analysis work in the Bitcoin market?

Yes. Perhaps it works even better than on other markets. Try building channels to see how the algorithms respond to them. Pay attention to the round levels. They have a strong psychological effect, and by observing the Bitcoin rate behavior at a multiple of 1,000, you can soon understand whether the rate is ready to go further or reverse.

Team that worked on the article

Glory is a professional writer for the Traders Union website with over 5 years of experience in creating content in the areas of NFT, Crypto, Metaverse, Blockchain, or Web3 in general. Over the last couple of years, Glory has also traded on different cryptocurrency and NFT platforms including Binance, Coinbase, Opensea, and others.

“I understand a lot about this space, being familiar with CEX, DeFi, and DEX, as well as operating across the Ethereum, Binance, and Polygon networks. Also, I know the intricacies and subtleties of NFTs and crypto, thus I am able to bring to table the best content and help connect with the audience better.”

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.