Note:

This article is not financial advice and is for educational purposes only. Buying cryptocurrencies is a high-risk type of investment.

Considering the recent increases in Bitcoin’s price, you might be wondering whether you should sell your Bitcoin. Now, this depends on your specific circumstances, your investment goals, and your risk appetite. So, some investors might choose to sell now and take a profit while others might choose to hold on and see whether they can't increase their returns.

If you’ve decided to sell, you've probably wondered how you can sell your Bitcoin? Fortunately, we're here to help. In this post, we'll show you how to sell Bitcoin and withdraw your money. We'll also delve deeper into whether you should consider selling now. After studying this guide, you'll know how to cash out Bitcoin and whether now is a good time.

Before looking at the process of selling Bitcoin in more detail, let's first consider where you can actually sell your Bitcoin. Fortunately, when it comes to selling Bitcoin, you have several options.

Cryptocurrency exchanges make selling Bitcoin a quick and easy process. When you sell your Bitcoin using a cryptocurrency exchange, you'll typically need to create an account with the platform and then transfer the Bitcoin in your wallet to the exchange. Once your Bitcoin has been received by the exchange, you can sell it by placing a sell order.

Here, you can choose to sell all your Bitcoin or only a portion of it. Once your Bitcoin is sold, you'll typically receive the proceeds in your fiat currency in a wallet held by the exchange. To cash out this amount, you'll then need to withdraw the fiat currency to a connected bank account or using a debit or credit card.

Exchanges offer higher liquidity than many of the other methods which also means that you'll get an objective market price for your Bitcoin. Now, compare that to peer-to-peer selling where someone might haggle you down to a lower price than you would get on an exchange.

When you use a peer-to-peer or P2P platform, you'll be able to sell your Bitcoin to another party. To do this, you'll generally place a listing on the platform setting out how much Bitcoin you want to sell, how much you want for it, and what payment method you’ll prefer.

Then, if someone wants to buy your Bitcoin they'll react to your listing. These platforms generally have escrow functionality which means the money for the purchase price will be paid to them, and they'll hold on to the funds until the Bitcoin is transferred to the other person.

With Bitcoin ATMs, you can withdraw money just like you would with any other ATM. These Bitcoin ATMs typically let you scan a QR code and then sell the Bitcoin in your wallet for cash. Once done, you'll be able to get the cash in fiat currency from the ATM. As these ATMs are located all over the world, they offer a simple and easy solution for you to sell your Bitcoin. Keep in mind, though, that they often charge high transaction fees compared to the methods mentioned above.

Considering that we recommend that you use an exchange to sell your Bitcoin, the question is: Which is the best exchange to cash out your Bitcoin? Luckily, there are many options available which include:

Binance was founded in 2017 and is registered in the Cayman Islands. Since January 2018, it's been the largest cryptocurrency exchange in the world with a market capitalization of over $1.3 billion. It offers trading in a wealth of cryptocurrencies including the popular ones like Bitcoin, Ethereum, Dogecoin, Cardano, and its own token, BNB.

Another option would be Coinbase. It's an American company established in 2012 and has grown significantly since then. In fact, in January 2023, it was the largest cryptocurrency exchange in the United States by trading volume, and it listed on the NASDAQ stock exchange in January 2023. It has two different exchanges, Coinbase and Coinbase Pro.

Another option is Kraken. It's a United States-based cryptocurrency exchange and bank, which was founded in 2011. It's available to residents of 48 states in the United States and residents of 176 countries around the world. It currently offers 72 cryptocurrencies available to trade, and it provides trading between cryptocurrencies and fiat currencies.

Between the above three exchanges, we recommend Binance. This is due to a few reasons. For one, because it's the largest cryptocurrency exchange in the world, it offers the best liquidity. And liquidity ensures that you’ll be able to sell your Bitcoin easily and for the best price.

In addition, it also offers a lot of withdrawal options that you can use to sell and cash out your Bitcoin in different fiat currencies. In our view, it's the exchange with all the tools you need to sell your Bitcoin quickly, easily, and efficiently.

To show you how to sell Bitcoin, we’ll use Binance as an example. While its user interface and functionality might differ compared to other exchanges, the process is basically the same.

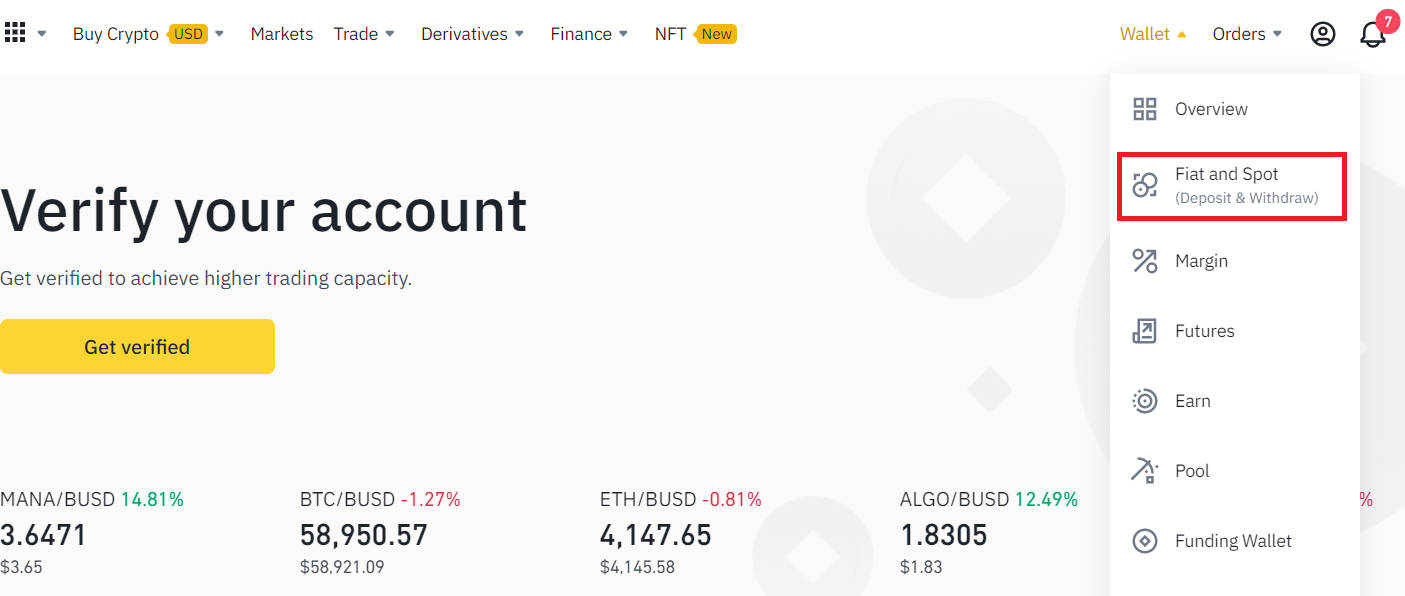

The first thing you’ll need to do to sell your Bitcoin is to go to Binance’s homepage and log into your account. Once you’ve logged in, you’ll need to go to the Wallet drop-down list and then to Fiat and Spot.

How to Sell Bitcoin on Binance

On the page that opens, you’ll then navigate to the Bitcoin you want to sell.

To sell your Bitcoin and convert it to a fiat currency, you’ll have two choices. The first is to trade your Bitcoin for a fiat currency using the Spot Trading functionality. Here, your Bitcoin will then be sold on the exchange.

Your other option is to use the Convert function to swap between Bitcoin and the fiat currency of your choice instantly.

Once you’ve sold your Bitcoin, you’ll receive the fiat currency in your wallet. To get the money in your bank account, you’ll need to withdraw it.

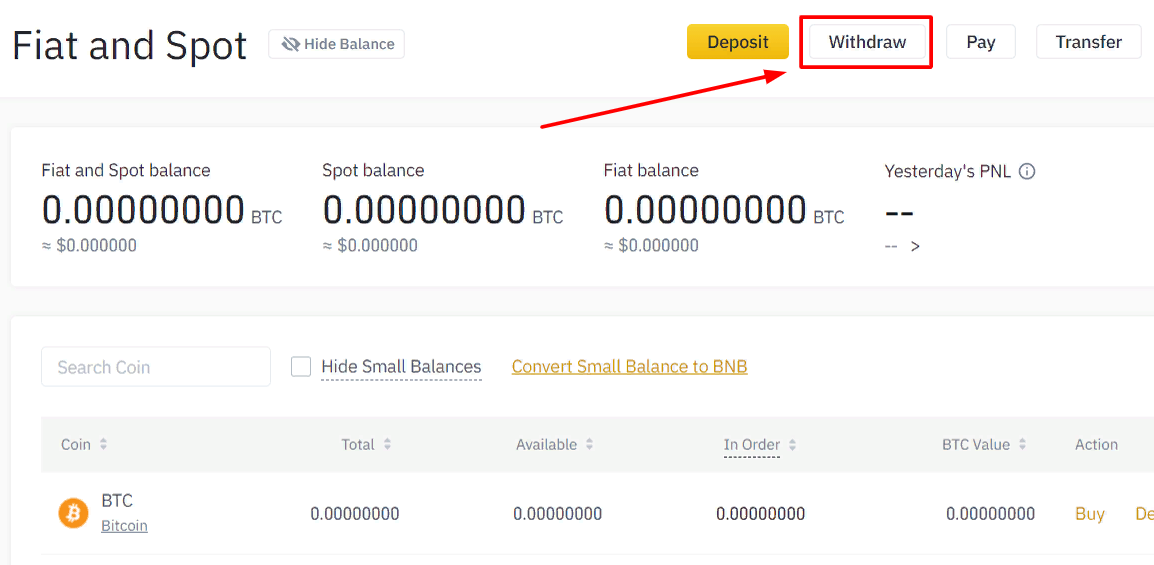

To withdraw your money, you’ll once again go to your dashboard and then to the Fiat and Spot wallet. You’ll then need to select the Withdraw tab.

How to Sell Bitcoin

On the screen that opens, you’ll select the Fiat tab, and then select the fiat currency you want to withdraw and your payment method. If you’ve not linked a bank account or debit or credit card, you’ll need to do this first. You’ll also need to specify how much you want to withdraw. Once done, you can click on Continue.

When you’ve clicked Continue, you’ll need to confirm your withdrawal by entering the verification code you’ve received. When you’ve done this, the withdrawal is complete.

Now that you know how to sell Bitcoin, the question is whether you should. In other words, is it a good idea to sell Bitcoin now? By this time, you already know that Bitcoin increases in value over time and that it can be a good investment.

In fact, it increased significantly during the past year which means, had you invested at the beginning of the year, you would have earned an attractive return on your investment.

However, you also probably know that Bitcoin is reasonably volatile. As a result, there are big up and down swings in its price and between the increases since the beginning of the year, there have been periods where its value decreased significantly.

This makes it challenging to predict where the highs and the lows are. And as you know, the ideal is to buy when the price is low and sell when the price is high.

Considering this, if you bought Bitcoin at a high price, you should not sell any. In simple terms, you'll only realize a loss if you sell your Bitcoin. In other words, Bitcoin’s price might still increase in the future which means if you sell now, you might lose out on a return on your investment.

However, if you bought low, now might be a good time to sell some of your Bitcoin. This is even more so when you've made back the money you invested in the first place. To illustrate this, let's look at a simple example.

Let's assume you bought a $1,000 worth of Bitcoin earlier this year. With the increase in price, your Bitcoin is now worth $3,000, for example. This means you'll be able to sell $2000 worth of Bitcoin, and you'll still be left with $1,000 you invested. As a result, no matter what happens from now, you'll make a return on your investment.

In the same breath, you can also consider keeping all your Bitcoin and not selling any. This is an effective strategy when you don't need the money immediately because, as mentioned earlier, the price of Bitcoin is likely to increase.

Ultimately, whether you sell or keep your Bitcoin depends on your specific situation and your risk appetite.

Not to take anything away from Bitcoin as it is a good investment, but considering that it can be volatile with massive variations in price, you might want to know what else you can invest in.

Fortunately, our experts are here to help. They’ve compiled a list of the best altcoins that you can invest in in 2023. Their recommendations are based on criteria like performance, technology, and popularity among investors.

By using this table, you'll be able to find a suitable alternative investment to Bitcoin or, if you should wish, you can invest in Bitcoin and some of these altcoins to diversify your portfolio and, by implication, limit your risk.

| Cryptocurrency | Industry | Current price | 1y return | 1m Return | Total score | |

|---|---|---|---|---|---|---|

Cryptocurrency exchange | 228.50$ | -24.87% | 0.26% | 9.5 | Invest | |

Blockchain platform | 0.38$ | 18.56% | 22.36% | 9.2 | Invest | |

Payments | 0.61$ | 42.91% | 0.66% | 9 | Invest | |

Payments | 0.08$ | -19.63% | 19.52% | 8 | Invest | |

Blockchain platform | 5.47$ | -2.69% | 14.59% | 8 | Invest | |

Payments | 71.57$ | -8.52% | 2.26% | 7.6 | Invest | |

Payments | 0.00$ | NaN% | NaN% | 7.5 | Invest | |

Decentralized exchange | 0.00$ | NaN% | NaN% | 7.4 | Invest | |

Blockchain platform/Media | 0.00$ | NaN% | NaN% | 7 | Invest | |

Internet of Things | 0.00$ | NaN% | NaN% | 6.9 | Invest |

Note:

This article is not financial advice and is for educational purposes only. Buying cryptocurrencies is a high-risk type of investment.

Now you know what options you have when you want to sell your Bitcoin and how to do it. Hopefully, this post also helped illustrate when you should consider selling your Bitcoin.

For more insights, guides like these, broker and exchange reviews, and more, why not join Traders Union today.

To give you more information, we've compiled a list of frequently asked questions that people often have when it comes to selling Bitcoin.

When you want to sell your Bitcoin, you have several options. For example, you can sell your Bitcoin on an exchange and withdraw your money in the fiat currency of your choice. You also have the option to sell your Bitcoin on a P2P marketplace or by using a Bitcoin ATM.

Typically, when you sell Bitcoin or any other cryptocurrency, you'll need to pay a fee that’s typically known as a gas fee. These fees generally differ between different exchanges and depending on how busy the network is. For this reason, it's always best to make sure with the specific exchange how much you'll need to pay to sell your Bitcoin.

Whether you should sell your Bitcoin now is a difficult question to answer. This is simply because it depends on your specific set of circumstances and your risk appetite.

The payment methods available when you want to withdraw fiat currency after you've sold your Bitcoin, depends on the specific exchange. Some exchanges offer only card payments while others have other payment options available. For instance, on Binance you can choose between card withdrawals, bank account withdrawals, and other methods.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).