Best Time Of Day To Trade USD/ZAR

The USD/ZAR pair is a volatile exotic pair, though there are times that see higher volatility which presents increased trading opportunities. The times of highest volatility are:

-

1

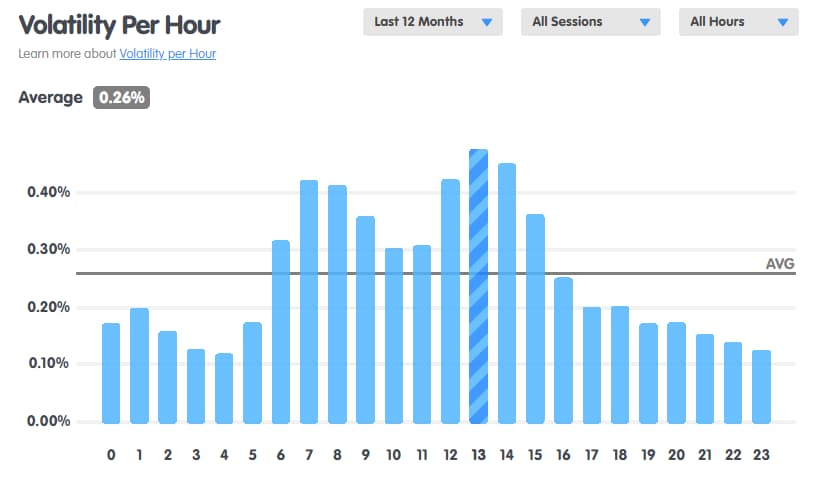

Overall 6AM to 4PM GMT: Volatility is high during these hours, which make up the end of the Asian session, the entire European session and most of the American session. Volatility is above average here

-

2

Highest Peak 12PM to 4PM GMT: Volatility peaks in these hours and is highest (above 0.4%) during the American session opening and the middle of the European session, when they overlap.

-

3

Second Peak 7AM to 9AM GMT: Volatility is at its second highest point when the European session opens and the Asian session closes. It remains above average until peaking again at 12PM

The U.S. dollar (USD) and the South African rand (ZAR) make up the exotic pairing USD/ZAR, and can be a challenging one to trade. As an exotic pair, USD/ZAR sees higher than usual volatility, and low liquidity, which make it one of the riskier trading pairs out there. However, there are better times to engage in USD/ZAR trading during the 24/5 Forex trading day.

This article looks at whether USD/ZAR is a good pair to trade, what times USD/ZAR is most volatile, when is best to trade USD/ZAR, and the advantages of trading USD/ZAR.

Is USD/ZAR a good pair to trade?

As of April 2022, according to statista.com, the USD/ZAR currency pair is the 19th most traded in the world, and accounts for 0.9% of daily trading volume, even though South Africa only accounts for 0.3% of daily Forex trading.

USD/ZAR is an exotic currency pair, meaning it’s made up of the U.S. dollar and the currency of an emerging economy – in this case the South African Rand (ZAR). Exotic currency pairs typically have lower trading volumes and liquidity, and higher bid ask-spreads. However, USD/ZAR is the most active of all exotic pairs according to Benzinga, which mitigates some of this additional risk.

USD/ZAR is also an interesting pair to trade due to its correlation to the South African commodity market. South Africa is a major producer of key commodities, such as gold, platinum, diamonds and chromium, making ZAR an influential global currency. Since commodities are globally denominated in dollars, fluctuations in international commodity markets impact ZAR’s value. For example, in 2022, gold and platinum prices rose, which caused a 30% increase in South African export earnings. As a result, the ZAR appreciated in value by 10% against the U.S. dollar.

USD/ZAR trading hours

USD/ZAR, like all currency pairs, can be traded 24 hours a day, five days a week (Monday to Friday, or Sunday night to Friday depending on your time zone and location). However, there are times that are preferable for trading USD/ZAR. Major foreign exchange markets in different countries are open at specific times during the day, leading to variations in liquidity and volatility throughout the trading day. It’s important to know when each market is open, and when market sessions overlap, to coordinate your trading times and strategy.

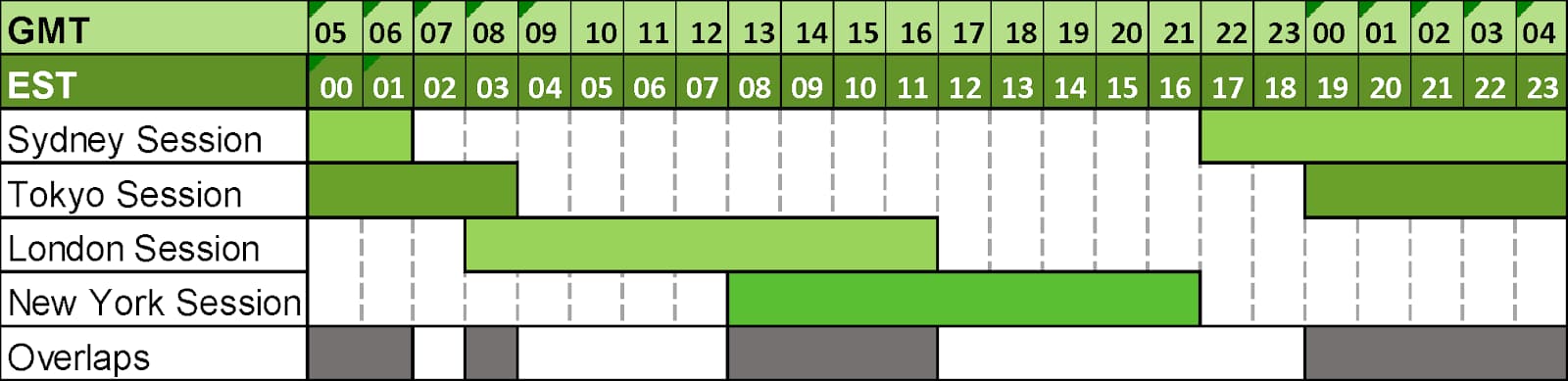

There are four major foreign exchange markets around the world, each with their own market sessions throughout the trading day:

-

Tokyo Session (Asian Session): Runs from 12:00 AM to 9:00 AM GMT. It’s dominated by Asian markets. USD/ZAR sees its lowest daily volatility during this session.

-

London Session (European Session): Is open from 8:00 AM to 5:00 PM and overlaps with Tokyo, providing liquidity. The EUR, GBP, and CHF pairs are most active. USD/ZAR sees its highest volatility during this session.

-

New York Session (North American Session): Running from 1:00 PM until 10:00PM GMT, this session overlaps with London, resulting in high liquidity. USD pairs are the most in focus.

-

Sydney Session (Pacific Session): Open from 10:00 PM to 7:00 AM GMT. It’s the smallest session, and AUD and NZD pairs are most active. It overlaps with Tokyo’s session and provides continuity between sessions.

USD/ZAR trading hours

The best times to trade USD/ZAR

The best times to trade USD/ZAR will depend largely on a trader’s trading strategy, location and time zone, and financial goals. However, trading during times of high volatility means higher liquidity, narrower spreads in the bid-ask price, and more trading opportunities leading to higher profit potential. However, times of high volatility also means higher risk, as price movements are more significant and unpredictable.

Volatility per hour - Source: Babypips.com, GMT Time Zone

The times of day that see the highest volatility in USD/ZAR trading, based on GMT, are:

-

1

Multi-Session Overlaps 6AM to 4PM GMT: Volatility in USD/ZAR is above average during these hours, which make up the end of the Asian session, the entire European session and most of the American session.

-

2

London – New York Overlap 12PM to 4PM GMT: USD/ZAR sees peak daily volatility in these hours and is highest when the American session opens and overlaps with the middle of the European session.

-

3

Tokyo – London overlap 7AM to 9AM GMT: Volatility reaches its second highest point as the European session opens and the Asian session closes. It remains above average until peaking again in the New York- London overlap.

What is the daily volatility of the USD/ZAR?

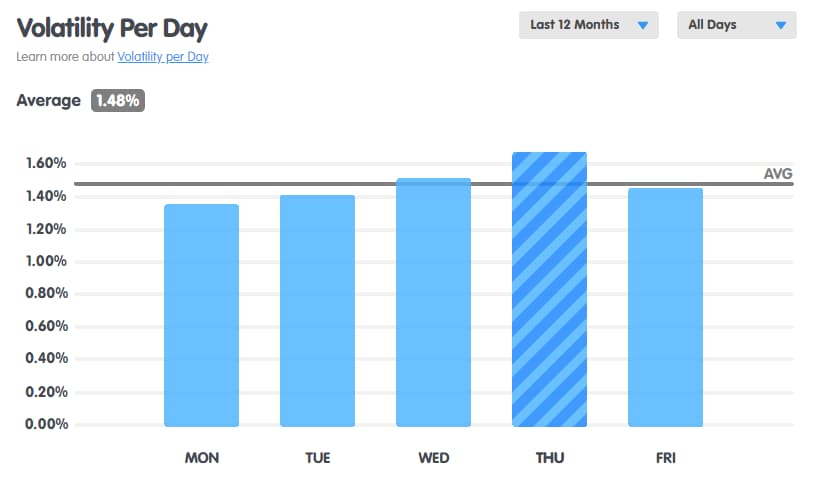

Many factors can influence daily volatility in USD/ZAR, causing it to fluctuate throughout the trading week. On Monday, traders are often reacting to weekend events when the market opens. Stability varies throughout the week, and with most currency pairs volatility is at its highest on Fridays. However, with USD/ZAR, volatility is highest on Thursdays and above average on Wednesdays, though reaches its lowest on Mondays.

Daily Volatility of USD/ZAR (Source: babypips.com)

Best Forex brokers

How to trade USD/ZAR?

When trading USD/ZAR, there are several factors that are unique to the currency pair that should be taken into consideration when trading. USD/ZAR is an exotic currency pair, meaning that it is less liquid than most major and minor pairs, though it is the most liquid of all of the exotic pairs. Your trading strategy should take this into account.

Pay attention to these considerations:

-

1

Economic Indicators: Economic growth in both the U.S. and South Africa can influence the exchange rate. Unemployment rates indicate economic challenges and can affect the exchange rate, so bear in mind South Africa has one of the highest unemployment rate in the world.

-

2

Interest Rates: Divergent inflation rates can impact currency value. Changes in interest rates in the U.S.A. and South Africa can affect a currency’s attractiveness, influencing the exchange rate.

-

3

Political Stability: South Africa is a politically tumultuous country. Political stability or instability in either country can impact investor confidence and the exchange rate.

-

4

Commodity Prices: South Africa is a major exporter of commodities. Changes in commodity prices, especially precious metals like gold, can influence the Rand.

-

5

News from South African Reserve Bank: The SARB uses interest rates and inflation targeting to influence inflation levels, to protect the Rand’s value. While the SARB does not have a specific exchange rate target, it may intervene in the foreign exchange market to address excessive volatility or disruptions. Make sure to follow SARB News.

-

6

Trade Surpluses/Deficits: The balance of trade between the U.S. and South Africa can affect their respective currencies. Pay attention to trade news and policy between the two countries.

Pros of trading the USD/ZAR currency pair

The South African Rand (ZAR) is one of the most traded currencies in Africa, and the South African economy is the third largest on the continent, after Egypt and Nigeria. Its economy makes it attractive to investors and traders looking to diversify their assets.

South Africa is also a central trading partner for many African countries, including Zimbabwe, Mozambique, Botswana and Lesotho, resulting in high demand for ZAR.

Additionally, ZAR is a freely convertible currency, meaning that it can be freely exchanged for foreign currencies in the international foreign exchange market. This status makes it more available, and liquid compared to many other African currencies.

There are several advantages to trading the USD/ZAR currency pair.

-

High volatility: As an exotic pair, USD/ZAR can enable traders to potentially earn profits at a faster than usual rate. Traders can also experience higher returns as a result of the wider price fluctuations.

-

Emerging Market Opportunities: South Africa is considered an emerging market, and trading the Rand provides exposure to the economic dynamics and opportunities of an emerging market economy.

-

Economic Stability: Compared to other emerging economies featured in other exotic pairs, South Africa’s economy is relatively stable. This means higher liquidity in USD/ZAR, which can be more thinly traded.

-

Commodity Correlation: South Africa is a major exporter of commodities, including gold and platinum. Changes in commodity prices can impact the Rand, providing trading opportunities for those who follow commodity market trends.

The price of USD/ZAR tends to fluctuate a lot, so it’s important to follow price action and employ analytics. See our Traders Union expert analytics here.

Summary

Overall, if you’re trading USD/ZAR, the currency pair will provide increased opportunities to diversify your portfolio and take advantage of an emerging market. Its correlation to commodity prices can also provide unique trading opportunities.

However, due to USD/ZAR being an exotic pair, it is not recommended for beginners. Its increased volatility and low liquidity are characteristics that make the pair riskier for traders. Make sure to implement carefully planned risk management strategies to minimize losses.

FAQs

What time does the USD ZAR market open?

The Forex market is open 24 hours a day, five days a week, and the AUD/USD pair can be traded anytime during the trading week. The overall Forex market opens on Sunday at 10PM GMT, when the Sydney (Pacific) market opens, and closes on Friday at 10PM GMT when the New York (American) session closes.

How much is $1 USD in rand?

In the long term, the UDS/ZAR exchange rate is in an uptrend. In 2013 the U.S. dollar was worth 9 South African rand, in 2024 it reached 19. For the exact exchange rate today, visit this page

What is the best time to trade Forex?

The best times to trade forex are during the overlapping market sessions with high liquidity. The London-New York overlap (1PM AM to 5PM GMT) and the London session (8 AM to 5PM GMT) are key periods for major currency pairs.

What are the most popular exotic currency pairs?

The most popular is USD/ZAR, followed by EUR/TRY, USD/MXN, USD/THB, USD/SGD, USD/NOK, and USD/HKD.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

4

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

-

5

Exotic Currency Pairs

Exotic currencies are currencies from countries with smaller or emerging economies, and they are less commonly traded in the foreign exchange market compared to major currencies like the US Dollar, Euro. These currencies are often considered exotic because they are not as liquid or widely used in international trade and finance.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).