Gold vs BTC: Which is a better investment for you?

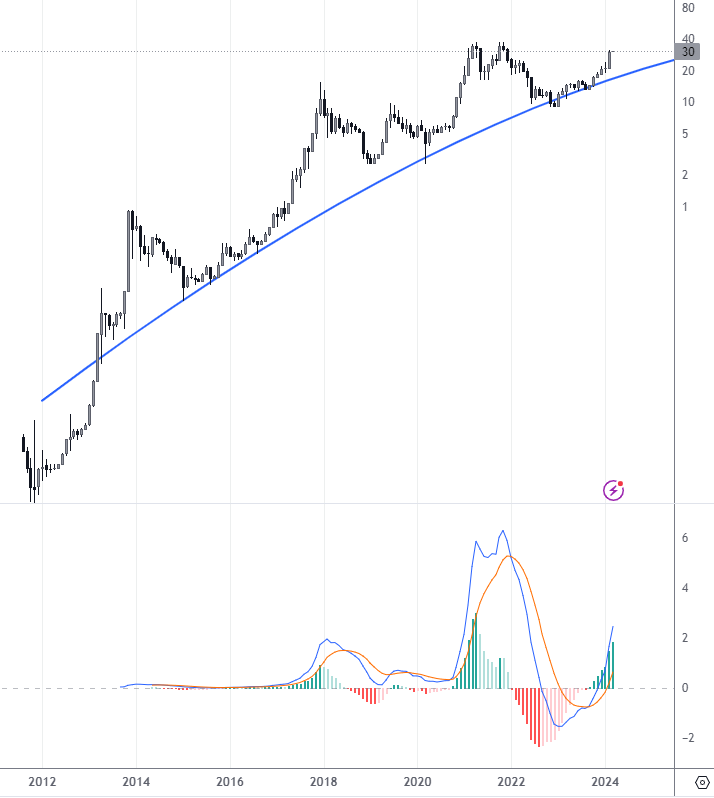

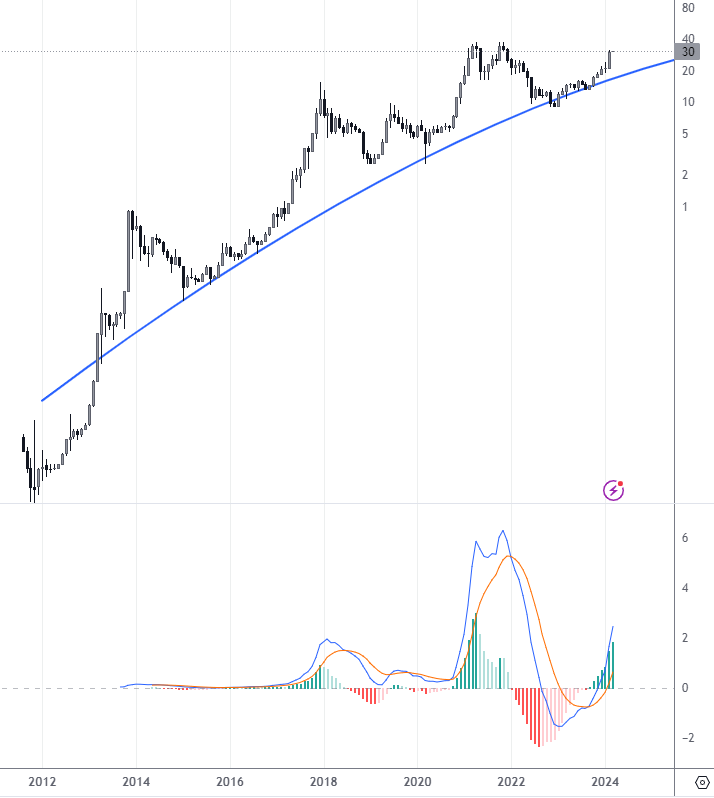

The chart below shows that as the years go by, more and more gold is being given for one bitcoin. This is a valid argument, but it cannot definitively conclude that bitcoin is better than gold.

Bitcoin vs Gold: A long-term chart

The debate between investing in gold versus Bitcoin is a decision that should align with individual investment goals and use cases.

Use cases and goals

Gold has stood the test of time as a universal symbol of wealth. Its use cases extend from a hedge against inflation and currency devaluation to a tangible asset that can be inherited through generations. For investors seeking stability and a conservative investment approach, gold's long-standing history offers comfort.

Bitcoin, being a relatively new asset class, appeals to those with a more progressive investment outlook. It is seen as a hedge against the same macroeconomic factors but is also embraced by those looking to diversify into digital assets that have the potential for significant growth.

Long-term returns

Gold has provided steady, though not spectacular, returns over the decades. Its price appreciation reflects its perceived value as a finite resource and a fallback during geopolitical uncertainties. In contrast, Bitcoin's historical returns have been meteoric at times but come with substantial volatility and risk. The potential for high returns is balanced by the possibility of dramatic declines.

| Period |

Annual |

Return, % |

|

Gold |

Bitcoin |

2023 |

13.65 |

155.90 |

|

2022

|

2.08

|

-65.07

|

|

2021

|

-3.73

|

39.84

|

|

2020

|

25.75

|

302.79

|

|

2019

|

18.28

|

89.52

|

Ways to own it

Gold can be owned physically in the form of bullion or coins, and virtually via gold certificates, ETFs, or stocks in gold mining companies. Each method has different implications in terms of liquidity, security, and ease of trade.

Bitcoin ownership is entirely digital, maintained through wallets and traded on exchanges. It can also be invested in through Bitcoin trusts, ETFs, or by owning stocks in companies with large Bitcoin holdings. Digital ownership comes with concerns about security, such as hacking risks, but offers high mobility and ease of transfer.