deposit:

- $250

Trading platform:

- MT4

- WebTrader

- FSC

- 0%

InvestMarkets Review 2024

deposit:

- $250

Trading platform:

- MT4

- WebTrader

- FSC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

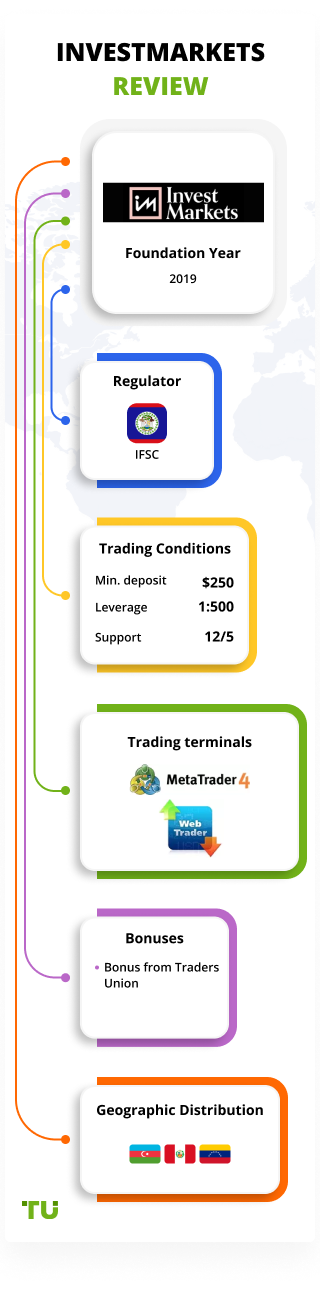

Summary of Investmarkets Trading Company

Investmarkets is a broker with higher-than-average risk and the TU Overall Score of 4 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Investmarkets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Investmarkets ranks 215 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

InvestMarkets is a broker for investing in an area with low tax rates.

The InvestMarkets broker started operating in 2019. It offers clients the opportunity to trade in six asset classes such as currency pairs, cryptocurrencies, stocks, commodities, stock indices, ETFs, through contracts for difference (CFDs). InvestMarkets is operated by Arvis Capital Limited, which is regulated by FSC of Belize with license number 000307/489 (“trading of financial and commodity derivatives and other assets”), registration number 155177.

| 💰 Account currency: | USD, EUR, GBP, ZAR, RUB, CHF, USD, TRY |

|---|---|

| 🚀 Minimum deposit: | from 250 USD |

| ⚖️ Leverage: | up to 1:500 (on all accounts) |

| 💱 Spread: | Average spread EUR/USD — 1.8 pips (VIP); 3.2 pips (Base) |

| 🔧 Instruments: | Currency pairs (50+), cryptocurrencies (30+), CFD on stocks (150+), indices (30+), metals (8), energy resources (6), agriculture (15+), ETF (3) |

| 💹 Margin Call / Stop Out: | 50%/20% |

👍 Advantages of trading with Investmarkets:

- A wide range of available trading instruments.

- Desktop and mobile versions of the MetaTrader 4 platform are available for trading, as well as the convenient Web platform.

- Trading Central and Tip Ranks services are available.

- Absence of trading commissions.

- A wide range of methods for depositing and withdrawing funds.

👎 Disadvantages of Investmarkets:

- There are no PAMM or MAM accounts for passive investing.

- Regulation is in an offshore jurisdiction.

- Wide spreads.

Evaluation of the most influential parameters of Investmarkets

Trade with this broker, if:

- You are looking for convenience in trading. Desktop and mobile versions of the MetaTrader 4 platform are available, as well as a convenient Web platform for flexibility in accessing your trading account.

Do not trade with this broker, if:

- Regulation is crucial for you. The broker is regulated by the International Financial Services Commission of Belize (IFSC), which is considered less stringent than regulatory bodies like the FCA or CySEC.

- Advanced platform features are essential for your trading strategy. The broker's platform might lack sophisticated tools and functionalities compared to major competitors.

Table of Contents

Geographic Distribution of Investmarkets Traders

Popularity in

Video Review of Investmarkets i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Investmarkets

The CFD broker InvestMarkets has been providing services for over two years. The company offers clients medium to high floating spreads. Information about where the company’s servers are located, who is the liquidity provider, what is the latest statistics on order execution are not available to the public. The support team did not answer these questions.

InvestMarkets offers four types of accounts: Base, Gold, Platinum, and VIP. There are no commissions on any accounts, but the spread differs depending on the type of account. For example, on the Base account, the average spread on EUR/USD is 3.2 pips, but on the VIP account, the spread is reduced to 1.8 pips. The maximum leverage for all accounts is 1:500, but it may vary depending on the trading instrument.

Detailed and comprehensive information on current spreads, commissions, and other costs for each base instrument is available in PDF format on the InvestMarkets’ website, in the legal section. In case you do not understand the information presented in the PDF, clarifications can be obtained from the technical support specialists. Support operators respond quickly in chat format, but they are not always informative. The support service works only on weekdays.

Dynamics of Investmarkets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

At the moment, the InvestMarkets broker does not offer any ways to create passive income. The PAMM and MAM accounts and social trading services are not available to clients. The only option is to connect your InvestMarkets account to the signal providers that are integrated into the MT4 terminal.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

InvestMarkets’ affiliate program

The broker doesn’t provide a referral program.

Trading Conditions for Investmarkets Users

InvestMarkets offers clients more than 250 instruments for trading, including the classic MetaTrader 4 terminal, and a proprietary WebTrader. Their clients can also select from among several types of accounts, and clients can use a leverage of up to 1:500 on each account, depending on the trading instrument. Potential clients can test the trading conditions on demo accounts. There are no Islamic accounts for Muslim traders.

$250

Minimum

deposit

1:500

Leverage

12/5

Support

| 💻 Trading platform: | МТ4 (desktop, mobile), WebTrader |

|---|---|

| 📊 Accounts: | Base, Gold, Platinum, VIP |

| 💰 Account currency: | USD, EUR, GBP, ZAR, RUB, CHF, USD, TRY |

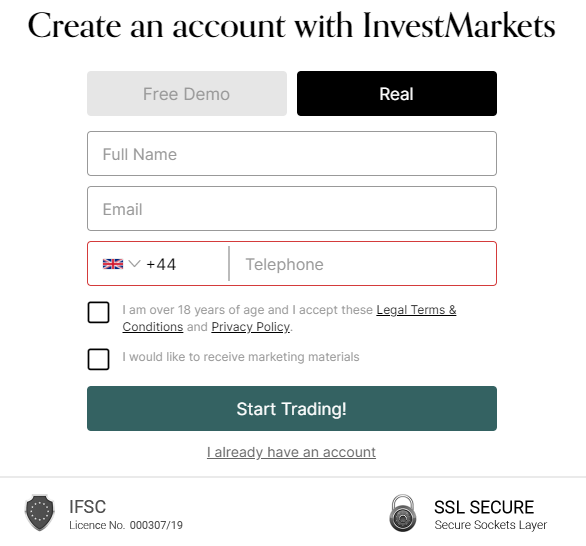

| 💵 Replenishment / Withdrawal: | International Bank Transfer, Credit/Debit Card, Neteller, Skrill, AstroPay, WebMoney, Jeton, Sofort, and others |

| 🚀 Minimum deposit: | from 250 USD |

| ⚖️ Leverage: | up to 1:500 (on all accounts) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Average spread EUR/USD — 1.8 pips (VIP); 3.2 pips (Base) |

| 🔧 Instruments: | Currency pairs (50+), cryptocurrencies (30+), CFD on stocks (150+), indices (30+), metals (8), energy resources (6), agriculture (15+), ETF (3) |

| 💹 Margin Call / Stop Out: | 50%/20% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Available |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | High fees for inactivity |

| 🎁 Contests and bonuses: | No |

Comparison of Investmarkets with other Brokers

| Investmarkets | RoboForex | Eightcap | Exness | Pocket Option | FXGT.com | |

| Trading platform |

WebTrader, MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | Pocket Option, MT5, MT4 | MetaTrader4, MetaTrader5 |

| Min deposit | $250 | $10 | $100 | $10 | $5 | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.8 point | From 0 points | From 0 points | From 1 point | From 1.2 point | From 0.5 points |

| Level of margin call / stop out |

50% / 20% | 60% / 40% | 80% / 50% | No / 60% | 30% / 50% | 50% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Investmarkets | RoboForex | Eightcap | Exness | Pocket Option | FXGT.com | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Investmarkets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Basic | $32 | Yes |

| Gold | $29 | Yes |

| Platinum | $23 | Yes |

| VIP | $18 | No |

There are swaps (commission for moving a position to the next day), the fees are frequently updated; check with the support service for the current values.

The analysts of Traders Union also compared the size of the average trading commission of InvestMarkets, RoboForex, and FxPro. The comparative results are presented in the below table.

| Broker | Average commission | Level |

| Investmarkets | $25.5 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of InvestMarkets

InvestMarkets builds its work on compliance with two rules: access to professional analytics and a wide range of markets. Traders have access to four types of accounts, as well as demo accounts with 100 thousand virtual dollars.

InvestMarkets by the numbers:

-

4 account types from which to choose.

-

6 asset classes for trading.

-

250 trading instruments.

InvestMarkets is a broker for novice traders

The broker conducts clients’ trades through MT4 and a proprietary WebTrader platform. The personal account is built into the WebTrader platform, which increases the convenience of trading and working with your account with this broker.

Useful services of InvestMarkets:

-

Tip Ranks. This is a service that shows updated information on popular stocks such as up-to-date analysts’ forecasts, insider actions, recommendations, market trends in dynamics.

-

TC Featured Ideas. A service of investment ideas from the Trading Central team of analysts based on technical and fundamental strategies.

-

TC Market Buzz. A proprietary search engine for “hot” markets, which are being discussed or are active more than others at the moment. It helps to better navigate the congested information space.

-

Economic calendar. It helps market participants to be ready for important macroeconomic news.

-

Mailing. The investment analytics you need is right in your inbox with simple language about current trends.

Advantages:

There are six asset classes available for trading.

A wide range of methods for depositing/withdrawing funds.

No commissions for making deposits to the account.

The broker provides daily free analytics, as well as auxiliary tools to improve the quality of trading.

Clients can open demo accounts without any restrictions.

How to Start Making Profits — Guide for Traders

InvestMarkets offers four types of accounts for corporate and individual clients. All accounts have the leverage of up to 1:500. There is no commission on any accounts since the broker’s service fee is included in the spread.

Account types:

Information from Trading Central and Tip Ranks analysts is available for all accounts.

InvestMarkets is a broker that offers access to investment transactions in a loyal tax jurisdiction.

Bonuses Paid by the Broker

For new clients, the broker may provide a deposit bonus of 50% or $5,000 (whichever is less). To activate the bonus, you need to contact the manager. Getting the bonus can take up to 48 hours on weekdays. Contact support to clarify the relevance of the bonus program at the moment.

Investment Education Online

InvestMarkets has an Education section with training materials on its website. Materials in the Academy are aimed at novice traders.

The broker regularly conducts webinars (usually once each working day) for beginners. At the webinars, the expert on behalf of the company analyzes the current news and the current state of popular markets. The broker does not have pages in social networks and does not have a Youtube channel. The broker does not have cent accounts, so the only way to consolidate the knowledge gained in practice will be by training on a demo account.

Security (Protection for Investors)

InvestMarkets is regulated by the Belize International Financial Services Commission (FSC). The license number is 000307/166. The registration number is 155177.

The complaint handling policy on the broker’s website states that the broker undertakes to inform its clients about the receipt of the complaint within five working days and to investigate the complaint within two months.

👍 Advantages

- A wide range of electronic payment systems for making deposits and withdrawals of money

👎 Disadvantages

- To open an account, you must provide detailed financial information

- Regulation in an offshore jurisdiction

- No negative balance protection

- Client funds are not protected by the insurance fund

Withdrawal Options and Fees

-

Withdrawal requests are processed within 24 hours on business days. Data on withdrawal requests can be found in your personal account by clicking on the Banking button.

-

The broker does not charge commissions for making deposits, but they do apply when withdrawing capital. The standard fee is set at 30 USD for bank transfers, 3.5% for debit/credit cards and Neteller, and 2% for Skrill and Perfect Money.

-

VIP account holders can withdraw money without commission, Gold account holders can make one free withdrawal per month, Platinum account holders can make three free withdrawals per month, Basic account holders can make a free withdrawal only once.

-

There is no minimum amount for withdrawals to debit/credit cards, Skrill or Neteller. Bank wire and other money transfers may have a $120 minimum amount limit.

-

Bank transfers and withdrawals to credit/debit cards take up to five business days but may take longer depending on the circumstances. Money is received on electronic payment systems within a few minutes after the broker approves the withdrawal request.

-

Verification is optional to be able to make a deposit.

Customer Support Service

Support operators are available from 8:00 am to 9:00 pm (Cyprus time), Monday through Friday.

👍 Advantages

- You can ask a question in online chat without being a client of the company

- Quick response

👎 Disadvantages

- Works only on weekdays

- Support is only available in English; other languages - upon request

This broker provides the following communication channels for existing clients and potential investors:

-

phone — in South Africa +27 10 753 1177, Mexico +52 55 4164 7611, and Singapore +65 3158 9403;

-

email — info@investmarkets.com;

-

online chat.

Not only a registered client but also a trader without an active account can ask a broker’s representative a question.

Contacts

| Foundation date | 2019 |

| Registration address | Unit 303, No. 16 Cor., Hutson and Eyre Streets, Blake Building, Belize City, Belize |

| Regulation |

FSC |

| Official site | https://www.investmarkets.com/ |

| Contacts |

Email:

nfo@investmarkets.com,

Phone: +27 10 753 1177 |

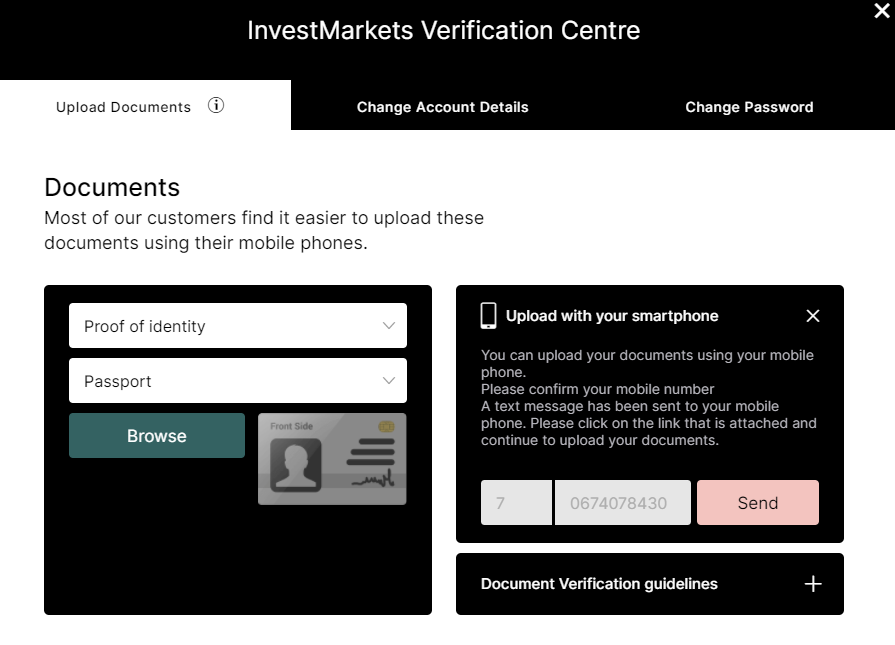

Review of the Personal Cabinet of InvestMarkets

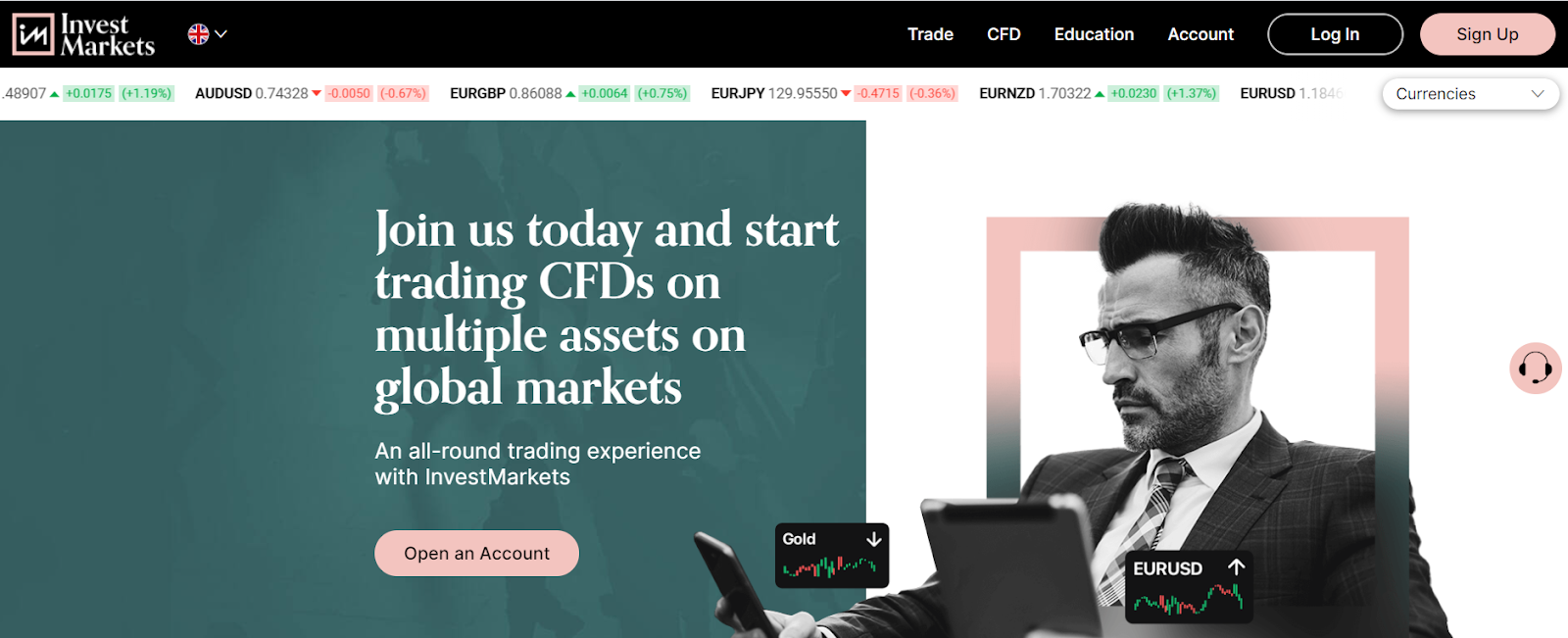

To start trading with InvestMarkets, you need to go through a simple registration. A quick guide looks like this:

Click Sign Up on the InvestMarkets website.

The system will open a registration form where you need to enter your personal data (name, address, phone number, etc.), as well as tick the boxes to agree to the terms of service. In this case, you also need to select the type of account to open: demo or real.

After registration, the client is invited to immediately fund the account to start real trading. However, you do not need to make funding, you can skip this step. The client can deposit funds when it decides to start trading.

The features of the personal account:

1. The client’s personal account is built into the WebTrader trading platform, as well as integrated with the broker’s website. After authorization, the client can enter his profile using the link in the top menu of the broker’s website.

1. The client’s personal account is built into the WebTrader trading platform, as well as integrated with the broker’s website. After authorization, the client can enter his profile using the link in the top menu of the broker’s website.

In the personal account, the trader can access the:

-

Functionality for uploading documents.

-

Functionality for changing personal data and passwords.

-

Banking link for deposits and withdrawal of funds.

-

Links to Trading Central and TipRanks services.

-

Functionality to support requests.

Articles that may help you

FAQs

Do reviews by traders influence the Investmarkets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Investmarkets you need to go to the broker's profile.

How to leave a review about Investmarkets on the Traders Union website?

To leave a review about Investmarkets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Investmarkets on a non-Traders Union client?

Anyone can leave feedback about Investmarkets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.