Crypto Investing Strategies for Beginners

It’s undebatable that crypto investing without a strategy is investing for a direct loss. A crypto investing system is a set of guidelines that create sell and buy signals.

A bitcoin investing system is unambiguous and lacks subjective elements. An investing system generates signals using a combination of technical indicators. Hence, good strategies can help you manage risks.

They can help you increase profitability regardless of the market environment. An investing system removes your emotions from the trade. Hence, it can prevent you from staking highly due to frustration from a previous loss.

Start investing in crypto right now with Binance!What is Cryptocurrency Investing Strategy

A crypto investing strategy is a step-by-step guide you use while buying and selling cryptocurrency. Most importantly, you should develop a crypto investment system that suits your knowledge levels.

Your bitcoin strategy should exemplify your risk tolerance and personality. And you can build your customized cryptocurrency strategy with the following sequential steps:

-

Defining your time frame

-

Identifying the market’s position

-

Finding your support and resistance levels

-

Identifying your entry levels

-

Identifying your exit levels

-

Carrying out multiple analyses

A crypto investing system only becomes effective if you stick to it. And to make your system binding, write down the rules. Always revisit these rules before you trade.

Again, always test the system before investing. You can use crypto investing platforms to see how your system behaves under different changes. Besides, you can record the performance of a change system.

You can invest your design on a live account if you find impressive results. But, trade only in adherence to the crypto investing strategies below;

The Timeframe

Choose a timeframe that resonates with you. If you don’t have enough time to watch the market throughout the day, be a long-term investor/trader. You’re also a long-term trader if you take a lot of time to analyze every trade.

And you can organize the timeframe of your chart weekly or daily. This time frame helps you make fewer transactions and hence spread your loss. Yet, such a system will only give you a few signals.

So as a long-term investor, you must be patient. And you must make more giant steps; otherwise, you need a big crypto account to avoid receiving margin calls.

Again if you’re impatient, you’ll spend a lot of your time observing the markets. And you’ll be tempted to trade, making you an intra-day trader constantly. An intra-day trader uses 15-minute to 1-minute charts.

Although, as an intra-day trader, you’ll have more trading opportunities daily, helping you avoid overnight risks. But you’ll pay the spread more oftenly. Hence you must become resilient to focus and constantly change your biases.

Or you can be a swing trader who uses hourly charts to implement short-term trades. These short-term trades last a couple of days or hours.

Yet you must identify the trend and wave of your preferred investing timeframe. And always trade in the trend’s direction.

Find Your Ideal Market Position

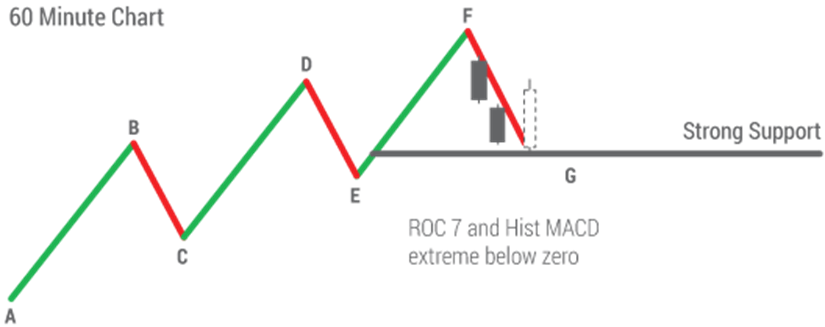

The trend should help you choose an appropriate market position. You can trade when there’s an uptrend implying a series of consecutive highs and lows. And often, an Uptrend has five waves, as illustrated below:

According to this illustration, Wave 1 moves from A to B. Wave 2 moves from B to C. And wave three moves from C to D. Finally, wave four moves from D to E while wave five moves from E to F.

Waves 5,3 and 1 move in the uptrend’s direction. And wave 4 and 2 move in the opposite direction of your upward trend. So, use trends to identify your market position.

Besides, the market trends influence the crypto price patterns. There’s a range, an upward and downtrend. An upward trend tells you it’s time to buy cryptocurrency.

And the downward trend tells you it’s time to sell your cryptocurrency. So ask yourself whether you’re safer entering your trades near the resistance or the support levels. The decision can help you control your risks better.

Identify Your Support and Resistance

You can use different strategies to identify your resistance and support levels. These strategies include:

Peaks and troughs

After opening the chart in your preferred timeframe, identify the highest peak. Mark it as an All-Time High peak. Likewise, check the lowest bottom peak and mark it as an All-Time Low peak.

And in a downtrend, every lower low is a support level. Yet every lower high is a resistance level, as shown in the diagram below.

Downtrend

In an upward trend, the opposite happens. Every consecutive higher peak is a resistance level. And every higher trough is a support level, as seen in the illustration below.

Uptrend

Previous time frame’s support and resistance levels

Counterchecking your previous support and resistance levels can help you identify your perfect resistance and support levels. For example, if you previously had a 15-minute time frame, check the 1-hour time frame.

And integrate the resistance and support levels to the 15-minute time frame. Again check your 4-hour time frame, take the resistance and support levels, and put them in your current 15-minute time frame.

The resistance and support levels to the 15-minute time frame

Your resistance and support levels from the higher time frames can match the low edge from the above illustration. This signifies that their price level is similar. Yet, such resistance and support levels would be your most important and robust.

Fibonacci levels

The Fibonacci retracement levels can help you identify your resistance and support levels. And for forex trading, the most common Fibonacci levels you should use are 23.6 %, 38.2%, and 61.8%.

So, prices retrace a substantial part of the original direction after any significant price moves downwards or upwards. And as the prices retrace, your resistance and support levels occur near or at the Fibonacci retracement levels.

Moving averages

Moving averages too can help you identify your resistance and support levels. In a downward trend, your moving average line acts as the resistance. And, prices bounce off the line and fall back.

But in an upward trend, your moving average is your support level. And when the prices bounce off your moving average, you have dynamic support. So you can use different moving averages(exponential or straightforward).

Trend line

Trend lines

In the chart above, the uptrend line is your support level. And the price action holds above the bar. Yet, the prices are below the downtrend line in the downward trend, acting as your resistance level.

So always have at least two points-two bottoms, or two peaks to draw your tentative trend line. Although if you have three or more points, you’ll have a good trend line.

Hence the more points in a trend line, the more significant the trend line. So, when the prices trade sideways within a range, they build strong resistance and support levels.

Market Entry

The trading bounce determines your market entry or exit. In an uptrend strategy, the trading bounce involves buying on the dips. And in a downward trend, a trading bounce involves selling on rallies.

So in the uptrend, you allow the prices to dip to the most substantial support level. Afterward, wait for a trade bounce from the support until prices rise again.

The trend must be Up and the wave down in a trade bounce. So wait for the trade bounce to buy to ensure your support holds.

Buying the dip

Buying the dip

And you can use stop loss below your support level to minimize losses in the trade bounce. Also, buy a dip using a white candlestick. And while selling a rally, ensure the trend is down, and the wave is up.

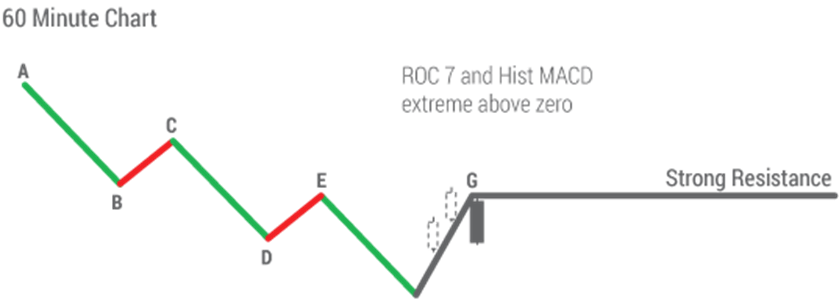

The prices should bounce off from the most substantial resistance levels. Sell on a black candle and set stop loss above the resistance levels.

Selling the Rally

Selling the Rally

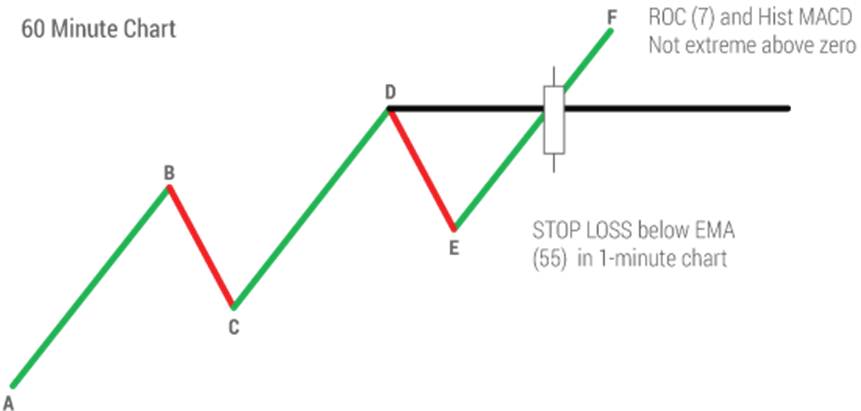

Trading the Breakout also influences your market exit or entry. In an uptrend, trading the breakout involves buying crypto when the prices break the resistance levels.

Buying

Buying

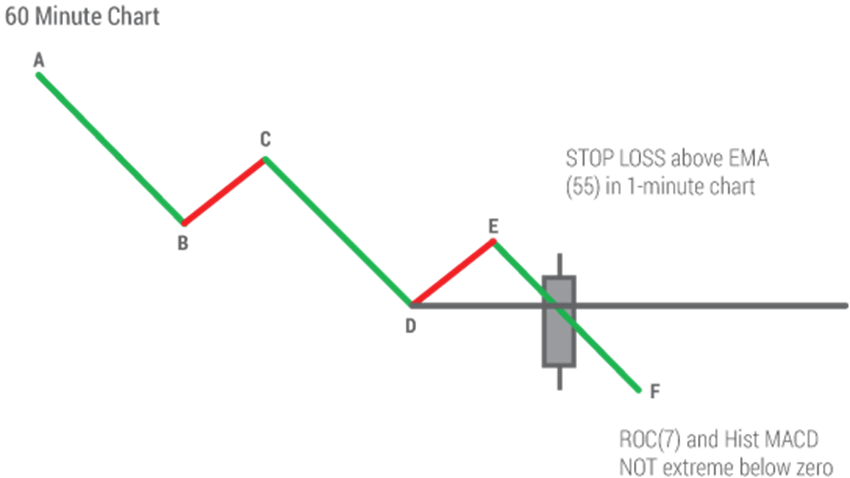

In a downtrend, trading the breakout signals a sale. You can sell your crypto after the prices cross below your support level. Observe your chart pattern for a flag, triangle, or consolidation.

Selling

Selling

Trading the Trend Reversal also determines your market entry or exit. When you have a failure swing, enter the market.

Buying

Buying

Selling

Selling

Market Exit

The stop loss and take profit signals tell you it’s time to exit the market.

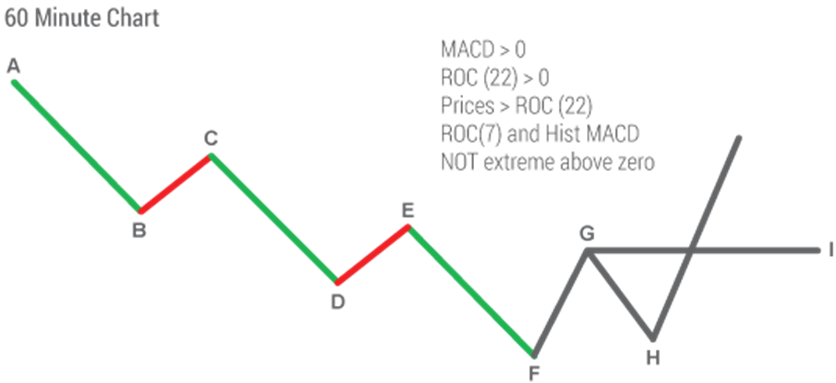

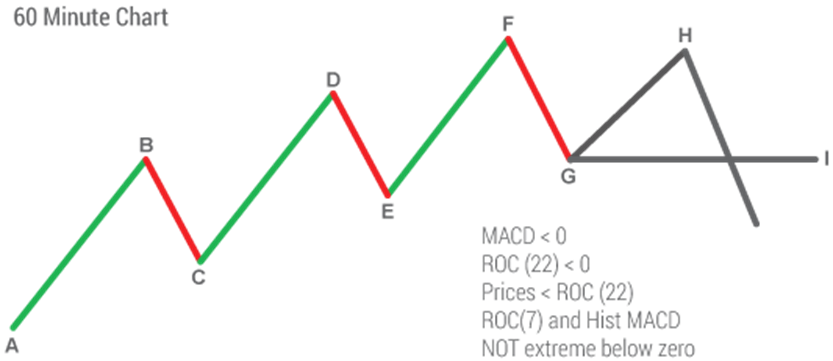

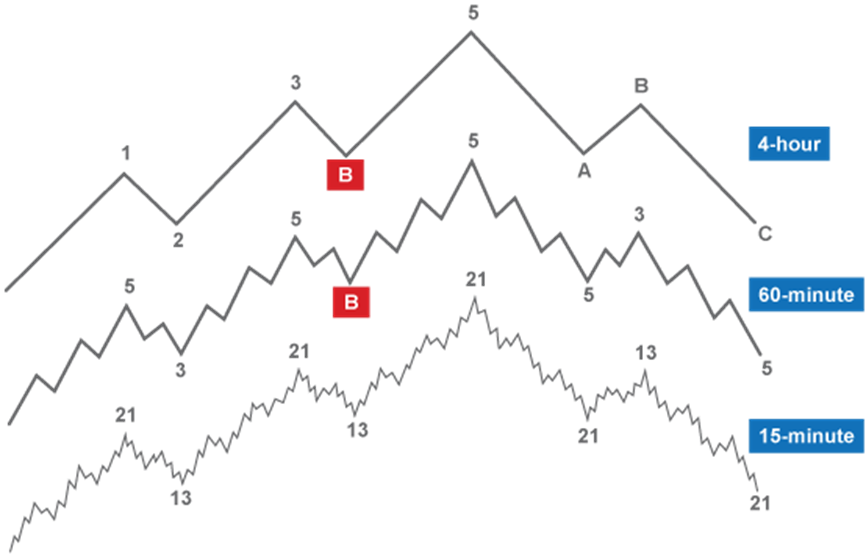

The Multiple Time Frame Analysis

This strategy can help you manage your risks. Avoid looking at a single time frame to trade. Check the following time frame higher to understand the general trend.

Then make your lower time frame to make a market entry. Besides, the trend’s direction can vary in every time frame. So using a multiple time frame analysis can help you minimize your losing trades.

Multiple time frame analysis

From the above illustration, it helps to use at least two or more time frames. Consider pairs with a 1:4 ratio for more precision.

Types of Investing Strategies

You can classify crypto investing and trading strategies based on four categories, as seen below:

According to the holding time of the transaction:

Scalping - it’s the shortest term trading allowing you to hold positions in minutes or seconds. Scalping helps you make many quick trades with small profits. It’s suitable for liquid markets and tight spreads.

Day trading crypto allows you to hold positions overnight. Daytraders enter and exit the market the same day. Hence day trading crypto lowers the risks of significant overnight moves. Daytraders hold trades for hours or minutes.

Swing trading allows you to hold trades for weeks or days. It’s suitable for breakout trading, counter-trend trading, and momentum trading.

Position trading - suitable if you want long-term price movements. The long-term trades span years, months, or weeks. Position traders leverage monthly and weekly charts to evaluate market entries and exits.

According to the trading strategy:

Trading with the trend involves leveraging the uptrends and downtrends. Trend traders also use moving averages, technical indicators, and trendlines to get positive trade signals.

Against the trend - the, contrarian investing involves buying a cryptocurrency when it’s weak then selling it when it’s strong. Investors who trade against the trend leverage the bargaining power.

Swing trading - involves trading to capture short or medium-term gains in crypto trading. Swing traders hold positions for more than a day.

According to the instruments used.

Investing on technical instruments

Investing on technical instruments involves focusing on charts to watch indexes and stock lines. Investing on technical instruments helps you gather signs of divergence or convergence to know when to buy or sell.

The graphical analysis involves analyzing charts and graphs to establish a positive signal. It consists reviewing historical prices, volumes, and time intervals according to their price movements.

The Fundamental analysis involves assessing a stock’s intrinsic value using associated financial and economic elements.

Non-standard strategies:

Arbitrage - involves buying crypto on one exchange then selling it on a different deal for profit. It’s quick and requires investors to be so knowledgeable.

High-frequency trading is algorithmic trading involving large orders in seconds. It increases liquidity in the market and eradicates small bid-ask spreads.

Crypto Investing Strategies Comparison

| Timeframe | Instruments | Risk level | |

|---|---|---|---|

Scalping |

15-60mins |

technical indicators like moving averages, RSI, Parabolic SAR |

the risk-reward ratio of 1:1 |

Day Trading |

15-60mins |

indices, futures like commodity futures |

not more than 1% of the total account value |

Swing Trading |

24hours |

moving averages, momentum indicators, candlestick charts |

the risk-reward ratio of 1:2 or 1:3 |

Best Cryptocurrency Passive Investment Strategies

Hardware and cloud mining - cloud mining involve renting mining hardware and software from service providers. It’s suitable for people with low capital. But it limits you to mining alone, and you must share proceeds with the service providers.

Hardware mining is a crypto mining strategy that needs you to be self-sufficient. You must have speed and suitable electric mining tools.

You can hire out your software and hardware and make good proceeds. It’s expensive as you must have experts on the lookout to stop mining.

Staking involves earning rewards for holding specific cryptocurrencies. It’s highly scalable and gives you passive income. But, staking has a liquidity risk, market risk, slashing risk, and security risk.

Investing in DeFi Products involves trading in digital, peer-to-peer financial services technologies. These technologies include loans, crypto trading, and interest accounts.

DeFi involves ethereum and other cryptos. DeFi offers you an effortless entry into the financial markets. But, DeFi is highly uncertain and has low liquidity and innovative contract issues.

NFT development involves developing blockchain technology that is non-fungal and unique. You can exchange NFT tokens but don’t get them in return.

And you must have a crypto wallet and cryptocurrencies like ethereum to develop NFT. NFTs are immutable, and you can use them to fractionalize the ownership of physical assets.

But, NFTs have an uncertain value and are severe environmental costs.

How to Choose a Crypto Investing Strategy: Tips for Novice Traders

Active trading - involves trading frequently to beat average index returns. It’s time-consuming and needs expert market analysis. It’s also rewarding but risky. So, choose this strategy when you have a lot of time to dedicate to learning.

Passive investment - involves buying and holding crypto for long. Choose passive investments when looking for future income sources like retiring benefits. They have lower costs, low risks, and high returns.

Which Platform is Best for Crypto Investors

Fortunately, you can use different brokers to trade cryptocurrencies. And cryptocurrency exchanges are also a critical element of crypto investing strategies.

But regardless of the investing option you choose, the best crypto investing platform should be secure and functional. The platform should meet your needs, whether you need liquidity aggregation or fiat-to-currency features.

Likewise, an investing platform should be easy to use. So opt for media with a more intuitive user interface if you’re a beginner. And finally, consider geography.

Some platforms are region-specific. And in consideration of all these factors, Coinbase and Binance are the two most convenient investing platforms. Let’s explore what each of them offers you:

Coinbase

Coinbase is the best trading platform for new traders. It has valuable educational materials and a seamless user interface.

Coinbase also offers you a wide variety of cryptocurrencies for your convenience. But, it has high user fees and a complex fee structure.

Binance

Binance is your ultimate crypto investing platform if you’re looking to pay low fees. Its trades are affordable, and the conversion fees are also low. Binance also has advanced data charts and graphics to enhance your market analyses.

And it has a high trade speed. But, Binance isn’t available in all states in the United States. And, coin variety is also limited.

Summary

Crypto investing strategies are the step-by-step rules you use to trade. And these rules are only effective so long as you stick to them. The crypto investment strategies help you lower your losses and optimize profit.

And there are many brokers and platforms you can use to trade. So familiarize yourself with all the investing strategies and choose the most convenient one to start trading.

FAQs

Which is the best crypto strategy?

There’s no single answer to this question. You should choose fy investing strategy that meets all your needs.

How can I master crypto investing?

You master crypto investing by investing and not gambling, leveraging liquid currencies, keeping your emotions in check, and buying strength and selling weakness.

How long do I need to trade crypto?

You can trade crypto on Binance in 10minutes.

Which is the best crypto investing platform?

There’s no one best crypto investing platform. Instead, the one that meets all your needs is your best crypto investing platform.

Glossary for novice traders

-

1

Swing trading

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

-

2

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

-

3

Forex indicators

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.