Note:

This article is not financial advice and is for educational purposes only. Buying cryptocurrencies is a high-risk type of investment.

What is Bitcoin?

Bitcoin is the original cryptocurrency and every year, interest in the first and other cryptocurrencies increases.

According to Google trends data at the time of this writing, Bitcoin has been the most actively discussed in the world:

at the end of 2017, one coin reached the value of $20,000;

in January 2023, one Bitcoin was valued as more than $60,000.

This article will explain in simple terms everything there is to know about Bitcoin for dummies, including:

main facts about Bitcoin

history of cryptocurrency

origin of Bitcoin

what Bitcoin looks like

advantages and disadvantages

how to make money on Bitcoin

and much more

Bitcoin is a digital currency. It is not printed on paper like a dollar bill and not cast in metal like a cent coin. Bitcoin exists electronically and cannot be touched. Basically, it is a set of symbols that is an integral part of the large electronic Bitcoin network.

The Bitcoin.org domain was registered in August 2008. But the birth of Bitcoin is considered to be October 31, 2008, on Halloween, when Satoshi Nakamoto published a white paper that announced the Bitcoin network.

Bitcoin is designed as a peer-to-peer (i.e., equal-to-equal or person-to-person) network. This means that the participants in the system can carry out transactions with each other without the participation of intermediaries or regulatory authorities.

The network works using blockchain technology. Figuratively speaking, a blockchain is a large ledger, where a block is a separate record.

Each subsequent entry in the chain is linked to the previous one using cryptographic ciphers (complex codes) that were invented in the 1970s for use by intelligence officers and embassies. Therefore, a common name of digital currencies operating on the blockchain is called cryptocurrencies.

A key element of the blockchain network is that it is decentralized. This means that there is no “master copy” of the ledger. All members of the network have a copy of the ledger, which is constantly updated.

Anyone can join the network, terminate and resume participation at any time. For maintaining the network in a working state, participants (miners) receive Bitcoins, each new Bitcoin appears as a result of complex resource-intensive calculations.

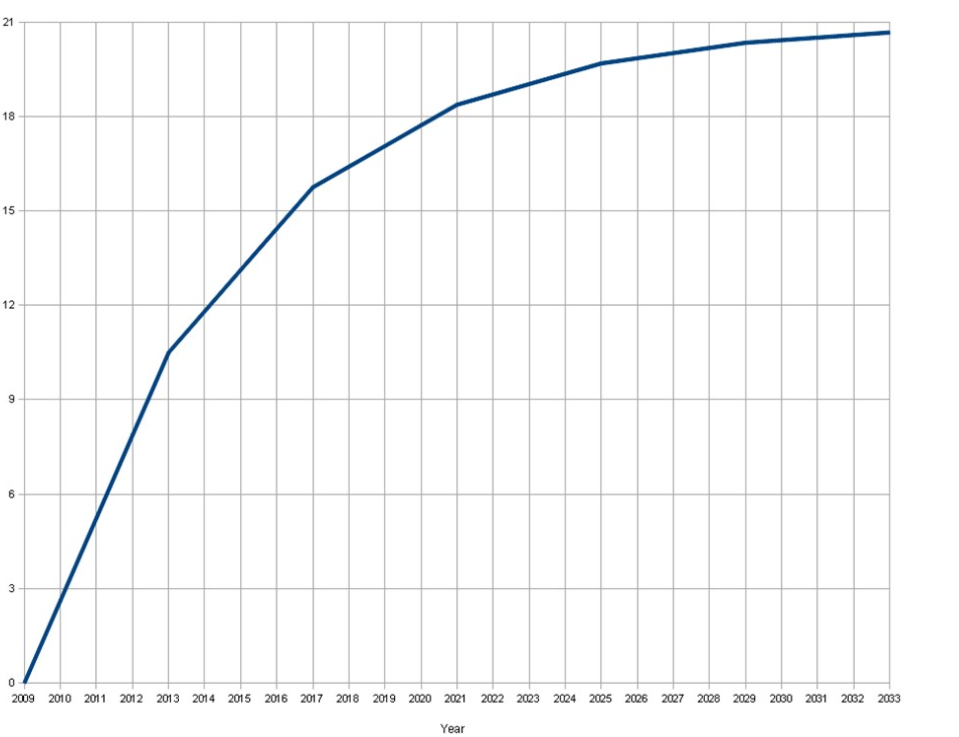

The network code is publicly available. It limits the maximum number of Bitcoins to 21 million coins, which protects Bitcoins from inflation. The Bitcoin rate is determined without the influence of states under the influence of supply and demand.

"Money is not a thing, but social relations"

~ K. Marx

Elementary economics teaches that money has five functions:

standard of value

medium of circulation

medium of payment

store of value

functions as world money

In the Middle Ages, there were coins made of precious metals. Then the world started minting paper money backed by gold. In 1971, at the Bretton Woods Conference, the United States abandoned the free exchange of dollars for gold, which was the end of the era of the gold standard.

The emission and circulation of money have always been provided by central state banks or state-authorized structures. However, ideas about how to change this order of affairs appeared at different times from different societies. For example, at the beginning of the 20th century, Henry Ford proposed the idea that money should be backed by electricity.

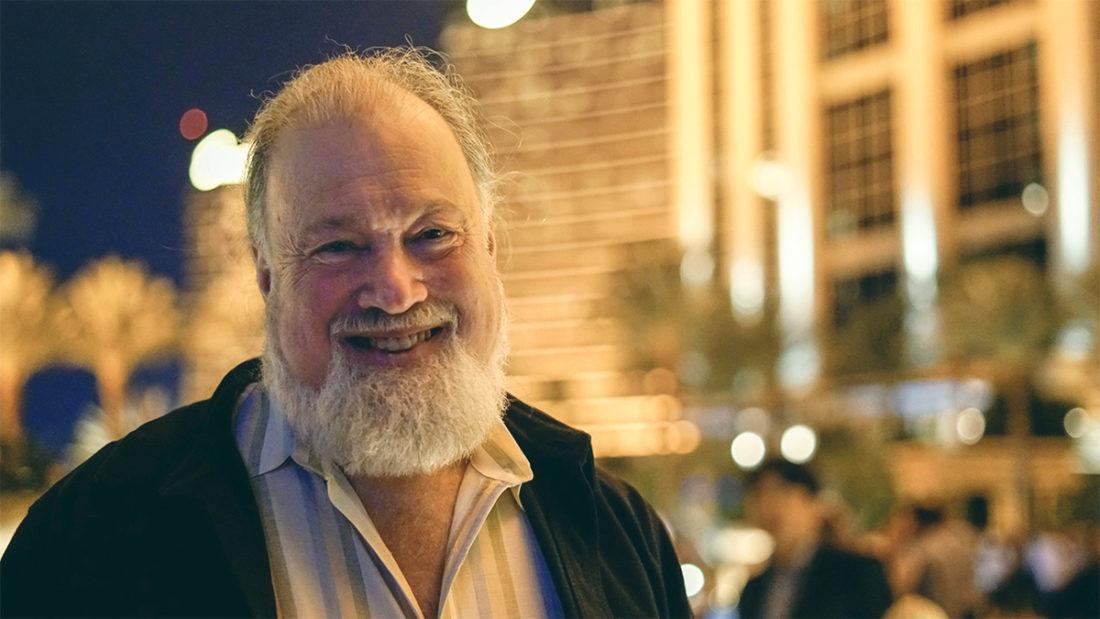

In 1982, computer engineer and encryption specialist David Chaum (pictured below) published a paper called “Blind Signatures for Untraceable Payments”. It detailed the anonymous transaction system that directly inspired future digital currency experiments.

David Chaum

In 1989, Chaum founded DigiCash and worked hard to forge partnerships with merchants and banks to give life to the project but went bankrupt in 1998. Perhaps he was simply ahead of his time.

In 1994, Nick Szabo proposed smart contracts which were essentially digitized agreements that are executed using code, and not according to the norms of current legislation. After much development of his original ideas, in 2005 he proposed the concept of Bit-Gold currency. However, it had drawbacks, the elimination of which required the creation of a controlling bank, which was difficult to implement.

In 1996, Douglas Jackson and Barry Downey founded E-gold, a digital currency system backed by gold from vaults in London and Dubai. However, the E-gold project faced serious legal and systemic problems. The founders were found guilty of running a money transfer business without a license.

In 1998, Wei Dai proposed B-money, an alternative peer-to-peer (P2P) financial system for online trading. The offer remained unrealized, but it was very similar to what Bitcoin is today.

In 2008, the global financial crisis broke out. Its roots were in the real estate mortgage market and it led to the bankruptcy of Lehman Brothers Holdings Inc, which was founded in 1847 and after operating for 158 years was the fourth-largest investment bank in the USA, with 25,000 employees globally. The world economy received a serious blow, and the negative effect has been felt by the broad segments of the population. The official financial system has shown itself to be unstable, and central banks and governments have discredited themselves.

It's a good time for Bitcoin to emerge. In a post on the Bitcointalk forum in 2010, Satoshi stated, "Bitcoin is the implementation of Wei Dai's 1998 B-money [...] and Bitgold offer made by Nick Szabo."

As was said, Satoshi Nakamoto published an 8-page White Paper on October 31, 2008.

On November 8, 2008, Bitcoin was registered with SourceForge, an open-source software development platform.

On January 3, 2009, Satoshi managed to get the first so-called “genesis” block in the chain. He included in the block a topical message of that time: "The Chancellor is on the verge of a second aid to the banks."

The second person to get Bitcoin was Hal Finney, a cryptographer. It probably happened on January 11th, as his tweet suggests.

On January 12, 2009, the first Bitcoin transaction took place between Satoshi and Finney at block 170.

Hal Finney was bold in his speculations that if Bitcoin becomes the only currency on Earth, then the rate could reach $10 million for Bitcoin.

In February 2009, on the P2P Foundation Forum, Satoshi wrote:

“The root problem with conventional currencies is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. "

At the end of 2009, a resource was created where you could buy Bitcoins for dollars. The cost of Bitcoin was set based on the cost of electricity needed to get it. In December 2009, a historic minimum was recorded there: 1,600 Bitcoins for $1.

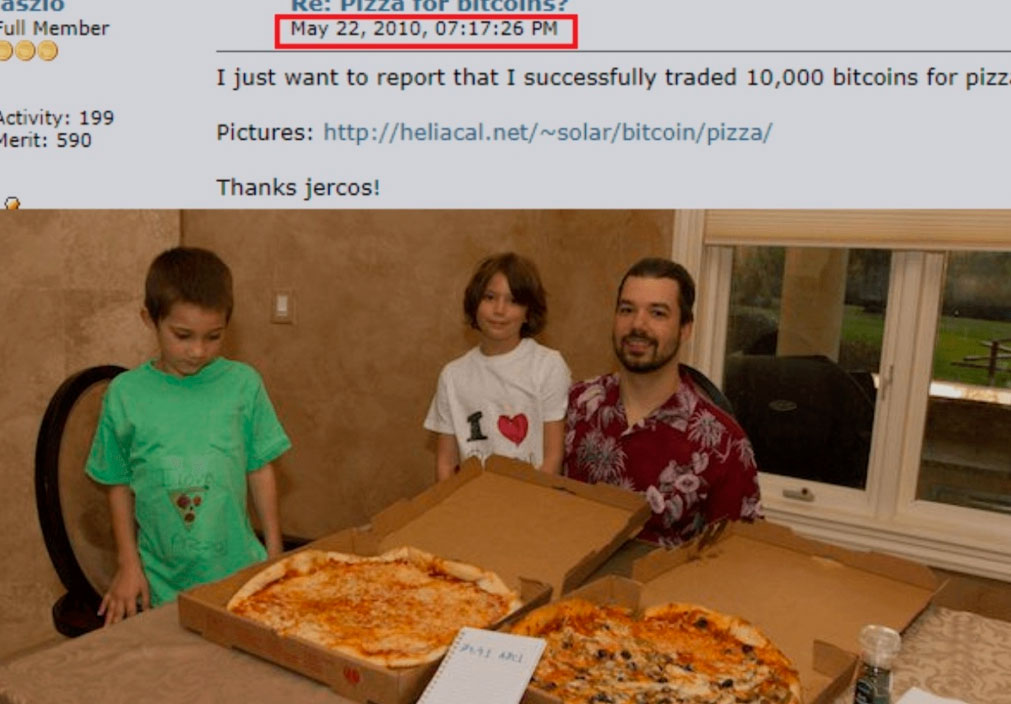

In May 2010, the first purchase of a real product for Bitcoins took place. Laszlo Hanech, a programmer from Florida, bought 2 pizzas for 10 thousand (!) Bitcoins.

Laszlo Hanech bought 2 pizzas for 10 thousand Bitcoins

The next significant development on the Bitcoin roadmap is the disappearance of the creator.

It is believed that the last post from Satoshi on the Bitcoin forums came in December 2010.

At the same time, it is known that he sent the last message to the developers on April 26, 2011, working actively to improve the security of the code.

Then Satoshi Nakamoto stopped communicating in any way, and no one knows his real identity. It is not even known whether Satoshi is one person or a group of programmers.

There are various theories proposed for Satoshi’s decision to go silent and his real identity. But we may never see the true reasons confirmed by the real person.

Many people ask what does Bitcoin look like?

Like all computer information, cryptocurrency is a file. Each Bitcoin is unique, so if you lose it, then in simple words, one Bitcoin in the system will become an “orphan”, and another crypto coin will not take its place. And this is the main difference between virtual currency and classic currency. Here you will not be able to run a "printing press", as, for example, with printing genuine fiat money, like the dollar.

The functioning of the Bitcoin network was originally laid down in its algorithm. When a participant connects to the network and deploys a node on his computing power, he is connected to the work of maintaining the network. In particular, the node is working on finding solutions to cryptography problems. The node owner receives a reward for his work.

This is a very time-consuming process, and the network is planned in such a way that over time and with an increase in the number of connected nodes the complexity of the tasks increases, and the amount of reward decreases. The algorithm is designed in such a way that it automatically adjusts the complexity of the tasks, the more participants, the more difficult the tasks, and vice versa.

The fact that the value of the reward decreases is called halving. The reward for miners is reduced by 2 times approximately every 4 years. If you connected to mining (network maintenance) at the dawn of Bitcoin, you would be very rich, but the further you go, the more economically unprofitable it is to mine Bitcoin.

The dynamics of the mined Bitcoins (in millions) over the years are presented in the graph below.

The dynamics of the mined Bitcoins (in millions)

Experts believe that the last of the 21 million Bitcoins will be mined by 2140.

No personal data of the wallet owner is tied to the virtual currency wallet. In addition, you can create a new address for each new transaction with Bitcoin, and in this way it will be impossible to track transactions.

The more Bitcoin comes into use, the more it attracts attention from the authorities. For example, it is common to register on a cryptocurrency exchange without specifying personal data. But to increase the limits, one must connect to robots via API where personal information and verification are already required. Exchanges do not want to quarrel with the authorities and are implementing “know your customer” policies.

Bitcoin cannot be regulated or issued by any government or central bank. Bitcoin depoliticized the currency because it is created by humans, which removes central authority over the population through money management. In simple terms, no government agency has the right to freeze, confiscate or expropriate your coins.

No one has been able to break the Bitcoin code (many specialists have tried) since it is built on blockchain technology. Do you have Bitcoins in your wallet? They are reliably protected unless you give the scammers access. To compromise a network, theoretically, more than 50% of the nodes need to be controlled, which is virtually an impossibility.

In 2011, Bitcoin was sold for $1-2 per coin, and 10 years later, the value per coin is a whopping$60,000! This makes Bitcoin the best investment in the 21st century. Moreover, surges in volatility provide excellent opportunities for making money within the day, as well as for those who hold positions for several days or weeks. In addition, unlike traditional exchanges, the Bitcoin system works without interruptions and around the clock. Comments on the fact that Bitcoin makes it possible to make good money seem to be superfluous here.

Since the maximum number of coins is limited by the code to 21 million coins, it gives BTC the properties of inflation protection. Consider also that according to the analytical agency Glassnode, about a third of all mined Bitcoins can be considered lost, because many wallet owners have lost access to them. This amounts to more than 7 million Bitcoins.

In today's environment, with central banks irresponsibly issuing money and governments piling up debt, Bitcoin, whose code is transparent, looks like a way to reduce inflation risk.

More and more sellers are willing to accept Bitcoins for their goods and services. Moreover, in El Salvador, a new law in January 2023 made it legal for local merchants to accept Bitcoin as payment for goods and. Thus, the country became the first state where cryptocurrency became the official currency.

For a long time, the proportion of 60% stocks and 40% bonds was considered the optimal formula for a balanced portfolio. However, the effectiveness of the formula is reduced because bonds do not provide the desired capital gains. Therefore, large investors and companies are not only interested in Bitcoins but also add them to their balance sheets, including through various funds and derivative financial instruments.

In order not to create an illusion for a novice crypto investor about Bitcoin as an ideal investment, the Traders Union will explore some of its disadvantages.

Liquidation is when a cryptocurrency exchange liquidates the positions that you have opened using leverage. Or the position is closed by stop loss. It has been said that Bitcoin offers a high earning potential, but the downside is the risk of loss. Given that the Bitcoin rate is very sensitive to news from the United States and China, a sharp movement in an unfavorable direction may leave you “at the bottom of the ladder”. Control your risks and don’t invest more than you can afford to lose.

One of the most significant disadvantages of investing in Bitcoin is the lack of supervision from the regulatory authorities. Cryptocurrency laws and taxes vary from country to country and are often ambiguous or controversial. Unfortunately, the lack of rules can lead to scams. Consumer protection rights are not applied. There is no governing body in charge of Bitcoin functionality. As a result, if you have any problems, you will not be able to complain to anyone.

Yes, this is possible with digital money. Bitcoins actually "disappear" if the hard drive fails or a virus damages the wallet file. It is not apparent that something can be done to bring it back. These coins will remain “orphans” in the blockchain system indefinitely. Such a scenario could bankrupt a wealthy Bitcoin investor in a matter of seconds with no funds to recover. There is no way to protect your Bitcoins from human or technological error. Therefore, you should take care in advance to create a backup of your wallet.

Considering the risks, you need to be careful when starting to trade Bitcoin.

Bitcoin trading has recently become more accessible to beginners, and the thirst for enrichment has taken possession of millions of people in all corners of the planet. But is it possible for everyone to understand all the intricacies of cryptocurrency trading and is it realistic to make money on Bitcoins?

The cryptocurrency market, and Bitcoin, in particular, is highly volatile. That is why it will be difficult for novice traders to cope with the incredible rate of change in the value of an asset. Only an experienced professional and experienced trader can cope with emotions, make the right decision as soon as possible and benefit from any situation in the cryptocurrency market.

A good alternative to crypto trading for beginners and a stable source of income can be trading in the Forex currency market, which is more predictable and less volatile in comparison with the cryptocurrency market.

If you intend to trade Bitcoin, then it is better to choose one of the leading cryptocurrency exchanges with a good reputation and low fees. They provide excellent support for beginners and a huge selection of cryptocurrency assets.

Binance is the world's leading Bitcoin trading platform in terms of trading volume.

The exchange also has the following advantages:

About 400 cryptocurrencies are listed

Fast replenishment and withdrawal of an account with cryptocurrency and fiat

One of the lowest commissions on the market

Coinbase is today the largest cryptocurrency exchange in the United States in terms of trading volume. The company has a strong focus on safety and regulation, which is why its activities always comply with the laws of the United States. In 2023, the company's shares were listed on the Nasdaq.

Coinbase Benefits:

High reliability

The largest exchange in the USA

114 cryptocurrencies listed

Competitive commissions

| Cryptocurrency | Industry | Current price | 1y return | 1m Return | Total score | |

|---|---|---|---|---|---|---|

Binance Coin (BNB) |

Cryptocurrency exchange |

603.20$ |

65.29% |

60.03% |

9.5 |

Invest |

Cardano (ADA) |

Blockchain platform |

0.75$ |

79.40% |

31.80% |

9.2 |

Invest |

Ripple (XRP) |

Payments |

0.00$ |

NaN% |

NaN% |

9 |

Invest |

Dogecoin (Doge) |

Payments |

0.00$ |

NaN% |

NaN% |

8 |

Invest |

Polkadot (DOT) |

Blockchain platform |

0.00$ |

NaN% |

NaN% |

8 |

Invest |

LItecoin (LTC) |

Payments |

0.00$ |

NaN% |

NaN% |

7.6 |

Invest |

Stellar (XLM) |

Payments |

0.00$ |

NaN% |

NaN% |

7.5 |

Invest |

Uniswap (UNI) |

Decentralized exchange |

0.00$ |

NaN% |

NaN% |

7.4 |

Invest |

Tron (TRX) |

Blockchain platform/Media |

0.00$ |

NaN% |

NaN% |

7 |

Invest |

IOTA (MIOTA) |

Internet of Things |

0.39$ |

62.48% |

40.10% |

6.9 |

Invest |

Note:

This article is not financial advice and is for educational purposes only. Buying cryptocurrencies is a high-risk type of investment.

We started the article by mentioning the functions of money generally, and Bitcoin is a monetary unit. Therefore, as a takeaway for this beginner's Bitcoin article, let's take a look at how cryptocurrency copes with the functions of money.

Standard of value. Bitcoin is used as a standard of value, although due to the high value of the coin, the price tag in BTC can be inconvenient to perceive, as it contains many digits after the decimal point.

Medium of circulation and payment. Bitcoin is widely used as a means of payment for goods. These functions are fully implemented in El Salvador, where Bitcoin is officially recognized as a monetary unit for the first time in the world by a country. However, two restrictions seriously slow down the integration of Bitcoin into a financial system:

Obstacles from official regulators. Central banks, the IMF, and others look at the new monetary competitor with disapproval. Bitcoin is also viewed by them as a vehicle for money laundering and a prohibited goods trading area. Scammers love Bitcoin because of its anonymity.

The speed of adding new blocks. To be a mass medium, transactions on the Bitcoin network must occur quickly and in large quantities, which is impossible due to the existing code. Therefore, “add-ons” like the Lightning system are created for Bitcoin, which improves performance. However, it is hardly sufficient to serve the currency and transactional flows of billions of people.

Store of value. Keeping money in a cold wallet is a safe way to accumulate wealth, given that the price of Bitcoin is steadily increasing in the long term. Therefore, those who want to save capital and save up for retirement are showing interest in Bitcoin. In 2023, pension funds in Australia, the USA, and Canada showed great enthusiasm for Bitcoin.

World money function. Although Bitcoin can be used as a means of payment between citizens of different countries, it cannot yet be used in payments between states. However, Bitcoin has the potential to become a reserve currency in the future, and this is consistent with the initial philosophy of Satoshi Nakamoto, the coin’s creator.

At the dawn of its making, the price of Bitcoin was compared to the price of energy required for mining. Over time, the Bitcoin rate began to be influenced by the statements and decisions of regulators, politicians, well-known investors, corporate news, news about halving, and other events. It should also be borne in mind that Bitcoin is quoted across the dollar. Therefore, the BTC/USD rate also depends on the news of the US economy.

Actually, not much. Although the price of ₿1 is measured in thousands of US dollars, you can buy a small fraction of Bitcoin. For example, 1 uBTC = ₿0.00000100, or 1 micro Bitcoin - one-millionth part of a coin. On the other hand, it is necessary to assess the economic feasibility of such a valuation. Rationally, you can start trading Bitcoin with only several hundred dollars.

Proper storage requires a cryptocurrency wallet or e-wallet. It can be created on a cryptocurrency exchange. This is risky because major exchanges are at risk of hacker attacks and regulatory sanctions. You can create a cold wallet, which is much more reliable (it's like a flash drive that stores Bitcoins). Storing Bitcoin on an account with a broker is also an acceptable option. The wallet is the address to which Bitcoins will be transferred to you.

Selling Bitcoins is easy even for beginners. Since Bitcoin is a currency, you can use the services of exchange offices that abound online. There is an option to withdraw to a cryptocurrency exchange, this is a safer solution for large amounts. Also, selling Bitcoins through a broker and conveniently withdrawing them is a good option because a good broker provides various deposit/withdrawal channels.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).