Note:

Note that in the United States the clocks are set to winter time, but in Japan they are not.

Best time to trade USD/JPY:

12PM to 3PM GMT: At the middle of the London session and beginning of the New York session, during the market session overlap

12AM to 2AM GMT: The peak of the Sydney session and beginning of the Tokyo session, in the middle of their market session overlap

6AM to 9AM GMT: The ending of the Tokyo and Sydney market sessions, during their overlap

The U.S.A and Japan are host to two of the world’s richest economies in 2023 according to Forbes, and their respective currencies, the U.S. dollar and Japanese Yen, are two of the most traded currencies out there. But as the two nations are on almost opposite sides of the planet, it can be difficult to know what time is the best time to trade USD/JPY. In this article, Traders Union explains if USD/JPY is a good pair to trade, looks at the best hours to trade USD/JPY and what affects the USD/JPY rate, and breaks down how to trade USD/JPY by looking at the advantages and disadvantages.

Out of the many trading pairs out there, USD/JPY is the second most popular one amongst traders, according to multiple sources. Japan and the U.S.A are two of the major global economies, so their respective currencies see a particularly high volume of transactions. Topped only by the EUR/USD pairing, USD/JPY is favored for its high liquidity, volatility, and stability. The low-interest-rate environment in Japan has also made the Yen a popular choice for the carry trade strategy, where investors borrow in a low-interest-rate currency to invest in one with a higher yield.

The Forex market is open 24 hours a day, five days a week, allowing traders to trade major currency pairs at any hour during the trading week. This means that traders can trade the USD/JPY pairing 24 hours a day, five days a week. However, due to different time zones and the varying opening hours of different country’s exchange markets, there are specific times during the day where liquidity is higher, making them preferable hours for trading.

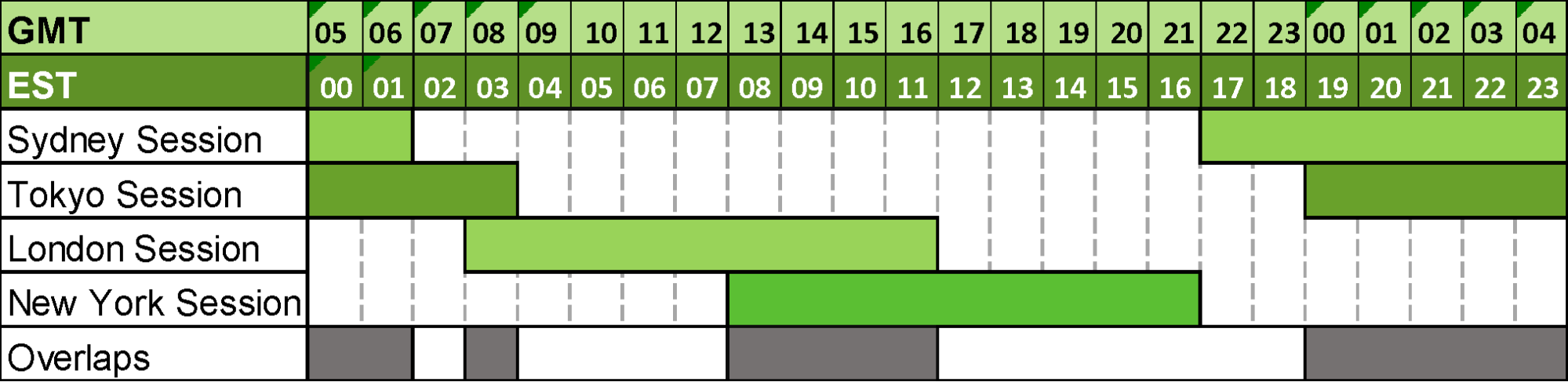

There are four major foreign exchange markets around the world, each with their own market sessions throughout the trading day:

Tokyo Session (Asian Session): Runs from 12:00 AM to 9:00 AM GMT. It’s dominated by Asian markets, particularly Japan and sees increased activity in JPY pairs

London Session (European Session): Is open from 8:00 AM to 5:00 PM and overlaps with Tokyo, providing liquidity. The EUR, GBP, and CHF pairs are most active

New York Session (North American Session): Running from 1:00 PM until 10:00PM GMT, this session overlaps with London, resulting in high liquidity. USD pairs are the most in focus

Sydney Session (Pacific Session): Open from 10:00 PM to 7:00 AM GMT. It’s the smallest session, and AUD and NZD pairs are most active. It overlaps with Tokyo’s session and provides continuity between sessions

Image: Market Session Hours in Forex

There are numerous factors which have an impact on the USD/JPY pairing rate. The most significant factor is the fact that Japan has a negative interest rate, which the Bank of Japan adopted in 2016. Japan’s negative interest rate makes the Yen an attractive option for those engaging in carry trading, where traders borrow in a currency with a lower interest rate (like JPY) to invest in a currency with a higher interest rate (like USD). Negative interest rates can also lead to a depreciation of the yen as investors seek higher yields elsewhere. This can in turn lead to an increase in USD/JPY.

Other factors that influence the USD/JPY rate are:

Global Economic Conditions: Events affecting the global economy, like the financial crisis or the COVID-19 pandemic, can impact USD/JPY

Bank of Japan (BOJ) Interventions: The BOJ occasionally intervenes in currency markets to influence the yen's value

Trade Relations: Trade balances and relationships between the U.S. and Japan can influence the exchange rate

Geopolitical Stability: Political events and stability can impact investor confidence

Risk Sentiment: USD/JPY is considered a relatively risk-sensitive pair. During times where sentiment perceives risk as high, investors may favor trading higher-yield currencies rather than JPY

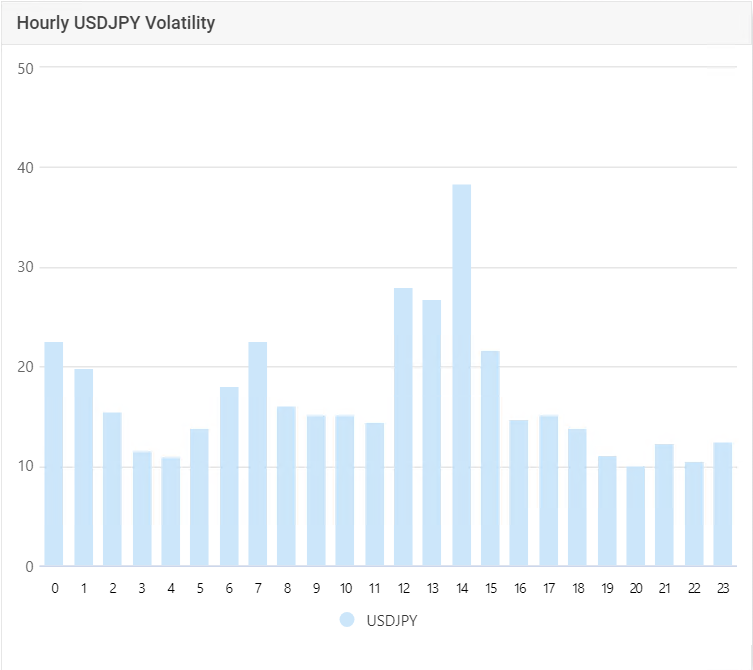

Due to the various market sessions and overlaps, there are specific times that are better to trade USD/JPY. Volatility varies throughout the trading day. Trading during periods of high volatility means increased profit opportunities, higher liquidity, and increased premiums in options trading. However, higher volatility also means higher levels of risk, as price movements are more significant and unpredictable.

The times of day that see the highest volatility in USD/JPY trading, based on GMT, are:

Lunchtime 12PM to 3PM: This is during the peak of the London market session and beginning of the New York session, during the market session overlap of New York and London

Midnight 12AM to 2AM: These hours are the peak of the Sydney session, and early hours of the Tokyo session. They see the overlap of the Asian and Pacific sessions

Early Morning 6AM to 9AM: GMT’s early hours mark the end and overlap of the Sydney and Tokyo sessions, the opening hours of the London session, and the Tokyo-London overlaps

Image: Hourly Volatility of USD/JPY in GMT (Source: Myfxbook)

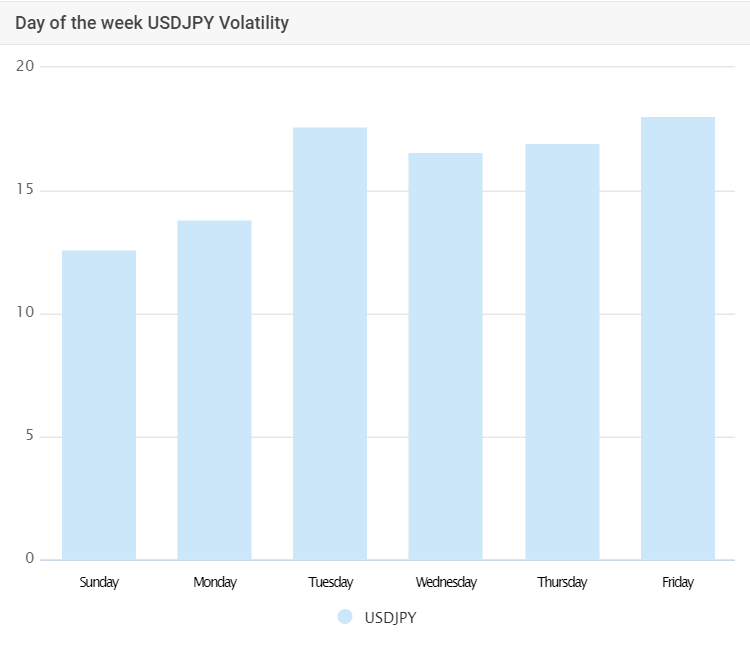

Volatility of USD/JPY also fluctuates from day to day and is highest on Friday. The second highest day is Tuesday. The day with the lowest volatility and therefore liquidity, is Monday.

Image: USD/JPY volatility by day (Source: Myfxbook)

If you are trading outside of the GMT time zone, it’s important to take your own time into consideration. Lunchtime on a Friday in Europe would be the early morning in the USA. Consider the time differences before deciding which time you will engage in trading.

Note:

Note that in the United States the clocks are set to winter time, but in Japan they are not.

When trading USD/JPY, the attributes unique to the pair should be considered. The type of trading you engage in also affects how you trade USD/JPY.

News Trading

When trading USD/JPY in response to significant news events, keep an eye on releases about the U.S.A. 's and Japan’s GDP, employment data, and inflation. Pay attention to statements and decisions from the Bank of Japan (BoJ) and the Federal Reserve (FED), as they influence currency values

Intraday trading

If intraday trading the USD/JPY pair, study patterns like flags, triangles, and head and shoulders for short-term trading signals. Use technical indicators such as moving averages, RSI, and stochastic oscillators for guidance on when to enter and exit positions

Long Term Trading

When trading USD/JPY long-term, use fundamental analysis to understand broader economic factors affecting the U.S.A. and Japan. Consider geopolitical events, interest rates, and economic growth. Assess interest rate differentials between the two countries for long-term positioning

Knowing how to trade takes a lot more understanding and explanation than just a few paragraphs. See our expert guide on trading strategies for beginners for an in-depth look at how to trade Forex.

The popularity of the USD/JPY pair brings with it many advantages. Let’s take a look at some of those:

Liquidity: The USD/JPY is the second most traded currency pair globally, offering high liquidity. This means that traders can easily enter and exit positions without significant slippage

Volatility: While not as volatile as some exotic pairs, the USD/JPY often exhibits enough price movement for traders to capitalize on short-term opportunities. Volatility can present trading opportunities for both short-term and long-term strategies

Safe-Haven Characteristics: The Japanese yen is often considered a safe-haven currency. During times of market uncertainty, traders may flock to the yen as a safe asset, influencing the USD/JPY pair

Global Economic Influence: Movements in the USD/JPY pair are influenced by economic indicators and events in both the United States and Japan. Traders often use information on these major economies to inform their trading decisions

Narrow spreads: As the USD and JPY are both strong, major currencies, the pricing of the pairing doesn’t fluctuate too massively. The pair has a relatively low spread

To stay up to date with recent news about movements and analytics related to USD/JPY, check out our USD/JPY page here.

Overall, the USD/JPY pair is one of the most popular pairs to trade. The two currencies that make up the pairing are known for their stability, and the different economic aspects of each of them make for an interesting trading choice, particularly for beginners.

The currency pair's action is marked by times of explosive impulsives and prolonged flat periods, due to economic events, news events and press releases. The prominence of the U.S.A. and Japan in worldwide market news makes USD/JPY an easier pair to follow than some minor or exotic pairs. USD/JPY is well suited for trend trading as the currency pairs' importance in international trade means that patterns tend to be slightly more predictable than lesser traded pairs.

There are of course risks that come with trading this pair, as is the case with all pairings. Make sure you have a detailed risk management strategy lined out. Try fleshing out your approach and putting it to the test using a demo trading account, which is free to use.

Friday sees the highest volatility for USD/JPY, and is also highest from 12PM to 3PM GMT.

The Forex market is open 24 hours a day, five days a week. The American market opens at 1PM GMT, and the Asian session starts at 12AM GMT. You can trade USD/JPY during any market session.

It’s highest from 12PM to 3PM GMT. It’s lowest at 8PM to 11PM GMT.

Yes, it’s the second most traded currency pair by trading volume. EUR/USD is the most popular.

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).