Best Forex Price Alerts 2024

For any active trader, having an edge in the markets is paramount. While doing thorough research and developing a rigorous strategy is ideal, it requires significant time commitment that many cannot afford. This is where swing trading alerts services come in - they aim to do the legwork for time-strapped traders by scouting the markets for high-probability setups. In this article, we assess some of the best options available for leveraging the insights of experienced analysts. We consider factors such as the breadth of coverage, communication methods, track records and pricing structures of various services.

-

How do I subscribe to a swing trading alerts service?

You need to choose a service, register for an account on their website, select a subscription plan that fits your budget, and provide payment details.

-

How often do alerts get sent?

This depends on the provider. Most issue alerts a few times per week when opportunities arise, though some may send 10-15 alerts weekly.

-

How profitable should I expect alerts to be?

Realistic targets are in the 55-65% success rate range for short-term trades. Consistent 100% gains are unlikely. Positive expectancy is the goal over many trades.

-

Do I need a large account to start?

No, most trades suggested are for small position sizes, even $100-500 equivalents, making alerts accessible to mini traders too. Scale up as you become more experienced.

What Is a Swing Price Alert?

In swing trade alerts, you are notified when a swing trade setup is available in the market. You have to subscribe to the signal provider to be able to receive them. In most cases, swing trade alert providers are experienced traders who sell their trading signals to make more money or financial firms that specialize in market research.

Swing trade alerts can be delivered via email, SMS, Skype, WhatsApp, or Telegram, depending on the provider. Subscribers have the option of executing the trade manually or ignoring it when they receive a trade alert.

Swing trade alert messages from providers usually contain information about which stock to trade, what direction to take (buy or sell), what entry level to use, and how much profit to aim for.

In addition to charts and explanations of their trade analysis, some swing trade alert providers include charts and explanations with their signal packages. By understanding the reasons behind the trade setup, you may be able to trust the trades and execute them properly to achieve the best results. You can also improve your trading knowledge with those charts and explanations.

You can achieve your trading goals faster if you subscribe to a swing trade alert service, regardless of whether you're a beginner or an experienced swing trader. Swing trade alerts aren't all worth your time and money, so you should choose a provider carefully. Decide which swing trade alert is right for you after you understand how they work.

Top 7 Swing Trading Alert Services

| Alerts Provider | Alert channel | Markets | Costs |

|---|---|---|---|

Learn2Trade |

Email, SMS, Telegram |

Forex, stocks, CFDs, crypto, commodities |

1-month subscription: £40, 3-month subscription: £30, 6-month subscription: £21.5, Lifetime subscription: £399, Swing trading group: £50 |

ForexSignals.com |

Email, SMS |

Forex |

The Apprentice: $59/month w/ 50% discount, The Committed: $37/month w/ 50% discount, The Professional: $26/month w/ 50% discount |

Trade Ideas |

Email, SMS |

Stocks |

Premium: $167/month, Standard $84/month |

Trend Spider |

Email, SMS |

Stocks & ETFs, cryptocurrencies, forex, futures, indices |

Advanced: $97/month, Elite: $67/month, Premium: $33/month |

Mindful Trader |

Email, SMS |

Stocks, options, futures |

$47/month |

Market Chameleon |

Stocks and options |

Free Service: $0, Stock Trader: $39/month, Options Trader: $69/month, Earnings Trader: $79/month, Total Access: $99/month |

|

The Trading Analyst |

SMS |

Stocks |

Monthly Plan: $147, Annual Plan: $787, Quarterly: $357 |

Learn2Trade

Learn2Trade

There is no doubt that Learn2Trade is one of the best platforms for receiving swing trading price alerts with high success rates and probability. With insightful trade ideas, market news, and price alerts, it is a one-stop solution for beginners and professionals alike.

Further, it isn't limited to any particular geographical territory or financial instrument. In addition to forex currencies, stocks, CFDs, crypto, and commodities, you can also receive information and signals regarding these instruments.

Unlike other trading platforms, Learn2Trade only focuses on signals for trading. To receive alerts for different assets, you can sign up with Learn2Trade regardless of the broker you use.

Free and paid versions are available, with the paid version offering more features and benefits. Using the Telegram app or directly on your phone, you can receive the signals via a Telegram group.

Their signals are mainly provided by experts who have over 15 years of experience in the field, according to their website. As it is based in the UK, its analysts are also based there.

There are currently over 50,000 members on Learn2Trade, so the community is quite diverse. The price alerts typically contain a lot more information than just prices, allowing traders to make informed decisions. Take profit and stop loss are included here.

ForexSignals.com

ForexSignals.com

A useful resource for traders, especially those who are new to trading, is ForexSignals.com. The price alerts they provide come from professionals with years of trading experience, just like Learn2Trade. Mentors also often do live streams to give traders trade ideas and educate them on different financial assets.

Subscribers to the premium version receive price alerts daily. Sadly, the free alerts provide very limited information. If you want the best experience, you need the premium version.

You can subscribe to its premium service on a monthly, three-month, or six-month basis.

Additionally, you get access to an extensive community of traders through the Trading Room feature, where you can exchange ideas and learn from other forex traders. The community on the platform is growing rapidly, and there are thousands of traders on it.

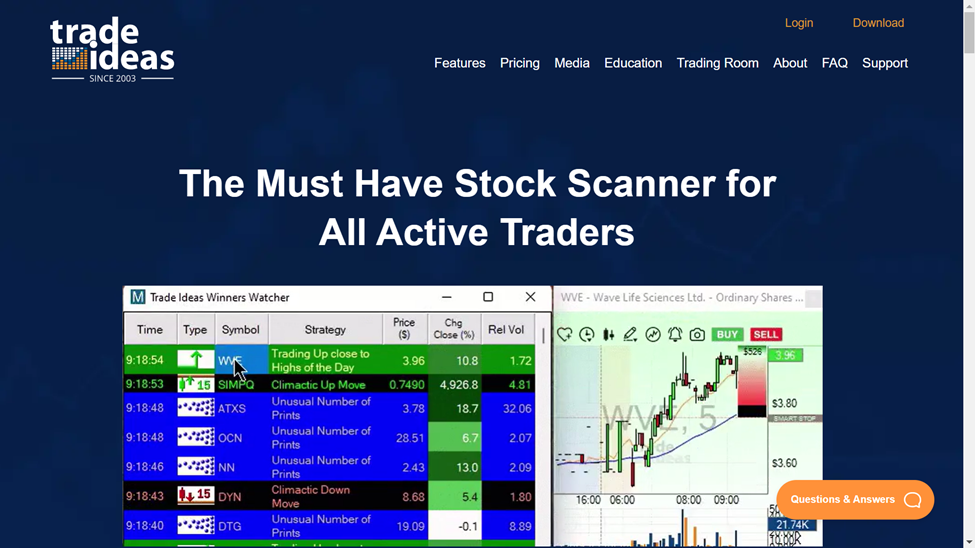

Trade Ideas

Trade Ideas

Holly is an AI-powered assistant at Trade Ideas. As your personal research analyst, Holly analyzes technicals, fundamentals, social media, earnings, and more to pick stocks and make trade recommendations in real time.

Holly keeps busy, too. Every night and morning before the markets open, she runs over 1 million simulated trades using over 70 proprietary algorithms to find the best investment opportunities.

There's more to Trade Ideas than that, however. Using a live simulated trading room, you can use these trade ideas in real-time. Demonstrating the stock picking service's ideas without risking your own money is possible in this way.

This powerful service lets you learn how to trade into trades that balance both your risks and rewards with real-time streaming trading ideas. In addition to investing, you can also learn more about the stock market.

Best Forex Automated Trading SoftwareTrend Spider

Trend Spider

With customizable alerts, charts, and multi-timeframe analysis, TrendSpider is an advanced technical analysis charting software. In addition to technical analysis, this software includes a variety of scan methods for analyzing stocks.

A scanner or screener is only the first step in the process. There are some scan results that can't be traded right away. To obtain a low-risk, high-probability trade, you sometimes need to add a further alert.

It is also possible to use alerts to exit a trade at optimum price points. The alerts will help you exit the trade. TrendSpider alerts are different from those found in other platforms. There are many options that are closer to scan conditions. Candlestick patterns can be used as alert triggers. It is also possible to add parameters for multiple timeframes (including intraday).

It's also easy to create alerts using trendlines, indicators, and Fibonacci levels by simply right-clicking. These alerts are referred to as Dynamic Price Alerts. You can receive alerts by email, SMS, or screen pop-ups.

Mindful Trader

Traders who subscribe to Mindful Trader receive swing trade alerts that have a proven track record of success. Approximately five to fifteen trade alerts are sent each week to users. Mindful Trader founder Eric Ferguson uses a data-driven approach to make his recommendations.

On the member dashboard, members can see the creator's watchlist, live positions, and historical trade data. To take advantage of short-term market movements, you can use this paid swing trading alerts service. Using the service's swing trading methodology, trade windows and clear guidance are provided for opening and/or closing positions.

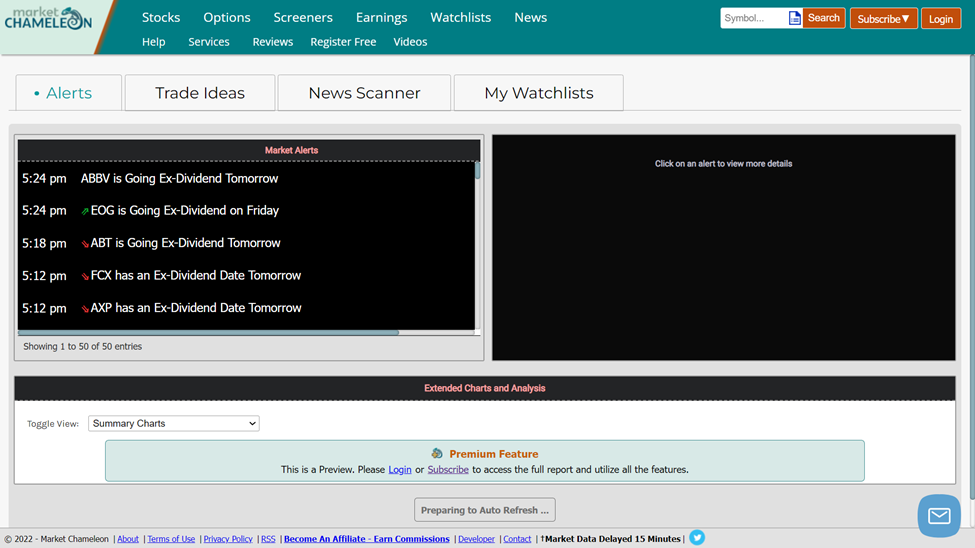

Market Chameleon

Market Chameleon

Market Chameleon offers stock and options trading alerts that can be used to uncover profitable trading opportunities. Investors can select from a variety of different products offered by the software.

It offers several unique tools built to provide high-yielding trade ideas if you are more of an options trader.

The service offers an unusual options volume scanner for options traders. By using this tool, you can find stocks whose options are trading at a higher rate.

A stock and options screener is another useful feature of Market Chameleon. The free tool boasts dozens of filters, including price changes and moving averages. You can also build customized screens using any of the 18 options trading strategies available through the screener tool.

Moreover, you can create as many watchlists as you like on the platform. Stocks with earnings on a specific day can be included in these watchlists as well as specific options contracts. One of the best things about the email alerts is that they can be customized. A notification will be sent to you if a stock you are watching behaves in a certain way.

The Trading Analyst

The Trading Analyst

An affordable alert service that offers a great mix of features, the Trading Analyst is well-balanced. With the service, you can follow a swing trading strategy without devoting much time to trading, and the recommendations are easy to follow.

It is easy to see that The Trading Analyst is a credible source of information. In 52% of trades, the service is profitable, with a profit factor of 2.05. This indicates that the service's profitable trades make a little more than twice what it loses when it is not profitable.

Typically, users receive two to ten trade alerts per week with targeted gains of 50% to 100%. Users also have access to a real-time portfolio tracker and an educational database, along with real-time alerts via SMS. There are weeks when the team is slower because they don't chase trades.

There is no screener or thorough research tools available with this alert service. As a result, this service is mainly aimed at traders who aren't able to conduct such research themselves, and would rather have someone else do it for them without paying a high fee. A weekly report keeps you informed of current market events and prepares you for the week ahead.

What Is the Best Price Alert Service?

The stock price alert services provided by stock alert service providers may earn the service provider some fee, but what’s their benefit to a stock trader? Here is what a stock trader gets from these important alerts.

Real-time stock alert services provide information on stock volume or price related events in the stock market. The information may also show sharp price changes within specific timeframes, large block trades of shares, stock trade resumptions or halts, and any other price or volume-related changes in stock trading. All these pieces of info- are important in making trading decisions.

Apart from monitoring and providing stock-related changes, the stock alert services also provide important educational content to traders who use it to better their trading skills.

Most stock alert service providers also provide analytical services that help the traders to learn about market dynamics and their influence on market and stock trends.

Some of the information provided through market and stock alerts is created by use of speculative and algorithmic processes that review market patterns and create predictions about possible future market or stock states. Such information helps traders to make future market and stock projections.

Some stock alert service platforms sync with trading platforms, and they may integrate with trading platforms to generate automatic signals that traders can use to implement a trading strategy without the human intervention of a trader. Such a possibility creates an automated marketing experience for you.

Stock alert service platforms such as ForexSignals create common online chat rooms for traders who use them to interact and share trading tips and insights in real-time.

The analytical nature of stock and market alert service platforms generates market and stock information that is essential in identifying and evaluating possible trading risks. Such information also helps traders to plan on how to avoid the identified trading risks.

Now that we’ve reviewed the importance of stock price and market alerts, let’s take a look at the principles held by the service providers.

How Do Swing Trading Signals and Alerts Work?

If you subscribe to a swing trade alert service, you will often receive emails, SMSes, push notifications, or alerts within a trading room. Stock trading and options trading are usually used by swing traders for short-term investments lasting a few days or weeks. To determine which stocks or other financial instruments to trade at a particular point in time, the trade alert provider considers trade setups, strategies, historical data, and market conditions.

Other swing trade alert services analyze price swings and then alert subscribers on their own based on their analysis of real-time trading opportunities. There are some swing trader services that are quite pricey. As a result, it is crucial to assess whether subscribing makes sense since a real added value must be generated before expenses can be recouped.

Long-term investors who use swing trade alerts will benefit from adding them to their buy and hold strategies. Swing trade alerts give you more time to execute trades, and the fill price is not as important as the overall performance. By contrast, day traders who trade individual stocks and execute options trades must know exactly what to do and when. Track records that are verified establish a level of transparency that is trustworthy. No matter what past results have been, there is never a guarantee that the same results will occur in the future. Using paper trading brokerage accounts will enable you to test the trade setup before committing your own funds.

Can Price Alerts Help?

Yes. A swing trade alert can provide you with many benefits. Even if you don't know how to identify tradable opportunities, swing trade alerts allow you to earn while you learn. It is as simple as receiving trade alerts from the provider, executing them as recommended, and making money.

The signal provider should also provide charts with the signal package and explain the trade setups so you can learn about the factors that move the markets. Using the analysis and the explanations, you can determine the factors that influence price movement, their reasons, and the reasons behind them.

Using swing trade alerts will help you improve your trading: Even if you already understand the financial markets and are profiting from trading, you can still improve your trading skills.

The signal provider will explain how they approach the market, what factors they consider important, and how they approach trade setups.

You can also learn new trading ideas to research, which if found promising, can be used to develop new trading strategies. You can therefore make the most of your trading strategies by using quality swing trade alerts to optimize them.

In all market conditions, no single strategy performs very well. You will be diversifying your market exposure. Some strategies perform very well in trending markets, but poorly in ranging markets, while others perform well in sideways markets.

Swing trade alerts can help you achieve this goal as an experienced trader because they provide you with different ways to attack the market. By using swing trade alerts, you can diversify your investment portfolio. In addition to reducing your overall risk in the market, diversification will help you offset the poor results of one approach with the great results of another.

Best Brokers 2024

Summary

This type of trading plan may be suitable for you if you can handle the risk of swing trading and follow the advice of a swing trade alert service even when prices fall.

You can own stock within seconds when you use the best services that provide real-time updates. Even if the price drops out of the recommended range, you can still buy or sell the stock a few hours, days, or even a week later.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.