How do you use stock market tools and indicators?

Traders employ various tools and indicators to gain an edge and improve performance. For example, they can use scanners, strategy builders and testers, calendars, condition signals, technical oscillators, and fundamental reports.

Technical indicators are utilized by graders on a global scale to get insights into the supply and demand of specific stocks. These indicators form the basis of technical analysis. There are numerous metrics that they take into consideration with the goal of providing clues to whether a price move will carry on with its direction.

Through these methods and tools, investors can get access to data through which they can determine if they should buy or sell a specific stock. Today, we will dive into all of the intricacies surrounding the usage of trading tools and indicators.

Basics of using tools and indicators for stock trading

Technical indicators and tools for stock trading are essential when determining in which direction a specific stock or other tradable asset will move. These are typically mathematically based, and traders will utilize them to get an in-depth look at the past and try to figure out future price trends and patterns.

There are stocks, funds, indices, bonds, and cash equivalents or money market instruments. Fundamentalists might track the economic data, annual reports, or other various measures of corporate profitability. However, technical traders will rely on charts and indicators to help them interpret price moves.

These tools and indicators aim to identify future trading opportunities and figure out upcoming trend changes. Strategies will rely on these indicators to determine entry, existing, and/or trade management rules. Each strategy will specify the conditions under which traders are established and when positions can be adjusted and closed. As a result, there are a lot of advantages to using some of the best apps for stock trading.

Economic calendars

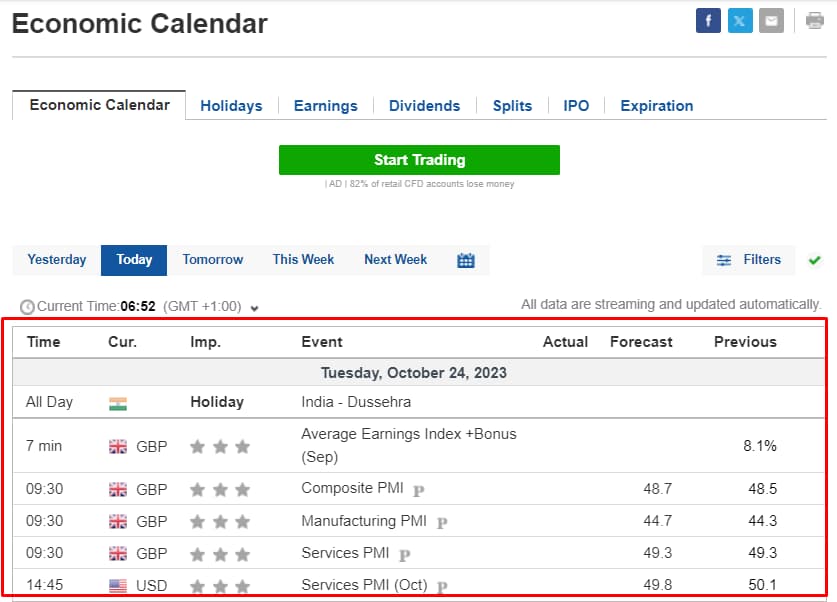

An economic calendar refers to the scheduled dates of specific and high releases of events, which could potentially have an effect on the movement of an individual security price or the overall market.

Economic calendar

Investors and traders will typically utilize this economic calendar to plan out their trades and portfolio reallocations and find chart patterns and indicators. Each of these has the potential to be caused or affected by these events. Most of them fall within projections of future financial or economic events or even report on past financial or economic events.

Condition based signals

Condition based signals are triggers to buy a specific stock or sell it based on a predetermined set of criteria. These can also be used to reconstitute a portfolio, shift allocations, or take newer positions.

Traders are able to create trading signals through the use of a variety of criteria, from simple earning reports to complex signals that are derived from pre-existing ones. The pros behind these signals are that they can enable objectivity, consistency, and system building.

However, the cons are the potential for false signals, hindsight bias, and lack of fundamentals. For example, if the price is above a specific level and MA crosses, it could lead investors in a specific direction where the desired outcome might not become a reality.

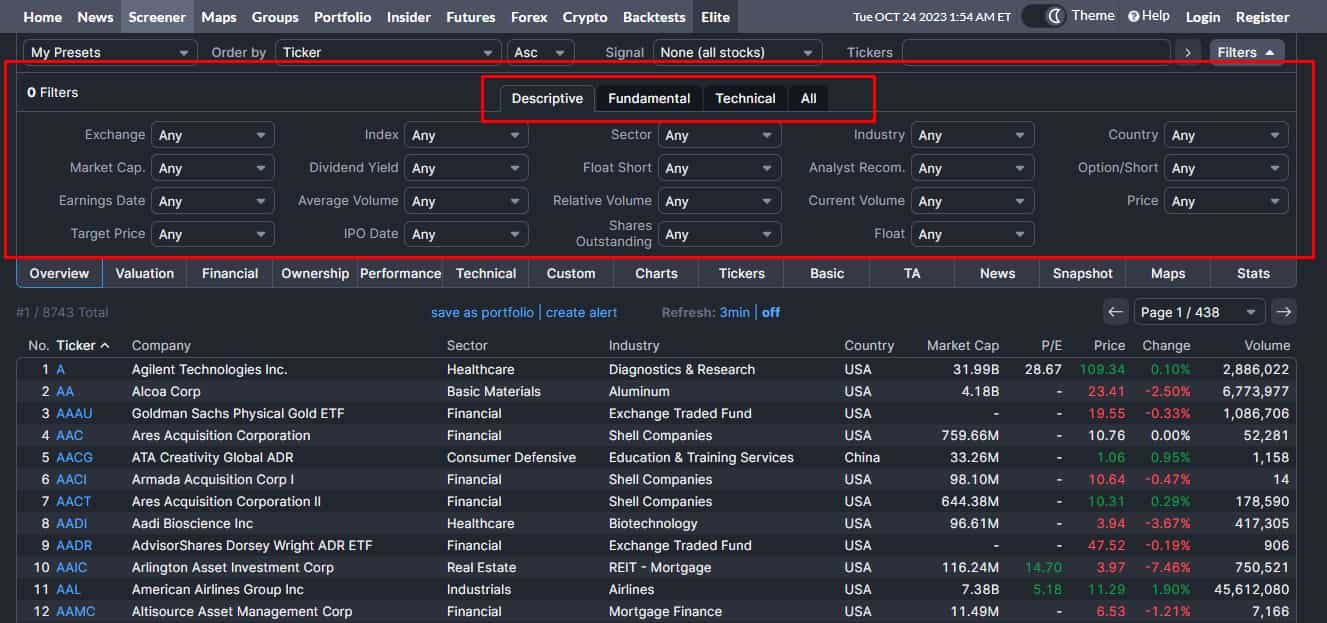

Filters and scanners

Currently, there are over 60,000 different stocks traded on exchanges on a global scale. Consequently, filters and scanners enable anyone to make a narrower range of choices in order to find stocks based on various criteria, which can be fundamental or technical.

Filters and scanners

The pros here are that anyone can get much more detailed data and filter out what they are not interested in whilst also changing changes in the market. The cons are delayed decision-making, bias, and the potential to miss out on filtered trades.

Strategy builders and testers

Strategy builders and testers can enable anyone to create and then test specific strategies that work best for any investor or trader's ambitions. The pros here include the fact that they can better manage their risk, conduct more efficient trade, and potentially earn more.

However, there are also cons, as backtesting does not always guarantee future success, and by emphasizing historical data, traders might miss some specifics for future price movement.

Following tools

Various tools and services can help investors and traders source information that might affect the market. These include Commitments of Traders (COT) reports, trades of insiders, famous inventors, and simple copiers of trades. By leveraging the power of a copy trader infrastructure, for example, traders can optimize their portfolios.

Organizers

Organizers also referred to as trading journals, are utilized to organize work with charts of different sectors and timeframes. All of this can contribute to better portfolio optimization and management.

Tools for technical analysis

There are also a lot of tools available for technical analysis of the market.

Filters and scanners

These are used to get specific data about the market prior to making any investment decision. Lines, Fibo levels, and other for-building figures are analyzed in order to help traders work with chart patterns. As a result, any investor needs to know the best Forex chart patterns to follow.

Fundamental reviews and statistics

Fundamental reviews and statistics can help traders and investors determine a stock's real or fair market value. If the fair market value is higher than the market price, it's undervalued, and a buy recommendation is given, for example. However, in contracts, technical analysis favors studying the historical price trends of stock to understand and predict short-term future trends.

As a result, fundamental review and statistics have the advantage of determining value and can analyze P/B ratio, Debt/Equity ratio, EPS, P/E ratio, and RoE ratio. On the flip side, the cons are that they might not always accurately represent the stock's future and cannot always guide traders toward determining what to expect.

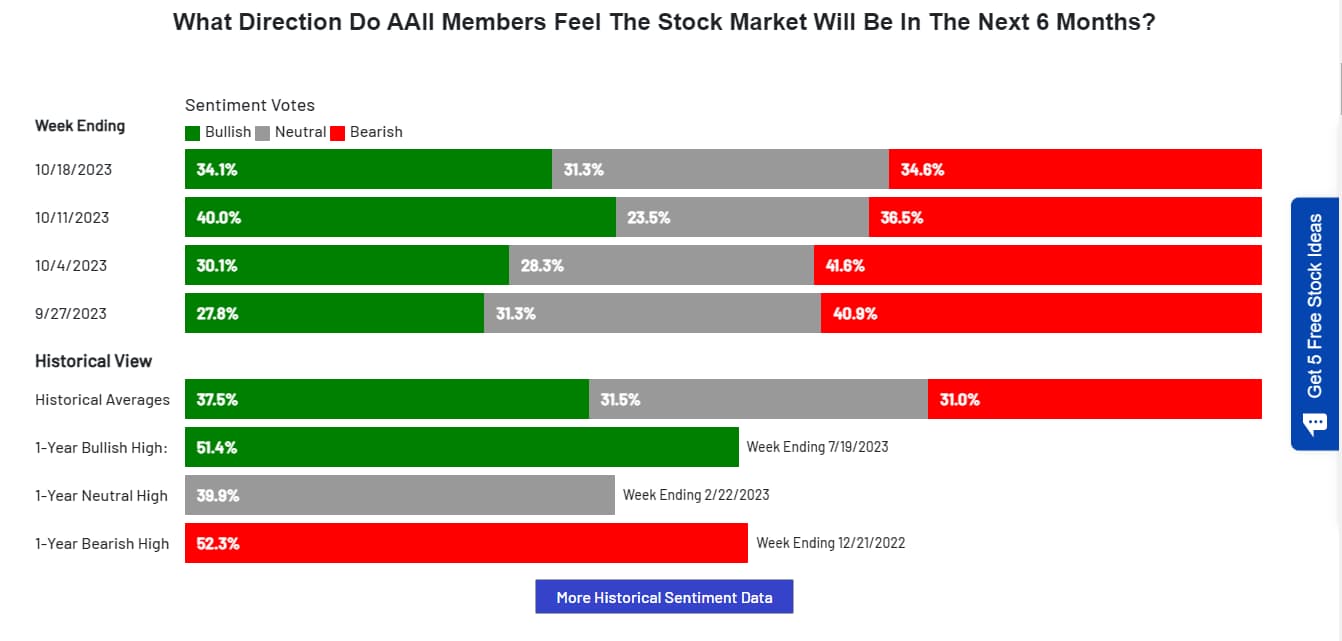

Tools for sentiment analysis

Numerous tools can be utilized for sentiment analysis. This is the process of analyzing digital text to determine if the emotional tone of the message is positive, negative, or even neutral. Some of the tools available include the Greed Fear Indicator, the Social Media Scanners, and the Positions of Broker's clients, for example.

Tools for sentiment analysis

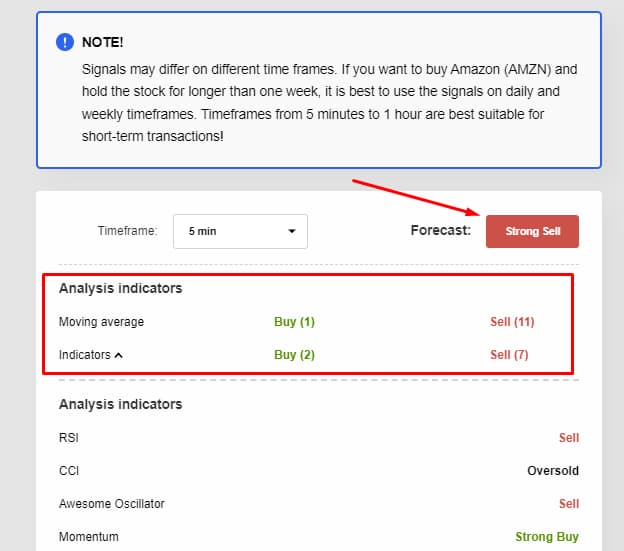

Technical indicators and oscillators

Technical indicators and oscillators can help traders analyze price movements, trends, momentum, and volatility alongside other aspects of the market. They are based on mathematical formulas, and these take advantage of values like price, volume, and time to generate signals or values that can be spotted on top of charts.

Economic calendar

In this case, the oscillator is a technical analysis tool to construct high and low bands between two extreme values. It then builds a trend indicator that fluctuates within the bounds. Traders use this trend indicator as a means of discovering short-term overbought or oversold conditions.

Traders and investors need to understand the best Forex indicators for successful trading in order to take advantage of these trends. The advantage here is that analysts can identify trends, as in the example showcased above. For example, the value above could turn bullish and surge above the $1,900 price level.

As a result, short-term traders will want to take advantage and buy it while it is low. By following the historical data, they can identify whether they are bullish, bearish, or sideways. They can also gain entry and exit signal data and help manage their risk.

However, this can all be subjective, and this does not account for fundamental factors. In addition, it might not work with all market conditions.

Tips on using tools and indicators for stocks

Understanding some of the key tips and tricks for using tools and indicators for stocks is essential. Relying only on a single tool is not recommended. The usage of multiple, different indicators for confirmation is essential.

However, traders should avoid using tools that are too similar in data. Each trader can also optimize their indicators and should not exclude stock fundamentals. In addition, consistently expanding knowledge and utilizing new tools and indicators can provide far more detailed data that would otherwise get missed.

Learning how each tool works in-depth through its documentation can also play a major role, as using just a small percentage of its capabilities could be limiting.

Best stock brokers 2024

FAQs

What are chart indicators?

Chart indicators are tools that can be applied to a trading chart. Their goal is to help make the market far clearer to the trader in question. They can confirm if it's trending or ranging, for example.

Is it profitable to trade with indicators?

To be profitable, traders must conduct different strategies and utilize different tools. While indicators are convenient, they are just a derivative of price. They simply indicate what has happened but not what will happen.

Which indicators show support and resistance?

Traders and analysts use numerous indicators, including trend lines, moving averages, and pivot points. However, to truly utilize them, traders will first need to know what the best indicator for support and resistance is.

How do you choose technical indicators for stock trading?

Choosing the right technical indicators can be a challenge. However, this task can be achieved if traders focus on the effects within five categories of market research. These include trend, mean reversion, momentum, volume, and relative strength.

Team that worked on the article

Milko Trajcevski is a truly determined content writer with a passion for the crypto industry. He has a successful track record of researching and effectively writing articles about cryptocurrency, non-fungible tokens, and blockchain covering the fields of crypto-asset regulations, wallets and exchanges, liquidity, altcoins, DApps, forks, mining, laddering, security and enterprise blockchain technology.

Milko focuses on contributing fresh and interesting articles to the Traders Union website, with expertise within the crypto-writing space, and a dedication to service.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.