LMAX Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10,000

- MT4

- MT5

- WebTrader

- 2008

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10,000

- MT4

- MT5

- WebTrader

- 2008

Our Evaluation of LMAX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

LMAX is a high-risk broker with the TU Overall Score of 2.43 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by LMAX clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. LMAX ranks 371 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

LMAX is a CFD and Forex broker that offers clients over 100 trading instruments. The company specializes in providing services for professional traders with large deposits operating in the EU, UK, and Oceania countries.

Brief Look at LMAX

LMAX Group (LMAX) is a CFD and Forex broker that has been operating since 2008. The company is headquartered in the UK. The broker offers clients trading in five classes of instruments, including Forex, stock indices, precious metals, commodities, and cryptocurrencies. LMAX operates under the licenses of the UK (Financial Conduct Authority, FCA) and Cyprus (CySec) regulators.

- 100+ trading instruments.

- Spreads from 0.2 pips.

- Proprietary analytical system.

- No withdrawal fee.

- Licenses from two reputable regulators.

- The minimum deposit is USD 10,000.

- The fee for using the platform is USD 300 per month.

- No PAMM or copy trading.

TU Expert Advice

Financial expert and analyst at Traders Union

The LMAX Group broker has been offering trading services to clients on the market for over 10 years. During this time, the company has done a lot to provide customers with the most convenient service. The improved MetaTrader 4 and MetaTrader 5 are used here as trading terminals. The company operates using ECN and STP technologies.

LMAX offers clients a single trading account. The minimum deposit amount on the platform is USD 10,000. This is because the broker is focused on professionals and receives the main income from the software subscription fee. For example, the payment for using the terminal is USD 300 per month, and for weekend trading and cryptocurrencies, it’s USD 2,000 per month. The spreads on the platform are minimal and start from 0.1 pips.

The broker is focused primarily on Forex trading. There are 100+ trading instruments available, 69 of which are currency pairs. LMAX also has a proprietary analytical platform, through which clients can receive data for fundamental analysis, and conduct technical analysis, etc.

- You prioritize deep institutional liquidity and tight spreads. LMAX operates as an execution venue, offering direct access to institutional liquidity pools. This can potentially result in tighter spreads and faster execution, providing advantages compared to traditional forex brokers.

- You value a wide range of tradable assets. LMAX offers access to over 100 instruments, including forex, metals, equity indices, commodities, and crypto CFDs. This diversity allows for ample diversification options to suit various trading strategies.

- A high minimum deposit is not reachable for you. The minimum deposit requirement set by the broker is USD 10,000. If you are seeking a broker with a lower entry barrier, this higher minimum deposit might be a consideration.

- You do not wish to service a monthly platform fee. This broker charges a platform fee of USD 300 per month. If you prefer brokers with no or lower platform fees, this aspect might impact your cost calculations and overall satisfaction with the broker.

LMAX Summary

| 💻 Trading platform: | МТ4 (desktop, mobile, web), МТ5 (desktop, mobile), WebTrader |

|---|---|

| 📊 Accounts: | Demo, standard |

| 💰 Account currency: | GBP, EUR, USD, AUD, CHF, JPY, PLN, SEK, SGD, HKD, and HUF |

| 💵 Replenishment / Withdrawal: | Credit cards, bank transfer, Neteller, Skrill |

| 🚀 Minimum deposit: | From USD 10,000 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.1 |

| 💱 Spread: | From 0.1 pips for EUR/USD |

| 🔧 Instruments: |

currency pairs (69) CFDs on indices (13) metals (7) energy (5) cryptocurrencies (8) |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | More than 20 large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | There is an inactivity fee on the account |

| 🎁 Contests and bonuses: | No |

The LMAX broker offers clients over 100 trading instruments. Clients have access to a single trading account. The company offers classic terminals MetaTrader 4 and MetaTrader 5. Traders can work with 1:30 leverage and clients can test the trading conditions of the broker on the company's free demo account. LMAX Group has swaps, but no Muslim accounts.

LMAX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

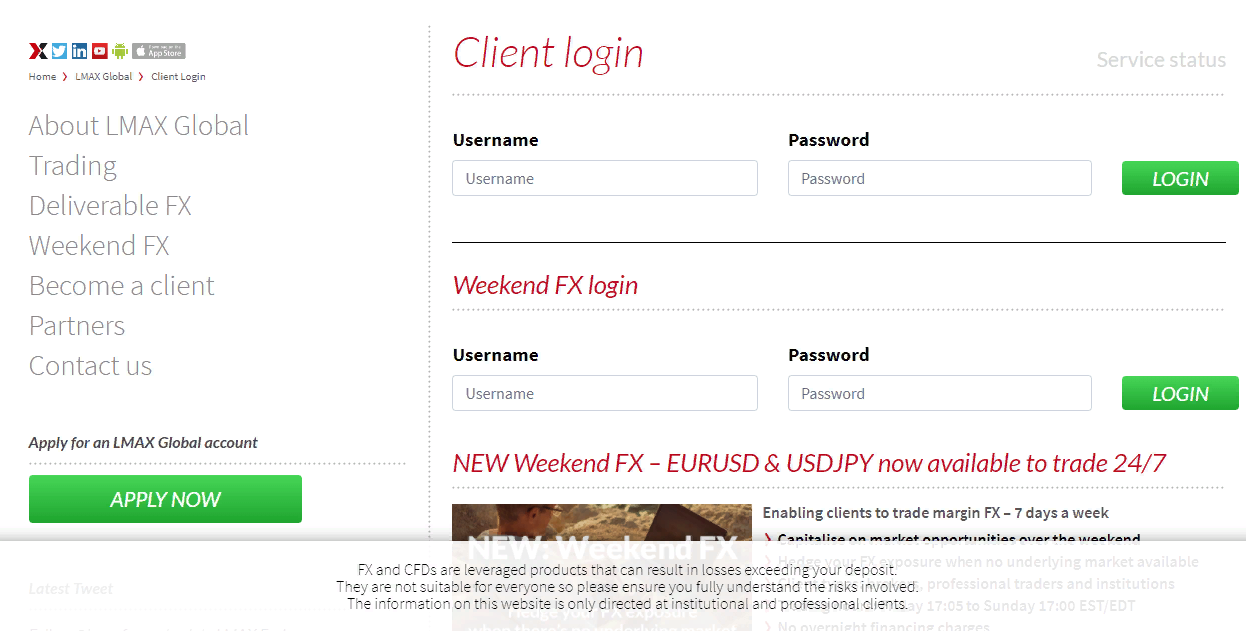

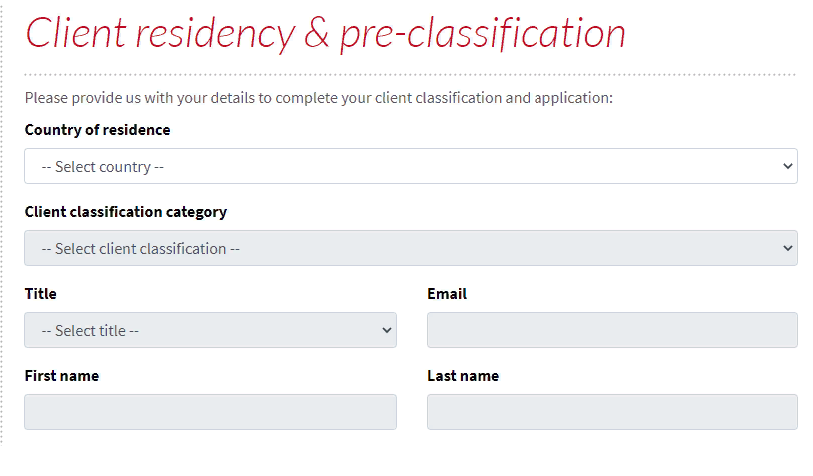

To start trading with the LMAX broker, you need to go through the registration and verification procedures. We offer step-by-step instructions on how to open an account on LMAX.

To start registration, click on the Client Login button.

Below there is the Apply Now button, click on it to open the online registration form.

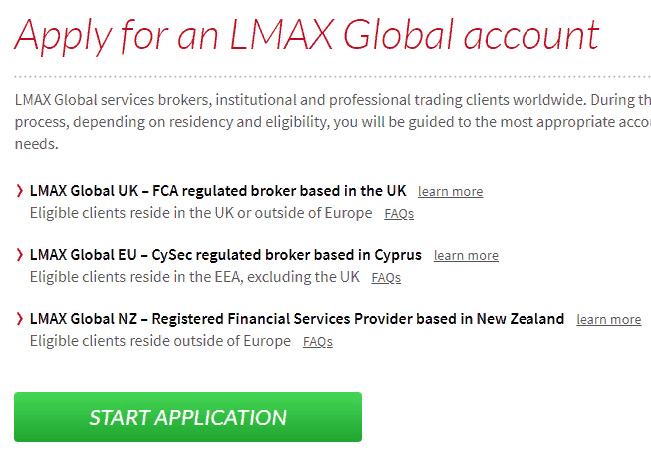

The broker will then inform you about the regulation. The LMAX Group is regulated in three jurisdictions and each business unit provides services to clients from different countries and territories.

Next, fill out the registration form and provide detailed information about yourself, including personal information, residential address, information about the origin of your capital, trading experience, etc. After filling out the form, go through verification and confirm your data, address, and financial status.

Also in the personal account, the trader has access to:

-

A detailed overview of each trading instrument. You can learn detailed statistical data, price changes, dynamics for the previous day, week, month, and other useful information.

-

Market analysis tools. The broker provides clients with a proprietary service where you can learn market data, information on fundamental analysis, use charts and indicators for technical analysis, etc.

-

Detailed history. In your account, you will find a trading history with a detailed description of all trades carried out. You will receive information about the points of opening and closing, about placed orders, about the time and dates of opening trades, etc.

Regulation and Safety

The LMAX Group is a UK-based broker. The company is headquartered in London. The company also has offices in Cyprus and New Zealand.

The broker carries out financial activities based on two licenses. LMAX received a license from the British regulator Financial Conduct Authority - FCA 783200. The broker also has a license for financial activities from the Cyprus financial regulator Cyprus Securities and Exchange Commission (CySec), No. 310/16. In addition, the company is an authorized member of the New Zealand Financial Regulator (FSPR).

Advantages

- Client funds are segregated from LMAX capital and held in segregated bank accounts

- Negative balance protection is active

- In case of violation by the broker of the obligations prescribed in the offer, the client can file a complaint with the regulator

Disadvantages

- To open an account, you must provide detailed financial information

- Without verification, you cannot make a deposit or withdraw funds

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | From $1 | No |

There are swaps (commission for transferring a position to the next day). The analysts of the Union also compared the size of the average trading commission of LMAX, Admirals, and FxPro. The comparative results are presented in the below table.

| Broker | Average commission | Level |

|---|---|---|

|

$1.8 | |

|

$1 | |

|

$8.5 |

Account Types

The LMAX Group offers retail clients only one type of trading account, so all traders work in the same conditions. For corporate clients, there is a special account, the conditions for which must be agreed directly with the broker. The company is aimed at professional traders with a large deposit. Therefore, to start trading on the platform, you need to fund your account with at least USD 10,000. We offer brief characteristics of the LMAX trading account.

Account types:

The LMAX Group is an STP broker that provides profitable trading conditions for professional traders who prefer to work with ECN technology.

Deposit and Withdrawal

-

LMAX processes withdrawal requests within 24-48 hours.

-

Money can be withdrawn to Visa and Mastercard (debit and credit), bank transfer, and to electronic payment systems such as Neteller and Skrill.

-

Bank transfer takes 1 to 2 business days. Money is received on EPS within a few minutes after the broker approves the withdrawal request.

-

LMAX does not charge fees for deposits or withdrawals.

-

To make a deposit, you need to go through verification.

Investment Programs, Available Markets and Products of the Broker

The LMAX broker Group does not offer clients any investment programs. There are no MAM or PAMM accounts, copy trading services, or other tools for generating passive income on this platform. Therefore, the platform is suitable directly for traders who actively trade in the financial markets. Methods for passive capital growth are not provided here. The LMAX broker offers clients an Introducing Broker (IB) affiliate program suitable for hedge funds, account managers, brokers, and more.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

LMAX’s affiliate program

-

Introducing Broker (IB). The broker's clients can use the platform's software to develop their own trading business.

Introducing Broker affiliates receive rebate income from LMAX. They also have access to trading terminals and all trading instruments provided by the broker. Payments are made to a special bonus account LMAX, and rebates accrue daily.

Customer Support

The broker's technical support service is open 24/5, from Sunday 22:00 to Friday 22:00 London time. On weekends, support is provided only for clients who trade on Weekend FX, as well as exchange cryptocurrencies.

Advantages

- In the online chat, you can ask a question without being a client of the company

- Support is available in English

Disadvantages

- Works 24/5

This broker provides the following communication channels for existing clients and potential investors:

-

phone number (as specified in the Contact section);

-

email;

-

online chat on the website and in the personal account;

-

feedback form.

Not only a registered client but also a trader without an active account can ask a broker's representative a question.

Contacts

| Foundation date | 2008 |

|---|---|

| Registration address | Yellow Building, 1A Nicholas Road, London W11 4AN |

| Official site | https://www.lmax.com/ |

| Contacts |

+44 20 3192 2572

|

Education

There is no tutorial section on the LMAX website. The company is focused only on professional traders who have the necessary knowledge and experience to work in the financial markets.

The broker does not have cent accounts, so the only way to practice the knowledge gained will be training on a demo account.

Comparison of LMAX with other Brokers

| LMAX | RoboForex | Pocket Option | Exness | Octa | XM Group | |

| Trading platform |

MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MT5, MobileTrading, XM App |

| Min deposit | $10000 | $10 | $5 | $10 | $25 | $5 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0.6 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed Review of LMAX

The LMAX Group is primarily targeted at large traders. The platform provides clients with the opportunity to work with five classes of trading instruments. Traders have access to the Market execution tool. The company's clients can use the LMAX automated services and analytics from a broker. For practice, clients have access to a free demo account.

LMAX by the numbers:

-

More than 10 years of experience.

-

100+ trading instruments available.

-

15 awards to its credit.

LMAX is a broker for active trading

The LMAX broker works on ECN and STP technologies. Thus, the company does not conduct transactions itself, per se, because traders get direct access to liquidity providers. This allows clients to trade with the lowest spreads and the fastest order execution possible. The broker offers clients the opportunity to work in the Forex market, as well as with CFDs on stock indices, precious metals, commodities, and cryptocurrencies.

For passive investors, there are no tools provided here, but for traders, LMAX offers great opportunities. Trading is carried out through the trading terminals MetaTrader 4 and MetaTrader 5. You can set up trading with one click. The broker does not impose any restrictions on trading strategies.

Useful services of the LMAX broker:

-

P2P cryptocurrency exchange platform. The broker provides clients with the ability to quickly exchange cryptocurrencies through its own exchanger. The exchange is made through the LMAX trading account.

-

Economic calendar. On the LMAX website, customers can follow important economic events two weeks in advance. Filters are also available that are triggered by importance, trading instruments affected by the event, expected volatility, etc.

-

Analytical platform. The LMAX broker offers its clients access to its own analytical service. Here traders can receive news, materials for fundamental analysis, and set up charts and tools for technical analysis, etc.

-

Blog. The company's specialists offer clients daily and weekly reports on important economic events. Events are published in text format as well as in podcast format.

Advantages:

There are five asset classes available for trading.

To ensure the safety of client funds, the company stores them in segregated accounts.

Negative balance protection is active.

Tight spreads (from 0.2 pips).

The broker provides free analytics and online tools to improve the quality of trading.

All clients, regardless of the size of the deposit, have access to the economic calendar and the company's blog. There are also paid services, which are charged in the format of a monthly subscription.

User Satisfaction