Mindful Trader Review 2024 - Stock Alert Service

Mindful Trader is a stock and options trading alert system. The platform user receives signals that determine the optimal points for opening trades according to swing trading strategies. The advantages of the service are transparency, minimal manageable risk, low subscription fee up to $50 per month.

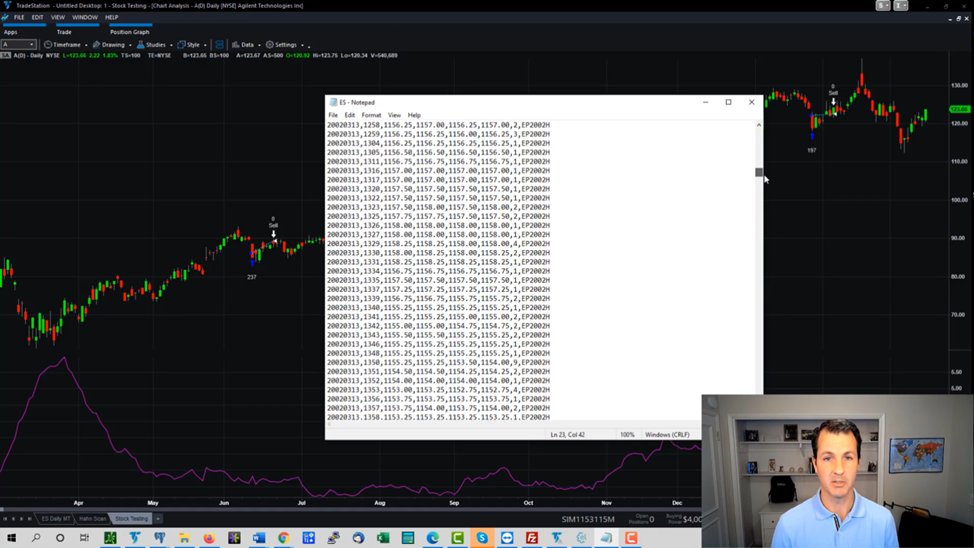

The Mindful Trader is an alert system intended for traders conducting swing trades with stocks and options. This system was developed by Eric Ferguson, a Stanford University graduate with over 20 years of experience in stock exchange trading. Ferguson established his own consulting firm and, in 2020, launched Mindful Trader, a paid online trading service that provides subscribers with alerts on trading options and stocks daily. Ferguson, however, provides more than just signals. He provides a large array of current analytics and explains the strategies he uses. This is a one-of-a-kind platform that is completely transparent and focused on specific results. In some ways, Mindful Trader is similar to a trades copying service, but the user gets absolute freedom without any obligations. The uniqueness of the project is that Ferguson’s trades are based on his own software solutions in the fields of backtesting and quantitative programming.

Backtesting is a type of software program that allows traders to test potential trading strategies against historical data.

Mindful Trader

What is a Mindful Trader?

The Mindful Trader service is relatively new; it is only 2 years old. Nonetheless, its author has over 20 years of proven trading experience. Eric Ferguson started trading professionally in 2001, using backtesting mechanics as a foundation for developing trading strategies. His annual income was 6% at the time, but it increased to 8% in 2002.

Ferguson soon realized that open sources did not provide enough statistics to conduct historical testing, which could provide a real basis for building successful swing trading strategies. Also, he did not find a reliable source of alerts for trading options and stocks, which was extremely difficult at the start of the 2000s. Therefore, Ferguson studied quantitative programming to develop his own software for complex analytics of data arrays. As a result, his income in 2003 was 160% and 145% in 2004.

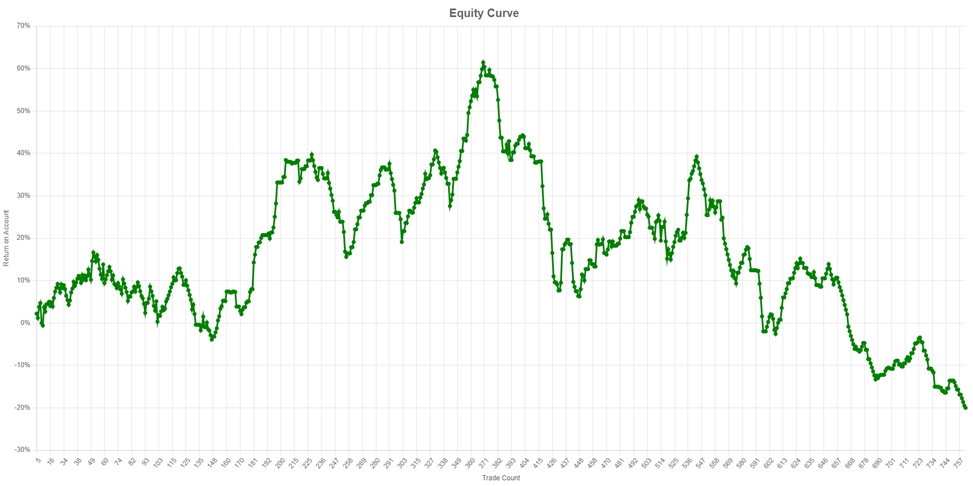

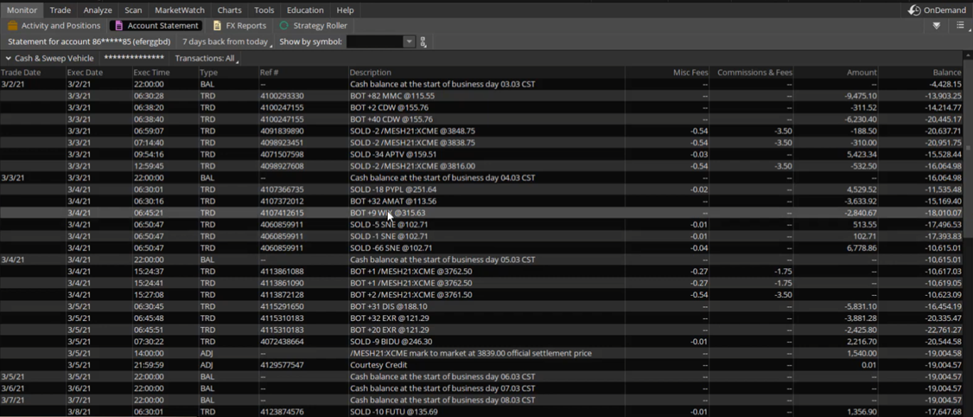

A review of the Mindful Trader shows that Ferguson’s actions are strictly transparent, and all the alerts he sends out are based on personal trading operations. If you focus on statistics, Ferguson's maximum income was 380% per year (this is open data that can be confirmed). The average annual income for 20 years is 146%. Of course, Ferguson doesn’t win all swing deals, it’s impossible. Therefore, his service operates based on a typical disclaimer statement. However, the analysis of user feedback in combination with expert assessment showed that alerts on trading options and stocks, which can be received through the Mindful Trader service, can significantly increase the profitability of a trader focused on swing trading.

A review of Mindful Trader by TU experts helped in determining which mechanisms and tools Ferguson uses in his work. But, more importantly, it reveals what opportunities are available to its subscribers. These are collections of stocks (six to eight a week), watch lists, and live positions. The platform also provides trading education.

Key features of the Mindful Trader service

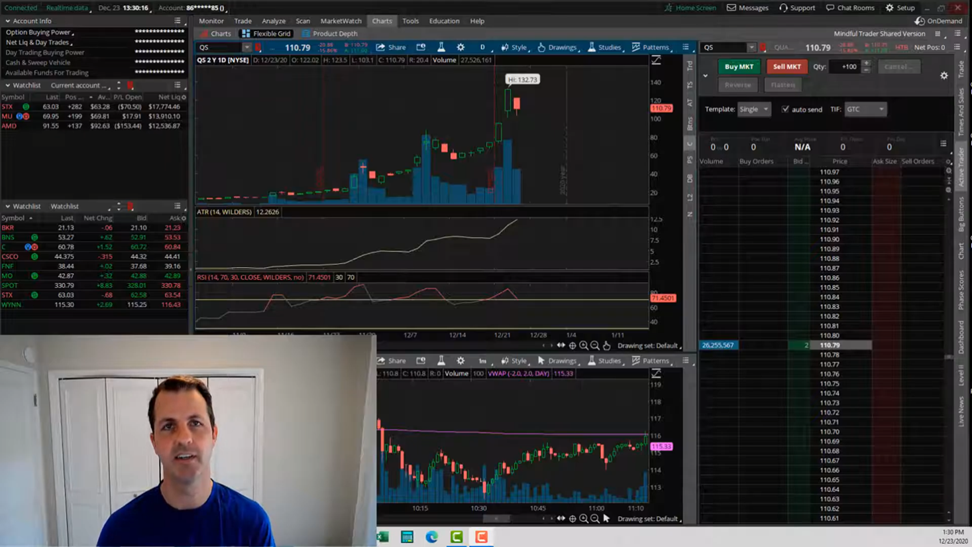

The platform is quite different from its analogs in terms of its capabilities. The main difference is that the service does more than simply provide alerts on trading options and stocks. The trader receives a detailed analysis of the market situation from Ferguson. The easiest way to see this is through the example of live trades. The section includes all trades ever conducted by Ferguson, including current ones. Here are the entry and exit points, stop-loss price, maximum hold time, position size, and other data.

The maximum holding time has a special place. Thanks to this parameter, instead of waiting until the price target is reached or the stop loss is triggered, Ferguson immediately sets an additional time limit of several days for the trade. This is necessary to minimize the risk since only three things can happen to it during the period of the trade: (i) the trade reaches the target value and closes; (ii) the trade reaches a stop loss and closes; or (iii) the trade does not reach either the target value or the stop loss and closes after the specified time.

As a result, Mindful Trader ensures that the risk is low and very short-lived and that losses are minimized. This approach demonstrates Eric Ferguson’s global strategy, which is called "momentum trading". If the expected momentum does not unfold within a couple of days (conditionally), the trade is closed. However, this is just one of the features provided by Mindful Trader, a trading option and stock alert system. Below the Traders Union will take a detailed look at all the functions, options, and services of this alert system.

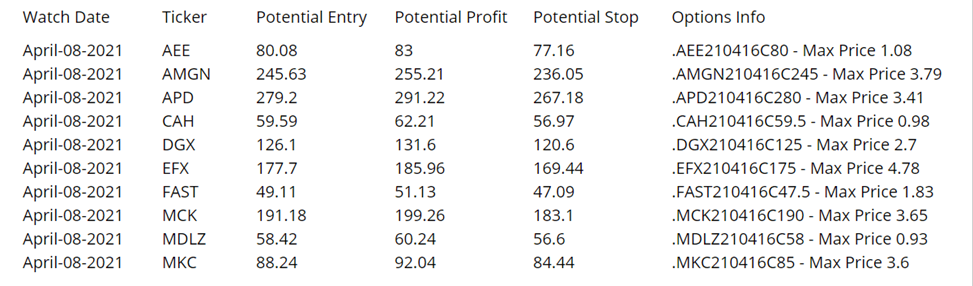

Trading alerts for stocks

This function is the primary reason swing traders subscribe to Mindful Trader. Alerts (also called notifications) sent by Eric Ferguson to subscribers include brief information about each stock traded and under what conditions he bought it. A trader can copy Ferguson’s trade completely or use it for their own analytics. Example of a typical alert: "I bought AMGN for 245.63. Set a profit target of 255.21. Set a stop loss of 236.05. Closing on 24.10.22".

The first word in the notification about trading options or stocks briefly tells you which position to open – long (buy) or short (sell). Mindful Trader sends sales alerts more frequently, while purchase alerts do not differ in structure. In this example, the trader received a purchase alert. The stock ticker of the company whose stock Ferguson is purchasing comes next in line. In this case, it is AMGN, the ticker of Amgen Inc., the largest biotech company in the United States.

The following is the purchase price (same as the trade entry price). Note the value of AMGN stock. Ferguson does not indicate here how many stocks he buys (this can be viewed in an individual block with all his trades). Concerning potential risk, a trader purchases as many stocks at the specified price as their own budget and money management rules allow. For example, you need to remember that the amount of each trade should not exceed 1-1.5% of your trading capital.

The currency used in Mindful Trader alerts is US dollars only. Therefore, if the notification contains "245.63", it means that Ferguson is buying AMZN stocks at $245.63. It is important to remember that the stock price may change by the time a trader enters a trade, but if he reacts quickly (quick use of the received signals is the essence of alerts), the changes will be insignificant. The same is true for the profit price, which in this case is 255.21. This means that as soon as the value of one stock reaches $255.21, the trade will be closed.

In alerts on trading options and stocks, Mindful Trader always indicates the stop-loss price, that is, the price after which the probability of making a profit is excluded. In the above example, this is $236.05. As soon as the stock price drops to the specified level, the trade will be automatically closed. In this case, the trader will suffer losses (like Ferguson himself), but they will be minimal under this market situation.

Finally, the "closing" menu item represents the maximum holding time, which was discussed above. It allows you to minimize potential losses. The idea is that the price may not fall to the stop-loss level, but at the same time, it may not rise to the target value of the asset. This condition can persist for many days, and every day a trader will take risks due to an unpredictable asset position or even lose money. To prevent this from happening, Mindful Trader’s alerts include a specific date, in the above example, 24.10.2023. At the beginning of the specified trading day, the trade must be closed if the target or stop loss is not reached.

Trading alerts for stocks

What to consider when working with Mindful Trader alerts?

Alerts on trading options and stocks from Mindful Trader have several important features. First, all the assets indicated in the alerts must first be added to the watch list. That is, the trader must already be tracking them and know the current state of the market. But this is a perfect-world case. In fact, the Ferguson service is used by a huge number of traders who do not want to understand trading essentials. They just copy his trades based on his signals and earn good money.

Second, do not forget that Eric Ferguson is engaged only in swing trading. It is for this reason that it is not necessary that your entry price exactly match Ferguson’s price indicated in the notification. Actually, this is a big advantage compared to the intraday trading style (which, of course, also has its advantages). If a trader trades within a day, the minimum price spread is conceptually important to him, so if he copies a trade based on an alert, it should be done at lightning speed. In other words, there is a significant difference between "245.63" and "245.75" for a trader trading within the day. Whereas a swing trader, whose trades last for several days, may well neglect such a difference.

Mindful Trader options

Third, the Mindful Trader watch list can be used as a source of information, whereas the motive for opening a trade will be a favorable (in the trader’s opinion) market condition. In other words, using Ferguson’s watch list, you don’t have to wait for him to notify you about trading options and stocks. The truth is that when the market opens, prices are sometimes even better than the expected entry price. But then the stop-loss level and target value also need to be adjusted, since they are calculated based on the actual trade entry price.

Options on Mindful Trader were introduced relatively recently, and Eric Ferguson initially traded only stocks and sent alerts on them. Today, the service provides alerts about options trading, which are also included in the watch list. Experienced traders can use this information to develop their own strategies and trade independently.

How to Invest in Stocks for Beginners with Little Money?Trading strategies based on backtesting

Transparency is one of the unique features of Mindful Trader, which underlies the services offered. Eric Ferguson, unlike most providers of alerts on trading options and stocks, does not hide his strategies. This also differentiates his service from trade copying services, where only the most basic information about the service provider is available. On Mindful Trader’s official website, there are several sections devoted to mathematical analysis, statistics, and the development of swing trading strategies. In particular, Ferguson talks a lot about backtesting as the foundation for stock market research. Each conclusion is supported by the chart of Ferguson’s main trading account.

Backtesting

The idea of backtesting is to project a trading strategy on historical data using algorithmic coding. Of course, backtest results may differ from real-world trading results, but many financial experts believe that this approach can provide the most realistic picture of an asset’s behavior at some point in time. Certain market conditions affect the trade's entry and exit points in the same way that they do during backtests. An example is a sudden lack of liquidity. But there are always moments that are simply impossible to predict. For example, consider the human factor.

However, there are many other points to consider. As for futures, for example, it is impossible to obtain records of the funds required to manage an MES contract on every date in history. As a result, the retrospective test will be unable to determine how purchasing power may have been affected for each trade. In addition, there are often situations in backtesting when there is a prospect of executing more than one successful trade per day. Moreover, the more trades that are made, the lower the accuracy of the forecast. So, Ferguson set his limit at no more than two trades per day.

Every successful trader knows about backtests and tries to use them. However, they soon discovered a large number of white spots. The author of Mindful Trader leveled nearly all of them. To do this, he always analyzes groups of stocks from diversified industries, draws up comprehensive strategies, evaluates financial prerequisites for at least 20 years, uses the principle of "raw advantages," and makes a statistical Monte Carlo test for each strategy. On top of that, there is a statistical correlation test created out-of-sample tests, standard deviation tests, and a Sharpe coefficient estimate.

Trading strategies based on backtesting

Also, Eric Ferguson takes into account fees and gaps in historical tests and freely publishes the information. The basics of his work are available on the Mindful Trader website for everyone. However, the detailed practice of developing trading strategies is provided only to paid subscribers. Of course, some traders do not need this. On the other hand, the Mindful Trader review reveals that the platform is used by both experienced and novice traders who want to understand all of the nuances to become professionals. Ferguson’s backtesting-based trading strategies are invaluable to such users.

Thus, Mindful Trader does something that no other options and stock trading alert service does. Ferguson doesn’t just send alerts to subscribers. Instead, he is ready to explain the ins and outs of the alerts.

On-sight swing trading courses and investment training

Eric Ferguson’s education courses are extremely popular. He creates step-by-step training programs and detailed guides that explain the principles of swing trading for paid subscribers. The materials are available in both text and video formats. All the steps are illustrated on the trading platform with specific examples.

Ferguson’s goal is for traders to learn how to use technical analysis tools to develop strategies and increase trade profitability on their own. Experienced traders who have completed their training at Mindful Trader can successfully use positions from Ferguson’s watch list to execute their own trades, sometimes even more successfully than their teacher. This is yet another truly unique moment when Ferguson shares his experience in full scope.

On-sight swing trading courses and investment training

Eric Ferguson conducts classes, including for professionals. However, his watch list and statistics are only available to subscribers. Unregistered users cannot get information on historical testing and proven strategies. So, it always makes sense to subscribe.

As was noted above, option trading alerts were only recently implemented on the platform. Previously, Mindful Trader published only alerts on stock trading. It’s the same with education: Ferguson’s education programs, which he develops specifically for the options trading sector, are now available. Of course, he relies on some fundamental principles in his stock trading. Ferguson applies the backtesting method to options trading as well. However, there are differences.

For example, Mindful Trader involves the purchase of call options that expire in about a week because at that moment the options are close to the minimum price. The target cost and stop loss are predetermined and remain unchanged throughout the trade. If the price does not reach any of these positions, the trader closes the trade the day before expiration. At the same time, the leverage used for options is higher than for stocks. This scenario increases the potential profit but also increases the possible losses.

On-sight swing trading courses and investment training

The Mindful Trader review demonstrates a unique approach to swing trading education. The whole education process is conveniently divided into steps and is intended for traders of different experience levels. Eric Ferguson explains everything using the example of his own trades, which increases the visibility of education and simplifies it. There is no intuition or ungrounded assumptions; only backtesting, mathematical calculation, and accurate forecasts.

Ferguson’s swing trading vision

Ferguson does not base his trading on the news. This means that if Apple has just released a new product, Ferguson will not run to buy stocks of this company, assuming an increase in their price. According to him, he does not read stock market news, but focuses on the actions of buyers and sellers and thereby predicts price movement.

The creator of Mindful Trader claims that a trading strategy based on the news has several fundamental problems. First, the news must be correctly interpreted, which is often difficult. For example, Amazon’s post about losses does not always result in a drop in the company’s stock price. Second, it is impossible to test the impact of news on stocks. When Microsoft presents new software, it will not be possible to predict how it will affect the value of the company’s securities under certain conditions.

Instead of news, Ferguson uses mathematics. He only trades when he has what he calls a "trading advantage". The statistical approach and analytics based on backtesting allow him to make sure that the chosen strategy is potentially successful, and that others with the highest probability will lead to losses. A trading plan can be built around recurring trends, which are demonstrated by charts and tables. This review of Mindful Trader shows that Eric Ferguson’s approach is exceptionally successful, and his experience is in high demand.

How much does Mindful Trader cost?

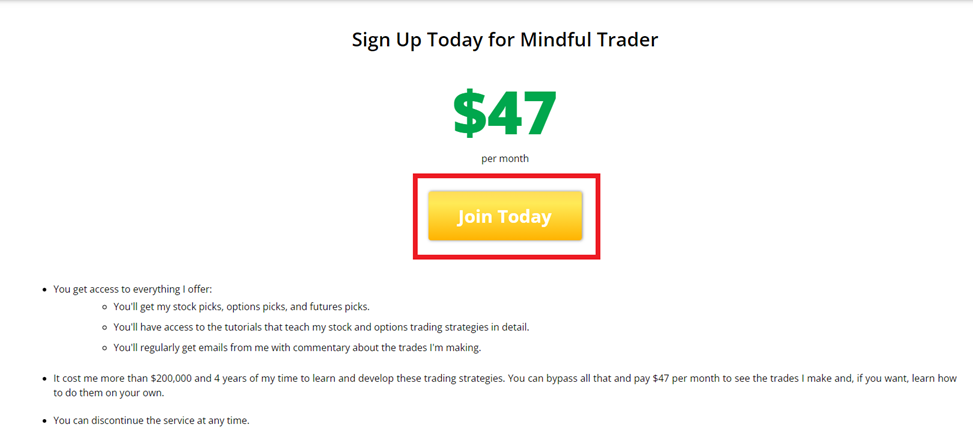

The platform charges a monthly subscription fee for its services, which is $47. There are no other paid plans or trial periods. The subscription is renewed automatically using the payment details specified during registration. The first month must be paid in full. The subscription can then be canceled through the user account settings, and access to the platform will be limited beginning the following month. According to TU’s Mindful Trader review, Eric Ferguson does not provide discounts, bonus codes, or other promotions to reduce the cost of the subscription.

Mindful Trader cost

Is the Mindful Trader alert service reliable?

Eric Ferguson has a complete set of supporting documents that allows him to conduct financial activities under current US law. He officially provides alerts about trading options and stocks, as well as offers education and training on trading methods, etc., for which he receives remuneration. Ferguson’s activities are 100% transparent, including tax reporting.

The service has been in operation for two years, and there have been no disputes or facts about Eric Ferguson’s failure to fulfill his obligations to clients during that time. He adds alerts and strategies, updates the watch list, and creates a frequently published newsletter. Also, he regularly holds educational sessions.

Thus, the Mindful Trader platform is reliable and trustworthy. However, Ferguson does not guarantee that traders will close all or a majority of their trades with a profit using his alerts, strategies, and education. Due to the impossibility of such guarantees, no service provides them. However, risk can be reduced by using backtesting and mathematical forecasting. This is exactly what the Mindful Trader does.

Best Day Trading Software and Tools to UseHow to get started with Mindful Trader?

Sign up on the Mindful Trader official website to receive alerts on trading options and stocks, as well as access to Eric Ferguson’s strategies and educational events. The Traders Union outlines the step-by-step registration procedure below.

1. Go to the official website of Mindful Trader. Click on the "Sign Up" button located in the upper right corner of the screen. You can also start registering by clicking the "Join Today" button on one of the secondary pages of the website below.

Getting started with Mindful Trader

2. On the pre-registration page, you will see the subscription price as well as a description of the information that Mindful Trader provides you as part of the subscription plan. Carefully read the information on this page, and check the block with the video at the bottom and the FAQs section. Click the "Join Today" button.

Getting started with Mindful Trader

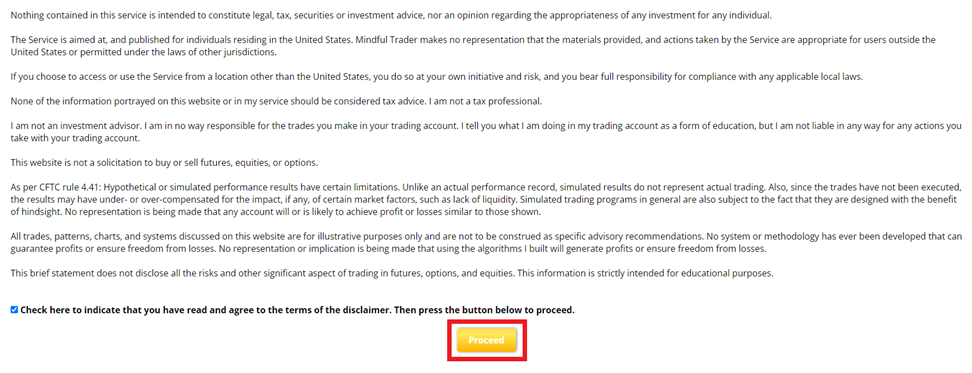

3. The next page is a "Disclaimer" section. It explains that the platform offers no guarantees. All information provided is strictly for advisory purposes only. After reading the Disclaimer, tick the box confirming that you accept the terms and click "Proceed".

Getting started with Mindful Trader

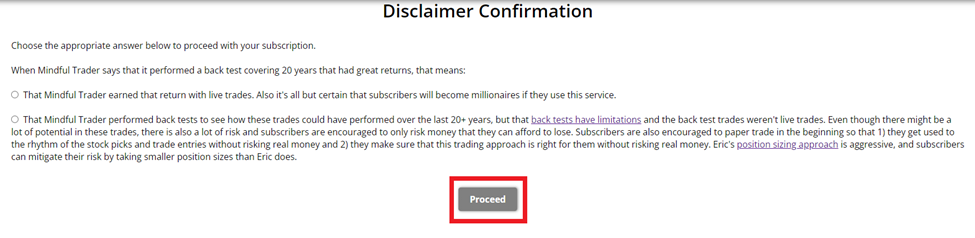

4. Take a one-question mini-test to show Eric Ferguson that you understand the platform’s main purpose – providing alerts about trading options and stocks, as well as the risks involved. Select the answer and click "Proceed".

Getting started with Mindful Trader

5. Next, choose the payment method – PayPal or bank card (debit or credit card). Select the method that suits you and enter the details. Pay for the subscription by confirming the transfer. Follow the on-screen instructions to gain access to your user account.

Getting started with Mindful Trader

TU reminds you that the subscription will be automatically renewed using the payment details you provided during the initial payment. You will not be able to use the platform without paying for its services. If there are not enough funds on your wallet or bank card, your subscription will not be renewed, and you will lose access to the service. You can unsubscribe at any time through your user account.

FAQ

What is Mindful Trader?

It is a platform that sends alerts on trading options and stocks. The provider of alerts is Eric Ferguson, a professional trader with 20 years of experience and a developer of specialized software.

Why should I subscribe to Mindful Trader?

The service sends alerts for swing traders every trading day. Aside from operational alerts, Ferguson sends stock portfolios to subscribers, as well as access to its trades, a watch list, and unique trading strategies.

Are there any educational programs on the Mindful Trader website?

Yes, Eric Ferguson has developed a course on swing trading in stocks and options. His program is divided into blocks for traders of different experience levels and contains text and video materials. Ferguson teaches traders, among other things, his own methods of technical analysis.

What do I need to know about subscribing to Mindful Trader?

You cannot register on the website without paying for the first month. The subscription is $47 and must be paid monthly. The subscription is automatically renewed based on the default settings, but you can disable auto-renewal through your user account.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Backtesting

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

-

3

Swing trading

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

-

4

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

5

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.