How to Short Bitcoin? A Step-By-Step Guide

Cryptocurrency is the future, and you want to maximize yours. Becoming familiar and learning how to short bitcoin and make crypto work for you. Here you'll find step-by-step instructions, advice, and guidelines on how to profit from bitcoin's temporary slump. It is the perfect time to consider the best options to short bitcoin.

This article will guide you through the most efficient approach to short bitcoin in a step-by-step strategy. You will see a return on your investment if you apply these concepts with careful analysis and comprehension.

Start trading cryptocurrencies right now with Binance!

Best Options to Short Bitcoin

Short selling is an investment strategy that allows you to capitalize on a decline in value in a specific asset. This article will show you how to maximize your potential by short-selling Bitcoin, as well as what to avoid.

Bitcoin's value has dropped over 8% in the last few days. The US Securities and Exchange Commission denied the approval of a petition drawn up by VanEck, a global investment company. This caused a second setback, as the proposal that was denied was intended to promote a Bitcoin-based exchange-traded fund (ETF).

According to the bank's analysts and experts, if Bitcoin continues to plummet, the price of a share in 2023 can reach up to $73,000. However, with bitcoin's instability, a rise of more than twice the current value of $60,000 is also possible. Additionally, it may dip around or under $30,000.

This is, however, the ideal time for you to profit from the current bitcoin decline in its value. The following are the 5 best and effective methods to short bitcoin:

1. Margin Trading on Cryptocurrency Exchanges:

Bitcoin margin trading is the process of borrowing money from an intermediary or broker to invest in Bitcoin. This can be done with many cryptocurrencies that experience a large dip but are expected to rise again.

Traditional trading allows you to acquire a much larger amount of capital. Therefore, your investment receives a great amount of leverage. Margin trading has attracted increasing attention from many investors over the past few years because of the increased advantage in your investment.

Let's examine this approach mathematically and break down the advantage of Bitcoin margin trading. If you begin with a Bitcoin margin with a 2X leverage, and Bitcoin's value increases by 20%, your return on investment (ROI) will yield 40% due to the advantage you have in the increased leverage. If you didn't have any leverage, the ROI will yield an increased value of 20%.

You must still consider the nature of investing and the risks it presents. However, margin leverage can reach levels as high as 25X and above. The yield will complement the leverage regardless of the amount.

Most of the time, the exchange lends money to investors so that they can expand their capital and use it for Bitcoin margin trading. Consequently, this method leads to an open position with high leverage, which is places you at an advantage as an investor.

While any type of investment has potential for risks, this method of trade poses a smaller amount of risk since each position has a liquidation value that is determined by the leverage ratio.

2. Bitcoin Futures and Options

-

Futures and options on bitcoin futures and options are defined as a margined portfolio. A marginalized portfolio allows for increased capital efficiency.

-

However, this does not negate the risks involved. Bitcoin futures options are pricey, as many would expect from trade with this type and frequency of market volatility. The cost of an option is generally defined in terms of systematic risk, or the amount of volatility represented by the recent value of the cryptocurrency.

-

Bitcoin futures allow individuals to invest throughout the Bitcoin (BTCUSD) market without directly controlling the base cryptocurrency or commodity. These operate similarly to both commodity markets or index futures contracts being that they analyze the market to draw conclusions or predict the most likely value of a cryptocurrency's future price.

-

The Chicago Mercantile Exchange (CME) draws up monthly contracts for cash settlement monthly contracts. This is highly important for the settlement of the contract because fiat currency or cash is provided to the investor as opposed to receiving a physical delivery of Bitcoin, as it is in current value.

-

Trading Bitcoin futures rather than the underlying cryptocurrency offers a number of advantages. First, Bitcoin futures contracts are traded on a CFTC-regulated exchange, which could encourage major investment firms and new invests to participate in the cryptocurrency market trade.

-

The cryptocurrency market has been unregulated since its establishment not long ago. The regulatory bounds reduce the risk of lost assets for intuitional money. Bitcoin exchange uses cash settlements rather than Bitcoin wallets

-

Consequently, reducing the risk of possessing a volatile asset market with large fluctuations. Futures contracts allow the cryptocurrency market to enforce restrictions on positions and price limits, which help investors to limit their risk exposure to a particular investment sector.

-

As of January 2023, investors are allowed to get exposure to Bitcoin without needing to purchase or sell futures. Bitcoin futures are tracked by ProShare's use of the Bitcoin Strategy Fund (BITO).

3. Short CFDs for Bitcoin

-

A contract for differences (CFD) is a financial technique that agrees to pay out fiat cash for a settlement predicated upon the price or value between open and closing prices. CFDs for Bitcoin are bought when attempting to short Bitcoin; the process is similar to Bitcoin futures.

-

Both investment techniques are based on the prediction that Bitcoin value will decline, which allows you to profit using these financial investing strategies. However, keep in mind that all predictions are not accurate especially in a newly formed decentralized system of currency.

-

CFDs have a longer settlement period than Bitcoin futures, which have preset settlement schedules. Bitcoin CFDs also do not necessitate the cryptocurrency's physical delivery. As a result, investors will avoid paying any custody fees. Some Bitcoin CFD markets allow investors to form a contract based on Bitcoin's performance in comparison to fiat value or another cryptocurrency other than Bitcoin.

-

This allows investors to trade and profit, without necessarily knowing how to attain and maintain Bitcoin safely and effectively. Another great benefit to using CFDs is these contracts essentially reduce or eliminate the requirement that investors typically manage, such as many security issues with Bitcoin, such as establishing, maintaining, and encrypting a Bitcoin wallet as well as installing additional measures like a backup.

-

A CFD can be viewed as a bilateral contract that models a condition in which the investor is controlling the underlying asset, in this case, Bitcoin.

4. Bitcoin Options

-

Bitcoin options operate similar to other call or put option. It allows the investor to choose to pay a premium for the right to purchase and sell an asset on a designated and agreed-upon date.

-

The Bitcoin options premium also allows the investor to specify a predetermined and fixed price or value and the amount of the asset to be sold. However, the investor is not required to heed this obligation.

-

Bitcoin options enable traders and investors to monitor, study, and make informed decisions about the direction of Bitcoin value. This is beneficial because the investor or trader does not need to digitally own the cryptocurrency

Margin Shorting Vs Futures Shorting Vs Bitcoin CFDs Vs Bitcoin Options

| Margin trading | Bitcoin Futures | Bitcoin CFDs | Bitcoin options | |

|---|---|---|---|---|

Risk Level |

High |

Low |

Medium |

Low |

Usual Leverage |

1:2 to 5:1 |

50:1 |

50:1 |

3:1-5:1 |

Fees |

High |

Medium |

High |

Medium |

Best Crypto Exchange to Short Bitcoin

There are numerous reasons why Binance is the best cryptocurrency exchange to short Bitcoin. Binance has the best margin trading account and many features that benefit the investor for Bitcoin futures.

Binance Level of Margin: 20X

Binance Trade Fees: 0.015% to 0.1%

Binance Other Fees: 0.50% instant buy and sell fees

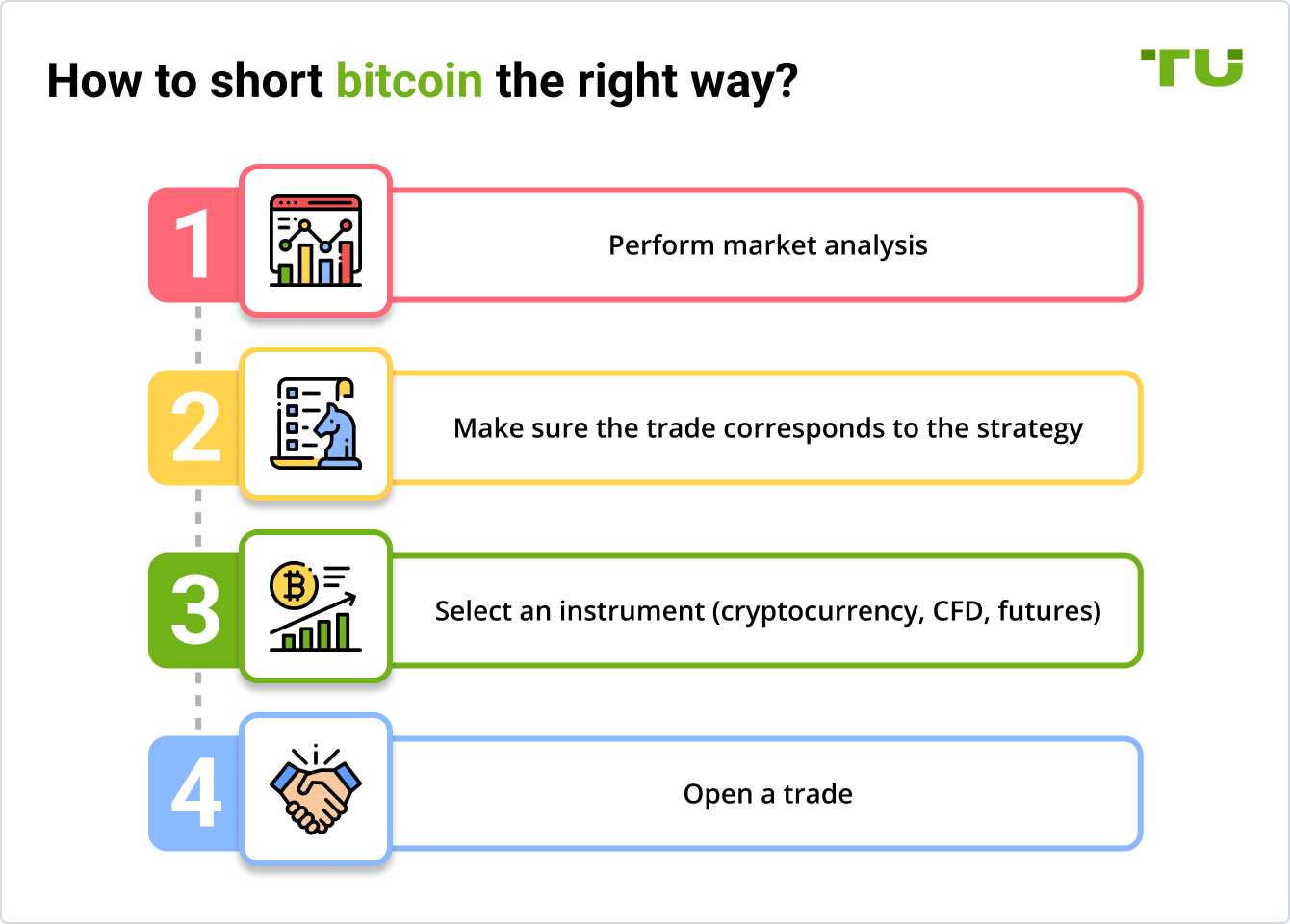

How to Short Bitcoin?

Below are step-by-step instructions on how to short Bitcoin on Binance using margin as well as Bitcoin futures:

Register an account through Binance.

Consider the best shorting option based on the information you’ve learned

Monitor the cryptocurrency market and make profitable decisions based on your analysis

Should I Short Bitcoin?

Shorting Bitcoin can be challenging, even for the most experienced traders and investors. Professional investors understand the market well and risk management. They make decisions based on the analysis of the market and what they can afford to lose in their investment. The cryptocurrency market is highly volatile. Only invest what you can afford to lose. If you do choose to short bitcoin, do so with careful study and evaluation.

Summary

By shorting Bitcoin, investors and traders can profit when Bitcoin value drops in the market.

The cryptocurrency market is highly volatile.

Bitcoin’s value fluctuates often.

Small drops in Bitcoin value can draw reasonable profits in a relatively short time.

There are several ways to short Bitcoin.

Invest only what you can afford to lose.

FAQs

Can I retain possession of my shorting position?

Yes, if you are not liquated.

How do you know it is the optimal time to short Bitcoin?

Often, when Bitcoin drops in value, many investors and traders are quick to short. This causes the value to rise, forcing the investors and traders to repurchase their assets so that they retain original value. There is no definitive way to measure the optimal time to short Bitcoin because of its instability in value. The best option is to study the past nine years that Bitcoin entered the trading market. Analyzing the trends and the scenarios that produced them will help determine a general accuracy of the optimal time to short Bitcoin.

How does interest play a role in shorting Bitcoin?

Short sales of stocks may be subject to negative rebates if the position is kept open. This interest will accrue from the short sale settlement date until the buy-to-cover settlement date. At the end of the month, the fee will be assessed.

How do I know if shorting Bitcoin is for me?

If you are truly interested in investing and shorting Bitcoin. Study and begin with small investments to get a feel for it. Invest what you can lose.

Glossary for novice traders

-

1

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

5

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Team that worked on the article

Dwight specializes in risk, corporate finance, alternatives, fintech, general business trends, and financial markets, and he has broad experience managing complex projects. Dwight is an author for the Traders Union website.

Dwight was a financial columnist for The Wall Street Journal and The New York Times during the Great Financial Crisis. He has served as Editor-in-Chief of Worth, a personal finance magazine for the wealthy, and as Editor of Risk, the premiere global publication about derivatives, risk management, and quantitative finance, based in London.

He has also served as Managing Editor at The Economist Group and ran the Americas operations of two British trade publications.

For the last 12 years, Dwight has worked as a freelance writer and editorial project manager, serving clients in the financial technology, banking, broker/dealer, consulting, asset management, and corporate sectors. This has given him considerable experience in idea generation and project management, working collaboratively to help clients meet their goals with little or no supervision.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).